Exploring Narrative Economics: An Agent-based-modeling Platform

that Integrates Automated Traders with Opinion Dynamics

Kenneth Lomas

a

and Dave Cliff

b

Department of Computer Science, University of Bristol, Bristol BS8 1UB, U.K.

Keywords:

Economic Agent Models, Intelligent Auctions & Markets, Multi-agent Systems.

Abstract:

In seeking to explain aspects of real-world economies that defy easy understanding when analysed via conven-

tional means, Nobel Laureate Robert Shiller has since 2017 introduced and developed the idea of Narrative

Economics, where observable economic factors such as the dynamics of prices in asset markets are explained

largely as a consequence of the narratives (i.e., the stories) heard, told, and believed by participants in those

markets. Shiller argues that otherwise irrational and difficult-to-explain behaviors, such as investors partici-

pating in highly volatile cryptocurrency markets, are best explained and understood in narrative terms: people

invest because they believe, because they have a heartfelt opinion, about the future prospects of the asset,

and they tell to themselves and others stories (narratives) about those beliefs and opinions. In this paper we

describe what is, to the best of our knowledge, the first ever agent-based modelling platform that allows for

the study of issues in narrative economics. We have created this by integrating and synthesizing research

in two previously separate fields: opinion dynamics (OD), and agent-based computational economics (ACE)

in the form of minimally-intelligent trader-agents operating in accurately modelled financial markets. We

show here for the first time how long-established models in OD and in ACE can be brought together to en-

able the experimental study of issues in narrative economics, and we present initial results from our system.

The program-code for our simulation platform has been released as freely-available open-source software on

GitHub, to enable other researchers to replicate and extend our work.

1 INTRODUCTION

In his influential 2017 paper (Shiller, 2017), later

expanded into the successful 2019 book Narrative

Economics: How Stories Go Viral and Drive Ma-

jor Economic Events (Shiller, 2019), Nobel Laure-

ate Robert Shiller introduced the concept of narrative

economics as an overlooked factor in understanding

market trends. In brief, Shiller argues that in many

markets the movement and maintenance of prices are

driven to a significant extent by the stories – i.e., the

narratives – that market participants tell each other.

Shiller draws comparisons between the spread of nar-

ratives and the transmission of infectious diseases,

and argues that financial bubbles and crashes (most

notably in cryptocurrency markets) can plausibly be

accounted for as primarily driven by the narratives

that traders tell each other, even when those narratives

make little sense to outside observers.

a

https://orcid.org/0000-0003-2279-1782

b

https://orcid.org/0000-0003-3822-9364

The narratives told in and about a market are ex-

ternalisations, verbalizations, of the participants’ inte-

rior beliefs or opinions. In this paper, we present the

first results from a novel synthesis of two previously

separate fields that both rely on agent-based mod-

elling: our work combines practices from minimal-

intelligence agent-based computational economics

(ACE) with ideas developed separately in the research

field known as opinion dynamics. We show here for

the first time how existing well-known and widely-

used ACE models of trader-agents can be extended so

that each trader also holds its own independent opin-

ion, which is our minimal approximation model of

Shiller’s notion that real traders are influenced by the

narratives that they hear, read, and tell. In our work,

an individual trader’s opinion may be influenced to

varying degrees by the opinions of other traders that

it interacts with; and the trader’s own opinion also di-

rectly influences its individual trading activity, i.e. the

sequence of bids and/or offers that it quotes into a sin-

gle central financial exchange that all traders in our

model interact with. Our model financial exchange is

Lomas, K. and Cliff, D.

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics.

DOI: 10.5220/0010337101370148

In Proceedings of the 13th International Conference on Agents and Artificial Intelligence (ICAART 2021) - Volume 1, pages 137-148

ISBN: 978-989-758-484-8

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

137

technically a continuous double auction (CDA) mar-

ket operating with a limit order book (LOB), which

is exactly the structure of existing financial markets

such as the New York Stock Exchange, and all other

major national and international financial exchanges.

In keeping with the spirit of minimalism that moti-

vates much ACE work, We show here for the first time

how zero-intelligence (ZI) and minimal-intelligence

(MI) trader-agents can be extended so that each trader

also holds its own independent opinion. For consis-

tency with prior work in opinion dynamics (OD) re-

search, we model each trader’s opinion as a signed

scalar real value, e.g. as a number in the continuous

range [−1.0, +1.0]: this approach is long-established

in OD research, a field that over its multi-decade his-

tory has seen developed a succession of models intro-

duced to explore and/or account for observable pat-

terns of opinion dynamics in human societies. In

our work we have explored the integration of ZI/MI

traders with the following previously-established OD

models: the Bounded Confidence model (Krause,

2000; Hegselmann and Krause, 2002); the Rela-

tive Agreement model (Deffuant et al., 2002; Mead-

ows and Cliff, 2012); and the Relative Disagreement

model (Meadows and Cliff, 2013). We refer to these

three opinion dynamics models as the BC, RA, and

RD models respectively.

The trader-agents that we extend by addition

of these OD models are Gode & Sunder’s (1993)

Zero Intelligence Constrained (ZIC), and the Near-

Zero-Intelligence (NZI) trader agents of (Duffy and

Utku nver, 2006) which minimally extend Gode &

Sunder’s ZI approach in such a way that markets pop-

ulated by NZI traders can exhibit asset-price bubbles.

We refer to the extended agent designs as opinionated

agents: we name our opinionated version of ZIC as

OZIC, and our opinionated version of NZI as ONZI.

For both OZIC and ONZI agents, the bounds of the

probability distribution used to randomly generate a

trader’s bid or offer prices is dependent at least in part

on the current value of that agent’s opinion-variable;

and that opinion variable can change over time as

a consequence of interactions with other traders in

the market, thereby modelling Shiller’s notion of nar-

rative economics: in our system opinions can drive

prices, and prices can alter opinions. To the best of

our knowledge, we are the first authors to report on

such a system, a synthesis of opinion dynamics and

market-trading agents, and so the primary contribu-

tion of this paper is the modelling platform that we

describe for the first time here. The source-code for

our system has been placed in the public domain as a

freely-available open-source release on GitHub.

1

1

github.com/ken-neth/opinion dynamics BSE.git

We evaluate and test the performance of these

trading agents, contrasting and comparing the BC,

RA, and RD opinion dynamics models, using as our

financial-market simulator BSE, a long-established

open-source simulator of a LOB-based financial ex-

change for a single asset, and freely available in the

public domain since 2012 (Cliff, 2018). This paper

summarises (Lomas, 2020), which contains extensive

further visualization and discussion of additional re-

sults that are not included here.

In Section 2 we summarise relevant prior aca-

demic literature. Section 3 describes near-zero-

intelligence traders in more depth. Section 4 then in-

troduces our innovation, the addition of opinions to

trading-agent models, giving opinionated traders, and

results from simulation studies running on our plat-

form are presented in Section 5.

2 BACKGROUND

2.1 Opinion Dynamics

People are complicated. In particular, how ideas are

formed and conveyed to others are difficult to model

as there are numerous factors that could affect the be-

haviour of individuals. Nevertheless we can say, with

some degree of certainty, that people hold opinions

and these opinions are changed by interacting with

the world. Taking this a step further, people commu-

nicate and at some point during or after the commu-

nication their opinions may alter as a consequence.

Given a sufficiently large population we can design

models for how their opinions will change over time,

i.e. models of the system’s opinion dynamics (OD).

Of course these models make clear assumptions and

may not fully encapsulate the inner workings of a per-

son but can nevertheless be useful in understanding

problems relying on the opinions of large populations.

One early OD model is given in (DeGroot, 1974).

In this model, a group of experts have different opin-

ions on a subject and want to reach a consensus. The

experts decide on a format of structured debate where

each individual expert has a turn to express their opin-

ion, taking the form of a real number, and at the end

every expert updates their own individual opinion, us-

ing a fixed weight. The experts continue to take turns

sharing their opinions until a consensus is reached.

(DeGroot, 1974) proves that they will always reach a

consensus given positive weights.

A number of later works have analysed the DeG-

root model. In (Chatterjee and Seneta, 1977) the De-

Groot model’s treatment of the consensus problem is

related to the ergodicity problem in probability theory,

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

138

which concerns stochastic state spaces where from a

given state all possible states are reachable and hence

backwards traversal of the state space is difficult.

The DeGroot model was subsequently analysed

by (Friedkin, 1999), who described experiments to

understand how the model’s mean opinions change

over time. Choice-shifts are shown by the difference

between the final group mean opinion and their ini-

tial mean opinion. These experiments showed how

individuals in the population could have greater influ-

ence on the overall consensus, and Friedkin argued

that choice shifts are an inherent problem in discus-

sions of issues where influence is not balanced.

2.1.1 Bounded Confidence

A variation on the DeGroot model was described in

(Krause, 2000) and named the Bounded Confidence

(BC) model. In this, all agents in a fixed-size popula-

tion hold an opinion that is represented as a real num-

ber. The agents share their opinions and only update

their opinions if they are closer than a given devia-

tion threshold. The reasoning for this is that humans

are less likely to have their opinions swayed by some-

one whose opinion heavily deviates from their own.

A formal specification of the BC model is given in

(Hegselmann and Krause, 2002) and summarised as

follows: given a population of size n, x

i

(t) represents

the opinion of expert i at time t. This is updated by:

x

i

(t + 1) = a

i1

x

1

(t) + a

i2

x

2

(t) + ... +a

in

x

n

(t),

where a

i j

is the confidence factor between experts i

and j. Crucially the confidence factor between two

experts can be zero if the difference in their opinions

are too great. Since at each time step opinions change,

it is possible that at a much later time step two agents

that initially held too-distant opinions can come to be

within a sufficiently close range to start to agree.

At the beginning of a simulation, all opinions

should be distributed over [−1, +1] ⊂ R , with any in-

dividuals holding opinions less than or greater than a

certain extreme value parameter regarded as extrem-

ists. As time progresses, experts whose opinions de-

viate by less than the deviation threshold move closer

together according to a confidence factor. The opin-

ions of the experts will converge until the simulation

reaches a stable state with do further changes.

2.1.2 Relative Agreement

Another well-known Opinion Dynamics model, the

Relative Agreement (RA) model was proposed by

(Deffuant et al., 2000). In the RA model experts hold

opinions, that are each represented as a real number,

but with the difference that they also hold an uncer-

tainty, which acts like a range around their opinion.

The experts communicate and provided the overlap

of their uncertainties exceeds the expert’s individual

uncertainty then they update their opinion and uncer-

tainty by a weight parameter and a Relative Agree-

ment value.

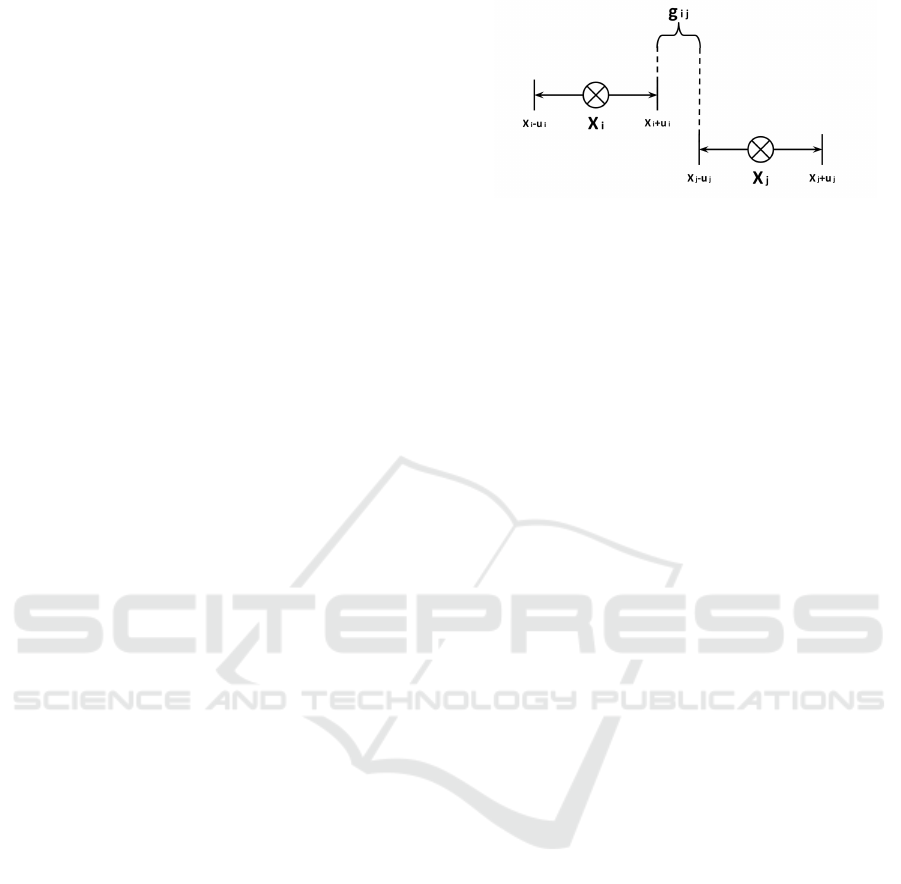

Figure 1: Overlap h

i j

for experts i and j with opinions X

i

and X

j

and uncertainties u

i

and u

j

respectively.

According to the RA model definition in the Def-

fuant et al. 2000 paper, opinions are updated as fol-

lows: a pair of experts i and j are chosen at random

from the population of experts. Firstly, calculate the

overlap h

i j

, as illustrated in Figure 1,

h

i j

= min(x

i

+ u

i

,x

j

+ u

j

) − max(x

i

− u

i

,x

j

− u

j

),

where x

i

is the real number representation of the opin-

ion of expert i, and u

i

is the uncertainty of expert i in

their own opinion. Then, subtract the size of the non-

overlapping part 2u

i

−h

i j

so the total agreement of the

two experts is given by:

h

i j

− (2u

i

− h

i j

) = 2(h

i j

− u

i

),

and so the RA between i and j is given by:

RA

i j

= 2(h

i j

− u

i

)/2u

i

= (h

i j

/u

i

) − 1

Then if h

i j

> u

i

, the update is given by:

x

j

:= x

j

+ µRA

i j

(x

i

− x

j

)

u

j

:= u

j

+ µRA

i j

(u

i

− u

j

)

where µ is a constant parameter for convergence, sim-

ilar to the confidence factor in the BC model. (Def-

fuant et al., 2000) show that the RA model converges

to an average of n = w/2u opinions as opposed to the

BC model that converges to n = floor(w/2u) opin-

ions.

Extremists were added by (Deffuant et al., 2002),

which also describes three modes of convergence that

occur with the RA model: central convergence; bipo-

lar convergence; and single-extreme convergence. As

with BC, at the beginning of an RA simulation all

opinions are randomly distributed over [−1, +1] ⊂ R .

Central convergence appears as all of the opinions

converge towards a stable single central value, around

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics

139

zero. In the case where the opinions converge to-

wards two separate values and reach a stable state,

we have bipolar convergence. When all opinions

converge towards an extreme value and reach a sta-

ble state, exceeding a given extreme parameter, we

have single-extreme convergence. In a later paper

(Deffuant, 2006), an asymmetric influence rule is de-

scribed where agents that are more convinced of their

own opinion exert greater influence upon others.

In (Deffuant et al., 2002) a metric is used to mea-

sure the influence of extremists in a population called

the y metric. The y metric, or indicator, is given by

the formula:

y = p

2

+

+ p

2

−

,

where p

+

denotes the proportion of experts that were

initially moderate but held a positive extreme opin-

ion by the end of the simulation, and p

−

denotes the

proportion of experts that were initially moderate but

held a negative extreme opinion by the end of the sim-

ulation. Deffuant et al. use the y metric as an indicator

of convergence type, i.e. central convergence at y = 0,

bipolar convergence at y = 0.5, and single extreme

convergence at y = 1.

2.1.3 Relative Disagreement

The RA model has been shown to successfully simu-

late useful convergences in populations with extrem-

ists initialized. A more recent model, introduced in

(Meadows and Cliff, 2013), and called the Relative

Disagreement (RD) model improves on the RA model

by introducing probability λ of an update occurring

and the idea of reactance. In (Meadows and Cliff,

2013) the RD model was shown to achieve the same

opinion convergences as the RA model without the

need for initialising the population with extremists.

Reactance is the motivation to disagree with an

opinion. In psychology it has been rationalised as a

desire to exercise freedom when that freedom is un-

der threat (Steindl et al., 2015). It is an important part

of how people behave and how they come to hold cer-

tain opinions. The RD model incorporates the idea

of reactance by having individuals’ opinions diverge

when they disagree to enough of a degree. In con-

trast to h

i j

in RA, g

i j

is the non overlapping distance

calculated by:

g

i j

= max(x

i

− u

i

,x

j

− u

j

) − min(x

i

+ u

i

,x

j

+ u

j

)

Subtract the extent of the overlap 2u

i

− g

i j

to give

the total disagreement:

g

i j

− (2u

i

− g

i j

) = 2(g

i j

− u

i

)

The RD between i and j is given by:

RD

i j

= 2(g

i j

− u

i

)/2u

i

= (g

i j

/u

i

) − 1

Figure 2: Illustration of non overlapping distance g

i j

for

experts i and j with opinions X

i

and X

j

and uncertainties u

i

and u

j

respectively.

If g

i j

> u

i

, update the opinions and uncertainties with

probability λ, where λ is a parameter.

x

j

:= x

j

+ µRD

i j

(x

i

− x

j

)

u

j

:= u

j

+ µRD

i j

(u

i

− u

j

)

2.2 Markets and Traders

The famous 18th-Century Scottish economist Adam

Smith included a description of what he called The

Invisible Hand in his landmark book (Smith, 1759);

Smith used the term to embody the unintended posi-

tive effects of selfish behaviour in a market. This idea

forms the basis for allocative efficiency, sometimes

thought as the “fairness” of a market. Where utility

is the measure of the usefulness a person gets from

a product, the allocative efficiency of a market is the

total utility gained from trade, expressed as a percent-

age of the maximum possible utility to be gained.

Understanding the details of how selfish interac-

tions among competitive traders in a market can give

rise to desirable outcomes, such as efficient alloca-

tion of scarce resources between producers and con-

sumers, has been a desire of economists ever since

Adam Smith. A major step forward was taken by

American economist Vernon Smith who in the late

1950s started a program of experimental studies of

human traders interacting in markets under repeatable

laboratory conditions – a field that became known as

experimental economics, the founding and growth of

which resulted in Vernon Smith being awarded the

Nobel Prize in Economics in 2002. Much of Smith’s

experimental work studied the dynamics of markets

in which human traders, either buyers announcing

bid-prices or sellers announcing ask-prices, interacted

with one another via a market mechanism known as

the continuous double auction (CDA) which is the

basis of almost all of the world’s major financial mar-

kets. In a CDA a buyer can announce a bid at any time

and a seller can announce an offer at any time, and

any buyer is free to accept an ask at any time while

any seller is free to accept a bid at any time.

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

140

In establishing experimental economics research,

Vernon Smith had devised experimental CDA auc-

tions for teaching purposes and later as a tool to ob-

serve how traders in a market act according to differ-

ent specified conditions (Smith, 1962). Vernon Smith

and his fellow experimental economists focused en-

tirely on the interactions among human traders in their

market laboratories but in 1993, inspired by Vernon

Smith’s work, the economists Gode & Sunder devised

experiments to compare the allocative efficiency of

minimally-simple automated trading systems against

human traders. Gode & Sunder’s automated traders

we so simple that they were, entirely justifiably, re-

ferred to as zero-intelligence (ZI) traders. Most no-

tably, in (Gode and Sunder, 1993) the authors de-

scribe the design of a ZI trader known as ZIC (for

ZI-Constrained) which generated random bid or ask

prices, subject to the single budget constraint that the

prices generated should not lead to loss-making deals:

ZIC is constrained by a limit price and so draws its bid

quote price from a uniform random distribution below

the limit price, and its ask quote price from a uniform

random distribution above the limit price.

To everyone’s surprise the allocative efficiency

scores of CDA markets populated by ZIC traders

was demonstrated to be statistically indistinguishable

from those of comparable CDA markets populated

by human traders. Gode & Sunder’s result indicated

to many people that the high intelligence of human

traders was irrelevant within the context of a CDA-

based market, and a research field formed, with var-

ious authors publishing details of automated trading

systems that refined and extended the ZI approach.

Often these early automated traders involved some

means of making the trader adaptive, so that it could

adjust its response to changing market conditions. As

adaptivity to the environment is seen by some as a

minimal signifier of intelligence, adaptive ZI-style au-

tomated trading agents became known as minimal-

intelligence (MI) traders.

Numerous variations on ZI/MI traders have been

proposed to test the limits of their trading perfor-

mance and to provide more human-like trader to test

new trading strategies against. A notable work, which

extended a MI trading strategy to enable the study

of asset price bubbles and crashes, is (Duffy and

Utku nver, 2006), discussed in more detail below.

The primary contribution of this paper is to com-

bine the Opinion Dynamics models with ZI/MI auto-

mated traders, creating a new class of automated trad-

ing strategies: ones that are still zero- or minimal- in-

telligence, but which also hold opinions.

In the 27 years since Gode and Sunder published

their seminal 1993 paper on ZIC, the field of agent-

based computational economics (ACE) has grown

and matured. For reviews of work in this field, see

(Chen, 2018; Hommes, C. and LeBaron, B., 2018).

ACE is a subset of research in agent-based modelling

(ABM), which uses computational models of inter-

acting agents to study various phenomena in the nat-

ural and social sciences: see (Cooks and Heppenstall,

2011) for more details.

2.3 The BSE Financial Exchange

We used the BSE open-source simulator of a contem-

porary financial exchange populated with a number

of automated trading systems. The BSE project is

open source and publicly available on Github, at:

https://github.com/davecliff/BristolStockExchange

(Cliff, 2018).

BSE is a simulated CDA-based financial market,

which is populated by a user-specifiable configura-

tion of various automated-trader systems; it includes

a number of predefined classes of automated trader

each with unique trading strategies.

BSE’s implementation of a CDA, like real-world

financial exchanges, requires buyers and sellers to

submit bid and ask prices simultaneously and contin-

uously onto an exchange mechanism that publishes

the orders to a Limit Order Book, (LOB), each order

(each bid or ask) specifies a price and a quantity. A

transaction will go through when a buyer’s bid price

and a seller’s ask price are the same or ’cross’, i.e. if

a buyer’s bid exceeds a seller’s ask, or a seller’s ask is

less than a buyer’s bid. When the transaction is com-

plete, the orders have been filled hence they are re-

moved from the LOB. On a Limit Order Book (LOB),

the bids and asks are stacked separately on ordered

lists each sorted from best to worst: the best bid is the

highest-priced one and the remaining bids are listed

in decreasing-price order below it; the best ask is the

lowest-priced one and the remaining asks are listed in

ascending-price-order below it.

BSE comes with several types of ZI/MI automated

traders built-in, including Gode & Sunder’s ZIC,

and also Vytelingum’s AA trader (Vytelingum, 2006)

which was demonstrated by (De Luca and Cliff, 2011)

to outpefrom human traders, so an experimental mar-

ket can readily be set up and populated with some

number of traders of each type. However BSE does

not include the Near-Zero Intelligence (NZI) trader-

type introduced by (Duffy and Utku nver, 2006), so

we created our own implementation of that and added

it to BSE: the source-code for that implementation

is available in our GitHub repository, the location of

which was given in the footnote in Section 1. In the

next section we describe NZI traders in more detail.

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics

141

3 NEAR-ZERO-INTELLIGENCE

TRADERS

In (Duffy and Utku nver, 2006), NZI traders are de-

fined to mimic the behaviour of traders in markets

where asset prices bubble and crash, i.e. where the

price of a tradeable asset rises quickly and falls pre-

cipitously. As the name implies, NZI traders are sim-

ilar to Gode and Sunder’s ZI traders but have some

added features. The following is a summary of key

aspects of NZI traders.

3.1 The Weak Foresight Assumption

Firstly, Duffy and nver define the weak foresight as-

sumption (WFA) which gives the traders knowledge

that the trading session is coming to an end. This in-

volves two variables:

¯

D

T

t

and π

t

, both of which are

explained further below.

A trading period is defined as 240 seconds where

at the end of a trading period the traders earn a div-

idend per unit of the asset they own. The dividend

amount is a random variable drawn from a uniform

distribution with support: d

1

,d

2

,d

3

,d

4

where {0 ≤

d

1

< d

2

< d

3

< d

4

}. Hence the expected dividend is

given by:

¯

d =

1

4

4

∑

i=1

d

i

At the start of each simulation of T trading peri-

ods, a trader i has a balance of x

i

and owns a number y

i

of units of the tradeable asset. Before the first trading

period, t = 1, we have the equation:

x

i

+

¯

D

T

1

y

i

= c

where c is a constant for all i.

During the simulation of the market sessions,

¯

D

T

t

decreases as t → T . It represents the fundamental

market price or the default value of the asset at pe-

riod t which earns zero profit. It is calculated by the

equation:

¯

D

T

t

=

¯

d(T − t +1) +

¯

D

T

T +1

¯

D

T

t

is a value that decreases by

¯

d each trading period

t, this makes up the first part of the WFA.

The second part of the WFA is π

t

, the probability

of a trader being a buyer in trading period t. It is given

by the equation:

π

t

= max{0.5 − ϕt,0}

where ϕ ∈ [0, 0.5/T ). Since 0 ≤ ϕ <

0.5

T

then 0 < π

t

≤

0.5, and as t → T , the probability of a trader being a

buyer decreases over time; therefore traders are less

likely to buy as time goes by. The combination of

a reduction in tendency to buy, caused by π

t

, and a

decrease in the default value of the asset,

¯

D

T

t

, results

in traders having a “weak” awareness of the future

hence, the name “weak foresight assumption”.

3.2 The Loose Budget Constraint

In (Gode and Sunder, 1993), their ZIC trader has a no

loss constraint. That constraint on ZIC traders forces

them to buy and sell at prices bounded by the intrinsic

value, and transacting at that price would not result in

asset price inflation.

In contrast to Gode and Sunder’s work, (Duffy

and Utku nver, 2006) propose a “loose” budget con-

straint: if trader i is a seller and has an asset, submit

an ask price; and if trader i is a buyer and has suffi-

cient cash balance, submit a bid price:

if trader i is a seller and trader i has an asset then

submit ask

else if trader i is a buyer then

submit min(balance, bid)

end if

3.3 The “Anchoring Effect”

Another departure from (Gode and Sunder, 1993) is

that Duffy & nver’s NZI traders are not entirely zero-

intelligence. In fact they have knowledge of the mean

transaction price from the previous trading period, de-

noted ¯p

t−1

, which is used to calculate the trader’s ini-

tial quote price in a trading period – thus the trader’s

quote price is to some extent “anchored” by the previ-

ous period’s prices. In the first session, ¯p

t−1

= 0, and

the traders submit low quote prices.

3.4 Formal Specification

Simulations involve T market periods or sessions,

t ∈ [1,T ], and within each iteration of each market

session a trader i is chosen to submit an order in se-

quence S, s ∈ S. The uniform random variable u

i

t,s

is

calculated using

¯

D

T

t

via:

u

i

t,s

∈ [ε

t

,

¯

ε

t

]

where ε

t

= 0,

¯

ε

t

= k

¯

D

T

t

and k > 0 is a parameter. The

upper bound of u

i

t,s

,

¯

ε

t

, will decrease over time since

¯

D

T

t

decreases. Therefore the range for u

i

t,s

becomes

smaller and with an average of

1

2

k

¯

D

T

t

, the value of u

i

t,s

should decrease.

If a trader is a seller then offer the ask price a

i

t,s

,

a

i

t,s

= (1 − α)u

i

t,s

+ α

¯

P

t−1

,

where α ∈ (0,1) is a constant parameter. Using the

loose budget constraint so a buyer can only offer as

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

142

much money as they possess, if a trader is a buyer

then offer the bid price b

i

t,s

,

b

i

t,s

= min{(1 − α)u

i

t,s

+ α

¯

P

t−1

,x

i

t,s

}

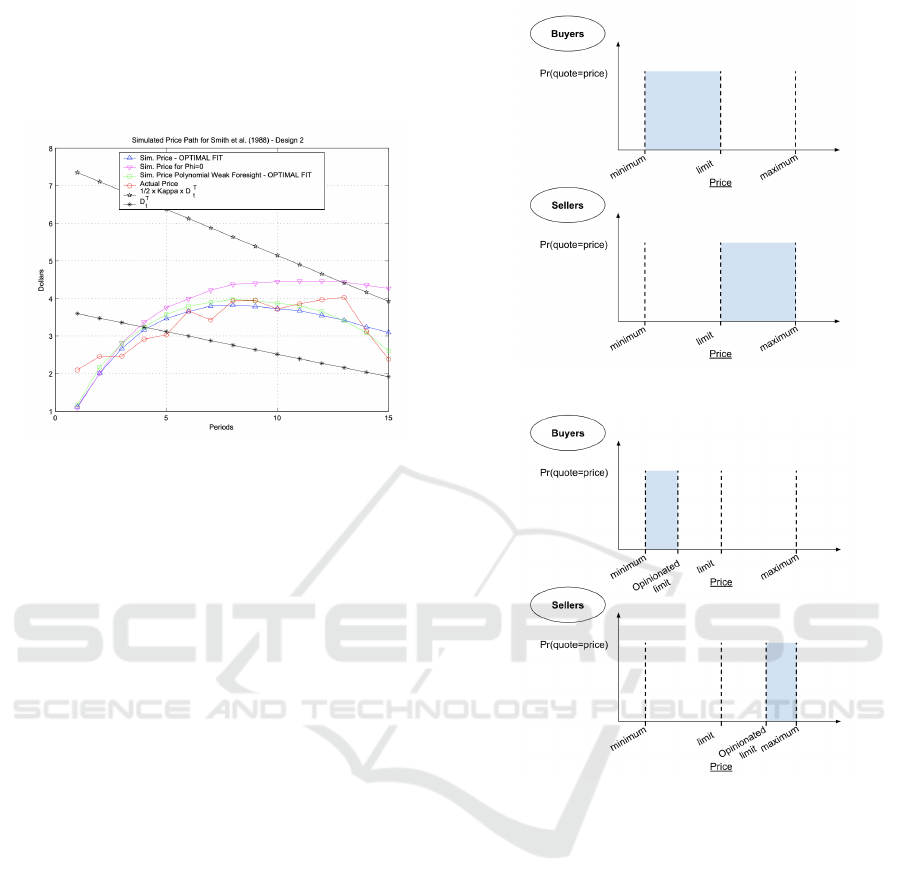

Figure 3: Comparison of mean transaction price path in

the simulations and actual data from (Duffy and Utku nver,

2006).

The combination of a decreasing

¯

D

T

t

value and an

anchoring to the mean transaction price of the pre-

vious trading period

¯

P

t−1

results in a humped shape

pattern in the transaction history. This hump is the

model’s endogenous rise in price, i.e. the ‘bubble’,

followed by a fall or ‘crash’. The mean transac-

tion price per trading period increases initially due to

the high

¯

D

T

t

value which increases the bid and ask

prices above the previous mean transaction price

¯

P

t−1

.

Eventually as the value of

¯

D

T

t

decreases, the mean

transaction price levels out closer to α

¯

P

t−1

which is

less than or equal to

¯

P

t−1

.

4 OPINIONATED TRADERS

We introduce a new variation on the ZIC trader

model, from (Gode and Sunder, 1993), called the

Opinionated-ZIC (i.e., OZIC) trader, that submits

quote-prices affected by its opinion.

The BSE simulator (Cliff, 2018) contains an im-

plementation of the ZIC trader, which has knowledge

of the Limit Order Book (LOB), it sets its minimum

quote price to the worst bid on the LOB, its maxi-

mum quote price to the best ask price on the LOB,

and its limit price to that specified by the customer

order currently being worked on. If the ZIC trader

is a buyer then it submits orders with a quote price

generated from a random draw between the minimum

quote price and the limit price. Otherwise, if the ZIC

trader is a seller then it submits orders with a quote

price generated from a random draw between the limit

(a) Quote price range of ZIC traders.

(b) Quote price range of OZIC traders.

Figure 4: Diagrams of quote price range for Gode & Sun-

der’s Zero Intelligence Constrained (ZIC) Traders in 4a and

for our Opinionated-ZIC (OZIC) Traders in 4b. The shaded

region represents the uniform distribution that the traders’

quote prices are drawn from.

price and the maximum quote price. The quote price

distribution for ZIC traders are illustrated in Figure

4a, with the buyers’ quote price distribution on the left

and the sellers’ quote price distribution on the right.

The Opinionated Zero-Intelligence-Constrained

(OZIC) trader model submits quote prices that vary

according to its opinion. If the OZIC trader is a buyer

and its opinion is negative then it submits a low bid,

and if its opinion is positive then it submits a bid that

is higher but still capped at its limit price. On the other

hand if the OZIC trader is a seller and its opinion is

negative then it submits a low ask, and if its opinion

is positive then it submits a high ask. This models

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics

143

the idea that traders will submit quote prices close to

what they believe the actual value of the stock to be,

and if a traders holds a positive opinion of the stock

they would believe the value of the stock to be greater

than a trader holding a negative opinion of the stock.

As illustrated in Figure 4b, the quote price range

for OZIC buyers are between the minimum price and

their opinionated limit, and the quote price range for

OZIC sellers are between their opinionated limit and

the maximum price.

If the OZIC trader i is a buyer then calculate the

opinionated limit OL

i

by:

OL

i

= f (x) =

L(1 + x

i

) + M(1 − x

i

)

2

,

where L is the limit price, M is the minimum price,

and x

i

is the opinion of OZIC trader i: this gives

f (−1) = M; f (0) =

L+M

2

: and f (1) = L. Then gen-

erate a bid quote price as a random draw from the

interval [M, OL

i

].

If the OZIC trader i is a seller then calculate the

opinionated limit OL

i

by:

OL

i

= f

0

(x) =

L(1 − x

i

) +

¯

M(1 + x

i

)

2

,

where L is the limit price,

¯

M is the maximum price,

and x

i

is the opinion of OZIC trader i: this gives

f

0

(−1) = L; f

0

(0) =

L+

¯

M

2

; and f (1) =

¯

(M). Then

bid quote prices are generated as a random draw from

the interval [OL

i

,

¯

M].

4.1 Opinionated NZI Traders

We also introduce here an Opinionated Near-Zero-

Intelligence (ONZI) trader based on the near-zero-

intelligence (NZI) trader model of (Duffy and

Utku nver, 2006). The ONZI trader model offers the

possibility of price bubbles dependent on the prevail-

ing opinions of the population, i.e. if the opinions are

mostly positive then the bubble should be greater than

if the opinions were mostly negative.

4.2 Recreating NZI Trader Model

Duffy & Utku nver’s NZI trader model uses a random

component u

i

t,s

, given by u

i

t,s

∈ [0,k

¯

D

T

t

], where i is

the index of the trader, t is the current trading period

out of T periods, s is the order of the trader in the

sequence that the traders submit orders, k is a constant

parameter, and

¯

D

T

t

is the default value of the asset.

The ask price a

i

t,s

is calculated using u

i

t,s

as described

in Section 3.

In (Duffy and Utku nver, 2006), optimal param-

eter values were calibrated to best match their sim-

ulated data with the data collected from experiments

with human traders. The values are as follows: k

∗

=

4.0846, α

∗

= 0.8480, φ

∗

= 0.01674, and S

∗

= 5. We

use the optimised parameter values k

∗

and α

∗

here-

after, however we have not used φ

∗

because in our

work the buyers and sellers do not change specifica-

tion and we have not used S

∗

as small values of S do

not show opinion convergences in large populations

very well. The ask and bid price of traders are calcu-

lated in such a way that they require the default value

¯

D

T

t

of the asset and the mean transaction price of the

previous trading period

¯

P

t−1

. To get the default value

of

¯

D

T

t

for each trading period t, the expected divi-

dend amount

¯

d is calculated by the average of divi-

dends [0,1,2,3] which is 1.5 and the final value is set

¯

D

T

T +1

= 40. These values form a similar gradient for

¯

D

T

t

over time to that shown in (Duffy and Utku nver,

2006).

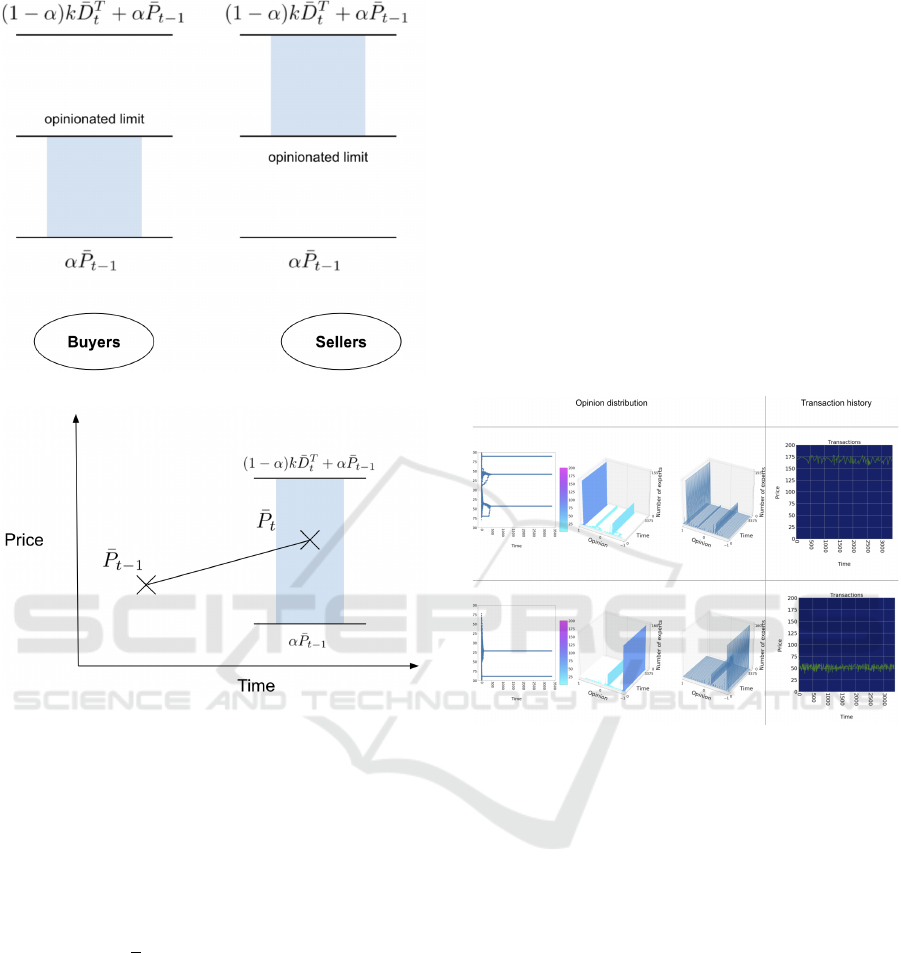

4.3 Opinionated Limit

We created an opinionated limit to integrate trader

opinions with the NZI strategies. Similarly to the

opinionated limit calculation in our OZIC trader

model, the opinionated limit of the ONZI trader

model can be calculated from between α

¯

P

t−1

and

(1 − α)k

¯

D

T

t

+ α

¯

P

t−1

, as shown in Figure 5a, because

the maximum u

i

t,s

value is k

¯

D

T

t

. So for an ONZI trader

i, with opinion x

i

, the opinionated limit OL

i

is calcu-

lated by:

OL

i

=

(1 − α)(k

¯

D

T

t

+ α

¯

P

t−1

)(1 + x

i

) + (α

¯

P

t−1

)(1 − x

i

)

2

This form is closest to that of OZIC traders but is eas-

ier to read when expressed in terms of the opinion-

ated uncertainty OU

i

t,s

, based on the definition of u

i

t,s

,

which is given by:

OU

i

t,s

∈ [0,

1

2

k

¯

D

T

t

(1 + x

i

)]

Then the quote price a

i

t,s

is calculated by:

a

i

t,s

= (1 − α)OU

i

t,s

+ α

¯

P

t−1

The effect of the opinionated uncertainty u

i

t,s

is il-

lustrated in Figure 5b, where the value of

¯

P

t

is the

mean transaction price for trading period t. Dur-

ing trading period t, every trader will submit quotes

between α

¯

P

t−1

and (1 − α)k

¯

D

T

t

+ α

¯

P

t−1

so if there

are n transactions that take place at the maximum

(1 − α)k

¯

D

T

t

+ α

¯

P

t−1

then the average

¯

P

t

will be:

1

n

n

∑

((1 − α)k

¯

D

T

t

+ α

¯

P

t−1

) = (1 − α)k

¯

D

T

t

+ α

¯

P

t−1

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

144

(a)

(b)

Figure 5: Diagram of quote price range for Opinionated

near-zero-intelligence (ONZI) Traders in 5a and an illus-

tration of the possible range for the mean transaction price

¯

P

t

of trading period t in relation to the previous mean trans-

action price

¯

P

t−1

in 5b.

Similarly if all transactions in trading period t occur

at the minimum α

¯

P

t−1

, then the average

¯

P

t

will be:

1

n

n

∑

(α

¯

P

t−1

) = α

¯

P

t−1

The shaded region in Figure 5b represents the

range that

¯

P

t

can be in, i.e. between α

¯

P

t−1

and

(1 − α)k

¯

D

T

t

+ α

¯

P

t−1

. The value of

¯

D

T

t

will decrease

hence the range for

¯

P

t

decreases however will roughly

remain centered. In contrast, a population of ONZI

traders will submit high quote prices, close to the

maximum, when they hold positive opinions and will

submit low quote prices, close to the minimum, when

they hold negative opinions.

5 RESULTS

5.1 OZIC Traders

5.1.1 Baseline Results

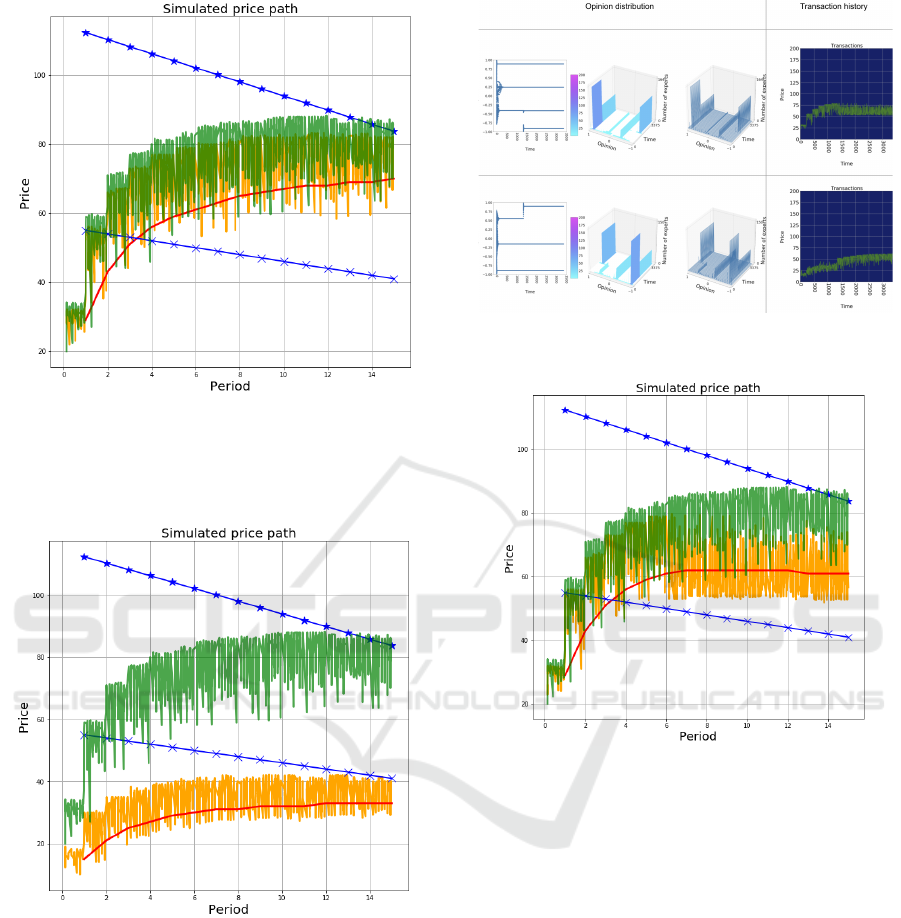

The more useful results are in the extreme cases of

opinion distribution, i.e. when all the traders hold

extremely positive opinions or negative opinions. In

Figure 6, we have shown the effects of extremely pos-

itive opinion distribution on the transaction history

which is quite high, whereas for an extremely nega-

tive opinion distribution the transaction history shows

very low prices. The results use the RA model with

pe = 0.5 and w = 0.5, and a function that specifies the

distribution of extremists.

Figure 6: OZIC traders with extreme opinions. Upper row

of plots is for traders with extremely positive opinions;

lower row is for traders with extremeley negative opinons.

The plot at far left shows the convergence of opinion values

in the population over time, in the 2D style used by (Def-

fuant et al., 2002) among others – the population converges

to a situation where all traders hold one of three opinions;

the two central plots display the same opinion-distribution

data as 3D plots (heatmap-colored on the left; uncoloured

on the right), which gives a better indication of the number

of traders that hold each converged-upon opinion. The dark-

background plot at far right in each row os the transaction-

price time series from this experiment.

In Figure 7, we have plotted the transaction histo-

ries of OZIC traders with extremely positive opinions,

in orange, and extremely negative opinions, in green.

When compared this way it is clear that the traders

with extremely positive opinions trade at much higher

prices than traders with extremely negative opinions.

5.1.2 Extreme Opinion Shift

We initialise a given proportion of extremists to be ex-

tremely positive or negative initially and switch them

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics

145

Figure 7: Comparison of OZIC trader transaction histories

with extremely negative and positive opinions.

to the polar opposite opinion half way through the du-

ration of the simulation. Figure 8 shows the results for

a population of 100 OZIC buyers and 100 OZIC sell-

ers using the RA model with proportion of extremists

pe = 0.5, confidence factor µ = 0.5, and uncertainty

in the range [0.2,2.0].

Figure 8: OZIC traders with extreme shifts in opinion at the

start of Period 6; format as for Figure 6.

The results show a clear change in mean trans-

action price in relation to opinion distribution. For

a positive to negative opinion shift, the traders start

selling and buying at high prices and after t = 1350

drastically shift to lower prices. Similarly for a nega-

tive to positive opinion shift, the traders begin trading

at low prices and after t = 1350 trade at higher prices.

5.2 ONZI Trader Results

5.2.1 Baseline Results

The same rationality for testing the extreme opin-

ion distributions for ONZI traders applies to testing

ONZI traders. With extremely positive opinions, the

shape of the transaction history peaks higher and has

a greater initial gradient than that of ONZI traders

with extremely negative opinions. ONZI traders with

extremely negative opinions show a shorter hump

shaped pattern than the ONZI traders with extremely

positive opinions.

Figure 9: ONZI trader transaction histories with extreme

positive and negative opinions; format as for Figure 6.

In Figures 10 and 11, inspired by a graph in (Duffy

and Utku nver, 2006), we have plotted the transac-

tion histories of the ONZI trader, in orange, against

an ordinary near-zero-intelligence (NZI) trader’s re-

sults, in green. We have also plotted

¯

D

T

over time and

1/2κ

¯

D

T

over time to illustrate the effect it has on the

transaction price over time. The average transaction

price per trading period is also shown to encapsulate

the overall behaviour of the market trends, in red. The

simulated data for NZI traders, in green, tapers off and

does not crash because we are not using a decreasing

proportion of buyers in the population.

The transaction price data for ONZI traders with

extremely positive opinions is very close to the sim-

ulated transaction history of near-zero-intelligence

traders, as shown in Figure 10. On the other hand,

the transaction price data for ONZI traders with ex-

tremely negative opinions is much lower than the sim-

ulated transaction history of near-zero-intelligence

traders, as shown in Figure 11.

5.2.2 Extreme Opinion Shift

Figure 12 shows ONZI traders with extremely posi-

tive opinions until half way through the simulation,

i.e. t = 1350, when the opinions shift to extremely

negative, and vice versa. The opinion dynamics

model used is RA with confidence factor µ = 0.5 and

proportion of extremists pe = 0.5 for both initializa-

tions of extremists. Similarly to the results in Figures

13 and 14, we have plotted the transaction histories of

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

146

Figure 10: ONZI trader transaction history with extremely

positive opinions; compared to the original NZI results

shown in Figure 3. Yellow lines show transaction history

of traders with extreme positive opinions; green lines are

baseline comparison; red line shows mean transaction price.

Figure 11: ONZI trader transaction history with extremely

negative opinions; compared to the original NZI results as

shown in Figure 3. Color-coding of lines is as for Figure 10.

ONZI traders with drastically shifting opinion distri-

butions against the ordinary NZI traders, the default

value

¯

D

T

, the expected uncertainty 1/2κ

¯

D

T

, and the

mean transaction price per trading period. The mean

transaction price per trading period, in red, is a use-

ful indicator of the trends generated from the opinion

distribution, as the average transaction price over time

increases and decreases according to positive and neg-

ative opinions respectively.

Figure 12: ONZI extreme opinion shifts; format as for Fig-

ure 6.

Figure 13: ONZI traders with extremely positive opinions

drastically shifting to negative opinions at the start of Period

6. Color-coding of lines is as for Figure 10.

6 CONCLUSIONS

In this paper we have described what we believe to be

the first ever system that integrates ideas from opinion

dynamics into well-established trader-agent models,

and in doing so we have created the first platform for

the experimental exploration of agent-based models

of narrative economics. In his seminal work on narra-

tive economics, Nobel Laureate Robert Shiller argues

for a program of empirical research, gathering data on

the stories, the narratives, that humans tell each other

about economic affairs, which shape and change their

opinions about future economic events, and where

those opinions are themselves also significant factors

in the dynamics of economic affairs. Our work opens

up an experimental approach that is complementary

to the one proposed by Shiller: using our platform,

Exploring Narrative Economics: An Agent-based-modeling Platform that Integrates Automated Traders with Opinion Dynamics

147

Figure 14: ONZI traders with extremely negative opinions

drastically shifting to positive opinions at the start of Period

6. Color-coding of lines is as for Figure 10.

experimentalists can now also run agent-based sim-

ulations to better understand the dynamic interplay

between opinions, expressions of those opinions, and

subsequent economic outcomes.

ACKNOWLEDGEMENTS

The work described here was orally presented in Oc-

tober 2020 at an international conference on Zero-

and Minimal-Intelligence Trading Agents held virtu-

ally at the Yale School of Management, Connecticut,

USA. We are grateful to the participants of that meet-

ing for their insightful questions and comments, and

for awarding this work the Best Student Paper prize.

REFERENCES

Chatterjee, S. and Seneta, E. (1977). Towards Consensus:

Some Convergence Theorems on Repeated Averag-

ing. Journal of Applied Probability, 14(1):88–97.

Chen, S. H. (2018). Agent-based computational eco-

nomics: How the idea originated and where it is go-

ing. Routeledge.

Cliff, D. (2018). BSE : A Minimal Simulation of a Limit-

Order-Book Stock Exchange. Proc. European Mod-

elling and Simulation Symposium, pages 194–203.

Cooks, A. and Heppenstall, A. (2011). Introduction to

Agent-Based Modelling. Agent-Based Models of Ge-

ographical Systems, pages 85–105.

De Luca, M. and Cliff, D. (2011). Human-agent auction

interactions: Adaptive-aggressive agents dominate. In

Proceedings of the Twenty-Second International Joint

Conference on Artificial Intelligence.

Deffuant, G. (2006). Comparing Extremism Propagation

Patterns in Continuous Opinion Models. Journal of

Artificial Societies and Social Simulation, 9(3):8.

Deffuant, G., Neau, D., and Amblard, F. (2000). Mixing

Beliefs Among Interacting Agents. Advances in Com-

plex Systems, 3:87–98.

Deffuant, G., Neau, D., and Amblard, F. (2002). How

can extremism prevail? A study based on the rela-

tive agreement interaction model. Journal of Artificial

Societies and Social Simulation, 5(4):1.

DeGroot, M. (1974). Reaching a Consensus. Journal of the

American Statistical Association, 69(345):118–121.

Duffy, J. and Utku nver, M. (2006). Asset Price Bubbles and

Crashes with Near-Zero-Intelligence Traders. Eco-

nomic Theory, 27:537–563.

Friedkin, N. (1999). Choice Shift and Group Polarization.

American Sociological Review, 64(6):856–875.

Gode, D. and Sunder, S. (1993). Allocative Efficiency of

Markets with Zero-Intelligence Traders: Market as a

Partial Substitute for Individual Rationality. Journal

of Political Economy, 101(1):119–137.

Hegselmann, G. and Krause, U. (2002). Opinion dynamics

and bounded confidence: models, analysis and simu-

lation. Journal of Artificial Societies and Social Sim-

ulationn, 5(3):2.

Hommes, C. and LeBaron, B., editor (2018). Computa-

tional Economics: Heterogeneous Agent Modeling.

North-Holland.

Krause, U. (2000). A discrete nonlinear and non-

autonomous model of consensus formation. Proc. 4th

Int. Conf. on Difference Equations, pages 27–32.

Lomas, K. (2020). Exploring narrative economics: A novel

simulation platform that integrates automated traders

with opinion dynamics. Master’s thesis, University of

Bristol Department of Computer Science.

Meadows, M. and Cliff, D. (2012). Reexamining the Rela-

tive Agreement Model of Opinion Dynamics. Journal

of Artificial Societies and Social Simulation, 15(4):4.

Meadows, M. and Cliff, D. (2013). The Relative Disagree-

ment Model of Opinion Dynamics: Where Do Ex-

tremists Come From? 7th International Workshop on

Self-Organizing Systems (IWSOS), pages 66–77.

Shiller, R. (2017). Narrative Economics. Technical Report

2069, Cowles Foundation, Yale University.

Shiller, R. (2019). Narrative Economics: How Stories Go

Viral & Drive Major Economic Events. Princeton Uni-

versity Press.

Smith, A. (1759). The Theory of Moral Sentiments. Penguin

Classics.

Smith, V. (1962). An Experimental Study of Competi-

tive Market Behaviour. Journal of Political Economy,

70(2):111–137.

Steindl, C., Jonas, E., Sittenhaler, S., Traut-Mattausch, E.,

and Greenberg, J. (2015). Understanding Psychologi-

cal Reactance. Zeitschrift fr Psychologie, 223(4):205–

214.

Vytelingum, P. (2006). The Stucture and Behavior of the

Continuous Double Auction. PhD thesis, University

of Southampton.

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

148