Does the Board of Commissioners Affect Tax Avoidance? Evidence

from Banking Industry in Indonesia

Supriyati

1

and Indah Hapsari

2

1

Department of Accounting, STIE Perbanas Surabaya, College of Economics and Business, Wonorejo Rungkut, Surabaya,

Indonesia

2

Department of Accounting, STIE Perbanas Surabaya, College of Economics and Business, Surabaya, Indonesia

Keywords: Independent Commissioner, Gender, Tenure, Political Connection, Tax Avoidance.

Abstract: Tax avoidance is one of the company's taxation strategies to reduce a company's tax burden. In order to realize

tax avoidance efforts without incurring tax risks and sanctions, the role of the board of commissioners is

important in tax avoidance efforts. The board of commissioners have to ensure the business strategy,

management, potential risk in every decision made and ensure that the company's activities comply with

applicable legal regulations. The board of commissioners is expected to be able to supervise and control tax

policy. The board of commissioners must be able to carry out its supervisory function appropriately,

independently and transparently in order to optimize financial performance and company sustainability.

Research conducted on 156 samples of banking company data in Indonesia for the 2015-2019 period using

regression testing has proven that only the variable number of independent commissioners has a significant

effect on tax avoidance efforts. As for the variable of gender, tenure and political connections of the board of

commissioners have no significant effect on tax avoidance efforts. The number of independent commissioners

is the main factor affecting tax avoidance efforts. This is in line with the regulations of the Financial Services

Authority and the Limited Liability Company Law.

1 INTRODUCTION

Tax is a taxpayer contribution to the State which is

compelling and all tax revenues are used to finance

government activities. In Indonesia, taxes are the

largest source of state revenue compared to other

sources of revenue. On the other hand, the taxpayers

view regarding tax revenue and tax compliance is

different. The reluctance of taxpayers to fulfill their

tax obligations still occurs because taxes are seen as

a component of expenses, a deduction of their assets,

a reduction in corporate profits, and a reduction in

return for company shareholders. The problem of tax

compliance is still a major problem in Indonesia that

affects government revenue from taxation.

For taxpayers, tax is an element of burden that has

an impact on the achievement of company profits and

assets so that taxpayers try to lower the tax paid. Tax

avoidance is a practice that many companies do

because this effort is legal and can reduce corporate

tax payments (Hanlon & Heitzman, 2010; Taylor &

Richardson, 2012; Coulmont et al., 2018). Tax

avoidance efforts are part of corporate governance

(Jamei, 2017; Supriyati et al., 2019) and the

company's overall tax strategy (Higgins et al., 2012;

Hudiwinarsih, 2018) and part of the tax planning step

by exploiting tax policy loopholes (Chan et al., 2013;

Armstrong et al., 2015; Supriyati et al., 2019). Based

on a survey report made jointly by Ernesto Crivelly,

an investigator from the IMF in 2016, using the

database of the International Center for Policy and

Research (ICTD) and the International Center for

Taxation and Development, data on corporate tax

avoidance emerged from 3000 countries. Indonesia is

ranked as the 11th largest with the value of taxes paid

to the Directorate General of Taxes (DGT) estimated

at US $ 6.48 billion (https://www.tribunnews.com

dated 20 November 2017).

Law Number 40 of 2007 concerning Limited

Liability Companies Article 1 states that the

company's organs are the General Meeting of

Shareholders, the Board of Directors and the Board of

Commissioners. Thus, the Financial Services

Authority (OJK) Regulation Number 55 / POJK.03 /

2016 concerning The Implementation of Governance

for Commercial Banks, article 1 paragraph 1-4,

Supriyati, . and Hapsari, I.

Does the Board of Commissioners Affect Tax Avoidance? Evidence from Banking Industry in Indonesia.

DOI: 10.5220/0010469101030110

In Proceedings of the 3rd International Conference on Finance, Economics, Management and IT Business (FEMIB 2021), pages 103-110

ISBN: 978-989-758-507-4

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

103

explains the importance of the role of directors and

boards of commissioners in banks. The board of

commissioners is in charge of general and / or special

supervision according to the articles of association

and provides advice to the board of directors. The

board of commissioners play a role in implementing

the company's strategy including strategies in the

field of taxation and tax avoidance efforts.

Agency theory (Jensen &Meckling, 1976) stated

that a conflict that occurs between the principal and

the agent, one of which is the existence of moral

hazard and the agent's opportunistic behavior thus a

supervisory function for the agent is needed. The

board of commissioners has a very important role in

the supervisory function of company operations and

management behavior. The board of commissioners,

which is dominated by outsiders, has a stronger role

because they are more independent in overseeing

management behavior (Aliani, 2014; Chyz &

Gaertner, 2018; Jihene & Moez, 2019). The board of

commissioners is expected to be able to supervise and

control tax policy as part of the company's strategy so

that the company is able to meet stakeholder

expectations and avoid tax sanctions. Independent

commissioners have an effect on tax avoidance (Uun,

2016; Doho & Santoso, 2020). However, it is

different from research carried out by Prasetyo &

Pramuka (2018), Kartana & Wulandari (2018),

Novita et al, (2020) which states that independent

commissioners have no significant effect on tax

avoidance.

This study focuses more on the characteristics of

the board of commissioners. In addition to general

provisions regarding the number of independent

commissioners, it is also linked to gender, tenure and

political connections to the board of commissioners.

Executive board gender influences tax planning

(Richardson, 2011; Aliani, 2014; Khlif & Achek,

2017; Ambarsari et al. (2020) because gender is

required in conservative reporting. Long tenure

affects experience in decision making, influences

corporate risk taking (Chan et al., 2013), as well as on

tax planning (Goldman et al., 2017; Duan et al.,

2018). The replacement of company commissioners

reduces tax avoidance because the company will

receive wider public attention. Companies that have

political connections will get government protection,

easy access to capital loans, low risk of tax audits,

thus making companies more aggressive in carrying

out tax planning which results in financial

transparency (Faccio, 2006; Butje & Tjondro, 2014;

Duan et al., 2018).

The problem of taxpayer compliance and tax

avoidance is still an important topic in the field of

taxation, as well as the results of previous research

which have not shown consistency in the results of

their research, which make a reference for conducting

this research again. This study aims to see the effect

of the characteristics of the board of commissioners

in the banking industry on tax avoidance efforts.

2 LITERATUR REVIEW AND

HYPOTHESIS

DEVELOPMENTS

2.1 Agency Theory

Agency theory describes a relationship between the

agent as business management and the principal as a

shareholder. The principal has the right to grant

authority to the agent to carry out all activities on

behalf of the principal in his capacity as decision

making. Jensen &Meckling (1976) in agency theory,

the contract between agent and principal occurs in the

company's operations. The agent as the party in

charge of managing the company has more

information about the company's capacity, work

environment and the company as a whole. On the

other hand, principals do not have sufficient

information about agent performance. The difference

in the information held can cause harm to one of the

parties who has less information.

The self-assessment system currently in effect in

Indonesia provides an opportunity for agents to

calculate taxable income as low as possible, so that

the tax burden borne by the company decreases. The

existence of asymmetric information carried out by

the agent to the principal causes the agent to be able

to do tax planning so that the agent gets its own

benefits that cannot be obtained from cooperation

with the principal. Tax planning as part of the

company's strategy must be directed not only to

benefit the agent, but must be able to protect the

interests of other stakeholders such as creditors,

shareholders, and the government. The role of the

board of commissioners is important in overseeing

the actions of directors in respective companies,

especially in the field of taxation.

2.2 Tax Avoidance

Tax avoidance is the process of controlling actions in

order to avoid unwanted tax consequences. Tax

avoidance is a transaction scheme shown by

minimizing the tax burden by taking advantage of

loopholes in state taxation regulations (Hanlon &

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

104

Heitzman, 2010; Richardson & Lanis, 2007; Taylor

& Richardson, 2012). Tax avoidance is an effort

made by taxpayers whether it is successful or not to

reduce or write off the tax debt based on applicable

taxation provisions. Tax avoidance does not violate

tax laws because the taxpayers' efforts to reduce,

avoid, drink or alleviate the tax burden are made

possible by the Taxation Law.

Tax avoidance has become an integral part of a

company’s strategies (Supriyati et al., 2019). The role

of the company is realized in an effort to avoid tax in

the form of effective tax rate (ETR) which is a

comparison of corporate tax expense with net income

before tax (Hanlon & Heitzman, 2010). The smaller

the ETR percentage, the lower the company's tax

burden. This shows an indication of the company's

efforts to reduce the company's tax burden in legal

ways.

2.3 Hypothesis Developments

2.3.1 Independent Commissioner and Tax

Avoidance Efforts

An independent commissioner is a member of the

board of commissioners who is independent and has

no relationship with other commissioners, directors,

shareholders, or company management who have the

task of supervising and directing the performance of

company management. Based on OJK Regulation

No. 33 / POJK.04 / 2014 Chapter III Article 20

paragraph 3 Concerning the Board of Commissioners

states that the presence of independent

commissioners in a company is at least thirty percent

of the total board of commissioners of the company.

This independent commissioner is in charge of

overseeing the performance of the company's

management in carrying out business activities and

directing business activities to be carried out properly

and in accordance with applicable regulations. The

presence of an independent board of commissioners

in a company is very important because it can reduce

or minimize conflicts that occur between one party

and another. Independent commissioners may not

have a business relationship or special relationship

with other directors, shareholders and the board of

commissioners because this can affect their ability to

be neutral or impartial to anyone thus the goals of the

company can be achieved. The company's board of

commissioners, which is dominated by outsiders, has

a much stronger role because they are more

independent in monitoring the achievement of

company performance and management behavior.

(Uun, 2016; Sofiati & Zulaikha, 2018; Butje &

Tjondro, 2014). The greater the number of

independent commissioners, the greater their role in

tax planning supervision so that tax avoidance efforts

can avoid tax sanctions and be able to optimize the

company's financial performance.

H1: The number of independent commissioners has a

significant effect on tax avoidance efforts.

2.3.2 Gender and Tax Avoidance Efforts

Gender is categorized as male and female. In terms of

leadership, the difference between the two is

communal and agentic. Communal defined is

included as a person who is full of affection, helpful,

friendly, kind, sympathetic, interpersonal sensitive,

gentle, and soft-spoken. Meanwhile, men are

associated with very aggressive, ambitious,

dominant, confident, strong, and independent and

individualistic characters. The differences in the

nature of men and women have an impact on their

behavior. One of them is risk behavior. Men and

women have different risk preferences (Ho et al,

2015; Khlif & Achek, 2017; Farag & Mallin, 2018).

The impact of gender in accounting conservatism

and earnings management is based on the fact that

female gender is more risk averse than male. Women

have more ethical behavior than men in choosing

accounting policies (Francis et al., 2016; Khlif &

Achek, 2017). However, these studies were not in line

with research conducted by Charness & Gneezy

(2012), Faccioet al. (2016) which explained that

women tend to avoid risk in decision making

compared to men. Commissioner gender has no effect

on Tax Avoidance. This ethical behavior minimizes

any fraudulent actions that can be committed by

leaders or managers.

H2: The gender of the board of commissioners has a

significant effect on tax avoidance efforts.

2.3.3 Tenure and Tax Avoidance Efforts

Tenure is the service period for the board of

commissioners to work / serve in the company. Some

strategic management theorists argue that the tenure

of a board of commissioners in an organization

affects the executive's condition. The longer the

tenure of the board of commissioners causes rigidity

in the corporate structure and the less it is to promote

or change the old strategy (Chyz & Gaertner, 2018).

The board of commissioners with long tenure has

good experience in supervision. The quality and

performance of the board of commissioners are better

in understanding the internal conditions of the

company and formulate the company's external

Does the Board of Commissioners Affect Tax Avoidance? Evidence from Banking Industry in Indonesia

105

strategy appropriately, including the supervision of

tax avoidance efforts by the company.

H3: The tenure of the board of commissioners has a

significant effect on tax avoidance efforts.

2.3.4 Political Connections and Tax

Avoidance Efforts

Companies are said to have political connections if at

least in one of the primary shareholders (a person with

at least 10 percent of the total voting rights) or one of

the company leaders (CEO, president or vice

president). Chairman or company secretary) are

members of parliament, ministry or possess a relation

with politicians or political parties (Faccio, 2006;

Francis et al., 2012; Butje & Tjondro, 2014; Duan et

al., 2018). Companies with political connections will

receive protection from the government, easy access

to obtain capital loan, the risk of tax audits is low,

which makes companies more aggressive in

implementing tax planning which results in cloudy

financial transparency. Various kinds of privileges

can be obtained by companies easily. A board of

commissioners with political connections is able to

oversee the company's operations in order to reduce

tax penalties and maintain reporting transparency.

Political connections influence tax avoidance (Butje

& Tjondro, 2014; Duan et al., 2018).

H4: The political connection of the board of

commissioners affects tax avoidance efforts.

Figure 1: Theoretical Framework.

3 RESEARCH METHODOLOGY

This study is quantitative research. The populations

in this study were all banking companies listed on the

Indonesian stock exchange. The unit of analysis used

was the banking annual report. The observation

period in this study was carried out in 2015-2019. The

sampling technique in this study used purpose

sampling with the following criteria: a) banking

companies listed on the Indonesia Stock Exchange in

five periods during the 2015-2019 period, b) listed

companies have never experienced losses in the 2015-

2019 period, c) does not have an ETR value above 1

or below 0. The data used is the annual report and the

data is obtained from the official IDX website.

Tax avoidance is a transaction scheme shown by

minimizing the tax burden by taking advantage of the

loophole of tax provisions. In this study it was

proxied using the effective tax rate (ETR) ratio used

by Hanlon & Heitzman (2010), Lanis & Richardson

(2011) namely income tax expense divided by net

profit before tax. The number of Independent

Commissioners is a ratio between the number of

independent commissioners and the total board of

commissioners in the company (Farag & Mallin,

2018; Chyz & Gaertner, 2018; Ambarsariet al., 2020).

Gender (Farag & Mallin, 2018) is a dummy variable

with a value of 1 if it is classified as female and 0 if it

is classified as male. Tenure is the service period for

commissioners to work / serve in the company. The

tenure of more than two terms was given a dummy

score of 1 and terms of office with a term of less than

2 periods were valued as a dummy of 0. Political

connections were given a dummy score of 1 if there

was a political connection and 0 if there was none.

This study also uses control variables, namely

company characteristics such as profitability (retur

non aset), company size (ln total assets), capital

intensity (fixed assets compared to total assets),

company growth (total equity compared to total

assets) and leverage (ratio of liabilities to equity).

Multiple linear regression analysis was used to

examine the model and the effect of the number of

independent commissioners (X1), gender (X2),

tenure (X3), and political connections (X4) on tax

avoidance efforts (Y). In addition, the coefficient of

determination and t test were also carried out.

The regression equation in this study is as follows:

TA= α + β1KI + β2GDR+ β3MJ+ β4 KP+ e (1)

TA= α + β1KI + β2GDR+ β3MJ+ β4 KP+ β5ROA

+ β6SIZE+ β7CI + β8GROWTH+ β9LEV+ e (2)

4 EMPIRICAL RESULTS

4.1 Sampel Selection

The banking sector was chosen as the sample in this

study because the banking sector has a close

relationship with tax avoidance. Revocation of PER-

01 / PJ / 2015 due to limitations in tax audits with

banking confidentiality, however PER-01 / PJ / 2015

stipulates that the DGT can obtain customer

N

umber of BOC

Gender

Tenure

Political

Tax Avoidance

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

106

information that can be used for tax purposes.

Following are the details of the samples obtained for

testing where 156 sample data were obtained that

were ready to be tested.

Table 1: Sample composition.

Sample Selection Criteria Total of Sample Data

Registered company = 43 x 5

years

215

Deductions based on criteria:

The company that suffered a

loss, ETR exceeded 1 and

data are not available

49

Total Observations 156

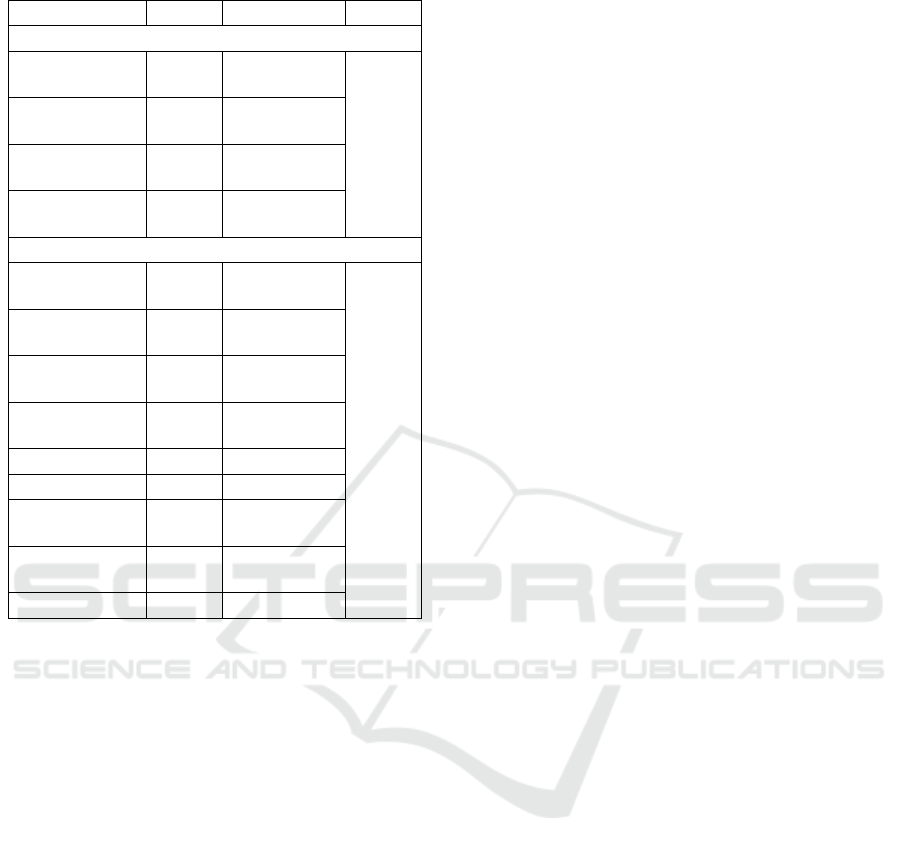

4.2 Descriptive Statistics

The statistical analysis indicated by the minimum,

maximum, mean, as well as the crosstab test for the

dummy variables is shown below. The average value

of the independent commissioner variable is 0.60,

indicating that the number of independent

commissioners still dominates the total board of

commissioners. The average value of the tax

avoidance variable is 0.23, which is close to 0,

indicating that most companies are making tax

avoidance efforts. The profitability average value of

0.07 indicates the company's ability to generate

profits is low. The average company size was 18.26

or Rp. 399,924,414,000 shows that the company's

assets are quite large. The average capital intensity

value of 0.44 shows that the company's fixed assets

are only 44% of the total assets owned. The company

growth average value of 0.24 shows that the

company's growth is still low. The average leverage

level is 2.35, indicating that part of the company's

capital comes from debt, especially from customers

and other creditors.

Table 2: Descriptive Test Results.

Variable Min Max Mean

Independent

commissioner

0.33 1.00 0.60

Gender 0.00 1.00 0.10

Tenure

0.00 1.00 0.51

Political

connections

0.00 1.00 0.41

Tax avoidance 0.01 0.77 0.23

Profitability 0.00 0.64 0.07

Company size

12.48 31.71 18.26

Capital intensity

0.08 1.00 0.44

Growth

0.00 0.70 0.24

Leverage

0.15 9.81 2.35

The results of crosstab testing showed 135 (87%)

classified as male, and the remaining 21 (13%) were

classified as female. When viewed from the tenure of

the male board of commissioners, it shows that 69

(51%) have tenure of more than 2 years, 66 (49%) and

a tenure of less than 2 years. When viewed from the

presence or absence of political connections, it shows

that 76 (56%) did not have political connections, the

remaining 59 (44%) had political connections. On the

other hand, if it is seen from the tenure of the female

board of commissioners, it shows that 11 (52%) had

tenure of more than 2 years, 10 (48%) had tenure

under 2 years. When viewed from the presence or

absence of political connections, it shows that 16

(76%) had no political connections, the remaining 5

(24%) had political connections.

Table 3: Crosstab Testing Results.

Tenure Gender Political

Connection

Gender

Male Female Male Female

<2

periods

66 11 No 76 16

>2

periods

69 10 With

Connections

59 5

Total 135 21 Total 135 21

4.3 Results

The results of the model test or the F test indicated the

fit model. The results of model 1 test showed that only

the independent commissioner variable had a

significant effect on tax avoidance efforts. The results

of model 2 test after the inclusion of control variables

showed that the independent commissioner variable,

profitability, capital intensity, company growth and

leverage had a significant effect on tax avoidance

efforts.

The number of independent commissioners has a

strong enough influence on compliance in paying

taxes as regulated by the Financial Services Authority

Article 21 paragraph 2, it is explained that there is an

independent commissioner who does not take sides

with anyone in the company. The increasing number

of independent commissioners is expected to

encourage transparency in monitoring management

behavior. In banking companies, it shows that on

average 60% is dominated by independent

commissioners and the average level of avoidance

efforts is strong. The results also showed that the

greater the composition of the commissioners had a

significant effect on tax avoidance efforts.

Independent commissioners are able to provide an

independent attitude so that the supervisory function

runs well. The duties and functions of the independent

Does the Board of Commissioners Affect Tax Avoidance? Evidence from Banking Industry in Indonesia

107

Table 4: Descriptive Test Results.

ß Sig Adj R

2

Model 1:

Independent

commissioner

0.133 0.028** 0.012

Gender

-

0.055

0.186

Tenure

-

0.041

0.149

Political

connection

-

0.039

0.179

Model 2:

Independent

commissioner

0.118 0.034** 0.062

Gender

-

0.053

0.196

Tenure

-

0.036

0.214

Political

connection

-0.041 0.167

Profitability -0.291 0.099***

Company size 0.001 0.810

Capital

intensity

0.312 0.007*

Company

growth

0.160 0.055***

Leverage 0.032 0.005*

*) significant in 0.01

**) significant in 0.05

***) significantin 0.10

commissioner are to supervise and control in

providing useful information to the alified party.

Independent commissioners are also responsive in

paying attention to the presence or absence of tax

avoidance so as to reduce tax sanctions.

The company's strategy regarding taxation must

be supervised and controlled in a structured manner

by management, commissioners and audit committee

so that the company is not too aggressive and avoids

tax sanctions that will harm the company later. The

presence of independent commissioners as parties

involved in supervision is expected to be able to act

independently because independent commissioners

have no direct interest in the company's operations or

decision-making parties. This is in line with agency

theory regarding the importance of the supervisory

function so that agents are not selfish and able to be

accountable for their duties in a transparent manner.

The results of this study are supported by previous

research carried out by (Sofiati & Zulaikha, 2018;

Kurnia et al., 2019) which stated that the independent

board of commissioners tends to encourage company

management to disclose broader information to

shareholders and stakeholders.

This was different from the results of other

hypothesis testing. Gender, tenure and political

connections of commissioners did not have a

significant effect on tax avoidance. The majority of

boards of commissioners in Indonesian banking were

male, with a tenure of more than 2 terms and without

political connections. The risk preferences faced in

the banking and other financial service industries are

indeed classified as larger, therefore there was no

need for individual character requirements to occupy

the position of commissioner. Besides, tax avoidance

efforts are considered a routine strategy that

companies must undertake as a legal effort, without

having to consider the presence or absence of political

connections. Banking still prioritizes the provisions

stipulated in the OJK regulations and the Limited

Liability Company Law, particularly in relation to the

number of independent commissioners and the

commissioners' field of expertise. The results of this

study are supported by Charness & Gneezy (2012);

Faccio et al. (2016); Winasis et al., (2017), Farag &

Mallin (2018), Chyz & Gaertner (2018)

In addition, tax avoidance efforts are also

influenced by financial performance such as

profitability, capital intensity, company growth and

leverage. Efforts to maximize profits and company

assets can be achieved if the company is able to make

efficiency and minimize costs. One of them is by

reducing the company's tax burden and tax payments.

Therefore, tax avoidance efforts are appropriate when

included as part of the company's strategy so that the

sustainability of the company can be maintained.

5 CONCLUSIONS

Tax avoidance efforts are one of the company's

strategies specifically related to the taxation aspect.

Tax avoidance is influenced by the number of

independent commissioners and the company's

financial performance. Meanwhile, gender, tenure

and political connections do not have a significant

effect on tax avoidance efforts. The existence of

independent commissioners as parties involved in

supervision is expected to be able to act

independently because independent commissioners

have no direct interest in the company's operations or

decision-making parties. This is in line with agency

theory regarding the importance of the supervisory

function so that agents are not selfish and able to take

account for their duties transparently.

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

108

This study has limitations: 1) many companies

have suffered losses before tax and the complete data

is not available thus the amount of data tested was not

much compared to other sectors, 2). The financial

industry has different measurement indicators from

other industrial sectors thus it requires sufficient time

in tabulation and testing. With the limitations of the

research, the suggestions are: 1) it should be able to

focus on other sectors or increase the research period

in order to obtain sufficient and generalizable

samples, 2) it should be able to focus on the two

pillars of good corporate governance and other

variables suspected to affect tax avoidance, for

example the board of directors, audit committee, non-

financial aspects, the role of the independent auditor.

The implication of this research is the definition

of tax planning needs to be improved because

currently it has become the main concern of company

stakeholders. Likewise for companies and corporate

stakeholders to consider strategies in the field of

taxation as part of the company's strategy and utilize

various tax policies or facilities to support tax

avoidance efforts. The government is also expected to

be able to formulate tax policies and facilities that

accommodate the interests of companies but do not

harm state revenues. The synergy between the

company and the government is expected to create

voluntary compliance among taxpayers.

REFERENCES

Aliani, K. 2014. CEO characteristics and corporate tax

planning evidance from US companies. International

Journal of Managerial and Financial Accounting, 6(1),

49–59.

Ambarsari, D., Pratomo, D., & Kurnia, K. 2020. Pengaruh

Ukuran Dewan Komisaris, Gender Diversity pada

Dewan, dan Kualitas auditor eksternal terhadap

Agresivitas Pajak. Kompartemen: Jurnal Ilmiah

Akuntansi, 17(2), 163–176.

Armstrong, C. S., Blouin, Jennifer L., & Larcker, D. 2015.

The Incentives for Tax Planning. Journal of Accounting

and Economics, 60(1), 391–411.

Butje, S., & Tjondro, E. 2014. Pengaruh Karakter Eksekutif

dan Koneksi Politik Terhadap Tax Avoidance. Tax and

Accounting Review, 4(2), 1–9.

Chan, K. H., Mo, P. L. L., & Zhou, A. Y. 2013. Government

ownership, corporate governance and tax

aggressiveness: evidence from China. Accounting and

Finance, 53(4), 1029–1051. https://doi.org/10.1111/

acfi.12043

Charness, G, & Gneezy, U. 2012. Strong Evidence for

Gender Difference in Risk Taking. Journal of

Economic Behaviour and Organization, 83(1), 50–58.

Chyz, J. A., & Gaertner, F. B. 2018. Can paying “too much”

or “too little” tax contribute to forced CEO turnover?

The Accounting Review, 93(1), 103–130.

Coulmont, M., Berthelot, S., & Gagné, C. 2018. Executive

Compensation and Corporate Income Tax: A Question

of Societal Equity. International Journal of Accounting

and Taxation, 6(1), 42–51.

Doho, S. Z., & Santoso, E. B. 2020. Pengaruh Karakteristik

CEO, Komisaris Independen, dan Kualitas Audit

Terhadap Penghindaran Pajak. Media Akuntansi dan

Perpajakan Indonesia, 1(2), 70–82.

Duan, T., Ding, R., Hou, W., & Zhang, J. Z. 2018. The

burden of attention : CEO publicity and tax avoidance.

Journal of Business Research, 87, 90–101.

https://doi.org/10.1016/j.jbusres.2018.02.010

Faccio, M., Marchicha, M., & Mura, R. 2016. CEO Gender,

Corporate Risk Taking, and The Effiency of Capital

Allocation. Journal of Corporate Finance, 39, 193–

209.

Faccio, M. 2006. Politically Connected Firms. The

American Economic Review, 96(1), 369–386.

Farag, H., & Mallin, C. 2018. The influence of CEO

demographic characteristics on corporate riak-tasking :

evidence from Chines IPOs. European Journal of

Finance, 24(16), 1528–1551.

Francis, B. B., Hasan, I., & Sun, X. 2012. CEO political

affiliation and firms’ tax avoidance. Available at SSRN

2013248.

Francis, B. B., Hasan, I., Sun, X., & Wu, Q. 2016. CEO

Political Preference and Corporate Tax Sheltering SC.

Journal of Corporate Finance, 38, 37–53.

https://doi.org/10.1016/j.jcorpfin.2016.03.003

Goldman, N., Schuchard, K., & Williams, B. 2017. How

Does CEO Tenure Affect Corporate Income Tax

Planning and Financial Reporting Decisions? Available

at SSRN 2969662.

Hanlon, M., & Heitzman, S. 2010. A review of tax research.

Journal of Accounting and Economics, 50(2), 127–178.

https://doi.org/10.1016/j.jacceco.2010.09.002

Higgins, D., Omer, T. C., & Phillips, J. D. 2012. Does a

Firm’s Business Strategy Influence its Level of Tax

Avoidance? SSRN Electronic Journal.

https://doi.org/https://doi.org/10.2139/ssrn.1761990

Ho, S. S. M., Li., A. Y., Tam, K., & Zhang, F. F. 2015. CEO

Gender, Ethical Leadership, and Accounting

Convervatism. Journal of Education. Analytic

Philosopy, 13(1), 351–370.

Hudiwinarsih, Gunasti.,& Supriyati. 2018. Governance and

Aspect of Tax Avoiding to Determining The Value of

Banking in Indonesia. International Journal of Civil

Engineering and Technology, 9(10), 991–1000.

Jamei, R. 2017. Tax Avoidance and Corporate Governance

Mechanisms: Evidence from Tehran Stock Exchange.

International Journal of Economics and Financial

Issues, 7(4), 638–644.

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm:

Managerial behavior, agency costs and ownership

structure. The Corporate Financiers, 3(4), 305–360.

https://doi.org/10.1057/9781137341280.0038

Does the Board of Commissioners Affect Tax Avoidance? Evidence from Banking Industry in Indonesia

109

Jihene, F., & Moez, D. 2019. The Moderating Effect of

Audit Quality on CEO Compensation and Tax

Avoidance: Evidence from Tunisian Context.

International Journal of Economics and Financial

Issues, 9(1), 131–139.

Khlif, H., & Achek, I. 2017. Gender in accounting research:

a review. Managerial Auditing Journal.

https://doi.org/10.1108/MAJ-02-2016-1319

Kurnia, K., Pratomo, D., & Handoko, T. 2019. the Effect of

Ceo Compensation, Independen Director and Audit

Quality on Tax Aggressiveness. Accruals, 3(1), 62–72.

Lanis, R., & Richardson, G. 2011. The effect of board of

director composition on corporate tax aggressiveness.

Journal of Accounting and Public Policy, 30(1), 50–70.

https://doi.org/10.1016/j.jaccpubpol.2010.09.003

Merks, P. 2007. Categorizing international tax Planning.

Fundamentals of International Tax Planning, 66–69.

Novita, T. B., Titisari, K. H., &S. 2020. Corporate

Governance,Profitabilitas, Firm Size, Capital Intensity

dan Tax Avoidance. In Seminar Nasional Akuntansi

(Vol. 2).

Prasetyo, Irwan.,& Pramuka, B.. 2018. Pengaruh

kepemilikan institusional, kepemilikan manajerial dan

proporsi dewan komisaris independen terhadapTax

Avoidance. Jurnal Ekonomi, Bisnis Dan Akuntansi,

20(2).

Richardson, G., & Lanis, R. 2007. Determinants of the

variability in corporate effective tax rates and tax

reform: Evidance from Australia. Journal of

Accounting and Public Policy2, 26, 689–704.

Richardson. 2011. The Effect of Board of Director

Composition on Corporate Tax Aggressiveness. J

Account Public Policy, 30, 50–70.

Sofiati, S.A., & Zulaikha, Z. 2018. Analisis Pengaruh Tata

Kelola Perusahaan, Karakteristik dan Kompensasi

Eksekutif terhadap Penghindaran Pajak. Diponogoro

Journal of Accounting, 7(4).

Supriyati., Tjahjadi, Bambang.,& Tjaraka, H. 2019. Does

Corporate Tax Aggressiveness Matter in Good

Corporate Governance-Corporate Financial

Performance relationship? Evidence in Indonesia.

International Journal of Civil Engineering &

Technology, 10(07), 235–252.

Taylor, G., & Richardson, G. 2012. International Corporate

Tax Avoidance Practices: Evidence from Australian

Firms. International Journal of Accounting2, 47(4),

469–496. https://doi.org/https://doi.org/10.1016/j.int

acc.2012.10.004

Tooma, R. 2006. Tax Planning in Australia: When Is

Aggressive Too Aggressive? Tax Notes International,

42(5), 427.

Uun, Sunarsih.,& Kurnia. 2016. Good Croporate

Governance In Manufacturing Companies Tax

avoidance. Etikonomi2, 15(2), 85–96.

Winasis, S. E., Nur, E., & Yuyetta, A. 2017. Pengaruh

Gender Diversity Eksekutif Terhadap Nilai Perusahaan,

Tax Avoidance Sebagai Variabel Intervening: Studi

Kasus Pada Perusahaan Pertambangan Yang Terdaftar

Di Bei Tahun 2012-2015. Diponogoro Journal of

Accounting, 6(1), 311–324. https://www.tribun

news.com/internasional/2017/11/20/indonesia-masuk-

peringkat-ke-11-penghindaran-pajak-perusahaan-

jepang-no3

FEMIB 2021 - 3rd International Conference on Finance, Economics, Management and IT Business

110