Security of Digital Banking Systems in Poland: Users Study 2019

Wojciech Wodo and Damian Stygar

Department of Computer Science, Wroclaw University of Science and Technology, Wybrzeze Wyspianskiego 27,

Keywords:

Banking, Electronic Banking, Mobile Banking, Security, Biometrics, 2FA.

Abstract:

Our aim of this study was to discover believes, behaviors, thoughts and habits of digital banking users in

Poland, we wanted to understand their motivation and drivers while using electronic and mobile financial

services. Thanks to using Design Thinking research methodology we empathized users deeply and defined

personas - representing user groups of common features and way of thinking and acting. Our desk research

and users interview resulted in the identification of a number of aspects of e-banking, that can/should be taken

into consideration by its users and, possibly, providers in order to assess the security of the service from the

perspective of usability. We have interviewed 62 people in Poland (age span 16-72, different professions

and familiarity level with e-banking solutions) in a form of qualitative study – in-depth survey (one hour per

person) and discussed security issues with several Polish banks representatives. This paper is essence extract

of full research conducted in this area. It presents and summarises the main assumptions and results.

1 INTRODUCTION

The year 2019 for the development of digital ser-

vices and digitization of administration in Poland was

very significant. We mean both state administration

services, where tax settlement has been fully started

for the first time - Your e-PIT (Ministry of Finance,

2019), new ID cards have been introduced with the

electronic layer (Ministry of Digital Affairs, 2019a),

the mObywatel application (Ministry of Digital Af-

fairs, 2019b) enabling confirmation of identity, but

above all preparing the financial sector for the im-

plementation of the PSD2 Directive (European Par-

liament, 2015), launching and issuing of the test API

interface by the banks (Zwiazek Bankow Polskich,

2019a) and fintech reinforcement to take over the fi-

nancial services sector (Zwiazek Bankow Polskich,

2019b). This state of affairs is very pleasing from

the point of view of economic development and in-

creasing the comfort of implementation of many ac-

tivities, both private and business. However, behind

the rapidly moving digitization comes the risk of: cy-

bersecurity threats, lack of user awareness, room for

abuse and failure to adapt legal provisions quickly.

The government has taken steps to guarantee a legal

basis for certain activities and services. These ac-

tivities are: the Act on Cyber Security (Polish Par-

liament, 2018c), the Act prohibiting the production

of documents imitating identity documents and docu-

ments authorizing to perform activities (Polish Parlia-

ment, 2018b), or the previously ratified, widely dis-

cussed GDPR (Polish Parliament, 2018a).

1.1 Motivation

The enormous pace of adoption of new technologies

in every domain of life, both private and business

1

,

is not reflected in informational and education cam-

paigns that would ensure safe and informed use of the

benefits of digital services. The area of this study is

electronic finance, digital banking and financial ser-

vices.

We are interested in how do current users of finan-

cial services and electronic banking perceive available

solutions, how do they view security issues, how do

they feel like when using different forms of payment,

or whether are they aware of the threats arising from

various technological solutions and risky behaviors.

We would like to get to know the users better, their

attitudes and fears, to be able to identify areas that are

worth special attention in the context of education, in-

formation, and the ability to change the formula of the

services provided.

The guidelines we have developed aim to identify

elements that improve the comfort and safety of using

1

https://hbr.org/2013/11/the-pace-of-technology-

adoption-is-speeding-up

Wodo, W. and Stygar, D.

Security of Digital Banking Systems in Poland: Users Study 2019.

DOI: 10.5220/0008555202210231

In Proceedings of the 6th International Conference on Information Systems Security and Privacy (ICISSP 2020), pages 221-231

ISBN: 978-989-758-399-5; ISSN: 2184-4356

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

221

new services. We believe that our research will help

to capture aspects that were not included in the prepa-

ration and design of services and systems by banks or

state administration. We want to shed new light on

the financial services ecosystem from a user perspec-

tive that is not uniform. This paper is essence extract

of full research conducted in this area. It presents and

summarises the main assumptions and results.

1.2 State of the Art

In the area of electronic banking, research is ongoing

to monitor the state of its development, availability of

services, threats and the structure of users. Thanks to

the activity of the Polish Bank Association (ZBP) the

Bank Cybersecurity Center was established, which

monitors incidents and threats in the network, and

coordinates and manages difficult situations. ZBP

also regularly publishes reports on topics related to

the level of adoption of banking services in the coun-

try, as well as security issues. It is worth quoting the

2018 report on the ”Cybersecure Portfolio” (Zwiazek

Bankow Polskich, 2018) indicating the behavior and

preferences of banking customers as well as paper

”PSD2 and Open Banking - Revolution or evolution?”

(Zwiazek Bankow Polskich, 2019b) looking at the is-

sues of open banking and the PSD2 directive, as well

as business opportunities and threats to the fintech

market. Thanks to the cooperation of the Conference

of Financial Companies in Poland and EY, an annual

report (since 2009) on fraud in the financial sector is

created (The Conference of Financial Companies in

Poland, 2018). The report presents changes in the

digital banking services market, new threats and pol-

icy changes for financial institutions. In 2019, Mas-

terCard performed research in the context of Polish

consumers’ attitudes towards online shopping, taking

into account the upcoming changes in e-commerce

payments. The result of their work is the ”Secure

e-shopping” report. The authors prove that biomet-

rics will become the standard for confirming iden-

tity in payments. In addition, more than 75% of re-

spondents believe that strong authentication of online

card payments, which will enter into force in mid-

September 2019, is needed, which clearly sets a new

trend in banking. In 2016, Polish users’ preferences,

their attitudes and level of awareness in relation to the

security of mobile devices and biometrics were exa-

minded. This work resulted in the report ”Security

and biometrics of mobile devices in Poland. User

surveys 2016” (Wodo and Ławniczak, 2016). The

study distinguished four main types of users of mo-

bile devices and applications, assigning them charac-

teristic features, views and behaviors. Disturbingly,

more than half of the users showed nonchalance and

carefree approach to security aspects, they did not at-

tach importance to the value of their data and identity.

The most important conclusion of the report is that it

is impossible to create one universal solution that re-

sponds to all security needs of mobile device users.

Security systems should be designed with a specific

audience in mind that combines similar characteris-

tics, views and needs. The topic of corporate banking

security was in turn taken up by KPMG, preparing the

2018 report on Mobile Technology Security (KPMG,

2018). The report shows that companies are more at-

tentive to security than individual customers. Over

half of the surveyed companies use mobile devices in

their business practice, and 76% of organizations do

not allow the processing of company data on employ-

ees’ private mobile devices. Over half of the compa-

nies enforce authentication for access to a mobile de-

vice and only install mobile applications approved by

the organization. Yubico sponsored research in 2019

devoted to users’ approach to passwords and identity

authentication security, resulting in the State of Pass-

word and Authentication Security Behaviors Report

(Ponemon Institute LLC, 2019). The study was con-

ducted in the United States, Great Britain, Germany

and France on a sample of 1,761 people involved in IT

technologies. Interestingly, over 57% of respondents

said that due to the fact that password management

is inconvenient and cumbersome, they would like to

use alternative methods to authenticate their identity.

56% of respondents were in favor of using dongles.

The report shows that the use of two-factor authenti-

cation is not common, 67% of respondents do not use

2FA in any form in their personal lives, and 55% do

not even use it at work.

2 USERS’ STUDY

In order to analyze the situation in the area of security

technology of electronic and mobile banking services

in Poland, exploratory research on the user market

was carried out using the Design Thinking method-

ology. It is a method of creating innovative products

and services based on a deep understanding of users’

problems and needs, developed at Stanford Univer-

sity in California (Brown, 2009). The main assump-

tion of this method is to focus on the user, because it

is he who will bring the answer to the guiding ques-

tions related to awareness and approach to electronic

banking security systems. In order for the proposed

solution to reach maturity, it should undergo several

project cycles during which it will verify the decisions

taken and the directions of work chosen, and above

ICISSP 2020 - 6th International Conference on Information Systems Security and Privacy

222

all it will collide with its final recipient - the user. The

stages of the Design Thinking process are illustrated

in Figure 1.

Source: www.longevity3.stanford.edu/designchallenge

Figure 1: General scheme for Design Thinking pro-

cess.

We do not forget about possible limitations of our

research, that is the way we would like to discuss

them in following paragraphs. This paper reaches

third stage of DT process - Ideation. The study in-

volved 62 people constituting the research sample, in-

cluding 32 men and 30 women aged 18 to 78 years

– 18-23 (48,4%), 24-45 (32,3%), 45+ (19,4%). It

should be emphasized that the conducted research is

a qualitative research in which a single interview with

the respondent lasts about an hour and is focused on a

thorough understanding of the respondents’ attitudes,

thoughts and behaviors. We tried to select our re-

search group in such a way it could be diversified both

in terms of gender and age, but also education and

profession, thanks to which the obtained information

has a greater cognitive value and is not biased.

At the same time, a larger share of a group of peo-

ple aged 18-23, i.e. a learning / studying group, was

taken into account, as they are natural users of new

technologies and will soon start their professional life.

They will constitute a new segment of financial ser-

vices clients, hence we decided that their examination

is particularly important for the conclusions and rec-

ommendations for the future.

2.1 Questionaire

According to the adopted methodology, work be-

gan with the creation of an interdisciplinary research

team, which due to the diverse experience of mem-

bers, could look at the research problem from many

perspectives. The construction of the questionnaire

is the result of the diversified knowledge and expe-

rience of the team that developed it to maximize the

answers to the most important questions from users.

In the first phase of the Design Thinking process, a

framework interview questionnaire was constructed.

The rules and guidelines suggested by American pro-

cess creators were taken into account, while remem-

bering the context of the study. As it was decided

to use in-depth interview, the importance of explor-

ing the respondent’s needs and fears was emphasized.

Attention was also paid to behavioral aspects - i.e. be-

havior, gesticulation during the answers given and the

inseparable expression of emotions associated with it,

e.g. through the tone of voice, speed of speech or fa-

cial expressions. It was decided that the above aspects

should constitute the frame of the interview, and the

questionnaire should be the starting point of the con-

versation, which direction the questioner will decide

on. Before proceeding to the interview phase, a re-

search team of ten members was trained to conduct

research correctly and uniformly to ensure consis-

tency and quality of the data obtained. The question-

naire covered 13 areas and consisted of open ques-

tions whose purpose was to explore the area of us-

ing electronic and mobile banking. The emotional

background accompanying the responses expressed in

the respondents’ behavior was also examined, and at-

tempts were made to capture the motivation of their

decisions. The interview also raised issues of views

regarding the issue of cybersecurity. The main pur-

pose of the questionnaire was to highlight the needs,

concerns or concerns of users related to various as-

pects of using electronic banking and related services.

The areas discussed in the interview concerned: - use

of electronic and mobile payments, ways of carrying

them out and authentication; - a sense of security re-

sulting from the use of online and mobile payments;

- use of mobile applications for electronic payments

and their updates; - experiences and emotions (per-

sonal or loved ones) related to cyber attacks; - hygiene

in using electronic and mobile banking, knowledge

of security rules and compliance with them; - knowl-

edge of issues related to cyber attacks on electronic

finances and sources of information about them; - the

use of payment cards and contactless payments, appli-

cable limits and security rules; - knowledge of double

verification mechanisms (2FA), ePUAP system, iden-

tity verification services such as ”log in via a bank”

and attitudes towards them as well as the degree of

their use; - imagining an ideal security system for

electronic banking services and mobile;

2.2 Collected Data Presentation

This part of the study will present data obtained from

interviews, both in quantitative terms, as well as their

discussion broken down into individual issues. The

research areas will be provided with the users’ own

statements, which will allow to accurately illustrate

the attitude, opinions and approach to the discussed

issues. This approach allows you to more easily iden-

Security of Digital Banking Systems in Poland: Users Study 2019

223

tify your (reader) views and behaviors with described

people, because their characters become closer and

more real to us through references to situations, facts

and behaviors known to us from our own lives. The

presented statements are only part of the interview - it

is impossible to describe all dependencies in a graphic

form, nevertheless those that best illustrate the pur-

pose of the research were presented.

2.2.1 How Do You Pay for the Services and the

Products? Why?

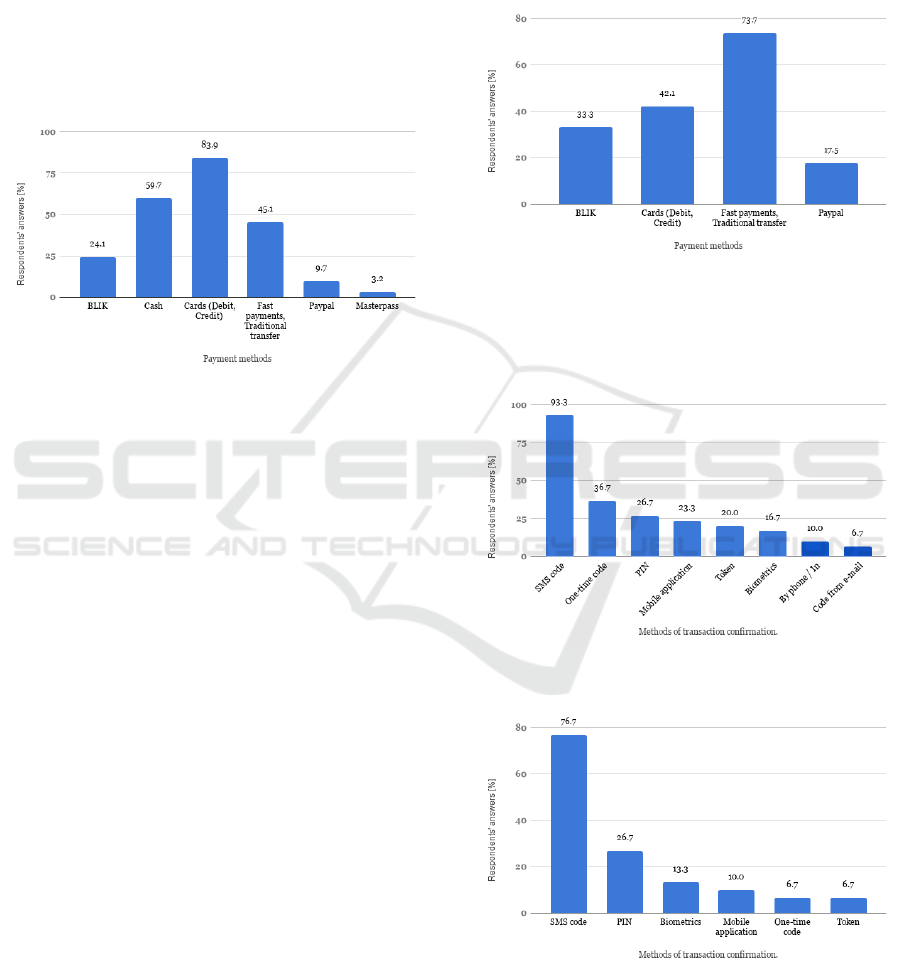

Figure 2: How do you pay for the services and the products?

Why? (n=62).

The overwhelming number of people - 83.9% of re-

spondents, pay by card (debit, credit, etc.) on a daily

basis. Many answers show that mobile banking users

like to ”enjoy freedom” - for many, card payments are

fast, and the lack of the need to have a full cash wal-

let with them is a convenience that has repeatedly ap-

peared in the statements of respondents. However, it

is not only speed that determines how the respondents

pay.

People are more likely to choose methods they

know and inspire more confidence. Thanks to such

answers it can be concluded that the popularization

of a given payment method and its advertising affects

the number of people who will use it.

2.2.2 How Do You Pay for Online Shopping?

Why?

Of all respondents, 92% pay for online purchases.

Others. 8% either do not shop online at all, or ask

someone close to buy, or only use cash on deliv-

ery. Fear accompanies more than one user of elec-

tronic banking. Once again, the respondents’ main

reasons for using selected payments are speed and

convenience, which is emphasized by several of the

respondents.

According to the respondents’ answers, they do

not consider using certain payment methods in terms

of security. For example, a card payment transaction

is a reasonable choice for online payments. While the

respondents mention the simplicity and speed of this

solution, it is worth adding that card payment is also

secure, for example due to chargeback. Thanks to it,

in certain cases, the owner of a payment card may

apply for a refund of the transaction amount.

Figure 3: How do you pay for online shopping? Why?

(n=57).

2.2.3 What Methods of Transaction

Confirmation Do You Know and Use?

Figure 4: What methods of transaction confirmation do you

know? (n=30).

Figure 5: What methods of transaction confirmation do you

use? (n=30).

In both cases, many respondents misunderstood the

question. It concerned transaction confirmations,

such as a one-time code, which allowed the payment

ICISSP 2020 - 6th International Conference on Information Systems Security and Privacy

224

process to start. In the interpretation of some of the

respondents, transaction confirmations are SMS no-

tifications and emails that say that the payment pro-

cess has been completed. Due to this interpretation

error, the statistical sample for these questions is half

of those surveyed.

The best-known method of confirming transac-

tions is a one-time SMS code. This may be primarily

due to their high popularity in Polish banking.

Banks encourage the use of SMS codes, withdraw

other transaction authorization methods

2

, and several

respondents pointed out that in their bank SMS codes

were the only possible option to choose.

SMS codes may not be a secure way of confirm-

ing transactions, as there is an option to add a trusted

recipient. After this action, the SMS code is not re-

quired to complete the transaction. It is also possible

to duplicate the SIM card and take the victim’s num-

ber

3

. The implementation of the SMS code mecha-

nism is also sometimes faulty. The code may not be

associated in any way with the transaction performed

by the user, so it is possible to use it at the same

time for another transaction (e.g. substitution of given

transactions).

2.2.4 Do You Feel Safe/Comfortable When You

are Paying Online?

Anwers for this question are following (for n=56):

Yes - 69,6%, No - 5,4%, Not Always - 25%.

An overwhelming number of people say that they

feel safe when using the above payment. A frequent

justification among the respondents was the lack of

unpleasant experiences. An additional answer was

distinguished - ”not always”.

Considering the answers and conclusions from

previous questions, it can be seen that respondents

in everyday life do not worry about safety. What

counts is that the service works well, hence the re-

peated emphasis on the speed and convenience of the

solution. The security of banking systems is not long

in the minds of users. Most of them are unaware of

lurking threats or unpleasant consequences. Many re-

spondents personally did not experience any unpleas-

ant incidents. This may lead to the conviction that

they cannot be attack objects, which translates into a

(false) sense of security.

2

https://www.zadluzenia.com/pekao-rezygnacja-z-kart-

kodow-jednorazowych/

3

https://niebezpiecznik.pl/post/duplikat-karty-sim-

kradziez-bank-mbank-bzwbk/

2.2.5 Do You Check Your Bank Account in

Public Places?

The majority of respondents believe that home and

work are safe places for financial operations. Some-

times, however, there is a need to carry out a financial

operation in a public place and then the respondents

decide to do it (44.8% of respondents), with the pro-

viso that they use their device (25% checkers), try to

find a secluded place, or at least cover the screen dur-

ing entering login details or transaction data (35.7%

verification). In addition, 11.5% of respondents who

check the account declare that they are accompanied

by a sense of discomfort. The above numbers show

the respondents’ concerns related to violation of the

sphere of privacy or potential threat to finance. Only

less than 31% of respondents perform financial ac-

tivities in public places without fear and discomfort.

Some of the surveyed people have developed meth-

ods that allow a greater degree of security to use elec-

tronic finances in public places, namely using a per-

centage slider in a banking application that reflects the

account balance in relation to the set amount.

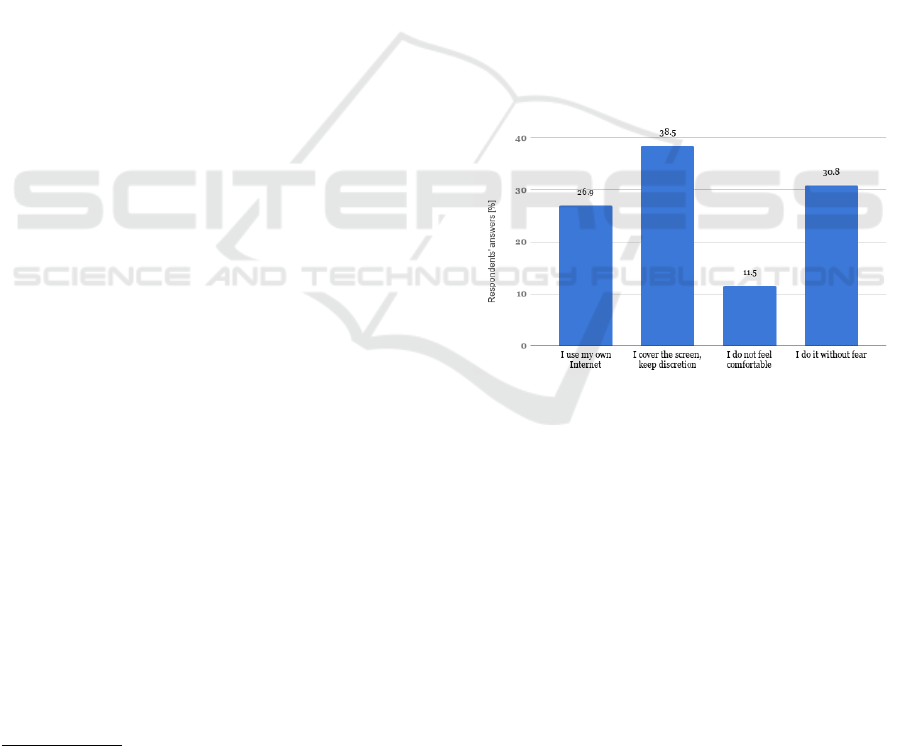

Figure 6: Behaviors and emotions among people checking

a bank account in public places. (n=26).

2.2.6 Have You Heard about Cyber Attacks on

Electronic Finance?

Over 88% of respondents have heard about cyber at-

tacks on electronic finances, however, after analyzing

quotes describing this information, one may get the

impression that this information is rudimentary, im-

precise, not bringing with it solid knowledge, what

should be done to avoid such an attack in the future.

Only 12.9% of those surveyed answered in the first

place about such incidents.

2.2.7 Where do You Get Knowledge about

Cybersecurity?

The dominant source of information on cybersecurity

among the respondents are general media (approx.

Security of Digital Banking Systems in Poland: Users Study 2019

225

Figure 7: Where do you get knowledge about cybersecu-

rity? (n=62).

60%), such as the Internet (information portals) as

well as television and the press.

These are carriers of unprofessional information,

but they should clearly be used to reach a large group

of recipients, hence banks should devote more atten-

tion to them while conducting information and educa-

tional campaigns.

About 25% of respondents declare that they read

ads and banking information, this would indicate an

important educational and information channel.

One should work on the form of banking mes-

sages, because for the average recipient the content

transmitted there is unattractive and incomprehensi-

ble, which means that they quickly lose their atten-

tion and do not have the proper effect. Over 20% of

respondents advise friends on security issues, this in-

formation channel cannot be directly influenced. On

social media, which for almost 15% of respondents

are a source of information about security already. By

addressing these communication channels, you can

reach the majority of different users, so they are excel-

lent places for educational and warning campaigns.

2.2.8 Do You Think That Cyber Attacks Apply

to You?

Answers show, around 74% of people think that cy-

ber attacks can affect them. At first, this result looks

promising, because it shows that there is awareness of

the threat arising from the world of cyber crime. Un-

fortunately, some of these people immediately under-

estimate the reality of such attacks by saying: ”I will

not be attacked because I have no money” (∼11%) or

”I am not afraid because I have secured myself well”

(∼6.5%). This is reflected in the answers to the next

interview question. A large proportion of respondents

(around 21%) do not believe that cyber attacks affect

them, arguing with their opinions on the content of

bank accounts.

The conclusions of these results are appalling, be-

cause a large group of people clearly do not realize

that they can become the target of cyber criminals and

that you do not need to have big money or be impor-

tant. They clearly lack awareness of how such attacks

take place and that in most cases they are not targeted,

but automated, based on phishing and installing mal-

ware on victims’ devices.

2.2.9 Have You Personally or Someone Close

Become a Victim of a Cyber-attack on

Finances? What did You Feel? What did

this Person Feel?

Figure 8: Have you personally or someone close become a

victim of a cyber-attack on finances? (n=62).

The answers to this question are an extremely impor-

tant clue, because they show that almost 80% of re-

spondents did not experience harm and did not fall

victim to a cyber attack on their finances.

Lack of such direct and strong experience makes

their perception of threat less real, it is difficult for

them to imagine what their situation would look like

and what emotions would accompany them. It is also

associated with a lack of reflection on cyberspace se-

curity issues in everyday life. It is easy to imagine

what will happen if we do not close the apartment and

lose our possessions, it is much harder to think about

virtual money and bank accounts that are intangible

and distant.

Over 21% of respondents declare that unpleasant

incidents related to cyber attacks occurred in their

families or friends, this experience should sensitize

them to security issues, but they are not their own

experience, so the impact of such situations is much

smaller.

8.1% of respondents have suffered harm as a re-

sult of a cyber attack, their attitude and approach to

security have changed dramatically.

ICISSP 2020 - 6th International Conference on Information Systems Security and Privacy

226

2.2.10 Does Your Bank Warn You about Cyber

Attacks?

Answers (for n=59) are following: Often, through

various channels - 58%, Sometimes - 25%, No no-

tifications I did not notice - 17%. It is very important

to ensure the awareness of users of electronic bank-

ing. They should be kept informed of any attacks they

may be exposed to. Otherwise, they can easily be-

come victims. To the question ”Does your bank warn

you about cyber attacks?” As many as ∼83% of re-

spondents said yes. This is positive information, but

you should ensure that this indicator increases all the

time, because it means that the remainder of ∼17%

are not sent or are published in a form that remains

unnoticed by users.

While answering the question, a condition was

noted, which should be given special attention. About

22% of surveyed users who said they received notifi-

cations openly admit that they do not read this infor-

mation.

2.2.11 What Safety Rules Do You Know?

Figure 9: What safety rules do you know?

The responses show that a large proportion of respon-

dents are aware to use strong passwords and change

them regularly.

Equally popular indications were to avoid open-

ing suspicious emails and links. It allows, among oth-

ers avoid entering login details on the crafted page.

The surveyed people do not use public networks when

using electronic banking, fearing the interception of

sensitive data. The ”Regularly updated software” op-

tion definitely received the least number of indica-

tions, however, this is due to the fact that the vast

majority of respondents use automatic updates and do

not have to remember that on a daily basis. The rule to

check the URL of the bank’s website was quite popu-

lar. Some respondents use bookmarks in the browser,

so they do not have to enter the address themselves.

However, it is common behavior to enter the bank

name in the Google search engine and select the link

that comes first from the searched items. This behav-

ior combined with the lack of address verification can

lead to dangerous situations.

2.2.12 Do You Know Any Form of Phishing?

About 15% of people openly admitted that they do not

know any forms of phishing.

Figure 10: What forms of phishing do you know? (n=59).

Physical and virtual methods were among the

types of phishing scams mentioned. The physical,

which according to the answers constitute about 1/4

of the total indications, can be attributed to the method

of ”granddaughter”, photocopying an ID card and

the use of skimmers in ATMs. However, by far the

most popular form among the respondents is phish-

ing, which obtained almost 46%.

The possibility of photocopying an ID card as

a form of phishing has been mentioned alarmingly

rarely. The problem with this type of behavior was to

be solved by the ”Act of November 22, 2018 on pub-

lic documents”(Polish Parliament, 2018b) , but pho-

tocopying will still be possible.

2.2.13 How Do You Verify the Bank’s Website?

Figure 11: How do you verify the bank’s website? (n=56).

About 30% of surveyed users said that they did not

verify their bank’s website at all. People who carry

out verifications mainly check the presence of a ”pad-

lock” at the bank’s address and graphic design, and

Security of Digital Banking Systems in Poland: Users Study 2019

227

only 9% of people additionally check the certificate.

A disturbing phenomenon is that the people who carry

out the verification do not have adequate knowledge

whether this is sufficient treatment. Therefore, they

feel anxious when using electronic solutions because

they are not sure if this guarantees their security.

2.2.14 Have You Heard of Two-Factor

Authorization (2FA)?

As it turned out, there are often those who have heard

of 2FA (69% people), 24% of respondents are not

concerned with knowledge about 2FA. Only after ex-

plaining the interviewers did the respondents often re-

alize that they knew and even used this solution.

Some users are not familiar with the names of the

solutions they use. The reason for this may be the fact

that banks use too superficial - descriptive names of

solutions, as well as the fact that many surveyed users

of electronic banking do not broaden their knowledge

in the field of security.

Author’s comment: It is important that banking

institutions not only inform the user in a clear but also

non-trivialized manner about the solutions used. A

short but reliable explanation could encourage a better

understanding of how a given system, method (e.g.

authentication) works.

2.2.15 Do You Use Two-Factor Authorization

(2FA)?

Most respondents use 2FA (67,4%). The question was

asked to a group of respondents who in the previous

question declared knowledge of two-factor authoriza-

tion. Analyzing the answers to the above question,

one can notice a certain lack of consistency of respon-

dents. Many people want to use additional security

features, although they may be less convenient than,

e.g., one-factor authorization. Of course, there will

be people who do not want to use additional security,

because they associate it with a problem, not secu-

rity. Therefore, we need to popularize authorizations

such as biometrics, which is a convenient and effec-

tive way of confirming identity. Similar conclusions

were made in the results of research carried out by

MasterCard

4

.

2.2.16 Do You Use the Application (on Your

Phone / Computer) to Store Passwords /

PINs for Login / Authentication?

Subjects almost equally use and do not use mecha-

nisms to store and manage passwords for authenti-

4

www.zadluzenia.com/bezpieczne-e-zakupy-

mastercard/

cation services. Among those who declare the use

of such mechanisms (46.7%), the most popular is re-

membering passwords in the browser (over 66% of

use cases). The Apple user pool uses a keychain

(10% of use cases). In addition, people who use

these solutions indicate that not for banking appli-

cations! The attitude of the respondents to mecha-

nisms and tools supporting the process of remember-

ing passwords and keys for authentication services is

described.

2.2.17 How Do You Imagine an Ideal Electronic/

Mobile Payment Security System?

From the answers given, it can be concluded that users

feel the need to increase the level of security. The

most frequent indications are the greater use of bio-

metrics, e.g. fingerprint, iris scan. Such solutions in-

spire the trust of respondents, regardless of their age

or experience in electronic banking. This was indi-

cated by both younger and older people.

Based on some interviews, an image of a person

is also created for whom comfort is definitely more

important than safety. Such a person would gladly

give up, for example, confirming activities by using

SMS codes. This opens the way to the popularization

of biometric solutions.

In addition, attention was paid to the problem of

the multitude of data for logging in to various web-

sites. The respondents believe in the security of bank-

ing solutions and would be more willing to use the

possibility of authentication through a banking ser-

vice, as it is the case with the ePUAP website. This

creates a chance to introduce solutions such as myID

(Krajowa Izba Rozliczeniowa, 2019).

2.3 Personas

The research allowed to deepen knowledge about

users of electronic and mobile banking. Based on the

analysis of the answers given by users and the accom-

panying emotions, three main personas were identi-

fied, combining similar behavioral traits, needs and

fears. Personas distribution (for n=62) is: Naive Na-

dia (45%), Fearful Frak (10%) and Reasonable Rick

(45%).

2.3.1 Persona 1 - Naive Nadia

This person has little knowledge of current banking

systems. She is usually familiar with the very ba-

sic principles of using electronic or mobile payments,

and her knowledge of attacks on electronic banking is

often low or negligible. This results in Nadia’s con-

viction that she cannot be the target of a hacker at-

ICISSP 2020 - 6th International Conference on Information Systems Security and Privacy

228

tack, because she is an unattractive target because she

does not have a large amount of financial resources

and is not an important person. In banking, she values

speed and convenience above all. She does not think

about the security of the systems she uses, therefore

she does not feel the need to explore her knowledge

in this direction, believes that someone else will take

care of its security. Nadia often has no need to use

technical innovations and the basic payment mech-

anisms she is used to are satisfied with it, she does

not see the benefit of using them. She is not looking

for new safety information in the media. Naive Na-

dia in some cases is accompanied by the belief: ”I do

not know, so I do not care”, which is dangerous for

her finances. Despite the use of electronic and mobile

banking, she is not interested in whether the given so-

lution is secure. Often, elements such as payment and

authentication methods are selected only on the basis

of the bank’s recommendations and uses factory set-

tings.

2.3.2 Persona 2 - Fearful Frank

A person who has some concerns about electronic

and mobile banking. Despite his fears, he uses mod-

ern solutions but with great uncertainty. Frank has

some knowledge related to banking, but it is usually

not complete, which can lead to various inaccuracies.

This person derives information mainly from the in-

ternet, but not from professional sources, hence often

operates on ”half truths” about an attack or system.

In addition, Frank may be very distrustful of financial

systems, fear espionage and conspiracy, which results

from a lack of his thorough knowledge and a lack of

willingness to deepen it. His attitude is often repre-

sented by statements such as ”they know”, ”every-

thing is monitored”, ”I don’t trust my phone”. Frank

feels calmer when he is aware of how the solutions he

uses work. If in his opinion the application is simple

and transparent, and his data is not saved anywhere,

then he is not afraid of losing funds or attacks. What

is most important for him in banking can summarize

the statement: ”The certainty that a given transaction

will be carried out, that nobody will mix anything in

it and the money will go to the right recipient.”

2.3.3 Persona 3 - Reasonable Rick

A person well-versed in banking and new technolo-

gies, aware of the risks associated with cyberattacks

on electronic finance. Rick knows and applies vari-

ous security mechanisms and generally adheres to se-

curity principles. This person draws knowledge from

various sources, they are often reliable and proven.

Rick sometimes even visits industry portals to read

some details. In addition to speed or convenience, it

often mentions that security is an important feature of

the banking system. It may happen that Rick overes-

timates his knowledge and his confidence is too high,

which is expressed in beliefs such as ”messages from

the bank are too simple, I already know everything”

and thus skips bank alerts or exposes to new threats.

Figure 12: How do you verify the bank’s website? (with

personas distribution) (n=56).

Among those who do not verify the bank’s web-

site, those with the characteristics of Naive Nadia pre-

dominate. This proves that it is primarily the lack of

knowledge and putting convenience over security that

are the cause of exposure to potential attacks. It can

be seen that as users become more aware, the num-

ber of ingredients that are verified when visiting the

bank’s website also increases. This is illustrated by

the increased participation of people with the charac-

teristics of Reasonable Rick in subsequent answers to

this question.

Figure 13: What is your payment limit? (with personas

distribution) (n=58).

Based on the answers and distinguished people

during the study, it can be concluded that people with

the characteristics of Reasonable Rick set definitely

higher limits than other persona. It may be related

to the fact that these people feel safe because they

make more effort while verifying other security mech-

anisms.

Security of Digital Banking Systems in Poland: Users Study 2019

229

3 RESULTS AND FURTHER

STUDY

This part of the study will summarize the research car-

ried out and formulate the main conclusions resulting

from it. In addition, recommendations will be devel-

oped for both users and financial institutions.

3.1 Main Outcomes

• Users often mention as a service that they use a

specific brand of the company that provides this

service. This demonstrates the strength of the

brand’s recognition and its impact on the recipi-

ent.

• Respondents begin to understand the need to use

biometrics, trust it more and appreciate the bene-

fits it brings.

• Users benefit from new, digital services if they ex-

perience benefits for themselves. An excellent ex-

ample was the possibility of settling PIT tax in

2019, where you could log in with the help of a

trusted profile or a bank. Many respondents used

the ePuap platform service for the very first time.

• Respondents show confidence in banking insti-

tutions and willingly use authentication mecha-

nisms through them (including the Trusted Profile

service). This indicates a promising direction for

the development of identity management services

and its verification by financial institutions.

• 60% of respondents indicate television, the press

and ordinary non-industry information portals as

the main source of information about security.

The use of these sites during socio-educational

campaigns can significantly contribute to raising

users’ awareness.

• Market penetration through 2FA solutions is quite

high, about 70% of respondents declare the use

of a double authorization mechanism. The imple-

mentation of the PSD2 directive by the banking

sector will further promote the use and awareness

of these solutions.

• Only 3.8% of people indicated photocopying their

ID as a form of phishing. This shows the lack of

awareness of the consequences of such behavior

among the respondents. The solution to this prob-

lem was to be the Act of 22 November 2018 on

public documents (Polish Parliament, 2018b), but

the interpretation of the provisions in relation to

financial institutions is still not clear.

• 1/3 of respondents cannot answer at what level

they have set limits, e.g. cash withdrawals or

transfer amounts. 22% of respondents use lim-

its of over PLN 3,000, including 9% set over PLN

5,000. Given the average earnings in Poland for

2019, which is PLN 3,600 net, these people risk

losing almost all of their earnings.

• Over 60% of respondents verify the bank’s web-

site by checking the ”green padlock”, similarity of

the website’s graphics and the HTTPS protocol in

the address bar, but they are still not sure if this is

enough. Only about 9% of respondents check the

site’s certificate.

• Over half of the respondents (approx. 63%) are

aware of the reality of cyber threats on their fi-

nances. On the one hand, it still shows a lot of

room for education of users, while on the other

it calms down a bit, showing that awareness of

threats arising from cyberspace is growing every

year (The Conference of Financial Companies in

Poland, 2018).

• Only a small number of people surveyed (about

8%) directly experienced a cyber-attack on their

finances or data, hence most of the respondents

cannot imagine how this situation looks like and

what their emotions are. It is foreign and distant

to them.

• The popularity of applications for electronic pay-

ments such as GooglePay or ApplePay is not

large, less than 13% of users declare their use.

This is probably due to the high availability of var-

ious mobile and electronic payment mechanisms

in Poland (Shoper, 2019), hence the need to use

these specific is not great.

4 CONCLUSIONS AND FUTURE

WORK

Summing up our research, we identify the evident

need to match security solutions and communica-

tion methods to several existing client archetypes, be-

cause they are characterized by distinctly different

needs and approach to the issue of electronic bank-

ing. Among the diversified surveyed group, there are

still large gaps in knowledge and awareness regarding

cybersecurity issues when using digital banking solu-

tions. The good news is that an increasing number of

people know and use the second verification factor as

well as point out biometrics as an alternative to stan-

dard security mechanisms. Efforts should be made to

constantly educate the market and customers in co-

operation with institutions and companies that have

recognition among customers.

ICISSP 2020 - 6th International Conference on Information Systems Security and Privacy

230

As the main focus for future work in this area

we would like to investigate in more detail the us-

age of second security factor (i.e. biometrics, tokens)

in mobile banking security systems and apps. What

is also important in the context of banking security

is the General Data Protection Regulation (European

Parliament, 2016) and its impact on security mecha-

nism and at least data processing and storing, includ-

ing backups and erasing data on customer demand.

What should be addressed here is appropriate mecha-

nisms fulfilling both banking law and GDPR, which is

challenging, especially in the prospect of implement-

ing the PSD2. We will create assesment criteria to

perform preliminary evaluation of Polish and Euro-

pean Banks in the first place, we will quantify the an-

swers and assign scoring for each criteria. We also

want to extend our study to other coutries, in Europe

as well as in Asia and North America.

ACKNOWLEDGEMENTS

We would like to express our gratitude to our col-

league Klaudia Winiarska for support during inves-

tigating these issues, brainstorming and contestation

of assumptions.

REFERENCES

Brown, T. (2009). Change by Design: How Design Think-

ing Transforms Organizations and Inspires Innova-

tion. HarperBusiness.

European Parliament (2015). Directive (eu) 2015/2366

of 25 november 2015 on payment services in the

internal market. Official Journal of the European

Union. https://eur-lex.europa.eu/legal-content/EN/

TXT/PDF/?uri=CELEX:32015L2366&from=EN.

European Parliament (2016). General Data Protection

Regulation. http://data.consilium.europa.eu/doc/doc

ument/ST-5419-2016-INIT/en/pdf/. Accessed on

21.10.2019.

KPMG (2018). Bezpiecze

´

nstwo technologii mobilnych.

https://assets.kpmg/content/dam/kpmg/pl/pdf/2018/

11/pl-raport kpmg bezpieczenstwo technologii mob

ilnych.pdf.

Krajowa Izba Rozliczeniowa (2019). myID. https://www.

mojeid.pl/. Accessed on 21.10.2019.

Ministry of Digital Affairs (2019a). eID card. https://www.

gov.pl/web/e-dowod/. Accessed on 21.10.2019.

Ministry of Digital Affairs (2019b). mObywatel. https://ww

w.gov.pl/web/mobywatel/. Accessed on 21.10.2019.

Ministry of Finance (2019). Your e-PIT. https://www.poda

tki.gov.pl/pit/twoj-e-pit/. Accessed on 21.10.2019.

Polish Parliament (2018a). Ustawa z dnia 10

maja 2018 r. o ochronie danych osobowych.

http://prawo.sejm.gov.pl/isap.nsf/download.xsp/WD

U20180001000/U/D20181000Lj.pdf.

Polish Parliament (2018b). Ustawa z dnia 22

listopada 2018 r. o dokumentach publicznych.

Journal of Laws of the Republic of Poland.

http://prawo.sejm.gov.pl/isap.nsf/download.xsp/

WDU20190000053/O/D20190053.pdf.

Polish Parliament (2018c). Ustawa z dnia 5 lipca

2018 r. o krajowym systemie cyberbezpiecze

´

ntwa.

Journal of Laws of the Republic of Poland.

http://prawo.sejm.gov.pl/isap.nsf/download.xsp/

WDU20180001560/O/D20181560.pdf.

Ponemon Institute LLC (2019). State of pass-

word and authentication security behaviors

report. ponemon institute research report.

https://www.yubico.com/wp-content/uploads/2019/

01/Ponemon-Authentication-Report.pdf.

Shoper (2019). Płatno

´

sci. raport. https://www.shoper.pl/st

atic/raporty/Shoper Raport Platnosci 2019.pdf.

The Conference of Financial Companies in Poland (2018).

Nadu

˙

zycia w sektorze finansowym. raport z bada-

nia. https://www.zpf.pl/pliki/raporty/raport naduzyc

ia 2018.pdf.

Wodo, W. and Ławniczak, H. (2016). Bezpieczenstwo

i biometria urzadzen mobilnych w Polsce. Bada-

nia uzytkownikow 2016, pages 1–16. Oficyna

Wydawnicza Politechniki Wrocławskiej, Wroclaw,

Poland.

Zwiazek Bankow Polskich (2018). Cyberbezpieczny

portfel. https://www.zbp.pl/getmedia/5f90b612-a

c57-43fc-bc98-49870e34d555/Raport ZBP - Cyber

bezpieczny Portfel.

Zwiazek Bankow Polskich (2019a). Polish API. https://po

lishapi.org/. Accessed on 21.10.2019.

Zwiazek Bankow Polskich (2019b). PSD2 i Open Banking

- Rewolucja czy ewolucja? https://assets.kpmg/cont

ent/dam/kpmg/pl/pdf/2019/03/pl-raport-kpmg0-zbp

-psd2-i-open-banking-rewolucja-czy-ewolucja.pdf.

Security of Digital Banking Systems in Poland: Users Study 2019

231