Deglobalization and Consumer Security at the Present Stage of

Economic Transformation

Ekaterina Selezneva

a

and Julia Davydova

b

Vyatka State University, Kirov, Russia

Keywords: Deglobalization, trade, consumer security, crisis, trends, risk reduction.

Abstract: Disputes about deglobalization issues do not subside both in the scientific environment and at the level of the

political, economic sphere, in public discourse. Many believe that globalization continues, as society lives in

a common information environment. Therefore, it is necessary to give first of all the concept of

deglobalization. Deglobalization, from an economic point of view, is a process of reducing interdependence

and economic integration between certain units around the world, usually national states. These are such

changes in the economic system when economic trade and investment between countries are declining. This

process began a long time ago, but it was relatively slow, but since 2020 this process has accelerated

significantly, taking into account border closures, protections, etc. At the same time, in many countries,

including Russia, problems arose with the absence of some goods, raw materials, medicines, amid rising

prices. Therefore, the topic of deglobalization and consumer safety is currently very relevant and requires

further research and development of further actions of state authorities in the field of production and sale of

consumer goods.

1 INTRODUCTION

Obviously, the world economy has entered a phase of

deglobalization, as evidenced by the decline in trade

ties, the growth of protectionist measures to protect

regional and domestic markets, the actual rejection of

WTO requirements in many countries, as well as the

growth of political contradictions. But at the same

time, deglobalization can have both positive and

negative consequences for the Russian economy

during its transformation. It can be, on the one hand,

an impetus to ensure food security and, as a result of

consumer security, but, on the other hand, it can cause

rising prices and shortages, limited goods, and a

decrease in the quality of goods in the consumer

market.

Therefore, in order to maintain socio-economic

and consumer stability within the country, to ensure

consumer security, the issue of studying the process

of deglobalization and its impact on the consumer

market is extremely urgent.

The purpose of the study is to analyze the process

of deglobalization and its impact on consumer

a

https://orcid.org/0000-0003-0761-7612

b

https://orcid.org/0000-0003-0712-7955

security at the present stage of economic

transformation.

Research tasks: describe the general situation on

the world market, signs of deglobalization, assess the

consequences for the consumer market; identify

trends and prospects for the development of the

consumer market.

2 MATERIALS AND METHODS

The work used materials of official statistics,

including international statistics, reports of the

Central Bank of the Russian Federation, the EAEU,

the EU, the Russian Academy of Sciences, their own

observations and studies of the authors on the selected

topic.

The following research methods were used in the

work:

bibliographic method - monitoring of materials

of print and electronic business and specialized

publications,

analytical methods - analytical market review

Selezneva, E. and Davydova, J.

Deglobalization and Consumer Security at the Present Stage of Economic Transformation.

DOI: 10.5220/0010702900003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 341-346

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

341

based on own observations, materials of marketing

and consulting companies;

statistical and mathematical methods - collection

and analysis of information presented on the websites

of state and scientific institutions.

3 RESULTS AND DISCUSSION

There is a false idea that the process of

deglobalization in the scientific community has

aroused keen interest only recently. But it really isn't.

Yes, in 2020, many politicians and economists started

talking about this, but this process was obvious to

specialists earlier. Schedule 1 clearly proves this

point.

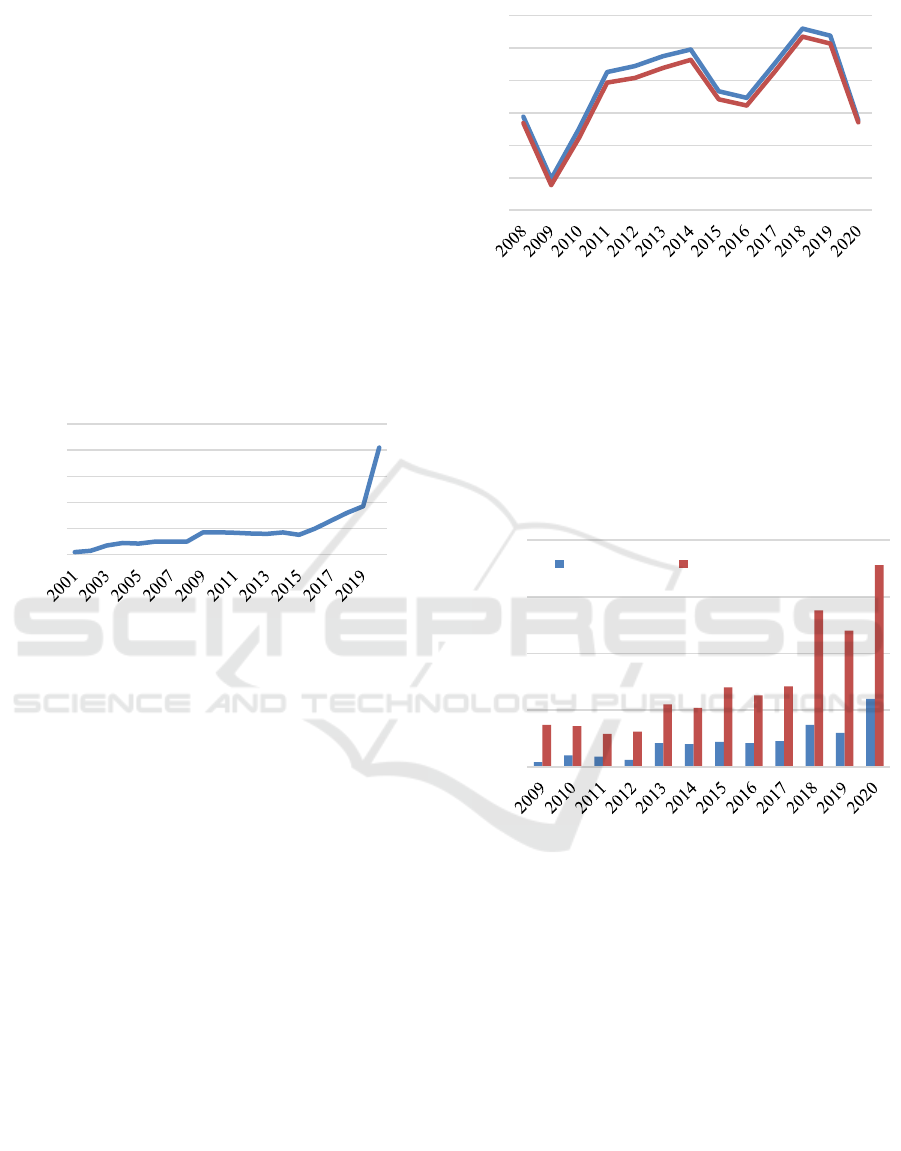

Figure 1: Frequency of use of the concept of

"deglobalization" in scientific works taken into account in

the database Google Scholar (Google Scholar URL:

https://scholar.google.ru)

Since the neoliberal model of world exchange and

production chains obviously came to a standstill back

in 2008, for more than 10 years there has been a

decline in the growth rate of the world economy.

Every year, countries apply and develop an increasing

number of protectionist measures, and the process of

convergence of integration into the world trading

system of the Russian Federation is becoming

increasingly dubious. It is the economic model of

production and sale that forms the characteristics of

the consumption of goods and services (R. A.

Abdulov, D. B. Dzhabborov, O. O. Komolov, G. A.

Maslov, T. D. Stepanova, 2021.). And it is currently

being transformed and adjusted to the new conditions

of survival into a systemic crisis. Considering that the

main mechanism of interaction between countries is

export-import transactions, it is advisable to present

the dynamics of trade (Fig. 2).

Figure 2: World exports and imports of goods and services,

2008-2021 (in trillion US dollars) (World Trade Statistical

Review 2020)

Based on the data presented, it is suggested that

exports and imports of goods over the past 12 years

showed uneven dynamics and changed depending on

political and economic contradictions between

countries, as well as due to the growth of protectionist

measures (Figure 3).

Figure 3: Trade regulation measures (Trade and tariff data,

WTO)

According to Global Trade Alert, in the period

from 2009 to 2020, states adopted more than 11.5

thousand measures aimed at regulating foreign trade,

cross-border capital flows and migration. 3/4 of them

were protectionist. (Komolov, O. O., 2018.)

The exchange of goods was also influenced by the

decline in the world economy, both on the basis of

objective and subjective reasons caused by

lockdowns and quarantines in many countries, border

closures.

0

200

400

600

800

1000

14

16

18

20

22

24

26

0

500

1000

1500

2000

liberalization protectionism

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

342

Table 1: GDP and world trade growth forecasts, %, 2020-

2021 years (European Commission. Directorate General for

Communication; TNS Opinion & Social, 2015)

data

source

date of

publication

GDP Trade

2020 2021 2020 2021

WTO

(optimistic

scenario)

apr 2020 -2,5 7,4 -

12,9

21,3

WTO

(pessimistic

scenario)

apr 2020 -8,8 5,9 -

31,9

24

IMF Jun 2020 -4,9 5,8 -

11,0

8,4

World Bank May 2020 -5,2 4,2 -

13,4

5,3

OZSR (base

case)

Jun 2020 -

4,5м

5,0" -9,5 6,0

Thus, all international organizations predicted a

decline in 2020, but a rapid recovery in 2021, but

already in May 2021 it is obvious that this will not

happen.

Also, the cost of goods in many countries,

including the Russian Federation, was influenced by

an increase in the prices of container cargo

transportation, which increased by more than 5 times

in several months of 2020.

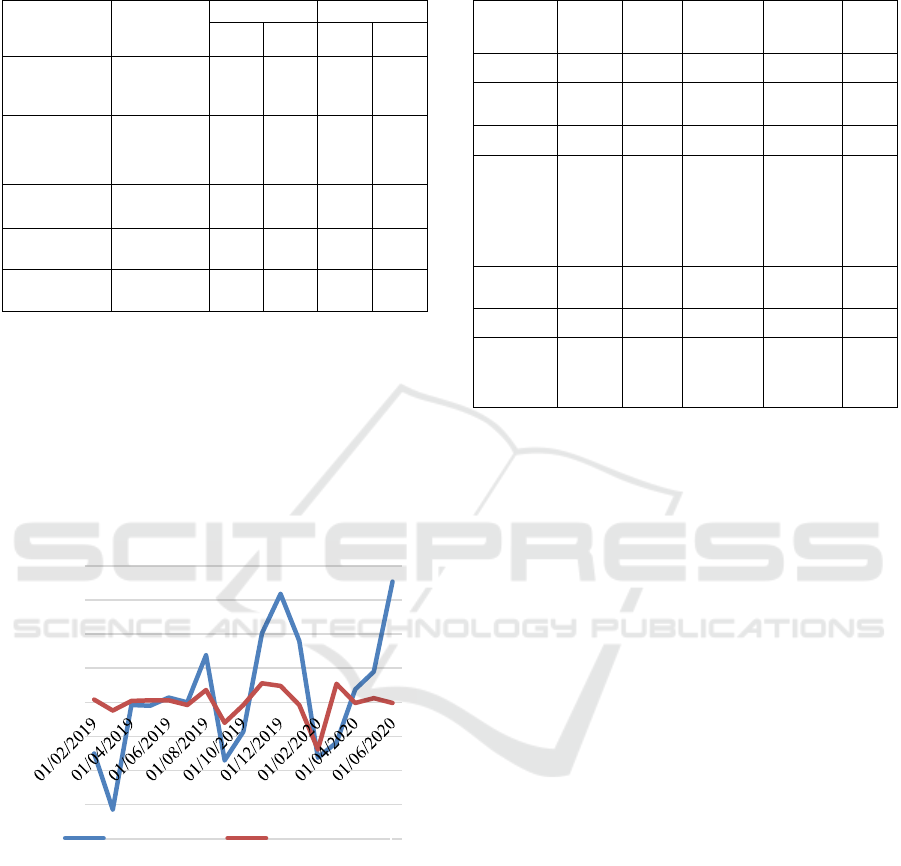

Figure 4: Movement of freight costs according to ERAI and

WCI (Deglobalization: what the global crisis will lead to,

2021).

If by October 2020 the cost of delivering a 40-foot

container from China was about 1.5 thousand dollars,

now it already reaches 12 thousand dollars.

Negative economic indicators are also recorded in

associations of countries. Thus, according to the EEC,

the following values were recorded in the EAEU

member countries (Table 2).

Table 2: Main socio-economic indicators for January - July

2020, in% against the corresponding period of the previous

year (Eurasian Economic Commission, 2020)

indicator Arme

nia

Belar

us

Kazakhs

tan

Kyrgyzs

tan

Russ

ia

GDP 4.9 -1.7 -1.8 -5.3 -3.6

agricultu

re

1.9 2.8 2.5 2.7 3.3

industry 1.3 -2.5 1.3 -0.9 4.2

Scope of

construct

ion

works

performe

d

-5.7 3.5 6.3 -27.9 -0.4

goods

turnover

1.0 -7.3 -3.8 -18.0 -6.4

retail -14.9 2.9 -11.7 -19.0 -5.8

passenge

r

turnover

-60.3 -30.9 -51.6 -52.9 -47.4

In mid-2021, the situation leveled off slightly, but

the pace remains negative. The closure of borders and

the reduction of cargo flows contributes to increased

attention to the strategic sectors of the agro-industrial

complex and industry. The main task at the moment

is to provide citizens with affordable and high-quality

food products and create solvent demand in the

market. To date, this task is facing many countries

and will be extremely difficult to solve.

The preamble of the Law of the Russian

Federation "On Protection of Consumer Rights" gives

the concept of safety of goods (works, services) - this

is the safety of goods (work, services) for the life,

health, property of the consumer and the environment

under the usual conditions of its use, storage,

transportation and disposal, as well as the safety of

the process of performance of works (provision of

services). But consumer security involves many more

aspects than the quality of goods. We will present the

main ones in the context of the process of

dehlabolization and transformation of the economy

(Karanina, E., Selezneva, E., Chuchkalova, S.,2020).

1 This is the provision of solvent demand, which

forms the volume of revenue in the retail market and

the turnover of industrial goods, that is, it is the main

driver of economic growth. We will determine the

dynamics of real incomes of citizens based on the data

of Figure 5.

-20,0%

-15,0%

-10,0%

-5,0%

0,0%

5,0%

10,0%

15,0%

20,0%

change WCI change ERAI

Deglobalization and Consumer Security at the Present Stage of Economic Transformation

343

Figure 5: Rate of change in average per capita income (new

methodology) (Federal State Statistics Service)

Based on the figure, it can be seen that the real

incomes of the population have sown a lot, it is

necessary to take into account the fact that the new

calculation methodology significantly eliminates

negative trends.

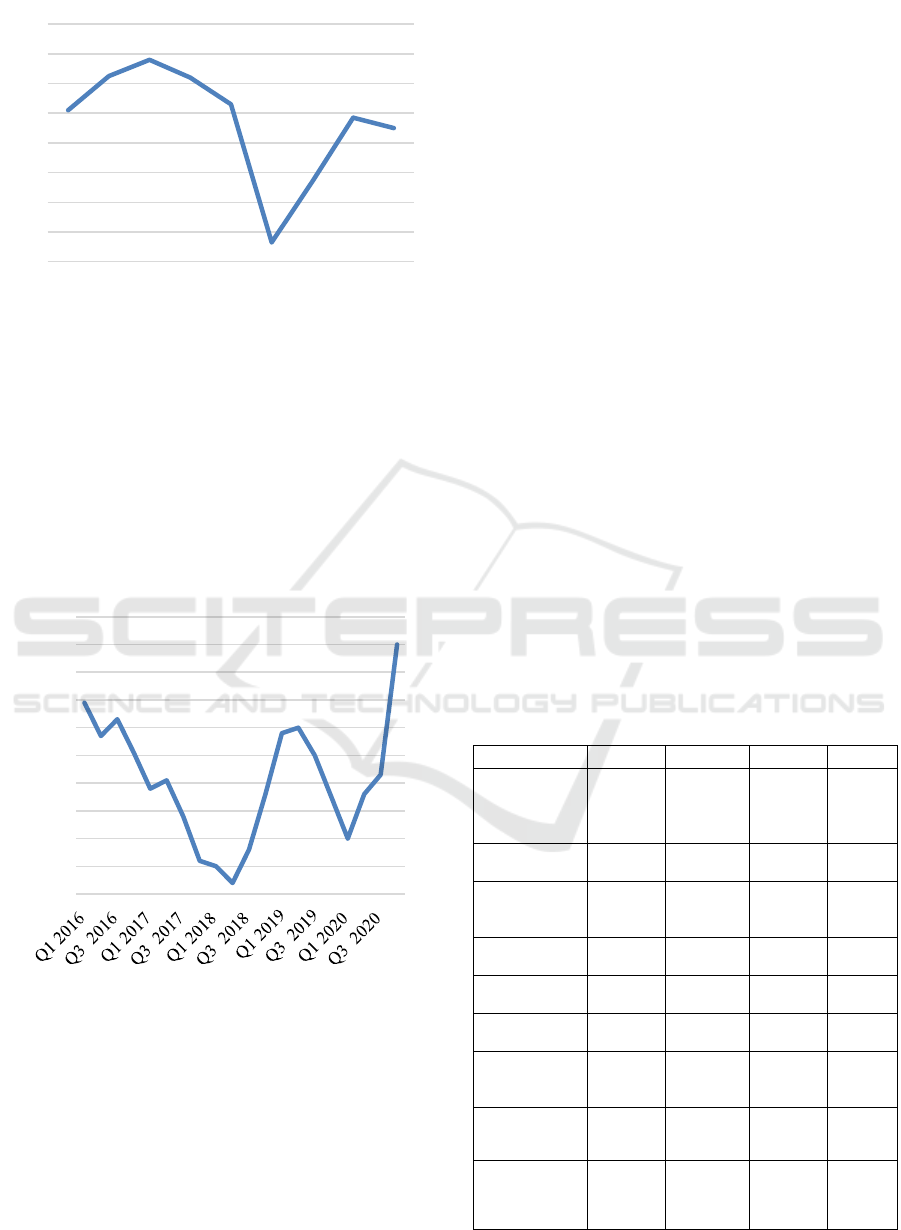

2 The second important factor that is most

relevant at present in the consumer market is the price

increase. Inflation trends are shown in Figure 6.

Figure 6: Food inflation for 2016 - 2020,% (Federal State

Statistics Service)

Thus, there is a significant increase in food prices,

which intensified in 2021. So in December 2020,

President Vladimir Putin demanded to stop the rise in

food prices. As a result, the following measures were

taken to contain it.

Freezing of prices for sugar and sunflower oil

until the end of the first quarter of 2021. The Ministry

of Agriculture, Minpromtorg and FAS (Federal

Antimonopoly Service) concluded the agreement

with producers and retail chain stores on restriction of

the prices of sugar and sunflower oil.

Establishment of grain export quotas. From

February 15 to June 30, grain export quotas amount

to 17.5 million tons. At the same time, wheat exported

within the quota is subject to a duty of 25 euros per

ton. From March 1, the export duty on wheat within

the quota of 17.5 million will double, barley and corn

exports will also be subject to duty.

New mechanism of regulation of prices of

socially important goods. The government can set

maximum permissible retail prices for up to 90 days

if socially significant products have risen in price by

10% or more within 60 days (Karanina, E.,

Selezneva, E., Chuchkalova, S.,2020).

3. For consumer security, an important factor is

the information component of the consumer market.

Panic sentiments repeatedly led to empty shelves in

stores, caused even more excitement for sugar,

buckwheat, salt and even toilet paper. Many

information stuffing is targeted, with organizers

pursuing both economic and political goals. For

example, at the beginning of 2021, information was

repeatedly thrown in on rising prices for clothes,

shoes and accessories either by the summer or by the

autumn-winter season of 2021.

4. The fourth factor in consumer security is

competition in the retail market. The main indicators

of retail chains are presented in Table 3.

Table 3: Operating indicators for 2020 of major retail

chains (Russian Foreign Trade Statistics)

indicator «Lenta» «Magnit» X5 O'key

Revenue of

the Q4 2020,

million

rubles.

124 786 407 227 527 091 48 939

QoQ/QoQ

increase,%

5,85 10,60 12,33 6,04

Revenue

2020, million

rubles.

444 278 1 553

777

1 976

357

172

738

Increase

YoY,%

6,41 16,81 13,95 4,64

LFL selling

2020 г., %

5,4 7,4 5,5 5,4

LFL traffic

2020 г., %

-5,5 -5,9 -6 -10,7

LFL average

bill 2020 г.,

%

11,6 14,1 12,2 18

sales area

2020 г. , sq.m

1518598 7497000 7840000 599536

Change of

sales area for

the year, %

1,95 4,10 8,30 0,21

104,2

106,5

107,6

106,4

104,6

95,3

99,4

103,7

103,0

94

96

98

100

102

104

106

108

110

Q1

2019

Q2

2019

Q3

2019

Q4

2019

Q1

2020

Q2

2020

Q3

2020

Q4

2020

Q1

2020

6,90%

5,70%

6,30%

5,10%

3,80%

4,10%

2,80%

1,20%

1,00%

0,40%

1,60%

3,60%

5,80%

6,00%

5,00%

3,50%

2,00%

3,60%

4,30%

9,00%

0,00%

1,00%

2,00%

3,00%

4,00%

5,00%

6,00%

7,00%

8,00%

9,00%

10,00%

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

344

It should be noted that the main indicators of retail

chains in terms of revenue and retail space have been

declining since Q3, 2015. The main factor of the

decline is the lack of growth of solvent demand of the

population. This changed the structure of retail

formats. Large supermarkets become totally

unprofitable and chains mainly switch to the format

"at home," or small wholesale stores. The only two

chains that announced profits in 2019 were Bristol

and Red and White, which is associated with a small

area of stores and mainly alcoholic beverages.

The decrease in solvent demand led to an increase

in chains and reductions in stores (Table 4).

Table 4: Number of business entities in trade (Federal State

Statistics Service)

Quantity,

thousands of

units

2017 2018 2019 % +-

Wholesale and

retail trade

organization;

Repair of

motor vehicles

and

motorcycles

1465,1 1280,2 1084,2 74,0 -

380,9

including:

wholesale and

retail trade in

and repair of

motor vehicles

and

motorcycles

126,6 117 103,3 81,6 -23,3

wholesale and

retail trade in

and repair of

motor vehicles

and

motorcycles

1011,3 872,8 726,5 71,8 -

284,8

retail trade

other than

motor vehicles

and

motorcycles

327,2 290,3 254,5 77,8 -72,7

Individual

entrepreneurs

in retail trade

other than

motor vehicles

and

motorcycles

1294,3 1258,2 1191,4 92,0 -

102,9

Today, against the backdrop of an outflow of

customers and a decrease in demand, grocery retailers

are changing their assortment policy and optimizing

the matrix. At the same time, companies strive to find

the most optimal approaches to portfolio

management. With the help of a well-selected

assortment, networks can not only increase their trade

turnover, but also strengthen their market position.

So, according to the Lenta network, the assortment of

a standard store is about 13-15 thousand items (before

the crisis there were 35-50 thousand).

5. The problem of quality and falsification is a

serious problem in the consumer market. Despite the

apparent abundance, the quality of goods in almost all

retail chains leaves much to be desired. Counterfeit

food products are high. In addition, the turnover of

non-food counterfeit products in the Russian

Federation last year amounted to about 5.2 trillion

rubles. based on data from Rospotrebnadzor and

Rosstat. This is comparable to 4.7% of the country's

GDP. In general, almost 30% of non-food everyday

goods sold in Russia turn out to be counterfeit.

ACKNOWLEDGEMENTS

The article was prepared with the support of the grant

of the President of the Russian Federation NSh-

5187.2022.2 for state support of the leading scientific

schools of the Russian Federation within the

framework of the research topic «Development and

justification of the concept, an integrated model of

resilience diagnostics of risks and threats to the

security of regional ecosystems and the technology of

its application based on a digital twin».

4 CONCLUSIONS

Thus, in the consumer market, taking into account the

influence of world economic processes and

dehlabolization, there are the following

transformation trends that affect the level of security:

the impact of global negative trends, namely

unreasonable emissions, global inflation, competitive

wars and reduced investment efficiency;

inflation in the domestic market;

reduced assortment due to lack of solvent

demand and irregularities in supply chains;

changing service delivery formats;

concentration of trading business;

control of state corporations in retail both real

and electronic;

Strengthening government control, including

through IT technology.

Thus, the main task that the consumer market and

the Government of the Russian Federation will face

is to ensure solvent demand. At the same time, rather

stringent market regulation measures will be used in

relation to prices, providing regions and individual

Deglobalization and Consumer Security at the Present Stage of Economic Transformation

345

networks with food. Perhaps a decision will be made

to create separate state stores for poor citizens and

citizens with children. According to the logic of

things, this will need to be done in the conditions of

falling incomes. Only this factor can include the

"Mokhovik" of the real economy, increase

employment and real incomes of the population.

REFERENCES

Analytical note of the Central Bank. Globalization and

deglobalization: the role of emerging markets and

conclusions for Russia, 2019.

Abdulov, R. A., Dzhabborov, D. B., Komolov, O. O.,

Maslov, G. A., Stepanova, T. D., 2021. Deglobalizatio

n: the crisis of neoliberalism and the movement towards

a new world order, Scientific Laboratory of Modern

Political Economy.

Deglobalization: what the global crisis will lead to,

https://promdevelop.ru/

Eurasian Economic Commission, http://eec.eaeunion.org

Federal State Statistics Service, http://www.gks.ru

Google Scholar, https://scholar.google.ru

Karanina, E., 2020. Improving the national logistics model

on an international scale in the context of the economic

crisis. In IOP Conf. Series: Materials Science and

Engineering. 918(1).

Karanina, E., 2020. The creditworthiness of individuals as

a risk factor for the socio-economic security of the

region. In Topical Problems of Green Architecture,

Civil and Environmental Engineering, TPACEE 2019.

E3S Web of Conf. 164. pp. 2267-1242.

Komolov, O. O., 2018. Deglobalization in the context of

world economic stagnation. In Economic revival of

Russia. 4(58).

Russian Foreign Trade Statistics, https://statimex.ru/

Smirnov, V.V., 2021. Deglobalization as a consequence of

the trade war and pandemic. In Young Scientist. 5 (347).

Standard Eurobarometer 84. Report: Public opinion in the

European Union, 2015. pp. 104–113.

Trade and tariff data, WTO, https://www.wto.org/

World exports of goods and services, http://global-

finances.ru/mirovoj-eksport-po-godam/

World Trade Statistical Review 2020, https://www.wto.o

rg/

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

346