Assessment Technique of the Impact of Blockchain Technology

Diffusion on the Sustainable Development of the National Economic

System (on the Example of the Russian Federation Economy)

Marat R. Safiullin

1,3 a

, Leonid A. Elshin

1,2,3 b

and Aliya A. Abdukaeva

1,2,3 c

1

Kazan Federal University, Kremlin Street, 18, Kazan, Russia

2

Kazan National University of Science and Technology, Karl Marx Street, 68, Kazan, Russia

3

GBU "Center for Advanced Economic Research of the Academy of Sciences of the Republic of Tatarstan"

Kazan, st. K. Marx, 23/6

Keywords: Blockchain Technologies, Economic Growth Dynamics, GDP, Blockchain Systems, Cointegration, Scenario

Analysis, Risks.

Abstract: Blockchain technologies arouse intense interest in both business entities and government regulators with a

certain level of uncertainty about generated effects both for themselves and for the national economy as a

whole. The distributed data storage technologies are becoming an integral part of the modern economy and

have an increasing impact on the prospects and competitiveness of its development. To understand the "depth"

of their impact, possible changes in socioeconomic dynamics under the action of blockchain technology

diffusion, it is very important to develop methodological approaches to a formalized assessment of risks and

opportunities for the national economic system in the context of the issue. The purpose of this study is to

strengthen the positions of formalized approaches to the stated scientific and practical problem. The paper

proposes an impact algorithm of the blockchain technology on GDP dynamics through the transformation of

key parameters of economy financial and real sectors. The implemented analysis and argumentation, it was

substantiated that the integration of blockchain technology into economic processes of the national economic

system will most significantly affect the change in the financial results of credit institutions, increase the

capital availability of economic agents, as well as accelerate the processes of socialization of access channels

of business entities to financial markets (greater access of economic agents to stock trading platforms) Based

on proposed and tenable hypotheses, a cointegration model has been developed, making it possible to

determine the main effects and potential impact of possible transformations of economic activity (most

susceptible to changes as a result of blockchain technology diffusion) on GDP dynamics. The resulting

estimates of the sensitivity of economic dynamics to considered adjustments made it possible to identify the

potential for economic growth as a result of possible integration of blockchain technology into the economic

environment.

1 INTRODUCTION

The socioeconomic medium digitalization is

fundamentally transforming traditional spheres of

economic activity. Analogue television has been

replaced by digital television; fiat payments are being

replaced by electronic ones; data exchange and their

management models were transferred to the

electronic document management system, etc.

a

https://orcid.org/0000-0003-3708-8184

b

https://orcid.org/0000-0002-0763-6453

c

https://orcid.org/0000-0003-1262-5588

Blockchain technology can also significantly change

the established processes and models of business

entities, as well as the financial sphere, expanding the

FinTech paradigm.

Blockchain technology was developed by S.

Nakamoto in 2008 (Nakamoto, 2008) in order to get

round centralized systems transaction regulation and

operational processes based on distributed

(decentralized) data storage mechanisms. Thus, “an

Safiullin, M., Elshin, L. and Abdukaeva, A.

Assessment Technique of the Impact of Blockchain Technology Diffusion on the Sustainable Development of the National Economic System (on the Example of the Russian Federation

Economy).

DOI: 10.5220/0010590103250331

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 325-331

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

325

algorithm was developed for the buyer and the seller

to make transactions directly over the network using

encryption and conciliation mechanisms by

blockchain network nodes” (Guo and Liang, 2016).

2 METHODS

But despite the growing interest on the part of the

expert and scientific community in distributed data

storage technology and the problems of studying their

impact on the national economy and its individual

sectors development, there is no a unanimous view on

the problem solution and the lack of common

approaches to a formalized assessment of possible

generated opportunities and risks. Normally, as the

review of foreign and Russian scientific literature

shows, studies aimed at methodological analytic

approaches to the impact of blockchain technology on

economic dynamics are limited either by qualitative

characteristics, or are implemented through expert

assessments, as well as reasoning of a general logical

order. At the same time, in the vast majority of cases,

the authors believe that these studies are relevant,

practically an scientifically significant, requiring

proper methodological mechanisms. For example,

this view is described in the works of E. А.

Pekhtereva (Pekhtereva, 2018), R.K.

Nurmukhametova, P.D. Stepanova, T.R. Novikova

(Nurmukhametov et al, 2018), Yu.A. Konopleva,

V.N. Kiseleva, S.E. Cheremnykh (Konopleva et al.,

2018), E.D. Butenko, N.R. Isakhaev (Butenko et al,

2018), V.A. Popov (Popov, 2018), M.A. Markov,

M.D. Slyusar, O.R. Trofimenko (Markov et al, 2018),

N.Yu. Sopilko, K.L. Malimon, I.A. Kanyukov

(Sopilko, 2018).

Foreign scientists also study the set problems.

Most works of foreign researchers note the need for

the closest attention to the study of blockchain

technology, both from the standpoint of qualitative

and quantitative analysis (Vranken and Hong, 2016;

Bariviera et al., 2017; Cocco et al., 2017; Pieters and

Vivanco, 2017).

Supporting the arguments on the role of

blockchain technology in the modern developing

world, their possible impact on macroeconomic

generations, it should be stated that some countries

have been actively following the path of development

and integration of the considered technology under

into the economic environment in recent years. The

People's Republic of China, where "since May 2020,

the national cryptocurrency of the Central Bank of

China (DCEP) has been put into circulation" (The

date of the launch, 2020). A number of Chinese banks

already in 2020 began to apply distributed data

storage technology in their operational activities for

making payments, digital accounts, a big data register

and other purposes.

As additional examples, it should be noted that

back in 2015, an international consortium (R3) was

organized, bringing together more than 80 financial

institutions in the field of blockchain technology. The

non-financial sector companies are also actively

involved in the study and testing of blockchain

technology as part of their business operations. IT

companies actively generate proposals and

developments in this area.

The distributed data storage technology is

integrated into the turnover of the Russian Federation

national economy. So, according to the draft road

map for the blockchain technology development in

the RF, presented by the Russian state corporation

Rostech, “the volume of the distributed ledger

technology market in Russia in 2018 amounted to 2

billion rubles, by 2024 it will increase to 80 billion -

454 billion rubles. In the world, the volume of the

distributed ledger technology market in 2018

amounted to $ 2 billion, by 2024 it will increase to $

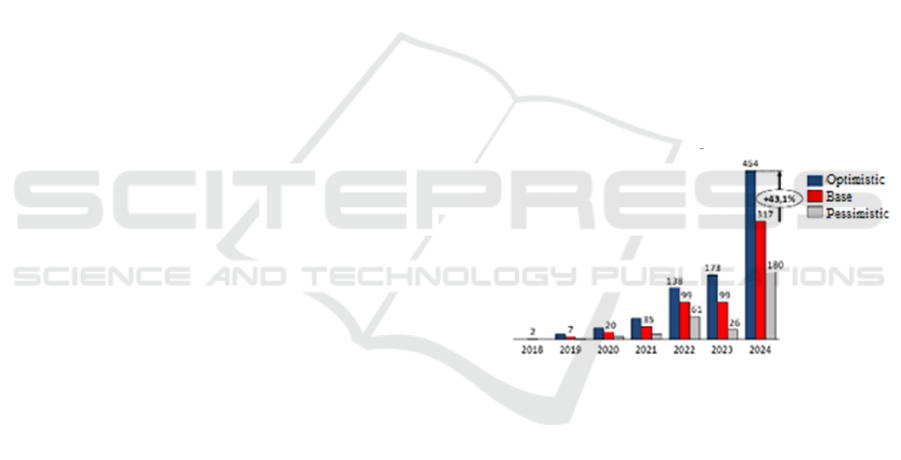

23 billion - $ 54 billion” (Figure 1).

Figure 1: Forecast of the market size of distributed registry

technologies in Russia until 2024, billion rubles.

Abstracting in this study from the risks and threats

posed by the blockchain technology integration (for

example, such as money laundering due to the

planetary, cross-border structure of distributed

ledgers, the risks of 51% attacks, Sibyl, etc.), the

authors are developing a model to assess the effect of

their diffusion (as a result of the "penetration" of

distributed data storage technology into operational

processes) on the gross domestic product dynamics.

Then a model was developed with corresponding

assessments implemented, making it possible to

determine the impact on GDP of blockchain

technology integration into the economic

environment. The solution to this problem will make

it possible to understand the sensitivity of the

country's economic dynamics to adjustments in

certain functional segments of the national economy.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

326

The quarterly data from official sources were

used. The calculations were performed using the

Eviews statistical package. Table 2 shows the

developed model variables, their symbols, and data

sources.

Table 1: Description of the variables of the developed model.

Variable Symbol Data source

Dependent

Gross domestic product, bln. rubles GDP Federal State Statistics

Service

Independent

Stock market trading volume, bln. rubles 𝑉

то

р

гов

Moscow Exchange

Money transfers made through the payment system of the Bank of Russia

using transfer services/settlement systems, bln. rubles

𝑉

транзакций

Central Bank of the

Russian Federation

Total profit/loss received by operating credit institutions, mln. rubles 𝑉

финрез

Central Bank of the

Russian Federation

An important methodological aspect that

predetermined the model development procedure is

that in the case of financial time series, use of

traditional methods of correlation-regression analysis

can cause biased, inconsistent and inefficient

estimates. This model may be unsuitable for further

analysis and forecasting.

The study of dependencies between financial

(stochastic) time series can be perorme using

cointegration analysis. The initial analysis stage is to

determine the cointegration rank. At the same time,

cointegration rank between GDP and exogenous

factors is determined using a preliminary analysis of

the selected series. First of all, it is necessary to make

sure that the analyzed series are represented by

integrated series of the first order. The stationarity of

the first-order difference was carried out using the

Dickey-Fuller test, with the following condition

(relative to the analyzed time series): 𝑦

~ I (1) if the

series of first-order differences Δy = 𝑦

- 𝑦

is

stationary Δ 𝑦

~ I (0).

According to, the hypothesis of the absence of a

causal relationship is refuted for all studied pairs of

time series at a 5% significance level, except for the

following pair: The volume of money transfers made

through the payment system of the Bank of Russia

and the profit (loss) of credit institutions according to

Granger.

If the set of time series is an integrated first-order

process, then the use of the regression model can

result in biased, inconsistent, and ineffective

estimates. Such series are called cointegrated and use

the cointegration equation. To test the cointegration,

the assessment method used in this study includes the

Johansen Juselius cointegration test (

Watson M.W.,

1994):

𝑌

𝐴

𝑌

…𝐴

𝑌

𝐵𝑋

𝜀

(1)

Based on the implemented iterations, the

following equation of the required dependence was

derived:

ВВП 48,67 0,01 ∗ 𝑉

торгов

0,05∗

𝑉

транзакций

6,35∗𝑉

финрез

(3)

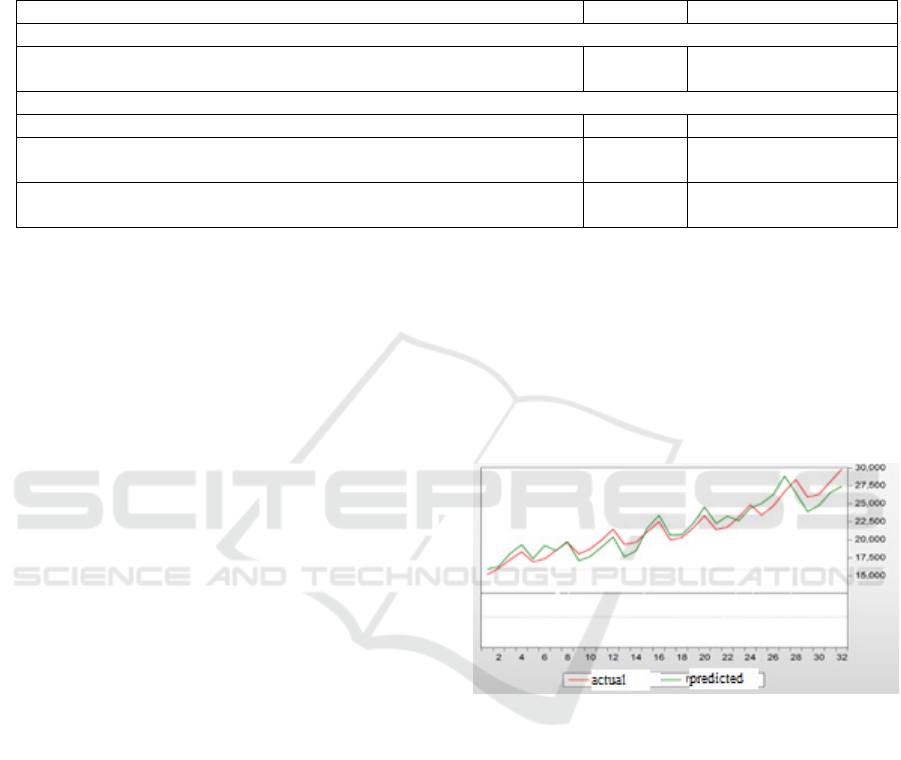

Comparison of actual GDP values with those

predicted based of the resulting model is shown in

Figure 2.

Figure 2: Comparison of the actual and predicted time

series

Source: developed by the authors

The developed cointegration equation indicates

the presence of a positive impact on GDP of the

considered exogenous factors, making it possible to

quantify the degree and possible potential of their

impact in terms o "blockchaining” economic

processes.

Based on the results obtained as the final iteration

of the study, a scenario analysis of the value adjusting

effect of the considered set of factors due to the

diffusion of distributed data storage technology on the

economic growth dynamics in the RF is implemented.

Assessment Technique of the Impact of Blockchain Technology Diffusion on the Sustainable Development of the National Economic

System (on the Example of the Russian Federation Economy)

327

2.1 Effect 1

To provide predictive estimates of the impact of

cryptotransactions on the stability and parameters of

GDP development, 4 scenarios of economic

"blockchaining" and transition of the financial

transactions market to the crypto environment were

proposed (Table 5).

The transition scale is specified by the need for a

comparative analysis of our estimates, in terms of the

impact on GDP dynamics, with similar estimates

published in other studies (Tilooby, Al. 2018.).

As a baseline scenario, within the framework of

the analysis of GDP sensitivity to an increase in the

capital liquidity of economic agents as a result of the

payment system transfer to crypto transactions, the

most conservative of the considered scenario No. 1

was adopted, providing an increase in the liquidity of

economic entities up to 128 billion rubles. (Table 3).

2.2 Effect 2

Clearly, we should consider both positive and

negative factors. The risks posed by the transition of

the financial transaction system to a decentralized

blockchain environment should be thoroughly

studied. However, in terms of a formalized

assessment of economic effects, it should be stated

that the transition of transactions to the crypto

environment will not affect the volume of money

transfers made through the payment system of the

Bank of Russia. Moreover, when we mean the

formation of the so-called digital ruble, based on

blockchain principles and technology, but, at the

same time, retaining control by the regulator. In other

words, the effect of “interconnected vessels” arises -

the transfer of payments from the fiat environment

will result in a proportional growth of the payment

system based on the digital money.

The only negative effect here may be the loss of

part of the income by credit institutions as

commission fees for transfers. However, given that

the share of this item of profit is less than 1% of the

total profit of banking institutions, the generated

negative externalities will be insensitive both for the

financial sector and the national economic system as

a whole.

2.3 Scenario Analysis of the Trading

Volume Adjustment in the Stock

Market as a Result of the

Blockchain Technology Penetration

According to the MICEX, in 2019 the trading volume

in the stock, money, foreign exchange and

commodity markets amounted to 778,155 bln. rubles.

(https://www.moex.com/ru/ir/interactive-

analysis.aspx). The average brokerage fee for leading

brokers in 2019 corresponds to 0.3% of the

transaction amount. Thus, we can conclude that

commission fees corresponded to the value of

2334.465 bln. rubles, which corresponds to about

1325 rubles per 1 resident of the RF. Many brokers,

insufficient transparency of commission calculations,

and data search complex procedures are barriers for

new investors. Moreover, brokerage fee, depository

service fees can account for more than half of an

investor's potential income. In 2019, several of the

largest US brokers at once - Interactive Brokers,

Charles Schwab, TD Ameritrade and E*Trade -

announced that they would not be taking

commissions for online stock trading. The companies

expect zero commissions to attract more customers.

To test the hypothesis that there is a connection

between the trading volumes on the stock exchange

and the increase in the income of the population, due

to the abolition of commission fees, a regression

model was proposed. “Trading volume on the

Moscow Interbank Currency Exchange” was taken as

a dependent indicator, and “Average per capita

monetary income of the population” was taken as an

independent indicator. The following equation is

obtained with the coefficient of determination equal

to 𝑅

=0.97:

𝑌 6243,9 6,16

(10)

The resulting equation makes it possible to

evaluate the effect of canceling brokerage

commissions. Thus, an increase in household income

by 1,325 rubles contributes to a quarterly increase in

trading volumes on the MICEX by 9,246 bln. rubles.

Table 2: Significance parameters of the regression equation.

Factors

t-

statistics

P-

Value

Y-crossing -6,243.90 -0.16 0.87

Average per capita

monetary income of

the population

6.16 4.97

3,6191

2E-05

𝑅

0,88

Source: developed by the authors

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

328

3 RESULTS AND DISCUSSION

According to the presented research algorithm on the

gross domestic product of the national economy, as

part of the integration of blockchain technology into

the economic environment, 3 key factors will have an

effect:

1. 𝑉

финрез

2. 𝑉

торгов

3. Increase in the liquidity of economic agents due

to the working capital growth. This effect is

determined base on the dependences obtained

between the level of change in current assets and GDP

dynamics (Formula 3).

𝑌 20513 0,79𝑥 (3)

It is important to note that this indicator value of

the constructed cointegration model will not change

due to the generated effect of “interconnected

vessels”.𝑉

транзакций

This means that the diffusion of

blockchain technologies and the crypto transactions

built on their basis will not affect the volume and

value characteristics of payments made in the

economy. There will be a flow of transactions,

accompanied by traditional electronic/fiat-based

regulatory mechanisms, into the blockchain

environment.

Table 3 presents the main resulting effects

characterizing the possible increase in the studied

exogenous factors due to the penetration of blockchain

technology into the national economic system.

Table 3: Possible effects caused by the correction of the

investigated factors of the cointegration model as a result of

the blockchain technology diffusion.

No. Exogenous factor of the

cointegration model

Expected, in

accordance with the

scenario analysis,

increase in the factor

value, in bln. rubles.

1 𝑉

финрез

- total amount

of profit/loss received

by operating credit

institutions

+ 88.5 per year;

+ 22.125 average

quarter

2 𝑉

торгов

- trading

volume on the stock

market

+ 9246.63 average

quarter

3 Increase in working

capital, revitalization of

business activity (1

factor effect

𝑉

т

р

анзак

ц

ий

)

+128.0 per year

(baseline scenario 1,

Table 9)

Based on the results, identifying the

characteristics of the possible growth of exogenous

factors of the developed model, Table 12 presents an

analysis of the sensitivity of GDP to their projected

adjustments.

Table 4: Analysis of the gross domestic product sensitivity

to changes in model exogenous factors.

No. Factor Average

quarterly GDP

growth, bln.

rubles

GDP

growth

per year,

bln.

rubles

1 𝑉

финрез

- total

amount of

profit/loss

received by

operating credit

institutions

22.125*6.35 =

+139.7

558.8

2 𝑉

торгов

- trading

volume on the

stock market

9246*0.01 =

+92

368.0

3 Increase in

working capital,

revitalization of

business activity

25.3* 101.2

TOTAL: 332.7 1,028.0

* The calculation was performed according to formula 3.

Explanation of calculations: 20,513 + 0.79* ((34,351/4)

+128/4) = 27,322.6 - taking into account the growth of

working capital by 128.0 bln. rubles per year. 20,513 + 0.79

* (34,351/4) = 27,297.3 - excluding the growth of liquidity

by 128.0 bln. rubles. Quarterly growth = 27,398-27,297 =

25.3 bln. rubles.

Assessment Technique of the Impact of Blockchain Technology Diffusion on the Sustainable Development of the National Economic

System (on the Example of the Russian Federation Economy)

329

Table 5: Scenario analysis of changes in commission income of credit institutions in the Russian Federation and an increase

in the liquidity of economic entities as a result of the transition of the payment system of the Russian Federation to the crypto

environment.

Total money

transfers, as of

01/01/2019

Estimate

d

commis

sion

rate,%*

Fee

and

comm

ission

incom

e, bln.

rubles

Sensitivity analysis of the reduction in fee and commission income of credit

institutions as a result of “Transfer of funds” indicator reduction by:

Scenario No. 1:

10%

Scenario No. 2:

20%

Scenario No. 3:

30%

Scenario No. 4:

50%

Total money transfers, bln. rubles

Fee and commission income, bln. rubles

Growth of capital liquidity of economic

entities, bln. rubles**

Total money transfers, bln. rubles

Fee and commission income, bln. rubles

Growth of capital liquidity of economic

entities, bln. rubles**

Total money transfers, bln. rubles

Fee and commission income, bln. rubles

Growth of capital liquidity of economic

entities, bln. rubles**

Total money transfers, bln. rubles

Fee and commission income, bln. rubles

Growth of capital liquidity of economic

entities, bln. rubles**

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

q-ty,

mln.

pcs.

volum

e, bln.

rubles

0.09

1,396.

8

1,409,815.3

1,268.8

128.0

1,253,169.2

1,127.9

268.9

1,096,523.0

986.9

409.9

783,230.7

704.9

691.9

1,715.7

1,566,461.4

* The rate value is determined by calculation based on the ratio of commission income of credit institutions and the volume

of remittances for the year

** The value of the capital liquidity growth of economic entities corresponds to the reduction of commission income of credit

institutions (For scenario 1, column 4 - column 6)

Source: compiled according to the Central Bank of the Russian Federation

4 CONCLUSIONS

Thus, based on the results, we can state that within the

framework of the considered effects caused by the

blockchain technology diffusion into the economic

environment, an increase in gross domestic product is

possible by 1,028.0 bln. rubles, which is about 1.0%

according to data for 2019. Thus, it can be argued

about a very significant role of the use of distributed

data storage technologies in the implementation of

state policy aimed at digital transformation. At the

same time, it is important to note that this possible

increase shall be classified as conservative, since the

basis, when carrying out scenario calculations, are

made adjustments that characterize the very moderate

possible transformations of the factors used in the

cointegration model.

It is worth noting that the purpose of this study

was to strengthen formalized approaches to the study

of the scientific and practical problem against the

background of the overwhelming predominance of

qualitative approaches to blockchain technology and

their possible impact on key macroeconomic

parameters.

Clearly, the proposed model and solutions cannot

claim to be a reference algorithm for the

implementation of this kind of research. Realizing the

depth of the problem, it is necessary to state in a

completely unambiguous way about a wider set of

factors and processes in the economy, transforming

under the impact of the distributed data storage

technology penetration into the economic

environment.

Meanwhile, the built-in potential of the developed

model, including, among other things, a scenario

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

330

analysis of possible adjustments of exogenous factors

in the context of an extremely limited information

base that reveals the characteristics and prospects for

the blockchain technology penetration into real and

financial sectors of the national economy, makes it

possible to outline not only probable consequences,

but also to obtain formalized estimates of the

probabilistic change in the gross national product. It,

in turn, opens up new horizons for interpreting the

prospects and feasibility of legalizing blockchain

technology and creates new opportunities for holding

discussion platforms on this topic.

ACKNOWLEDGEMENTS

The study was performed based on a grant from the

Russian Science Foundation (project No. 19-18-

00202).

REFERENCES

Bariviera, A.F., Basgall, M.J., Hasperué, W. and Naiouf, M.

(2017). Some stylized facts of the Bitcoin market.

Physica, 484: 82–90.

Butenko, E. D. (2018). Outlines of the application of

blockchain technology in a financial organization.

Finance and Credit, 24 (6): 1420-1431.

Cocco, L., Concas, G. and Marchesi, M. (2017). Using an

artificial financial market for studying a cryptocurrency

market. Journal of Economic Interaction and

Coordination, 12(2): 345-365.

Coindesk (2017). Blockchain Q1 Report. Retrieved from

http://www.coindesk.com/coindesk-releases-state-of-

blockchain-q1-2017-research-report/

de Meijer, C. R. W. (2016). Blockchain and the securities

industry: Towards a new ecosystem. Journal of

Securities Operations & Custody, 8(4): 322-329.

Fortune (2016). Blockchain Will Be Used by 15% of Big

Banks By 2017. Retrieved from

http://fortune.com/2016/09/28/blockchain-banks-2017

Granger, C. W. J. (1969). Investigating Causal Relations by

Econometric Models and Crossspectral Methods.

Econometrica, 37(3): 424–438.

Guo, Y. and Liang, C. (2016). Blockchain application and

outlook in the banking industry. Financial Innovation,

2(1): 24.

Kim, K. J. and Hong, S. P. (2016). Study on Rule- based

Data Protection System Using Blockchain in P2P

Distributed Networks. International Journal of Security

and its Application, 10 (11): 201-210.

Konopleva, Yu.A. (2018). Blockchain as a new stage in the

development of the Russian economy. Economics and

Management: Problems, Solutions, 5(4): 136-140.

Markov, M.A. (2018). Blockchain: history of development

and application in the modern world. Banking, 1: 69-

75.

Myers, M. D. and Newman, M. (2007). The qualitative

interview in IS research: Examining the craft.

Information and organization, 17(1): 2-26.

Nakamoto, S. Bitcoin: A peer- to- peer electronic cash

system (2008). URL: https://bitcoin.org/bitcoin.pdf

Nurmukhametov, R.K. (2018). Blockchain technology and

its application in trade finance. Financial analytics:

problems and solutions, 2(344): 179-190.

Pazaitis, A., De Filippi, P. and Kostakis, V. Blockchain and

value systems in the sharing economy: The illustrative

case of Backfeed. Technological Forecasting and

Social Change.

Pekhtereva, E.A. (2018). Prospects for the use of

blockchain technology and cryptocurrency in Russia.

Economic and social problems of Russia, 1(37):71-95.

Pieters, G. and Vivanco, S. (2017). Financial regulations

and price inconsistencies across Bitcoin markets.

Information Economics and Policy, 39: 1-14.

Popov, V.A. (2018). General trends in the development of

technology and philosophy of blockchain in the coming

years. Banking, 3: 14-19.

Safiullin, M.R, Krasnova, O.M. et al. (2018). Peculiarities

of assessing inclusive growth at the regional level (on

the example of the Republic of Tatarstan). Nizhny

Novgorod.

Sopilko, N.Yu. (2018). Blockchain technology and ways of

its promotion in the modern world. Economy and

Entrepreneurship, 1(90): 606-610.

The date of the launch of the national cryptocurrency of

China has become known. RBC. Access mode:

https://www.rbc.ru/crypto/news/5e982b909a7947cba2

87a41b, free (04/29/2020)

Tilooby, Al. (2018). The Impact of Blockchain Technology

on Financial Transactions. Dissertation. Georgia State

University.

Vranken, H. (2017). Sustainability of bitcoin and

blockchains. Current Opinion in Environmental

Sustainability, 28: 1-9.

Watson, M.W. (1994). Vector Avtoregression and

Cointegration. Handbook of Econometrics, 4: 2844-

2915. Amsterdam: North-Holland.

Yli-Huumo, J., Ko, D., Choi, S., Park, S., and Smolander,

K. (2016). Where Is Current Research on Blockchain

Technology? A Systematic Review. Plos One, 11(10):

e0163477-e0163477.

Assessment Technique of the Impact of Blockchain Technology Diffusion on the Sustainable Development of the National Economic

System (on the Example of the Russian Federation Economy)

331