The Effect of Financial Literacy on Financial Management Behaviour

with Self-control as Intervening Variable

Shinta Heru Satoto, and Sri Budiwati W. P.

Universitas Pembangunan Nasional Veteran Yogyakarta

Keywords: Financial Literacy, Financial Management Behaviour, Self-Control

Abstract: This research aims to explain the influence of financial literacy on financial management behavior with self-

control as intervening variables. This research was conducted on the management of the Village Owned

Enterprises (BUM Des) in Sleman Regency, with 54 respondents. Used three variables, the data collected

will be tested using the regression and path analysis. This study shows that financial literacy has a positive

effect on financial management behaviour. This study also investigates the indirect effect of financial

literacy on financial management behaviour through self-control. The result shows that the direct effect is

stronger than an indirect effect on the influence of financial literacy on financial management behaviour.

The higher the financial literacy of the BUM Des management, the better the self-control of the

management in spending or consumption based on needs that are planned. So, it can be concluded that the

management's knowledge, skills, and confidence in financial planning and management, combined with

self-control related to financial expenditure, will significantly influence the behaviour of financial

management regarding decision making in the use of village finances.

1 INTRODUCTION

Government efforts to equalize development are

carried out in various ways. One of them is an effort

to equalize welfare in rural areas because the village

is one of the potential places for the country's

economy. The many village potentials that can be

developed and a large number of natural resources

that have not yet been exploited, encourage the

government to issue policies that can support the

development of village potential. The policies made

by the government include those listed in UU No. 6

of 2014 concerning Villages, followed by

Government Regulation No. 60 of 2014 concerning

village funds sourced from the State Budget.

Based on this law, every village has the right to

receive funding from the government sourced from

the state budget. Village funds can be used to

develop village potential, one of which is to

establish village-owned enterprises (BUM Des)

aimed at boosting the economy of village

communities. BUM Des was formed by the village

government to utilize all economic potential, natural

resources, and human resources to improve the

village community. BUM Des is managed by the

village government and also the village community

to strengthen the village economy and is formed

based on the needs and potential that exists in the

village.

The problem that often arises from the existence

of village funds is the ability to manage village

funds. The ability of administrators of village-owned

enterprises to manage village funds is an important

factor in achieving the objectives of the fund. Errors

in management and planning that often occur tend to

be caused by the behaviour of management who do

not have adequate financial knowledge. In general,

two factors influence a person's behaviour, namely,

internal factors and external factors. External factors

include culture, social class, and family. While

internal factors include motivation, the learning

process, and self-concept, in the concept of finance,

the learning process can be interpreted as a person's

knowledge to understand knowledge related to

finance or what is referred to as financial literacy

(Weningsih, 2018). The Organization for Economic

Co-operation and Development / International

Network on Financial Education (OECD / INFE)

(2009) argues that the lack of financial literacy is

recognized as one of the factors that contribute to

financial information decisions that are lacking in

information, thus causing negative impacts. Remund

Satoto, S. and W. P., S.

The Effect of Financial Literacy on Financial Management Behaviour with Self-control as Intervening Variable.

DOI: 10.5220/0009960501790186

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 179-186

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

179

(2010) also states that financial literacy is a

measurement of one's understanding of financial

concepts, and has the ability and confidence to

manage personal finances through appropriate short-

term decision making, long-term financial planning,

and attention to economic events and conditions.

Several studies have shown an influence between

financial literacy and behaviour in financial

management, including research conducted by Robb

& Woodyard (2011), Lusardi & Mitchell (2011), and

Michaud (2017). Robb and Woodyard prove that

functional financial literacy will have a positive

influence on a person's financial behaviour, where

someone will be able to manage or allocate their

finances appropriately. Michaud's research (2017)

found that financial literacy is associated with

increased income and plays an important role in

improving welfare. Michaud stressed that

behavioural interventions also need to be considered

because this will guarantee the achievement of

welfare in the form of increased income when

someone already has an understanding of financial

literacy. Whereas, Lusardi & Mitchell (2011) found

that behavioural factors, such as perceptions about

the importance of financial literacy, satisfaction at a

certain level on understanding financial literacy and

the results obtained, would greatly affect a person's

level of financial management ability. Their research

also found that financial literacy will be very easily

understood through interactions between individuals

in a work environment or a community.

Mistakes that occur in financial management are

also often caused due to a lack of self-control from

someone. Self-control is a person's ability to

maintain behaviour. Someone with good self-control

will have better financial behaviour and will be able

to manage the financial resources they have

(Kiyosaki, 2012). They will not spend on things that

are not needed or for activities that are not useful.

Self-control will lead to wise decision making and

better financial welfare. Besides, self-control will

help someone has a strong self-desire to achieve

success in the future. Lack of self-control will lead

to irrational decision making, low self-confidence,

and destructive behaviour (Younas, et.al; 2019).

Kahneman and Krueger (2010) found the effect of

self-control on financial behaviour. According to

Kahneman, someone with good cognitive abilities

will be able to manage their finances to achieve

goals.

From the results of the pre-survey conducted, it

is known that someone who has sufficient financial

knowledge, will have sufficient self-control in

managing finances. Based on this, this study was

conducted to examine the effect of financial literacy

on financial management behaviour by using self-

control as an intervening variable. The study was

conducted on administrators of village-owned

enterprises (BUM Des) of Sleman regency in

managing village funds obtained from the

government.

2 LITERATURE REVIEW AND

HYPOTHESES

2.1 Financial Management Behavior

Financial management behavior is a determination,

acquisition, allocation and use of financial resources

in accordance with specified objectives (Horne and

Wachowicz (2002). The more active a person's

financial management behavior will be, it can

improve financial welfare, and vice versa, failure in

financial management will lead to negative

consequences in the long run.

Deacon and Firebaugh (1988) define financial

management behavior as a set of behavioral results

in the form of planning, implementation, and

evaluation involving the scope of cash, loan,

investment, insurance, and pension planning. Failure

to manage finances will lead to serious long-term

consequences, not only for someone but also for the

company. Financial behavior as part of financial

management behavior can be measured by looking

at someone's actions, including financial knowledge,

financial attitudes, and locus of control (Dowling, et

al., 2009)

2.2 Financial Literacy and Financial

Management Behaviour

Financial literacy is knowledge and understanding of

financial concepts and risks as well as the skills,

motivation, confidence to apply such knowledge and

understanding to make effective decisions in the

financial context, improving financial well-being,

both individual and community welfare (OECD,

2016: 87). Financial literacy can also be defined as a

combination of awareness, knowledge, skills,

attitudes, and behaviours needed to create financial

awareness and ultimately achieve individual welfare

(OECD, 2011).

Houston (2010: 306-307) explains that financial

literacy shows how well an individual can

understand and use information related to finance.

Financial literacy can also lead to components of

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

180

resources that can be used in financial activities to

improve the quality of life expected from

consumption, such as behaviours that can improve

financial welfare.

According to Braunstein and Welsch (2002: 445-

447), several factors that cause financial literacy

between individuals include 1) technological

changes, 2) increasing debt problems, and 3)

changes in individual finances. According to

Michaud (2017), financial literacy is associated with

better future planning related to the rate of return

from higher deposits, as well as debt with low-

interest rates. For workers, low financial literacy

results in increased financial bankruptcy due to the

high frequency of absences and low productivity.

Also, workers who have financial literacy skills will

better understand the company's financial condition,

especially in times of crisis, which allows workers to

be able to make profitable deals for the parties

involved.

Several studies on the effect of financial literacy

on financial management behaviour, among others,

were conducted by Klapper, Lusardi, and Panos

(2012), Murithi (2012), Stromback, et al. (2017),

and Weningsih (2018). Financial literacy becomes

the main focus of financial education and supports

the creation of awareness about the importance of

welfare in life. Inadequate financial literacy will

affect one's financial decision making. If someone's

financial literacy is high, then someone will have

good behaviour in financial decision making.

Research Murithi (2012) found that understanding

financial literacy has a better effect when something

similar is offered to an individual in a group.

Klapper et al. (2012) proved the influence of

financial literacy on financial behaviour by looking

at the positive influence of financial literacy on the

use of formal services in the financial sector. The

higher the level of financial literacy, the higher the

capacity of deposits, and the lower the amount of

expenditure during a financial crisis. This research

shows that financial literacy can make an individual

face the conditions of economic change through

savings and become a wise person in financial

management.

H1: Financial literacy has a positive effect on

financial management behaviour

2.3 Self-control and Financial

Management Behaviour

Self-control is the ability to control someone to

organize, maintain and direct behaviour that directs

someone to give positive consequences. The ability

to control oneself is related to one's ability to control

emotions and encourage others (Weningsih, 2018).

Self-control is the level at which a person makes

consistent choices (Sutter, et.al, 2013). Self-control

is a non-cognitive skill that is important in

individual decision making, such as consumption

and savings.

According to Schultz and Schultz (2013: 317),

self-control is the ability of a person to exercise

control and manage behaviour with full

consideration before doing something. Self-control

can be influenced by internal factors (such as age,

emotional control, psychological well-being, and

how religious a person is), and external factors (such

as family environment, and peers).

Mischel (2014) states that self-control can be

related to financial literacy, where someone who has

the knowledge and financial literacy abilities will be

able to control themselves in financial management.

Dikria and Mintarti's research (2016) proves that

financial literacy has a positive influence on self-

control. Someone who has the knowledge and skills

about financial literacy combined with self-control

will be more selective in spending. Someone with

high financial literacy will be better able to predict

an event, so they will be more careful in controlling

their finances and making decisions.

H2: Financial literacy has a positive effect on

financial management behaviour with self-control as

an intervening variable.

3 RESEARCH METHOD

This study is a quantitative study that aims to

examine the effect of financial literacy on financial

management behaviour with self-control as an

intervening variable. This research was conducted

on the management of the Village Owned

Enterprises (BUM Des) in Sleman Regency, with 54

respondents. Data collection was carried out by

distributing questionnaires consisting of 28 question

items representing 3 variables, consisting of 15

question items for financial literacy variables, 7

question items for self-control variables, and 6

question items for financial management behaviour

variables.

The data used in this study are financial literacy

(independent variable), financial management

behaviour (dependent variable), and self-control

(intervening variable).

The Effect of Financial Literacy on Financial Management Behaviour with Self-control as Intervening Variable

181

3.1 Financial Literacy

Financial literacy is defined as the knowledge, skills,

and attitudes that influence behaviour in improving

the quality of decision making and financial

management to prosper. Financial literacy is

measured using indicators: 1) money management,

2) financial planning, 3) financial well-being, and 4)

financial knowledge (Australian Unity Financial

Wellbeing Questionnaire - design and validation)

3.2 Financial Management Behaviour

Financial behaviour is a study that studies how

psychological phenomena affect financial behaviour.

Financial behaviour measured using indicators: 1)

consumption; 2) debt management; 3) money

management; 4) savings and investment (Strömbäck

et. Al, 2017)

3.3 Self-control

Self-control is related to better financial

management and involves one's ability to resist

desires or impulses to spend excessively. Self-

control is measured using indicators 1) stopping bad

habits; 2) resist temptation; 3) maintain self-

discipline; 4) focus on short-term goals; and 5)

laziness (Strömbäck et. Al, 2017)

The data collected will be tested using the

regression analysis to testing the influence of

financial literacy on financial management

behaviour and from the results obtained later

conclusions will be drawn. To test the direct and

indirect effect of financial literacy toward financial

management behaviour trough self-control, the path

analysis was conducted. Path analysis is the part of

the regression analysis used to analyze the

relationship between dependent variable with

independent variable directly or indirectly through

one or more intermediaries. The path calculation

describes the influence of Financial Literacy (X)

directly and indirectly to Financial Management

Behaviour (Y2) through Self-Control (Y1).

The structural equation used is as follows:

Y1 = β1X+ε1 ………………… sub structural (1)

Y2 = β1X +β2Y1 + ε2 …. …...sub structural (2)

4 RESEARCH RESULTS

4.1 Descriptive Statistics

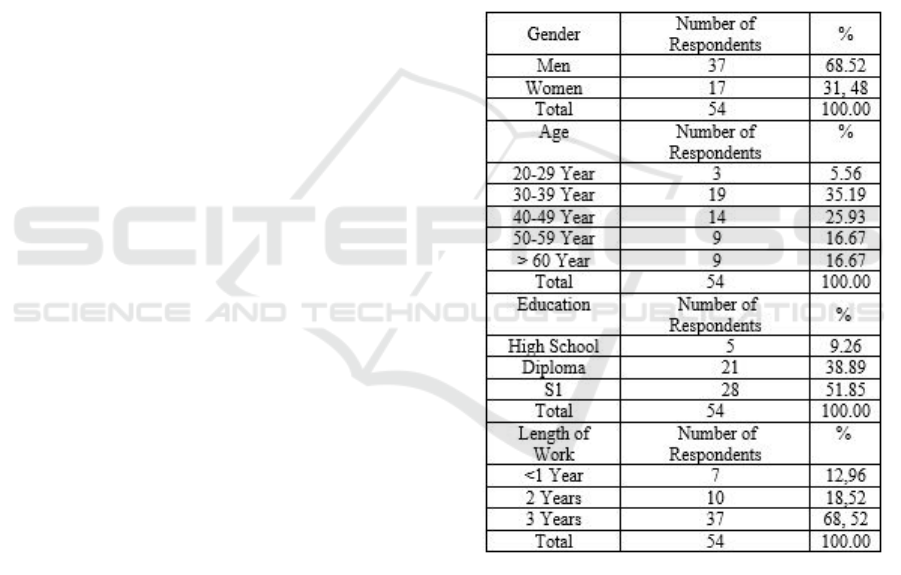

Table 1 below shows descriptive statistics from

research respondents. 68.52% of respondents were

male while the rest were female. The majority of

respondents aged between 30 and 39 years. 9.26% of

respondents had the last high school education,

38.89% had a Diploma education, and the remaining

51.85% had a Bachelor's degree. 68.52% of

respondents have taken care of BUM Des for 3

years, 18.52% have worked for 2 years, and the rest

work for less than 1 year.

Table 1. Characteristics of respondent

4.2 Test Results

Testing the effect of financial literacy on financial

management behaviour, presented in table 2, shows

that financial literacy has a positive effect on

financial management behaviour as indicated by a

regression coefficient of 0.840 and a significance of

0,000 less than 0.05. These results prove that the

higher the financial literacy of the BUM Des

management, the better their behaviour in managing

village finances.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

182

Good understanding and sufficient knowledge

along with the expertise possessed in terms of

savings, loans, and investments will make an

individual wiser in making financial decisions to

achieve goals in the future.

Table 2. Testing the influence of financial literacy on

financial management behaviour

Model Unstandardized

Coefficient

t. Sig

R

2

B Std

Error

Const

ant

0,59

5

7,771

1,70

7

,000

0,73

9

X

0,84

0

4,374

9,63

5

,000

Financial problems often occur because of errors

in financial management such as making wrong

decisions in spending that tends to cause someone to

be more consumptive. Lusardi and Mitchell (2017)

state that the lack of understanding of products and

mechanisms in the financial markets, as part of

financial literacy, results in suboptimal decision

making related to investment. In this case, financial

literacy is associated with an inability to make

decisions regarding managing deposits (savings),

low participation in financial markets (van Rooj,

Lusardi, and Alessie, 2011) and low ability to

diversify in portfolios (Guiso and Jappelli, 2009).

Regarding loans (credit), someone with a low

level of financial literacy tends to decide to take

loans at a higher cost. A person who uses credit to

finance expenses often experiences excess loans

because of excessive spending activities, such as

spending on clothing purchases, electronic

equipment, vehicles, and recreational activities

funded by loans (Lucks, K., 2016). Therefore,

someone with the right level of financial literacy

tends to be more rational in spending and will be

better at managing their finances. Based on the

results, the first hypothesis (H1) is acceptable, that

financial literacy has a positive effect on financial

management behaviour.

Table 3. Summary of the Regression Analysis

Model Unstandardize

d Coefficient

t. Sig R2

B Std

Error

Sub structural X Y1

Constant 1,265 ,338

3,7

49

,000

0,537

XY1

,657 ,085 7,7

,000

71

Sub structural X Y1 Y2

Constant

-,087 ,338

-

,25

8

,79

7

0,72

9

XY2

,486 ,110

4,4

05

,00

0

Y1

Y2

,539 ,123

4,3

74

,00

0

Table 3 shows the result of regression analysis

on the effect of financial literacy on financial

management behavior with self-control as an

intervening variable. On the influence of financial

literacy on self-control, the result shows that the

regression coefficient of financial literacy variables

of 0.657, significant at 0,000. It shows that there is a

positive influence on financial literacy on self-

control. The higher a person's financial literacy, the

better someone will be in self-control related to

financial activities carried out. Self-control is the

ability of a person to exercise control and manage

his behavior before deciding to do something.

Someone with good financial literacy will be able to

control himself and will be more careful in using his

money and have various considerations before

taking an action

The results of testing the effect of financial

literacy on financial management behavior with self-

control variables as intervening variables in table 3

show the regression coefficient of financial literacy

variables of 0.486 and self-control regression

coefficient of 0.539, both significant at 0,000. This

shows that financial literacy has a positive effect on

financial management behavior with self-control as

an intervening variable.

Table 4. Summary of the Path Analysis

Model

Path

Coefficie

nt

T Sig.

R2

Sub structural 1 (X Y2 )

X

0,463 4,405 ,000

0,537

Sub structural2 (X Y1 Y2 )

X

0,733 7,771 ,000

0,739

Y1

0,460 4,374 ,000

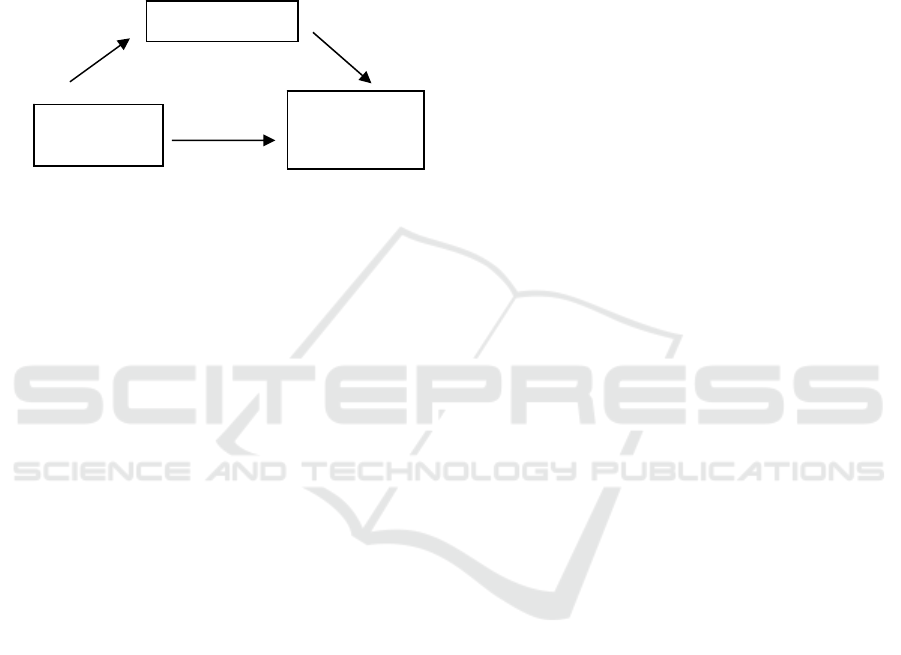

The result of path analysis in Table 4 shows that

the path coefficients of variables financial literacy is

0.733, and the path coefficient for self-control is

0.460, and significant at 0.000. This shows that there

is an indirect effect of financial literacy on financial

management behaviour through self-control. The

indirect effect of financial literacy on financial

The Effect of Financial Literacy on Financial Management Behaviour with Self-control as Intervening Variable

183

management behaviour is (0.733) x (0.460) =

0.33719. While the direct effect of financial literacy

on financial management behaviour is 0.463,

significant at 0.000. Thus, it can be concluded that

the direct effect of financial literacy on financial

management behaviour is greater than the effect of

financial literacy on financial management

behaviour through self-control variables. The effect

between variables is presented in the following

figure 1

0,733 0,460

0,463

Figure 1. Effect of Financial Literacy on Financial

Management Behaviour with Self-Control as an

intervening variable

The result of this study is consistent with the

study of Weningsih (2018) and Ramalho and Forte

(2018). Ramalho and Forte (2018) show the positive

influence of financial knowledge as part of financial

literacy on self-control, and the positive influence of

financial knowledge on the behavior of financial

management, both directly and through self-control.

Weningsih (2018) shows that financial literacy hurts

consumptive behaviour with self-control as

intervening variable. Financial literacy combined

with self-control will make more selective

consumption pattern. Financial literacy,

accompanied by good self-control will lead to good

financial management behaviour. Some person who

has good self-control will be more careful in

managing his finance and will try to be an intelligent

person in carrying out various financial activities.

Based on the results, the second hypothesis (H2)

is acceptable, that financial literacy has a positive

effect on financial management behaviour through

self-control as intervening variables.

5 DISCUSSION

The results indicate a positive influence of financial

literacy on the financial management behaviour of

the village caretaker-owned business (BUM Des)

entities village in Sleman district. This shows that

financial literacy in the management of the BUM

Des in Sleman Regency in terms of village financial

management shows good results. Administrators can

plan and manage village finances well, such as

managing funds to pay debts, have financial

planning for things in the future, and unforeseen

needs, and have sufficient basic financial

knowledge. So it can be concluded that the

management of the BUM Des in Sleman Regency

has good financial literacy and the financial

behaviour of the management in financial planning

and managing the business unit's finances has been

done appropriately and adequately.

Indirectly, self-control as an intervening variable

influences the relationship of financial literacy to

financial management behaviour. This indirect effect

shows that the higher the financial literacy of the

BUM Des management, the better the self-control of

the management in spending or consumption based

on needs that are planned, and not based on

conditions for a moment, as well as the ability of the

board to think for goals long-term. This will

significantly affect the management in making

financial decisions in achieving public welfare. The

management's knowledge, skills, and confidence in

financial planning and management, combined with

self-control related to financial expenditure, will

greatly influence the behavior of financial

management regarding decision making in the use of

village finances. This will significantly support the

achievement of the objectives of village fund

granting, namely improving the village economy and

achieving the welfare of the village community.

6 CONCLUSION

Financial literacy can be defined as a person's

ability, understanding, and skills to manage their

finances to reduce management errors in making

financial decisions for welfare purposes. This

financial literacy is related to general financial

knowledge about deposits and loans, investment,

and security guarantees. Good financial literacy will

greatly affect the behaviour of financial

management, both in terms of planning, controlling,

and making financial decisions. The high financial

literacy will affect self-control. The higher the

financial literation, the better one's self-control will

be in carrying out financial management. Self-

control is often associated with one's ability to

control and manage behaviour before making a

decision. In terms of financial management, self-

control is an activity that drives a person to make

savings by reducing impulsive purchases (Otto,

Davies &Charter, 2004). Someone with good

Self-Control

Financial

Literacy

Financial

Management

Behaviou

r

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

184

financial literacy, combined with self-control ability,

will produce good management behavior. Good

financial management will be crucial for the

achievement of the long-term goals of the formation

of a Village-Owned Enterprise that is improving the

village economy and achieving the welfare of the

community.

REFERENCES

Braunstein, S., Welsch, C., 2002, Financial Literacy: An

Overview of Practice, Research, and Policy, Federal

Reserve Bulletin, pp 445-447

Brown, M., Henchoz, C., Spycher, T., 2016, Culture,

Financial Literacy, and Self Control

Christian, RP, Komalasari, F., Hadiansah, I., 2016, The

Effect of Financial Literacy and Attitude on Financial

Management Behavior and Satisfaction, International

Journal of Administrative Science & Organization,

September 2016, Volume 23, Number 3

Deacon, R.E., Firebaugh, F.M., 1988 Family Resources

Management; Principles and Applications, Toronto:

Allyn & Bacon

Dowling, N.A., Corney, T., Hoiles, L., 2009, Financial

Management Practices and Money Attitudes as

Determinants of Financial Problems and

Dissatisfaction in Young Male Australian Workers,

Journal of Financial Conceling and Planning, 20(2): 5-

13

Dikria, Okky , and Mintarti, 2016, Pengaruh Literasi

Keuangan dan Pengendalian Diri terhadap Perilaku

Konsumtif Mahasiswa Jurusan Ekonomi

Pembangunan Fakultas Ekonomi Universitas Negeri

Malang angkatan 2013, Jurnal Pendidikan Ekonomi,

9(2), pp 143-155

Guiso,L., A.T., Jappelli., 2009, Financial Literacy and

Portofolio Diversification, Working Paper

Houston, S.,J., 2010, Measuring Financial Literacy, The

Journal of Consumer Affairs, 44(2),pp 296-316

Kahneman, D., and Krueger, AB, 2010, Of subjective

well-being, 20 (1): 3-24

Kebede, M., Klauer, N., and Kumar, J., 2015, Financial

Literacy and Management of Personal Finance: A

Review of Recent Literature, Journal of Finance and

Accounting www.iiste.org, Vol.6, No.13, 2015

Klapper, LF, Lusardi, A. &Panos, GA (2012): "Financial

Literacy and The Financial Crisis," National Bureau of

Economic Research (NBER) WORKING PAPER

SERIES, Working Paper 17930, [online], at

www.nber.org/papers/w17930 [accessed on February

5, 2015

Letkiewitz, J., C., 2012, Self Control, Fiancial Literacy

and Financial Behavior of Young Adults, Disertation,

Graduation Program on Human Ecology, The Ohio

StateUniversity

Lucks, K.E., 2016, The Impact of Self Control on

Investment Decisions, MPRA Papers, No. 73099

online at https://mpra.ub.uni-muenchen.de/73099

Lusardi, A. and Mitchell, O., 2011," Financial Literacy

Around the World: An Overview ", Discussion Paper

02 / 2011-023, Netspar Discussion Papers

Mischel,W., 2014, The Marsmallow Test: Mastering Self-

Control(4ed), New York:Little Brown and Company

Morgan, P.J., and Trinh,L.Q., 2019, Determinants and

Impacts of Financial Literacy in The Lao PDR, Asian

Development Bank Institute, ADBI Working Paper

928

M. Rizky, D.,P., Nadia, A., 2018, Analysis Factorss

Influencing Financial Management Behavior,

International Journal of Academic Research in

Busines and Social Sciences, Vol 8, No.8, August

2018, pp 308-326

Nguyen, M.,T., Thao, P.,T., 2015, Factor Affecting

Personal Financial Management Behaviors: Evidence

fro Vietnam, Proceedings of the Second Asia-Pacific

Conference on Global Business, Economics, Finance,

and Social Sciences (API5Vietnam Conference,

Danang-Vietnam, 10-12 July

OECD. (2013) "OECD / INFE Toolkit for Measuring

Financial Literacy and Financial Inclusion: Guidance,

Core Questionnaire, and Supplementary Questions

Organization for Economic Co-operative and

Development (OECD), 2016, International Network

on Financial Education (INFE), International Survey

of Adult Financial Literacy Competencies, Paris,

available at: www.oecd-International-Survey-of-

Adult-Financial-Literacy-Competencies.pdf (accessed

18 March 2017)

Parrotta, JL, & Johnson, PJ, 1998, The Impact of Financial

Attitudes and Knowledge on Financial Management

and Satisfaction of Recently Married Individuals.

Financial Counseling and Planning, Vol. 9, No. 2. PP.

59-75.

Ramalho, T.B., and Forte, D., 2019, Financial Literacy in

Brazil-Do Knowledge and Se;f-Confidence Relate

With Behavior?, RAUSP Management Journal,

Vol.54, No.1, pp 77-95

Remund, D.I., 2010, Financial Literacy Explicated: The

Case for a Clearer Definition in an Increasingly

Complex Economy, Journal of Consumer Affairs,

Vol.44, No.2, pp 276-296

Robb, CA, & Woodyard, USA, 2011, Financial

Knowledge and Best Practice Behavior. Journal of

Financial Counseling and Planning, Volume22 Issue 1

of the

Stromback, C., Lind, T., Skageruld, K., Västjäll, Tinghog,

G., 2017, Does Self-Confidence Predict Financial

Behavior and Financial Well-Being? Jounal of

Behavioral and Experimental Finance, 14,pp 30-38

Sutter, M., ngerer,S., Glaetzee-Ruetzler, D.R., Trautmant,

S.T., 2013, Impatience and Uncertainty: Experimental

Decisions Predict Adolescents’Field Behaviour, The

American Economic Review, 103(1), pp.510-531

Weningsih, R.T., 2018, The Effect of Financial Literacy

on Consumptive Behavior with Self-Controls as

Intervening Variables, Undergraduate Thesis,

University Yogyakarta State

The Effect of Financial Literacy on Financial Management Behaviour with Self-control as Intervening Variable

185

Younas, W., et.al, 2019, Impact of Self Control, Financial

Literacy and Financial Behavior on Kiyosaki, RT,

2012, Financial Well-Being, The Journal of Social

Sciences Research, Vol. 5, Issue 1, pp: 221-218,

RichDad Poor Dad.

Available:http://www.csce001.com/edit_zoop/uploadfi

le/system/20150408/20150408135909188.pdf

Van Rooij,M., Lusardi., A., and K. Alessie, 2011,

Financial Literacy, Retirement Planning, and

Household Wealth, Economic journal, 122, pp 449-

478

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

186