Introduction to LifeBlocks: A Blockchain based Insurance Platform

Shikhar Bhatt, Sumit Hotchandani, Kailash Raj Gaur and Sumedha Sirsikar

Maharashtra Institute of Technology, Pune, MH, India

Keywords:

Blockchain, Insurance, Ethereum, Encryption, Cryptography, Smart Contract, IPFS.

Abstract:

In India, the insurance sector is rife with inefficiencies. The entire process, from buying an insurance policy to

settling claims, has numerous stumbling blocks. Blockchain is considered as a disruptive technology that could

revolutionize and bring huge benefits to the insurance sector. It can be can be a game-changer, making the

entire insurance process simpler, secure and efficient. Through this paper, we are proposing a blockchain based

system “LifeBlocks” to solve various problems in the insurance sector. The paper talks about the problems in

the current insurance process and how our system overcomes these problems. The paper discusses the four

major use-cases of the system along with technologies like Parity Ethereum, InterPlanetary File System (IPFS)

and Smart Contracts used to develop our insurance platform.

1 INTRODUCTION

Blockchain(Nakamoto, 2008) is a distributed ledger

of records. It provides security by cryptographically

storing the data. It is inherently permanent and im-

mutable i.e. once recorded, data on the blockchain

can not be changed retroactively. Involved parties

can view all the data(transactions) ensuring trans-

parency in the system. Blockchain supports smart

contracts(Buterin, 2013)(Waltl et al., 2019) which

are programmable logic that self-execute once pre-

determined conditions are met without the need for

third-party intervention. Blockchain technology of-

fers a novel way for constructing secure distributed

systems. Initially designed as a system service for

detecting double spending in cryptocurrency systems,

blockchain is widely applicable to many business ap-

plications where there is a requirement of trust among

distributed parties.

A blockchain is maintained by a set of nodes

which do not fully trust each other. Nodes in the

blockchain agree on time-stamped ordered set of

blocks, each containing multiple transactions, thus the

blockchain can be viewed as a log of ordered trans-

actions. This log of transactions is called a ledger.

The nodes keep replicas of this ledger and agree on

an execution order of transactions. Whenever there

is a transaction, it is broadcasted to the other nodes

in the network and added to the pool of un-verified

transactions. One of the nodes verifies the transaction

by solving a random cryptographic puzzle and then

broadcasts the solution. Other nodes act as validators

and check if the solution is correct or not. If correct

then the transaction is included in the ledger else re-

verted. This is the basic life-cycle of a blockchain

transaction.

“LifeBlocks” aims to create a streamlined and ef-

ficient healthcare system by leveraging the blockchain

technology. With blockchain already being a crypto-

graphically secured platform and other applied cryp-

tographic algorithms for secure file management and

sharing makes the system robust and helps maintain

integrity in the system. In addition, the tamper-proof

nature compels the entire process of insurance to be

efficient.

The paper is organized as follows: In section II,

we describe the current landscape of health insurance

in India, and how digital disruption can be key in it’s

evolution. Section III describes in detail our approach

to the problem - various components in the system

and how they improve the insurance process. Sec-

tion IV covers all the important technologies used and

their importance in the system. Section V concludes

the paper with possible future work for our system.

2 CURRENT LANDSCAPE OF

HEALTH INSURANCE

The right to health care is an essential and universally

agreed upon human right. This basic human right

has been kept out of the reach of the common man

due to escalating costs and unavailability of quality

medical services. Health insurance has emerged as

an alternative to finance health care in light of these

concerns. Health insurance is a contract between an

Bhatt, S., Hotchandani, S., Gaur, K. and Sirsikar, S.

Introduction to LifeBlocks: A Blockchain based Insurance Platform.

DOI: 10.5220/0009854000770081

In Proceedings of the 17th International Joint Conference on e-Business and Telecommunications (ICETE 2020) - DCNET, OPTICS, SIGMAP and WINSYS, pages 77-81

ISBN: 978-989-758-445-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

77

individual or group and an organization, wherein the

organization provides the buyer health care coverage

in exchange for a fixed amount known as “premium”,

which is decided based on a myriad number of fac-

tors.(Anita, 2008)

Health insurance refers to a wide variety of poli-

cies. These range from policies that cover the cost

of doctors and hospitals to those that meet a specific

need, such as paying for long term care. Health insur-

ance in India is one of the fastest growing industries.

Although there is a wide scope for growth, the sec-

tor is currently under-performing compared to other

developed and emerging countries, especially when it

comes to key performance indicators like insurance

penetration and density. Penetration defined as ratio

of insurance premium paid over GDP of the country is

3.69% in India compared to 5.62% in other emerging

Asian economies and 6.13% in the rest of the world

as of 2017. (Majumdar et al., 2019) Density indicates

the coverage of a country’s population i.e. the ratio of

total insurance premium paid to the total population

of the country. India’s insurance density of USD 73 in

2017 lagged considerably behind the global average

of USD 650 and USD 360 of other Asian economies.

(Majumdar et al., 2019)

Insurance (Raikwar et al., 2018) providers recog-

nize the advantages of technology in other industries

and along with other stakeholders are making well-

thought investments in leveraging technology to drive

better customer experience, faster closure of claims

and ease of buying insurance policies. The insurance

sector has been a late adopter of technology but is now

witnessing disruption. With adoption of AI and chat

bots, insurance companies are able to provide round

the clock customer support and the data being col-

lected helps them understand the market better and

launch more user-friendly products. As a result, the

industry is experiencing a new era of growth in an in-

creasingly competitive space.

The evolution of India’s insurance sector holds

great promise for both customers and the entities that

operate within the industry. Disruption will likely

continue and will result in the creation of many in-

novative companies and transformative services.

3 PROPOSED SYSTEM

This section talks about the four major use-cases

of our system as mentioned- Identity Management,

Electronic Health Records Upload and Sharing, Pol-

icy Servicing and Claim Settlement. Subsequently,

each use-case is discussed in detail.

3.1 Identity Management

For any system to be used by the customers, it must

have a mechanism to seamlessly on-board them. If we

look at any ordinary system, the user signs-up using

a unique user-name and password and further uses it

to log into the system. As our system “LifeBlocks”

uses the blockchain technology, the process of user

on-boarding is quite different.

The users of our system are divided into three

categories- customers, hospitals and insurance com-

panies. The registration process for all the three cate-

gories of users is similar with only minor changes in

the details to be provided at the time of registration.

The registration process comprises of two steps:

1. Creating an Ethereum Account

This step is same for all categories of user. To

create an ethereum account, our system uses a

browser extension called Metamask. The user

needs to download the extension on their web-

browser. After the Metamask extension is suc-

cessfully installed, the user just needs to follow

the steps directed by the Metamask to create an

ethereum account. The users will be given a pass-

phrase for the created account which they need to

save or store it safely. This pass-phrase can be

used to recover the ethereum account.

2. Sign-up on the Portal

This step varies slightly for different users. For

a customer, they need to provide their Aadhaar

number and a One-Time-Password is sent to the

customer’s mobile number linked with their Aad-

haar. If all details are valid, the customer is reg-

istered and can avail the services on our platform.

For a hospital or an insurance company, they need

to provide the Unique Identifier and the secret key

provided to them by the government. The rest

of the process is same as that of a customer. A

mapping between the user’s Aadhaar number and

their ethereum address is made in the smart con-

tract, when the registration process is completed

successfully.

For all users, the process of registration also involves

the generation of a PGP key-pair in which the private

key is encrypted by the seed-phrase provided by the

user in the registration form. This encrypted PGP key-

pair is stored on the IPFS (Benet, 2014) and the subse-

quent IPFS address generated for the key-file is stored

in the smart contract i.e. on the blockchain. This pro-

cess is completely automated and the user need not

worry about any of the related processes. They just

need to remember the seed-phrase which is required

to decrypt the PGP private key.

DCNET 2020 - 11th International Conference on Data Communication Networking

78

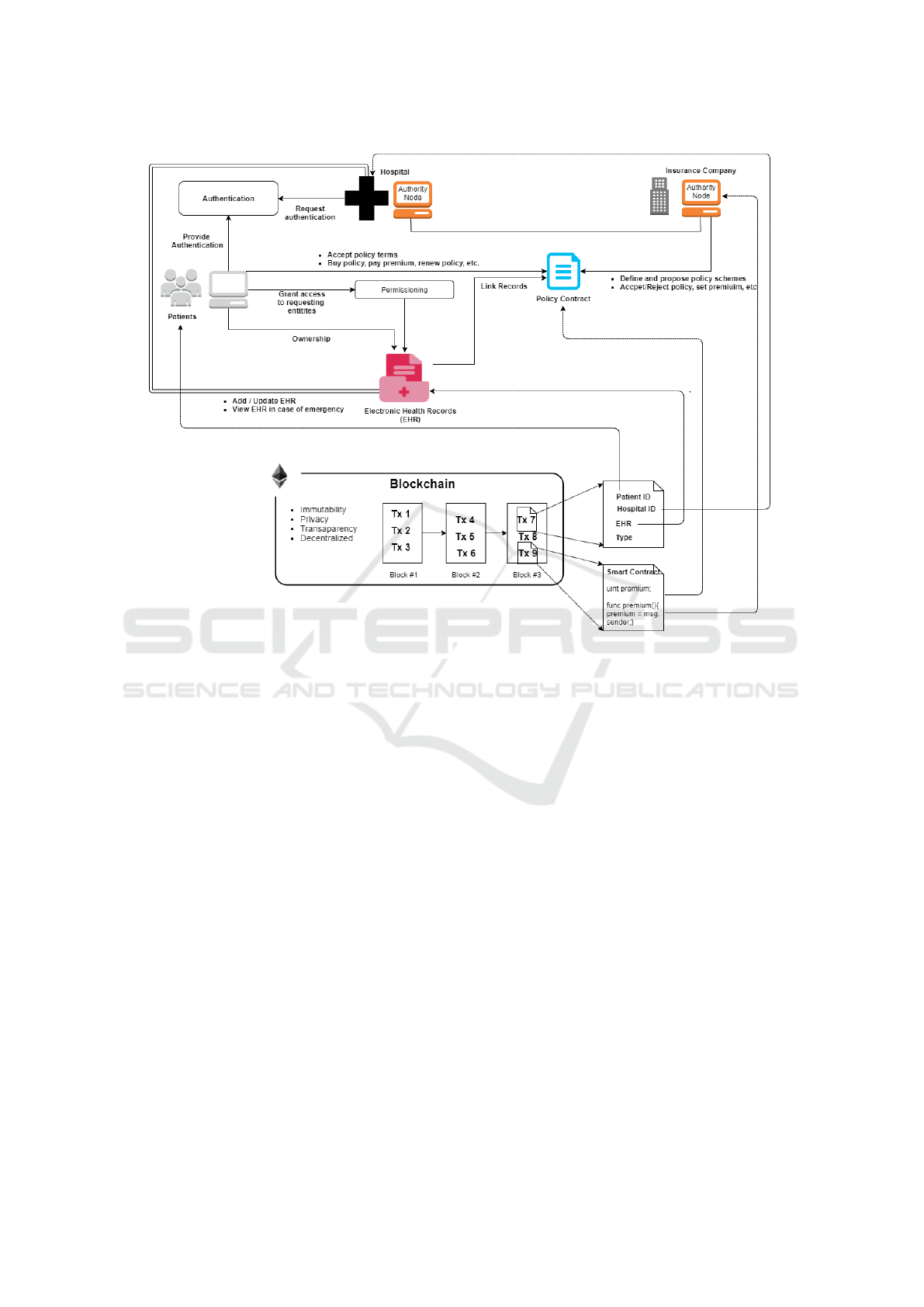

Figure 1: System Architecture.

Such an identity management system gives people the

freedom to create self-sovereign and encrypted digital

identities, hence replacing the need for creating mul-

tiple usernames and passwords.

3.2 Electronic Health Records Upload

and Sharing

Today, there are inefficiencies in the management of

health records. The patients have no control over their

medical records. Since most of the medical records

are paper-based, it’s difficult for the patients to keep

track of their medical history.

The following steps explain the process of medical

record management i.e. record upload and sharing:

1. Record Upload

This process begins when a customer/patient goes

to a hospital. The medical records generated are

uploaded by the hospital on a distributed file stor-

age system built using InterPlanetary File Sys-

tem(IPFS) (Benet, 2014) and the hash-key of

the address generated is stored in smart con-

tract. The records are processed before being

stored on IPFS. For each record a unique sym-

metric “master” key is generated using which the

record is encrypted. This master key is encrypted

with the user’s PGP public key(generated at the

time of registration). The encrypted record is

stored on the IPFS. The generated hash-key of the

record’s IPFS address and the encrypted master

key are stored in the smart contract along with

the record’s other details. Since the record’s mas-

ter key can only be decrypted with the patient’s

PGP private key, only patients have access to their

medical records. The end users of the system

i.e. patients and hospitals are abstracted from all

the technical intricacies involved in the encryption

and decryption process.

2. Record Sharing

The customer securely shares the symmetric key

of the record with the recipient(hospital/insurance

company) of their choice. The record’s symmet-

ric key is first decrypted with the user’s PGP

private key. The decrypted symmetric key is then

re-encrypted using the hospital’s or insurance

company’s PGP public key. This newly encrypted

symmetric key is stored in the smart contract.

The recipient can view the user’s medical record

Introduction to LifeBlocks: A Blockchain based Insurance Platform

79

by decrypting it with the symmetric key, which

can be un-locked using their own PGP private key.

Our system manages the inefficiencies prevalent in

the current system by cryptographically securing the

medical records which gives users complete control

over their records. These medical records are elec-

tronically stored on the blockchain allowing users to

easily track their medical history and access them

anytime and anywhere.

3.3 Policy Servicing

Policy Servicing includes applying for an insurance

policy, paying premiums and handling the various

stages of the insurance policy life-cycle. Initially, the

insurance company deploys policy scheme contracts.

The user can view all the different policy schemes de-

ployed by various by multiple insurance companies.

The user can apply for only one insurance policy at

a time and a new smart contract is deployed for the

same. This new smart contract stores necessary de-

tails like the buyer, seller and coverage information of

the insurance policy. While applying, the customers

have to share certain medical records with the insur-

ance company. The insurance company can either ac-

cept or reject the application. If the application is ac-

cepted the state of the policy contract created remains

as APPLIED else it is set to as DEFUNCT. If policy

accepted and customer pays the premium the state of

the policy is set to ACTIVE. Further, the state of the

policy may change based on the duration of the pol-

icy. It may go in to GRACE, LAPSE, INACTIVE or in

the DEFUNCT state.

3.4 Claim Settlement

This is the most important use-case of our system.

The entire process of claim settlement is automated.

In our system, in case of a claim-able event, for exam-

ple an accident, the hospital uploads the medical bills

and records tagged as claim-able. The smart contract

checks if the patient has any health insurance policy

or not. If yes, the uploaded bill and records are an-

alyzed and checked against the conditions defined in

the contract. Based on the analysis, the amount to be

given to the patient against the health insurance pol-

icy is calculated. The amount is then automatically

sent to the patient’s ethereum account by the insur-

ance company. All the above discussed processes are

automated, saving precious time of all the involved

parties.

4 TECHNOLOGIES USED

4.1 Ethereum

Ethereum (Buterin, 2013)(BLO, reum) is an open

software platform based on blockchain technology

that enables developers to build and deploy decen-

tralized applications. It is basically a peer-to-peer

network of virtual machines that any developer can

use to run distributed applications(DAPPs). These

computer programs could be anything, but the net-

work is optimized to carry out rules that mechani-

cally execute when certain conditions are met, like a

contract. Ethereum uses its own decentralized pub-

lic blockchain to cryptographically store, execute, and

protect these contracts.

4.2 Parity

It is an open-source software for building the

decentralized Web. Parity develops cutting-edge

blockchain technologies to foster innovations. Par-

ity Ethereum provides the core infrastructure essential

for the speedy and reliable services. It uses Proof of

Authority consensus protocol. It provides clean, mod-

ular code base for easy customization along with min-

imal memory and storage footprint. The decision to

use Parity was due to it’s use of the Proof of Author-

ity consensus mechanism that allows only one node to

verify a particular transaction and other just validate

it. This would provide a more close and controlled

system but one with a much faster transaction rate.

4.3 Inter-Planetary File System (IPFS)

InterPlanetary File System (Benet, 2014) (IPFS) is a

protocol and network designed to create a content-

addressable, peer-to-peer method of storing and shar-

ing hypermedia in a distributed file system. In other

words, IPFS is a distributed file system that seeks to

connect all computing devices with the same system

of files. In a way, this is similar to the original aim of

the Web, but IPFS is actually more similar to a single

BitTorrent swarm exchanging git objects. Instead of

referring to objects (pics, articles, videos) by which

server they are stored on, IPFS refers to everything

by the hash on the file. The idea is while retrieving a

file, IPFS will ask the entire network about that par-

ticular file which corresponds to that particular hash

and a node on IPFS that does can return the file al-

lowing you to access it. The mechanism is to take a

file, hash it cryptographically so it ends up with a very

small and secure representation of the file which en-

DCNET 2020 - 11th International Conference on Data Communication Networking

80

sures that someone can not just come up with another

file that has the same hash.

IPFS is the perfect distributed file storage solution

as it meshes in seamlessly with the Blockchain archi-

tecture. Through it’s decentralized architecture and

built-in data redundancy, IPFS ensures fault-tolerance

and low-cost file distribution. The immutable nature

of data on IPFS is necessary when dealing with sensi-

tive documents like medical and insurance records.

4.4 Smart Contracts

Smart contracts (Buterin, 2013)(Waltl et al., 2019) are

self-executing contracts with the terms of the agree-

ment between buyer and seller being directly written

into lines of code. The code and the agreements con-

tained therein exist across a distributed, decentralized

blockchain network. Smart contracts permit trusted

transactions and agreements to be carried out among

disparate, anonymous parties without the need for a

central authority, legal system, or external enforce-

ment mechanism. They render transactions traceable,

transparent, and irreversible.

5 CONCLUSION/FUTURE WORK

The paper proposes a blockchain based model for im-

plementing a complete insurance process - from buy-

ing an insurance policy to settling claims. The med-

ical records are securely stored with an access-based

mechanism that ensures privacy and gives the record-

owner complete control over their medical records.

This approach ensures that none of the records, be

it medical or insurance, are lost or tampered with,

maintaining integrity in the system. Having insur-

ance policies as smart contracts that can trigger pay-

outs based on pre-defined parameters would help fa-

cilitate faster claim settlement, thus building a more

customer-centric ecosystem. This model not only

benefits customers but also the insurance companies

by allowing them to directly market and sell insur-

ance policies as smart contracts, thereby reducing op-

erational costs of the company by cutting down on the

middlemen involved in the current system.

Complex policy conditions, like intricacies of dis-

eases covered, when introduced in our proposed sys-

tem might lead to complications at the time of set-

tling claims, thereby delaying the process. In order to

support fully automated claim settlements in the fu-

ture, a more robust system design with deeper domain

knowledge is required. Running computational anal-

ysis on a blockchain ledger is a strenuous task due

to scalability and data retrieval problems in the cur-

rent Blockchain ecosystem. As the Blockchain com-

munity continually looks to address these issues, the

system would then allow governments to detect and

predict disease patterns and help pharmacies in medi-

cal inventory management.

REFERENCES

(https://blockgeeks.com/guides/ethereum/).

Anita, J. (2008). Emerging Health Insurance in India – An

overview. 10th Global Conference of Actuaries.

Benet, J. (2014). IPFS - Content Addressed, Versioned, P2P

File System.

Buterin, V. (2013). A Next-Generation Smart Contract and

Decentralized Application Platform.

Majumdar, A., Chatterjee, S., Gupta, R., and Rawat, C. S.

(2019). Competing in a new age of insurance: How

India is adopting emerging technologies. PwC.

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic

Cash System.

Raikwar, M., Mazumdar, S., Ruj, S., Gupta, S. S., Chat-

topadhyay, A., and Lam, K.-Y. (2018). A Blockchain

Framework for Insurance Processes. 9th IFIP Inter-

national Conference on New Technologies, Mobility

and Security (NTMS).

Waltl, B., Sillaber, C., Gallersd

¨

orfer, U., and Matthes, F.

(2019). Blockchains and Smart Contracts: A Threat

for the Legal Industry? Business Transformation

through Blockchain, Cham: Springer International

Publishing, pp. 287-15.

Introduction to LifeBlocks: A Blockchain based Insurance Platform

81