On the Issue of the Management Paradigm and Improving the

Methodology for Assessing the Level of Economic Security of an

Economic Entity

E. Karanina

1

and N. Abasheva

1

1

Vyatka State University, Kirov, Russia

Keywords: Economic security, indicator approach, security risk assessment.

Abstract: The article examines problems of changing the management paradigm of business entities in the context of

achieving security goals and influencing the state on its formation. The authors state that to create security

conditions for an organization of any legal form and form of ownership, it is necessary to follow the purpose

and value of a particular entity, which is strategically the foundation for its security. Having analyzed the

experience of applying various methodological techniques to assessing the level of economic security of

organizations, the authors suggest and substantiate an approach based on using calculated indicators

(coefficients) of acceleration (deceleration) of quantitative values of economic security indicators. A specific

example demonstrates the possibility and feasibility of the proposed technology for diagnosing the security

state, proves the advantages of this assessment in the dynamics of the economic system.

1 INTRODUCTION

The problem of ensuring the economic security of

entities at the level of theoretical research and

implementing a risk-oriented mechanism in the

activities of the primary link of the economy is

currently based on a number of scientific approaches.

Each approach is a certain stage in the development

of scientific and practical thought within the

framework of the considered question. According to

the evolutionary method, we can distinguish the

following conceptual approaches to managing an

organization in the context of security problems:

- an informational approach based on the leading

role of the information subsystem and, in many

respects, ignoring other internal and external sources

of threats;

- a defensive approach, which prioritizes the

organization's readiness to confront current external

threats, ignoring their dynamics and creating a

preventive mechanism;

- an institutional approach providing the creation

of a full-fledged environment for the functioning of

an economic entity in a security mode, but at the same

time transfers the center of gravity in decision-

making in this area to the macro level;

- a competitive approach that motivates an

organization to form such key success factors that

allow to withstand competitive pressure or lead the

market, but at the same time concentrate its efforts on

creating competitive advantages, sometimes without

taking into account other risks to economic security;

- a resource-functional approach (embedded in the

definition of the "economic security"), it shifts the

center of gravity in assessing this phenomenon solely

on the factors of providing the organization with

various types of resources and their effective use,

which can often contradict the multifunctional role of

security requirements as conceptual basis for the

existence of an economic entity;

- a situational approach that focuses on the

specific situation with variables affecting the

activities of organizations, and is the foundation for

using a set of methods for interpreting the situation. It

is necessary for making decisions in the field of

security, but at the same time, often putting the

organization before choosing the priority of a specific

functional safety subsystems to the detriment;

- a process approach, which determines the need

to form a sequence of actions and operations, taking

into account the target to ensure the safety of various

subsystems of organizations.

Karanina, E. and Abasheva, N.

On the Issue of the Management Paradigm and Improving the Methodology for Assessing the Level of Economic Security of an Economic Entity.

DOI: 10.5220/0010694400003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 117-123

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

117

Subsequently, the evolution in views on security

issues led the scientific world to interpret this

phenomenon from the standpoint of forming new

paradigms in management, implemented on the basis

of an integrated, systematic and strategic approach.

However, despite their indisputable significance and

applied value in the management of an organization

with its focus on safety, there are methodological

problems that require immediate solutions, confirmed

by the low effectiveness of business entities in a

safety mode.

The authors' analysis of theoretical studies and the

assessment of the enterprises experience in different

industries, made it possible to divide the existing

methodological problems into 2 groups. The first

group relates to the purpose of the functioning of the

security system at the level of the primary link of the

economy. The second one is a directly related

assessment of the level of economic security of the

organization. The solution of these methodological

issues predetermined the goal and objectives of the

study Its novelty is determined, on the one hand, by a

different strategic vision of security tasks at the

micro-level, on the other hand, by the proposal of the

author's model for assessing the safety state of

business entities.

2 MATERIALS AND METHODS

Studying questions of the article was based not so

much on the economic meaning of the concept

"economic security", but on the emerging

contradictions of its logical interpretation from the

standpoint of cause-and-effect relationships. I.S.

Yakshina in her works refers to a certain

contradiction in the definition of this concept. In her

opinion, “the phenomenon of economic security must

be considered from the definition of its derivative -

“economic danger”. Without it, according to the

dialectical approach, security cannot exist, therefore,

cannot be chosen as the beginning of research. In

modern Russian science, the concept of "security" is

interpreted as a state when there is no danger. Danger

is understood as some degree of threat. We believe

that there can be no “state when there is no danger”,

since if there is an object, then there is a set of factors

that threaten it” (Yakshina, 2013).

Studying this issue, the authors's purpose was not

to carry out a philological examination of the

concept,. But these conclusions made it possible to

form a new conceptual approach to defining the place

of the phenomenon "economic security" both for a

specific market entity and for the state as a whole,

focusing on national security problems. According to

the authors, the position of G.V. Ivaschenko should

be taken into account. In his work "On the concept of

security", he states that security is not a state of

protection of the subject's interests. Security means

conditions in which subjects preserve and reproduce

their values (Ivashchenko, 2000). As a consequence,

I.S. Yakshina offers the following interpretation of

this concept: “ensuring economic security is the

process of creating such conditions for the existence

of economic entities, which imply not only the

preservation and protection of a certain essential

position, but also the creation of opportunities for

entering a new, higher level development and

prosperity in conditions of uncertainty and risk, since

only development expands and strengthens internal

potential” (Yakshina, 2013).

The question is who should create these

conditions, who is the subject of forming security

conditions? Starting from a systematic approach and

taking into account that the security subsystem of an

economic entity is inscribed in the general system of

national security, it is necessary to place this problem

for joint management of the organization and the

state. At the same time, the role of the state should be

realized not only in the context of creating a

comfortable legal and other "field" for business,

providing the conditions when decisions on creating

a security system will be generated by each market

entity. It is about the role of the state, which will

subordinate these conditions, and, consequently, the

activities of economic entities to a certain doctrine.

Their essence is determined by the purpose of the

given entity in the market. First of all, it is necessary

to amend the current legislation. For example, the

Civil Code, defining the purpose of a business entity

in the market, orients the latter towards making a

profit. Profit for a commercial organization is

considered as the goal of its activities and a criterion

of economic security. At the same time, profit or loss,

as a category of economic science, is a financial

result, which means that it cannot be a goal. There is

a violation of cause-and-effect relationships.

The creation of security conditions proceeds from

the purpose and value of a particular entity, which is

strategically the foundation for its security. Taking

into account the existing economic culture, which is

emerging in the domestic market, such an ideological

position should be formed by the state, proceeding

from its own national security goals, subordinating

them to the security goals of a particular market

entity.

Let us give a specific example. The aim of

commercial banks is to fulfill the transmission task in

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

118

the economy, directing free financial resources of

enterprises and the population into the domestic

economy, including investment purposes. A sharp

decline in the share of lending, including investment

lending, in active banking operations and an increase

in income from speculative operations negatively

affect the economic security of the state. However,

given the significant growth in the banking sector's

profits, we can speak of an increase in the security

potential of the financial sector of the economy with

the existing assessment methods. Thus, the

strategically wrong accents and the infrastructure

system begins to work for itself, in spite of its

intended role in the national security system. Taking

into account the requirements for building a security

system in the state, there is a conflict: the goals (tasks)

of a lower level (specific market participants) begin

to conflict with the goals of a higher (national) level.

Only the state can correct this situation, having

clearly defined the target guidelines for building a

system of economic security of economic entities.

Another component of the problems is the

assessment of economic security at the micro-level.

This issue is natural, since the process of making

decisions on ensuring economic security begins with

the diagnostic stage. Its effectiveness is determined

by the methodological approaches and techniques

that the analyst uses in this activity.

At present, with a wide variety of methods for

diagnosing economic security systems of economic

entities, the main application is methods of indicator

assessment. Within this approach, the main questions

are about the indicators used for diagnostic purposes

and their thresholds. The most commonly used

indicators are for assessing the financial condition

and use of financial resources. According to some

authors (Sergeeva, 2019, Karanina, Ryazanova,

Gritsuk, 2018, Klychova, Zakirova, Dyatlova,

Klychova, Zaugarova, Zalyalova, 2019), the most

preferred indicators are for assessing liquidity,

financial stability, turnover and profitability. On the

basis of partial deviations from the threshold values,it

is possible to get an integral indicator, while

researchers offer different approaches to determining

the weight coefficients (scores) that define the

contribution of each indicator to the overall

assessment of the level of economic security

(Azarenko, 2017).

Another common approach to assessing the level

of economic security is the approach tested in risk

management technology. The variety of methods

existing here can be summarized by qualitative and

quantitative interpretation of risks. Some authors

propose a methodology for integral risk assessment,

where the materiality of risk is taken as a weighting

indicator (Aleksandrov, 2019). There are other

approaches to assessing the level of economic

security: an integrated approach that basically

combines an indicator approach and an approach

based on risk diagnostics; bankruptcy diagnostics and

others.

However, practical experience with various

methods does not give the analyst satisfying results.

The main reasons of it are the following. First of all,

such a widespread approach requires an objective

selection of evaluation criteria for the organization's

activities in the safety mode, and a set of indicators

that determine each of the criteria. It is simply

illogical to use here standard approaches without

taking into account the specifics of the organization's

activities. But the problem is associated with the

threshold values of indicators, which, in some cases,

should have a completely different meaning than the

generally accepted one. For example, the autonomy

coefficient for trade enterprises, and in some cases, it

is simply impossible to establish threshold

(normative) values. However, from a methodological

point of view, the described situation is even more

problematic.

For the stage of assessing the actual state of the

economic security of an enterprise, using the

indicator method is extremely convenient. It

determines its widespread distribution. There are also

information bases that allow to get the initial

information. Its users can be third parties interested in

the assessment, for example, creditors. But after all,

analysis and assessment is the basis for planning, in

this case based on a system of indicators.

Unfortunately, in the practice of domestic enterprises,

such planning often leads to "technocratic methods of

correcting the values of indicators", substituting

tactical decisions for the strategy of forming a system

of economic security. Moreover, taking into account

the frequency of forming credentials, the safety

management process is more reminiscent of episodic

decisions of a spontaneous nature to bring individual

security subsystems into a stable state. Considering

that the balance sheet data is a state of the

organization on a specific date, which does not reflect

the actual dynamics in the development of the system,

it is necessary to switch to assessing the dynamics of

indicators. It is also advisable for domestic

enterprises to select those indicators which help to

more clearly assess the state of security. Each

industry needs its own threshold values of indicators,

since the goal is to achieve an optimal level of safety.

In the next section of the article, we substantiate these

proposals giving an example of the financial

On the Issue of the Management Paradigm and Improving the Methodology for Assessing the Level of Economic Security of an Economic

Entity

119

subsystem of economic security of the timber

industry complex of the Kirov region.

3 RESULTS AND DISCUSSION

Improving the indicator assessment mechanism in

order to analyze and monitor the financial subsystem

of the economic security of enterprises, the authors

proceed from the following provisions.

1. It is necessary to eliminate the separation of

actual methods of assessing the financial

condition and the values of indicators calculated

on this basis from the calculation of

performance indicators and risks of financial

and economic activities, calculated on the basis

of data of internal management accounting and

strategic analysis of the environment (for

example, analysis of strategic risks of financial

activities, etc.).

2. It is necessary to make industry-specific

adaptation of threshold values of indicators and

their actualization, taking into account modern

realities and adjustments to the concept of

financial management. For example, if in the

early 2000s the value of the financial leverage

ratio exceeding 2 was considered critical, now a

large number of organizations, especially public

ones, demonstrate values that significantly

exceed this indicator.

3. It is necessary to change the methodological

approach to using threshold values of indicators,

which should be based not on the level of

achievement of the desired value of the

indicator, but on its dynamics. It is necessary to

ensure proper correctness in the estimates of the

financial subsystem of the organization due to

the deterioration of the parameters of the

external environment in conditions of

deployment the global financial crisis and the

consequences of the pandemic.

Let us illustrate this approach using the example

of enterprises in the forestry and logging industry.

Initially, the geometric mean formula calculates

changes in the values of indicators for a set of

financial indicators, the average industry values for

which are determined on the basis of the consolidated

statements of enterprises in the industry, for example,

for the period 2014-2019.

For example, the calculation of the geometric

mean by the current liquidity ratio is the following:

К=

1,1415 ∗ 1,1554 ∗ 1,1928 ∗ 1,1679 ∗ 1,1980

= 1,08

Calculations are made in the same way for the

entire list of indicators selected for analysis. Let us

call the obtained values the coefficients of

acceleration (deceleration) of financial indicators.

Comparing the indicator of industry dynamics for

the corresponding indicator with a similar indicator

for the investigated enterprise, it is possible to

determine the nature of the development of the

hazard, or, on the contrary, strengthening the security

potential of the enterprise to the basic level.

The table below summarizes the results of

comparative calculations for the selected range of

indicators for enterprises in the timber industry.

Table 1: Comparative table of the acceleration (deceleration) coefficients of the values of the financial indicators of the studied

enterprise and the average values of the indicators for the enterprises of the timber industry.

Financial indicator

Acceleration

(deceleration)

coefficient for the

enterprise

Acceleration (deceleration)

coefficient for the timber

industry

Deviation of the coefficient

for the enterprise from the

industry coefficient%

Assessment (impact

on the state of

economic security of

the enterprise)

Financial soundness indicators

Autonomy ratio 3,26 1,15 183 positive

Financial leverage ratio

0,4 0,85 -53 positive

Equity capital

flexibility ratio

0,41 0,96 -57 negative

Solvency indicators

Current liquidity ratio

1,81 1,08 68 positive

Quick ratio

1,81 1,03 76 positive

Absolute liquidity ratio

0,37 1,09 -66 negative

Profitability indicators,%

Return on sales,% 1,7 0,92 85 positive

Return on assets,% 0,7 0,82 -15 positive

Return on equity,% 1,2 0,84 43 positive

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

120

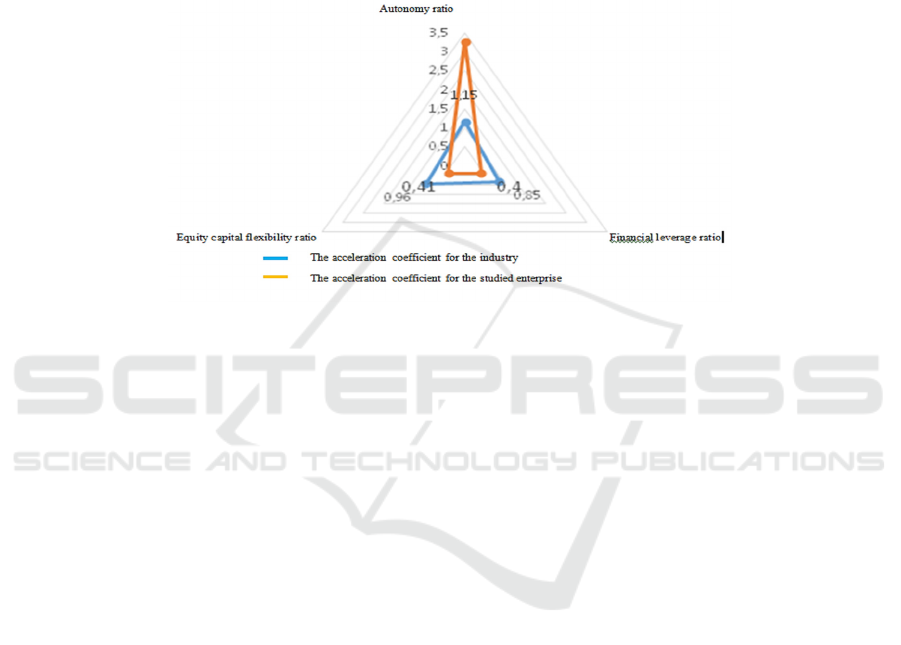

Next, let us move to building a risk map based on

the proposed improved indicator assessment method.

Fig. 1 shows the map of financial security risks within

the framework of the proposed methodology for

comparing the acceleration (deceleration)

coefficients of the values of the financial stability

indicators of the studied enterprise with the values of

the indicators for the timber industry. As it is seen, the

coefficient of acceleration of the autonomy indicator

in the enterprise is 183% higher than the industry

average. The company is increasing its financing of

its activities from its own funds at a faster rate than

the enterprises of the industry, which has a positive

effect on the state and safety potential.

The deceleration coefficient of the capital

maneuverability indicator shows that the capital of

the studied enterprise is prone to immobilization

compared to organizations on average in the industry.

It will have a negative impact when comparing their

security potentials.

Figure 1: Map of financial security risks within the framework of the proposed methodology for comparing the acceleration

(deceleration) coefficients of the values of the financial stability indicators of the studied enterprise with the values of the

indicators for the timber industry.

Figure 2 presents a map of financial security risks

within the framework of the proposed methodology

for comparing the acceleration (deceleration)

coefficients of the values of the solvency indicators

of the studied enterprise with the values of the

indicators for the timber industry.

The acceleration coefficient for the current

liquidity indicator of the enterprise is higher than the

analogous coefficient for the industry in general. This

means that the enterprise increases its prospective

solvency every year. Enterprises in the timber

industry do this at a slower rate.

A similar situation is observed regarding the

acceleration factor for the quick liquidity indicator.

The analyzed coefficient of the enterprise is 76%

higher than the average for the industry enterprises.

This determines great opportunities for the studied

organization in comparison with the industry

enterprises to repay short-term liabilities using the

most liquid assets (cash and short-term investments),

as well as timely collection of short-term receivables.

The opposite conclusion concerns the rate of

deceleration of the absolute liquidity indicator. The

deviation of this indicator for the enterprise in

comparison with the coefficient of its acceleration for

the industry in general is 66%, which may indicate an

increase in problems with instant solvency and cause

serious risks from the standpoint of economic security

On the Issue of the Management Paradigm and Improving the Methodology for Assessing the Level of Economic Security of an Economic

Entity

121

Figure 2: Map of financial security risks within the framework of the proposed methodology for comparing the acceleration

(deceleration) coefficients of the values of the solvency indicators of the studied enterprise with the values of the indicators

for the timber industry.

Next, we conduct a study of the acceleration

(deceleration) coefficients of profitability indicators

(within the selected set of indicators) for the studied

organization and for the industry as a whole and

illustrate it using the risk map in Figure 3.

The acceleration coefficients in terms of return on

sales and return on equity in the studied enterprise are

higher than the average for enterprises in the industry,

which positively characterizes the commercial

subsystem and the potential for strengthening the

economic security of the enterprise.

The organization invests its own funds more

efficiently in production and economic activities in

comparison with using its own funds in the forest

industry as a whole. As for the rate of deceleration of

the profitability of assets, we can conclude that the

efficiency of using assets at the enterprise, in the

presence of a downward trend in the industry as a

whole, is much lower.

Figure 3: Map of financial security risks within the framework of the proposed methodology for comparing the acceleration

(deceleration) coefficients of the values of the profitability indicators of the studied enterprise with the values of the indicators

for the timber industry

4 CONCLUSIONS

The approach proposed by the authors allows a more

correct assessment of the level of economic security

of the primary link of the economy, supplementing

the traditional indicator approach with the

introduction of calculated indicators (coefficients) of

acceleration (deceleration) of quantitative values of

indicators. The set of the latter is determined by the

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

122

analyst. This technology allows to solve the problem

of the threshold values of indicators that are specific

for each industry. On the other hand, it provides an

opportunity to assess the state of safety in dynamics,

and not to fix the fact of deviation from any standard

value, the value of which is not always objective.

Moreover, this approach allows to take into account

the industry characteristics and the influence of the

external and internal environment on the processes in

the industry, which makes the conclusions more

objective, and the decisions in the field of economic

security realizable.

ACKNOWLEDGEMENTS

The article was prepared with the support of the grant

of the President of the Russian Federation NSh-

5187.2022.2 for state support of the leading scientific

schools of the Russian Federation within the

framework of the research topic «Development and

justification of the concept, an integrated model of

resilience diagnostics of risks and threats to the

security of regional ecosystems and the technology of

its application based on a digital twin».

REFERENCES

Azarenko, N. Yu., 2017. Application of the system-target

development model in assessing the economic security

of an economic entity. In International scientific

research journal. 10(64). 2. pp. 70-74.

Aleksandrov, G. A., 2019. Economic security and

investment attractiveness of enterprises: the nature of

the relationship and the problem of assessment. In

Economic relations. 9(3). pp. 2269-2284.

Ilysheva, N., Karanina, E., Baldesku, E., Zakirov, U., 2017.

Detection of the Interdependence of Economic

Development and Environmental Performance at the

Industry Level. In Montenegrin Journal of Economics.

13(4). pp. 19-29.

Ivashchenko, G.V., 2000. On the concept of "safety". In

Theoretical journal CREDO. 24.

Karanina, E., Ryazanova, O., Gritsuk, N., 2018. Conceptual

approach to the assessment of economic security of

economic entities on the example of transport

enterprises. In International Scientific Conference

Environmental Science for Construction Industry –

ESCI 2018 MATEC Web Conf. 20 August 2018. 193. p.

8.

Karanina, E., Kartavyh, K., 2017. Economic security of

modern Russia: The current state and prospects. In

MATEC Web of Conferences: 2017 International

Science Conference on Business Technologies for

Sustainable Urban Development (SPbWOSCE 2017),

St. Petersburg, 20-22 Deсember 2017. p. 170.

Karanina, E. Yurieva, L., Dolzhenkova, E., 2018. Assessing

the innovative attractiveness of industrial companies in

the conditions of high uncertainty. In Espacios. 39. 28.

Klychova, G., Zakirova, A., Dyatlova, A., Klychova, A.,

Zaugarova, E., Zalyalova, N., 2019. Methodological

tools to ensure economic security in the personnel

management system of enterprises. In Innovative

Technologies in Environmental Science and Education

(ITESE-2019) E3S Web Conf. 04 December 2019. 135.

p. 13.

Sergeeva, I.A., 2019. Analysis of methodological

approaches to assessing the economic security of an

enterprise. In Modern economy: problems and

solutions. 8 (116). pp. 64-78.

Yakshina, I.S., 2013. Modern theoretical approaches to the

content of the category of economic security of subjects

of economic activity. In Humanitarian research. 10.

On the Issue of the Management Paradigm and Improving the Methodology for Assessing the Level of Economic Security of an Economic

Entity

123