The Maximum Feasible Scenario Approach

for the Capacitated Vehicle Routing Problem with Uncertain Demands

Zuzana Bor

ˇ

cinov

´

a and

ˇ

Stefan Pe

ˇ

sko

Department of Mathematical Methods and Operations Research, Faculty of Management Science and Informatics,

University of

ˇ

Zilina, Univerzitn

´

a 8215/1,

ˇ

Zilina, Slovakia

Keywords:

Capacitated Vehicle Routing Problem, Uncertain Demands, Robust Optimization, Worst-case Scenario.

Abstract:

This study deals with the Capacitated Vehicle Routing Problem where customer demands are uncertain with

unknown probability distribution. We follow the robust optimization methodology to formulate and solve

the Robust Vehicle Routing Problem with Demand Uncertainty. Since the robust solution is a route plan,

which optimizes the worst case that could arise, our focus is concentrated on determining the worst-case

demands to solve the robust optimization model. The computational experiments examined two proposed

strategies to indicate their performance in terms of the extra cost and unmet demands.

1 INTRODUCTION

The Capacitated Vehicle Routing Problem (CVRP)

is one of the combinatorial optimization problems

which aims to find a set of minimum total cost routes

for a fleet of capacitated vehicles based at one depot,

to serve a set of customers under the following con-

straints:

(1) each route begins and ends at the depot,

(2) each customer is visited exactly once,

(3) the total demand of each route does not exceed

the capacity of the vehicle (Laporte, 2007).

The first mathematical formulation and algorithm for

the solution of the CVRP was proposed by Dantzig

and Ramser (1959) and five years later, Clarke

and Wright (1964) proposed the first heuristic for

this problem. Till to date many solution methods

for the CVRP have been published. General sur-

veys can be found in (Toth and Vigo, 2014) and (La-

porte, 2009). The CVRP belongs into the category

of NP hard problems that can be exactly solved only

for small instances of the problem. Therefore, re-

searchers have concentrated on developing heuristic

algorithms to solve this problem, for example (La-

porte et al., 2014), (Gendreau et al., 2010).

Contrary to the deterministic CVRP, which as-

sumes that the problem parameters (e.g. the customer

demands, travelling costs, service times, etc.) are de-

terministic and known, the robust CVRP (RVRP) con-

siders the parameters affected by uncertainty with un-

known probability distribution. In robust optimiza-

tion methodology introduced by Ben-Tal and Ne-

mirovski (1998), uncertainty is modeled as a bounded

set U which contains all possible continuous or dis-

crete values referred as scenarios. The objective of

the RVRP is to obtain a robust solution, that is feasi-

ble for all scenarios in U .

There are some works in the literature dealing

with the RVRP with different (combined or sepa-

rated) uncertain parameters. For example, Sungur

et al. (2008), Moghaddam et al. (2012), Gounaris

et al. (2013), Gounaris et al. (2016) and Pessoa

et al. (2018) study the RVRP with uncertain de-

mands. Toklu et al. (2013), Han et al. (2013) and

Solano-Charris et al. (2014) apply robust optimiza-

tion for the RVRP with uncertain travel costs. Lee

et al. (2012) and Sun et al. (2015) consider RVRP in

which travel times and also demands are uncertain.

This paper deals with the RVRP in which the cus-

tomer demands are uncertain and the distribution of

them is unknown. Our research is inspired by a work

of Sungur et al. (2008), who proposed the first so-

lution procedure for the RVRP with demand uncer-

tainty. The authors used a robust version of the CVRP

formulation with Miller-Tucker-Zemlin constraints

based on specific uncertainty to determine vehicle

routes that minimize transportation costs while satis-

fying all possible demand realizations. Their model

may be perceived as a worst-case instance of the de-

terministic CVRP in which the nominal demand pa-

rameter is replaced by a modified one from the uncer-

tainty set, thus solving the RVRP is no more difficult

than solving a single deterministic CVRP. But, de-

pending on the nature of the scenarios, some RVRPs

may become infeasible problems. Therefore, we are

Bor

ˇ

cinová, Z. and Peško, Š.

The Maximum Feasible Scenario Approach for the Capacitated Vehicle Routing Problem with Uncertain Demands.

DOI: 10.5220/0008943801590164

In Proceedings of the 9th International Conference on Operations Research and Enterprise Systems (ICORES 2020), pages 159-164

ISBN: 978-989-758-396-4; ISSN: 2184-4372

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

159

interested in extending of this method to infeasible in-

stances.

The structure of this paper is organized as follows.

Section 2 is devoted to introduce the RVRP formula-

tion whith uncertain demands which is derived from

our two-index CVRP formulation (Bor

ˇ

cinov

´

a, 2017).

Next, our robust solution approach is presented in

Section 3. In Section 4 the computational results are

reported and compared with adopted method of Sun-

gur et al. Finally in Section 5, conclusions are drawn.

2 THE RVRP WITH UNCERTAIN

DEMANDS FORMULATION

The RVRP with demand uncertainty can be defined

by a complete directed graph G = (V, H, c) with V =

{0, 1, 2, . . . , n} as the set of nodes and H = {(i, j) :

i, j ∈ V, i 6= j} as the set of arcs, where node 0 repre-

sents the depot for a fleet of p vehicles with the same

capacity Q and remaining n nodes represent geo-

graphically dispersed customers.

The positive travel cost c

i j

is associated with each

arc (i, j) ∈ H. The cost matrix is symmetric, i.e.

c

i j

= c

ji

for all i, j ∈ V, i 6= j and satisfies the trian-

gular inequality, c

i j

+ c

jl

≥ c

il

for all i, j, l ∈ V .

The uncertain demands associated with each cus-

tomer j ∈ V −{0} are modeled as discrete scenarios.

The scenarios are constructed as deviations around an

expected demand d

0

j

, i.e. demand d

k

j

of customer j in

scenario k is positive value, d

0

j

−εd

0

j

≤ d

k

j

≤ d

0

j

+εd

0

j

,

where ε is a non negative constant, which determines

the maximum perturbation percentage.

Two-index decision variables x

i j

are used as bi-

nary variables equal to 1 if arc (i, j) belongs to the

optimal solution and 0 otherwise. For all pairs of

nodes i, j ∈ V − {0}, i 6= j we calculate the savings s

i j

for joining the cycles 0 → i → 0 and 0 → j → 0

using arc (i, j) as in Clarke and Wright’s saving

method (1964), i.e. s

i j

= c

i0

+c

0 j

−c

i j

. Then, instead

of minimizing the total cost, we will maximize the to-

tal saving (Bor

ˇ

cinov

´

a, 2017). To ensure the continu-

ity of the route and to eliminate sub-tours, we define

an auxiliary continuous variable y

j

, which shows (in

the case of collecting of the goods) the vehicle load

after visiting customer j. To simplify mathematical

modelling, we replace each feasible route 0 → v

1

→

v

2

→ · · · → v

t

→ 0 by a path from node 0 to node v

t

,

i.e. 0 → v

1

→ v

2

→ ··· → v

t

.

The RVRP with uncertain demands seeks the op-

timal solution that satisfies all demand realizations.

Let U

d

denotes a set which contains all scenario vec-

tors, U

d

= {d

k

, k = 1, . . . , m}, where m is a given

number of scenarios. Then, according to Bertsimas

and Sim (2003), the robust optimization model of

the problem can be stated as

RVRP 1:

max

n

∑

i=1

n

∑

j=1

i6= j

s

i j

x

i j

, (1)

subject to

n

∑

j=1

x

0 j

= p, (2)

n

∑

i=1

x

i0

= 0, (3)

n

∑

i=0

i6= j

x

i j

= 1, ∀ j ∈ V − {0}, (4)

n

∑

j=1

i6= j

x

i j

≤ 1, ∀i ∈ V − {0}, (5)

y

i

+ d

k

j

x

i j

− Q (1 − x

i j

)≤ y

j

,

∀d

k

∈ U

d

, i, j ∈ V − {0}, i 6= j, (6)

d

k

j

≤ y

j

≤ Q, ∀d

k

∈ U

d

, j ∈ V − {0}, (7)

x

i j

∈ {0, 1}, ∀i, j ∈ V, i 6= j. (8)

In this formulation, the objective function (1)

maximizes the total travel saving. The constraints (2),

(3), (4) and (5) are the indegree and outdegree con-

straints for depot and customers. Constraints (6) are

the route continuity and sub-tour elimination con-

straints and the constraints given in (7) are capac-

ity bounding constraints which restrict the upper and

lower bounds of y

j

. Finally, (8) are the obligatory

constraints.

The general approach of robust optimization is

to optimize the worst-case value over all data uncer-

tainty (Sungur et al., 2008). Let d

w

j

denotes the de-

mand of customer j in the worst scenario. Then, we

replace the constraints (6) and (7) with the constraints

y

i

+ d

w

j

x

i j

− Q (1 − x

i j

)≤ y

j

,

∀i, j ∈ V − {0}, i 6= j, (9)

d

w

j

≤ y

j

≤ Q, ∀ j ∈ V − {0}. (10)

Thus, similar to Sungur et al.(2008), we can solve

the RVRP as an instance of the CVRP. We refer to the

resulting model as RVRP 2.

3 DETERMINING

THE WORST-CASE SCENARIO

The key step in this approach is to identify the worst-

case scenario and subsequently substitute its values

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

160

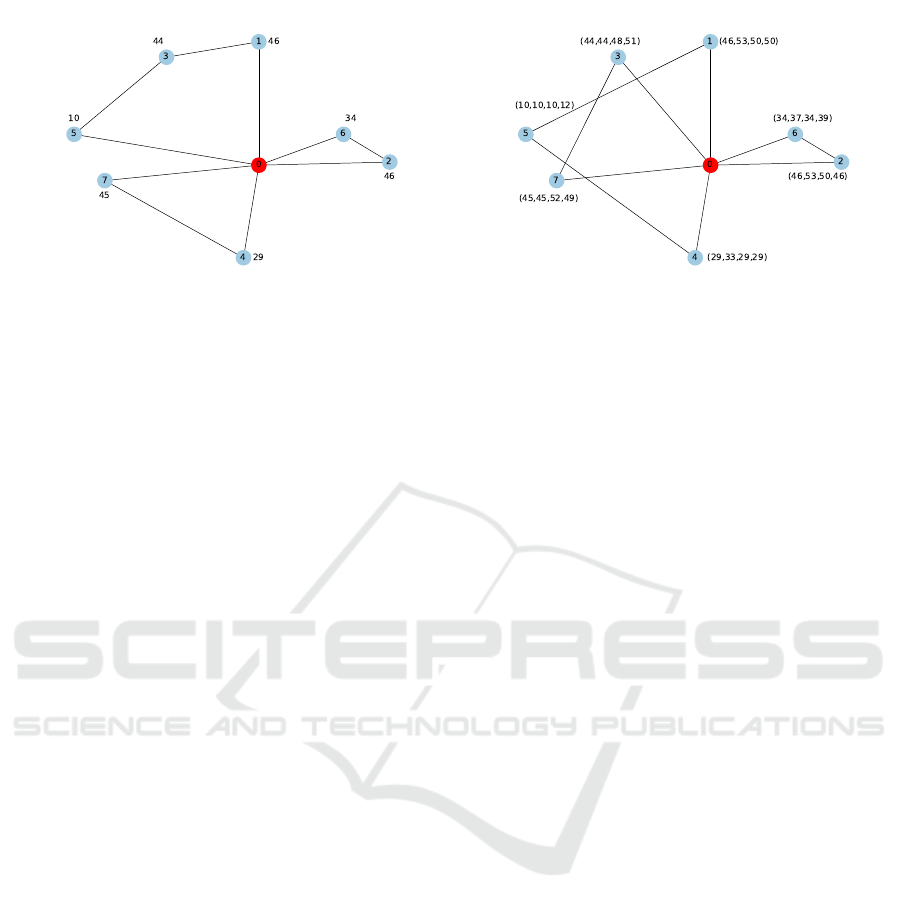

Figure 1: CVRP: Optimal deterministic solution. Figure 2: RVRP: Robust solution.

d

w

j

into the constraints (9) and (10). We suggest

following two strategies for determining the worst-

case scenario: the maximum demand scenario and

the maximum feasible demand scenario.

3.1 The Maximum Demand Scenario

In the first strategy (Strategy 1) we consider that all

customer demands take their maximum values in each

scenario (Ord

´

o

˜

nez, 2010), i.e. the worst-case sce-

nario values are d

w

j

= d

max

j

= max{max

k

d

k

j

, d

0

j

} for

j ∈ V − {0}, k ∈ {1, . . . , m}, where m is a number

of scenarios. This strategy gives a solution, which

is immune to demand variation under each scenario.

However, the CVRP with the maximum demand sce-

nario may be infeasible if vehicles have not sufficient

capacity. Then a robust solution can not be found.

3.2 The Maximum Feasible Demand

Scenario

The main idea of this strategy (Strategy 2) is to serve

as many demands as possible, i.e. we find such a sce-

nario with values d

w

j

∈ {d

k

j

, k = 0, . . . , m} to maximize

the sum of satisfied demands with respect the fleet

size and vehicle capacities.

We assume the decission variables t

i jk

, which in-

dicate whether vehicle i serves demand d

k

j

or not.

The mathematical model that determines feasible sce-

nario with maximum sum of satisfied demands can be

described as follows:

max

p

∑

i=1

n

∑

j=1

m

∑

k=0

t

i jk

d

k

j

, (11)

subject to

n

∑

j=1

m

∑

k=0

t

i jk

≥ 1, ∀i ∈ {1, . . . , p}, (12)

p

∑

i=1

m

∑

k=0

t

i jk

= 1, ∀ j ∈ {1, . . . , n}, (13)

n

∑

j=1

m

∑

k=0

t

i jk

d

k

j

≤ Q, ∀i ∈ {1, . . . , p}, (14)

t

i jk

∈ {0, 1},

∀i ∈ {1, . . . , p}, j ∈ {1, . . . , n}, k ∈ {0, . . . , m}. (15)

The objective function (11) maximizes the sum of

the demand values selected from a set of scenarios

to be served. The constraints (12) express that each

vehicle must serve at least one customer. The con-

straints (13) impose that every customer is visited

once by one vehicle and exactly one its demand value

is selected to be served. The constraints (14) ensure

that the total load does not exceed the capacity of

any vehicle. Finally, the constraints (15) define the bi-

nary decission variables. Obviously, it is not guaran-

tee that all the demand of each customer will be met

under this strategy.

4 COMPUTATIONAL

EXPERIMENTS

In order to assess the efficiency and quality of the pro-

posed robust solution approach, we design compu-

tational experiments and analyze the robust solu-

tions obtained with alternative strategies in terms of

their demand and cost performances. The mathe-

matical models were coded in Python 3.7 (2019) and

solved by the solver Gurobi 8.1 (2019). A computer

with an Intel Xeon 32 cores, 2.4 GHz processor and

256 GB of RAM was used to perform the computa-

tional experiments.

The Maximum Feasible Scenario Approach for the Capacitated Vehicle Routing Problem with Uncertain Demands

161

4.1 Test Instances

We use standard instances publicly available at

www.coin-or.org/SYMPHONY/branchandcut/VRP/

data/ for our computational experiments. Because

the instances are originally designed for deterministic

CVRP, it was necessary to modify them to include

demand uncertainty. The customer demands specified

in the benchmark were taken to be their nominal

values d

0

j

. For each deterministic CVRP benchmark,

we construct four classes of uncertainty sets of 5

scenarios within the allowed perturbation percentage

ε ∈ {0.05, 0.1, 0.15, 0.2}. All instances were solved

with a runtime limit of one hour.

4.2 Performance Measures

To evaluate the performance of the proposed strate-

gies, we use the performance measures presented

in (Sungur, 2008) including the relative extra cost and

unmet demands.

Let z

r

and z

d

be the cost of robust and determinis-

tic solutions respectively. The ratio ζ =

z

r

− z

d

z

d

quan-

tifies the relative extra cost of the robust solution ver-

sus the deterministic optimal one. It is clear, that

smaller ζ means the better cost performance.

Let g

d

and g

r

represent the maximum unmet de-

mand that can occur when using the deterministic and

robust solution respectively and D is the total nomi-

nal demand, i.e. D =

n

∑

i=1

d

0

i

. The unmet demand is

the sum of demands in each route that exceeds the ve-

hicle capacity. The ratio γ =

g

d

− g

r

D

, reflects the rel-

ative decrease of unmet demand in the robust solution

compare to deterministic optimal one when it faces

the maximum demand scenario. Obviously, the larger

γ indicate the better demand performance. We notice

that every solution found by Strategy 1 has g

r

= 0.

Example:

Figure 1 shows a CVRP optimal solution

with n = 7 customers and p = 3 vehicles of

the capacity Q = 100. Customer demands

d = (46, 46, 44, 29, 10, 34, 45) are displayed next

to the nodes. The cost of this solution z

d

= 227.

Figure 2 illustrates a robust solution of the same

problem with m = 4 discrete scenarios of uncertain

demands, which were generated randomly by pertu-

bation ε = 0.20:

d

1

= (46, 46, 44, 29, 10, 34, 45),

d

2

= (53, 53, 44, 33, 10, 37, 45),

d

3

= (50, 50, 48, 29, 10, 34, 52),

d

4

= (50, 46, 51, 29, 12, 39, 49).

The route demands in particular scenarios are:

• Route 1, 5, 4 : 85, 96, 89, 91

• Route 3, 7 : 89, 89, 100, 100

• Route 2, 6 : 80, 90, 84, 85

It is evident, that the total demand of any route in each

scenario does not exceed vehicle capacity. The cost

of robust solution z

r

= 291, i.e. the relative extra cost

ζ = 0.282.

Since Strategy 1 failed in solving this problem, de-

picted robust solution was found by Strategy 2,

whereby the maximum feasible scenario is d

w

=

(53, 53, 51, 33, 12, 39, 49). To evaluate the demand

performance, we calculate the total demands in each

route for a case if all customer demands take their

maximum value d

max

= (53, 53, 51, 33, 12, 39, 52).

The summations of demands in the optimal solution

routes are 116, 85 and 92, i.e. there is g

d

= 16 un-

satisfied demands. In the robust solution, the sum-

mations of demands in the routes are 98, 103 and 92,

therefore g

r

= 3 and the relative decrease of unmet

demand γ = 0.051.

4.3 Numerical Results

The results of both proposed strategies are summa-

rized in the Table 1.

In this table, the first column represents the name

of instances. The name of each instance allows deter-

mine its characteristics, since it has a format X-nA-

kB-eC, where A is the number of nodes, B represents

the number of vehicles and C indicates perturbation

percentage. For example an instance P-n16-k8-e5 has

16 nodes, 8 vehicles and was derived from the in-

stance P-n16-k8 by demand generation with ε = 0.05.

The columns Cost performance and Demand per-

formance show the two performance measures ζ and

γ respectively, as explained before. An indicator ”in”

denotes an infeasible instance.

As we can observe from Table 1 the strategy,

which optimizes the maximum demand scenario

(Strategy 1) results to infeasible solutions in some

cases, while strategy based on the maximum feasible

demand scenario approach (Strategy 2) has an appro-

priate solution in all cases. For all other cases both

of strategies have achieved the same results, because

the maximum feasible demand scenario is equal to

the maximum demand scenario. It means, that Strat-

egy 2 is an extension of Strategy 1 for problems with

infeasible maximum demand scenario.

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

162

Table 1: The comparison of two strategies.

Strategy 1 Strategy 2

Instance Cost Demand Cost Demand

perform. perform. perform. perform.

P-n16-k8-e5 0.000 0.000 0.000 0.000

P-n16-k8-e10 0.000 0.004 0.000 0.000

P-n16-k8-e15 0.027 0.008 0.027 0.008

P-n16-k8-e20 in in 0.027 0.004

P-n20-k2-e5 0.005 0.006 0.005 0.006

P-n20-k2-e10 0.005 0.010 0.005 0.010

P-n20-k2-e15 in in 0.023 0.003

P-n20-k2-e20 in in 0.009 0.000

P-n23-k8-e5 0.091 0.006 0.091 0.006

P-n23-k8-e10 0.091 0.006 0.091 0.006

P-n23-k8-e15 in in 0.174 0.000

P-n23-k8-e20 in in 0.102 0.000

E-n13-k4-e5 0.121 0.021 0.121 0.021

E-n13-k4-e10 0.121 0.053 0.121 0.053

E-n13-k4-e15 0.121 0.082 0.121 0.082

E-n13-k4-e20 0.166 0.117 0.166 0.117

E-n22-k4-e5 0.043 0.008 0.043 0.008

E-n22-k4-e10 0.043 0.008 0.043 0.008

E-n22-k4-e15 0.043 0.007 0.043 0.007

E-n22-k4-e20 0.043 0.006 0.043 0.006

E-n23-k3-e5 0.002 0.005 0.002 0.005

E-n23-k3-e10 0.002 0.026 0.002 0.026

E-n23-k3-e15 in in 0.000 0.000

E-n23-k3-e20 in in 0.000 0.000

A-n34-k5-e5 0.000 0.000 0.000 0.000

A-n34-k5-e10 0.000 0.000 0.000 0.000

A-n34-k5-e15 0.042 0.004 0.042 0.004

A-n34-k5-e20 in in 0.042 0.004

A-n44-k6-e5 0.000 0.000 0.000 0.000

A-n44-k6-e10 0.002 0.004 0.002 0.004

A-n44-k6-e15 0.049 0.019 0.049 0.019

A-n44-k6-e20 in in 0.044 0.009

A-n53-k7-e5 0.032 0.000 0.032 0.000

A-n53-k7-e10 0.028 0.008 0.028 0.008

A-n53-k7-e15 in in 0.049 0.035

A-n53-k7-e20 in in 0.046 0.026

5 CONCLUSIONS

In this paper the robust optimization was used to

solve the Capacitated Vehicle Routing Problem with

demand uncertainty. The main contribution of our

work is to design a new strategy to cope with uncer-

tain demands. At first, we present the mathematical

model RVRP 2, derived from our two-index CVRP

formulation, which optimizes the worst-case scenario.

Then we are concerned with determining the worst-

case scenario. In Strategy 1, the worst-case scenario

takes the maximum demand values, which sometimes

leads to an infeasible problem. Therefore we propose

strategy (Strategy 2) based on an idea to satisfy as

many demands as possible with respect the fleet size

and vehicle capacities. Hence, in contrast to Strat-

egy 1, it always designes an appropriate solution, even

though it is not strictly robust.

A possible future research is to extend this study

to solving large-scale problem instances.

ACKNOWLEDGEMENTS

The paper was conducted within the project KEGA

041

ˇ

ZU-4/2017 Experimental Mathematics Accessi-

ble for All (granted by Ministry of Education), sup-

ported by the research grants APVV-14-0658 Opti-

mization of urban and regional public personal trans-

port and VEGA 1/0342/18 Optimal dimensioning of

service systems.

REFERENCES

Ben-Tal, A., Nemirovski, A. (1998). Robust convex

optimization. Mathematics of Operations Research,

23(4):769–805.

Bertsimas, D., Sim, M. (2003). Robust discrete optimiza-

tion and network flows. Mathematical Programming

Series B, 98(1-3):49–71.

Bor

ˇ

cinov

´

a, Z. (2017). Two models of the capacitated vehi-

cle routing problem. In: Croatian operational research

review.,8(2):463–469.

Clarke, G., Wright, J. W. (1964). Scheduling of vehicles

from a central depot to a number of delivery points. Op-

erations Research, 12(4):568–581.

Dantzig, G. B., Ramser, J. H. (1959). The truck dispatching

problem. Management Science, 6(1):80–91.

Gendreau, M., Potvin, J. Y. (2010). Handbook of Meta-

heuristics, Second Edition, Springer, New York.

Gounaris, C. E.,Wiesemann, W., Floudas, C. A. (2013).

The robust capacitated vehicle routing problem under

demand uncertainty. Operations Research, 61(3):677–

693.

Gounaris, C. E., Repoussis, P. P., Tarantilis, C. D., Wiese-

mann, W., Floudas, C. A. (2016). An Adaptive Mem-

ory Programming Framework for the Robust Capac-

itated Vehicle Routing Problem. Transportation Sci-

ence, 50(4): 1239–1260.

The Maximum Feasible Scenario Approach for the Capacitated Vehicle Routing Problem with Uncertain Demands

163

Gurobi (2019). Gurobi Optimizer Reference Man-

ual, version 8.1. Gurobi Optimization, Inc.

https://www.gurobi.com/documentation/8.1/refman/

index.html. Accessed 03/04/19

Han, J., Lee, C., Park, S. (2013). A robust scenario ap-

proach for the vehicle routing problem with uncertain

travel times. Transportation Science, 48(3):373–390.

Laporte, G.,Ropke, S., Vidal, T. (2014). Heuristics for the

vehicle routing problem. Vehicle routing: Problems,

Methods and Applications, Second Edition. Philadel-

phia: SIAM, 18–87.

Laporte, G. (2009). Fifty Years of Vehicle Routing. Trans-

portation Science, 43(4):408–416.

Laporte, G. (2007). What you should know about the vehi-

cle routing problem. Naval Research Logistics, 54:811–

819.

Lee, C., Lee, K., Park, S. (2012). Robust vehicle routing

problem with deadlines and travel time/demand uncer-

tainty. Journal of the Operational Research Society,

63(9):1294–1306.

Moghaddam, B. F., Ruiz, R., Sadjadi, S. J. (2012). Vehicle

routing problem with uncertain demands: An advanced

particle swarm algorithm. Computers & Industrial En-

gineering, 62:306–317.

Ord

´

o

˜

nez, F. (2010). Robust Vehicle Routing. INFORMS

Tutorials in Operations Research, 153–178.

Pessoa, A., Poss, M., Sadykov, R., Vanderbeck, F. (2018).

Solving the robust CVRP under demand uncertainty.

ODYSSEUS, Jun 2018, Calgliari, Italy. 7th Interna-

tional Workshop on Freight Transportation and Logis-

tics.

Python (2019). The Python Language Reference. Python

Software Foundation. https://docs.python.org/3/. Ac-

cessed 03/04/19

Solano-Charris, E. L., Prins, C., Santos, A. C. (2014). A ro-

bust optimization approach for the vehicle routing prob-

lem with uncertain travel cost. In Control, Decision and

Information Technologies (CoDIT) International Con-

ference, pp. 098–103.

Sun, L., Wang, B. (2015). Robust optimization approach

for vehicle routing problems with uncertainty. Interna-

tional Journal of Computer Applications in Technology.

Sungur, I, Ord

´

o

˜

nez, F., Dessouky, M. (2008). A robust opti-

mization approach for the capacitated vehicle routing

problem with demand uncertainty. IIE Transactions,

40(5):509–523.

Toklu, N. E., Montemanni, R., Gambardella, L. M. (2013).

An ant colony system for the capacitated vehicle routing

problem with uncertain travel costs. IEEE Symposium

on Swarm Intelligence (SIS), pp. 32–39.

Toth, P., Vigo, D. (2014). Vehicle routing: Problems, Meth-

ods and Applications. Society for Industrial and Ap-

plied Mathematics (SIAM).

ICORES 2020 - 9th International Conference on Operations Research and Enterprise Systems

164