Market Impact in Trader-agents: Adding Multi-level Order-flow

Imbalance-sensitivity to Automated Trading Systems

Zhen Zhang

a

and Dave Cliff

b

Department of Computer Science, University of Bristol, Bristol BS8 1UB, U.K.

Keywords:

Market Impact, Adaptive Trader Agents, Financial Markets, Multi-Agent Systems.

Abstract:

Financial markets populated by human traders often exhibit so-called “market impact”, where the prices

quoted by traders move in the direction of anticipated change, before any transaction has taken place, as

an immediate reaction to the arrival of a large (i.e., “block”) buy or sell order in the market: traders in the

market know that a block buy order is likely to push the price up, and that a block sell order is likely to push

the price down, and so they immediately adjust their quote-prices accordingly. In most major financial markets

nowadays very many of the participants are “robot traders”, autonomous adaptive software agents, rather than

humans. This paper addresses the question of how to give such trader-agents a reliable anticipatory sensitivity

to block orders, such that markets populated entirely by robot traders also show market-impact effects. This

is desirable because impact-sensitive trader-agents will get a better price for their transactions when block

orders arrive, and because such traders can also be used for more accurate simulation models of real-world

financial markets. In a 2019 publication Church & Cliff presented initial results from a simple deterministic

robot trader, called ISHV, which was the first such trader-agent to exhibit this market impact effect. ISHV

does this via monitoring a metric of imbalance between supply and demand in the market. The novel contri-

butions of our paper are: (a) we critique the methods used by Church & Cliff, revealing them to be weak, and

argue that a more robust measure of imbalance is required; (b) we argue for the use of multi-level order-flow

imbalance (MLOFI: Xu et al., 2019) as a better basis for imbalance-sensitive robot trader-agents; and (c) we

demonstrate the use of the more robust MLOFI measure in extending ISHV, and also the well-known AA

and ZIP trading-agent algorithms (which have both been previously shown to consistently outperform human

traders). Our results demonstrate that the new imbalance-sensitive trader-agents introduced in this paper do

exhibit market impact effects, and hence are better-suited to operating in markets where impact is a factor of

concern or interest, but do not suffer the weaknesses of the methods used by Church & Cliff. We have made

the source-code for our work reported here freely available on GitHub.

1 INTRODUCTION

Financial markets populated by human traders of-

ten exhibit so-called market impact, where the prices

quoted by traders shift in the direction of antici-

pated change, as a reaction to the arrival of a large

(i.e., “block”) buy or sell order for a particular as-

set: that is, mere knowledge of the presence of the

block order is enough to trigger a change in the

traders’ quote-prices, before any transaction has ac-

tually taken place, because the traders know that a

block buy order is likely to push the price of the asset

up, and a block sell order is likely to push the price

down, and so they adjust their quote-prices accord-

a

https://orcid.org/0000-0002-4618-6934

b

https://orcid.org/0000-0003-3822-9364

ingly, in anticipation of the shift in price that they

foresee coming as a consequence of the block-trade

completing. This is bad news for the trader trying to

buy or sell a block order: the moment she reveals her

intention to buy a block, the market-price goes up;

the moment she reveals her intention to sell, the price

goes down. From the perspective of a block-trader,

the market price moves against her, whether she is

buying or selling, and this happens not because of the

price she is quoting, but because of the quantity that

she is attempting to transact.

Block-traders’ collective desire to avoid market

impact has long driven the introduction of automated

trading techniques such as “VWAP engines” (which

break block orders into a sequence of smaller sub-

orders that are released into the market over a set pe-

riod of time, with the intention of achieving a specific

426

Zhang, Z. and Cliff, D.

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems.

DOI: 10.5220/0010391004260436

In Proceedings of the 13th International Conference on Agents and Artificial Intelligence (ICAART 2021) - Volume 2, pages 426-436

ISBN: 978-989-758-484-8

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

volume-weighted average price, hence VWAP), and

has also driven the design of major new electronic ex-

changes such as London Stock Exchange’s (LSE’s)

Turquoise Plato trading venue (London Stock Ex-

change Group, 2019), in which block-traders are al-

lowed to obscure the size of their blocks in a so-called

dark pool market, with LSE’s automated matching

engine identifying one or more willing counterparties

and only making full details of the block-trade known

to all market participants after it has completed: see

(Petrescu and Wedow, 2017) for further discussion.

Many of the world’s major financial markets now

have very high levels of automated trading: in such

markets most of the participants, the traders, are

“robots” rather than humans: i.e., software systems

for automated trading, empowered with the same le-

gal sense of agency as a human trader, and hence

“software agents” in the most literal sense of that

phrase. Given that these software agents typically

replace more than one human trader, and given that

those human traders were widely regarded to have re-

quired a high degree of intelligence (and remunera-

tion) to work well in a financial market, it is clear that

the issue of designing well-performing robot traders

presents challenges for research in agents and artifi-

cial intelligence, and hence is a research topic that is

central to the themes of the ICAART conference.

This paper addresses the question of best how to

give robot traders an appropriate anticipatory sensi-

tivity to large orders, such that markets populated en-

tirely by robot traders also show market-impact ef-

fects. This is desirable because the impact-sensitive

robot traders will get a better price for their transac-

tions when block orders do arrive, and also because

simulated market populated by impact-sensitive au-

tomated traders can be studied to explore the pros

and cons of various impact-mitigation or avoidance

techniques. We show here that well-known and long-

established trader-agent strategies can be extended by

giving them appropriately robust sensitivity to the im-

balance between buy and sell orders issued by traders

on the exchange, orders that are aggregated on the

market’s limit order-book (LOB), the data-structure

at the heart of most electronic exchanges.

To the best of our knowledge, the first paper to

report on the use of an imbalance metric to give auto-

mated traders impact-sensitivity was the recent 2019

publication by Church & Cliff, in which they demon-

strated how a minimal nonadaptive trader-agent called

Shaver (which, following the convention of practice

in this field, is routinely referred to in abbreviated

form via a psuedo-ticker-symbol: “SHVR”) could be

extended to show impact effects by addition of an im-

balance metric, and Church & Cliff gave the name

ISHV to their Imbalance-SHVR trader-agent (Church

and Cliff, 2019). SHVR is a trader-agent strategy

built-in to the popular open-source financial exchange

simulator called BSE (BSE, 2012), which Church &

Cliff used as the platform for their research. Al-

though Church & Cliff deserve some credit for the

proof-of-concept that ISHV provides, we argue here

that the imbalance-metric they employed is too frag-

ile for practical purposes because very minor changes

in the supply and demand can cause their metric to

swing wildly between the extremes of its range. One

of the major contributions of our paper here is the

demonstration that a much better, more robust, metric

known as multi-level order-flow imbalance (MLOFI)

can be used instead of the comparatively very frag-

ile metric proposed by Church & Cliff. Another ma-

jor contribution of this paper is our demonstration

of the addition of MLOFI-based impact-sensitivity to

the very well-known and widely cited public-domain

adaptive trader-agent strategies ZIP (Cliff, 1997) and

AA (Vytelingum, 2006; Vytelingum et al., 2008).

Although our primary aim was to add impact sen-

sitivity to these two machine-learning-based trader-

agent strategies, we also demonstrate in this paper that

ISHV can be altered/extended to use MLOFI, and our

improvement of Church & Cliff’s work in that regard

is an additional contribution of this paper.

The extended versions of the AA, ZIP, and ISHV

trader-agent strategies that we introduce here are

named ZZIAA, ZZIZIP, and ZZISHV respectively.

In this paper, after our criticism of Church & Cliff’s

methods, we described more mathematically sophisti-

cated approaches to measuring imbalance, which are

more robust, and which we incorporate into our agent

extensions. We then present results from testing our

extended trader-agents on BSE, the same platform

that was used in Church & Cliff’s work. Full de-

tails of the work reported here are available in (Zhang,

2020b), and all the relevant source-code has been

made freely available on GitHub (Zhang, 2020a).

Section 2 of this paper presents an overview of

relevant background material: readers already famil-

iar with automated trading systems and contemporary

electronic financial exchanges can safely skip ahead

straight to Section 3. In Section 3 we give a brief sum-

mary of Church & Cliff’s 2019 work and then provide

our detailed critique of their core method, which we

demonstrate to be significantly lacking in robustness,

and we then describe our MLOFI approach in detail.

Then Section 4 is where we describe the steps taken

to add MLOFI-based impact-sensitivity to ZIP, AA,

and ISHV; and the results from those extended trad-

ing algorithms are presented in Section 5.

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems

427

2 BACKGROUND

Since the mid-1990s researchers in universities and

in the research labs of major corporations such as

IBM and Hewlett-Packard have published details of

various strategies for autonomous trader-agents, of-

ten incorporating AI and/or machine learning (ML)

methods so that the automated trader can adapt its

behaviors to prevailing market conditions. Notable

trading strategies in this body of literature include:

Kaplan’s “Sniper” strategy (Rust et al., 1992); Gode

& Sunder’s ZIC (Gode and Sunder, 1993); the ZIP

strategy developed at Hewlett-Packard (Cliff, 1997);

the GD strategy reported by Gjerstad & Dickhaut

(Gjerstad and Dickhaut, 1997) the MGD and GDX

automated traders developed by IBM researchers

(Tesauro and Das, 2001; Tesauro and Bredin, 2002);

Gjerstad’s HBL (Gjerstad, 2003); Vytelingum’s AA

(Vytelingum, 2006; Vytelingum et al., 2008)); and

the Roth-Erev approach (see e.g. (Pentapalli, 2008)).

However, for reasons discussed at length in a recent

review of key papers in the field (Snashall and Cliff,

2019) this sequence of publications concentrated on

the issue of developing trading strategies for orders

that all had the same fixed-size quantity, and that

quantity was always one. That is, none of the key pa-

pers listed here deal with trading strategies for outsize

block orders, and none of them directly explore the is-

sue of how an automated trader can best deal with, or

avoid, market impact.

Trader-agent strategies such as Sniper, ZIC, ZIP,

GD and MGD were all developed to operate in elec-

tronic markets that were based on old-school open-

outcry trading pits, as were common on major fi-

nancial exchanges until face-to-face human-to-human

bargaining was replaced by negotiation of trades via

electronic communication media; but more recent

work has concentrated on developing trading agents

that issue bids and asks (i.e. quotations for orders

to buy or to sell) to a centralised electronic exchange

(such as a major stock-market like NYSE or NAS-

DAQ or LSE) where the exchange’s matching engine

then either matches the trader’s quote with a willing

counterparty (in which case a transaction is recorded

between the two counterparties, the buyer and the

seller) or the quote is added to a data-structure called

the Limit Order Book (LOB) that is maintained by

the exchange and published to all traders whenever

it changes. The LOB aggregates and anonymises all

outstanding orders: it has two sides or halves: the bid-

side and the ask-side. Each side of the book shows

a summary of all outstanding orders, arranged from

best to worst: this means that the bid-side is arranged

in descending price-order, and the ask side is arranged

in ascending price-order, such that at the “top of the

book” on the two sides the best bid and ask are visi-

ble. For all orders currently sat on the LOB, if there

are multiple orders at the same price then the quanti-

ties of those orders are aggregated together, and often

multiple orders at the same price will be later matched

with a counterparty in a sequence given by the orders’

arrival times, in a first-in-first-out fashion. The public

LOB shows only, for each side of the book, the prices

at which orders have been lodged with the exchange,

and the total quantity available at each of those prices:

if no orders are resting at the exchange for a particular

price, then that price is usually omitted from the LOB

rather than being shown with a corresponding quan-

tity of zero. Illustrations of LOBs appear later in this

paper, commencing with Figure 2.

The difference between the price of the best bid

on the LOB at time t and the price of the best ask at t

is known as the spread. The mid-point of the spread

(i.e. the arithmetic mean of the best bid and the best

ask) is known as the mid-price which is denoted here

by P

mid

. The mid-price is very commonly used as a

single-valued statistic to summarise the current state

of the market, and as an estimate of what the next

transaction price would be. However, the midprice

pays no attention to the quantities that are bid and of-

fered. If the current best bid is for a quantity of one at

a price of $10 and the current best ask is for a quantity

of 200 at a price of $20 then the mid-price is $15 but

that fails to capture that there is a much larger quantity

being offered than being bid: basic microeconomics,

the theory of supply and demand, would tell even

the most casual observer that with such heavy sell-

ing pressure then actual transaction prices are likely

to trend down – in which case the mid-price of $15

is likely to be an overestimate of the next transaction

price. Similarly, if the bid and ask prices remain the

same but the imbalance between supply and demand

is instead reversed, then the fact that there is a re-

vealed desire for 200 units to be purchased but only

one unit on sale at the current best ask would surely

be a reasonable indication that transaction prices are

likely to be pushed up by buying pressure, in which

case the mid-price of $15 will turn out to be an un-

derestimate. This lack of quantity-sensitivity in the

mid-price calculation leads many market practition-

ers to instead monitor the micro-price, denoted here

by P

micro

, which is a quantity-weighted average of the

best bid and best ask prices, and which does move in

the direction indicated by imbalances between supply

and demand at the top of the LOB: see, e.g., (Cartea

et al., 2015).

To the best of our knowledge the first impact-

sensitive trading algorithm was ISHV (Church and

Cliff, 2019). ISHV is based on the SHVR trader

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

428

built into the popular BSE public-domain financial-

market simulator (BSE, 2012; Cliff, 2018). A SHVR

trader simply posts the buy/sell order with its price set

one penny higher/lower than the current best bid/ask.

This single instruction gives it a parasitic nature, in

the sense that it can mimic the price-convergence be-

haviour of other strategies being used by other traders

in the market.

Instead of shaving the best bid or offer by one

penny, Church & Cliff’s ISHV trader instead chooses

to shave by an amount ∆s which varies with ∆m de-

fined in Equation 1:

∆m = P

micro

− P

mid

(1)

The difference of the micro-price and the mid-price

can identify the degree of supply/demand imbalance

to a useful extent. If ∆m ≈ 0, there is no obvious im-

balance in the market. If ∆m < 0, then the quantities

of the best bid and the best offer on the LOB indicate

that supply exceeds demand and the subsequent trans-

actions prices are likely to decrease; whereas ∆m > 0

indicates that demand outweighs supply and subse-

quent transaction prices will have an upward ten-

dency.

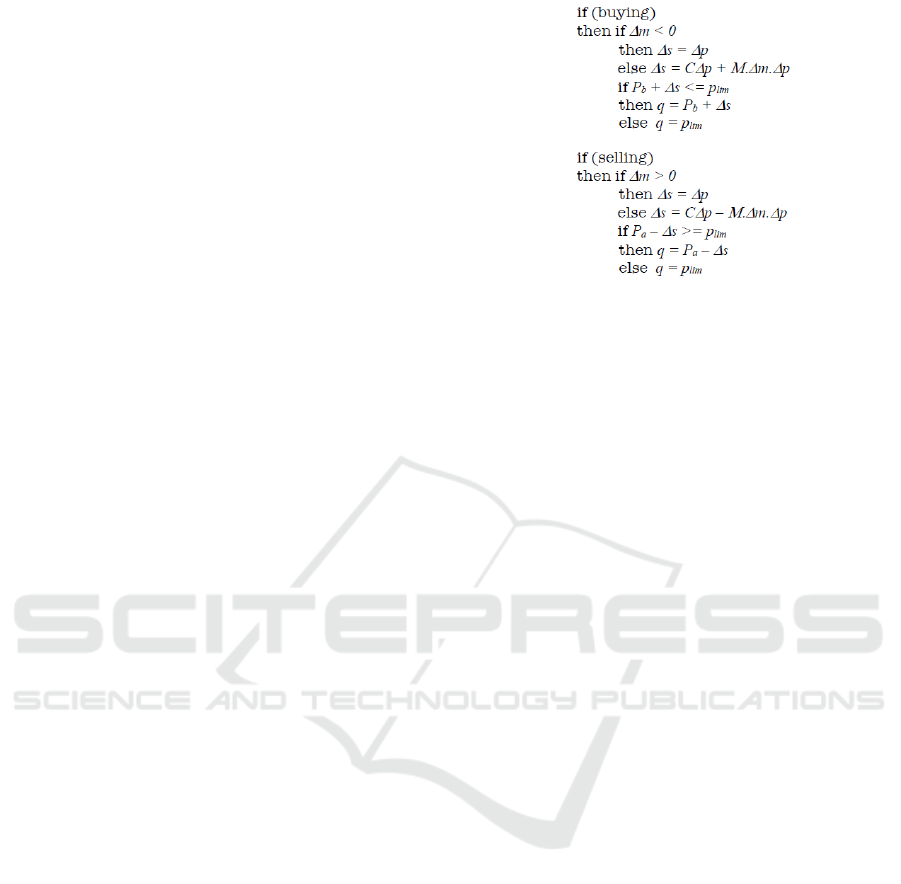

The pseudocode for ISHV is shown in Figure 1.

It implements a function that maps from ∆m to ∆s to

determine how much it will shave off its price. For a

buyer, if ∆m < 0, it knows the price will shift in its

favour and shaves its price as little as possible (the

exchange’s minimum tick-size ∆p – often one penny

or one cent – is chosen). However, if ∆m > 0, ISHV

“believes” the later prices will be worse and attempts

to shave a large amount off (C∆p + M∆m∆p). C and

M are two constants that determine the SHVR’s re-

sponse to the imbalance (they are the y−intersect and

gradient for a linear response function; nonlinear re-

sponse functions could be used instead). Church &

Cliff showed that ISHV can identify and respond ap-

propriately to the presence of a block order signal at

the top of the LOB.

Church & Cliff were careful to flag their ISHV

trader as only a proof-of-concept (PoC): ISHV was

developed to enable the study of coupled lit/dark trad-

ing polls such as LSE Turquoise Plato system in com-

mercial operation in London, as mentioned in the In-

troduction to this paper. Without impact-sensitive

trader-agents, it is not possible to build agent-based

models of contemporary real-world trading venues

such as LSE Turquoise Plato. Having experimented

further with Church & Cliff’s PoC system, we came

to realise that there are severe limitations in ISHV as

described in Figure 1: these limitations stem from the

fact that Equation 1, which is at the heart of ISHV,

uses values only found at the top of the LOB. That

Figure 1: Pseudocode for the bidding behavior of ISHV,

source from (Church and Cliff, 2019).

is, Equation 1 involves only the price and quantity of

the best bid and the best ask. As we will demonstrate

in the next section, this makes the method introduced

by Church & Cliff so fragile that it is unlikely to be

usable in anything but the simplest of simulation stud-

ies; as we show in the next section, for real-world

markets it is necessary to look deeper into the LOB,

to go beyond the top of the LOB.

3 FRAGILITY OF THE LOB-TOP

For brevity, we will limit ourselves here to presenting

a qualitative illustrative example which demonstrates

how wildly fragile the Church & Cliff method is. For

a longer and more detailed discussion, see Chapter 3

of (Zhang, 2020b).

Consider a situation in which the top of the LOB

has a best bid price of $10 and a best ask price of $20,

as before, and where the quantity at the best bid is

200 and at the best ask is 1. As we explained in the

previous section, this huge imbalance between supply

and demand at the top of the book indicate that the

excess demand is likely to push transaction prices up

in the immediate future. Church & Cliff’s ISHV does

the right thing in this situation.

Now consider what happens if the next order to

arrive at the exchange is a bid for $11 at a quantity of

1. Because this fresh bid is at a higher price than the

current best bid, it is inserted at the top of the bid-side

of the LOB. The previous best-bid, for 200 at $10,

gets shuffled down to the second layer of the LOB.

At that point, the best bid and the best ask each show

a quantity of one, and so ISHV acts as if there is no

imbalance in the market, despite the fact when view-

ing the whole LOB it is clear that the quantity bid is

now 201 (i.e. 1 at $11 and 200 at $10) while the ask

quantity is still only 1: if anything, the imbalance has

increased but ISHV reacts as if it had disappeared be-

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems

429

cause ISHV looks only at the top of the LOB.

There is more that could be said, but this should

be enough to convince the reader that any impact-

sensitive trader-agent algorithm that looks only at the

data at the top of the LOB is surely going to get it

wrong very often, because it is ignoring the supply

and demand information, the quantities and the prices,

which lie deeper in the LOB. What we introduce in

the rest of this paper addresses this problem.

4 MEASURING IMBALANCE

A reliable metric is needed to capture the quantity

imbalance between the supply side and the demand

side, at multiple levels in the LOB (i.e., not just the

top) and which can quantitatively indicate how much

the imbalance will affect the market. We first discuss

the Order-Flow Imbalance (OFI) metric introduced by

(Cont et al., 2014) and then describe the extension

of this into a reliable Multi-Level OFI (MLOFI) met-

ric very recently reported by (Xu et al., 2019). After

that, we show how MLOFI can be used to give robust

impact-sensitivity to ISHV (Church and Cliff, 2019),

AA (Vytelingum, 2006; Vytelingum et al., 2008), and

ZIP (Cliff, 1997). AA and ZIP are of particular inter-

est because in previous papers published at IJCAI and

at ICAART it was demonstrated that these two trader-

agent strategies can each reliably outperform human

traders (Das et al., 2001; De Luca and Cliff, 2011b;

De Luca and Cliff, 2011a; De Luca et al., 2011).

4.1 Order Flow Imbalance (OFI)

Cont et al. argued that previous studies modelling im-

pact are extremely complex, and that instead a single

factor, the order flow imbalance (OFI), can adequately

explain the impact (R

2

= 67% in their research) (Cont

et al., 2014). They indicated that OFI has a positive

linear relation with mid-price changes, and that the

market depth D is inversely proportional to the scope

of the relationship. OFI means the net order flow at

the bid-side and the ask-side, and the market depth,

D, represents the size at each bid/ask quote price.

To calculate the OFI they focused on the “Level 1

order book”, i.e. the best bid and ask at the top of the

LOB. Between any two events (event

n

and event

n−1

),

only one change happens in the LOB (check the con-

dition from top to bottom, and from left to right; in

other words, we should compare the change of price

first and if the price does not change, then compare

the change of quantity). Using D ↑ and D ↓ to respec-

tively denote an increase and a reduction in demand;

and S ↑ and S ↓ to denote an increase/decrease in sup-

ply, Cont et al. had:

p

b

n

> p

b

n−1

∨ q

b

n

> q

b

n−1

=⇒ D ↑

p

b

n

< p

b

n−1

∨ q

b

n

< q

b

n−1

=⇒ D ↓

p

a

n

< p

a

n−1

∨ q

a

n

> q

a

n−1

=⇒ S ↑

p

a

n

> p

a

n−1

∨ q

a

n

< q

a

n−1

=⇒ S ↓

Where p

b

is the best bid price; q

b

the size of the best

bid price; p

a

the best ask price; and q

a

the size of

the best ask price. The variable e

n

is defined to mea-

sure this tick change between two events, (event

n

and

event

n−1

), shown in Equation 2, where I can be re-

garded as a Boolean variable.

e

n

= I

{p

b

n

>p

b

n−1

}

q

b

n

− I

{p

b

n

≤p

b

n−1

}

q

b

n−1

−I

{p

a

n

<p

a

n−1

}

q

a

n

+ I

{p

a

n

≥p

a

n−1

}

q

a

n−1

(2)

The rules for I are as follows, and only one of them

will happen between any two consecutive events:

1. if p

b

increases, e

n

= q

b

n

2. if p

b

decreases, e

n

= −q

b

n−1

3. if p

a

increases, e

n

= q

a

n−1

4. if p

a

decreases, e

n

= −q

a

n

5. if p

b

remains same and q

b

n

6= q

b

n−1

, e

n

= q

b

n

− q

b

n−1

6. if p

a

remains same and q

a

n

6= q

a

n−1

, e

n

= q

a

n−1

− q

a

n

If N(t

k

) is the number of events during [0, t

k

],

then OFI

k

refers to the cumulative effect of e

n

that

has occurred over the time interval [t

k

− 1, t

k

], as

shown in Equation 3.

OFI

k

=

N(t

k

)

∑

n=N(t

k−1

)+1

e

n

(3)

After this, a linear regression equation can be built,

per Equation 4, where ∆P

k

= (P

k

− P

k−1

)/δ and δ is

the tick size (1 cent in Cont et al.’s experiments), β is

the price impact coefficient, and ε

k

is the noise term

mainly caused by contributions from lower levels of

the LOB:

∆P

k

= βOFI

k

+ ε

k

(4)

Moreover, Cont et al. stated that the market depth, D,

is an important contributing factor to the fluctuations,

and is inversely proportional to mid-price changes.

They defined the average market depth, AD

k

, in the

“Level 1 order book” as shown in Equation 5; and β

can be measured by AD

k

, shown in Equation 6, where

λ and c are constants and v

k

is a noise term.

AD

k

=

1

2(N(T

k

) − N(T

k

) − 1)

N(T

k

)

∑

N(T

k−1

)+1

(q

B

n

+q

A

n

) (5)

β

k

=

c

AD

λ

k

+ v

k

(6)

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

430

Given equations 4 and 6, the relationship between

∆P and OFI and AD is constructed as seen in

Equation 7, according to which, Cont et al. ran the

linear regression by using the 21-trading-day data

from 50 randomly chosen US stocks, and the average

R

2

= 67%. They demonstrated that OFI is positive

in relation to the change of mid-price. If OFI > 0,

meaning a net inflow on the bid side or a net outflow

on the ask side, the mid-price has a significantly

increasing momentum, and the higher OFI is, the

more the mid-price will increase. Conversely, if

OFI < 0, meaning a net outflow on the bid side

or a net inflow on the ask side, the mid-price has a

significantly decreasing momentum, and the lower

OFI is, the more the mid-price will decrease.

∆P

k

=

c

AD

λ

k

OFI

k

+ ε

k

(7)

OFI is clearly a useful metric, but it operates only on

values found at the top of the LOB, i.e. the best bid

and ask. In that sense, it is as sensitive to changes

at the top of the book as is the Church & Cliff ∆

m

metric. Next we describe how OFI can be extended

to be sensitive to values at multiple levels in the LOB,

which gives us Multi-Level OFI, or MLOFI.

4.2 Multi-level Order Flow Imbalance

Fortunately, (Xu et al., 2019) demonstrated how to

measure multi-level order flow imbalance (MLOFI).

A quantity vector, v, is used to record the OFI at

each discrete level in the LOB: see Equation 8,

where m denotes the depth of price level in the LOB.

The level-m bid-price refers to the m-highest prices

among bids in the LOB, and the level-m ask-price

refers to the m-lowest prices among asks in the LOB.

v =

MLOFI

1

MLOFI

2

...

MLOFI

m

(8)

The time when an n

th

event occurs is denoted by τ

n

;

p

m

b

(τ

n

) signifies the level-m bid-price; p

m

a

(τ

n

) denotes

the level-m ask-price; q

m

b

(τ

n

) refers to the total quan-

tity at the level-m bid-price, and q

m

a

(τ

n

) refers to the

total quantity at the level-m ask-price.

Similar to the OFI defined in Section 4.1, the

level-m OFI between two consecutive events occur-

ring at times τ

s

and τ

n

(s = n − 1) can be calculated

as follows:

∆W

m

(τ

n

) =

q

m

b

(τ

n

), if p

m

b

(τ

n

) > p

m

b

(τ

s

)

q

m

b

(τ

n

) − q

m

b

(τ

s

), if p

m

b

(τ

n

) = p

m

b

(τ

s

)

−q

m

b

(τ

m

), if p

m

b

(τ

n

) < p

m

b

(τ

s

)

(9)

and

∆V

m

(τ

n

) =

−q

m

a

(τ

m

), if p

m

a

(τ

n

) > p

m

a

(τ

s

)

q

m

a

(τ

n

) − q

m

a

(τ

s

), if p

m

a

(τ

n

) = p

m

a

(τ

s

)

q

m

a

(τ

n

), if p

m

a

(τ

n

) < p

m

a

(τ

s

)

(10)

where ∆W

m

(τ

n

) measures the order flow imbalance of

the bid side in the level-m and ∆V

m

(τ

n

) measures the

order flow imbalance of the ask side in the level-m.

From equations 9 and 10, we can get the MLOFI

in the level-m over the time interval [t

k

− 1,t

k

]:

MLOFI

m

k

=

∑

{n|t

k−1

<τ

n

<t

k

}

e

m

(τ

n

) (11)

where

e

m

(τ

n

) = ∆W

m

(τ

n

) − ∆V

m

(τ

n

) (12)

We now give four illustrative examples of the

MLOFI mechanism in action. Figure 2 shows the sit-

uation of the LOB at time t

k−1

, and there is only one

event that occurs during the time interval [t

k−1

,t

k

], and

here we’ll only consider the 3-level OFI.

Figure 2: The LOB at time t

k−1

.

4.2.1 Case 1: New Order at Level-1 of the LOB

A new buy order comes into the LOB and occupies

the best-bid position shown in Figure 3.

Figure 3: The LOB at time t

k

: a new buy order comes.

• Level-1: since p

1

b

(t

k

) > p

1

b

(t

k−1

) (i.e. 93 > 90),

MLOFI

1

k

= q

1

b

(t

k

) = 5;

• Level-2: since p

2

b

(t

k

) > p

2

b

(t

k−1

) (i.e. 90 > 87),

MLOFI

2

k

= q

2

b

(t

k

) = 7;

• Level-3: since p

3

b

(t

k

) > p

3

b

(t

k−1

) (i.e. 87 > 82),

MLOFI

3

k

= q

3

b

(t

k

) = 2;

So, the quantity vector v

k

is:

v

k

=

5

7

2

(13)

All three numbers in v

k

are positive, which indicates

the upward trend of the price.

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems

431

4.2.2 Case 2: Partial Fulfillment or Cancellation

A new sell limit order crosses the spread, or a buy

limit order at the best-bid position cancels. Figure 4

shows the resultant LOB.

Figure 4: The LOB at time t

k

: crossing the spread or a buy

order cancellation.

For the level-1, as p

1

b

(t

k

) = p

1

b

(t

k−1

) (i.e. 90 = 90),

MLOFI

1

k

= q

1

b

(t

k

) − q

1

b

(t

k−1

) = 2 − 5 = −3;

For the level-2, as p

2

b

(t

k

) = p

2

b

(t

k−1

) (i.e. 87 = 87),

MLOFI

2

k

= q

2

b

(t

k

) − q

2

b

(t

k−1

) 2 − 2 = 0;

For the level-3, as p

3

b

(t

k

) = p

3

b

(t

k−1

) (i.e. 82 = 82),

MLOFI

2

k

= q

3

b

(t

k

) − q

3

b

(t

k−1

) = 0;

So, the quantity vector v

k

is:

v

k

=

−3

0

0

(14)

Where −3 at Level 1 indicates a potential downward

trend for the price, because the total demand on the

bid side decreases.

4.2.3 Case 3: Full Fulfillment or Cancellation

This is similar to Case 2, but (as illustrated in Fig-

ure 5) assumes that all orders at Level 1 in the ask

book (A

1

) are transacted by an incoming buy order, or

that the order in A

1

is cancelled. In this case, we need

to consider the change on the ask side:

Figure 5: The LOB at time t

k

: crossing the spread or a sell

order cancellation.

• A

1

: p

1

a

(t

k

) > p

1

a

(t

k−1

) (i.e. 98 > 95),

=⇒ ∆V

1

(t

k

) = −q

1

a

(t

k−1

) = −3; MLOFI

1

k

=

−∆V

1

(t

k

) = 3;

• A

2

: p

2

a

(t

k

) > p

2

a

(t

k−1

) (i.e. 100 > 98),

=⇒ ∆V

1

(t

k

) = −q

2

a

(t

k−1

) = −5; MLOFI

2

k

=

−∆V

1

(t

k

) = 5;

• A

3

: p

3

a

(t

k

) > p

3

a

(t

k−1

) (i.e. 105 > 100),

=⇒ ∆V

1

(t

k

) = −q

2

b

(t

k−1

) = −1; MLOFI

3

k

=

−∆V

1

(t

k

) = 1;

So, the quantity vector v

k

shown in Equation 15

demonstrates that if the supply reduces or a buy has

sufficient interest to transact, the price tends to go up.

v

k

=

3

5

1

(15)

4.2.4 Case 4: New Order at Level-m of the LOB

Figure 6: The LOB at time t

k

: crossing the spread or a sell

order cancellation.

Assuming now that a new large-sized order comes to

the level-2 ask, if we only consider order flow imbal-

ance in the top level of the LOB, we cannot detect this

new block order. This is the reason why we choose to

use MLOFI.

As there is no change in the level-1 bid,

MLOFI

1

k

= 0. Because a new order comes to the

second-level bid, p

2

b

(t

k

) > p

2

b

(t

k−1

) (i.e. 89 > 87) and

MLOFI

2

k

= q

2

b

(t

k

) = 100. Based on the same rule,

MLOFI

3

k

= q

3

b

(t

k

) = 2. So, the quantity vector v

k

is:

v

k

=

0

100

2

(16)

If we only care about first-level order flow imbalance,

we get OFI = 0. However, if we consider second and

third levels, we get MLOFI

2

k

= 100 and MLOFI

3

k

= 2,

which indicate a huge surplus on the demand side. If

a trader can obtain this information and take action

accordingly, it may result in larger profits or smaller

losses.

5 ZZIAA: AA TRADERS WITH

IMPACT

In this section we describe how ZZIAA is created,

by the addition of MLOFI-style imbalance-sensitivity

to the original AA trader strategy. Our intention for

ZZIAA was to develop an “impact-sensitive” module

that is not deeply embedded into the original AA so

that, if successful, this relatively independent mod-

ule could also easily be applied to other trading al-

gorithms. For this reason we chose the Widrow-Hoff

delta rule to update the quote of the ZZIAA towards

an impact-sensitive quote, as shown in Equation 17.

The p

AA

(t + 1) is derived from the long-term and

short-term factors using the information at time t (see

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

432

(Vytelingum et al., 2008)), and τ(t) is the target price

computed with consideration of MLOFI:

p

IAA

(t + 1) = p

AA

(t + 1) + ∆(t) (17)

where

∆(t) = β(τ(t) − p

AA

(t + 1)) (18)

and

τ(t) = p

benchmark

(t) + o

offset

(t) (19)

The core of the IAA derivation is how to find τ(t),

which consists of two parts, the benchmark price

p

benchmark

(t) and o

offset

(t). The p

benchmark

(t) de-

pends on whether the mid-price exists. As Equa-

tion 20 shows, if the mid-pice is available, we can set

p

benchmark

(t) as the mid-price, but if it is not, we set

p

benchmark

(t) as p

AA

(t + 1), which can be obtained at

time t.

p

benchmark

(t) =

p

mid

(t), if ∃p

mid

p

AA

(t + 1), if @p

mid

(20)

The o

offset

(t) is derived from the MLOFI and the av-

erage depth. Assume that we consider M numbers of

levels MLOFI in the LOB, shown in Equation 21, and

that each MLOFI captures the last N events shown in

Equation 22.

a(t) =

MLOFI

1

(t)

MLOFI

2

(t)

...

...

MLOFI

M

(t)

(21)

where

MLOFI

M

(t) =

N

∑

n=1

e

m

n

(22)

We can define the average market depth for m levels

in a similar way:

d(t) =

AD

1

(t)

AD

2

(t)

...

...

AD

M

(t)

(23)

where:

AD

M

(t) =

1

N

N

∑

n=1

q

a

M

n

+ q

b

M

n

2

(24)

Knowing the quantity vector a(t), we need a

mechanism to switch this vector to a scalar. Sim-

ilar to Equation 7, we define the offset as Equation 25.

v

offset

=

i=m−1

∑

i=0

α

i

c ∗ MLOFI

(i+1)

(t)

AD

(i+1)

(t)

(25)

where α is the decay factor (initialized as 0.8) and c

is a constant (we use c = 5). Note: if AD

m

(t) = 0, the

item α

m−1

c∗MLOFI

m

(t)

AD

m

(t)

will not be counted.

To summarise, our work extends AA by the novel

introduction of prior contributions to the economet-

rics of LOB imbalance from Cont et al. and of Xu et

al. in the following ways:

• Cont et al. and Xu et al. run linear regressions to

build their model and use statistical methods to

test the significance of factors. The constants such

as c come from modelling real-world data. How-

ever our version does not run a linear regression

and the constants such as c and α are determined

based on previous studies (Cont et al., 2014; Xu

et al., 2019). We can check the model’s perfor-

mance by exploring different values of constants.

• In the prior work, MLOFI

M

(t) and AD

M

(t) are

influenced by the events within a specified time

interval. In contrast, in our work, MLOFI

M

(t) and

AD

M

(t) are calculated based on the last N events

that occurred in the LOB, regardless of length of

the time interval between successive events.

6 RESULTS

Because our MOLFI-based “impact sensitive” mod-

ule added to AA was deliberately developed in a non-

intrusive way, it can easily be replicated into any

other algorithm. In this section we first show re-

sults from ZZIAA and then we follow those with re-

sults from adding the MLOFI module to ISHV (giv-

ing ZZISHV), and to ZIP (giving ZZIZIP). Because

of space limitations, the performance comparisons

shown here focus on situations where the imbalance

would cause a problem for the non-imbalance sensi-

tive versions of the trader agents – and we demon-

strate that our extended trader agents are indeed supe-

rior. Extensive sets of further results are presented in

(Zhang, 2020b), which demonstrate that the extended

trader-agents perform the same as the unextended ver-

sions in situations where there is no imbalance to be

concerned about in the LOB.

For each A:B comparison we ran 100 trials in

BSE (BSE, 2012), the same open-source simulator

of a financial exchange that was used by Church &

Cliff. Each trial involved creating a market where

there were N traders of type A (e.g., ZIP) and N

traders of type B (e.g., ZZIZIP) who were allocated

the role of buyers, and similarly N of type A and

N of type B who were allocated the role of sellers.

Thus one market trial involved a total of 4N trader-

agents: for the results presented here we used N = 10.

As is entirely commonplace in all such experimental

work, buyers were issued with assignments of cash,

and sellers with assignments of items to sell, and each

trader was given a private limit price: the price below

which a seller could not sell and above which a buyer

could not buy. The distribution of limit prices in the

market determines that market’s supply and demand

curves, and the intersection of those two curves indi-

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems

433

cates the competitive equilibrium price that microe-

conomic theory tells us to expect transaction prices to

converge to.

Although very many of the previous trader-agent

papers that we have cited here have monitored the ef-

ficiency of the traders’ activity in the market, we in-

stead monitored profitability (which only differs from

efficiency by some constant coefficient). Each indi-

vidual market trial would allow the traders to interact

via the LOB-based exchange in BSE for a fixed pe-

riod of time, and at the end of the session the average

profit of the Type A traders would be recorded, along

with the average profit of the Type B traders. In the

results presented here we conducted 100 independent

and identically distributed market trials for each A:B

comparison, giving us 100 pairs of profitability fig-

ures. To summarise those results we plot as box-and-

whisker charts the distribution of profitability values

for traders of Type A, the distribution of profitabil-

ity values for traders of Type B, and the distribution

of profitability-difference values (i.e., for each of the

100 trials, for trial t compute the difference between

the profitability of Type A traders and the profitability

of Type B traders in trial i). To determine whether the

differences we observed were statistically significant,

we used the Wilcoxon-Mann-Whitney U Test.

6.1 ZZIAA

Figure 7 summarises the comparison data generated

between AA and ZZIAA. In the U test, when com-

paring the ZZIAA with AA, p = 0.007 which meant

that the profit difference between ZZIAA and AA was

statistically significant.

6.2 Comparison of ZZISHV and ISHV

We can see from Figure 8 that the profit generated by

ZZISHV was much greater than ISHV. However, this

only means that ZZISHV is better than ISHV under

this particular market condition, and this might not be

the case under other market conditions. In the test, the

outperformance of ZZISHV can easily be explained:

as a seller, when ISHV met favourable imbalances,

it worked like SHVR and posted a price one penny

lower than the current best ask; in contrast, under the

same condition, ZZISHV chose to set price ∆p higher

than the current best ask and seek for transaction op-

portunities some time later. For example, assume that

the current best ask is 70 and ISHV will post an or-

der with the price equal to 69. Assume that ZZISHV

gets the offset value equal to 20 from the “impact-

sensitive” module, and the quoted price will be 90.

The aim of both ISHV and ZZISHV is the same:

Figure 7: Profit distributions from original AA tested

against ZZIAA.

Figure 8: Performance of ZZISHV and ISHV when facing

large-sized orders from the bid side.

to be sensitive to imbalances in the market. The

former uses a function that maps from ∆

m

to ∆

s

to

achieve this objective and ∆

m

is generated based on

the mid- and micro-prices in the market. In con-

trast, the latter uses MLOFI to achieve the goal. The

biggest difference between ISHV and ZZISHV is that

ISHV can only be sensitive to imbalances at the top of

the LOB and the MLOFI mechanism helps ZZISHV

to be sensitive to m-level imbalances on the LOB and

thus detect them earlier than ISHV in some cases. The

drawback comes in determination of appropriate pa-

rameter values for both ISHV and ZZISHV, where

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

434

trial-and-error is the best current option. In the map

function of ISHV (∆s = C∆p ± M.∆m.∆p if the im-

balance is significant), the parameters C and M were

somewhat arbitrarily set by (Church and Cliff, 2019)

to C=2 and M=1. For ZZISHV, when quantifying

MLOFI, we use Equation 25, and the key parameter

c and decay factor α are artificially determined. We

set m = 5 (consistent with the result from (Cont et al.,

2014)) and α = 0.8. The optimal values of these pa-

rameters are not known; poor choices of these con-

stants may cause agents to perform badly.

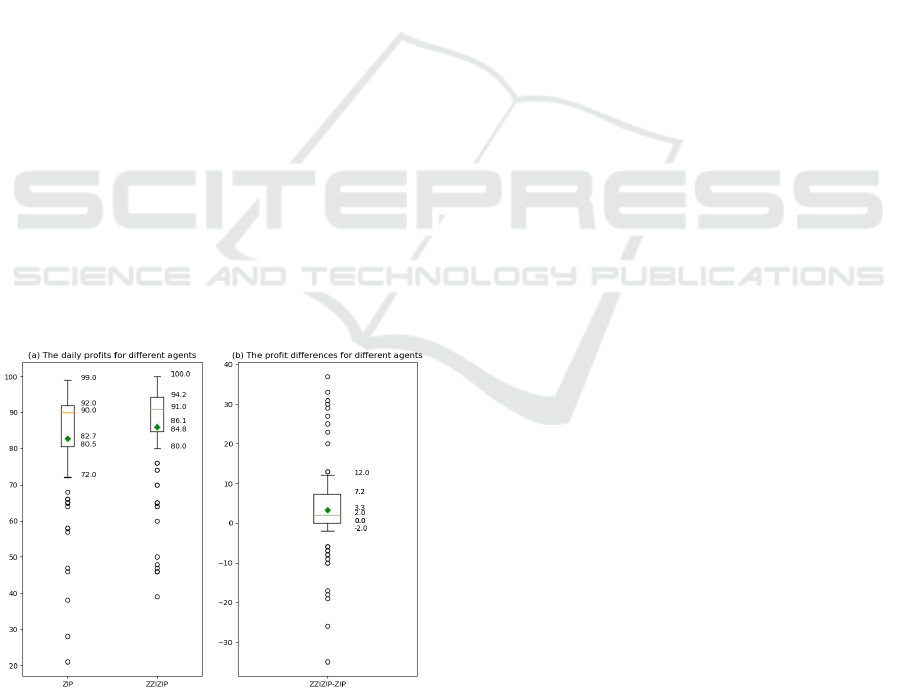

6.3 Comparison of ZZIZIP and ZIP

ZZIZIP is ZIP with the addition of the MLOFI mod-

ule. In the example we present here, sellers will face

an excess imbalance from the demand side. The box

plots in Figure 9 illustrate the results: ZZIZIP has less

variance than ZIP and their median profitability was

slightly higher than that of ZIP; in the second figure,

we can see that although there were some outliers on

both the top and bottom, and the bottom whisker was

located below zero, the whole box was distributed be-

yond zero. Employing the U Test, we got p = 0.002

and can therefore conclude that the profit generated

by ZZIZIP was statistically significantly greater than

ZIP. Despite this, it is worth noting that the average

difference in profitability is less than half of the dif-

ference between AA and IAA, given that other con-

ditions remain unchanged. So, our next question is:

what causes the smaller difference in profits between

ZZIZIP and ZIP?

Figure 9: Performance of ZIP and ZZIZIP when facing

large-sized orders from the bid side.

To answer this, we need to examine how ZIP works.

ZIP uses the Widrow-Hoff Delta rule to update its

next quote-price towards its current target price. The

current target price is based on the last quote price

in the market. Due to this, the last quote price af-

fects the bidding behaviour of ZIP considerably. In

this test, on the ask side, the 10 ZIP sellers were not

impact-sensitive and the 10 ZZIZIP sellers were. But,

although the ZIP traders were not themselves impact-

sensitive, they were affected by the quote prices com-

ing from the ZZIZIP active in the same market, and

so the ZIPs’ quote prices approached the ZZIZIPs’

to some extent. In other words, this adaptive mech-

anisms within the non-impact-sensitive ZIP gave it

a degree of impact-sensitivity, because it was influ-

enced by the activities of the impact-sensitive traders

in the market. In the test, if we treat ZZIZIP and ZIP

as a group, the average profit generated is 84.82 (95%

CI: [82.16, 87.48]). If we replace 10 ZZIZIPs with 10

ZIPs (total 20 ZIP sellers), the average profit of ZIP is

79.21 (95% CI: [77.11, 81.31]). With the presence of

ZZIZIP, all sellers tend to make more profit.

7 DISCUSSION & CONCLUSION

We know of no paper prior to (Church and Cliff,

2019) in which trader-agents are given a sensitivity

to quantity imbalances between the bid and ask sides

of the LOB. Such imbalances are often (but not al-

ways) caused by the arrival of one or more block

orders on one side of the LOB. In this paper we

have provided a constructive critique of Church &

Cliff’s method, pointing out the extreme fragility of

imbalance-sensitivity metrics like theirs that moni-

tor only the top of the LOB. We then explained the

OFI and MLOFI metrics of (Cont et al., 2014) and

(Xu et al., 2019) respectively, and demonstrated how

MLOFI could be integrated within Vytelingum’s AA

trading-agent strategy to give ZZIAA. We demon-

strated that ZZIAA performs extremely well: it per-

forms the same as AA when there is no imbalance,

and significantly outperforms AA in the presence of

major LOB imbalance. We then showed how the

imbalance-sensitivity mechanisms that we developed

for ZZIAA can readily be incorporated into other

trading-agent algorithms such as ZIP (Cliff, 1997)

and SHVR (Cliff, 2018). Results from ZZIZIP and

ZZISHV are similarly very good and further demon-

strate that the mechanisms developed here have given

robust imbalance-sensitivity to a range of trader-agent

strategies. In future work we intend to explore the

addition of MLOFI-based impact-sensitivity to con-

temporary adaptive trader-agents based on deep learn-

ing neural networks (le Calvez and Cliff, 2018; Wray

et al., 2020). Complete details of the work described

here are given in (Zhang, 2020b) and all of our rel-

Market Impact in Trader-agents: Adding Multi-level Order-flow Imbalance-sensitivity to Automated Trading Systems

435

evant source-code for the system described here has

been made freely available as open-source code on

GitHub (Zhang, 2020a), enabling other researchers to

examine, replicate, and extend our work.

REFERENCES

BSE (2012). Bristol Stock Exchange open-source fi-

nancial exchange simulator. GitHub repository:

https://github.com/davecliff/BristolStockExchange.

Cartea, A., Jaimungal, S., and Penalva, J. (2015). Algorith-

mic and High-Frequency Trading. Cambridge Univer-

sity Press.

Church, G. and Cliff, D. (2019). A simulator for studying

automated block trading on a coupled darks/lit finan-

cial exchange with reputation tracking. Proceedings of

the European Modelling and Simulation Symposium.

Cliff, D. (1997). Minimal-intelligence agents for bargain-

ing behaviors in market-based environments. Hewlett-

Packard Labs Technical Report HPL-97-91.

Cliff, D. (2018). An open-source limit-order-book ex-

change for teaching and research. In Proceedings of

the IEEE Symposium Series on Computational Intelli-

gence (SSCI-2018), pages 1853–1860.

Cont, R., Kukanov, A., and Stoikov, S. (2014). The price

impact of order book events. Journal of Financial

Econometrics, 12(1):47–88.

Das, R., Hanson, J., Tesauro, G., and Khephart, J. (2001).

Agent-human interactions in the continuous double

auction. Proceedings IJCAI-2001, pages 1169–1176.

De Luca, M. and Cliff, D. (2011a). Agent-human interac-

tions in the continuous double auction, redux. Pro-

ceedings ICAART-2011.

De Luca, M. and Cliff, D. (2011b). Human-agent auc-

tion interactions: Adaptive-aggressive agents domi-

nate. Proceedings IJCAI-2011.

De Luca, M., Szostek, C., Cartlidge, J., and Cliff, D. (2011).

Studies of interactions between human traders and al-

gorithmic trading systems. Driver Review 13, UK

Government Office for Science, Foresight Project on

the Future of Computer Trading in Financial Markets.

http://bit.ly/RoifIu.

Gjerstad, S. (2003). The impact of pace in double auc-

tion bargaining. Working paper, Department of Eco-

nomics, University of Arizona.

Gjerstad, S. and Dickhaut, J. (1997). Price formation in

continuous double auctions. Games and Economic

Behavior, 22(1):1–29.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero-intelligence traders. Journal of

Political Economy, 101(1):119–137.

le Calvez, A. and Cliff, D. (2018). Deep learning can

replicate adaptive traders in a limit-order-book finan-

cial market. In Proceedings of the IEEE Symposium

Series on Computational Intelligence (SSCI-2018),

pages 1876–1883.

London Stock Exchange Group (2019). Turquoise trading

service. Description Version 3.35.5.

Pentapalli, M. (2008). A comparative study of Roth-Erev

and Modified Roth-Erev reinforcement learning algo-

rithms for uniform-price double auctions. PhD thesis,

Iowa State University.

Petrescu, M. and Wedow, M. (2017). Dark pools in eu-

ropean equity markets: emergence, competition and

implications. ECB Occasional Paper, 193.

Rust, J., Palmer, R., and Miller, J. H. (1992). Behaviour

of trading automata in a computerized double auction

market. In The Double Auction Market: Theories and

Evidence, pages 155–198. Addison Wesley.

Snashall, D. and Cliff, D. (2019). Adaptive-aggressive

traders don’t dominate. In van den Herik, J., Rocha,

A., and Steels, L., editors, Agents and Artificial Intel-

ligence: Selected Papers from ICAART 2019, pages

246–269. Springer.

Tesauro, G. and Bredin, J. L. (2002). Strategic sequential

bidding in auctions using dynamic programming. In

Proc. First Int. Joint Conf. on Autonomous Agents and

Multiagent Systems: part 2, pages 591–598.

Tesauro, G. and Das, R. (2001). High-performance bidding

agents for the continuous double auction. Proc. 3rd

ACM Conference on E-Commerce, pages 206–209.

Vytelingum, K., Cliff, D., and Jennings, N. (2008). Strate-

gic bidding in continuous double auctions. Artificial

Intelligence, 172(14):1700–1729.

Vytelingum, P. (2006). The structure and behaviour of the

Continuous Double Auction. PhD thesis, University

of Southampton.

Wray, A., Meades, M., and Cliff, D. (2020). Automated cre-

ation of a high-performing algorithmic trader via deep

learning on level-2 limit order book data. In Proceed-

ings of the IEEE Symposium Series on Computational

Intelligence (SSCI-2020).

Xu, K., Gould, M., and Howison, S. (2019). Multi-level

order-flow imbalance in a Limit Order Book. SSRN

3479741.

Zhang, Z. (2020a). GitHub repository: https://github.com/

davecliff/BristolStockExchange/tree/master/

ZhenZhang.

Zhang, Z. (2020b). An impact-sensitive adaptive algorithm

for trading on financial exchanges. Master’s thesis,

University of Bristol Dept. of Computer Science.

ICAART 2021 - 13th International Conference on Agents and Artificial Intelligence

436