Analysis of International Experience in Building Anti-Money

Laundering and Counter-Terrorist Financing Mechanisms in the

Digital Economy

Vladimir Ivanovich Avdiysky

a

and Vyacheslav Mikhailovich Bezdenezhnykh

b

Department of Economic Security and Risk Management of the Faculty of Economics and Business, Financial University

under the Government of the Russian Federation, Moscow, Russia

Keywords: Financial monitoring, AML/CFT system, financial intelligence, Federal Financial Monitoring Service

(Rosfinmonitoring), databases.

Abstract: The objective of this paper is to analyze foreign experience in building anti-money laundering and counter-

terrorist financing mechanisms to improve Russian AML/CFT legislation and government policy aimed at

enhancing the effectiveness of anti-money laundering efforts under the current conditions of digital

transformation. The tasks that are expected to be accomplished in order to meet the objective: analysis of the

existing foreign methodologies for the collection, analysis and pre-checking of data on financial and economic

transactions involving funds or other assets of an illegal or economically inappropriate nature; substantiation

of the need to transform state policy in the sphere of cooperation with foreign countries and international

organizations in the field of AML/CFT; formulation of proposals for the formation of a framework for digital

info-analytic and organizational and methodological state control of measures to detect and suppress the

legitimization (laundering) of proceeds of crime. Theoretical foundation of the study consists of the works of

domestic and foreign criminologists, legal scholars, economists, sociologists and political scientists dealing

with the problems of combating money laundering, identification and elimination of causes and conditions

contributing to the commission of these offences, countering corruption, theft, fraud, drug trafficking and

other offences for the purpose of untaxed income.

1 INTRODUCTION

Practice shows that in today's environment, financial

monitoring, being a unique and very effective tool,

allows for the effective use of the financial system in

the fight against crime and for tracing virtually any

offence where there is a financial trail using the

money movement chain – in Russia this institution

has been in use relatively recently. There is no doubt

that since the creation of the Federal Financial

Monitoring Service, and to this day, Russia has done

a lot of work to improve and develop the efforts in

AML/CFT, including creating mechanisms to

facilitate the use of financial information in the fight

against crime. However, an objective data analysis

shows that it is not all that optimistic. There is

certainly much to report from the point of view of

a

https://orcid.org/0000-0002-6685-3589

b

https://orcid.org/0000-0001-9827-6328

establishing these institutions, but there are also a

number of problems that need to be addressed

quickly. Unfortunately, as of today, in our country

there are still:

low efficiency of the entire system in terms of

convictions and confiscation of the proceeds of

crime;

inefficient and highly selective monitoring of

financial transactions of officials and

businessmen associated with them, as well as

the intermediaries;

lack of proper efficient cooperation between

the executive authorities involved in the anti-

money laundering and counter-terrorist

financing system.

All this has an extremely negative impact on

Russia's economic and national security as a whole.

In this regard, it appears that the analysis of foreign

Avdiysky, V. and Bezdenezhnykh, V.

Analysis of International Experience in Building Anti-Money Laundering and Counter-Terrorist Financing Mechanisms in the Digital Economy.

DOI: 10.5220/0010699200003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 303-311

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

303

experience in building anti-money laundering and

counter-terrorist financing mechanisms, taking into

account the current challenges and threats, is relevant

and will make it possible to develop specific

proposals for improving this activity in Russia.

2 MATERIALS AND METHODS

Analysis of the formation of national authority liaison

systems in countries that have been successfully

assessed by the FATF shows that most foreign

jurisdictions establish a specialized national system

within which a financial monitoring service operates.

However, the international AML/CFT standards

developed by the UN, the FATF, the EU, the

Wolfsberg Group and the Basel Committee have a

decisive impact on the legal and organizational

framework. They become the source of the legal

framework for establishing a national system, which

leads to the existence of common features of a

financial monitoring system in individual states. The

established international and national AML/CFT

requirements respectively form the rules and

guidelines specifically for companies. In these

conditions, the performance of well-functioning

systems is aggregated in the indicators of cooperation

in sharing necessary information in the areas of

contact listed above.

In this regard, it is useful to consider the UK's

experience in ensuring effective law enforcement

cooperation, where there is a database containing

information on suspicious transactions, which can be

directly accessed by the police.

A similar system exists in the United States,

where authorities actively and routinely use financial

intelligence data and other information to identify

suspects, gather evidence in investigations, and trace

illicit proceeds related to ML/TF/PWMD, and

predicate offences.

The greatest US strength in this area is the

information processing centres and joint working

teams that bring together federal, state and local

partners in an inter-agency environment. Information

processing centres serve as hubs for receiving,

analyzing and gathering threat information, sharing

such information and dissemination of important

intelligence data on indicators of wrongdoing (based

on financial information, national intelligence and

information provided by local, state and regional

authorities).

It should be emphasized that the US authorities

use not only financial intelligence, but also other

information from a variety of sources:

a) FinCEN database is the main financial

intelligence repository in the United States,

containing information on suspicious

transactions, currency transaction reports,

reports on international transportation of cash

or monetary instruments, reports on foreign

bank and financial accounts, and reports on

monetary payments over USD 10,000, received

during transactions, or in the course of

business;

b) FEDWIRE: The Federal Reserve Bank of New

York can search names, addresses and account

numbers for any money transfers that are made

through this system;

c) CHIPS (Clearing House Interbank Payments

System): searching the CHIPS network

through which bank transfers are made;

d) tax returns;

e) correspondent bank accounts;

f) operational databases that include data from

prosecutors, investigative intelligence,

criminal records and mutual legal assistance

requests and other data;

g) information from company, vehicle and

property registries as well as data from publicly

available sources.

FinCEN provides direct, independent access to its

data for representatives of relevant federal, state and

local oversight agencies. Nine key authorities are

given enhanced access, with full- and part-time staff

provided, enabling the authorities to collaborate

directly with FinCEN's analysts.

The situation in Austria is different, due to the

limited analytical capacity and legal restrictions

imposed on the Austrian Financial Intelligence Unit,

performing only the most general analysis of financial

information, which is also reflected in the lack of its

own database that would allow conducting in-depth

investigations. The FATF has therefore

recommended that the jurisdiction develop its own

financial information database and make it available

to law enforcement agencies.

Law enforcement agencies in China, as is the case

with Russia, can obtain information from the FIU

upon request and do not have liaison officers at the

AML Analysis and Monitoring Centre, the AML

Bureau and the thirty-six provincial branches of the

National Bank of China to facilitate such indirect

access to information, which affects the speed with

which anti-money laundering measures are

implemented.

It is further noted that current financial data from

financial intelligence agencies allow China to launch

new investigations into predicate offences and

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

304

ML/TF/PWMD crimes, although this is often not the

case due to a lack of direct access to financial

information databases and the need to go through

bureaucratic procedures to generate requests. Thus,

the statistics reviewed by the FATF show a 100%

success rate of investigations based on requested

materials, while the number of proactively submitted

materials has not resulted in a comparably high

number of investigations and has not contributed to

successful criminal investigations conducted by law

enforcement agencies – a similar situation is observed

in Russia.

Analysis of materials regarding Italy show that

law enforcement authorities in the country receive all

suspicious transaction reports, technical reports

(analysis materials used only as financial intelligence

information, but not as evidence and proof) and other

information indicating the risk level and carry out

preliminary investigations to confirm or refute the

conclusions drawn by the financial intelligence unit.

FATF stresses that due to the restriction on the use of

technical reports and the provision of information on

"clean" transactions, law enforcement agencies are

forced to repeat the examination of submitted data, a

situation very similar to that in Russia, where

Rosfinmonitoring submits information to the

Ministry of Internal Affairs with a note "not to be

included in the criminal case file".

The technical reports (analysis material) and

STRs provided by the financial intelligence unit can

only be used as financial intelligence information (i.e.

they cannot be used as evidence or proof). Unlike

most foreign financial intelligence units, the Italian

FIU is obliged to provide to the relevant authorities

(i.e. the Guardia di Finanza and the Antimafia

Investigative Directorate) the STRs which it

considers as unconfirmed and for which the

verification has been discontinued (i.e. "closed"

STRs). "Preliminary investigation", conducted by

Guardia di Finanza and the Antimafia Investigative

Directorate, includes verification of information

provided by the FIU in databases of law enforcement

bodies. "Preliminary investigation" of "closed" STRs

is not carried out in all cases, however, such STRs are

still provided to the Guardia di Finanza and the

Antimafia Investigative Directorate in case they are

required in specific circumstances.

Spanish law enforcement agencies, on the other

hand, have direct access to a wide range of financial

and other data, similarly to the USA [18]: the state

register of land (cadastre), companies, real estate; the

register of life insurance policies of the Ministry of

Justice; the unified computerized directory of notaries

(containing accurate legal and beneficial ownership

information and to which law enforcement agencies

have real-time access); the social security registry

(TGSS); the database of the Bank of Spain on

payment balances; the database on holders of

financial assets.

Thus, a cross-section of different international

practices has shown that the most effective measure

of interactions is the following system:

1) FIU performs accumulation and analysis of

financial information;

2) A single database is created, containing not

only FIU information, but also tax, customs,

banking and other information from various

public and private registers.

3) Interaction between authorities is based not

only on requests, but also on the provision of

effective proactive investigations by the FIU,

which can be the basis for preliminary

investigations, but also on the provision of real-

time access to the database.

So, by comparing the analysis data obtained as a

result of researching the mechanism of interaction

within the domestic AML/CFT system and

international experience, it becomes possible to

compare strengths and weaknesses, opportunities and

threats to the development of the current level of

interaction of federal executive bodies in detecting

and combating money laundering.

Table 4 presents such a comparison in the form of

a SWOT analysis, based on both the reviewed

academic literature and professional materials, as

well as a survey by Rosfinmonitoring experts in the

field.

Table 4: SWOT-analysis of the interaction of federal executive bodies in Russian AML/CFT system

Strengths Weaknesses

1. To date, a functioning system of inter-agency cooperation and interaction has

been established, implemented through the Inter-agency Commission on Combating

Money Laundering, Terrorist Financing and the Financing of Proliferation of

Weapons of Mass Destruction, the Inter-agency Working Group on Combating

Illicit Financial Transactions, the Inter-agency Commission on Countering

Extremism, the Inter-agency Commission on Countering the Financing of

Terrorism, State Anti-Drug Committee, National Anti-Terrorism Committee, as

well as cooperation agreements with 27 organizations and government agencies.

1. The interaction involves constantly fine-tuned

forms of real time communication. The system

prioritizes the exchange of information through

request-response cooperation.

2. Although the reporting entities and the

responsible authorities have sufficient human

resources, law enforcement agencies do not have

the expert knowledge in the field of crimes related

to complex ML/TF/PWMD schemes.

Analysis of International Experience in Building Anti-Money Laundering and Counter-Terrorist Financing Mechanisms in the Digital

Economy

305

Table 4: SWOT-analysis of the interaction of federal executive bodies in Russian AML/CFT system (cont.).

2. Based on Federal Law No 115-FZ and Russian Government Decree No. 492,

dated May 29, 2014, high qualification requirements for financial monitoring

specialists have been developed, and through cooperation agreements with

universities, qualified AML/CFT personnel are being trained, which has enabled the

system to be filled with high-level analysts.

3. Over the years of development of the AML/CFT/PWMD mechanism in Russia,

a serious methodological basis has been accumulated, based both on the FATF

Recommendations and on our own experience, which is expressed in the

development of relevant laws, regulations of the FFMS, Bank of Russia, Assay

Chamber, Roskomnadzor, law enforcement agencies and other documents and

materials.

3. There is a lack of complete methodological

coherence in referring the results of financial

investigations to law enforcement agencies for

preliminary investigation and further legal action

for fair punishment, and confiscation.

Opportunities (areas) for the development Threats (risks) for the current interaction

1. Legislation should be harmonized to allow for effective forms of cooperation

between Rosfinmonitoring and the law enforcement agencies, including through the

development of the institution of interim measures and the creation of a unified

methodology for financial and preliminary investigations.

2. Use of new (digital) methods of interaction in the implementation of cooperation

between the federal executive bodies in the field of AML/CFT by providing real-

time access to the federal database.

3. Creating sufficient awareness of the dangers of ML/TF/PWMD offences and

social intolerance towards such offences.

1. Lowering of the priority of detecting

legitimization as a politically biased trend based

on the corrupt interests of government institutions.

2. Creation of a criminal misdemeanour institution

making it possible to evade certain money

laundering offences.

3. The impact of "double standards" in the

AML/CFT/PWMD-related international

interactions between FIUs.

Based on the SWOT analysis, it can be concluded

that, in addition to the above proposals, in present-day

conditions the most effective methods and tools to

improve the effectiveness of the existing

AML/CFT/PWMD interaction system are those

based on modern digital solutions that allow for the

fastest exchange of necessary information, which

must be processed and analyzed in accordance with a

common methodology, in order to avoid repetition of

actions by different authorities (e.g. the situation with

the stamp "not to be included in the criminal case file"

on the results of financial investigations). These

measures are particularly necessary at a time of

digital transformation, when a potential offender has

the ability to commit malicious acts in an extremely

short period.

3 RESULTS AND DISCUSSION

When researching the market for digital financial and

security solutions, it should be noted that the

development of modern financial technology is far

ahead of AML/CFT regulation. What is also clear is

that the second decade of the twenty-first century has

seen an explosion of digital technologies that have

literally entered the lives of everyone on the planet.

The first descriptions of the ongoing process were

published in the '90s by Don Tapscott in his book

«The Digital Economy: Promise and Peril in the Age

of Networked Intelligence", and a little later by

Nicholas Negroponte in "Being Digital", where the

digital economy is described as "bits instead of

atoms". To date, an in-depth scientific view of the

phenomenon of the "Great Digital Revolution",

linked to the concepts of "Industry 4.0" and "Society

5.0" as it is also known as the fourth industrial

revolution, which certainly brings many challenges

and threats to modern humanity, has already been

formed.

The digital economy is already going far beyond

the Internet or process automation to include

hyperconnectivity, the Internet of things, big data,

advanced analytics, wireless networks, mobile

devices and social media, and so on. In this regard,

the global phenomenon of digitalization is leading to

fundamental changes in business models, in the way

the government works and in the way the social

relations are organized.

Thus, domestic academics already estimate that

"the information and communications technology

complex is growing at a rate of around 30% a year",

a clear example being the United States, where the

level of digitalization is now estimated at a third of

the country's GDP, amounting to around USD 6

trillion. – such trends set the appropriate trends in

global economic development, making the 6th

technological stage the growth driver. Thus, the

overall focus on digitalization lays down a powerful

vector for the development of both the economy of

individual sectors and the country as a whole.

Digitalization and economic growth are closely

linked concepts in the current environment.

The digitalization in the long term entail the

automation of the implementation of some activities

in various fields: financial, industrial, political, socio-

cultural and others. The capital assets of enterprises,

renewed due to robotic automation, will be able to

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

306

carry out their functions without or with minimal

human intervention.

For example, a research by KPMG, shown in

Table 5, shows that the private sector is already fully

engaged in the digitalization trend, actively

developing this area, which, if it achieves the

necessary investment levels, will become one of the

main drivers of economic growth: its contribution to

GDP growth will exceed 50% by 2030, driven by

improvements in the efficiency and competitiveness

of other economic sectors. Overall, Russia's gross

product will increase by 34% between 2017 and 2030,

precisely because of the information industry and the

digitalization of sectors of the economy.

Table 5: The use of digital technology in the Russian economy

Technology Overall Retail Teleco

m

Financial

institutions

Metallurgy IT Oil and

gas

Transport

Bi

g

Data 68% 55% 100% 84% 67% 100% 50% 14%

Chat-

b

ots 51% 50% 75% 60% 33% 40% 50% 29%

Robot

automation

50% 40% 100% 56% 83% 20% 50% 14%

OCR 36% 20% 25% 56% 67% 1% 50% 14%

AI 28% 5% 75% 40% 17% 80% 25% 1%

IoT 24% 15% 100% 12% 50% 20% 25% 29%

VR/AR 21% 20% 25% 16% 33% 40% 25% 14%

Blockchain 19% 20% 25% 32% 1% 20% 1% 1%

Source: compiled by a team of contributors.

In the financial sector, however, there are

particularly striking trends indicating the enormous

potential for digital financial services (or fintech – "a

complex system combining the new technology and

financial services sector, start-ups and related

infrastructure"), which will be based, as the Bank of

Russia states in its study, on the mobile technology,

Big Data, robots, AI, biometrics, etc. Firstly, it is

defined that by 2021, 35-50% of bank customers will

use mobile banking; secondly, 82 percentage points

of financial institutions are going to increase

interaction with fintech companies within 3-5 years;

thirdly, 56% of financial sector representatives

position digital transformation as the basis of their

business strategy; fourthly, investment in fintech

companies in the US in 2016 - 2013 has doubled to a

record USD 24.7 bln.

Also under the Digital Economy national project,

BIG DATA technologies are included in the list of

priority technologies, along with artificial

intelligence and neurotechnology. In November

2017, experts developed a draft "Convention on

Robotics and Artificial Intelligence" (adopted by the

State Duma Committee on Economic Policy,

Industry, Innovation and Entrepreneurship in the first

half of 2018), which combined all the currently

existing principles for regulating the industry into one

system.

Thus, the digitalization process in Russia today is

an undeniable reality that must also be used to create

the most effective AML/CFT/PWMD system,

including the establishment of digital inter-agency

cooperation.

Touching on the oversight practices already

today, the digital transformation offers great

opportunities to realize this goal.

For example, RegTech, which includes

compliance, identity management and control, risk

management, regulatory reporting and transaction

monitoring, is already a technology that helps

financial services firms comply with regulatory

requirements and financial compliance rules. It

allows businesses to build a constructive dialogue

with regulators, which is necessary against the

background of radical digital transformation.

SupTech, on the other hand, includes real-time

analysis of credit institution data on various

transactions in order to detect fraud, analyze the

affiliations of persons of interest, including

borrowers, predict cash demand and, based on

payment data, draw conclusions regarding the

stability of credit institutions. Practice shows that this

digital technology can also be used extensively for

financial intelligence, fiscal and operational

information on the illegal activities of a business

entity.

Thus, the technology makes it possible to

automate administrative procedures, improve the

reporting quality and enhance the decision-making

system. Therefore, it becomes possible to carry out

automated remote verification of certain economic

entities in a continuous manner by creating

customized algorithms.

Of course, the availability of technical and

technological capabilities to implement RegTech and

SupTech provides conditions for, but does not

Analysis of International Experience in Building Anti-Money Laundering and Counter-Terrorist Financing Mechanisms in the Digital

Economy

307

guarantee the improvement in the quality of control

and supervisory and regulatory activities, since these

are only tools or a "superstructure" of the overall

public administration system, so the crucial role will

be played by qualitative changes in the legal

framework, in the organization and methodological

support of business processes and their adaptation to

new conditions.

Indeed, advanced big data analysis has the

potential to detect potentially criminal transactions

not only in the traditional financial system, but also in

its virtual superstructure by forming special criteria or

risk indicators and training neural networks in this

way, although the overall impact of digitalization on

money laundering is clearly mixed: not only are the

mechanisms of financial institutions and, therefore,

money laundering schemes becoming more complex,

but new ways of carrying out control and oversight

functions are also emerging, although unfortunately,

Russian regulators are now lagging behind the

"miscreants" in terms of realizing the potential of

modern technology for their own purposes, which

means that the volume of legalized assets is only

increasing.

It is also important to note that the application of

digital technologies is only possible when the

traditional anti-money laundering system works

effectively and is ready for the implementation of an

"add-on" designed to simplify the technical work of

financial monitoring specialists by providing the

ability to process large volumes of information at

lower cost in an automated mode, and it is vital to

consider information security risks, which is now

possible with the introduction of special DLP

software, and the increasing complexity of the

management system due to the use of new solutions.

At the same time, as can be seen from the analysis

of international practices, leading countries around

the world, such as the US, have already developed

specific legal and digital solutions to ensure

compliance with the necessary AML/CFT/PWMD

regulations. This experience should be used and

Russia.

So, firstly, it would seem rational to develop a

single model platform for processing financial

information at the level of reporting entities in order

to make high technology available to the whole

sector, which would increase the efficiency of anti-

money laundering system. Secondly, it is necessary to

improve the existing federal database by combining it

with the proposed complex for the reporting entities

and providing specialized access for other competent

authorities, following the example of the US, Spain

and other countries.

Having formulated the general directions for the

development and improvement of the existing main

aggregator of financial information collection and

analysis - the federal database of the FFMS - it is

necessary to describe in detail the structure and

functioning mechanisms of the proposed system.

While stipulating at the outset the availability of

information from this database to various authorities,

it should be noted that bank secrecy will be respected,

as it will transform into a business secret or secrecy

of the investigation. We would also like to

immediately note our support for a unified household

database [14], given that a federal database could be

the basis for such a "unified base", following the

example of the US, including not only financial

information on suspicious transactions, but also the

following information:

• Unified State Register of Taxpayers;

• Unified National Register of Legal Entities;

• Information from the judiciary and law

enforcement agencies;

• Information on education and academic

degrees, including those obtained abroad;

• Data on compulsory pension and health

insurance;

• Data on registration with the Federal Service

for Labour and Employment for the

unemployed and on the granting of a work

permit for foreigners;

• Information on the registration of private

entrepreneurs and self-employed persons;

• Numbers assigned when a citizen is registered

with the tax office;

• Information on military registration;

• Tax and banking information.

In order to ensure the security of this database, it

is necessary, as mentioned above, to develop a unified

inter-agency regulation defining not only the

procedure for interaction between agencies, but also

the procedure for the formation and use of the

database. At the same time, a special training of

Rosfinmonitoring staff on the system and instructing

on the secrecy regime should be provided for, with

their further secondment to other authorities,

accessing the system from a special computer device

equipped with an information security system to

counter data leaks (DLP system), which would block

any unauthorized access to the system and any

illegitimate data uploads. It is also possible to

configure the access system to prevent the acquisition

of information containing state secrets relating to the

country's political leaders and other designated

individuals, the access to which could result in critical

damage to Russia's national security.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

308

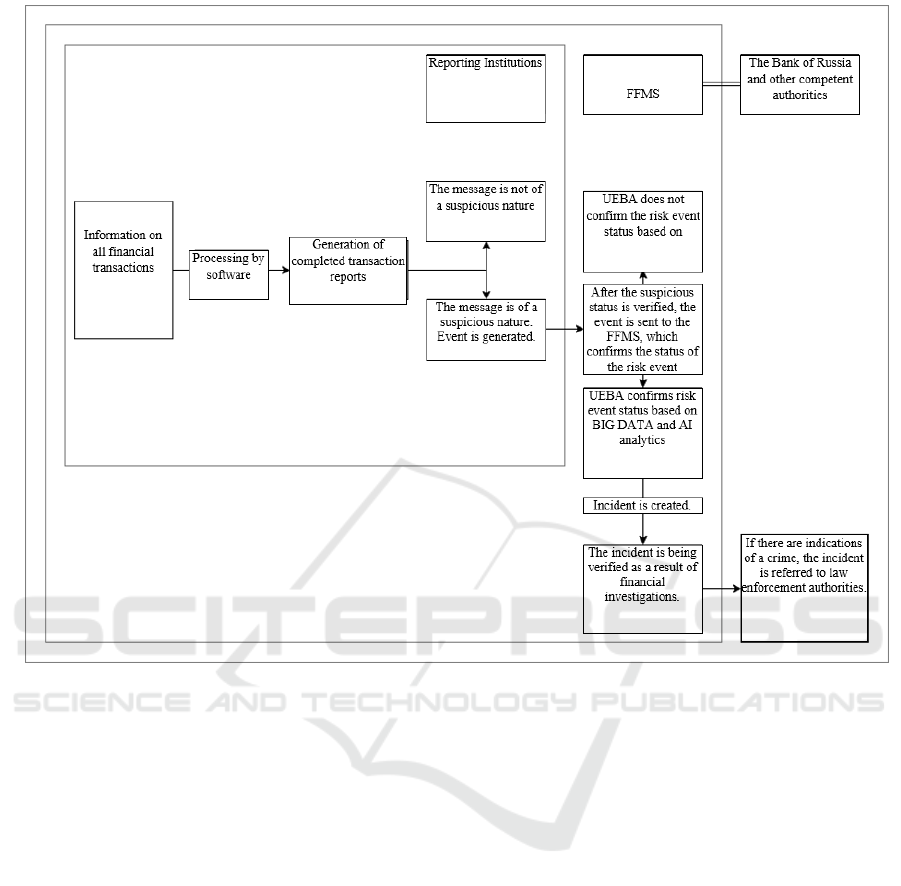

Based on this analysis, three modes of access to

the system are envisaged:

1) Reporting entity, which should use this

software to track transactions carried out in

accordance with Law No. 115-FZ, blocking them or

reporting them to Rosfinmonitoring if necessary. This

stage is formulated as the processing of transaction

reports by means of an automated selection of the

riskiest transactions, after processing of which and

confirmation of such status by the officer responsible

for the implementation of financial monitoring

measures, an event is created, expressed in the

identification of a suspicious transaction, and sent to

Rosfinmonitoring.

2) Federal Financial Monitoring Service as an

operator and a database administrator having access

to all the operations that took place in the system, but

receiving reports of recorded events related to the

identification of suspicious transactions, which are

further processed by AI based on UEBA system (User

and Entity Behavioral Analytics), and after

confirmation of abnormality the events become

incidents and are transferred to the employee for

further verification and financial investigation.

3) Other competent authorities which are granted

access through inter-agency cooperation and which

receive the full scope of analytical financial

information without the right to administer the base,

but with the ability to conduct their own

investigations. Access granted to these authorities,

through seconded FFMS analysts, may be restricted

in accordance with legal requirements by the

administrator of the database – Rosfinmonitoring.

Figure 3, for example, graphically illustrates the

functioning of the proposed system with the

designation of responsibilities, the flow of

information and the rules for processing it, as well as

the availability of this information to various entities

subject to inter-agency cooperation.

In addition, there appears to be a need to transition

from using a federal database for transaction analysis

to a mechanism used in Europe and the US called the

"People-Centric Approach". The approach is not

based on looking for suspicious transactions, but on

comparing the cash flows of an individual entity or

individual. In other words, the comparison of its

income and expenditure. It is clear that the

combination of both techniques, using modern digital

technology, will yield the greatest results in the field

of anti-money laundering. This is why the developed

mechanism, based on transaction analysis with the

addition of in-depth and comprehensive information

on a person or entity stacked from other public

registers and databases, will make it possible to

analyses the behaviour of a particular subject for

anomalies using the UEBA system, as well as to build

graphs of that subject's links with other persons for

the most expeditious investigations.

Speaking of the UEBA (User and Entity

Behavioral Analytics) function, we note that it is a

class of systems that allows, based on data sets about

subject-users, using machine learning algorithms and

statistical analysis, to build their behavior models,

forming user patterns (criminal behavior,

conscientious behavior, etc.), identify deviations

from these models, both in real time and

retrospectively. So, the UEBA systems,

architecturally, solve 4 main tasks:

- Applied analytics of data from various sources,

both simple statistical and advanced, using

machine learning techniques, in real time

and/or at specific intervals;

- Rapid identification of irregularities, most of

which are not detected by classical analysis

tools;

- Prioritization of events based on risk level for

faster response by administrators;

- A more efficient response to events by

providing administrators with enhanced

incident information, including all entities that

were involved in the abnormal activity. Based

on the above, the core of any UEBA system

includes technologies for dealing with large

data arrays.

Analysis of International Experience in Building Anti-Money Laundering and Counter-Terrorist Financing Mechanisms in the Digital

Economy

309

Figure 4: Operation scheme of the proposed system. Source: developed by the author.

4 CONCLUSIONS

Thus, the most comprehensive mechanism of

effective interaction between federal executive bodies

in detecting and combating money laundering is

proposed, based on the implementation of a set of

organizational and practical measures using new

digital forms of communication, which are fully

implemented based on Rostelecom-Solar technology,

with the analytical support from relevant experts.

In summary, the proposed measures would

improve the domestic AML/CFT/PWMD system in

full compliance with the FATF recommendations

described in the 2019 Russian Federation Mutual

Evaluation Report:

1. Supplementing the information available to

Rosfinmonitoring by using other data sources.

2. Enhancing law enforcement agencies' use of

financial analysis and other relevant

information to better identify bribery and abuse

of power, consistent with the risks identified in

the national money laundering risk assessment

report.

3. Enabling the investigation and prosecution of

offences involving sophisticated money

laundering schemes to be prioritized, with

intelligence and in-depth advanced analytical

techniques to support effective detection.

4. With UEBA and a People-Centric Approach,

including link graph tools, it will be possible to

conduct the most comprehensive analysis of

sources of funds and their possible links to

predicate offences, including corruption

offences.

REFERENCES

Presidential Decree No. 203 dated 09.05.2017 "On the

Strategy of the Information Society Development in the

Russian Federation for 2017-2030",

www.consultant.ru/

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

310

Federal Law No. 273-FZ "On Combating Corruption" dated

December 25, 2008, http://www.consultant.ru/

Federal Law No. 115-FZ "On Countering the Legalisation

(Laundering) of Criminally Obtained Incomes and the

Financing of Terrorism" dated August 07, 2001,

http://www.consultant.ru/

Austria Mutual Evaluation Report – 2016. FATF,

https://mumcfm.ru/

Spain Mutual Evaluation Report – 2014. FATF,

https://mumcfm.ru/

Italy Mutual Evaluation Report – 2015. FATF,

https://mumcfm.ru/

PRC Mutual Evaluation Report – 2019. FATF,

https://eurasiangroup.org/

Russian Federation Mutual Evaluation Report – 2019.

FATF, https://eurasiangroup.org/

US Mutual Evaluation Report – 2016. FATF,

https://mumcfm.ru/

Official website of the Federal Financial Monitoring

Service. Rosfinmonitoring, http://www.fedsfm.ru

Official website of the Japan Financial Intelligence Centre

(JAFIC), https://www.npa.go.jp/

Eskindarov, M.A., Abramova, M.A., Maslennikov, V.V.,

Amosova, N.A., Varnavsky, A.V., Dubova, S.Ye.,

Zvonova, Ye.A., Krivoruchko, S.V., Lopatin, V.A.,

Pischik, V.Ya., Rudakova, O.S., Ruchkina, G.F.,

Slavin, B.B., Fedotova, M.A., (2018) Directions of

development of financial technologies in Russia: expert

opinion of the University of Finance. In The world of

the new economy. 2. pp. 6-23.

Money Laundering Stages. Finance and Credit,

https://pravo.studio/

National risk assessment of money laundering and terrorist

financing 2017,

https://assets.publishing.service.gov.uk/

Analysis of International Experience in Building Anti-Money Laundering and Counter-Terrorist Financing Mechanisms in the Digital

Economy

311