Analysis of Community Needs Level with Life Insurance Interest

Iin Afrina

Department of Management, STIE Trisna Negara, South Sumatera, Indonesia

Keywords: Community needs, interest in life insurance

Abstract: Life Insurance is one type of insurance business that focuses on health, education, savings, and old-age

insurance, but for some people who know it actually assume that life insurance is very useful but for others,

it is actually life insurance that will get strong criticism from the community. They feel afraid that if they are

deceived by life insurance by just taking the money, they also feel threatened that death will approach them.

This study aims to provide public confidence that life insurance is important for the community to obtain

savings, health insurance, education, and guarantees in old age. This life insurance has been established for

more than 90 years and has expanded all over the world.

1 INTRODUCTION

A person's soul is very influential in the life lived by

each individual. If someone's soul wants to get more

treatment, then it must be wise to use the money to

get it, namely by getting life insurance, in addition to

getting health protection, education, savings also get

assets on the old days. This life insurance is not

haphazard in choosing agents who are registered at

the head office because previously prospective

customers go through oral tests and written

examinations that are very strict, if one does not pass

it can not run the life insurance agent profession,

therefore responsibility towards customers is

prioritized for the sake of the smooth life insurance

company.

This life insurance has positive and negative

impacts from the community because, for some

people, this life insurance is useful and beneficial, but

for others, it will be criticized, and they fear death will

quickly come to them when it is included in the life

insurance. Beginning in the history of life insurance,

founded in 1984 in London, this company is the

largest life insurance company and the largest retail

financial service in the world that controls 25 million

customers. This life insurance is listed on the London

Stock Exchange (1924) and New York. In 1912 Life

Insurance claimed Titanic Disaster and obtained an

AA + rating from standard & poor, s and Moody, s as

world recognition in managing a very healthy and

strong financial condition. In 2009 Forbes magazine

gave a statement in which it was stated that there were

100 world companies that would survive for another

100 years, and one of them was the Prudential life

insurance company.

Prudential Life Insurance was established in

Indonesia in 1995 and had experience in Indonesia for

more than 17 years, and this insurance is also the

market leader for unit-linked products (life insurance

products that are linked to investment) in Indonesia.

This insurance has the best award, namely, in 2002-

2006, the Best Asset Life Insurance above Rp.1

Triluan. In 2007, the Best Asset Life Insurance was

over IDR 5 Trillion. In 2008-2010 the Best Asset Life

Insurance above Rp. 7.5 trillion. In 2011-2012 the

Best Asset Life Insurance was above Rp. 15 Trillion.

The concept possessed by this insurance is an

education fund, wealth accumulation, and an

emergency fund.

The world's first well-recorded policy was issued

in England on June 15, 1583, on behalf of William

Gybbons, one of London's salt merchants who were

afraid of rumors of an infectious plague that was

contagious at the time. Gybbons asked for coverage

of $ 400 for a one-year protection period and paid $

32 in return to the guarantor, a group of money

owners who used to gather at a coffee shop. The basis

for the purchase of life insurance by William

Gybbons at the time was the spread of word of mouth

that said that for 70 years, there would be contagious

infectious diseases that attacked the city of London

and its surroundings five times. Every time the

disease came, at least 20% of the population of

London who died and to overcome the panic of

citizens, in 1603, the city of London issued a Bills of

Mortality to prove that the deaths that occurred were

Afrina, I.

Analysis of Community Needs Level with Life Insurance Interest.

DOI: 10.5220/0009966504470451

In Proceedings of the International Conference of Business, Economy, Entrepreneurship and Management (ICBEEM 2019), pages 447-451

ISBN: 978-989-758-471-8

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

447

not as big as the rumors. In its development, Bills of

Mortality is the basis of the Table of Mortality, and

now the term is known as Life Insurance.

2 RESEARCH METHODS

Samples used in this study are data time series,

including housewives, civil servants, farmers,

entrepreneurs. Types and sources of data used are

secondary quantitative data. The data collection

technique used is the documentation method. This

study uses secondary data from the unity insurance

book and insurance book, including data on health

funds, education funds, pension funds, savings, death

funds from various countries.

Correlation analysis method Productmoment is

used to find an outdegree of the linear relationship

between one variable with another variable

(Suliyanto, 2008). Data analysis using SPSS software.

The research model to determine the effect of the level

of community needs on life insurance interests.

3 RESULTS

The results of data processing using Life Insurance

product-moment correlation analysis methods with

various types or classes selected include A, B, C, D,

shown in table 1.

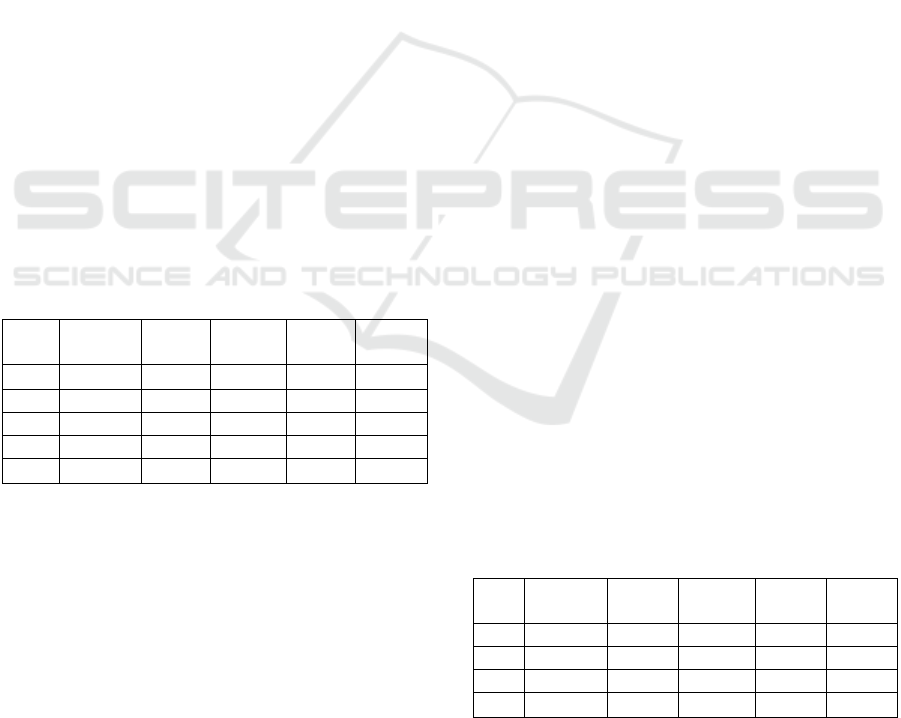

Table 1: Correlation Analysis Product MomentAsuran Life

type

Education

Fund

Fundmor

tality

healthFun

d

pension

fund

Savings

Class AJ AJ AJ AJ AJ

A 0.964 0.991 0.965 0.963 0.963

B 0.981 0.941 0.967 0.957 0.976

C 0.310 0.696 0.669 0.521 0.097

D 0.897 0.906 0,903 0,881 0.848

Source: Results of Data Processing with SPSS

In class A, the results of the correlation of AJ have

a value of r = 0.964, (significant) the correlation is

positive and is in very strong criteria. The results of

the correlation of education funds have a value of r =

0.991 (significant); the correlation is positive and is

in very strong criteria. The results of the correlation

of death funds have a value = 0.965 (significant); the

correlation is positive and is in very strong criteria.

The results of the correlation of health funds have a

value of r = 0.963 (significant); the correlation is

positive and is in very strong criteria. The correlation

results of pension funds and savings have a value of r

= 0.963 (significant); the correlation is positive and is

in very strong criteria.

In class B, the results of the correlation of

education funds have a value of r = 0.981

(significant); the correlation is positive and is in very

strong criteria. The results of the correlation of death

funds have a value of r = 0.941 (significant) positive

correlation and are in very strong criteria. The results

of the correlation of health funds have a value of r =

0.967 (significant); the correlation is positive and is

in very strong criteria. The correlation results of

pension funds have a value of r = 0.957 (significant);

the correlation is positive and is in very strong

criteria. The results of the correlation of savings have

a value of r = 0.976 (significant); the correlation is

positive and is in very strong criteria.

In class C, the results of the correlation of

education funds have a value of r = 0.310 (not

significant); the correlation is positive and is in the

weak criteria. The results of the correlation of death

funds have a value of r = 0.696 (not significant); the

correlation is positive and is in the medium criteria.

The results of the correlation of health funds have a

value of r = 0.669 (not significant); the correlation is

positive and is in the medium criteria. The results of

the pension fund correlation have a value of r = 0.521

(not significant); the correlations are positive and are

in the medium criteria. The results of savings

correlations have a value of r = 0.097 (not significant);

the correlation is positive and is in very weak criteria.

In class D, savings funds have a value of r = 0.897

(significant), the correlation is positive and is in very

strong criteria. Results of the correlation of death

funds have a value of r = 0.906 (significant); the

correlation is positive and is in very strong criteria.

The results of the correlation of health funds have a

value of r = 0.903 (significant); the correlation is

positive and is in very strong criteria. The correlation

results of pension funds have a value of r = 0.881

(significant); the correlation is positive and is in very

strong criteria. Savings correlation results have a

value of r = 0.848 (significant); the correlation is

positive and is in very strong criteria.

Table 2. Correlation Analysis Product Moment Insurance

class

Type

Education

Fund

Funddeat

h

Fund

health

pension

fund

Savings

A 0.509 0.452 0.500 0.476 0.496

B 0.299 0.238 0.144 -0.544 -0.495

C -0.407 0.000 0.176 -0.544 -0.495

D 0.299 0.354 0.223 0.188 0.147

Source: Results of Data Processing with SPSS

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

448

Results of data processing using the method of

correlation of life insurance product-moment

according to type A, B, C, D are shown in Table 2.

In class A, the results of the correlation of

education funds have a value of r = 0.509 (not

significant), the correlation is positive and is in the

medium criteria. The results of the correlation of

death funds have a value of r = 0.452 (not significant);

the correlation is positive and is in the weak criteria.

Health fund correlation results have a value of r =

0.500 (not significant); the correlation is positive and

is in the medium criteria. The results of the pension

fund correlation have a value of r = 0.476 (not

significant); the correlation is positive and is in the

weak criteria. The results of the correlation of savings

have a value of r = 0.496 (not significant); the

correlation is positive and is in the weak criteria.

In class B, the results of the correlation of

education funds have a value of r = 0.299 (not

significant); the correlation is positive and is in very

weak criteria. The results of the correlation of death

funds have a value of r = 0.238 (not significant); the

correlation is positive and is in very weak criteria.

The results of the correlation of health funds have a

value of r = 0.144 (not significant); the correlation is

positive and is in very weak criteria. The correlation

results of pension funds have a value of r = -0.544

(not significant); the correlation is negative and is in

very weak criteria. Savings correlation results have a

value of r = -0.495 (not significant); the correlation is

negative and is in very weak criteria.

In class C, the results of the correlation of

education funds have a value of r = -0.407 (not

significant) the correlation is negative and is in the

medium criteria. The results of the correlation of

death funds have a value of r = 0,000 (not significant);

the correlation is positive and is in very weak criteria.

The results of the correlation of health funds have a

value of r = 0.176 (not significant); the correlation is

positive and is in very weak criteria. The correlation

results of pension funds have a value of r = -0.544

(not significant); the correlation is negative and is in

the medium criteria. Savings correlation results have

a value of r = -0.495 (not significant); the correlation

is negative and is in the weak criteria.

Table 3. Correlation Analysis Product Moment Insurance

class

type

Fund

education

fund

death

health

fund

pension

funds

Savings

CU CU

A 0.509 0.452 0.500 0.476 0.496

B 0.299 0.238 0.144 -0.544 -0.495

C -0.407 0.000 0.176 -0.544 -0.495

D 0.299 0.354 0.223 0,188 0,147

Source: Results of Data Processing with SPSS

The results of data processing using the life

insurance product-moment correlation analysis

method, according to type A, B, C, D class, are shown

in Table 2.

In class A, the results of the correlation of

education funds have a value of r = 0.509 (not

significant), correlation positive value, and are in the

medium criteria. The results of the correlation of

death funds have a value of r = 0.452 (not significant);

the correlation is positive and is in the weak criteria.

Health fund correlation results have a value of r =

0.500 (not significant); the correlation is positive and

is in the medium criteria. The results of the pension

fund correlation have a value of r = 0.476 (not

significant); the correlation is positive and is in the

weak criteria. The results of the correlation of savings

have a value of r = 0.496 (not significant); the

correlation is positive and is in the weak criteria.

In class B, the results of the correlation of

education funds have a value of r = 0.299 (not

significant); the correlation is positive and is in very

weak criteria. The results of the correlation of death

funds have a value of r = 0.238 (not significant); the

correlation is positive and is in very weak criteria.

The results of the correlation of health funds have a

value of r = 0.144 (not significant); the correlation is

positive and is in very weak criteria. The correlation

results of pension funds have a value of r = -0.544

(not significant); the correlation is negative and is in

very weak criteria. Savings correlation results have a

value of r = -0.495 (not significant); the correlation is

negative and is in very weak criteria.

In class C, the results of the correlation of

education funds have a value of r = -0.407 (not

significant) the correlation is negative and is in the

medium criteria. The results of the correlation of

death funds have a value of r = 0,000 (not significant);

the correlation is positive and is in very weak criteria.

The results of the correlation of health funds have a

value of r = 0.176 (not significant); the correlation is

positive and is in very weak criteria. The correlation

results of pension funds have a value of r = -0.544

(not significant); the correlation is negative and is in

the medium criteria. Savings correlation results have

a value of r = -0.495 (not significant); the correlation

is negative and is in the weak criteria.

In class D, the results of the correlation of

education funds have a value of r = 0.299 (not

significant); the correlation is positive and is in very

weak criteria. The results of the correlation of death

funds have a value of r = 0.354 (not significant); the

correlation is positive and is in the weak criteria. The

results of the correlation of health funds have a value

of r = 0.223 (not significant); the correlation is

positive and is in very weak criteria. The results of the

pension fund correlation have a value of r = 0.188 (not

significant); the correlation is positive and is in very

Analysis of Community Needs Level with Life Insurance Interest

449

weak criteria. The results of the savings correlation

have a value of r = 0.147 (not significant); the

correlation is positive and is in very weak criteria.

The results of data processing using the product-

moment correlation analysis method for class A, B,

C, D types are shown in Table 3.

In class A, the correlation results for education

funds have a value of r = - 0.650 (not significant); the

correlation is negative and is on the medium criteria.

The results of the correlation of death funds have a

value of r = -0,669 (not significant); the correlation is

negative and

is in the medium criteria. The results of the

correlation of health funds have a value of r = -0,643

(not significant); the correlation is negative and is in

medium criteria. The correlation results of pension

funds have a value of r = -0,632 (not significant); the

correlation is negative and is in the medium criteria.

The results of the correlation of savings have a value

of r = -0,628 (not significant); the correlation is

negative and is in the medium criteria.

In class B, the results of the correlation of

education funds have a value of r = -0.067 (not

significant); the correlation is negative and is in very

weak criteria. The results of the correlation of death

funds have a value of r = -0.131 (not significant); the

correlation is negative and is in very weak criteria.

The results of the correlation of health funds have a

value of r = -0.142 (not significant); the relationship

is negative and is in very weak criteria. The

correlation results of pension funds have a value of r

= -0.047 (not significant); the correlation is negative

and is in very weak criteria. Savings correlation

results have a value of r = -0.108 (not significant); the

correlation is negative and is in very weak criteria.

Table 4: Results of correlation Analysis Product Moment

of Life Insurance class

type

Class

of Education

Fund

Death

Fund

Health

Fund

Pension

Fund

Savings

A -0,650 -0,669

-

0,6430,633

-0,632-

0,632

-0,628-

0,628

BB -0,067-0,067

-0,131-

0,131

-0,142-

0,142

-0,047-

0,047

-0,108-

0,108

CC 0,4070,407

-0,174-

0,174

-- 0,287 0,406 0,172

D -0,122 -0,200 -0,125 -0,101 -0,072

Source: Results of Data Processing with SPSS

In class C, the correlation results of education

funds have a value of r = 0.407 (not significant); the

correlation is positive and is in the weak criteria. The

results of the correlation of death funds have a value

of r = -0,174 (not significant); the correlation is

negative and is in very weak criteria. The results of

the correlation of health funds have a value of r = -

0.287 (not significant); the correlation is negative and

is in very weak criteria. The correlation results of

pension funds have a value of r = 0.406 (not

significant); the correlation is positive and is in the

weak criteria. The results of the correlation of savings

have a value of r = 0.172 (not significant); the

correlation is negative and is in very weak criteria.

In class D, the results of the correlation of

education funds have a value of r (Y) -0.122 (not

significant); the correlation is negative and is in very

weak criteria. The results of the correlation of death

funds have a value of r = -0,200 (not significant); the

correlation is negative and is in very weak criteria.

The results of the correlation of health funds have a

value of r = -0.125 (not significant); the correlation is

negative and is in very weak criteria. The correlation

results of pension funds have a value of r = -0,101

(not significant); the correlation is negative and is in

very weak criteria. Savings correlation results have a

value of r = -0.072 (not significant); the correlation is

negative and is in very weak criteria.

4 CONCLUSIONS AND

SUGGESTIONS

Based on the results of the analysis and discussion in

this study, it is concluded that there is a correlation

between classes A, B, C, and D with all the

performance of Life Insurance that includes

education funds, death funds, health funds, pension

funds, and savings. Class types A, B, C, D, correlate

with all performance life insurance, including

education funds, death funds, health funds, pension

funds, savings. Public interest is correlated with the

entire life insurance performance, including

education funds, death funds, health funds, pension

funds, savings.

The findings of this study contribute to Life

Insurance agents to more effectively process new

customers so that the interest of other communities

increases even more in getting the desired policy, and

accordingly, more and more customers participate in

life insurance.

REFERENCES

Asian Confederation of Insurance. 2002. Members.

Retrieved from https: //aaccu.coop/member-

category.php.

Keller, K. Lane. (2003). Strategic Brand Management.

Second Edition. Prentice-Hall.

ICBEEM 2019 - International Conference on Business, Economy, Entrepreneurship and Management

450

Khosmas, FY (2010). New People's Economy. Journal of

the Tajungpora University Pontianak.

Kotler, Phillip, and Armstrong, G. (2001). Marketing

Principles, volume 2 of the eighth edition, Jakarta:

Erlangga Publisher.

Lau, Geok Then, and Sook Han Lee. (2000). Consumers

Trust in a Brand and The Link to Brand Loyalty.

Journal of Market Focused Management.

Nitisemiyio, S. Alex. (2003). Personnel Management.

Jakarta: Ghaha Indonesia.

Relationship among GDP, Per capita GDP, Literacy Rate

and Unemployment Rate. British Journal Publishing

Sultan Qaboos University, 14 (2), 169-177.

Sifaqurrahman, M. (2013).

Soehardi, Sigit. (2002). Practical Marketing, Third Edition.

Yogyakarta: BPFE.

Sugiyono (2001). Administrative Research Methods.

Bandung: Alfabeta.

Suliyanto. (2008). Business Projection Techniques. Jakarta:

Andi Publisher.

Swastha, Basu. (2006). Modern Marketing Management.

Yogyakarta: BPFE.

World Bank. 2015. World Bank Group Data.

Retrieved fromhttp: //data.worldbank.org/indicator /.

www.prudential.co.id

www.prudentialasia.com

Analysis of Community Needs Level with Life Insurance Interest

451