Effect of Liquidity on Profitability

Yanshanti Buan Agusfina, and Sinarti

Department of Business Management, Politeknik Negeri Batam, Jl. Ahmad Yani, Batam, Indonesia

Keywords: Liquidity, Profitability, Current Ratio, Quick Ratio, Liquid Ratio, Net Profit Margin, Return on Equity, Return

on Capital Employed.

Abstract: This study aims to determine the effect of liquidity and profitability on 20 companies listed on the Indonesia

Stock Exchange in the infrastructure, utilities and transportation sectors for 5 years from 2013 -2017. This

study uses regression analysis to test 3 indicators of liquidity ratio (current ratio, quick ratio, and liquid ratio)

and 3 indicators of profitability ratio (net profit margin, return on equity, and return on capital employed).

The results of this study found that 2 liquidity indicators affect profitability indicators and 7 liquidity

indicators do not affect profitability indicators. Liquidity indicators that affect profitability indicators are the

Current Ratio significantly influence Return on Equity and, Quick ratio significantly influence to Return on

Capital Employed.

1 INTRODUCTION

Company management has an important task in

deciding and managing the company's economy in

order to maximize value and optimize profits.

Financial statements have the main focus of earnings,

financial statement information should have the

ability to predict future earnings with reference to

earnings in previous years. The optimal level of profit

can be calculated and analysed using profitability

ratios. Profitability ratios calculate the level of

company profitability in relation to the sale of total

assets, as well as own capital (Sartono, 2001). The

amount of profit is often compared to financial

conditions, this is to assess whether a company tends

to focus on profit or focus on company liquidity.

According to Hanafi & Halim (2012) Liquidity is

a measure of a company to meet short-term

obligations by considering current assets. Liquidity

refers to the company's ability to meet its short-term

obligations. Liquidity management ensures that the

company has the ability to meet current obligations.

Companies with high liquidity have a low

profitability risk, therefore companies must accept

low profits.

The company will be faced with a condition when

the company must determine the decision between

liquidity and profitability. If the company prefers to

increase the level of profit (profitability) will reduce

the level of liquidity. Conversely, if the company

prefers to increase liquidity, the company will reduce

the level of profitability. This needs to be considered

by the company, considering the liquidity and

profitability are two important things to guarantee and

develop the company's survival in the future. A high

level of liquidity allows the company to pay

obligations, but if the level of liquidity is low then the

company will experience insolvency and if this

problem continues to drag on, the company will likely

experience bankruptcy.

Previous research was conducted by Darmawan

(2010) in Indonesia using financial statements, with

the result that the liquidity ratio increased, but in

reality, the company was unable to pay the company's

obligations. The value of liabilities is higher than the

value of a guarantor owned by the company. The

company's profitability ratio generates significant

profits. Subsequent research in Sri Lanka by

(Ajanthan, 2013) found a significant relationship

between liquidity and profitability. Olerewaju &

Adeyemi (2015) investigated the existence and

direction of the interconnection between liquidity and

profitability for the period 2004-2013. They found no

causal relationship between liquidity and profitability

for 11 banks and unidirectional causality for 4 banks.

Similar research was also conducted by Hamid &

Akhi (2016) in Bangladesh, they suggest that there

is no significance between profitability and liquidity

in chemical companies in Bangladesh except Current

Ratio. Suryaningsih (2018) conducted a study in

Agusfina, Y. and Sinarti, .

Effect of Liquidity on Profitability.

DOI: 10.5220/0010354301470153

In Proceedings of the 2nd International Conference on Applied Economics and Social Science (ICAESS 2020) - Shaping a Better Future Through Sustainable Technology, pages 147-153

ISBN: 978-989-758-517-3

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

147

Indonesia on construction and building sub-sector

companies, the results of which liquidity and

solvency affected profitability.

Throughout 2017 the realization of investment

has increased especially in the infrastructure, utilities,

and transportation sectors reaching 51.42%.

Investment worth IDR 708.9 billion is recorded in

domestic investment in the transportation equipment

business. The Central Statistics Agency (BPS)

informs the public that in 2017 Indonesia's economic

growth reached 5.07% and stated that the

transportation and warehousing sector had the fastest

growth.

Chairman of the Indonesian Supply Chain,

Setijadi predicts that in 2019 Indonesia's

transportation sector will grow to reach 11.15% to

Rp740.4 trillion. On the other hand, the

telecommunications industry in 2018 experienced the

worst conditions in its growth. According to

Ririek Adriansyah as chairman of the

Telecommunications Association said that the growth

of Indonesian telecommunications - 6.4%, this is the

worst history during the growth of the Indonesian

telecommunications industry. The

telecommunications industry experienced a decline,

but at the same time in the era of President Jokowi's

administration, within 5 years the government

accelerated the construction of infrastructure into the

National Strategic Project (PSN). Until now the

National Strategic Project is recorded in the process

of working as many as 245 PSN at a cost of up to

Rp4,197 trillion rupiah. The current condition of

industry growth, especially in the infrastructure,

utilities and transportation sectors, requires

management's attention and management at every

company. It is important to consider the economic

growth promoted by the infrastructure, utilities and

transportation sectors.

2 LITERATURE REVIEW

Several studies on the relationship between liquidity

and profitability have been carried out, including

Konadu (2009) who examined the effects of liquidity

on profitability for banks listed on the Ghana Stock

Exchange for the period 2002-2006. Konadu includes

Current Ratio, Quick ratio, cash ratio, and net

operating cash flow ratio as indicators of liquidity.

Meanwhile, net profit margin, Return on Equity

(ROE), Return on Assets (ROA) and net asset

turnover ratios as indicators of profitability. The

results identified a negative relationship between

liquidity and profitability in the Ghana banking

sector. Research conducted by Vieria (2010)

examined the relationship between liquidity and

profitability of airlines for 2005-2008 between short

and medium term found a positive relationship in

both cases.

Subsequent research by Saleem & Rehman

(2011) examined 26 oil and gas companies from

Pakistan for 2004-2009 to identify the

interdependence of liquidity and profitability. They

find that Current Ratio, Quick ratio and liquidity ratio

have a significant impact on Return on Investment

(ROI) while only liquidity ratios affect ROA and have

no impact on ROE. A similar study conducted by

Niresh (2012) examined the cause and effect

relationship between liquidity and profitability for 31

manufacturing companies listed in 2007-2011 in Sri

Lanka found no significant relationship between

liquidity (Current ratio, Quick ratio, and Liquid ratio)

and profitability (net profit, return on capital used,

and ROE).

Saluju & Kumar (2012) in their research on the

liquidity and profitability trade off from Airtel Bharti

Limited for 5 years found a negative relationship

between liquidity and profitability. Siame (2012)

analyzes the effect of liquidity on profitability for 120

companies registered from different industries of

South Africa between 2000-2009 and concludes that

for all industries namely the consumer goods

industry, the resource industry, and the service sector,

there is a negative relationship between profitability

and liquidity measured by the cash conversion cycle.

Further research conducted by Bolek & Wilinski

(2012) studied the relationship between liquidity and

profitability of construction companies listed on the

Warsaw Stock Exchange index for the quarter period

in 2000-2010 and concluded that the possible

influence of the Quick ratio on ROA was around

98.24% which was 80 .77% for the cash conversion

cycle. The results of research by Ibe (2013) which

explored the impact of liquidity management on

profitability for Afribank Plc, United Bank for Africa,

and Diamond Bank Plc. Nigeria from 1995-2010 and

found a significant relationship between bank

liquidity and profitability. In addition, this study also

identified liquidity management as a major problem

for the Nigerian banking industry.

Zygmunt (2013) tried to find out the impact of

liquidity on profitability for 10 IT companies

registered from Poland for 2003-2011 and concluded

a statistically significant correlation. He found a

positive relationship between the receivable

conversion period and the inventory conversion

period with profitability (ROA, ROE and return on

sales).

ICAESS 2020 - The International Conference on Applied Economics and Social Science

148

A similar study was carried out in Bangladesh by

Akter & Mahmud (2014) that identified the

relationship between liquidity and profitability of the

banking sector in Bangladesh. They examined 12

banks from 4 different sectors namely government,

Islamic, multinational, and private commercial banks

for 2006-2011 and found no significant relationship.

Olerewaju & Adeyemi (2015) investigated the

existence and direction of the interconnection

between liquidity and profitability of 15 quoted bank

deposit money in Nigeria for the period 2004-2013.

They found no causal relationship between liquidity

and profitability for 11 banks and unidirectional

causality for 4 banks.

Mahardika (2015) uses the 2012-2014 quarterly

financial statements of the company. The sample used

was 10 property companies registered with ISSI. The

results of the study explained that jointly and

simultaneously (F test) liquidity affects profitability

(ROI and ROE). Suryaningsih (2018) tested the effect

of liquidity ratios and solvency ratios on profitability

in the construction and building subsector companies

on the Indonesia Stock Exchange for the period 2012-

2016, using a sample of 10 companies and periods

during the year. The result is liquidity and solvency

affect profitability.

Based on the results of research on 26 oil and gas

companies from Pakistan for 2004-2009 to identify

the interdependence of liquidity and profitability.

They find that Current Ratio, Quick ratio and Liquid

Ratio have a significant impact on Return on

Investment (ROI) while only liquidity ratios affect

ROA and have no impact on ROE (Saleem & Rehman

2011). The financial statements report how the

condition and financial position of a company in

the period and operational activities for several

periods. The condition and position of financial

statements can be studied and analysed using

financial ratios. Financial ratios are designed to assist

and evaluate financial statements (Brigham &

Houston, 2014).

Based on this explanation, the hypothesis can be

formulated as follows:

H1: Current Ratio significantly influences the Net

Profit Margin.

H2: Current Ratio significantly influences Return

on Equity.

H3: Current Ratio significantly influences the

Return on Capital Employed.

H4: Quick ratio significantly influences the Net

Profit Margin.

H5: Quick ratio significantly influences Return

on Equity.

H6: Quick ratio significantly influences Return

on Capital Employed.

H7: Liquid Ratio significantly influences the Net

Profit Margin.

H8: Liquid Ratio significantly influences Return

on Equity.

H9: Liquid Ratio significantly influences Return

on Equity Capital Employed.

3 RESEARCH METHOD

The technique used in sampling is non-probability

sampling, namely purposive sampling, the sample is

based on special provisions. In determining the

sample, it is required that only infrastructure, utilities,

and transportation companies have financial

statements listed on the Indonesia Stock Exchange for

the period 2013-2017. The company must also report

profitability and liquidity during the observation year.

If the sample does not meet these requirements, the

sample cannot be used.

Data analysis techniques are used to answer the

research hypothesis. The analytical tool used is

simple linear regression using the help of a programs

PSS 20.

According to Ghozali (2013), to measure the

strength of the relationship between variables using

regression analysis. Simple linear regression is a

method to determine the effect of two variables that

are divided into dependent and independent variables

and show the direction of the relationship. Regression

can be calculated with the following formula:

Y = α + βx (1

)

Information:

Y : Dependent Variable

α : Constant

βx : Variable Coefficient x

The basis for decision making in the regression

analysis can be seen from the significance value, i.e.

if the significance value> 0.05 then there is no

influence of the independent variables on the

dependent variable. Conversely, if the significance

value <0.05 then there is the influence of the

independent variable on the dependent variable.

The object of research used in this study is

infrastructure, utilities, and transportation companies

which publish their financial statements and are listed

on the Indonesia Stock Exchange. The sample taken

is a sample selected using predetermined criteria.

Effect of Liquidity on Profitability

149

74 companies are listed as population companies

listed on the Indonesia Stock Exchange, because this

research uses purposive sampling where the sample

must be based on certain criteria when used in

research. There were 54 companies that did not meet

the criteria for the study sample. Then, researchers

found 20 companies that fit the research criteria to be

used as research samples. Furthermore, the 20

companies multiplied by 5 years, the researchers get

a total of 100 samples.

4 RESULT AND DISCUSSION

The results of testing Hypothesis 1 regarding the

effect of Current Ratio on Net Profit Margin can be

seen in table 1.

Table 1: Result of the simple linear regression testing

hypothesis 1.

Based on the test results above, it can be seen that

the significance level of 0.665 is greater than 0.05, so

hypothesis 1 that is the current ratio significantly

influences the unsupported net profit margin. This

means that the net profit margin is not influenced by

the current ratio as an indicator of the liquidity ratio.

The results of this study are in line with research

conducted by Niresh (2012) who examined the cause

and effect of the relationship between liquidity and

profitability for 31 manufacturing companies

registered in 2007-2011 in Sri Lanka found no

significant relationship between liquidity (Current

ratio, Quick ratio , and Liquid ratio) to net profit

margin as an indicator of profitability.

Hypothesis 2 test results about the effect of the

current ratio on return on equity can be seen in table

2.

Table 2: Result of the simple linear regression testing

hypothesis 2.

Based on the test results above it can be seen that

the significance level of 0.033 is smaller than 0.05 so

that the 2 current ratio hypothesis has a significant

effect on return on equity, so this hypothesis is

supported. It can be concluded that the return on

equity is influenced by the current ratio as an

indicator of liquidity ratios. The results of this study

contradict the previous research conducted by Saleem

& Rehman (2011) examined 26 oil and gas

companies from Pakistan for 2004-2009 to identify

interdependencies of liquidity and profitability. They

find that Current Ratio, Quick ratio and liquidity ratio

have a significant impact on Return on Investment

(ROI) while only liquidity ratios affect ROA and have

no impact on ROE.

Hypothesis 3 testing results about the effect of

Current Ratio on Return on Capital Employed can be

seen in the following table 3.

Table 3: Result of the simple linear regression testing

hypothesis 3.

Based on the results, can be seen that the

significance level of 0.059 is greater than 0.05, it can

be concluded that the hypothesis 3 Current Ratio

significantly influence Return on Capital Employed

can be stated hypothesis test results 3 are not

supported. This means that the return on employed

capital is not influenced by the current ratio as an

indicator of the liquidity ratio. The results of this

study are in line with previous studies conducted by

Saleem & Rehman (2011) and Niresh (2012).

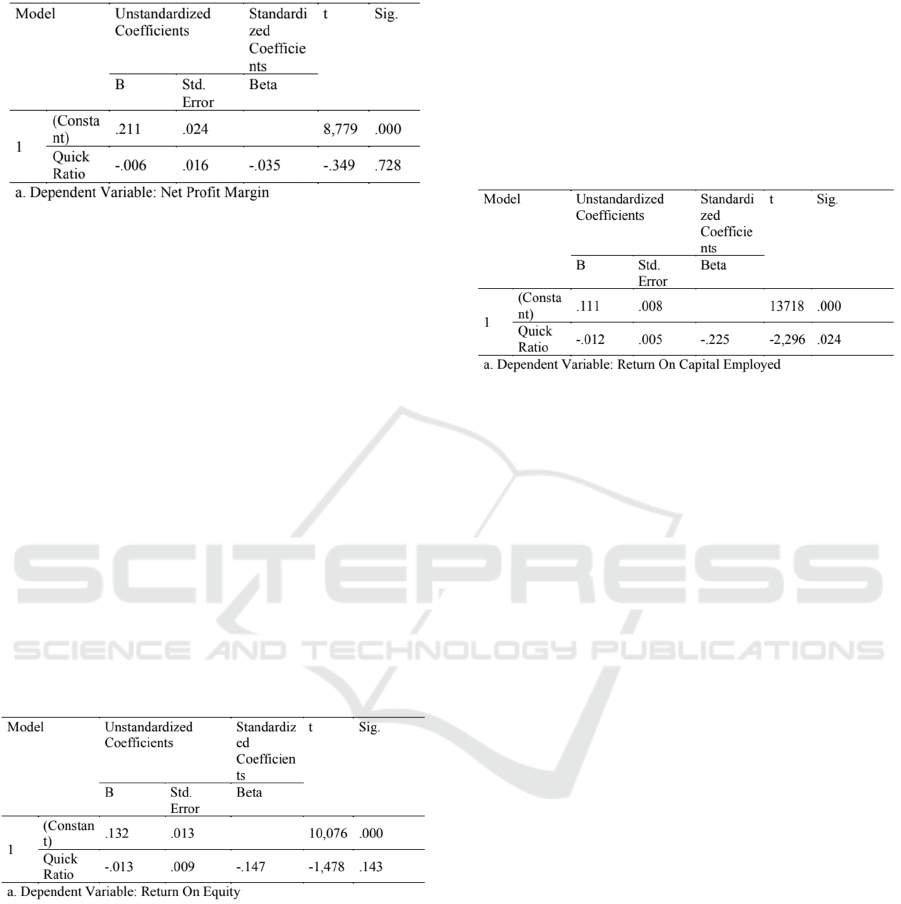

The results of testing the hypothesis about the

effect of Quick Ratio on Net Profit Margin can be

seen in table 4.

ICAESS 2020 - The International Conference on Applied Economics and Social Science

150

Table 4: Result of the simple linear regression testing

hypothesis 4.

Based on results the above test can be seen that

the significance level of 0.728 is greater than 0.05, it

can be concluded that Hypothesis 4 Quick Ratio

significantly affects the Net Profit Margin it can be

stated that the results of hypothesis 4 test are not

supported. It can be concluded that the net profit

margin is not affected by the quick ratio as an

indicator of liquidity ratios. This results is in line with

research conducted by Niresh (2012) who examined

the cause and effect of the relationship between

liquidity and profitability for 31 manufacturing

companies registered in 2007-2011 in Sri Lanka did

not find a significant relationship between liquidity

(Current ratio, Quick ratio, and Liquid ratio) to the net

profit margin as an indicator profitability.

The results of testing the hypothesis about the

effect of Quick Ratio on Return on Equity can be seen

in table 5.

Table 5: Result of the simple linear regression testing

hypothesis 5.

Based on the results of the above test it can be seen

that the significance level of 0.143 is greater than

0.05, it can be concluded that the 5 Quick Ratio

hypothesis has a significant effect on Return on

Equity, it can be stated that the results of hypothesis

test 5 are not supported. It can be concluded that

return on equity is not influenced by quick ratio as an

indicator of liquidity ratios. The results are in line

with the results of previous studies conducted by

Saleem & Rehman (2011) examined 26 oil and gas

companies from Pakistan for 2004-2009 to identify

interdependencies of liquidity and profitability. They

found that the quick ratio had a significant impact on

Return on Investment (ROI) while only the liquidity

ratio affected ROA and had no impact on return on

equity (ROE).

The results of testing the hypothesis about the

effect of Quick Ratio on Return on Capital Employed

can be seen in table 6.

Table 6: Result of the simple linear regression testing

hypothesis 6.

Based on the results of the above test it can be seen

that the significance level of 0.024 is less than 0.05, it

can be concluded that the hypothesis 6 Quick Ratio

significantly influences Return on Capital Employed

can be stated that the results of the hypothesis test 6

are supported. It can be concluded that the return on

capital employed is influenced by the quick ratios an

indicator of liquidity ratios. The results of the

research in hypothesis 6 (H6) are in line with the

results of previous studies conducted by Viera (2010)

found a positive effect on quick ratio as an indicator

of liquidity on return on capital employed as an

indicator of profitability. The results of the three

hypothesis tests state that there is a negative influence

which means that if there is an increase in the quick

ratio liquidity indicator it will reduce the profitability

indicator of net profit margin, return on equity and

return on capital employed. Conversely, if there is a

decrease in the liquidity indicator quick ratio will

increase the profitability indicator of net profit

margin, return on equity and return on capital

employed.

The results of testing the hypothesis of the effect

of Liquid Ratio on Net Profit Margin can be seen in

table 7.

Based on the results of the above test it can be seen

that the significance level of 0.639 is greater than

0.05, it can be concluded that the 7 Liquid Ratio

hypothesis significantly influences the Net Profit

Margin, it can be stated that the results of the

hypothesis 7 test are not supported. It can be

concluded that the net profit margin is not affected by

liquid ratio as an indicator of liquidity ratios.

Effect of Liquidity on Profitability

151

Table 7: Result of the simple linear regression testing

hypothesis 7.

The results of testing the hypothesis of the effect

of Liquid Ratio on Return on Equity can be seen in

table 8.

Table 8: Result of the simple linear regression testing

hypothesis 8.

Based on the results of the above test it can be seen

that the significance level of 0.096 is greater than

0.05, then the hypothesis 8 Liquid Ratio significantly

influences Return on Equity can be concluded that

hypothesis 8 is not supported. This means that return

on equity is not influenced by liquid ratio as an

indicator of liquidity.

The results of testing the hypothesis of the effect

of Liquid Ratio on Return on Capital Employed can

be seen in table 9.

Table 9: Result of the simple linear regression testing

hypothesis 9.

Based on the results of the above test it can be seen

that the significance level of 0.094 is greater than

0.05, then Dehypnotises 9 Liquid Ratio significantly

influences Return on Capital Employed it can be

concluded that Hypothesis 9 is not supported. This

means that return on employed capital is not affected

by liquid ratio as an indicator of liquidity.

According to Duijm (2016) assets liquid

contained in the balance sheet of financial statements

covering all cash, securities, cash reserves in the

central bank to capital. Good management and

policies will lead to the calculation and measurement

of the ability to get profitability of the company. In

the three hypothesis tests that have been carried out

in this study, finding that the liquid value of the

company does not affect the profitability aspects of

companies listed in the infrastructure, utilities, and

transportation sectors, namely net profit margin,

return on equity, and return on employed capital. The

results of the three hypothesis tests state that there is

a negative influence, which means that if there is an

increase in the liquidity liquid ratio indicator, it will

decrease the profitability indicator of net profit

margin, return on equity and return on capital

employed.

5 CONCLUSIONS

Based on the research that has been done, it can be

concluded:

Current Ratio effect on Return on Equity can be

interpreted that any change by the Current Ratio

liquidity indicator will cause Return on Equity to

increase or decrease. However, Current Ratio does

not significantly influence Net Profit Margin and

Return on Capital Employed. It can be concluded that

the value of Net Profit Margin and Return on Capital

Employed tends to be stable even though the Current

Ratio liquidity indicator changes.

Quick Ratio does not affect Net Profit Margin and

Return on Equity, meaning that any changes to Quick

Ratio do not have an impact on Net Profit Margin and

Return on Equity. However, Quick Ratio affects the

Return on Capital Employed meaning that any

changes to the Quick Ratio will cause the Return on

Capital Employed to decrease or increase.

Liquid Ratio does not affect the three indicators of

profitability, i.e. Net Profit Margin, Return on Equity,

and Return on Capital Employed. then any changes

that occur in Liquid Ratio will not affect all three

profitability indicators.

Every company whether listed on the IDX or not

must manage the company's liquidity as well as

possible. With high liquidity, the company will be

able to pay short obligations. High liquidity value also

ICAESS 2020 - The International Conference on Applied Economics and Social Science

152

has a high risk, so management must balance the

opportunity and risk. An increase in current assets and

current liabilities is one way to deal with low liquidity

values, while minimizing current assets and current

liabilities is one way to deal with if the liquidity value

is too high.

Furthermore, profitability is the main goal of

every company. High profit illustrates the high

productivity of financial performance. High

profitability is also not uncommon to attract investors

to want to invest. Wise financial management will

produce the right decisions for the future. Therefore,

companies should also pay attention to the level of

value of each profitability ratio indicator including

Net Profit Margin, Return on Equity, and Return on

Capital Employed.

REFERENCES

Ajanthan, A. (2013). A nexus between Liquidity and

Profitability; A Study of Trading Companies in Sri

Lanka. European Journal of Business and Management,

5 (7).

Akter, A., & Mahmud, K. (2014). Liquidity and

Profitability Relationship in Bangladesh Banking

Industries. International Journal of Empirical Finance,

143-151.

Bolek, M., & Wilinski, W. (2012). The Influence of

Liquidity on Profitability of Polish Construction Sector

Companies. Financial Internet Quartely e-Finance.

Brigham & Houson. (2014). Financial Management (8th).

Jakarta: Salemba Empat.

Ghozali, I. (2013). Application of Multivariate Analysis

with SPSS Program. Semarang: Diponegoro University

Publisher Agency.

Hamid, MK, & Akhi, RA (2016). Liquidity and

Profitability Trade-off in the Pharmaceuticals and

Chemicals Sector of Bangladesh. International Journal

of Science and Research, 420-423.

Hanafi, & Halim. (2012). Financial Statement Analysis.

Yogyakarta: UPPAMP YKPN.

Ibe, SO (2013). The Impact of Liquidity Management on the

Profitability of banks in Nigeria. Journal of Finance

and Bank Management, 37-48.

Konadu, JS (2009). Liquidity and Profitability: Empirical

Evidence from listed Banks in Ghana. Kwane Nkrumah

University of Science and Technology.

Kieso, DE, & Weygandt, JJ (2008). Intermediate

Accounting Edition VII Volume III. Jakarta: Binarupa

Aksara

Niresh, JA (2012). Trade Off between Liquidity and

Profitability a Study of Selected Manufacturing Firms

in Sri Lanka. Researchers World Journal of Arts,

Science and Commerce, 2-4.

Olerewaju, OM, & Adeyemi, OK (2015). Causal

Relationship Between Liquidity and Profitability of

Nigerian Deposit Money Banks. International Journal

on Academic Research in Accounting Finance and

Management Sciences, 165-171.

Saleem, Q., & Rehman, RU (2011). Impacts of Liquidity

ratios on Profitability Case of Oil and Gas Companies

of Pakistan. Interdisclipinary Journal of Research in

Business, 95-98.

Saluju, P., & Kumar, P. (2012). Liquidity and Profitability

Trade Off (A Study on Airtel Bharti Limited).

International Journal of Advanced Research in

Management and Social Sciences, 77-84.

Siame, C. (2012). The Relationship between

Profitability and Liquidity in South African Listed

Firms. University of Cape Town.

Suryaningsih, W. (2018). Analysis of the Effect of Liquidity

and Solvency on Profitability on Construction and

Building Companies listed on the IDX. Management

Skirpsi, Muhammadiyah University.

Vieria, RS (2010).

The Relationship Between Liquidity

and Profitability an Exploratory Study of Airline

Companies Between 2005 and 2008. Unpublished

Master Thesis of UMEA University.

Zygmunt, J. (2013). Does Liquidity impact on

Profitability. In Proceedings of the Conference of

Informatics and Management Sciences, 247-251.

Effect of Liquidity on Profitability

153