Modern Digital Technologies and Banking Tools

Yulia Evdokimova

1a

, Elena Egorova

1b

and Olga Shinkareva

2c

1

Russian State Social University, Wilhelm Pic Str., Moscow, Russia

2

Moscow City University, Selskokhozyaystvenny Drive, Moscow, Russia

Keywords: digitalization of the banking sector, financial and technological solutions, bank lending, digital banks.

Abstract: The banking system is a kind of circulatory system of the economy, ensuring, in fact, the stability of the

national socio-economic system through the smooth functioning of the financial sector. Modern research

shows that the banking sector is ahead of pace introducing the latest digital solutions, so digitalization

increases the loyalty of consumers of banking products and services, increases the return on capital of financial

and credit institutions. Analysis of the modern development and application of digital solutions by banks

makes it possible to track the trajectory of development, to identify positive and negative nuances. Based on

a detailed study of the retrospective, it is possible to develop ways to further develop the banking sector and

digitalize it. The impact of digitalization on the development of the economy and society is not very clear. At

the same time as one of the most significant factors of global economic growth, digitalization carries many

risks, both identified at this stage of time and still in its infancy. These contradictions require an increased

study of all varieties of digitalization in various sectors of the economy.

1 INTRODUCTION

At the present stage, there is an active change and

improvement in all aspects of life. Digitalization at

the present stage is not something futuristic, but is

actively used in many areas. Digitalization is a driver

of the development and change of technological

development of any industry. In modern conditions,

digitalization is more necessary than ever, and the

main financial sphere of redistribution of financial

resources is the banking system, the bank is a key

participant in the market, the development and

optimization of which depends on the level of

digitalization and introduced financial innovations.

Most large banks at the present stage create

ecosystems, actively develop artificial intelligence,

create marketplaces, improve the big data analysis

system and qualitatively change the technological

base. All this allows not only to optimize the work of

the credit institution in many aspects at the present

stage, but also to simplify interaction with the main

consumer - the borrower. Active deepening in the

digital aspects of the present and future - the key to

a

https://orcid.org/0000-0003-1721-1368

b

https://orcid.org/0000-0002-0403-7391

c

https://orcid.org/0000-0003-2291-3516

attracting customers and simplifying in interaction

with the bank's customers, as well as the ability to

consolidate the status of a powerful technological

financial player.

The relevance of the research topic is due to the

fact that financial technologies in the banking sector

actively improve the quality of banking products and

develop a mechanism for providing services, as well

as facilitate interaction between the bank and the

client. Of particular importance is the crisis caused by

the pandemic, which has greatly affected the

deteriorating financial conditions of many credit

institutions.

Under these conditions, the application and

improvement of innovative financial solutions are the

main driver of stabilization and development of the

banking sector. That is why it is necessary to study

the extent to which the banking system of Russia at

the present stage has developed and applied the latest

financial and technological solutions in the field of

lending, and to indicate a trend in the future. Digital

transformation of the banking sector is based on the

peculiarities of changes in state national policy,

information technology innovations and management

Evdokimova, Y., Egorova, E. and Shinkareva, O.

Modern Digital Technologies and Banking Tools.

DOI: 10.5220/0010698200003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 259-263

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

259

processes (Evdokimova, Y., Egorova, E. and

Shinkareva, O. (2020). At the same time, creative

competition comes to the fore. These components can

ensure sustainable development and increase the

potential of the economy to meet the needs of society.

The purpose of this study is to analyze the

financial and technological solutions in the field of

lending applied by Russian credit institutions.

In order to achieve this goal, it is necessary to

solve a number of the following problems:

- study the degree of spread of fintech in Russia

- analyze the level of digitalization of Russian

banks

- Identify the main financial and technological

solutions in the area of lending

- to indicate the trend in the development and

dissemination of digitalization of banking products

and services.

The object of the study is the banking system of

the Russian Federation.

The subject of the study is the system of financial

and technological solutions in the field of bank

lending.

2 MATERIALS AND METHODS

The methods of research in this work are diverse,

especially analysis and synthesis should be

distinguished. The identification of the relationship

between qualitative and quantitative changes was

actively used. The methods of system analysis,

grouping, aggregation and comparison, factor

analysis are also used. The study applied methods of

tabular and graphical interpretation. The logical

sequence of the study involves a more analytical

approach, since it reveals the main stages and trends

in the development of the digital transformation of the

banking sector and its impact on socio-economic

systems.

3 RESULTS AND DISCUSSION

In order to study the digitalization of Russian banks,

it is necessary, first of all, to indicate the general level

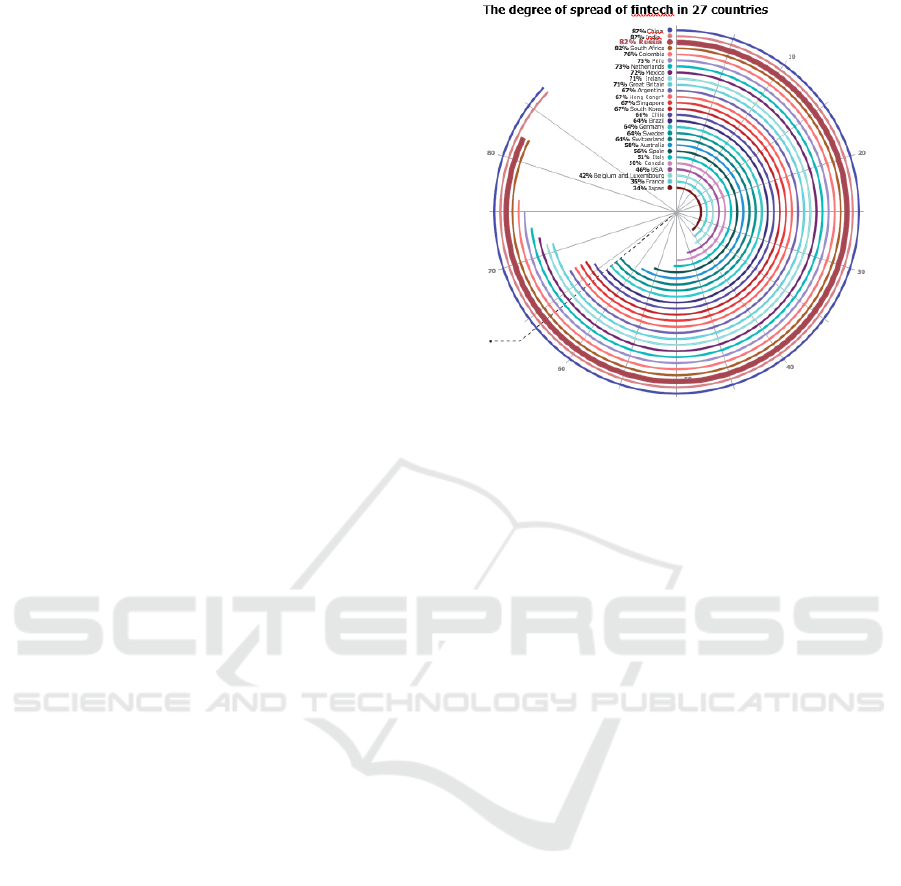

of digitalization in Russia (Figure 1).

In order to study the digitalization of Russian

banks, it is necessary, first of all, to indicate the

general level of digitalization in Russia (Figure 1).

Figure 1: Prevalence of fintech in 27 countries

(Bloomchain, 2019).

As can be seen from the figure presented, the level

of digitalization in Russia is 82%, which is a very

good result. Russia is among the top 3 countries in

terms of digitalization, while the level of distribution

of fintech is much ahead of many European countries.

This indicator is decisive, as it characterizes the level

of technological innovation in the country as a whole.

This applies to many sectors of the economy,

including banking. If we consider the level of

digitalization of companies in Russia and abroad, we

can note that about 70% of company executives in the

world have a well-developed digital transformation

program. In Russia, this indicator is 63%.

The pandemic of coronavirus infection has forced

banks to adapt to new technological conditions.

According to the Boston Consulting Group, Russian

banks turned out to be the most ready for digital

changes. In 2019, Russia took first place in terms of

penetration of contactless payments (Apple Pay and

Samsung Pay), and 3rd place in terms of penetration

by fintech service, as already noted above. And in 2

years, Russian banks closed about 3200 physical

branches, which indicates a high level of optimization

of remote banking and the provision of services. All

this indicates a high level of development of fintech

in the banking sector of Russia (Tadviser, 2020). As

for the main players and "engines" of fintech in the

banking area, there are 7 of them, and they are non-

banks: Tinkoff Bank, Module Bank, Point,

Rocketbank, Yandex.Money, Touch Bank, Talkbank.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

260

Table 1: Rating of leading digital banks by customer base

size (Tadviser, 2019).

№ Bank Country Number of clients

(

mln. of

p

eo

p

le

)

1 ING Diba German

y

8,5

2 Ca

p

ital One 360 USA 7,8

3 USAA Ban

k

USA 7

4 FNBO Direct USA 6

5 Rakuten Ban

k

Japan 5

6 Tinkoff Ban

k

Russia 5

7 TIAA Direct USA 3,9

8 Discover Ban

k

USA 3,5

9 Alior Ban

k

Polan

d

3

According to the table, it can be noted that the

Russian Internet bank Tinkoff Bank, along with the

Japanese Rakuten Bank, share fifth and sixth place in

the ranking of the world's leading digital banks with

a customer base of 5 million people, which is very

significant. It should be said that the opening of

Tinkoff Bank was the first step towards the

digitalization of the banking system of the Russian

Federation. For more than ten years, he has been

specializing in completely remote customer banking,

without having regional branches, but working with

the population in all cities of Russia. Other digital

banks operate in Russia, but it is Tinkoff that is the

only domestic bank in the top ten most popular

leading digital banks in the world.

Table 2: Rating of Russian banks by digitization level.

Bank Digitisation rating

Tinkoff Ban

k

1

VTB 2

Sberban

k

3

Raiffeisenban

k

4

Alfa-Ban

k

5

Sovcomban

k

6

Otkritie FC Ban

k

7

Home Credit Ban

k

8

Ak Bars 9

Ural Bank for Reconstruction and

Development

10

Promsvyazban

k

11

Bank "St. Petersburg" 12

Vostochn

y

Ban

k

13

Gaz

p

romban

k

14

MTS Ban

k

15

As for the level of digitalization of the main large

banks of Russia, a digitisation rating can be

distinguished, data - for February 2020 (Banki.ru,

2020).

Deloitte experts identify 3 groups of banks for

digitalization: Latercomers (Lagging), Adopters

(Followers), Smart Followers (Advanced Followers)

and Champions (Champions). According to the above

table, three Russian banks belong to the Champions

category, nine banks to the Advanced Users category,

and three more to the Followers category. It is also

worth noting the active interaction of Russian banks

with a partner - Skolkovo, which gives an advantage

in the launch and adaptation of new digital services.

Figure 2: Index of digitalization of banks by stages of

the client path (Deloitte, 2020).

When analyzing the six stages of the client's life

cycle, Russian banks showed a significant level of

digitalization at all stages of interaction with the

client. Above the average, respondents estimated the

level of the following processes: searching for

accessible information about banks, offered products

and cooperation conditions (in Russia, it is 6 p. higher

than the global average); opening an account (+ 7 p.);

daily interaction of the bank with the client (+ 7 p.);

provision of additional banking services (+ 8 p.).

Below the average global estimate was the index of

assessment of the first steps of the client when

working with the bank (-3 p.).

According to the digitalization index, Russian

banks are ahead of the world average. In general, we

can note a good level of digitalization of the banking

sector of Russia.

According to the digitalization index, Russian

banks are ahead of the world average. In general, we

can note a good level of digitalization of the banking

sector of Russia (Sedih, 2019).

The main financial and technological solutions

include:

1. In the field of payments and transfers (online

payment services, online translation services, P2P

currency exchange, B2B payment and transfer

services, cloud cash desks, smart terminals, mass

payment services, payment processing and support of

payment channels);

2. In the field of digital banking (automated

banking systems and banking infrastructure, scoring

systems, digital services and products, loyalty

programs);

0

20

40

60

80

world

leader

average

Russia

Modern Digital Technologies and Banking Tools

261

3. In the area of financing (P2P consumer lending,

P2P business lending, crowdfunding);

4. In the field of capital management (roboediting,

programs and applications on financial planning,

social trading, algorithmic exchange trading);

5. In the area of business support - electronic

accounting, legal and financial instruments;

6. Insurance (P2P insurance, smart insurance);

7. In the field of regulatory technologies

(customer identification and data validation - KYC

solutions, automation of data processing and

compliance, data protection, risk analysis and

possible solutions).

At the same time, banks are also actively

digitalizing the following types of activities:

- Artificial intelligence. Artificial intelligence

helps optimize many lending processes, as well as

information submission.

- Biometrics. Thanks to biometrics, verification

processes are simplified, while interaction between

the bank and the client is simplified.

- Cloud technology. Cloud technology helps to

develop banking applications, analyze the market and

work with data, as well as reduce the burden and

reduce costs in the field of digital technology.

- Robotization. Robotization allows you to

optimize the processes of providing banking services

and products, simplifying the lending process and

reducing the burden on bank staff, while minimizing

the likelihood of error.

- Mobile technology. Mobile banking is the basis

of the digital environment of banks at the moment.

This is a mandatory element in the digitalization

system and its qualitative development will optimize

the interaction of customers with banking products

and services, as well as increase loyalty.

- Big Data and data analysis. Without big data and

analysis, the bank cannot work at the present stage.

This mechanism allows you to increase the profit of

the bank, both in the short term and in the long term.

A huge analyzed array of data increases the ability to

use targeted applications, optimize debts, collect

customer information and many other strategic areas

of activity.

It can be noted that the main direction of

digitalization in the banking sector is focused on

mobile applications, P2P lending and the

development of digital solutions that help optimize

customer interaction processes. Mobile banking is a

priority. However, it is necessary to expand the

Internet throughout the country, which will increase

the number of active users of online banking

applications.

To this end, the national program "Digital

Economy" was created. More than 1 trillion rubles

from the federal budget and 535.3 billion rubles from

extrabudgetary sources for a period of 6 years are

allocated for the development of the Russian digital

economy. According to the targets of the national

program, by 2024, 97% of Russian households and

100% of socially significant infrastructure facilities

should have broadband access to the Internet. Now

these indicators are at the levels of 72.6% and 30.3%,

respectively.

Besides, it is planned to create eight basic data-

processing centers (DPC) in federal districts. The

share of Russia in the global volume of data storage

and processing services should grow from the current

0.9% to 5%. The Bank of Russia also contributes to

the development of digitalization by developing

infrastructure. The Marketplace project has already

been launched - an electronic channel for the sale of

financial products, which is expanding (Bank of

Russia, 2018).

4 CONCLUSIONS

In general, the trend of digitalization of the banking

sector of Russia is positive. Digitalization

fundamentally transforms previously used

management mechanisms, enhances their

effectiveness (Evdokimova Y., Shinkareva O. and

Bondarenko A., 2018). Banks put a lot of effort and

resources into optimizing digital solutions and their

development. The Central Bank is also developing

and improving digital infrastructure, which will be

based on:

- remote identification (biometric),

- Distributed Registry Technology – Masterchain,

- digital profile,

- financial marketplace (which is already

functioning and is actively developing),

- Express Checkout,

- fully electronic document flow,

- increased use of simple and enhanced electronic

signature.

The comprehensive coverage of digitalization

opportunities, the involvement of financial,

regulatory, technological components, as well as the

presence of systematic regulation and supervision of

the activities of financial and credit institutions

provides good starting opportunities for the further

development of positive aspects of digitalization in

the banking sector and the reduction of digital risks

that invariably accompany this process.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

262

REFERENCES

Bank of Russia, 2018. Main directions of development of

financial technologies for the period 2018-2020

Banki.ru, 2020. In the ranking of banks of the Russian

Federation in terms of digitalization, leaders changed

Bespalova, O., Hohlova, M., 2019. Development of the

banking sector of the Russian Federation in the

conditions of digitalization of the economy Economics.

In Sociology. Right. 2 (14). pp. 21-26.

Deloitte, 2020. Digital Banking Maturity 2020. In Digital

Research.

Evdokimova, Y., Egorova, E., Shinkareva, O., 2020.

Information technology in financial sector Russian

Federation - Driver of the formation of the Russian

economy. In E3S Web of Conferences. 208. 03017.

Evdokimova Y, Shinkareva O. and Bondarenko A., 2018.

Digital banks: development trends. In Proceedings of

the 2nd International Scientific conference on New

Industrialization: Global, national, regional dimension

(SICNI 2018).

Sedih I.A., 2019. Market of innovative financial

technologies and services. Higher School of

Economics, Moscow.

Tadviser, 2019. Digital transformation of Russian banks.

Tadviser, 2020. Digital transformation of Russian banks.

Bloomchain, 2019. Fintech 2019. Annual study of the

financial technology market in Russia.

Modern Digital Technologies and Banking Tools

263