Trading Agent Competition with Autonomous Economic Agents

David Minarsch

1

, Seyed Ali Hosseini

1

, Marco Favorito

1,2

and Jonathan Ward

1

1

Fetch.ai, U.K.

2

Sapienza University of Rome, Italy

Keywords:

Multi-Agent System, TAC, Trading Agent Competition, Blockchain, Smart Contract.

Abstract:

We provide a case study for the Autonomous Economic Agent (AEA) framework; a toolkit for the develop-

ment and deployment of autonomous agents with a focus on economic activities. The use case is the trading

agent competition (TAC). It is a competition between autonomous agents with customisable strategies and

market parameters. The competition is facilitated by the AEA framework’s native support for decentralised

ledger technologies, i.e. permissionless blockchains and smart contract functionality, for immutable transac-

tion recording and trade settlement. We provide an open-source implementation, study the result of the com-

petitions we ran, and compare it to theoretical results in the economics literature. We conclude by discussing

its real-world applications in crypto-currency, digital assets and token trading.

1 INTRODUCTION

Motivation. Agent frameworks (Kravari and Bassil-

iades, 2015) and multi-agent systems (MAS) have

only found limited real-world applications despite be-

ing developed in the research community (Sonenberg

et al., 2012; Wooldridge, 2009) for multiple decades

(Lesser, 1995). One reason might be the absence of

a native digital financial layer that enables economic

activities.

In general, economic models and activities are an

integral part of MAS (Shoham and Leyton-Brown,

2008). In particular, deployable MAS applica-

tions often incorporate an element of trade between

agents. Examples include those utilising any of the

following notions: incentives (Novikov, 2016), re-

wards/punishments (Hao and Leung, 2016), negotia-

tion (McBurney et al., 2003), and so forth. It is likely

that the realisation of such applications hinges upon

access to a native financial and settlement system de-

signed specifically to address the needs of MAS ap-

plications.

The advent of distributed ledger technology (DLT)

(Maull et al., 2017) makes it possible to finally pro-

vide a native digital financial system that is both de-

centralised and trustless (Chohan, 2019; Klems et al.,

2017), two properties fundamental to MAS itself.

This study, together with its associated implemen-

tation, serves as a practical demonstration of the syn-

ergies between MAS and DLT. It forms an early step

in our efforts to bring multi-agent system applications

to large-scale deployment.

Competition. We introduce a Trading Agent Com-

petition (TAC) as a reusable software package

1

and

use case of the AEA framework (Minarsch et al.,

2020); a framework that enables the development and

deployment of autonomous agents with a focus on

economic activities.

The competition focuses on a scenario that in-

volves one of the most fundamental forms of eco-

nomic interactions; bilateral trades. A society of

agents, each starting with a number of goods, engages

in one-to-one trades using a numeraire money token as

their medium of exchange.

Each agent, in the real world, would represent an

individual or a group of people, tasked with looking

after their interest by maximising their utility. To this

end, the agents must be made aware of their owners’

preferences (von Neumann and Morgenstern, 1944)

and values (Atkinson and Bench-Capon, 2016). In

the competition, this is simulated by explicitly giv-

ing each agent a representation of their owners’ pref-

erences over goods at the beginning of each round.

During the competition, the goal of each agent is to

maximise its owners’ interests by engaging in prof-

itable trades, taking into account their preferences.

1

The TAC framework is accessible here: https://github.

com/fetchai/agents-tac.

574

Minarsch, D., Hosseini, S., Favorito, M. and Ward, J.

Trading Agent Competition with Autonomous Economic Agents.

DOI: 10.5220/0010431805740582

In Proceedings of the 13th International Conference on Agents and Artificial Intelligence (ICAART 2021) - Volume 1, pages 574-582

ISBN: 978-989-758-484-8

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Application. The trading agent competition is facil-

itated by, and serves as a use case of, the AEA frame-

work. As such, it exploits different features of the

framework that correspond to the various facets of

a multi-agent system, such as search and discovery

services, agent communication, and transaction set-

tlement.

The competition itself has applicability in mul-

tiple areas. It can be used as a multi-agent game,

for instance to trade crypto tokens on the Ethereum

blockchain (Wood et al., 2014). It is a general Wal-

rasian market simulation tool which also allows for

studying the effects of different agent strategies on

trading performance (Kendall and Su, 2003). The

authors use it as an end-to-end test environment for

building scalable multi-agent systems.

2 MODEL

2.1 The Economy

The competition encapsulates a Walrasian economy

(Walras, 2014) with indivisible goods.

(Agents). There is a set A of agents par-

titioned into A

baseline

and A

model−based

such that

A = A

baseline

∪ A

model−based

. Note that A

baseline

or

A

model−based

can be empty as long as the minimum

number min agent of agents register for the compe-

tition (see Section 2.3). Section 3 describes the two

types of agents in more detail. There is also a special

agent c, called the controller, which runs the compe-

tition, and due to its special role, is not included in A.

Section 2.4 describes this agent in more detail.

(Goods). There is a tuple of n sets of goods

X =

h

X

1

, . . . , X

n

i

where each i ∈ {1, . . . , n} represents

one type of good (e.g. a fungible token) and each el-

ement of the set X

i

is an instance of that good type

(e.g. equivalent instances of the same fungible to-

ken). In general, we may have |X

i

| 6= |X

j

| for any

two i, j ∈ {1, . . . , n} where i 6= j; that is, the number

of available good instances (their aggregate supply)

could be different for two different goods.

(Money). There is a special type of good, indexed

by 0, the numeraire good or money. It serves as a unit

of account and medium of exchange to agents.

(Endowments). Agents are provided with en-

dowments in goods and money. That is, each agent

a ∈ A has an endowment e

a

=

h

e

a

1

, . . . , e

a

n

i

, a tuple

of length n, where the set e

a

i

⊆ X

i

is the endowment

of agent a in good i. Each agent is given at least

some base

amount > 0 of each good, thus for any

i ∈ {1, . . . , n}, we have base amount ≤ |e

a

i

| ≤ |X

i

|. We

assume that endowments are allocated such that for

each i ∈ {1, . . . , n} we have

S

a∈A

e

a

i

= X

i

; that is, all

endowments for a good sum to the total instances of

that good. Finally, every agent is endowed with the

same e

a

0

= money amount > 0. Goods and money can

only be traded in integer amounts, that is they are non-

divisible.

(Current Holdings). Each agent a’s current good

holdings are denoted by x

a

=

h

x

a

1

, . . . , x

a

n

i

where for

any i ∈ {1, . . . , n}, x

a

i

⊆ X

i

is the set of instances of

good i that agent a currently possesses. Therefore,

|x

a

i

| ∈ {0, . . . , |X

i

|}; note how agents can have no in-

stance of a good i at some point in time but trivially

never a negative amount. That is, there is no bor-

rowing of goods. We further assume that for each

i ∈ {1, . . . , n} we have

S

a∈A

x

a

i

= X

i

; that is, all agents’

current good holdings of a given good sum to the to-

tal instances of that good available. At the beginning

of a round in the competition, before any trades take

place, the good holding of any agent is equivalent to

its endowment. Furthermore, each agent a’s current

money holding is denoted by x

a

0

and it must always

be the case that

∑

a∈A

x

a

0

= |A| × money

amount and

for each agent a, x

a

0

≥ 0, that means there is also no

borrowing of money.

(Preferences). Agents are assigned preferences

for goods and money by the controller agent c.

Specifically, each agent a ∈ A has a preference

relation 4

a

on goods which totally ranks any possible

combination of good bundles. Preferences are

assumed to be transitive, thus for any three arbitrary

goods x, y and z, x 4

a

y and y 4

a

z means x 4

a

z. For

the purpose of this competition, each agent a has a

utility function u

a

which is quasi-linear in goods and

money:

u

a

(x

a

0

, x

a

) = x

a

0

+ g(x

a

) = x

a

0

+

∑

i∈{1,...,n}

s

a

i

× f (|x

a

i

|) (1)

such that s

a

i

> 0 and

f (|x

a

i

|) =

(

ln(|x

a

i

|) if |x

a

i

| > 0

−L otherwise

(2)

Breaking down the utility function in Equation 1, x

a

0

is agent a’s money holding, s

a

i

is the utility parameter

agent a assigns to good i, and f (|x

a

i

|) parameterizes

the number of instances of good i that agent a has.

The logarithmic nature of f (·) implies decreasing re-

turns; i.e. the agent values acquiring each additional

instance of a good less than acquiring the previous in-

stance. L > 0 is a large constant.

An agent a’s utility parameters for goods are rep-

resented by s

a

=

h

s

a

1

, . . . , s

a

n

i

where s

a

i

is the utility pa-

rameter agent a assigns to good i. Equation 3 ensures

the sum of the utility parameters for all goods are the

Trading Agent Competition with Autonomous Economic Agents

575

same for every agent a:

∑

i∈{1,...,n}

s

a

i

= 1 (3)

With the specific design of the utility function in

Equation 1, we are implementing the well stud-

ied Cobb-Douglas function (Brown, 2017) for g(x

a

)

which has the gross-substitutes property. This prop-

erty means that an increase in the price of one good

causes agents to demand more of the other goods.

The framework can be extended to utilise other

utility representation, the only requirement imposed

is that the utility representation provides a complete

ranking of all goods.

In the context of the competition, the utility func-

tion serves as the metric which the agents have to

maximise. The agent which best achieves this goal

becomes the winner of the competition.

(Trade Cost). We introduce a trade cost k to ex-

plicitly model transaction costs that would incur as a

result of settling trades, with special focus on DLT-

based financial systems. The trade cost has the side

benefit of limiting against some forms of denial-of-

service (DOS) attacks, provided the attacker cares

about winning the competition. Each transaction in-

curs the same cost k.

2.2 Relation to Economic Theory

Under certain assumptions, e.g. if transaction costs

are zero and goods are divisible, the gross-substitutes

property ensures that the game has a unique equilib-

rium.

2

Note however, that since we introduce a trade

cost and goods are indivisible, our game may have

many equilibria.

Furthermore, in the interest of tractability and to

guarantee an equilibrium, the gross-substitute prop-

erty limits preferences in that goods cannot be com-

plements.

Our simulation framework can benefit economic

analysis. It allows studying the properties of a

Walrasian economy populated by agents with non-

standard preferences. And, it enables the analysis of

interactions of heterogeneous trading strategies and

preferences in the same environment.

2.3 Trading Game Phases

The trading game has the following three phases:

Pre-trading: in which agents register with the con-

troller agent. Only if a min agent number of agents

register, then the competition moves to the next phase.

2

This competitive equilibrium is achieved via a so called

Walrasian auctioneer (Walras, 2014).

Trading: consists of k game instances g

1

, . . . , g

k

where at each game instance g

i

:

• The controller sends every participant a new draw

of endowments and preferences.

• Agents trade with each other.

• After some set time period or a sustained period

of no trades, whichever occurs first, the game in-

stance finishes and the controller constructs the

league table for this game instance.

Post-trading: the controller reports the final

league table as the weighted average of all game in-

stance league tables.

2.4 Controller Agent

A distributed ledger technology (DLT) (Maull et al.,

2017) is a secure and decentralised system for stor-

ing information and executing smart contract (Clack

et al., 2016) functionality.

In principle, a DLT provides all the functionalities

to facilitate the running and management of the TAC.

In particular, it allows goods and money to be repre-

sented as fungible (or non-fungible) tokens and stores

the transaction history of participants in a TAC.

As a first step towards a fully DLT-based TAC, we

decided to emulate its functionalities in the TAC via a

special controller agent c. This agent takes on the dual

responsibilities of transaction settlement and compe-

tition management, effectively making it the only en-

tity that holds the global state of the competition.

The controller agent’s responsibilities are detailed

below:

• At the beginning of each game instance, the con-

troller generates and assigns the endowments in

good e

a

and money e

a

0

, and the preferences s

a

of every participating agent a, ensuring they are

somewhat orthogonal.

• During each round, the controller registers and

settles transactions, ensuring the satisfaction of

the feasibility constraints listed in current hold-

ings in Section 2.1. This means that the controller

essentially keeps track of the good and money

holdings of every participating agent during the

competition.

• For every transaction submitted to the controller,

it ensures the transaction is cryptographically

signed by all parties involved. Transactions with

invalid signatures are rejected and deemed invalid.

• At the end of the competition, the controller con-

structs a league table containing the final scores

and ranking of all participating agents.

SDMIS 2021 - Special Session on Super Distributed and Multi-agent Intelligent Systems

576

2.5 Trustless Exchange

The trading environment in this competition is de-

signed to minimise the trust that agents need to place

in each other.

Specifically, the controller agent ensures that ev-

ery transaction sent to it is signed by all parties in-

volved in the transaction. Because the controller is

the only entity with the competition’s global state,

this makes it impossible for agents to submit invalid

transactions according to current holdings, e.g. fake

authenticity or attempt double-spending.

In the current implementation, agents have to rely

on the controller as a trusted third party. There is how-

ever another version where this responsibility of the

controller is pushed to a smart contract on a permis-

sionless DLT system.

3

2.6 Network Environment

The competition is held over a network. The environ-

ment consists of a so-called Open Economic Frame-

work (OEF) node, a controller agent, and a set of par-

ticipating agents. One functionality of the OEF node

is message relaying. This means that through appro-

priate APIs, agents send and receive messages to each

other, and the OEF handles the low level delivery of

the messages over the underlying network. Another

functionality of the OEF node is service registration

and search. Agents can register services (e.g. descrip-

tions of goods to sell/buy in terms of data models) and

search for registered services.

3 AGENTS

There are two types of agents in this competition:

baseline and model-based. In this section, we will

first describe what is common across these two agent

types. We then briefly present the negotiation system

the agents use in the competition in Section 3.1. We

then devote specific sections 3.2 and 3.3 to each agent

type, describing their differences in architecture and

strategy.

Regardless of their type, agents in the competition

focus on discovering how they can arrive at an opti-

mal bundle - as defined by their preferences - through

successive trades. Emphasis for agents is placed on

a) finding the right agents to trade with, and b) doing

the right trade with them. This might involve identi-

fying other agents’ needs to arrive at the optimal trad-

ing sequence. However, a dummy agent which simply

3

A reference to a preliminary newer version is available

on our TAC repository linked to above.

selects random bargaining partners and trades if it is

beneficial to it, without any longer term plan is still

able to improve its score in the competition.

The agents are designed to exhibit goal-oriented

behaviour while having the capability to react to

changes in the environment (Wooldridge, 2009;

Padgham and Winikoff, 2004). From a technical per-

spective, the agents have a so called main loop and an

event loop. The former controls the agent’s proactive

behaviour, where at each ‘tick’ of the loop, the agent

moves towards achieving its goal. The event loop on

the other hand is responsible for processing incom-

ing events. Events in the competition are represented

as messages, much like typical multi-agent systems,

which are placed in a queue by the event loop for pro-

cessing in the main loop.

More specifically, the main loop ticks e.g. every

10

th

of a second, and each time through the loop it:

1. Processes any incoming messages,

2. Updates the agent’s internal state,

3. Allows the agent to make decisions and act,

4. Waits until it is time to ‘tick’ again.

The key is ensuring that any message handling and

internal state update happens fast enough to always

(or mostly) avoid going over the allowed tick dura-

tion. The benefit of this architecture is that the whole

process is kept single threaded and the code straight-

forward to read. If there is a need for some heavy

processing, then one of the following is done:

• Splitting the task up into chunks and processing

them over several ticks (storing any intermediate

internal state).

• Concurrently executing the task in a single thread

(e.g. using co-routines in Python).

• Splitting the process across different threads, hav-

ing the main thread wait for all threads to finish

with their jobs.

3.1 Negotiation

The negotiation protocol agents use in the competi-

tion is inspired by the FIPA ACL (Committee, 2001).

This means, there is a multi-step dialogue during

which agents send messages of the form P(c

1

, . . . , c

n

)

where P, called a performative, conveys the type

of the message and c

1

, . . . , c

n

are the contents (e.g.

Request(resource), Propose(offer, price)). Table 1

lists the allowed messages and for each message spec-

ifies its valid replies.

An agent A initiates a negotiation by sending a

CFP (call-for-proposal) to their counter-party B. If

B processes a CFP, it replies with either a Propose or

Trading Agent Competition with Autonomous Economic Agents

577

Table 1: Negotiation messages.

Message Contents Replies

cfp(q) q : query propose(o, p)

decline()

propose(o, p) o : offer propose(o

0

, p

0

)

p : price accept()

accept() match−accept()

decline()

match-accept()

a Decline. Decline sent at any point in the negotiation

by anyone terminates the negotiation.

A Propose contains a list of offers, which partially

or totally match the query delivered in the CFP. Once

agent A receives the offers, it will either Accept or

Decline. Upon acceptance, A will send a message to

the controller agent c, confirming its transaction with

B. The negotiation is successfully completed if B as

the counter-party follows suit with a matching Accept

and another transaction submission to the controller.

However, B might also Decline at this stage, which

would be the case if its trading position has changed

between when it made the proposal and when it re-

ceives A’s Accept.

The second Accept is referred to as a Match-

Accept. Without it, B would have to send the transac-

tion to the controller after sending its proposal, which

is very limiting. This is because at this point there is a

high probability that the negotiation breaks down, be-

cause other simultaneous trades/negotiations impact-

ing this one might be more beneficial. The reason for

this is that any transaction submitted to the controller

must be considered in the forward looking state of the

agent, i.e. the state the agent finds itself in once all the

trades it committed to have been settled by the con-

troller agent c.

4

3.2 Baseline Agents

Baseline agents are the more basic agents of the two

types participating in a competition.

Recall each agent a has a utility function

u

a

(x

a

, x

a

0

), which given a good holding x

a

and money

holding x

a

0

, gives a number representing “how good

agent a’s current situation is”. The utility number

is used by the agent to compare different states and

4

Depending on their design, DLT systems provide dif-

ferent degrees of transaction finality. A transaction which is

included in the chain and therefore confirmed and executed

might still be reversed until it reaches finality (Rauchs et al.,

2018). Therefore, depending on the underlying DLT system

the forward looking state will have to be defined differently.

helps in decision making. For instance, when decid-

ing how much better off the agent would be if it ac-

quired another copy of a good i. This is equivalent

to comparing the utility values u

a

of the two hold-

ings

h

x

a

1

, . . . , x

a

i

, . . . , x

a

n

i

and

h

x

a

1

, . . . , ˜x

a

i

, . . . , x

a

n

i

where

| ˜x

a

i

| = |x

a

i

| + 1.

In general, an agent a compares two states with

good and money holdings of respectively x

a

, x

a

0

and

˜

x

a

, ˜x

0

a

, by calculating the marginal utility u

a

(

˜

x

a

, ˜x

a

0

)

- u

a

(x

a

, x

a

0

) = g(

˜

x

a

) − g(x

a

) + ˜x

0

a

− x

a

0

. This is the

quantity by which the agent assesses whether an ex-

change resulting in its good and money holdings to

change from x

a

to

˜

x

a

, respectively x

a

0

to ˜x

a

0

, pays off.

In particular, for the exchange to pay off, the change

in the marginal utility has to be positive.

A baseline agent without a world model a ∈

A

baseline

will trade as follows. For each good i in

its current holding

h

x

a

1

, . . . , x

a

n

i

, the agent simultane-

ously offers to buy an instance, and sell an instance

if it has at least two. The price p the agent is will-

ing to sell the instance for is equal or more than the

agent’s marginal utility for i in the goods component

only, i.e. p ≥ g(x

a

) − g(

˜

x

a

), where

˜

x

a

is the current

good holding x

a

minus the instance to be sold. On

the other hand, the price p

0

the agent is willing to pay

to acquire an instance is equal or less than the agent’s

marginal utility for i in the goods component only, i.e.

p ≤ g(

˜

x

a

) − g(x

a

), where

˜

x

a

is the current good hold-

ing x

a

plus the instance of the good to be bought.

With the above trading strategy, the agent will

never make any profit in negotiations where it pro-

poses a price. It can only make a profit in negotiations

where it receives a proposal.

3.3 Model-based Agents

A model-based agent uses information it gains from

acceptances and declines of its proposals to create a

price model for each good. It then uses the price

model to offer the price it assumes has the highest

likelihood to becoming a successful trade.

The algorithm that a model-based agent uses is

presented is pseudo-code in Algorithm 1. It resem-

bles a multi-armed bandit type model. The agents

starts with a beta distribution with parameters α = 1.0

and β = 1.0 (i.e. a uniform distribution), one for

each price bin with resolution 0.2 (see INIT). Dur-

ing the competition, each time an agent gets a success

or failure (Accept/Decline respectively) for a specific

price bin and good, it updates the distributions (see

UPDATE). The prices can then be sampled from the

model by checking for the distribution with the high-

est success probability. The choice must be taken

according to the agent’s role in the negotiation (i.e.

SDMIS 2021 - Special Session on Super Distributed and Multi-agent Intelligent Systems

578

Algorithm 1: Multi-Armed bandit model of price.

Input: goods 1, . . . , n

1: function INIT(a)

2: GoodPriceModels ← []

3: for i ∈ {1, . . . , n} do

4: GoodPriceModels[i] ← []

5: for price ∈ {0.0, 0.2, . . . , 20.0} do

6: GoodPriceModels[i].append(B(1.0, 1.0))

7: end for

8: end for

9: end function

10:

11: function UPDATE(i, price, outcome)

12: modelToUpdate ←

GoodPriceModels[i][price]

13: if outcome then

14: modelToUpdate.α += 1

15: modelToUpdate.β -= 1

16: else

17: modelToUpdate.α -= 1

18: modelToUpdate.β += 1

19: end if

20: end function

buyer/seller) and the last proposed price.

4 SIMULATION RESULTS

We have held an in-person version of the competition

using the provided framework as well as running the

competition in the form of a simulation, on which we

report the results in this section. The simulation runs

contained 10 agents, with half of the agents baseline,

and the other half model-based. We ran the simulation

103 times, each time with a different seed and other-

wise identical configuration. For the details on the

configurations chosen please consult the repository.

We first analyse the scores. The null hypothesis

we test for is that model-based agents have a weakly

smaller mean score than baseline agents. The alter-

nate hypothesis is that the model-based agents have a

strictly larger mean score than the baseline agents. A

one-sided t-test allows us to reject the null hypothesis

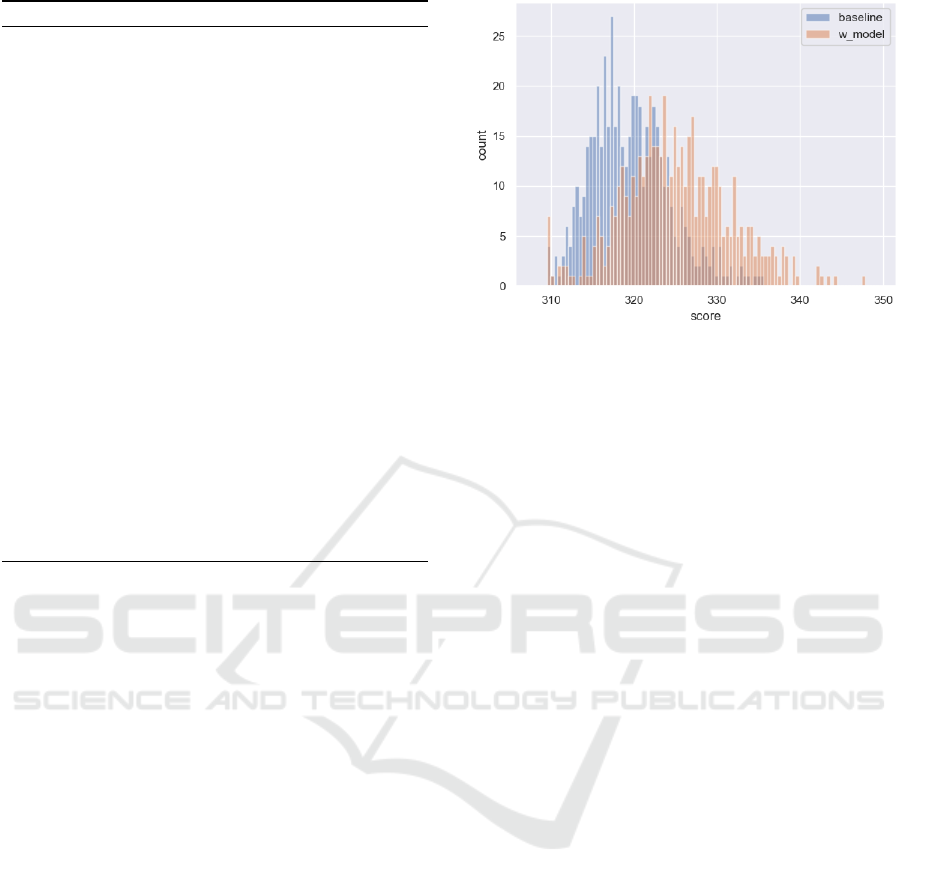

at a significance level α = 0.0001. Figure 1 shows the

distribution of scores for the two groups of agents.

It illustrates that model-based agents have a statisti-

cally significantly higher score than baseline agents.

The mean score of the model-based agents is 325.07

whilst the baseline agents achieve a mean score of

319.53.

We next look at the number of trades completed

Figure 1: Histogram of scores (in bins) achieved.

by the two groups of agents on average. The null hy-

pothesis we test for is that model-based agents have

a weakly larger average number of transactions than

the baseline agents. The alternate hypothesis is that

the model-based agents have a strictly smaller aver-

age number of transactions than the baseline agents.

We test the hypothesis for the number of transactions

from both the seller and the buyer perspective and the

number of transactions from the buyer perspective.

A one-sided t-test allows us to reject the null hy-

pothesis at a significance level α = 0.0001 in the case

of both the buyer and seller perspective. The mean

number of seller transactions of the baseline agents

is 10.72 whilst model-based agents transact on aver-

age 7.00 times as sellers. The mean number of buyer

transactions of the baseline agents is 10.80 whilst

model-based agents transact on average 6.93 times as

buyers.

Figure 2 visualises the distribution of number of

transactions. The graphs show that the baseline agents

transact significantly more (both statistically and eco-

nomically) than the model-based agents.

Lastly, we look at the prices charged by the two

groups of agents. The null hypothesis we test for is

that model-based agents have a weakly smaller mean

price than baseline agents. The alternate hypothesis

is that the model-based agents have a strictly larger

mean price than the baseline agents.

A one-sided t-test allows us to reject the null hy-

pothesis at a significance level α = 0.0001. The mean

price charged by the baseline agents is 3.02 whilst

model-based agents charge on average 3.18. Fig-

ure 3 shows the distribution of prices charged by the

two groups of agents. It illustrates that on average,

model-based agents charge higher prices than base-

line agents.

The simulation suggests a number of interesting

findings. Firstly, baseline agents trade much more

Trading Agent Competition with Autonomous Economic Agents

579

than their model-based counter-parts. They do so

at lower prices than model-based agents on aver-

age. This leads to outcomes where model-based

agents have a higher score on average than baseline

agents. Since both types of agents operate at the same

frequency, these findings suggest that model-based

agents make offers which do get rejected more often.

However, when they do get accepted they lead to a

relatively larger gain for them.

5 DISCUSSION

The competition setup mirrors a Walrasian Exchange

Economy, the workhorse model in economics for rep-

resenting a market, which demonstrates the concept

of allocative/Pareto efficiency well, i.e. allocating re-

sources to those who will make best use of them

(Mas-Colell et al., 1995).

Since agents negotiate one-on-one, they should

not be able to achieve the efficiency of the Walrasian

Exchange Economy. In particular, it has been shown

that in theory, an auction is more efficient than nego-

tiation under most circumstances (Bulow and Klem-

perer, 1996). However, this does not mean that in-

dividual agents won’t be able to outperform through

negotiations relative to an auction-based market out-

come. Specifically, due to the private information on

preferences and good holdings, there is vast scope

for some agents to perform better than others not by

chance alone.

The reason for the above is that, from a game-

theoretic perspective, the competition is not a zero-

sum game. That is to say, an increase in one partic-

ipant’s score is not necessarily - and in general un-

likely - at the cost of another. As a consequence, op-

position to proposals and potential trade is weak in

this setup since trades can be beneficial to all parties

involved.

In this competition, agents’ preferences and en-

dowments are provided exogenously by the controller

agent. Of course in a real-world use-case, the prefer-

ences and endowments would arise naturally. How-

ever, for the competition it is necessary to explicitly

impose these on the agents to guarantee an interesting

and fair setup.

Moreover, although the competition is designed

so that agents would treat goods independently, for

a hyper-rational agent, price changes in one good

should lead to changes in demand for the other goods

due to the gross-substitutes property embedded in the

utility function of the agents. Hence, the aggregate

supply in one good can affect the demand in another.

Figure 2: Histogram of buyer (top) and seller (bottom)

transactions.

Figure 3: Histogram of prices (in bins) charged.

5.1 Real World Applications

Beyond the competition aspect, this setup has other

applications. The first being a research tool for un-

derstanding markets and trading strategies. Thanks

to the modularity of the AEA framework, the com-

petition package, and the architecture of agents, it is

SDMIS 2021 - Special Session on Super Distributed and Multi-agent Intelligent Systems

580

easy to change the competition’s configuration and

variables, describe other types of markets, and apply

custom rules. Similarly, it is straightforward to write

agents which follow trading strategies other than the

two described in Sections 3.2 and 3.3.

An extension of the above is studying the ef-

fectiveness of implementing reinforcement learning-

based trading strategies on agents’ trading perfor-

mances. The AEA framework’s built-in support for

ML approaches to agent design facilitates this work.

Another use case is a trading platform for crypto-

currencies, tokens, and digital assets in general (Ku-

mar et al., 2020; Radomski et al., 2018). The setup of

this application is fairly close to the competition’s ex-

isting setup because a) users would have well defined

preferences over these assets, and b) computational

representation of their preferences could be provided.

Due to the above, we expect that this application is

straightforward to get at with minimal alterations to

the code base.

6 FUTURE WORK

There are many ways the trading environment could

be made richer, and the domain more complex. A nat-

ural extension is to introduce a market through a cen-

tralised auction process that is operated in a decen-

tralised way by a smart contract. Theoretically, this

should cause the agent-to-agent negotiation to unravel

(Neeman and Vulkan, 2002). However, it would be

interesting to observe what happens in a multi-agent

world where agents are unlikely (programmed to be)

hyper-rational.

Below we list a number of features which can en-

rich the competition:

• Richer Strategies: agents to be required to

deploy strategies based on a variety of tech-

niques (e.g. reinforcement learning (RL), evolu-

tionary/genetic algorithms, logic-based).

• Multiplicity of Issues: so several agent skills are

needed and no single type of agent strategy is su-

perior in all markets.

• Latencies: in real-world blockchain scenarios,

the settlement of trades is not instantaneous and

would need to be accounted for in the agent and

smart contract design. The current implementa-

tion of the forward looking state in the agent can

be improved upon accordingly.

• Temporal Preferences: agents can have different

degrees of urgency for reaching the final state and

different transaction costs. These two factors are

relevant for applications in the real world and so it

would be useful to parameterise them in the com-

petition for further explorations.

ACKNOWLEDGEMENTS

We thank our employer Fetch.ai for supporting this

research and the release of the open-source imple-

mentation.

REFERENCES

Atkinson, K. and Bench-Capon, T. (2016). States, goals

and values: Revisiting practical reasoning. Argument

& Computation, 7(2 - 3):135 – 154.

Brown, M. (2017). The New Palgrave Dictionary of Eco-

nomics. Palgrave Macmillan UK.

Bulow, J. and Klemperer, P. (1996). Auctions versus nego-

tiations. The American Economic Review, 86(1):180–

194.

Chohan, U. W. (2019). Are Cryptocurrencies Truly Trust-

less?, pages 77–89. Springer International Publishing,

Cham.

Clack, C., Bakshi, V., and Braine, L. (2016). Smart contract

templates: foundations, design landscape and research

directions. arxiv:1608.00771. 2016.

Committee, I. F. S. (2001). Communicative act library spec-

ification. Technical report, Foundation for Intelligent

Physical Agents.

Hao, J. and Leung, H.-f. (2016). Interactions in Multiagent

Systems: Fairness, Social Optimality and Individual

Rationality. Springer Publishing Company, Incorpo-

rated, 1st edition.

Kendall, G. and Su, Y. (2003). The co-evolution of trading

strategies in a multi-agent based simulated stock mar-

ket through the integration of individual learning and

social learning. Proceedings of IEEE, pages 2298–

2305.

Klems, M., Eberhardt, J., Tai, S., H

¨

artlein, S., Buchholz,

S., and Tidjani, A. (2017). Trustless intermediation in

blockchain-based decentralized service marketplaces.

In Maximilien, M., Vallecillo, A., Wang, J., and Oriol,

M., editors, Service-Oriented Computing, pages 731–

739, Cham. Springer International Publishing.

Kravari, K. and Bassiliades, N. (2015). A survey of agent

platforms. Journal of Artificial Societies and Social

Simulation, 18.

Kumar, M., Nikhil, N., and Singh, R. (2020). Decentralis-

ing finance using decentralised blockchain oracles. In

2020 International Conference for Emerging Technol-

ogy (INCET), pages 1–4.

Lesser, V., editor (1995). First international Conference on

Multiagent Systems. The AAAI Press.

Mas-Colell, A., Whinston, M. D., and Green, J. R. (1995).

Microeconomic theory, volume 1. Oxford University

Press New York.

Trading Agent Competition with Autonomous Economic Agents

581

Maull, R., Godsiff, P., Mulligan, C., Brown, A., and Kewell,

B. (2017). Distributed ledger technology: Applica-

tions and implications. Strategic Change, 26(5):481–

489.

McBurney, P., Van Eijk, R. M., Parsons, S., and Amgoud,

L. (2003). A dialogue game protocol for agent pur-

chase negotiations. Autonomous Agents and Multi-

Agent Systems, 7(3):235–273.

Minarsch, D., Hosseini, S. A., Favorito, M., and Ward,

J. (2020). Autonomous economic agents as a sec-

ond layer technology for blockchains: Framework

introduction and use-case demonstration. In 2020

Crypto Valley Conference on Blockchain Technology

(CVCBT), pages 27–35.

Neeman, Z. and Vulkan, N. (2002). Markets versus negotia-

tions: the predominance of centralized markets. Tech-

nical report, mimeo.

Novikov, D. (2016). Incentive Mechanisms for Multi-

agent Organizational Systems, volume 98, pages 35–

57. Springer.

Padgham, L. and Winikoff, M. (2004). Developing Intelli-

gent Agent Systems: A Practical Guide. John Wiley

& Sons.

Radomski, W., Cooke, A., Castonguay, P., Therien, J., Bi-

net, E., and Sandford, R. (2018). Eip 1155: Erc-1155

multi token standard. Standard, Ethereum.

Rauchs, M., Glidden, A., Gordon, B., Pieters, G., Reca-

natini, M., Rostand, F., Vagneur, K., and Zhang, B.

(2018). Distributed ledger technology systems a con-

ceptual framework. Technical report, Cambridge Cen-

tre for Alternative Finance.

Shoham, Y. and Leyton-Brown, K. (2008). Multiagent

Systems: Algorithmic, Game-Theoretic, and Logical

Foundations. Cambridge University Press.

Sonenberg, L., Stone, P., Turner, K., and Yolum, P. (2012).

Introduction to the special issue ten years of au-

tonomous agents and multiagent systems. Ai Maga-

zine, 33:11–13.

von Neumann, J. and Morgenstern, O. (1944). Theory of

Games and Economic Behavior. Princeton Classic

Editions. Princeton University Press.

Walras, L. (2014). Principles of economics: unabridged

eighth edition. Cambridge University Press.

Wood, G. et al. (2014). Ethereum: A secure decentralised

generalised transaction ledger. Ethereum project yel-

low paper, 151(2014):1–32.

Wooldridge, M. (2009). An Introduction to MultiAgent Sys-

tems. Wiley, 2 edition.

SDMIS 2021 - Special Session on Super Distributed and Multi-agent Intelligent Systems

582