Neural Networks Usability Analysis in Economic Security Indicators

Dynamics Forecasting

Anna G. Shmeleva

a

, Evgenii S. Mityakov

b

and Andrey I. Ladynin

c

Institute of Integrated Safety and Special Instrument Engineering, Informatics department, MIREA – Russian Technological

University, 78 Vernadsky Avenue, 119454, Moscow, Russia

Keywords: Economic security, Economic security indicators, Neural networks, Time series forecasting, Machine learning.

Abstract: The paper is devoted to neural network applicability analysis in economic security indicators forecasting

models. Exchange indicators usage makes it possible to introduce tools for economic security operational

monitoring, since they largely determine the economic environment dynamics development. Neural networks

training and various models comparative analysis for economic time series values predictions were carried

out using the dollar / ruble exchange rate example. The paper presents two initial data sets analysis with

information content of different amounts. Predictive indicators calculation was carried out using three neural

networks different models and gradient boosting method. The results obtained in the work make it possible

to identify the best neural network model for target indicators prediction, as well as to analyse neural networks

approaches effectiveness’ in the problems under consideration, depending on the dimension of the initial data.

Based on the simulation’s results, there is a conclusion, that neural network methods in economic security

indicators forecasting can be justified only on a significant sample size.

1 INTRODUCTION

Modern technological capabilities open up prospects

for new tools usage regarding economic processes

studies in systems of various hierarchy. It seems

intuitive and scientifically substantiated that

operational forecasting and strategic control require

the automated information systems widespread

implementation, including those based on artificial

intelligence methods and machine learning

algorithms (Tomashevskaya, 2020). Thus, in modern

realities, machine learning methods are highly

involved in solving various economic problems and

are being implemented in almost all spheres of human

life. The corresponding algorithms find their

application both for economic processes in a broad

sense analysis, and for solving specific practical

business problems, becoming one of the management

problems top-notch analysis tools (Shamin, 2019).

One of the key and widely discussed problem

classes, which analysis mechanisms allow modern

machine learning and artificial intelligence tools

a

https://orcid.org/0000-0003-2300-3522

b

https://orcid.org/0000-0001-6579-0988

c

https://orcid.org/0000-0001-7659-2581

usage is economic indicators forecasting, since, as a

rule, the analyzed values are quantitatively set by time

series.

An important task in various hierarchies systems

economic processes studies can undoubtedly be the

ensuring economic security problem. Analysis,

forecasting, monitoring and economic security

management problems regarding national economy

subjects are quite acute nowadays, due to endogenous

and exogenous environment constantly changing

situation. Appropriate scientific and methodological

basis development will allow in a fairly accurate

manner to predict relevant indicators values and, as a

result, make scientifically grounded management

decisions in order to minimize certain processes

negative impact. New challenges and threats dictate

new breakthrough technologies needs in management

tasks at all national economy levels.

Corresponding economic security indicators

operational control, analysis and dynamics

forecasting in order to ensure an appropriate

considering object safety level, along with traditional

Shmeleva, A., Mityakov, E. and Ladynin, A.

Neural Networks Usability Analysis in Economic Security Indicators Dynamics Forecasting.

DOI: 10.5220/0010695400003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 149-154

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

149

methods, require modern threats predicting

algorithms usage and effective strategies choice,

oriented on possible consequences prevention

(Shmeleva, 2019). Considering social and economic

processes, world’s digital transformation, computing

systems technological capabilities exponential

growth alongside with databases and information

storages significant development, machine learning

could be effectively used as an approach towards the

raised problem solution (Chio, 2020; Hastie, 2009;

Flah, 2015).

Machine learning mathematical tools have been

increasingly and effectively used in social and

economic processes studies. In various fields of

scientific knowledge, supervised and unsupervised

learning, reinforcement learning methods are widely

used (Bata, 2020). Machine learning methodology in

economic problems is being explored in many

authors’ works. For example, works (Adadi, 2021;

Athey, 2018) analyze machine learning impact on

economy development as a whole, meanwhile article

(Mullainathan, 2017) describes relationships between

economics and "Big Data" technologies.

In economic systems security indicators analysis

and prediction, artificial intelligence methodology

and machine learning is presented mainly at the micro

level, mainly regarding taxation, lending and banking

fields (Andini, 2019; Andini, 2018; Chakraborty,

2017). In macro-level problems studies, named

toolkit is presented mainly in exchange rates and

indicators analysis, while regional and sectoral

economy level has a lesser extent. The paper is

devoted to neural network models set up and its

following usage in economic time series values

prediction comparative analysis based on dollar /

ruble exchange rate historical indicators. Later, this

toolkit can be used to predict other economic security

indicators that have initial data sufficient amount.

2 MATERIALS AND METHODS

Quite often, in order to obtain a forecast, it is required

to solve a regression problem, which consists of

quantitative values predictions based on known data

in the past (Drejper, 2007). Within the economic

security framework studies the regression problem

may appear when building predictive models for

threats occurrence and economic security indicators

values calculation in the foreseeable time interval.

For example it is required to create a model predicting

economic security indicators dynamics based on the

initial data. Building such model can be attributed

towards supervised machine learning task, since

initially there is a retrospective data set (previous

periods indicator values dynamics), thus model

results should consist of indicators predicted values in

a given forecasting horizon. The described problem

structure unambiguously refers to regression methods

solving.

One of the most common and relevant machine

learning methods for forecasting time series are

models based on neural networks mathematical

apparatus. During its operation, algorithms based on

neural networks usage are affected by learning, which

is a key advantage, allowing to be used in processing

and analyzing information. Technically, training is

characterized by finding the model connections

coefficients, identifying the dependencies between

input and output data. The class of mathematical

methods based on neural network modeling is quite

extensive, since neural networks can have different

characteristics, model types, hyperparameters

variable values sets. Consequently, neural network

one and only optimal type selection for predicting

economic dynamics is a complex, relevant scientific

task that goes beyond the scope of this study. In

addition, optimal model choice largely depends on

the amount and dynamics of the initial input data,

imposing additional difficulties in the analysis.

Nevertheless, in this work, three different neural

networks comparative performance analysis, as well

as the gradient boosting method, is carried out.

Solving economic forecasting problems using

neural network methods is often an alternative to

simulation and econometric analysis. At the same

time, it is known that neural network models for

economic processes are often characterized by

redundant information of a significant amount. There

are practically no systematic characteristics of the

described phenomenon essence. The neural network

approach states the fact that it is possible to transform

a set of input parameters into an output variable with

a sufficiently high accuracy. Meanwhile, the input

variables number can be quite significant (several

thousand), and training and tuning a neural network

requires many model experiments. In this regard, the

expediency question usage such tools in specific

analysis practical problems and forecasting in various

levels economic security systems remains open.

In our opinion, the neural networks apparatus

usage is advisable in combination with traditional

econometric analysis methods. Moreover, neural

network mathematical apparatus implementation is

justified only with a significant sample size initial

data, which is far from standard regarding on the

indicators adopted in official documents basis, since

they usually have a measurement frequency of one

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

150

month or more. Thus, it is advisable to use neural

network forecasting methods as an auxiliary tool in

stock indicators or exchange rates analysis likewise

other indicators with a fairly extensive measurements

base. Nevertheless, comparative analysis using

results, obtained with traditional econometrics and

machine learning models can significantly enrich

research conclusions, as well as enchance results

explanation and interpretation abilities with neural

network modeling capabilities.

Speaking of time series forecasting, several

approaches were used allowing to analyze initial data

using different neural network models in order to

achieve objective results comparison. The long short-

term memory network known as the LSTM model

was chosen at first. Model’s formal definition, which

includes the so-called forgetting gates, can be noted

down as follows:

𝑓

= 𝜎

𝑊

𝑥

+𝑈

ℎ

+𝑏

,

(1.1

)

𝑖

=𝜎

𝑊

𝑥

+𝑈

ℎ

+𝑏

,

(1.2

)

𝑜

=𝜎

𝜎

𝑊

𝑥

+𝑈

ℎ

+𝑏

,

(1.3

)

𝑐

=

𝑓

∘𝑐

+

+𝑖

∘𝜎

𝜎

𝑊

𝑥

+𝑈

ℎ

+𝑏

(1.4

)

ℎ

=𝑜

∘𝜎

𝑐

,

(1.5

)

where: 𝑥

, ℎ

stand for input and output vectors

respectively, 𝑐

represents system’s states vector;

𝑊,𝑈,𝑏 are parameters matrix and vectors, 𝑓

, is a

forgetting gate vector, 𝑖

,𝑜

define input and output

gate vectors, respectively.

It should be noted that model (1.1-1.5) is widely

applicable to the time series problems analysis, which

is explained by its relatively high accuracy in relation

to the initial data under study. For comparative

analysis needs, the second chosen approach refers to

a recurrent network model, which is considered as a

basis for short-term memory networks development

(Bergmeir, 2021). Its formal record can be

represented as follows (2.1, 2.2).

ℎ

=𝜎

𝑊

ℎ

+𝑉

𝑥

+𝑏

,

(2.1

)

𝑧

=tanh

𝑊

ℎ

+𝑏

,

(2.2

)

where: ℎ

stands for hidden state, 𝑧

refers to

input and output parameters for the 𝑡 moment of time.

𝑊

и 𝑉

define weight matrices, 𝑏

– stands for bias

vector.

The third model for comparative analysis was the

RBF network, which uses radial basis functions as a

tool for neurons activation (Truc, 2018). As a rule,

RBF networks assume three layers, including an

input, nonlinear activation layer and a linear output.

The model can be represented as a real values vector,

and the output vector is determined based on the

following 𝜑 𝑅

→𝑅

mapping (3).

𝜑

𝑥

=𝑎

𝜌

|

𝑥−𝑐

|

,

(3

)

𝑁 determines hidden layer neurons number, 𝑐

is

a neuron main hidden layer and 𝑎

stands for 𝑖-th

output neuron weight.

It is advisable to make the following assumptions

(4.1-4.3) for time series analysis and forecasting:

𝜑

0

=𝑥

1

,

(4.1

)

𝑥

𝑡

≈𝜑

𝑡−1

,

(4.2

)

𝑥

𝑡+1

≈𝜑

𝑡

=𝜑

𝜑

𝑡−1

.

(4.3

)

In addition to these three models, the comparison

also included gradient boosting method (XGBoost),

which is also often used for time series forecasting,

characterizing by a relatively higher prediction

accuracy over short time intervals and data with

seasonality pronounced presence. The gradient

boosting method is associated with a corresponding

optimization function aimed to improve model

training processes efficiency (5.1, 5.2).

𝐿

=

=𝑙

𝑦

,𝑦

+

𝑓

𝑥

+Ω

𝑓

,

(5.1

)

Ω

𝑓

=𝛾𝑇+

1

2

𝜆

|

𝜔

|

,

(5.2

)

where: 𝑙 is the loss function, 𝑦

,𝑦

are 𝑖 -th

sample element values used for training and 𝑡-first

predictors sum, 𝑥

represents 𝑖 -th training sample

elemt, 𝑓

notes function trained at step 𝑡, 𝑓

𝑥

is a

prediction on 𝑖-th training sample element, Ω

𝑓

is

function 𝑓 regularization, 𝑇 formalizes vertices

number in the analyzing tree, 𝜔 represents leaves

values, 𝛾 and 𝜆 are regularization parameters.

Summarizing, these tools make it possible to carry

out predictive information qualitative characteristics

comparative analysis obtained on the neural network

basis. Obtained results were interpreted in the

graphical form, ready for further analysis.

3 RESULTS AND DISCUSSION

Neural networks training and forecast data obtaining

were carried out according to the dollar / ruble

exchange rate historical values. This indicator

belongs to the exchange-traded, as well as oil price or

RTS index. Exchange indicators usage makes it

Neural Networks Usability Analysis in Economic Security Indicators Dynamics Forecasting

151

possible to introduce tools for economic security

operational monitoring, since they highly determine

corresponding conjuncture progress dynamics.

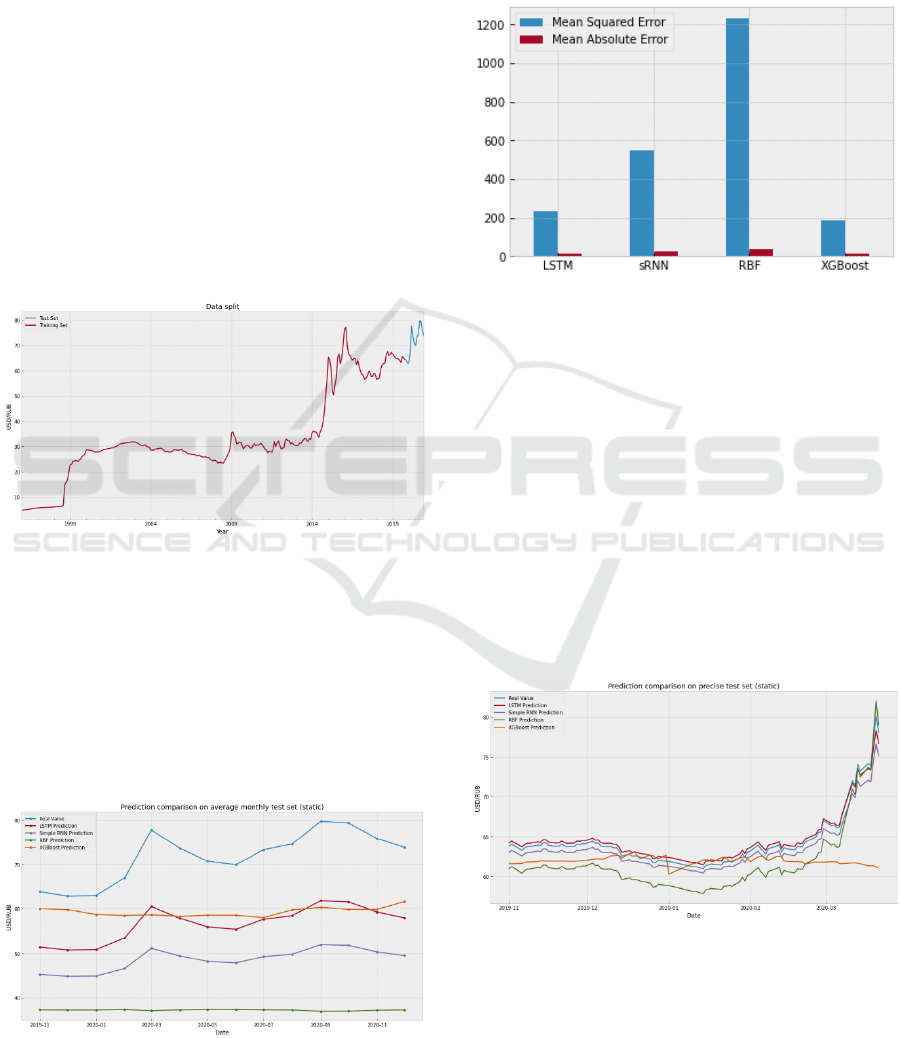

The first dataset contains dollar value in rubles

starting in January 1996 up to December 2020, with

observations made every month, so the total

observations number in the first dataset is 300. The

second dataset included dollar value in rubles from

March 21, 2000 to March 21, 2020, with daily

observations, 4968 observations in total. Despite the

higher observation frequency second set has many

missing days, such as weekends and holidays, as well

as occasional observations absences. Thus, second set

represents significantly large data amount, but it is

still incomplete and cannot be considered ideal. Both

data sets were divided into training and test sets in

accordance with the model requirements (Figure 1).

Values up to November 2019 were assigned to the

training set and observations starting from November

1, 2019 inclusive - to the test set.

Figure 1: Training and test samples dataset distribution

When the models were trained using the first set

consisting of 300 observations, as expected, the data

turned out to be insufficient for acceptable accuracy

predictions. The forecast using the XGBoost method

returned closest to the real data result, although it did

not repeat the trends. The radial basis function

network presented the worst result. Forecast

comparison results with real data on a segment of the

test sample are shown in Figure 2.

Figure 2: First dataset forecast results comparison

Based on presented forecasting models, it can be

concluded that gradient boosting method is highly

effective in studies based on priori information small

amount. However, it is obvious that such forecasts

have no practical sense with such a low accuracy.

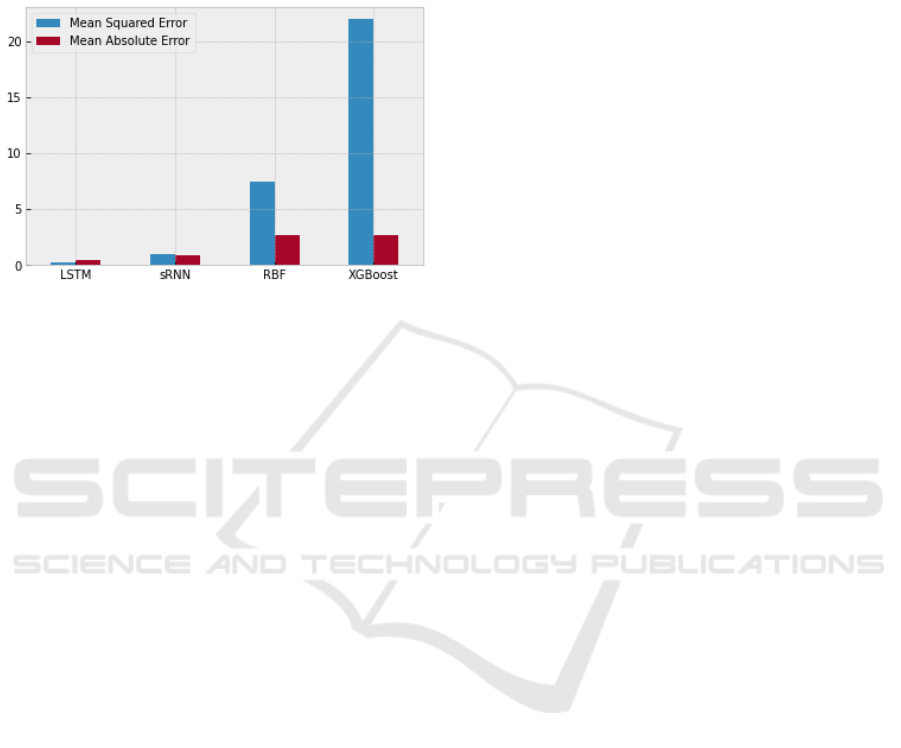

Figure 3 compares all methods root mean square and

mean absolute errors.

Figure 3: First dataset forecast errors comparison

Same models training on the second dataset with

a much higher observations frequency (and,

accordingly, a large number of them) provided a

qualitatively different result. All three neural network

models follow original data trends, in contrast to the

gradient boosting method, which shows average

value that is weakly correlated with real data over the

entire interval. The most accurate prediction was

recorded using the LSTM model with mean square

and mean absolute errors of 0.254327 and 0.4625752,

respectively. Apart from the XGBoost library, the

least accurate forecast was obtained using a network

of radial basis functions, however, it also came close

to real data near peak values in the segment’s end, as

shown in Figure 4.

Figure 4: Second dataset forecast results comparison

Obviously, in this case, neural network

predictions are much more accurate and more likely

to have practical use. It is expected that with large

training set representation, neural networks face

overfitting problem. However, in accordance with

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

152

this work’s purposes, aiming to show fundamental

differences in neural network models efficiency, the

comparison was made exclusively between the basic

models, without parameters precise manual

adjustment. Predicted indicators errors comparison

after second dataset training is shown in Figure 5.

Figure 5: Second dataset forecast errors comparison

4 CONCLUSIONS

Based on the presented analysis, the following

assumptions can be made: a dataset with a dimension

of 300 observations is clearly not enough to train

neural networks in order to predict such volatile time

series. Neural networks with LSTM and sRNN

models showed the best results in both cases,

respectively. The radial basis function network,

which performed the worst on the first set, gave a

much more accurate result due to training on a larger

sample. In both cases, gradient boosting method

returned a fairly average result, weakly correlating

with real data trends.

Thus, we can conclude that neural network

methods usage in economic security indicators

forecasting is justified only on a significant sample

size. Therefore, machine learning methods in

economic security analysis and forecasting problems

have not yet become widespread, since typical

research mainly involves indicators with a month or

more discrete interval. At the same time, machine

learning methodology in multi-level objects

economic security analysis will be more and more in

demand. This is mainly due to the information arrays

exponential growth and initial data structuring needs.

On one hand, machine learning algorithms provide

fast and accurate results, on the other hand, additional

resources are required.

Mathematical forecasting methods usage in

economic security indicators studies based on the

machine learning apparatus in combination with more

traditional analysis methods allow to reach adequate

comprehensive assessment results. This work results

make it possible to identify the most relevant neural

network model for economic systems indicators

prediction, as well as to compare various forecasting

methods effectiveness depending on the initial data

dimension. Thus, we advise to keep caution aimed to

secure management decisions effectiveness and

validity based on machine learning methods

evidence-based verification results. Compliance with

this requirement will create new perspectives in

analysis and forecasting, as well as reduce decision-

making associated risks.

REFERENCES

Tomashevskaya, V.S., Yakovlev, D.A., 2020. Additivity

condition for reference kiosk based on page load time.

In Russian Technological Journal.

Shamin, R.V., 2019. Machine learning in economics.

“Green print”. Moscow. p. 140.

Shmeleva, A.G., Ladynin, A.I. 2019. Industrial

Management Decision Support System: from Design to

Software. In Proceedings of the 2019 IEEE Conference

of Russian Young Researchers in Electrical and

Electronic Engineering (EIConRus).

Chio, K., Frimjen, D., 2020. Machine learning and security.

DMK Press. Moscow.

Hastie, T., Tibshirani, R., Friedman, J., 2009. The Elements

of Statistical Learning. Springer-Verlag.

Flah, P., 2015. Machine Learning. The science and art of

building algorithms that extract knowledge from data.

"DMK Press". Moscow.

Bata, M., Carriveau, R. & Ting, D.SK., 2020. Short-term

water demand forecasting using hybrid supervised and

unsupervised machine learning model. In Smart Water.

5. 2.

Adadi, A., 2021 A survey on data‐efficient algorithms in

big data era. In J Big Data. 8. 24.

Athey, S., 2018. The impact of machine learning on

economics. In The Economics of Artificial Intelligence:

An Agenda. University of Chicago Press.

Mullainathan, S., Spiess, J., 2017. Machine learning: an

applied econometric approach. In Journal of Economic

Perspectives.

Andini, M., 2019. Machine learning in the service of policy

targeting: the case of public credit guarantees. Bank of

Italy, Economic Research and International Relations

Area.

Andini, M., 2018. Targeting with machine learning: An

application to a tax rebate program in Italy. In Journal

of Economic Behavior & Organization.

Chakraborty, C., 2017. Machine learning at central banks.

Bank of England. Working Paper.

Drejper, N., Smit, G., 2007. Applied regression analysis.

«Vil'jams», Moscow.

Neural Networks Usability Analysis in Economic Security Indicators Dynamics Forecasting

153

Hansika Hewamalage, 2021. Recurrent Neural Networks

for Time Series Forecasting: Current status and future

directions. In International Journal of Forecasting. 37.

1.

Truc, N. V., Anh, D. T., 2018. Chaotic Time Series

Prediction Using Radial Basis Function Networks. In

4th International Conference on Green Technology and

Sustainable Development (GTSD).

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

154