Towards a Knowledge Graph-specific Definition of Digital

Transformation: An Account Networking View for Auditing

Florina Livia Covaci

1 a

, Robert Andrei Buchmann

1 b

and Radu Dragos

2

1

Business Information Systems Department, ”Babes

,

-Bolyai” University, Cluj-Napoca, Romania

2

Computer Science Department, ”Babes

,

-Bolyai” University, Cluj-Napoca, Romania

Keywords:

Knowledge Graph, Accounting Auditing, Digital Transformation, RDF.

Abstract:

This paper reports on an experimental Digital Transformation project where RDF graphs are adopted in an

organization’s accounting and document management system as a novel approach to accounting digitization,

going beyond traditional ERP systems to enable account-centric network analysis and more insightful master

data management - having accounting contextualized in a relationship-rich Knowledge Graph that captures

some of the tacit knowledge that accountants and auditors apply during their common tasks. Legacy ERP

systems that are based on relational databases face challenges when aggregating information regarding the

transactions that an account was involved in, which sometimes involve multihop JOINs, links to contextual

documents that may reside elsewhere, or rules that mimic (at least partially) an auditor’s reasoning. The paper

reports on a knowledge capture effort for mapping accounting information into an RDF graph in order to over-

come limitations of legacy systems with auditing support, currently implemented in a feasibility demonstrator

of low Technological Readiness Level. As theoretical implications, we also derive from this experience a

novel, specialized definition of Digital Transformation.

1 INTRODUCTION

Every organization maintains systematic records of

financial transactions, typically employing an ERP

system to support accounting activities. Records of

financial transactions are carried out based on ac-

counting principles which primarily treat data as ta-

ble structures and reports, although implied semantics

are always present in the form of an accountant’s tacit

knowledge about how accounts participate together

in double-entry records in various situations and how

those entries are co-dependent based on either practi-

cal patterns or accounting-specific regulations. More-

over, occurrence of errors in financial statements is

a problem to be dealt with on a monthly basis and

legacy accounting systems offer limited capabilities

sometimes requiring SQL skills or the support of an

IT department to look for non-compliant patterns in

multi/self-JOIN chains. The objective of this paper

is to report on a Design Science project that adopted

RDF graphs (Bizer C., 2009) as a treatment to a mas-

ter data management problem in a legacy accounting

a

https://orcid.org/0000-0003-1184-5992

b

https://orcid.org/0000-0002-7385-1610

system (and not only, but the current paper’s scope

is limited to the work of the accounting digitization

team).

An accounting information system should hold

not only financial data records, it should also accu-

mulate and manipulate knowledge (i.e. semantic links

and domain-specific rules), and then use that to mimic

the reasoning and data navigation patterns of an ac-

counting professional. Knowledge representation has

gained importance in recent years because of the rise

of semantic technology advertised as ”Knowledge

Graphs” (KG) which are indicated in recent Gartner

reports as being both an Artificial Intelligence hype

ingredient (Gartner, 2021a) and a data analytics trend

(Gartner, 2021b), with possible ramifications in vari-

ous Knowledge Management aspects.

The work at hand is an effort to translate some of

those qualities to accounting data analysis that is rel-

evant for catching accounting errors or investigating

accounting patterns that an auditor would also look

for, typically by visual scrutiny. Therefore, the prob-

lem statement is hereby formulated in terms of the

Design Science problem template (Wieringa, 2014):

Improve auditing capabilities with an existing

accounting information system (problem context)

Covaci, F., Buchmann, R. and Dragos, R.

Towards a Knowledge Graph-specific Definition of Digital Transformation: An Account Networking View for Auditing.

DOI: 10.5220/0010875000003116

In Proceedings of the 14th International Conference on Agents and Artificial Intelligence (ICAART 2022) - Volume 3, pages 637-644

ISBN: 978-989-758-547-0; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

637

...by treating it with a Knowledge Graph layer

over existing ledger data (artifact)

...to enable quasi-social views focusing on finan-

cial records connectedness (requirement)

...in order to enable auditing reasoning pat-

terns and contextualized accounting data management

(goals)

Design science is often used to build new sys-

tems in order to evaluate whether their prescriptions

are feasible and useful, and to gain deeper insights

into the problem being investigated. The field of

accounting information systems can benefit greatly

from this methodology as domain-specific informa-

tion, tacit knowledge and implicit reasoning patterns

can be captured in innovative design decisions.

The larger context for the problem tackled here

is an experimental Digital Transformation project

towards a data-centric IT architecture, from an

application-centric mindset that has lead over time to

financial data silos requiring scheduled synchroniza-

tion, as well as time consuming manual consolidation

and verification. To obtain a contextualized account

network, a GraphDB instance (Ontotext, b) is popu-

lated through its OntoRefine plug-in for lifting legacy

tabular data to RDF graphs (Ontotext, c). Seman-

tic queries and SPARQL-based reasoning patterns are

then employed in an account analytics workbench to

build a network of how accounts interact with each

other depending on their co-occurrences in a double-

entry ledger system, and to navigate those relation-

ships according to some patterns of domain-specific

interest.

The remainder of the paper is structured as fol-

lows: Section 2 summarizes the Accounting Cycle,

afterwards Section 3 describes the knowledge capture

process and derived semantic patterns. Section 4 dis-

cusses evaluation challenges and Section 5 presents a

SWOT analysis.

2 THE FINANCIAL

ACCOUNTING CYCLE

In a business, every transaction affects at least two ac-

counts - as a debit (increase in assets) and as a credit

(increase in liability, equity, income). The debit and

credit entries must always be equal. After the trans-

actions are recorded in the general journal the finan-

cial statements are prepared starting with a trial bal-

ance sheet. A balance sheet is a financial snapshot of

a company’s financial position at a specific point in

time. It includes a list of assets, liabilities, and the

difference between the two, known as net worth. The

balance sheet is built on the accounting equation (as-

sets = liabilities + owner’s equity).

The accounting cycle is a series of steps that trans-

form a company’s basic financial data into financial

statements. The accounting cycle ensures that the

company’s financial statements are consistent, accu-

rate, and in compliance with official accounting stan-

dards.

The accounting cycle consists of the following six

steps:

Step 1: Gather and analyze documentation for the

current accounting period, such as receipts, invoices,

and bank statements.

Step 2: The ledger is made up of journal entries,

which are a chronological list of all of a company’s

transactions, written down according to double-entry

accounting procedures. To ensure that the company’s

bookkeeping is always up to date, journal entries are

recorded to the ledger on a continual basis, as soon as

business transactions occur.

Step 3: Prepare a trial balance: this is analyzed

mainly for the accounts that involve expenses and in-

come accounts in correlation with the result of assets

and liabilities accounts. Based on this correlation pos-

sible errors in the recorded transactions are investi-

gated by analyzing the account statement.

The error detecting process requires a significant

amount of time because it implies the human anal-

ysis of multiple inter-related account statements that

reflect an economic event. The following types of er-

rors may occurs in the process of recording of trans-

actions:(Renu G., 2013)

A. Clerical Errors. Clerical errors are errors in

recording, posting, totalling, and balancing. Clerical

errors are further separated into two types: (I) omis-

sion errors and (ii) commission errors (e.g. posting

in wrong account, error in totaling and balancing; er-

rors in carry forward totals to trial balance and so on).

Clerical errors may or may not have an impact on trial

balance.

B. Errors of Principle. When commonly accepted

accounting principles are not followed when record-

ing the transactions in the books of account, it is

called a principle error. For example, selecting the in-

correct account head or declaring capital expenditure

as revenue. A trial balance or routine inspection will

not reveal such an inaccuracy. It can only be discov-

ered through searching or independent verification.

C. Compensating Errors. Compensating errors are

ones that occur as a result of previous faults being

compensated for. This is difficult to detect because

the net effect is zero. The totals and posts can all be

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

638

checked for these inaccuracies, which have no effect

on the trial balance.

D. Errors of Duplication. Duplication errors arise

when the identical transaction is entered twice in the

books of original entry and hence twice in the ledger

accounts. These have no impact on trial balance.

Step 4: Adjust the identified errors: based on

the identified errors in the previous step the recorded

transactions are adjusted in order to correctly reflect

the economic event.

Step 5: Prepare an adjusted trial balance, with the

adjusted transactions and amounts. This balance sheet

will be the starting point for preparing the company

financial statements.

Step 6: Prepare financial statements that will offer

a view about the performance of the company.

Knowledge on accounting patterns can be a ba-

sis for designing accounting intelligence systems and

this knowledge often relates to aggregating informa-

tion across multi-hop relationships that exist over the

network of interacting accounts. Knowledge Graphs

are a natural machine-readable information structure

that can capture this network.

3 FROM TACIT KNOWLEDGE

TO KNOWLEDGE GRAPH

The data-centric mindset (DCManifesto, 2021) is in

line with an auditor’s default mindset, one which rea-

sons in accounting principles while navigating a data

context. The navigable ”data context” is formed of all

the direct and indirect relationships to which a data

point participates, limited by a relevance threshold -

e.g., the number of ”hops” in indirect relationships

after which the semantic connectedness becomes too

weak to be of interest for the operational purpose).

This highly synthetic notion of ”context” was recently

formulated in (Cagle, 2021) and it is the asset primar-

ily harnessed during KG-based Digital Transforma-

tion.

In the host organization, such context navigation

is not typically supported by the existing ERP’s rigid

tabular views, leaving it to a human auditor to man-

ually browse printed account cards (as suggested in

Figure 1) in a manner that resembles Knowledge

Graph navigation but is performed on paper, a strenu-

ous exploration - at best assisted by search-and-filter

features on tabular views in the ERP system.

The legacy accounting system has limited capabil-

ities (mostly basic form validation) for providing au-

diting support in identifying errors. The identification

of errors is usually made based on the account state-

ment - a periodic summary of that account’s activity.

The individual verification is a time consuming pro-

cess since the number of accounting transactions can

be in a range of 20000-25000/month, but it is funda-

mentally a navigation of the graph of account associ-

ations, not unlike the KG browsing that open knowl-

edge repositories like DBPedia provide in a browser

(DBpedia, 2021).

In order to build the Knowledge Graph for our De-

sign Science project we followed a knowledge capture

approach that involved three sources of knowledge:

• Database Engineer – staff that contributed to the

development and implementation of the existing

ERP software, thus having a good understanding

the boundaries between legacy data silos and the

improvised conventions for synchronizing them;

• Domain-specific Operators - staff with experience

in financial-accounting field, the actual users of

the legacy systems able to demonstrate how work

is performed;

• National legislation - certain accounting rules are

prescribed as double-entry associations in natural

language form - available to domain-specific op-

erators as professional knowledge but not embed-

ded in ERP systems functionality. Although some

changes in legislation are occasionally observed,

they are rather rare and should be easily edited as

association rules that an information system can

automatically confront with ledger records.

The knowledge capture process comprised the fol-

lowing steps:

1. Identification of the main entities (in ER sense)

and corresponding tables of the existing ERP sys-

tem. The structure of the tables together with a

data samples were isolated in spreadsheets and

subjected to discussions to clarify the (sometimes

cryptic) meaning of data fields;

2. Person-to-person interactions with think aloud

operations recorded to capture the data brows-

ing experience and reasoning assumptions of the

domain-specific operators, isolating the hints they

look for during their monthly verifications;

3. Discussions between the Knowledge Engineers

and the Database Engineers to identify gaps in the

accounting cycle that are not explicitly captured

in current data silos schemas;

4. Retrieval of accounting rules from the national

legislation, those that can take the form of double-

entry association rules - i.e. which accounts are

allowed to credit a given account;

5. Several iterations of this process were necessary

to eliminate understanding gaps between three

Towards a Knowledge Graph-specific Definition of Digital Transformation: An Account Networking View for Auditing

639

Figure 1: Manual Account Statement Analysis Process.

categories of stakeholders (legacy database engi-

neer, operators and knowledge engineer).

Graph building was partly manual (the language

of the national legislation does not have reasonable

natural language support and creating such support is

out of the project’s scope) and partly based on the On-

toRefine ETL-like approach provided by GraphDB,

capable of semantic lifting and reconciling tabular

data sources. In the following we will reveal some

of the semantic patterns resulting from this process.

In a traditional ERP each transaction is recorded

in a double-entry ledger based on the raw information

that characterizes it, with attributes such as Debit Ac-

count, Credit Account, Value of transaction, Date of

transaction. Depending on the complexity of the or-

ganization, the recording of the transactions may re-

quire additional information like funding sources or

detailed subtypes of expense/income.

To illustrate the design decisions underlying the

Knowledge Graph approach, in the following we

showcase the required accounting transactions related

to the economic event of acquisition of inventory

items. In the debit of account 303 01 00 “Inventory

items in the warehouse” a record registered the value

at registration price of the inventory objects purchased

from third parties based on the invoice issued. The

credit account will be 401 01 00 ”Suppliers”(1). At

the same time in the debit of the account 442 60 00

”Deductible value added tax” and in the credit of ac-

count 401 01 00 there is need to be recorded the payed

added value tax for the purchased inventory items (2).

When the inventory item is put into use in the debit of

account 303 02 00 ”Inventory items in use” and in the

credit of account 303 01 00 is registered the price of

the inventory items (3). The payment of the invoice

is registered in the debit of the account 401 00 00 and

the credit of account 770 00 00 ”Available funds” (4).

When the inventory item is out of use the value at reg-

istration price of the inventory objects is registered in

the debit of account 603 00 00 ”Expenditure on in-

ventory items” and the credit of account 302 00 00

(5).

Table 1 provides a summary of the transactions

described above in a similar manner that they are

recorded in a table in a relational database.

Such tables were converted into a network of ac-

counts whose pairing can be weighted and enriched

by a number of aggregate properties. The work does

not currently employ a full fledged ontology (like e.g.

FIBO) as it focuses on SPARQL-based RDF-star rea-

soning that can enrich the graph or aggregate informa-

tion over relationship-rich data. Figure 2 shows some

of these records in a linked data form revealing chains

of how accounts influence each other by participating

in the same ledger double-entry.

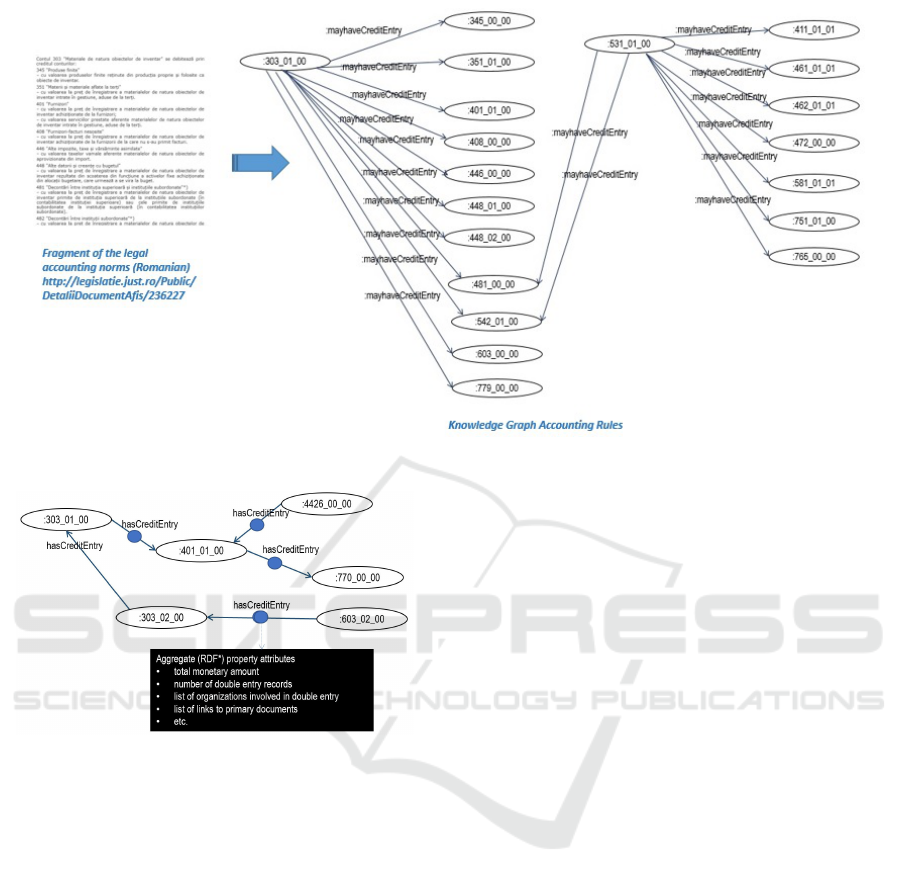

Regulations on how accounts can be associated

are available in the accounting law and belong to the

profession’s domain knowledge - they form a depen-

dency graph that can support certain levels of error

checking. Figure 3 shows a graph fragment with ac-

counting rules related to the recorded transactions in

Figure 2, also suggesting on the left side the national

law (in textual form) from which these rules have

been derived.

The knowledge graph can be exploited for iden-

tifying errors using SPARQL-based reasoning rules

which are deterministic. For compliance with the na-

tional law, the graph fragment with accounting rules

in Figure 3 becomes a reasoning premise to detect

principle accounting errors:

INSERT

{?transaction a :principleError}

WHERE

{

?transaction :debitAccount ?cd;

:creditAccount ?cc.

FILTER NOT EXISTS

{GRAPH :AccountingRules {?cd

:mayHaveCreditEntry ?cc}}

}

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

640

Table 1: Accounting transactions related to a purchase of inventory items.

Transaction ID Debit Account Credit Account Transaction Transaction Other relevant

Amount Date attrs (e.g. doc links)

1 303 01 00 401 01 00 750 03-10-2021 . . .

2 442 60 00 401 01 00 142.5 03-10-2021 . . .

3 303 02 00 303 01 00 750 03-17-2021 . . .

4 401 00 00 770 00 00 892.5 04-10-2021 . . .

5 603 00 00 302 00 00 750 11-10-2021 . . .

Figure 2: Knowledge Graph fragment lifted from legacy transaction data.

We go beyond error-checking to employ the RDF

approach for richer, relationship-focused analysis. A

network of accounts is generated by the following

rule based on two accounts participating in the same

double-entry transaction:

INSERT { << ?x :hasCreditEntry ?y >>

:totalMonetaryAmount ?z }

WHERE

{

SELECT ?x ?y (SUM(DISTINCT ?amount)

AS ?z)

WHERE {?transaction :debitAccount ?x;

:creditAccount ?y; :amount ?amount}

GROUP BY ?x ?y

}

In addition each co-participation is marked using

the RDF-star extension that allows RDF statements

to have their own properties - i.e., properties of prop-

erty instances aimed to close the functional gap be-

tween RDF graphs and labelled property graphs (Har-

tig, 2021). The rule example above computes the to-

tal amount involved by all interactions between the

connected accounts. Similarly other valuable aggre-

gations may be obtained as suggested in Figure 4 (e.g.

lists of partner organizations, lists of links to primary

documents).

In order to query the graph about all the accounts

that have influenced directly or indirectly on account

401 01 00 we can use the following SPARQL query:

SELECT ?x

WHERE

{:401_01_00 (ˆ:hasCreditEntry|

:hasCreditEntry)+ ?x}

In contrast to a relational database, a query about

all the accounts that 401 00 00 was involved with

in the same operation, needs to perform n inner join

operations on the accounting transactions table. The

challenge of performing such a query has to do among

others with the indefinite value of n (depending on

the account that we query on), which makes it an

ideal case for the navigation of the accounts’ network.

Since the network is not separated, but kept together

with the legacy system from which it was derived,

navigation through the network may also collect rel-

evant data attached to every operational pair of ac-

counts - amounts, document links etc. Detection of

Towards a Knowledge Graph-specific Definition of Digital Transformation: An Account Networking View for Auditing

641

Figure 3: Transformation of legal accounting norms to Knowledge Graph.

Figure 4: Networked View on the Account Interactions.

arbitrary length paths has been recently made avail-

able as a plug-in service on GraphDB (Ontotext, a) -

due to weak default support for path detection in the

SPARQL standard, forcing our early stage attempts

to involve an overhead of network analysis libraries.

Multihop directed chains of relationships can now be

detected and highlighted - e.g. the shortest path con-

necting two recorded transactions through a chain of

accounts:

SELECT ?start ?property ?end ?index

WHERE{

SERVICE

<http://www.ontotext.com/path#search>

<urn:path> {

path:findPath path:shortestPath;

path:sourceNode ?pathSource;

path:destinationNode ?pathDestination;

path:startNode ?start;

path:propertyBinding ?property;

path:endNode ?end;

path:resultBindingIndex ?index. }

:TransactionX:DebitAccount?pathSource.

:TransactionY:CreditAccount

?pathDestination. }

Traditional tabular analytics are not excluded - the

following builds a time series of all transactions using

some reference account as debit account:

SELECT (SUM(?amount) AS ?dailyAmount) ?date

WHERE

{?transaction :debitAccount :603_02_00;

:amount ?amount; :date ?date}

GROUP BY ?date

ORDER BY ?date

These are some relevant patterns prescribed for

the analysis workbench which makes it possible to

gain a networking view on accounts interaction with-

out making use of any network analysis tools. A

rudimentary interface for graph browsing/path high-

lighting, CONSTRUCT-ing subgraphs and running

SPARQL* queries was build on top to showcase key

operations (see Fig. 5).

4 TENTATIVE EVALUATION

Design Science artifacts can be evaluated according

to a large variety of criteria which have been orga-

nized in a taxonomy by (Prat-N., 2014). Limited by

the current Technological Readiness Level of the pro-

posed solution, we are currently focusing on:

Consistency with Organization: the proposed arti-

fact satisfies the set of competency questions derived

from interviews with operators (accountants) of the

legacy ERP systems. The competency questions are

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

642

Figure 5: Account Graph Navigator.

answered by the queries and reasoning patterns de-

tailed in the previous section. Consistency with tech-

nology: a Knowledge Graph can be populated with

legacy data in several ways - either an ETL strategy

lifts legacy data to a new form of data warehouse; or,

a virtual graph layer is deployed to unify access to ex-

isting data - the hereby reported project employs for

now the first approach with the help of GraphDB’s

OntoRefine RDFizer (Ontotext, c). The legacy ERP

system is however very limited in terms of interop-

erability channels and a future phase of the research

aims to build demonstrators of accounting operations

that can advocate replacement of the legacy systems;

obstacles in this respect are not only technological,

also having to do with extensive reskilling and change

management.

A second tier of evaluation priorities is postponed

for future work - i.e, Consistency with people: no data

is currently available on technology acceptance, as

the proposed artifact still requires some technical un-

derstanding of graph technology and query-level in-

teraction that should be obfuscated entirely behind a

graph-aware user experience. However, current itera-

tions focused on feasibility as a prerequisite for ac-

ceptance. Digitally savvy human capital is needed

in any Digital Transformation project - however KG

savviness is a major challenge due to lack of educa-

tional content - less than ten percent of the project

team had prior awareness about KG and a major ef-

fort of upskilling developers was needed; this effort

should not be further pushed to end-users, for which

a graph-driven user experience must be designed - a

distinct challenge that will be tackled by follow-up

projects.

We follow the practice of Design Science re-

search of trying to inform design-based theorizing,

by proposing the following key characteristic for a

KG-based Digital Transformation: it is a form of in-

formation system transformation supported by digital

means that specifically provide - both to relationship-

rich data governance and to relationship-aware dig-

ital assets (services, agents etc.) - an ability to nav-

igate data context, as it was defined at the beginning

of Section 3.

5 CONCLUSIONS AND FUTURE

WORK

Knowledge representation and reasoning are inspired

by human problem solving, and can empower intel-

ligent systems to mimic deterministic pattern seek-

ing. Considering the current Technological Readiness

Level of the proposal, we summarize a SWOT evalu-

ation to inform future iterations of the proposal, as the

project is open-ended and will evolve towards further

data integrability with heterogeneous sources that can

enrich the discussed patterns:

Strengths: We defined a method of mapping exist-

ing accounting transactions and accountant’s knowl-

edge to semantic query patterns based on RDF graphs

and the RDF-star extension. They exploit a net-

worked view of accounts interactions based on their

co-occurrence in the same ledger double-entry or

check them against regulatory constraints that are

domain-specific and only available in textual regula-

tions.

Weaknesses: The current proof-of-concept is on a low

Technological Readiness Level. An ontology is still

to be designed to further enrich the graph - we’re cur-

rently considering FIBO (FIBO, 2021) although it is

currently considered overkill relative to the project

objectives. For the work hereby reported we are cur-

rently not inclined towards developing a novel ontol-

ogy as data was lifted from legacy SQL-based silos

and inherits concepts and properties from the source

schemas. The focus of the reported project iteration

was on fulfilment of certain key use cases under proto-

typical feasibility conditions - to theorize on the Dig-

ital Transformation characteristics that were distilled

in Section 5.

Opportunities: Complex fraudulent patterns may be

devised and prescribed as graph-driven features. The

accounting ecosystem is fundamentally link-oriented,

something already demonstrated by the XBRL stan-

Towards a Knowledge Graph-specific Definition of Digital Transformation: An Account Networking View for Auditing

643

dard (XBRLInternational, ) which heavily relies on

XLink - we conclude that XBRL was the XML-

era compromise for a tentative accounting-specific

knowledge representationn. Financial authorities be-

ing preoccupied with cross-checking business activ-

ities that are fundamentally federated across partner

businesses, Knowledge Graphs may be a key enabler

for cross-organization auditing if such technology is

adopted at large.

Threats: The uptake of Knowledge Graphs is still lim-

ited and the data analytics methods practiced by audi-

tors are still fundamentally table-biased. Promoting

a mindset where semantic networks (in terms of the

accounting domain) meets the obstacle that most ac-

countants have no awareness of the existence of non-

tabular data models, even if they are closer to how

accounting principles are applied by a human opera-

tor.

As a future work we propose to extend our work

in order to identify possible benefits with respect to

fraud detection.

ACKNOWLEDGEMENTS

The current work was supported by the project

POC/398/1/1/124155 - co-financed by the European

Regional Development Fund (ERDF) through the

Competitiveness Operational Programme for Roma-

nia 2014-2020.

REFERENCES

Bizer C., Health T., B.-L. T. (2009). Linked data – the story

so far. In International Journal on Semantic Web and

Information.

Cagle, K. (Accessed June 20th, 2021). The

role of context in data. In Available at

https://www.linkedin.com/pulse/role-context-data-

kurt-cagle/.

DBpedia (Accessed April 1st, 2021). In https://dbpedia.org.

DCManifesto (Accessed April 1st, 2021).

In The Data-centric Manifesto

http://www.datacentricmanifesto.org.

FIBO (Accessed April 1st, 2021). Enterprise data manage-

ment council. fibo the financial industry business on-

tology. In https://spec.edmcouncil.org/fibo/.

Gartner (Accessed April 1st, 2021a). Gart-

ner: 2 megatrends dominate the gartner

hype cycle for artificial intelligence. In

https://www.gartner.com/smarterwithgartner/2-

megatrends-dominate-the-gartner-hype-cycle-for-

artificial-intelligence-2020/.

Gartner (Accessed April 1st, 2021b). Gartner: Top

10 data and analytics trends for 2021. In

https://www.gartner.com/smarterwithgartner/gartner-

top-10-data-and-analytics-trends-for-2021/.

Hartig, O. (Accessed April 1st, 2021). Po-

sition statement: Rdf* and sparql*. In

https://www.w3.org/Data/events/data-ws-

2019/assets/position/Olaf/Hartig.pdf.

Ontotext. Graph path search service on graphdb. In

https://graphdb.ontotext.com/documentation/9.9/

enterprise/graph-path-search.html.

Ontotext. Graphdb. In https://graphdb.ontotext.com/.

Ontotext. Ontorefine. In

https://graphdb.ontotext.com/documentation/free/

loading-data-using-ontorefine.html.

Prat-N., Comyn-Wattiau I., A. J. (2014). Artifact evalua-

tion in information systems design science research -

a holistic view. In PACIS 2014 Proceedings.

Renu G., B. M. (2013). Errors and frauds in financial trans-

actions: Auditors opinion. In The Global eLearning

Journal.

Wieringa, R. (2014). Design science methodology for infor-

mation systems and software engineering. Springer.

XBRLInternational. The xbrl standard. In

https://www.xbrl.org/.

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

644