Changing the Maintenance and Repair System While Expanding the

Connected Vehicles Fleet

Irina Makarova

1a

, Vladimir Shepelev

2,3 b

, Eduard Mukhametdinov

1c

and Anton Pashkevich

4d

1

Kazan Federal University, Syuyumbike prosp., 10a, 423822, Naberezhnye Chelny, Russian Federation

2

Silkway International University, Tokaev Street 27 “А”(housing А) Turkestan Street Corner,

160019, Shymkent City, Kazakhstan

3

South Ural State University, ave. V.I. Lenin 76, 454080, Chelyabinsk, Russian Federation

4

Politechnika Krakowska, Warszawska st., 24, Krakow, Poland

Keywords: Connected Vehicles, On-board Diagnostic Systems, Branded Service Systems.

Abstract: Autonomous vehicles have become a logical outcome of the realization to Intelligent Transport Systems di-

rection as a system strategy. The article analyses the directions of road vehicles intellectualization. The prob-

lems and ways to improve the safety, reliability and sustainability of transport systems are indicated. It is

shown that to control the connected vehicles reliability it is necessary to improve the branded systems of

maintenance and repair. This is realized through the improvement of on-board diagnostic systems. The use of

sensors that read data on the vehicle's state, its routes and external factors affecting reliability ensure the

adequacy and quality of the source information. Using a single information space for generating operational

databases as well as a defect codifier for generating failure statistics and their multidimensional analysis will

allow us to determine the service strategy and also carry out its adjustment if necessary when changing the

failure statistics.

1 INTRODUCTION

The modern cities problem, which is aggravated as

they grow, is the transport system, that in many cases,

due to its inefficiency, creates a lot of problems, rang-

ing from environmental ones, to difficulties in mobil-

ity. Lack of parking space, traffic jams and conges-

tion, problems of economic and infrastructural devel-

opment of remote areas - these are the consequences

of transport system's irrational development that need

to be addressed. The road transport development

strengthens these problems. According to analysts,

Autonomous Vehicles (AV) can solve many of these

problems. At the same time, the main trends in im-

proving the transport system efficiency are aimed,

firstly, at changing the transportation process, and

secondly, at reducing the urban space occupied by ve-

hicles (including the road network and parking lots).

a

https://orcid.org/0000-0002-6184-9900

b

https://orcid.org/0000-0002-1143-2031

c

https://orcid.org/0000-0003-0824-0001

d

https://orcid.org/0000-0002-4066-5440

This is facilitated by a shift from the model of per-

sonal vehicle ownership to a more efficient model of

its sharing, which will reduce both the need for park-

ing spaces and traffic, especially during rush hours,

since such a model involves using a joint car for reg-

ular trips, for example, to work or study. It will also

create opportunities for more equable development of

urban space, because it will expand the available op-

tions for transit to areas that are currently inaccessi-

ble.

Automakers are investing in the creation of

intelligent and energy-efficient vehicles, because in

the face of fierce competition, they are interested in

implementing reasonable and effective mobility

options. At the same time, both ownership options

and the possibilities of structural changes are

analyzed, however, as practice shows, consumers are

not yet ready to completely trust highly automated

vehicles. Numerous studies are devoted to the

622

Makarova, I., Shepelev, V., Mukhametdinov, E. and Pashkevich, A.

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet.

DOI: 10.5220/0009837706220633

In Proceedings of the 6th International Conference on Vehicle Technology and Intelligent Transport Systems (VEHITS 2020), pages 622-633

ISBN: 978-989-758-419-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

operating autonomous vehicles' problems: the

advantages, prospects and features of the

transportation process organization. However, almost

practically neither of the authors has been the focus

to the reliability issues of both the vehicle itself and

electronic control systems, although it is known that

even small changes in the design entail a number of

problems associated with ensuring their trouble-free

operation. The branded service system (BSS) is a

complex organizational and technical system that is

tuned to certain technological processes and,

apparently, a change in the paradigm of transport

process organizing and a person role decrease in it

through the expansion of the unmanned vehicles fleet

will require a change in the BSS paradigm. At the

same time, a whole series of issues should be resolved

both in the technical and organizational plan, as well

as in the socio-economic one.

Given that while autonomous vehicles have not

conquered the market and potential customers think

only about issues of trust in them from the point of

view of the transportation process safety, soon

enough questions of maintaining operability and

warranty will come to the fore. Of particular

importance to the customer when buying a vehicle is

the issue of providing a guarantee. The new product

success depends on both engineering solutions

(product reliability) and marketing policy (price,

guarantees). Warranty service costs depend on the

product reliability, in turn, the manufacturer can

expand the warranty if he is confident in the his

products reliability. Thus, the issues of reliability,

prices and guarantees should be considered together

(Byuvol, P.A. et al. 2017 ). With the expansion of the

autonomous vehicles fleet, the question of joint

ownership of them will inevitably arise. In this case,

the issue of the vehicle technical condition control

will become more complicated, which will also have

to be addressed through the BSS.

Considering questions about the warranty period

cost and duration, the authors of scientific and

practical studies note that all models should use

information about failures in the warranty period, as

well as the fact that the information quality affects to

adequacy of decisions depends (Lee SangHyun et al.

2008, Lee SangHyun et al. 2009, Last M.et al. 2010,

Xie W., Liao H. & Zhu X. 2014). Since the failures

causes can be due by various factors that are

heterogeneous and stochastic, it is necessary to have

a tool for processing large data amounts, that can be,

inter alia, textual (Buddhakulsomsiri J. et al. 2006).

For forecasting, various data mining methods are

used, including neural network algorithms

(Shubenkova, K. et al. 2018).

The article analyzes the reasons for the ambiguous

attitude of consumers to autonomous vehicles, the

advantages and prospects of this transport systems

development direction, especially in the context of

the resource conservation paradigm, the 4th Industrial

Revolution and Smart City. Thus, the article will

consider the concept of an updated BSS, methods and

the possibility of their application within the proposed

concept framework.

2 PROBLEM STATUS:

AUTONOMOUS VEHICLES,

PLUSES AND MINUSES

Autonomous vehicles are becoming a promising tech-

nology for improving urban mobility while saving

space and energy in urban areas. But it should be

borne in mind that the positive external effects that

are necessary for their non-deployment are not suffi-

cient. Highly automated vehicles are more economi-

cal, require less room for manoeuvres and parking,

however, all these advantages can only appear if their

share in the fleet is significant (Fig.1).

Figure 1: Modification the road user’s interaction with the

connected vehicles’ development.

2.1 Connected Vehicles Contribution to

Urban Sustainability

The document (Berrada, J. et al. 2017) goal is to de-

scribe and classify existing core business models, and

then apply them in the autonomous vehicles field. The

authors created a rating system using six identified

factors that influence value creation, and then evalu-

ated nine business models based on these factors. As

a result, the authors found that hybridization of two

or more business models is possible. For example, the

widespread deployment of private autonomous vehi-

cles may limit the benefits of using shared autono-

mous vehicles in the same area. The hybridization

method would allow taking advantage of each form

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

623

of the business model and lead to an increase in the

service quality.

According to Gartner, Inc. (Gartner Fore-

casts…2019), by 2023, the increase in the vehicles

production which have equipment that could provide

autonomous driving without human supervision will

reach 745,705 units compared to 332,932 units in

2019. This growth will mainly be observed in the

countries of North America, Greater China and West-

ern Europe, as the countries of these regions will be

the first to introduce rules regarding autonomous

driving technologies. The main obstacle to the auton-

omous vehicles development and production is the

fact that today there are no countries with existing

regulations that allow their legal operation. Accord-

ing to analysts, companies will not deploy autono-

mous vehicles until it becomes clear that they can op-

erate legally without human control, as vehicle man-

ufacturers are responsible for the vehicle actions of

the during its life cycle. According to Sean Behr, co-

founder and CEO of the company Stratim, which con-

trols more than 10,000 cars and vans from 50 custom-

ers, including BMW, Ford and General Motors, by

the decade end will begin to shift in the public mind,

as the motorization level will decrease due to an in-

crease in the volume of joint transportation services,

which will be, at least partially, autonomous.

For corporate fleets, however, the need for pre-

ventative maintenance and emergency vehicles re-

pairs will remain unchanged. Peter Smith, that is vice

president of vehicle services, Business & Industry, to

indicates that ABM currently provides a variety of

rental car maintenance services, including fluid in-

spection, tire inspection, interior and exterior clean-

ing, and shuttle services vehicles - to ensure a turno-

ver between rentals - for car rental companies. How-

ever, he raises the question that, given the existing in-

frastructure based on oil changes and spark plugs,

fleet owners will need to restructure their business to

keep their unmanned electric vehicles in good condi-

tion and make a profit. According to him, night truck

parking should be equipped with charging stations,

and maintenance compartments can become high-

tech canopies equipped with advanced telemetry sys-

tems and serviced by technical specialists. The on-

board systems on each truck will report ongoing

maintenance and more complex problems. Upon arri-

val of the truck at the service point, the technician will

be able to find and fix the problem. The reality is that

while automation will increasingly contribute to in-

creasing the productivity and usefulness of autono-

mous vehicles, these processes will still require mile-

stones, and people will always play a strategic role in

organizing maintenance and operation.

The rapid progress in autonomous driving tech-

nology raises the question of suitable operating mod-

els for future autonomous vehicles. The key factor de-

termining the viability of such operating models is the

competitiveness of their cost structure, for example,

due to the development of public transport and car

sharing systems, but, as shown in the article (Bösch

P.M. et al., 2018), this is effective only in case of in-

creased demand for certain types of transportation.

To prove the new vehicles types competitiveness,

the study (Loeb B. & Kockelman K.M. 2019) authors

simulated a fleet of shared autonomous electric vehi-

cles serving the requests of 41,242 agents in the Aus-

tin, Texas network to determine which fleet scenarios

are most beneficial for the operator and users. The

study provides detailed cost estimates of the shared

autonomous electric vehicles (SAEV) fleet, including

the costs of purchasing vehicles, maintenance, batter-

ies, electricity, building charging stations (including

land and paving), servicing charging stations, insur-

ance, registration, and general administrative ex-

penses. In addition, strategies to reduce load factors

are critical to the viability of this fleet, and they must

be modelled to determine their impact on vehicle

costs and effectiveness.

As McKinsey’s analysts point out, the automotive

industry is rapidly turning into a real mobile ecosys-

tem. Connected vehicles can become powerful infor-

mation platforms that not only improve driver capa-

bilities, but also open up new opportunities for busi-

ness to value creation (The future of… 2019). At the

same time, the basic logic of autonomous driving, es-

pecially in cities, will remain unchanged. Shared elec-

tric robo-taxis or shuttles can eliminate mobility pain

points in cities (for example, traffic jams, crowded

parking spaces and pollution), while improving urban

mobility, increasing its accessibility, efficiency, con-

venience for users, environmental friendliness and in-

clusiveness. With untrammelled integration into the

public transport system, this type of transport will be-

come an important factor contributing to the reduc-

tion in the current share of transportation by private

cars (Change vehicles…, 2019)

2.2 Connected Vehicles and the Service

System Role in Expanding Their

Fleet

2.2.1 Forecasts of Maintenance and Repair

Costs

According to the vehicle service activities' analysis,

one of the factors for increasing maintenance costs in

iMLTrans 2020 - Special Session on Intelligent Mobility, Logistics and Transport

624

2018 was the increase in prices for spare parts, in par-

ticular for the brake and calliper, due to an increase in

the number of models equipped with larger diameter

tires. Continuous improvement in the vehicles qual-

ity, which occurs every model year, contributes to the

decrease in the need for complex overhauls, which

leads to a maintenance costs reduction. In addition,

component reliability is enhanced, which in turn re-

duces repair costs, helping to offset the continued in-

crease in labour costs and high spare part prices. One

of the negative consequences of improving the vehi-

cles reliability is the temptation to extend their service

life, which is caused, inter alia, by a decrease in the

catastrophic failures frequency of vehicles with high

mileage. The vehicles utilization rate can also be in-

creased due to increased reliability. However, as ve-

hicles become more complex, the failures prediction

also becomes more complicated, and as a result, ve-

hicles repairs are mainly “in fact” (in case of malfunc-

tions). Although the technological innovations intro-

duced in modern vehicles are very reliable, in the

malfunction new component event they are very ex-

pensive to repair. This can lead to certain repair costs,

for example, on-board diagnostics systems and elec-

tronics (in particular, infotainment systems).

A growing number of vehicles are equipped with

Advanced driver-assistance systems (ADAS), which

have function such as collision avoidance, visibility,

lane departure warning, adaptive cruise control, pe-

destrian protection and blind spot monitoring. While

the ADAS advantages outweigh any disadvantages,

these are trade-offs that come with high acquisition

costs and new maintenance processes.

There are many ADAS types, some of which are

built into vehicles, while others are available as the

add-on package part. ADAS uses input from several

data sources, including vehicle's images, LIDAR, ra-

dars, image processing, computer vision and vehicles

networks. ADAS systems require specialized equip-

ment and specially trained personnel. Many repairs,

which were previously simple, now require ADAS

system calibration, which consists of cameras, sen-

sors and controllers, which requires specialized and

expensive tools and equipment.

On the other hand, OEMs have improved a num-

ber of vehicles, which helped lower costs on vehicles.

Examples include built-in diagnostic displays that

change the driver behaviour, and diagnostic trouble

codes (DTCs) that expand the dealer’s ability to more

quickly identify maintenance issues. One example of

a newer technology that reduces maintenance and re-

pair (M & R) costs is electronic steering, which is

more reliable than mechanical hydraulic assistance.

Another example of lower maintenance costs due to

higher quality components is that brake pad life is ex-

tended. As autonomous vehicles become available,

maintenance processes, such as replacing tires and

oil, and monitoring the braking system, will become

more predictable as they will be independent of driver

reaction. This will shift costs from using cheaper ser-

vice / repair providers to using OEM dealerships. Au-

tonomous vehicles also increase the forecasting accu-

racy the need for maintenance, which will allow for

preventive maintenance.

The autonomous vehicle industry is seen by many

vehicle manufacturers such as Waymo, Tesla, GM,

Ford, Mercedes-Benz, Volvo and many others as rev-

olutionary, while the leadership pursuit in this direc-

tion and rapid technological progress in the automo-

tive industry will lead to increased need for more per-

fect digital skills. According to current forecasts and

predictions, by 2021 there will be level 4 autonomous

vehicles. Level 5 vehicles are expected to appear by

2030. Politicians who are confident that autonomous

vehicles will appear in the near future are already

adopting new legislation and government regulations.

However, for vehicle services' owners and auto me-

chanics, the idea of what the new autonomous land-

scape means is less well known. (The Self-Driving…,

2019).

2.2.2 Mobility-as-a-Service (MaaS),

Personnel and Maintenance

Requirements

Contrary to the prevailing opinion that autonomous

vehicles will reduce the need for the auto mechanics

activity, according to experts, automated technolo-

gies will create new jobs, which will lead to a demand

for continuous training for service technicians. Au-

tonomous vehicles, with the as artificial intelligence

(AI) develops, accompanied by machine learning im-

provement and the advent of many mandatory addi-

tional sensors, will require wider diagnostic capabili-

ties. It is expected that future servicing specialists to

autonomous vehicle will require advanced degrees to

bridge possible skill gaps, which will be imple-

mented, including in a continuing education system.

In order to adapt to new technologies imple-

mented both in autonomous vehicles and in service

equipment, the need for maintenance of software and

electrical components will increase, but at the same

time, traditional automotive systems will also need

constant maintenance, which will require skills and

experience of highly qualified technical specialists. It

should be borne in mind that changing the vehicles

fleet structure will lead to a shift in the service pro-

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

625

cesses structure. For example, advanced computeri-

zation will help to reduce the number of collisions and

traffic accidents associated with a driver’s error,

which can lead to a decrease in the need for body re-

pair. At the same time, more emphasis will be placed

on software programming and data management. Big

data and forecasting technology will also play a role

in how maintenance personnel will service and repair

autonomous vehicles.

Automated vehicles are complete platforms,

therefore, for data management and predictive

maintenance, it is necessary to create an ecosystem in

which service management will be implemented. It is

planned that vehicles as a service will play an im-

portant role in the ever-growing economy of car shar-

ing, and in this regard, many vehicle components, in-

cluding infotainment applications such as platforms

for connected applications and services, will be ori-

ented towards this new request to “rent on demand”.

The goal of such integrated consumer systems will be

to ensure the passenger personalization and his

greater convenience. Obviously, a further increase in

the intensity of such services use will require ongoing

maintenance.

Analysts predict that vehicle maintenance costs

will continue to rise, mainly due to higher labour

rates. As the functionality develops and the depend-

ence of the vehicle’s performance on electronics and

software grows, independent service providers have

increased requirements for technician competencies.

A modern auto mechanic should develop with the

rapid development of the industry, and possess

knowledge not only of the simple mechanical and hy-

draulic vehicle's systems, but also be an electrical en-

gineer, which was facilitated by the OBD (on-board

diagnostics) systems appearance. Computerization

has introduced many new disciplines that auto me-

chanics need to learn, such as fuel types and systems,

electrical circuits, and troubleshooting computers.

The OBD II system advent created a new industry

standard, according to which auto mechanics had to

be certified in electrical systems for the M&R of mod-

ern vehicle components.

Now, auto mechanics need extensive training in

repairing autonomous vehicles that will be equipped

with much more powerful and sophisticated on-board

diagnostic tools than OBD II to accurately trouble-

shoot and predict component replacement or repair.

Between dealerships, independent service providers

and fleets that themselves perform maintenance of

their own vehicles fleet, intense competition for qual-

ified specialists is ongoing. In view of the new tech-

nologies introduction, it is necessary to invest heavily

in equipment for diagnosing and eliminating mal-

functions using data from the on-board vehicle's com-

puters. In addition, the increased vehicle's complexity

requires hiring technicians with higher technical

skills, who usually get higher salaries. Demand for

these technicians exceeds labour supply. This prob-

lem is exacerbated by the smaller number of young

technicians who are replacing senior qualified spe-

cialists older age, which requires higher wages to at-

tract new talents.

2.2.3 Faults Diagnostics and Processes

Organization in the Auto Service

Despite technological advances, autonomous vehi-

cles are still vehicles, each component of which, me-

chanical or electric, has a limited life cycle. There-

fore, the greater the mileage of an autonomous vehi-

cle, the more wear and tear. The higher the degree of

difficulty, the higher the risk of technical problems.

Until the autonomous vehicles fleet becomes suffi-

cient to obtain large statistical data sets about all fail-

ures kinds, there is a significant error probability.

This can cause a significant demand for qualified ve-

hicle service specialists, as well as vehicle service

system instability.

Vehicle Health Management (VHM) often in-

cludes real-time monitoring of operating conditions,

as well as decision-making on driving, operating, and

maintenance based on anticipated conditions. The ar-

ticle (Jaw L. and Wang W. 2004) presents a universal,

flexible integration and testing concept for checking /

evaluating control, as well as workability manage-

ment capabilities, which provide the necessary envi-

ronment for evaluating effectiveness, including the

accuracy of decision-making, algorithms and models

for managing workability status in real time and in

closed cycle.

Diagnosing faults in automotive systems is criti-

cal as it affects repair and maintenance times. One

common approach is to use a fault tree diagram. But

taking into account the implicit system's structure, the

authors of (James A.T., Gandhi O.P. & Deshmukh

S.G. 2018) proposed an approach with an explicitly

included built-in structure by means of digraph mod-

elling, which uses the graph theory's system ap-

proach. The proposed approach contains recommen-

dations for diagnosing the malfunction root causes.

The fault tree obtained from the developed digraph

system is suitable for computer processing. There-

fore, this methodology can be automated to diagnose

vehicle malfunctions. The methodology computeriza-

iMLTrans 2020 - Special Session on Intelligent Mobility, Logistics and Transport

626

tion will help in creating a knowledge base about fail-

ures, their causes and remedies. Therefore, this ap-

proach is especially useful for M & R engineers.

M & R of modern vehicles today is a difficult task,

since various causes of failures lead to similar symp-

toms in very complex vehicles. Existing fault diagno-

sis processes, based on failure's maintenance manuals

to manufacturer standard and personnel experience,

are often inadequate and lead to great effort and erro-

neous solutions. So, the article (Meckel S. et al.,

2019) presents methods for extracting knowledge

from unstructured and informal materials on online

forums with the aim of synthesizing diagnostic graphs

from the created knowledge base, which are software

part for use in vehicle maintenance, offering more ef-

ficient and targeted diagnostic actions and real-time

service.

The article (Borucka A. 2019) presents a wear

analysis of brake system components using vehicles

annual monitoring under various operating conditions

as an example. The goal was to study the significance

of the selected factors influence on the brakes wear

degree, as well as to present possible methods that

will be used in this area. This will provide not only a

higher safety level, but also more efficient task plan-

ning and the necessary expenses inclusion in the com-

pany's budget.

The maintenance strategy is keep to in order to en-

sure consistently high service quality, operability and

safe operation of the transport system, which requires

an appropriate schedule for vehicle maintenance. As

shown in (Kamlu S. & Laxmi V. 2019), maintenance,

which based condition, identifies the vehicle condi-

tion using either wired or wireless data to failure pre-

dicts and implementation appropriate maintenance

actions, such as repairs and replacements, before fail-

ure happens. In this paper, a Condition-based mainte-

nance (CBM) strategy was proposed that takes into

account various uncertainties, such as load, mileage

and terrain, to develop a fuzzy model for individual

vehicles. Hidden Markov models (HMM) can com-

bine all available prior knowledge in a Bayesian for-

mulation and, thanks to their Markovian structure,

provide the development of computationally complex

signal processing algorithms.

Improving the vehicle's operation efficiency is the

main goal of the diesel engines M & R system, in par-

ticular, by reducing the cost of engines maintenance

and overhaul, which are the most expensive vehicle

system (up to 25%). The article (Biniyazov A. M. et

al., 2019) authors study the patterns of the oil volume

influence in the diesel crankcase on the intensity of

changes in the engine technical condition and the oil

aging during operation.

The report (Sharma S., 2018) presents a method-

ological study on the changes analysis in the lubrica-

tion system of various medium-speed engines. In ad-

dition, this study includes an analysis of the engine oil

pressure effect on friction losses, torque study at var-

ious oil pressure values, and an analytical analysis en-

gine lubrication system functioning. Diagnostic data

collected from various engines was used as a reliable

source for detecting and troubleshooting a lubrication

system in an ordinary passenger vehicle.

The study (Börger A., Alfaro J., León P. 2019)

goal is to reduce the time required for trucks mainte-

nance. The authors indicate that due to inadequate

management and improperly performed maintenance

work, their repair time is increased. This work is

aimed at improving the terms of repair of trucks using

the Lean methodology - a management system whose

main task is to eliminate all waste in servise, which

reduces time to ensure greater customer satisfaction,

improve quality and reduce costs.

The article (Vintr S Z. and Holub R. 2003) dis-

cusses the optimizing the maintenance concept

method, which allows to reduce the vehicle life cycle

costs (LCC) based on operational reliability data

knowledge. The authors present a theoretical optimi-

zation model that describes the main relationships be-

tween LCC of the main vehicle subsystems and the

frequency of their scheduled (preventive) repairs. The

authors indicate that using the proposed model, it is

relatively easy to find reserves in the vehicle mainte-

nance concept and achieve significant savings in the

vehicle LCC using a simple measure of administra-

tive change in maintenance periods.

2.2.4 On-board Diagnostic Systems as a

Means of Working with Data

Depending on the vehicle driving automation level,

the on-board intelligent systems functions set also dif-

fers, which, as a rule, includes means to inform the

driver, help in difficult situations, to communicate

with dispatcher and service operators, as well as to the

vehicle condition's identify. So, the article (Nugroho

S.A. et al., 2018) authors cite the Car Data Recorder

Prototype (CDRP) system, which is able to improve

the accuracy of traffic accidents investigation, as it

can record the vehicles condition and report an acci-

dent by sending a notification in the SMS form using

the GSM module. The authors propose the on-board

diagnostics-II (OBD-II) function with the parameters

recording: the gas pedal position, the engine shaft

speed and engine temperature in the specified time

range. The article (Datta S. K., Härri J. and Bonnet C.

2018) discusses the importance of future autonomous

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

627

vehicles geo-temporal awareness: describes the IoT

platform for accurate positioning in highly automated

driving (HAD), which combines IoT with joint tech-

nologies, protocols and ITS algorithms to achieve

high-precision localization for future autonomous ve-

hicles. The document (Aljaafreh J A. et al. 2011) pre-

sents a vehicle data collection and analysis system for

automating fleet management using on-board diag-

nostics (OBD), GPS, RFID and WiFi technologies,

which are successfully integrated to develop this sys-

tem. The system integrated in the vehicle determines

the vehicle location using the GPS receiver, and the

vehicle status using the OBD interface, and driver

identifies by RFID.

The article (Godavarty S., Broyles S. and Parten

M. 2000) describes an approach to developing an

online diagnostic system using readily available com-

puting resources, such as laptop computers. You can

access this information through the PC interface and

some software, which is easier than directly from the

modern vehicles' on-board diagnostics systems (OBD

II). Online diagnostics can accelerate the new tech-

nologies development cycle, such as fuel cell vehi-

cles, as well as provide user support and optimize the

such vehicles performance by reducing downtime.

However therein, the main problem is the measure-

ment dispersion, caused by numerous interference

factors that make it difficult to compare the vehicles

behaviour in real conditions with their predetermined

reference analogues. The article (Nitsche C., Schroedl

S. and Weiss W. 2004) describes an approach in

which artificial neural networks are used to facilitate

the on-board diagnostics of fuel cell vehicles. The au-

thors believe that this method can be used to diagnose

short-term failures / errors, as well as long-term shift

in the vehicle power transmission's properties, for ex-

ample, in accordance with the deterioration of the fuel

cells state.

The article (Niazi M. A. K. et al. 2013) describes

the development of a universal OBD device and its

work with various vehicles based on OBD-TT stand-

ards, such as Land Rover Defender. This device dis-

plays real-time vehicle system status, including vehi-

cle speed, engine speed, throttle position, battery volt-

age, engine coolant temperature, etc., as well as diag-

nostic trouble codes (DTCs) for various vehicles. The

DTC from the vehicle microprocessor is generated as

a result of a system error or failure.

The document (Lin C. E et.al.,2007) presents a

modified system design based on vehicle monitoring

technology to present OBD data in real time. The sys-

tem proposed by the authors combines application de-

velopment technology for both OBD and Intelligent

Transport Systems (ITS) and can meet future vehicle

requirements for real-time ITS and ODB applications,

and also uses GPRS mobile communications for real-

time data transition over the internet.

The article (Wang Y. et al., 2016) authors, in order

to reduce vehicle exhaust emissions when using a sys-

tem with a selective urea catalyst, developed inte-

grated methods for on-board diagnostics and fault-

tolerant monitoring. The article presents a method for

detecting and troubleshooting a urea injection system

using data processing and their validation in the se-

lective catalyst reduction (SCR) system developed by

the authors. The article (Hu J. et al., 2011) introduces

the vehicle diagnostics methods and the on-board di-

agnostic system (OBD), compares and analyses sev-

eral types of diagnostic protocols that are widely used

in the OBD system. Compared to manual diagnostic

devices, this is a faster diagnostic method that pro-

vides powerful help and repair instructions. In addi-

tion, the system can be upgraded for more convenient

use and expansion of remote diagnostics.

The article (Bostelman R. and Shackleford W.

2010) presents the National Institute of Standards and

Technology (NIST) diagnostic tool and its applica-

tion in NIST automated guided vehicle (AGV),

which, according to the authors, is very useful for un-

derstanding the vehicle functionality. The manufac-

turer of AGV can benefit from this tool for design,

adjust, and monitor vehicle parameters and control al-

gorithms to enable robust autonomous vehicle con-

trol. The article (Zhang J., Yao H. and Rizzoni G.

2017) authors developed a systematic model diagnos-

tic approach based on a structural analysis of electric

drive systems, which can serve as the basis for the on-

board diagnostics systems for electric vehicles de-

sign. Remote technical condition monitoring includes

the use of V2I systems for the formation and applica-

tion of individual M & R systems. The V2I infor-

mation model developed in (Gritsuk I. et al., 2018) is

characterized by the vehicle digital field, limited by

regulatory rules, means of monitoring the technical

condition parameters and infrastructure components

for monitoring each vehicle. The system is based on

a general approach to the system study “Vehicle -

Driver - Operating Conditions - Vehicle Operation In-

frastructure”.

The article (Luka J. and Stubhan F. 1999) authors

indicate that the increase in the mechatronic systems

use in vehicles requires the diagnostic functions inte-

gration, which will be widely implemented in the ve-

hicle on-board software and will allow to improve the

diagnostic depth in the future, since they will be based

on functional and mathematical models. The data ob-

tained from the diagnostic functions describe the ve-

hicle general condition and are stored in non-volatile

iMLTrans 2020 - Special Session on Intelligent Mobility, Logistics and Transport

628

memory. The main information source can serve as

customer complaints that can be received through the

voice channel. Data about the vehicle, as well as in-

formation from the driver, are compared with failures

that arose earlier in other vehicles. Mobile diagnostics

will optimize the diagnosis and repair process, espe-

cially in the vehicle emergency event away from the

workshop.

3 RESULTS AND DISCUSSION

3.1 The Single Information Space

Concept When Creating

Infrastructure for Expanding the

Autonomous Vehicles Fleet

During the transition to the fourth industrial revolu-

tion, cyber-physical systems are formed which con-

nect, through informational interaction, subsystems

with different purposes, sizes and properties. So, the

connection between the production system and BSS

is carried out at the level of material flows using the

logistic system, and at the information level - by cre-

ating a single information space.

Today, the automobile plants products annually

are complicated not only constructively, which leads

to the need to improve the service and repair technol-

ogy, but also intelligently, which is expressed in the

emergence of new systems built into the vehicle.

These are systems responsible for management, secu-

rity, and the interface with various services and other

entities. Changing the concept of the transportation

process and the vehicle operation require careful prep-

aration and adequate processes management in BSS

network. In this regard, changes are inevitable in all

systems related to the vehicles life cycle: production,

logistics and service. The BSS concept will change be-

cause the manufacturer needs to qualitatively imple-

ment the principle of responsibility for his product

throughout the entire life cycle (Embracing Industry

4.0. 2019.), and this is possible only with appropriate

control over the processes in all systems, especially at

the initial stage AV launching on the market.

As follows from the analysis of consumer opin-

ions and analysts' forecasts, apparently, first of all, the

concept of using autonomous vehicles will be imple-

mented in freight logistics. It should be understood

that modern trucks, unlike cars, are almost impossible

to service in small auto repair shops. Another feature

that analysts talk about is the fact that possible

maintenance errors can be associated with a lack of

reliable information about failures and their causes,

which should accumulate as the autonomous vehicles

fleet expands. Therefore, its BSS will be a place of

collection and storage of information about the fea-

tures of operation, maintenance and repair of both a

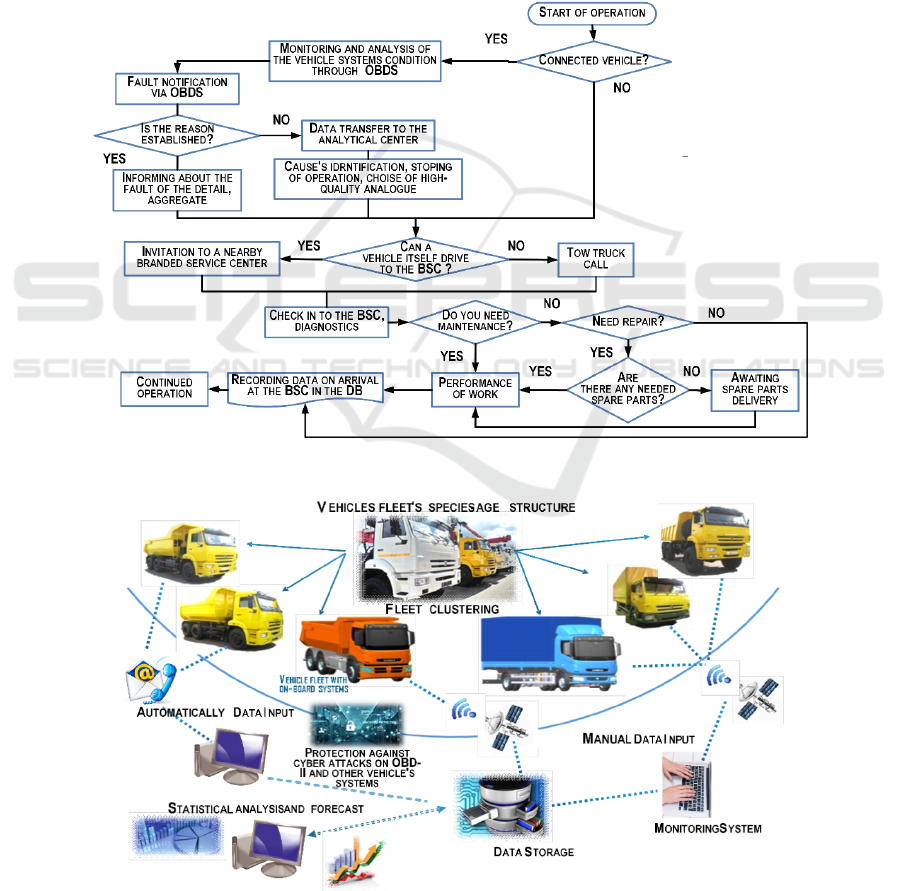

particular vehicle and the entire fleet (Fig. 2).

Given that despite the additional control and

other intelligent components, the vehicle still remains

a complex technical system, therefore a significant

part of the service and repair technologies will remain

the same. Moreover, intelligent vehicles will make up

a small fleet share for a considerable time. Neverthe-

less, it is necessary to pre-engage in preparing the in-

frastructure not only for organizing the transportation

process, but also for maintaining the vehicle in a

healthy and safe condition for reliable operation.

Figure 2: Unified information space of a manufacturer ve-

hicles.

It should be remembered that the logistics of the

future, like the entire industry 4.0, will be based on

new materials, nanotechnology, RFID technology or

cyber networks, so neo-industrialization will vary sig-

nificantly affect supply chain management and logis-

tics in general. To improve the accuracy of the infor-

mation necessary for supply chain management, it is

necessary to integrate RFID systems into MES sys-

tems, which will optimize outbound and inbound lo-

gistics. The RFID system allows you to: monitor the

supply chain in real time (using web access); track the

goods at each supply chain stage; reduce the human

factor impact.

The inclusion of each vehicle as an active object

by means of the communication channels in the

cyber-physical system, will make it possible to obtain

information about the state its nodes and aggregates

and to predict the residual life. With an adequate sen-

sors selection and on-board diagnostic systems im-

provement, this allows you to set the wear amount

and predict the probable failure moment. Thus, pos-

sessing such information and transferring it to the

production system's data storage cloud system, it will

be possible to predict the need for spare parts for re-

pairs and to establish a unique product samples within

the mass production framework.

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

629

For the such interaction scheme organization be-

tween the service system and the production system,

the including on an individual vehicle system of on-

board diagnostics and online data transaction is im-

plied. Such systems operate through four main com-

ponents: GPS satellites, vehicle on-board diagnostic

kit, GSM network and the GPS control service pro-

vider server. Satellites are used to obtain key infor-

mation about the vehicle, such as: location, direction

and speed. The on-board kit is a GPS-receiver, GSM-

transmitter and minicomputer, and also includes on-

board diagnostic devices. All the necessary infor-

mation from GPS satellites, from sensors and / or the

on-board computer is collected in the so-called black

box, from where it is transmitted through the GPRS

local GSM operator channel to the server, where the

information is properly processed and transmitted to

the cloud data storage. The end user (in this case, a

person or a machine) has access to information either

through special software, or through a regular Web

browser from planet anywhere with Internet access.

The use of wireless signal transaction technolo-

gies imposes increased requirements for the trans-

acted data security. The SmartMX type microcontrol-

ler, which is certified according to the international

Common Criteria standard to the EAL5 + level, will

be responsible for data security, which ensures com-

pliance with the highest security requirements. It of-

fers increased attack resistance and high performance,

with cryptographic coprocessors and ultra-low power

consumption. To serve a number of applications,

SmartMX supports proprietary operating systems

such as open platforms such as Java and MULTOS

(NXP SmartMX…, 2019).

3.2 Reliability Management in BSS to

Autonomous Vehicles

Competitiveness issues are addressed at product's life

cycle all stages. To a large extent, competitiveness

depends on the speed of updating the model range and

the reliability of products during operation. Since the

vehicle is a complex technical system consisting of

many parts, its reliability depends on how reliable

these parts are. Although there are not many details

limiting reliability, however, the issues of increasing

their reliability and predicting possible replacement

periods are relevant.

At the vehicle operation stage, which is the long-

est of all life cycle stages, the main customer’s re-

quirement is to maintain the vehicle in a technically

sound condition. This activity area acquires particular

relevance in connection the design complexity, there-

fore, the organization of a producer company single

information space with all dealer service centers will

allow to quickly identify problems and solve them

(Makarova, I.; et al. 2012, 2015, 2016).

As a rule, truck service is carried out in special-

ized service centers operating according to the manu-

facturer's standards. Since it is important for the vehi-

cle owner that the service is carried out as soon as

possible, a large number of scientific papers are de-

voted to the processes optimization methods. If the

failure of any detail or aggregates occurred during the

warranty period, then the issue of improving the re-

pair efficiency is important both for the manufacturer

and for the vehicle owner. The manufacturer must

provide a quick replacement of the failed system, and

the client must receive a working vehicle for the im-

plementation of the logistics process and profit. In the

transition to autonomous vehicles, the ensuring oper-

ability issues will be specific in nature and will be

based on information from on-board diagnostic sys-

tems, as well as, traditionally, on failure statistics,

which at the initial moment of entering AV on the

markets will be incomplete.

In addition, it must be borne in mind that, obvi-

ously, the regulations for daily maintenance and pre-

ventive maintenance will also change, since by re-

moving the person-driver from the control loop, we

thereby exclude the possibility of preventing a tech-

nical system sudden failure by indirect signs that can

be identified either by a person or a specific sensor (if

provided in the monitoring system).

Nevertheless, the algorithm for organizing the M

& R of autonomous vehicles can generally look like

the one shown in Figure 3.

3.3 Methods and Means of Data

Aggregation, Analysis and Security

Decision making is based on real data about the man-

aged object, therefore, for analysis, strategy develop-

ment and operational management aggregated infor-

mation is used. To storage, integration, updating and

coordination of operational data from heterogeneous

sources create data warehouses (DW). DWs are nec-

essary for the formation of a consistent and uniform

view of the control object as a whole, therefore they

contain information collected in real-time from sev-

eral operational databases of On-Line Transaction

Processing systems (OLTP). A multidimensional in-

telligent data model (OLAP cube) will be located in

the single information space's management center of

the automotive company.

To implement OLAP, you can use a hybrid option

that combines Relational OLAP (ROLAP) and Mul-

tidimensional OLAP (MOLAP). This provides higher

iMLTrans 2020 - Special Session on Intelligent Mobility, Logistics and Transport

630

scalability of ROLAP and faster calculation of MO-

LAP. Hybrid OLAP (HOLAP) servers allow storing

large amounts of detailed information. The database

administrator, in this case, will be responsible for en-

tering and updating the information, updating the data

in the measurement tables, as well as adjusting the

Fact table, if users need new queries.

Data for multivariate analysis can be obtained us-

ing a special utility directly from the database by for-

malizing the selected data array. Reporting Services

(SSRS) has a complete tools set for creating, manag-

ing and delivering reports, what allows you to create

reports for a large data sources number. Reporting

Services tools are fully integrated with SQL Server

tools and components. (SQL Server…, 2020). In ad-

dition, SSRS has APIs through which developers in-

tegrate or expand the data processing and reports in

user applications.

Given, that connected vehicles have a large differ-

ent sensors number, it is necessary to provide in BSS

the rules for their verification, as well as maintenance

and replacement procedures. If there are vehicles of

varying intellectualization degrees in the serviced ve-

hicle fleet, their preliminary clustering is required to

select the optimal service strategy for each vehicle

type. The conceptual scheme BSS management is

shown in Figure 4.

Figure 3: The BSS functioning algorithm when using connected vehicles.

Figure 4: Management organization in the BSS information space.

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

631

4 CONCLUSIONS

Executed studies have shown that trends in the auto-

motive industry are due to digitalization and intellec-

tualization, that largely depends on the information

quality. Increased requirements for safety and relia-

bility in transport systems increase the requirements

for the quality of data necessary for the management

and sustainable development of transport systems. In

our opinion, only complex solutions can have a posi-

tive effect. Growing data volumes increase the analy-

sis tools importance, most of which are based on

OLAP principles, modern big data analysis methods

and security tools. The BSS development and its im-

provement, taking into account the entry into the mar-

ket of intelligent vehicles, a significant part of which

will be connected, requires the creation of a single in-

formation space for process control throughout the

entire vehicle life cycle. This will allow you to timely

and effectively solve problems arising in the service

system, as well as build long-term strategies based on

big data analysis. For this, it is necessary that the de-

sign and technological solutions in the production

system are combined with rational management, in-

cluding in the service system. This will allow you to

find the optimal processes parameters at all stages of

the car's life cycle, as well as make rational manage-

ment decisions.

ACKNOWLEDGEMENTS

This work was supported by the Russian Foundation

for Basic Research: grant No. 19-29-06008\19

REFERENCES

Aljaafreh J A. et al. 2011. Vehicular data acquisition system

for fleet management automation. Proceedings of 2011

IEEE International Conference on Vehicular Electron-

ics and Safety. Beijing. pp. 130-133.

Berrada, J. & Christoforou, Z. & Leurent, F. 2017. Which

Business Models for Autonomous Vehicles?. URL:

https://www.researchgate.net/publication/329529327_

Which_Business_Models_for_Autonomous_Vehicles

Biniyazov A. M., Bayakhov A. N., Bektilevov A. Yu.,

Sadykov R. S., Zakharov V. P., Sarsenbaeva L. Kh.

2019. Operation Maintaining of Automobile Forced

Diesel Engines with Ensuring of Functional Condition

of the Lubrication System in Exploitation. International

Journal of Mechanical and Production Engineering

Research and Development (IJMPERD). Vol.9. No. 3.

pp. 1761-1768

Börger A., Alfaro J., León P. 2019. Use of the Lean Meth-

odology to Reduce Truck Repair Time: A Case Study.

In: Rocha Á., Adeli H., Reis L., Costanzo S. (eds) New

Knowledge in Information Systems and Technologies.

WorldCIST'19 Advances in Intelligent Systems and

Computing, vol 930. pp 655-665. Springer, Cham

Borucka A. 2019. Assessment of the Influence of Selected

Factors on the Wear of Braking System Components as

an Element of Reliability of Means of Transport, 4th

International Conference on Intelligent Transportation

Engineering (ICITE), Singapore. pp. 207-211.

Bösch P.M., Becker F., Becker H., Axhausen K.W. 2018.

Cost-based analysis of autonomous mobility services.

Transport Policy. Volume 64. pp. 76-91.

Bostelman R. and Shackleford W. 2010. Improved perfor-

mance of an automated guided vehicle by using a smart

diagnostics tool. IEEE International Conference on In-

dustrial Technology. Vina del Mar. pp. 1688-1693.

Buddhakulsomsiri J., Siradeghyan Y., Zakarian A. & Li X.

2006. Association rule-generation algorithm for mining

automotive warranty data. International Journal of

Production Research. Vol. 44, No. 14. pp. 2749–2770.

Byuvol, P.A. et al. 2017. Improving the branded service

network efficiency based on its functioning evaluation.

Astra Salvensis. Volume 2017. pp. 373-385

Change vehicles: How robo-taxis and shuttles will reinvent

mobility. 2019. URL: https://www.mckinsey.com/in-

dustries/automotive-and-assembly/our-in-

sights/change-vehicles-how-robo-taxis-and-shuttles-

will-reinvent-mobility

Datta S. K., Härri J. and Bonnet C. 2018. IoT Platform for

Precision Positioning Service for Highly Autonomous

Vehicles. 22nd International Computer Science and En-

gineering Conference. Chiang Mai.Thailand. pp. 1-6.

Embracing Industry 4.0. 2019. URL: https://www.bcg.com/

ru-ru/capabilities/operations/embracing-industry-4.0-

rediscovering-growth.aspx.

Gartner Forecasts More Than 740,000 Autonomous-Ready

Vehicles to Be Added to Global Market in 2023 2019.

https://www.gartner.com/en/newsroom/press-re-

leases/2019-11-14-gartner-forecasts-more-than-

740000-autonomous-ready-vehicles-to-be-added-to-

global-market-in-2023

Godavarty S., Broyles S. and Parten M. 2000. Interfacing

to the on-board diagnostic system. Vehicular Technol-

ogy Conference Fall 2000. IEEE VTS Fall VTC2000.

52nd Vehicular Technology Conference. Boston. MA.

USA. vol.4. pp. 2000-2004.

Gritsuk I., Volkov V., Mateichyk V., Grytsuk Y. et al. 2018

Information Model of V2I System of the Vehicle Tech-

nical Condition Remote Monitoring and Control in Op-

eration Conditions. SAE Technical Paper. 2018-01-

0024. URL: https://doi.org/10.4271/2018-01-0024.

Hu J., Yan F., Tian J., Wang P. and Cao K. 2010. Develop-

ing PC-Based Automobile Diagnostic System Based on

OBD System. Asia-Pacific Power and Energy Engi-

neering Conference. Chengdu. pp. 1-5.

James A.T., Gandhi O.P. & Deshmukh S.G. 2018. Fault di-

agnosis of automobile systems using fault tree based on

iMLTrans 2020 - Special Session on Intelligent Mobility, Logistics and Transport

632

digraph modeling. Int J Syst Assur Eng Manag 9. pp.

494–508. doi:10.1007/s13198-017-0693-6

Jaw L. and Wang W. 2004. A run-time test system for ma-

turing intelligent system/vehicle capabilities – SIDAL.

IEEE Aerospace Conference Proceedings (IEEE Cat.

No.04TH8720), Big Sky. MT. Vol.6. pp. 3756-3763

Kamlu S. & Laxmi V. 2019. Condition-based maintenance

strategy for vehicles using hidden Markov models. Ad-

vances in Mechanical Engineering. URL:

https://doi.org/10.1177/1687814018806380

Last M., Sinaiski A., Subramania H.S. 2010. Predictive

Maintenance with Multi-target Classification Models.

Intelligent Information and Database Systems. Lecture

Notes in Computer Science. Volume 5991. pp 368-377.

Lee SangHyun et al. 2008. A Fuzzy Logic-Based Approach

to Two-Dimensional Warranty System. Advanced In-

telligent Computing Theories and Applications. With

Aspects of Artificial Intelligence. Lecture Notes in

Computer Science. Volume 5227.pp 326-331.

Lee SangHyun et al. 2009. Fuzzy Failure Analysis of Auto-

motive Warranty Claims Using Age and Mileage Rate.

Emerging Intelligent Computing Technology and Ap-

plications. With Aspects of Artificial Intelligence. Lec-

ture Notes in Computer Science. Volume 5755. pp 434-

439.

Lin C. E., Shiao Y., Li C., Yang S., Lin S., Lin C. 2007.

Real-Time Remote Onboard Diagnostics Using Em-

bedded GPRS Surveillance Technology. IEEE Trans-

actions on Vehicular Technology. vol. 5. Iss.3. pp.

1108-1118.

Loeb B. & Kockelman K.M. 2019. Fleet performance and

cost evaluation of a shared autonomous electric vehicle

(SAEV) fleet: A case study for Austin, Texas. Trans-

portation Research Part A: Policy and Practice, Else-

vier, vol. 121(C), pp. 374-385.

Luka J. and Stubhan F. 1999. Mobile diagnosis [of vehicle

mechatronic systems]. Proceedings of the IEEE Inter-

national Vehicle Electronics Conference) (Cat.

No.99EX257), Changchun, China. vol.1. pp. 215-220

Makarova, I.; et al. 2012. Dealer-service center competi-

tiveness increase using modern management methods.

Transport Problems. Volume 7, Issue 2. Pages 53-59

Makarova, I.; et al. 2015. Improving the system of warranty

service of trucks in foreign markets. Transport Prob-

lems. Vol.10. Iss.1 pp. 63-78

Makarova, I.; et al. 2016. Improving the logistical processes

in corporate service system. Transport Problems. Vol.

11 Iss. 1. pp. 5-18 DOI: 10.20858/tp.2016.11.1.1

Meckel S., Zenkert J., Weber C., Obermaisser R., Fathi M.

and Sadat R. 2019. Optimized Automotive Fault-Diag-

nosis based on Knowledge Extraction from Web Re-

sources. 24th IEEE International Conference on

Emerging Technologies and Factory Automation

(ETFA). Zaragoza. Spain. pp. 1261-1264

Niazi M. A. K. et al. 2013. Development of an On-Board

Diagnostic (OBD) kit for troubleshooting of compliant

vehicles. IEEE 9th International Conference on Emerg-

ing Technologies (ICET). Islamabad. pp. 1-4.

Nitsche C., Schroedl S. and Weiss W. 2004. Onboard diag-

nostics concept for fuel cell vehicles using adaptive

modelling. IEEE Intelligent Vehicles Symposium.

Parma. Italy. pp. 127-132.

Nugroho S. A., Ariyanto E. and Rakhmatsyah A. 2018. Uti-

lization of Onboard Diagnostic II (OBD-II) on Four

Wheel Vehicles for Car Data Recorder Prototype. 6th

International Conference on Information and Commu-

nication Technology (ICoICT). Bandung. pp. 7-11.

NXP SmartMX: high security microcontroller IC. 2019.

URL: https://www.nxp.com/docs/en/bro-

chure/75017515.pdf.

Sharma S., Upreti M., Sharma B., and Poddar K. 2018.

Analysis of variation in oil pressure in lubricating sys-

tem. AIP Conference Proceedings 1953, 130027.

Shubenkova, K. et al. 2018. Possibility of digital twin’s

technology for improving efficiency of the branded ser-

vice system. Proceedings Global Smart Industry Con-

ference, GloSIC 2018, doi:10.1109/

GloSIC.2018.8570075

SQL Server Reporting Services (SSRS) Tutorial for Begin-

ners URL: https://www.guru99.com/ssrs-tutorial.html

The future of mobility is at our doorstep. 2019. URL:

https://www.mckinsey.com/industries/automotive-

and-assembly/our-insights/the-future-of-mobility-is-

at-our-doorstep

The Self-Driving Car Timeline – Predictions from the Top

11 Global Automakers. 2019. URL: https://emerj.com/

ai-adoption-timelines/self-driving-car-timeline-them-

selves-top-11-automakers/

Vintr S Z. and Holub R. 2003. Preventive maintenance op-

timization on the basis of operating data analysis. An-

nual Reliability and Maintainability Symposium.

Tampa. FL. USA. pp. 400-405.

Wang Y., Sun Y., Chang C. and Hu Y. 2016. Model-Based

Fault Detection and Fault-Tolerant Control of SCR

Urea Injection Systems. IEEE Transactions on Vehicu-

lar Technology. vol. 65. no. 6. pp. 4645-4654e.

Xie W., Liao H. & Zhu X. 2014. Estimation of gross profit

for a new durable product considering warranty and

post-warranty repairs. IIE Transactions. Vol.46, pp.

87–105.

Zhang J., Yao H. and Rizzoni G. 2017. Fault Diagnosis for

Electric Drive Systems of Electrified Vehicles Based on

Structural Analysis. IEEE Transactions on Vehicular

Technology. vol. 66. no. 2. pp. 1027-1039.

Changing the Maintenance and Repair System While Expanding the Connected Vehicles Fleet

633