Financial Technology Application in Small and Medium Businesses

Christian Herdinata

International business management

Faculty of Management and Business, Ciputra University

Keywords: Financial Technology, Regulation, Financial Literacy, Collaboration

Abstract: Financial Technology (Fintech) has provided access to many parties who do not have a bank account to enter

the formal business sector. The application of Fintech has proven to be able to open greater access to formal

financial services, encourage economic growth, as well as inclusive development and maintenance. To

support the application of Fintech in Indonesia, the purpose of this study is to find agreement, financial

literacy, and collaboration that focuses on the application of Fintech for small and medium businesses in

Indonesia. This research was conducted through quantitative research using multiple regression analysis

techniques. The results of this study are that financial regulation and literacy have no significant effect on the

application of fintech. However, collaboration has a significant effect on the application of fintech. Therefore,

this study provides a complete and comprehensive understanding related to the application of Fintech in small

and medium-sized businesses relating to regulation, financial literacy, and collaboration.

1 INTRODUCTION

Bappenas simulation results, investment financing

needs for infrastructure development in 2018 around

Rp 5,248 trillion. We see Fintech has a great market

capability so that Fintech can improve the welfare of

poor households through business financing, access

to clean water and electricity, and financial

management for education and health. The 2015-

2019 National Medium-Term Development Plan

(RPJMN), inclusive finance, is the government's

effort to realize economic independence by driving

the strategic sector of the domestic economy. The

goal is to increase public access to formal financial

services within the framework of inclusive and

equitable economic development. In line with the

RPJMN objectives, based on the Deloitte Consulting

Survey and the Indonesian Fintech Association in

2016, three things encourage the implementation of

Fintech in Indonesia, namely more explicit

regulation, collaboration, and especially financial

literacy. In response to this, the government will

continue to encourage financial literacy and inclusion

programs so that the target of the Financial Inclusion

Index announced by the government through

Presidential Regulation (Perpres) Number 82 of 2016

concerning the National Strategy for Financial

Inclusion (SNKI) by 75 percent, can be achieved in

2019. However, data OJK shows that only about 67

percent of Indonesian adults in 2016 had access to

formal financial institutions; The World Bank

explained that around 49 million SME units were not

yet bankable. For this reason, adaptive policies on

technology and partnerships with the private sector

and financial services are needed.

In the McKinsey Global Institute report, digital

financial services can provide access to 1.6 billion

people who do not have a bank account to enter the

formal business sector. As many as 95 million new

jobs could be created, and the GDP of developing

countries increased by $ 3.7 trillion. Therefore, the

use of Fintech is proven to be able to open greater

access to formal financial services, encourage

economic growth, and inclusive and sustainable

development. The challenge for Indonesia is to make

the process of development and public service

adaptive to the development of Fintech. Therefore,

the purpose of this study is to find out clear

regulations, collaboration, and financial literacy in

the application of Fintech optimization for MSMEs in

East Java. Therefore, this study wants to find out

whether regulation, financial literacy, and

collaboration have a significant effect on the

application of financial technology?

Herdinata, C.

Financial Technology Application in Small and Medium Businesses.

DOI: 10.5220/0009960801970200

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 197-200

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

197

2 LITERATURE REVIEW

2.1 Financial Technology (Fintech)

Creating development for the poor who are

vulnerable and able to access financial services, this

Fintech is one of the strategic solutions to realize

financial inclusion. This solution is dedicated to users

of financial services for payment, trading, capital

market activities, and much more (Ion and Alexandra,

2016). The process of technology substitution in it is

much better for encouraging long-term investment

and capital placement in various productive sectors

(Rong et al., 2013). However, many innovative

products have subsequently failed to reach critical

mass users and even do not exist anymore (Teja,

2017). Hyytinen, Pajarinen, & Rouvinen (2015)

stated that companies that focus their primary

attention on developing superiority products tend to

fail.

Fintech is a new financial technology product that

can facilitate various transactions, both payments,

investments, and insurance (Teja, 2017). Natural

features will produce a high level of comfort so that

the successful application of Fintech can be

optimized. The biggest challenge in developing

financial innovation is a superior product whose

function is accepted in the habit of using the user's

daily payment system without changing user habits

(Teja, 2017). Users do not need to go to banks

anymore and spend their time on credit arrangements,

currency exchange, and many more (Kalmykova and

Tyabova, 2016). These tools make life easier;

however, they pose a serious threat to banks; services

should be created more convenient and useful to

retain clients. Therefore, the bank and credit system

began to change actively (Kalmykova and Tyabova,

2016). This illumination of Fintech will achieve the

goal of user convenience, user comfort, and being

able also to minimize the cost of money creation to

various credit cards that are more familiar among

users (Teja, 2017).

2.2 Regulation

The Fintech market is proliferating, followed by the

emergence of new business start-ups every month,

but on the other hand, there are still no clear legal

regulations from the government related to the

development of this financial technology. Financial

technology is developing so fast that it is challenging

to manage all the innovative features of legal control

(Kalmykova and Tyabova, 2016). Users will

empirically consider the factors that influence the

expectations of both users and organizations in

adopting Fintech, including customer trust, data

security, the added value from fintech itself. Clear

regulations will increase customer confidence, data

security, and user design appearance, which influence

the implementation of FinTech (Stewart and Jurjens,

2018).

2.3 Collaboration

Sterman et al., In Teja (2017), stated that the strategy

of implementing Fintech, whose aim is to achieve

rapid growth, could create the risk of excess industrial

capacity. Thus the company needs to overcome these

problems by becoming a leader in a business

ecosystem through collaboration. By binding a user

network and changing the user's role into a developer,

the assumption is that the company will get more

acceptance (Lu, C., Rong, K., You, J., & Shi, Y.

(2014). Transforming users into developers can open

up new opportunities (Overholm, 2014; McKelvey et

al., 2015). The prospect of its application will grow

faster than competitors when using collaboration

between industry and the business ecosystem.

2.4 Financial Literacy

The Financial Services Authority surveyed in 2013

that the level of financial literacy of the Indonesian

population was divided into four parts, well literate

21.84%, sufficient literate 75.69%, less literate

2.06%, and not literate 0.41%. (www.ojk.go.id,

2017). The survey is based on the knowledge and

beliefs of Indonesians about financial services

institutions, including financial service products,

such as features, benefits and risks, rights, and

obligations related to financial products and services,

to their skills in using them. The potential impact of

Fintech on the financial industry, to create stability

and access to services (Philippon, 2016). Some

financial sectors and startups see Fintech as a gateway

to increase business opportunities. However, on the

other hand, there are also security threats increasing

rapidly and have become a challenge for Fintech

users if users are not equipped with a good

understanding of financial literacy (Stewart and

Jurjens, 2018).

Therefore, in this study, a research hypothesis was

formed relating to regulation, financial literacy, and

collaboration, and the application of financial

technology, as follows:

H1: Regulation has a significant effect on the

application of financial technology

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

198

H2: Financial literacy has a significant effect on

the application of financial technology

H3: Collaboration has a significant effect on the

application of financial technology

3 RESEARCH METHODOLOGY

The study was conducted using quantitative. The

research population is MSMEs in East Java. The

sampling technique uses nonprobability sampling,

which is a convenience sampling of 148 MSMEs. The

source of data used in this study came from primary

data through questionnaires and secondary data. The

data measurements were carried out in this study

using a Likert scale. Validity measurement is the

accuracy or accuracy of the test in carrying out its

measurement function Suryabrata (2000) in Rahayuni

(2015). The statement is said to be valid if the

significance value of the correlation is,00.05 or 5%

(Lingga, 2012). Reliability measurements to see the

questionnaire questions can consistently reflect the

construct being measured. A particular item in the

questionnaire must consistently produce things that

are relatively similar to the whole case seen through

measurements with the Cronbach's Alpha technique

with reliability that can be accepted if Cronbach’s

Alpha ≥ 0.6 (Priyatno, 2014: 64). The analysis

technique used in this study is Multiple Linear

Regression.

4 RESEARCH RESULT

The results of this research model show that the F test

is significant so that it meets the goodness of fit of a

model. The research sample consisted of 148 MSME

businesses in the study. The following table is the

results of the F test in Table 1.1

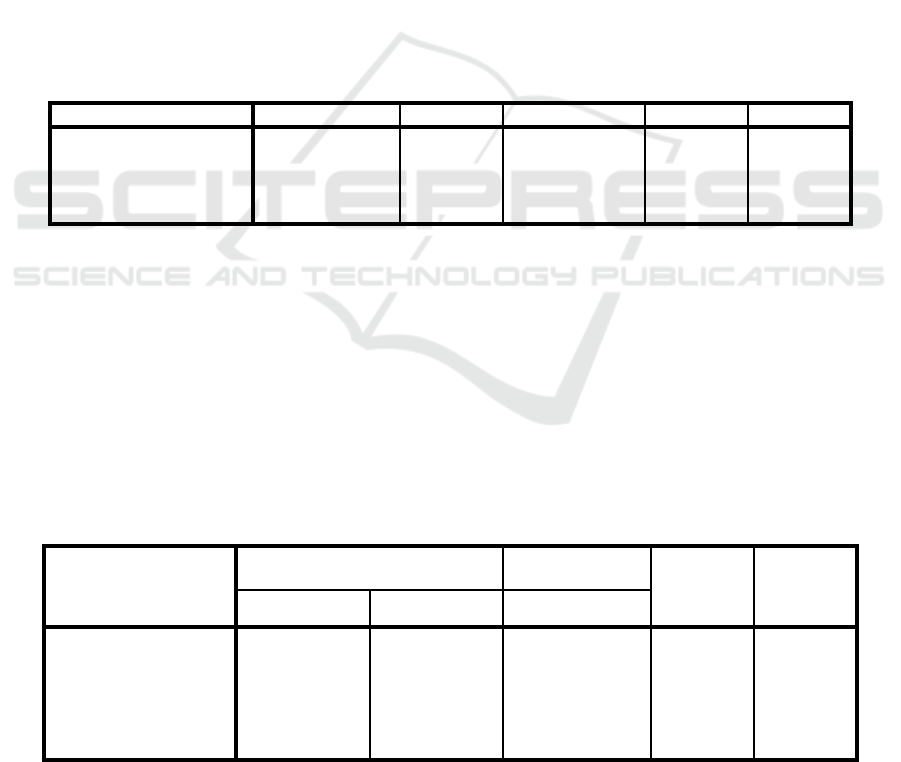

Table 1: Test Results F

Model Sum of Squares df Mean Square F Sig.

1 Regression 18.470 3 6.157 27.323 .000b

Residual 32.448 144 .225

Total 50.919 147

a. Dependent Variable: Y_PF

b. Predictors: (Constant), X3_Kol, X2_Lit, X1_Reg

The following are the results of the t-test on

testing the effect of regulations on the application of

financial technology found to have no significant

effect with a value of 0.147 greater than 0.05.

Therefore hypothesis (H1) is rejected. Furthermore,

to test the effect of financial literacy on the

application of financial technology, it had no

significant effect with a value of 0.170 greater than

0.05. Therefore, the H2 hypothesis is rejected. On the

other hand, the effect of collaboration on the

application of financial technology found a

significant effect that is equal to 0,000 below 0.05.

Therefore the hypothesis (H3) is accepted. T Test

results can be seen in Table 1.2.

Table 2: Test Results t

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

(Constant) 2.719 .230 11.838 .000

X1_Reg .086 .059 .139 1.457 .147

X2_Lit .106 .077 .116 1.379 .170

X3_Kol .268 .062 .419 4.309 .000 (*)

Information:

Dependent Variable = Y-PF

(*) = Sig. 0.05

Financial Technology Application in Small and Medium Businesses

199

The results showed that the effect of regulations

on the application of financial technology had no

significant effect. This can happen because the

Fintech market is growing so fast, followed by the

emergence of new business start-ups every month.

However, on the other hand, there are still no clear

legal regulations from the government related to the

development of this financial technology. This is in

line with Kalmykova and Tyabova (2016), who

explain that the control of the law is difficult to follow

the development of financial technology that is so

fast.

The effect of financial literacy on the application

of financial technology has no significant effect. This

is in line with the results of the Financial Services

Authority has surveyed in 2013 the level of financial

literacy of the Indonesian population is divided into

four parts well literate 21.84%, sufficient literate

75.69%, less literate 2.06%, and not literate 0.41 %

(www.ojk.go.id, 2017). This shows that the financial

literacy of the Indonesian population is still relatively

low. Therefore, financial literacy is not significant to

the application of financial technology because the

level of financial literacy still needs to be improved.

On the other hand, the effect of collaboration on

financial technology was found to be significant. This

shows that collaboration influences the application of

financial technology to SMEs. This shows MSMEs

must own that collaboration in the application of

financial technology. This is consistent with what

Teja (2017) revealed that collaboration with other

companies in a business ecosystem would produce

competence to achieve a critical mass of minimum

adopters and higher probability so that innovative

financial-related products will be able to be

successfully implemented.

5 CONCLUSION

This study found that financial regulation and literacy

had no significant effect on the application of

financial technology. On the other hand,

collaboration has a significant influence on the

application of financial technology. This shows that

financial regulation and literacy are things that need

to be improved so that the application of financial

technology can be optimized. Collaboration is a thing

that makes a significant contribution to the

application of financial technology. Therefore, the

role of government, the private sector, and society at

large and consumers, in particular, becomes vital in

the success of financial technology.

REFERENCES

Hyytinen, A., Pajarinen, M., & Rouvinen, P. (2015). Does

innovativeness reduce startup survival rates?. Journal of

Business Venturing, 30, 564-581.

Ion, Alexadra. (2016). Financial Technology (Fintech) and

Its Implementation on the Romanian Non-Banking

Capital Market. Practical Application of Science. Vol

IV, Issue 2.

Kalmykova, Ekaterina., Anna Ryabova. (2016). FinTech

Market Development Perspectives. SHS Web of

Conferences. Vol 10.

Lu, C., Rong, K., You, J., & Shi, Y. (2014). Business

ecosystem and stakeholders’ role transformation:

evidence from chinese emerging electric vehicle

industry. Expert Systems with Applications, 41, 4579-

4595.

McKelvey, M., Zaring, O., & Ljungberg, D. (2015).

Creating innovative opportunities through research

collaboration: an evolutionary framework and

empirical illustration in engineering. Technovation, 39-

40, 26-36.

Overholm, H. (2014). Collectively created opportunities in

emerging ecosystems: the case of solar service

ventures. Technovation, 39-40, 14-25.

Rong, Ke., Yongjiang Shi. (2013). Business ecosystem

extension: facilitating the technology substitution.

International Journal of Technology Management. Vol

63 no 3.4.

Stewart, Harrison,. Jan Jurjens. (2018). Data Security and

Consumer trust in Fintech Innovation in Germany.

Teja, Adrian. (2017). Indonesian Fintech Business: New

Innovations or Foster and Collaborate in Business

Ecosystems?. The Asian Journal of Technology

Management. Vol. 10 No. 1 pp 10-18.

Philippon, Thomas. (2016). The Fintech Opportunity.

National Bureu of Economic research.

http://www.nber.org/papers/w22476.

Priyatno, Duwi. (2014). SPSS 22 Pengolah Data Terpraktis.

Andi. Yogyakarta.

www.ojk.go.id, (2017). https: //www.ojk.go.id/id/ data-

dan-statistik/ laporan tahunan/ Pages/ Laporan -

Tahunan - OJK - 2017. aspx 10 september 2019

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

200