Survey on Mobile Banking and e-Wallet Usage and Its Security

Concerns

Anubhav Bose

1

, Chetna Choudhary

1

, Sunil Kumar Chowdhary

1

and Manoj Kumar

2

1

Amity University Uttar Pradesh, Noida

2

School of computer science, University of Petroleum and energy Studies, Dehradun

Keywords: e-Wallet, Mobile Banking, Online Transactions, Security Issues.

Abstract:

The rapid development in Information Technology has led to the introduction of many new technologies in

every aspect of our life. It has significantly contributed to the field of online transactions. As mobile

technology continuously grows, it has resulted in a rapid increase in transactions through mobile devices. It

has revolutionized e-banking and virtual money transactions by providing ease of quick transfer of money

from any location. Demonetization in India has further facilitated the use of mobile wallets as it encourages

cashless transactions online. There has also been a significant rise in usage of mobile banking during

demonetization as it saves a lot of time and effort to transact. However, there are many security concerns for

consumers due to the unfamiliarity and complexity of mobile devices and their associated technologies. The

major concern for users is the protection of their personal identification information and stealing of sensitive

payment information. This paper intends to study the usage patterns of mobile banking and E wallets and

identify the concerns related to security and privacy issues among the masses in the Indian context.

1 INTRODUCTION

The total number of mobile phone users in our

country are expected to increase to 730.7 million by

2018, which means almost half of the total

population of the country uses mobile phones.[9]

With the ease of connectivity and always on

availability, mobile phones today not only offer

advantages in terms of instant communication,

entertainment and greater productivity but they have

become tools that consumers use for banking,

payments, and shopping. Being easy and convenient,

currently, more than 43.7 million mobile users have

used Mobile banking services in one form or the

other (Trak, 2021). Until last year, e wallets totalled

200 million and expected to grow to 650 million by

2020 (BusinessLine, 2021). As mobile banking and

E wallet usage continues to grow by leaps and

bounds, security vulnerability and threats to

sensitive information are increasing fast.

In the coming times, the security of transactions

is probably going to emerge as the greatest worry

among Mobile banking and E wallet users. The

quick development in online theft and extortion are

on the ascent. Online fraud is found to be third

amongst economic crimes prevailing in our country

according to a survey conducted by PwC in 2011

(iPleaders, 2021). The incidence of ATM, credit,

debit and web transaction-related fraud has gone up

by over thirty five percent between 2012-13 and

2015-16 in our country, as concluded by the Central

Bank (ZDNet, 2021).

2 RELATED WORK

As we have seen, in recent years, there has been an

explosion of internet based electronic banking

applications (Dixit and Datta, 2010). Harshad Patel

and Vijay Pithadia (2013), found that “Advancement

achieved in the Information Technology and

communication Technology in the last two decades

has resulted in the successful implementation of

Electronic Banking in India” (Sailaja and

Thamodaran, 2016 ).

R. Karuppusamy and Dr N. Venkatesa

Palanchamy (2011) state in their study that “Ravi

(2008) stated that with the advent of innovative

technology, banks were able to provide customized

Bose, A., Choudhary, C., Chowdhary, S. and Kumar, M.

Survey on Mobile Banking and e-Wallet Usage and its Security Concerns.

DOI: 10.5220/0010789600003167

In Proceedings of the 1st International Conference on Innovation in Computer and Information Science (ICICIS 2021), pages 13-17

ISBN: 978-989-758-577-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

13

products and services like internet banking, mobile

banking, ATMs, Tele-Banking, to their customers.

Latest technology helped the banks to reduce their

transaction cost. But certain risks associated with

innovative technology and technology related frauds

were found to increase” (Karuppusamy and

Palanichamy, 2011).

In fact, in Aladwan's (2001) investigation of web

based banking, potential clients evaluated web security

and client's protection as the most significant future

difficulties that banks are confronting. Observed

efficiency of online banking has a direct impact on the

acceptance of web banking, too (Aladwani, 2001).

Customers stress that unapproved people can access their

online record and heavy monetary consequences will

take place. In India, slowly the Indian customer is

moving towards web banking. However, they are very

concerned regarding the security and privacy of web

banking (Malhotra and Singh, 2009). (Dixit and Datta,

2010) Infact, a majority of studies highlight the fact that

“security” is the biggest single concern for customers

when faced with the decision to use web banking.

Security has an issue perpetually, but its scope has been

modified from mere doubts regarding the privacy of

personal information to worries of monetary loss. (Sayar

and Wolfe, 2007).

A study done by Neha Dixit and Dr Saroj K.

shows that Security and protection, trust and

originality, have a positive impact on the

acknowledgment of web banking in India. Their

study aimed to find out the level of acceptance of

online banking among those customers who are over

thirty five years of age. (Dixit and Datta, 2010)

Jayaram. J and Dr P. N. Prasad (2013) deduce in

their examination that the greater part of the

investigations that have been done on issues

concerned with web banking in countries like

Australia (Sathye, 1999), Malaysia (Mukti, 2000;

Chung and Paynter, 2002; Sohail and Shanmugham

2004), Singapore (Gerrard and Cunningham, 2003a,

2006b), Turkey versus UK (Sayar and Wolfe, 2007)

and Saudi Arabia (Sohail and Shaikh, 2007).

(Jayaram and Prasad, 2013 ) A considerable measure

of work has not been done in India with importance

to e-banking concerns.

The current study intends to understand the

amount of level of usage of mobile banking and E

wallets and problems relating to the security and

privacy problems among the masses in the Indian

context.

3 RESEARCH MODEL

To investigate the E wallet and E banking Usage

patterns and related security concerns, we designed a

survey questionnaire. The questionnaire contains

three part: Demographics, E wallet and E banking

usage patterns and related Security Concerns.

We used Google forms to create, distribute the

survey and store the responses online. A total of 348

responses were received.

4 RESULTS AND ANALYSIS

4.1 Demographics and Personal

Attributes

1.Age: 81% of participants were 18-30 years old.

9.2% were younger than 18 years old, and 8.6%

were between 30-50 years. Only 1.1% of the

participants were above 50 years of age.

Figure 1: Age distribution.

2.Profession: 77.8% of the participants were

students and 17.3% were salaried professionals.

While only 3.2% of the participants were self-

employed, 1.4% were home makers. The majority of

the participants were from Non-IT domain

accounting for 77.8%. The remaining 17.3% were

associated with the IT industry.

Figure 2: Profession.

4.2 Usage Patterns

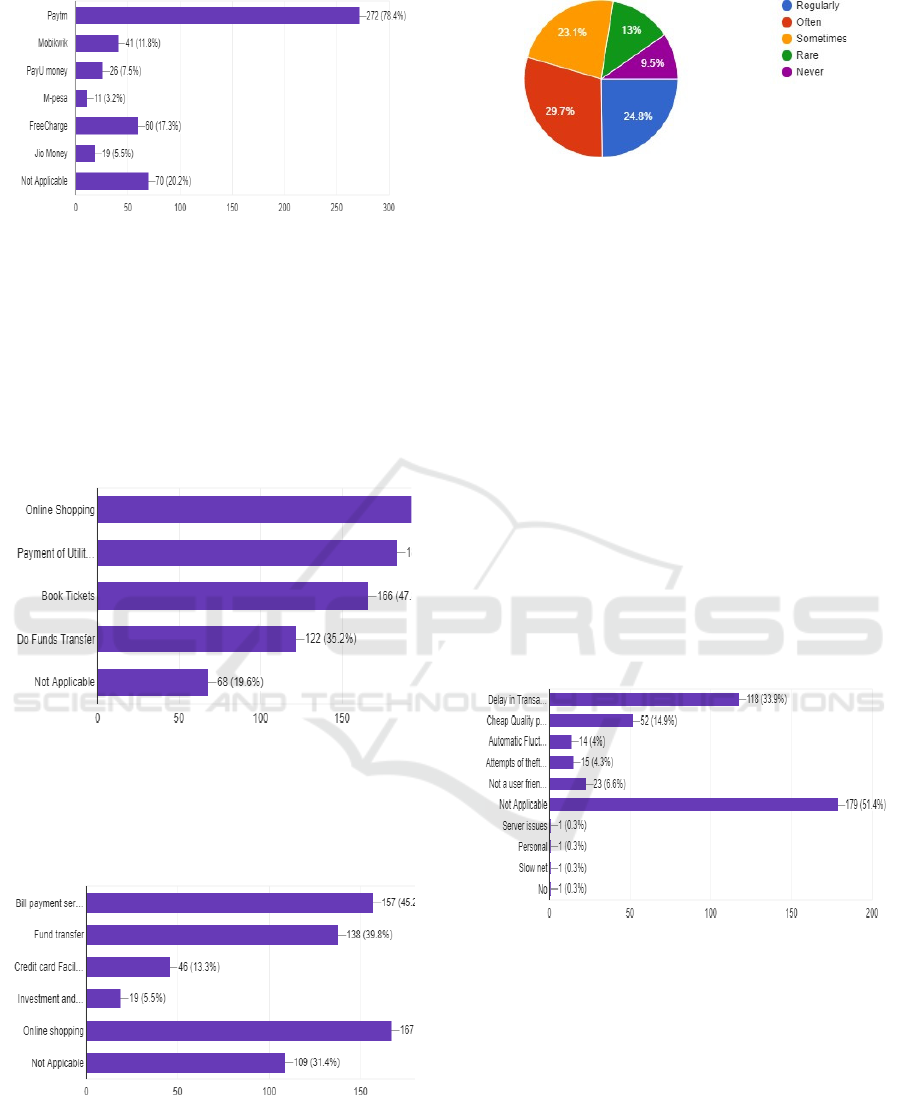

1.E-wallet type: The majority of the participants

used Paytm as their E-wallet, accounting to 78.4%.

While 17.3% used Freecharge,11.4% used

Mobikwik, 7.5% used PayU money, and 3.2% used

M-pesa. The remaining 20.2% of participants didn’t

use any.

ICICIS 2021 - International Conference on Innovations in Computer and Information Science

14

Figure 3: Types of E-wallets.

2.E-wallet usage: The majority of the participants,

59.4% used E wallets for online shopping while 53%

used it for payment of utility bills, and 47.8% used it

for booking tickets online. 35.2 used e wallets for

transferring funds.

3.E Banking Usage: 66% used E banking services,

while the rest 34% did not. Among those who use,

27.1% use State Bank of India’s services, which is

the highest number.

Figure 4: E-wallet usage purposes.

4.E banking Usage Pattern: As we had seen in E

wallets, In E-banking too, 48.1% used E banking

services for online shopping. 45.2% use it for bill

payment services and about 40% for funds transfer.

Figure 5: E-banking usage purpose.

5.Frequency: 24.8% of people have said that they

use E wallet and E banking services Regularly. The

highest, about 30%, use it. Often, and 23.1% use it

sometimes.

Figure 6: Frequency of usage.

6.Convenience: About 40% of the people find both e

wallets and e banking convenient to use, though

36% prefer only E wallets and almost 24% prefer

only E banking.

7.Effect of Demonetization: After demonetization in

the country in 2016, usage of e wallets and e

banking increased for almost 80% of all the people.

4.3 Security Concerns

1.Problems Faced: Almost 60% of the people have

not faced any problem while using E wallets and E

banking services, but about 40% of the people have

faced one.

2.Types of Problems faced: Among the users who

have faced a problem, the leading problem is Delay

in Transaction with about 34% suffering from it.

14.9% of respondents suffered from cheap quality

while shopping online and 6.6% from the problem of

not having a user-friendly interface.

Figure 7: Problems faced in online transaction.

A small number also suffered from Automatic

Fluctuation and Attempts of theft. However, almost

half of the respondents, 51.4%, did not experience a

single problem. Infact, the majority of the

population, 78.4% find online transactions safe to

use, which shows people’s immense level of trust.

21.6% have voted for a No.

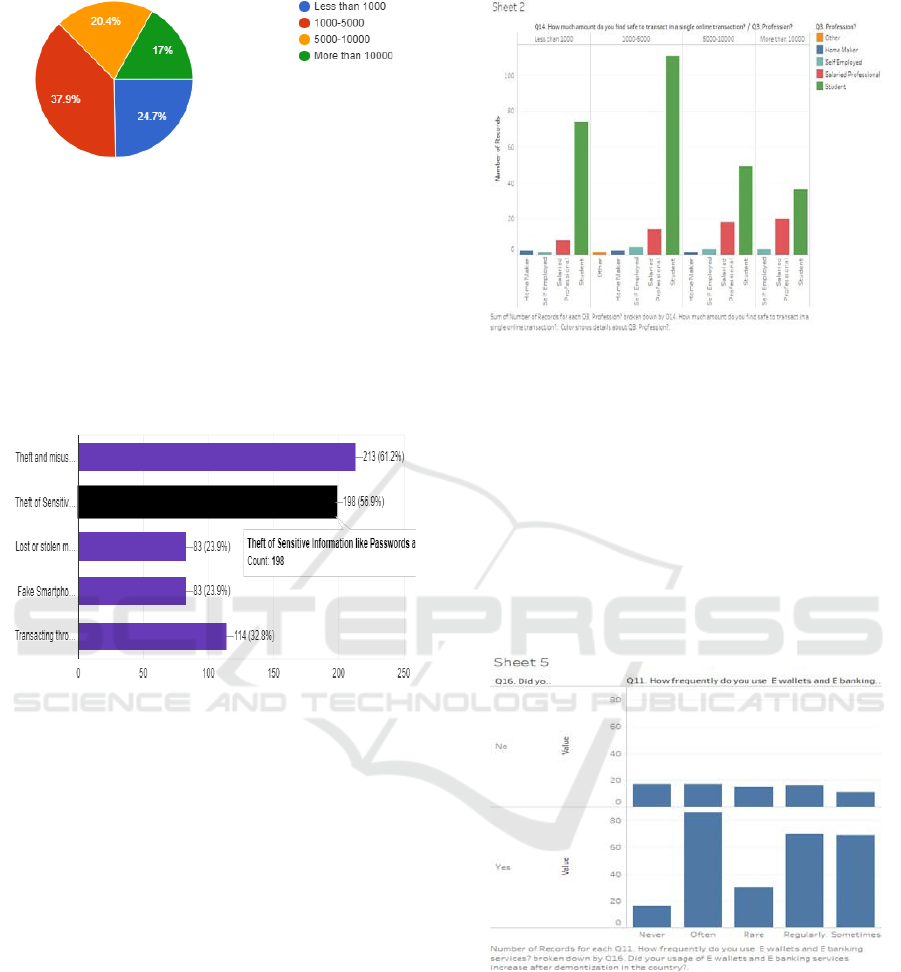

3.An amount that people find safe to transact: The

majority of the people, 37.9%, find it safe to transact

less than 5000INR.

Survey on Mobile Banking and e-Wallet Usage and its Security Concerns

15

Figure 8: Online transaction amount.

4.Security related concerns: About 61.2 of the

people fear the theft and misuse of Personal

information while 56.9% fear Theft of Sensitive

Information like Passwords and Pin leading to

financial loss. 32.8% fear that they might be

transacting through mobile devices infected by

malware. 23.9% of respondents feared that their

mobile would be stolen, and they might be

downloading Fake smartphone apps.

Figure 9: Security concerns.

4.4 Cross Analysis

1.Cross Analysing the two parameters; Profession

and the amount people find safe to transact, we see

that:

• Among the students, a maximum online transaction

is between 1000-5000 INR.

• Among the Salaried Professionals, a maximum

online transaction is More than 10000 INR.

• Among the Self Employed, a maximum online

transaction is again between 1000-5000 INR.

Figure 10: Relationship between Profession and online

transaction amount.

2.Cross Analysing the two parameters; Usage levels

after Demonetization and Frequency of Usage, we

see that all the levels (Regularly, Often, Sometimes,

Rare and Never) of Frequency of Usage were high

for people who had voted that their Usage of E

banking and E wallets Services increased after

Demonetization. Also, we see that the levels of

Frequency of Usage were low for people who had

voted that their usage did not increase after

demonetization.

Figure 11: Relationship between Demonetization and

frequency of usage of mobile transactions.

3.Cross Analysing the two parameters; Age and

Convenience concerning usage of E wallets or E

banking or both, we see that

• Below Age 18, Respondents prefer E wallets.

• Between 18-30, though the Respondents prefer

Both, their second preference is for E wallets.

• For 30-50 Age group, though the Respondents

prefer Both, their second preference, in this case, is

E banking.

ICICIS 2021 - International Conference on Innovations in Computer and Information Science

16

Figure 12: Relationship between Age and preference of e-

wallet or e-banking.

5 CONCLUSION

Our study found out that the usage of mobile

banking and E- wallets has significantly increased in

recent years. Demonetization has encouraged the

people of India to move towards a cashless economy

and has further facilitated the use of mobile banking.

The young people below 18 years prefer using e-

wallets and tend to transact not more than Rs 5000

while working professionals use both e-wallets and

mobile banking and tend to transact more than Rs

10000. Also, a lot of people are concerned about

performance and security issues of transacting

online via mobile devices. The major concerns are

theft and misuse of personal information and delay

in transactions. Many people who are more

proficient over the internet are also cautious about

installing fake smart phone applications via third

party stores. We conclude that in spite of the

security concerns, there is a major rise in the usage

of mobile banking and e-wallets in India.

Further, this paper will serve as a fundamental

advance in investigating clients' perspectives and

assumptions in regards to mobile banking and its

related security concerns. Additional research and

investigation are required to explore issues identified

with mobile banking in a more profound way and

what methodologies ought to be embraced by banks

by which they can upgrade the security provided to

their consumers.

REFERENCES

Karuppusamy, R. and Dr NV Palanichamy, (2011),

“Awareness and adoption of Value Added Services

offered by the banks in Coimbatore District”.

Dixit, N. and Dr SK, Datta. “Acceptance of E-banking

among Adult Customers: An Empirical Investigation

in India”.

Jayaram, J. and Dr P. N., Prasad (2013). “Review Of E-

Banking System And Exploring The Research Gap In

Indian Banking Context”.

Sailaja, P. and Dr.V., Thamodaran (2016). “Customers

Perception on Security System in Mobile banking”.

Kumar, K. and Mittal, M. (2013). “E-Banking Security

and Challenges: A survey”.

Patel, H. and Dr V., Pithadia (2013), “Emerging trends in

customer satisfaction of value added services in

selected banks at mehsana district of gujarat”.

Aladwani, A., “Online banking: a field study of drivers,

development challenges, and expectations”.

Nema, S. and Shukla, N., (2013), “Mobile Payment

Security issues: a Comprehensive Survey”.

https://www.statista.com/statistics/274658/forecast-of-

mobile-phone-users- in-india/

http://trak.in/tags/business/2009/10/08/mobile-banking-

users-india/

http://www.thehindubusinessline.com/economy/india-

skips-plastic- money-leapfrogs-into-mobile-wallet-

payments/article9407059.ece

https://blog.ipleaders.in/online-banking-frauds-in-india-

how-to-recover-lost-money/

http://www.zdnet.com/article/online-banking-and-plastic-

card-related- fraud-in-india-increases-35-percent/

Survey on Mobile Banking and e-Wallet Usage and its Security Concerns

17