The Impacts of the CEO’s Network Effect on Digitalization and Agile

Leadership in China

Xihui Haviour Chen

1a

, Victor Chang

2b

, Patricia Baudier

3c

and Kienpin Tee

4d

1

Edinburgh Business School, Heriot-Watt University, Edinburgh, U.K.

2

Department of Operations and Information Management, Aston Business School, Aston University, Birmingham, U.K.

3

EM Normandie Business School, Métis Lab, Paris, France

4

Zayed University, U.A.E.

Keywords: Social Capital, CEO Networks, CEO Transition, Agile Leadership, Digitalization, Innovation Efficiency.

Abstract: Digitalization as a business enabler has speeded and scaled innovation in many firms. As the corporate leader,

the CEO is there to set the stage for a learning process that facilitates strategic agility and enhances network

effects to create value. This study uses innovation efficiency as the proxy of digitalization to examine the

contribution of the CEO networks to firm-level innovation efficiency in Chinese listed firms. We apply a

frontier analysis approach (e.g., DEA and SFA) and measure innovation efficiency based on the scale ratio of

innovation output (i.e., patent counts) and input (R&D investment and R&D personnel). First, we find that

innovation is more efficient when CEO has more outside directorships by considering 13,516 firm-year

observations in Chinese listed high-tech firms between 2007 and 2017. Second, a significant and positive

relationship exists between a well-connected CEO and innovation efficiency when the newly appointed CEO

has larger networks than the predecessor. Third, it is found out that the positive correlation between a well-

connected CEO and innovation efficiency will become non-significant when the number of outside

directorships is above the yearly median level. This empirical study provides evidence for the network effects

of a CEO for improving innovation efficiency. The findings emphasize the contingent value of the CEO's

external social capital on agility, especially the multiple directorships in a transitional economy.

1 INTRODUCTION

The ability of corporate leaders to navigate change

has never been more crucial than in most recent years

due to 'Black swan' events, such as Brexit and

COVID-19. Whether a firm adapts to the challenges

and opportunities ahead will depend largely on how

agile the leaders are. On the other hand, digital

architecture is designed to drive cross virtual

collaborations and innovation. Agile leadership and

digitalization implementation are two key factors of

corporate success (Ferraris et al., 2021; Vecchiato,

2015). However, empirical studies of the relationship

between leader agility and corporate digitalization

remain sparse mainly due to the lack of ideal proxies

a

https://orcid.org/0000-0003-0723-4574

b

https://orcid.org/0000-0002-8012-5852

c

https://orcid.org/0000-0001-9881-4560

d

https://orcid.org/0000-0002-4233-0767

* Corresponding author

that could numerically measure the two variables.

Our study focuses on this issue and aims to fill this

gap by proposing two possible proxies.

In the enterprise context, digitization is the

process of changing from analog form, such as paper-

based, to digital form. Digitalization helps firms

increase speed, enhance efficiency and accelerate the

pace of competition (Škare and Soriano, 2021). A

digitalized firm not only converts invention ideas into

products faster but also consumes fewer resources

(Aklamanu et al., 2016). All firms in competitive

environments tend to digitalize their operation to

improve operational efficiency. The more digitalized

a firm is, the more efficient it can become. In this

paper, we determine innovation efficiency as a scale

Chen, X., Chang, V., Baudier, P. and Tee, K.

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China.

DOI: 10.5220/0011049400003206

In Proceedings of the 4th International Conference on Finance, Economics, Management and IT Business (FEMIB 2022), pages 43-54

ISBN: 978-989-758-567-8; ISSN: 2184-5891

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

43

ratio of innovation output (i.e., patent counts) and

input (R&D investment and R&D personnel) (Wang

et al., 2016). Previous literature has found that

computerization and programming tend to increase

patent production and replace manpower reliance

(Miceli et al., 2021). As such, we propose to use

innovation efficiency to proxy for the level of

digitalization.

According to the social capital and agility

literature (Aklamanu et al., 2016; Doz, 2020; Ferraris

et al., 2021), network effects (e.g., outside

directorships) enable firms to be more agile, gain

access to critical resources, legitimacy, and strategic

information. With classic strategies being upended

under the constant threat from new technologies and

business disruption (e.g. caused by the COVID-19,

Brexit, and the US-China trade war) occurring,

innovation formulation and implementation have

become imperative for most leaders (e.g. CEO)

(Ferraris et al., 2021). Our study thus proposes that a

well-connected CEO is an agile leader. As such, we

propose to use the number of CEO interlocking firms

as a proxy for leadership agility.

We select China as our research background

because China is arguably the most important

industrial producer and manufacturer globally. It sells

more manufacturing products and services than any

other country and has built up digital technologies in

a highly pragmatic way. Following the national plan,

China has devoted considerable effort to enhance

technological innovation. For example, the country

spent more than $378 billion on research and

development in 2020 alone, with a 10 percent

increase compared to 2019 (Shead, 2021). This

amount represented a level of innovation investment

second only to the United States. However,

innovation is often associated with risk. It requires

agility (Lee and Yang, 2014) and is seen as costly,

time-consuming, and uncertain (see Cao et al., 2015;

Lee et al., 2020; Sariol and Abebe, 2017; Zhang et al.,

2014). Throwing money into innovative projects

without considering their relative efficiencies may

cause misuse of resources and drop organizational

profitability. In order to address this concern,

improving innovation efficiency is of considerable

significance for enhancing the comprehensive

strength and international competitiveness of

companies.

This study is motivated by the fact that

digitalization as a business enabler has speeded and

scaled innovation in many firms around the Asian

region, particularly in China. With teams working

remotely during the COVID-19 lockdown, many

high-tech industries have shifted to agile working

patterns and have embraced the digitization process.

While digitalization accelerates the processes of

innovation, the CEO, as the corporate leader, is there

to set the stage for a learning process that facilitates

strategic agility, adaptability, and flexibility (Ferraris

et al., 2021; Vecchiato, 2015). Besides, the CEO also

works with executives and business partners from

external firms. Agility and speed of possessing digital

information have become critical to foresighted

emerging threats and seize new market opportunities

before their rivals even notice them. The paper takes

a stand on the empirical study that intends to provide

evidence for the network effects of a CEO for

improving innovation efficiency. A conceptual

framework has been developed (see Figure 1).

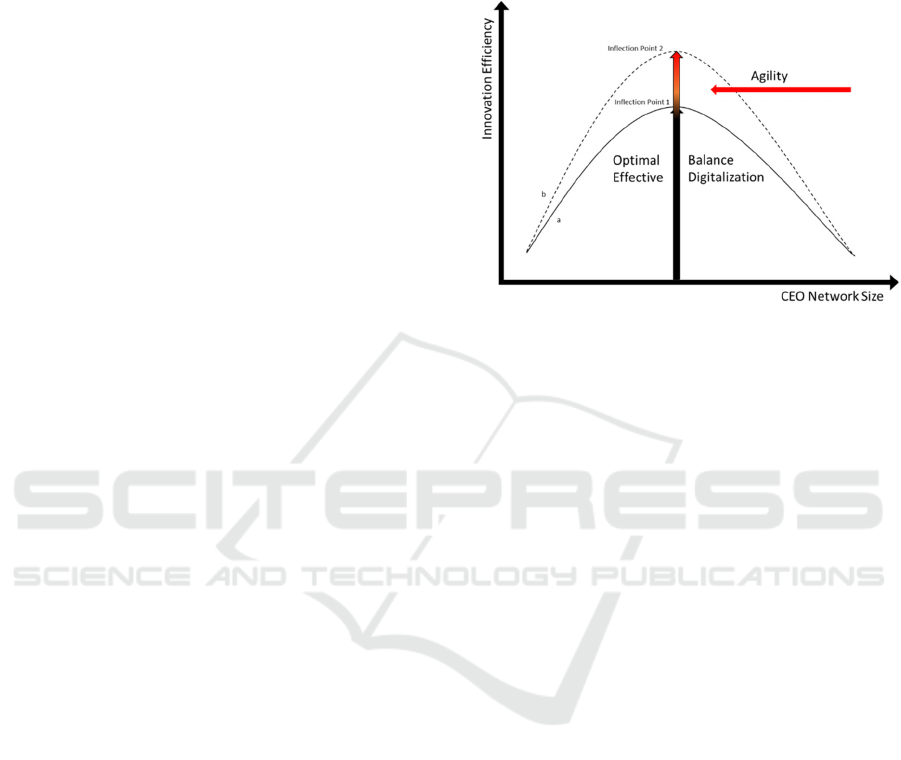

Figure 1: A Conceptual framework of CEO Network

Effects.

The study focuses on how agility and

digitalization enhance the contingent value of the

CEO's external social capital (i.e., the number of

external directorships) without compromising

innovation efficiency in a transitional economy. We,

therefore, have raised three research questions:

1. What is the effect of agility on digitalization?

2. What are the effects of CEO transition on

digitalization?

3. What is the possible relationship between

digitalization and CEO network size?

While using a sample of the panel data set

containing 13,516 firm-year observations in Chinese

listed firms between 2007 and 2017, our empirical

results show that if a CEO holds outside directorships,

the firm tends to have higher innovation efficiency

than its counterparts. Besides, a positive relationship

is found between a well-connected CEO and

innovation efficiency when the successor has more

outside directorships than the predecessor. Moreover,

the positive effects of a well-connected CEO on

innovation efficiency will become non-significant

after reaching a certain optimum level. Thus, our

study supports the theory of social capital and

suggests that the value of CEO networks could

reinforce the positive effects on innovation efficiency

in China.

This study proceeds as follows. After the

introduction, there is a conceptual framework and

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

44

research background section. A literature review on

agility, CEO networks and innovation efficiency in a

Chinese context is conducted, followed by the sample

composition and methodology. The empirical results

for this study are subsequently reported, addressing

the network effects of CEO on innovation efficiency.

2 LITERATURE REVIEW AND

HYPOTHESES

2.1 CEO outside Directorships and

Innovation Efficiency

Vecchiato (2015) comments that agility is the

capability of an organization to adapt, renew itself,

and thrive in a rapidly ambiguous, changing, and

raging environment. Teece et al. (2016) see

organizational agility as an organization's ability to

adapt to changes in the marketplace to gain

competitiveness quickly. However, many firms

struggle with a variety of advanced technologies

being adopted in different and new ways during the

COVID-19 (Chan et al., 2019; Noyes, 2020).

Therefore, agility is essential in responding the digital

disruption. In fact, the desire to be agile is

progressively unrelenting for companies, particularly

those functioning in wide-ranging culturally host

nations (Martínez-Climent et al., 2019; Shams et al.,

2021; Trost, 2019). According to Shams et al. (2021),

multinational enterprises (MNEs) have advocated

that digitalization encourages strategic agility and

reduces the risk of falling into inelasticity traps that

may result in business failure. From a diverse

standpoint, studies (e.g., Akhtar et al., 2018; Chan et

al., 2019; Scuotto et al., 2017) propose that firms take

advantage of digital technologies and create higher

value when agile firms’ abilities are continuously

developed and employed. This takes place, for

instance, when they are capable of foreseeing how

these new digital tools would take in the effect of the

contemporary business practices, products and

business models (Jagtap & Duong, 2019; Scuotto et

al., 2017; Vecchiato, 2015).

At an individual level, the existence of a CEO in

another firm’s board provides the potential for mutual

CEO intertwine, strengthening strategic links

between two or more companies (Helmers et al.,

2017). According to social capital theory, there are

many benefits to having a CEO who also serves on

multiple directorships. For example, CEOs with

external business ties know whether the practices and

relevant policies are being followed by other

subsidiaries and can thus avoid discrepancies.

Custodió and Metzger (2014) find that a CEO with a

finance career background in the Standard and Poor’s

1,500 firms is more actively managing focal firms’

financial policies and is highly likely to raise external

funds even when the tight credit situation occurs.

They also find that mature firms are more willing to

hire financial expert CEOs. In a recent study, Škare

and Soriano (2021) find that if family firms in the EU

want to increase agility, they must invest in human

capital. Ferraris et al. (2021) find a positive

relationship between the tenure of subsidiary CEOs in

India along with their social capital and multinational

enterprise strategic agility. Following this logic, the

CEO might work more productively with an agility

mindset in the digital era, thus further strengthening

his/her social networks in the society (e.g.,

directorships in other companies) to achieve a greater

outcome (e.g., innovation efficiency).

When digitalization is powered up by cutting-

edge technologies and data-driven insights, it

encourages agility. This is because it improves the

responsiveness and flexibility of firms, such as

allowing efficiency, identifying changes early

(Vecchiato, 2020) and coordinating connecting with

business partners and processes effectively (Miceli et

al., 2021; Škare and Soriano, 2021). According to

Miceli et al. (2021), both digitalization and agility are

prospective through various practices (e.g., specific

investments in intangible assets, guiding and

inspiring between firms). All these practices improve

the active stance and agile working in addition to the

resilience of the business (Miceli et al., 2021; Škare

and Soriano, 2021). Furthermore, digitalization

improves the sustainability of businesses, and the use

of advanced technologies can increase productivity

through the integration of information technology,

production and supply chain (Shams et al., 2021).

The uncertainty of the market demand and the

timing of new product launches make innovation

particularly daunting in a business environment.

Therefore, it is important for CEOs to embrace agility

(Dabić et al., 2021), learn new skills from holding

outside directorships and apply this knowledge to the

focal firms (Bhandari et al., 2018). For example, the

CEO can initiate a chain that sparks agile innovation

by having innovation labs that let selected R&D

personnel vet their innovative ideas against the firm’s

required capital and strategic direction. Moreover,

serving specific industries, such as banks and high-

tech or MNEs, enhances a CEO’s awareness of the

trends in micro-and macro-economic factors and

levels up a CEO’s agile mindset (Custodió and

Metzger, 2014; Hung et al., 2017; Martínez-Climent

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China

45

et al., 2019; Vecchiato, 2015). Doz (2020) finds that

an increasing number of firms need to attain strategic

agility, which results from strategic sensitivity,

leadership unity, and resource fluidity. However,

those firms face a lot of competition and diversity in

addition to the domineering of key strategic

redirections (e.g., toward Asian or other developing

marketplaces) as sources of new competencies,

knowledge, or new business models in the wake of

digital disruption or digitalization. Further, Doz

(2020) argues that senior executives' (e.g., CEO)

social capital and professional interaction with

outsiders contribute to gaining strategic sensitivity

and competitive advantages. Also, the assessment of

resources made by holding one or more outside

directorships helps CEOs stimulate ideas of new

technologies and productions, then execute the focal

firms' growth strategies (e.g., innovation). Take the

emerging online-to-offline (O2O) platforms in China

as an example - they set a new norm, such as shopping

experiences, media care and other professional

consultations in a post-COVID-19 world. Traditional

businesses (e.g., banks, hotels, restaurants and

boutiques) that shy away from offering digital

services are increasingly connecting with O2O

platforms and trying to be the survival of the fittest.

Hence, the hypothesis can be stated as follows:

H1: There is a positive relationship between agility

and digitalization.

2.2 CEO Transition

According to social capital theory, the presence of a

well-connected CEO (i.e., he/she sits on multiple

external boards) in a firm reflects the strong market

connections. Bhandari et al. (2018) specify that CEOs

who have larger external connections are related to

higher audit quality and provide economic benefits

(Dabić et al., 2021) and intellectual agility (Doz,

2020) to focal firms. An invitation or appointment to

act as a board member in an external firm

acknowledges the CEO's expertise that, to some

extent, enhances the social status in the market

(Boivie et al. 2016) and the influence of the CEO with

the focal firm (Khan and Mauldin, 2020). While

gaining experiences, reputation and reducing risks of

opportunistic behaviors of sitting on external boards,

the CEO has the potential to use these resources to

accelerate and update focal firm’s technologies,

digital transformation, research and industrial

commercialization (Doz, 2020), thus creating an agile

environment and enhancing innovation efficiency

(Cao et al. 2015; Lee et al. 2020; Sariol and Abebe,

2017), capital management (Bhandari et al. 2018;

Custódio and Metzger, 2014) and overall efficiency

of the firm. Therefore, there is a higher possibility of

building a culture of innovation when a well-

connected CEO can embed successful and agile

innovation strategies and learn failure cases from

other connected firms. Similar to Doz (2020),

Debellis et al. (2020) also have drawn on three key

capabilities that enable strategic agility (i.e.,

leadership unity, strategic sensitivity, and resource

fluidity). They have developed a hypothetical

framework that unravels this inconsistency.

Particularly, they argue that senior management who

is resourceful (e.g., professional interactions) with a

strong passion for creating value through foresight

would enhance family firms’ strategic sensitivity

(e.g., managing threats and seizing opportunities) and

be more innovative (Debellis et al. 2020). Overall,

when a firm decides to appoint a new CEO, it is

reasonable to consider a person with more outside

directorships than the current or previous CEO. The

following second hypothesis is formulated:

H2: There is a positive relationship between

digitalization and agility when the incoming CEO has

more outside directorships than the predecessor.

2.3 CEO Busyness

According to the power status and influence channel

of social capital, some CEOs may be keen to expand

his/her network through multiple appointments due to

the potential benefit of individual career development

and social status in society. On the other hand, many

firms restrict or prohibit the CEO's outside

directorship appointments because it requires a time

commitment and detracts from the CEO's agility to

work effectively on the focal firm (Harymawan et al.,

2019; Kahan and Mauldin, 2020). For example, in an

American context, Kahan and Mauldin (2020) find

that 24% of CEOs have outside directorships, but

little evidence showed that these network ties help

CEOs transfer knowledge and enable the CEOs to

improve practices in their focal firms. In an

Indonesian context, Harymawan et al. (2019) report a

negative CEO busyness and firm performance

relationship, and their results suggest that it is not

wise for a firm to have a CEO who holds two or more

outside directorships. According to this busyness

argument, Spencer Stuart (2019) reports that 77% of

American listed firms set restrictions on directors and

executive appointments on external directorships in

2019. From a human resource management

perspective, e Cunha et al. (2020) state that executive

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

46

attention is a significant but limited resource to

develop strategic agility among MNEs because

strategic agility requires a timely, responsive and

powerful action model to support it (Martínez-

Climent et al., 2019). Interestingly, results from Doz

(2020) show that senior executives consider the time

they spend in practice (5-10%) should be increased to

40-50%. The participants have provided feedback

that learning how to use it effectively for external-

strategic networks is more important than freeing up

their time. In China, the newly revised version of

Guidelines for Independent Directors of Listed

Companies in 2020 (Article 6, No. 48) clearly stated

that, in principle, an independent director should not

hold more than five outside directorships to ensure

time commitment and obligate responsibilities

effectively. To investigate the drivers for concern

over a CEO’s multiple outside directorships, we

propose:

H3: There is a negative effect of CEO network size

on digitalization after reaching an optimal level.

3 DATA AND METHODOLOGY

This study uses year-end financial data and board data

collected from the CSMAR and SIPO databases. We

have restricted the data for this research to eleven

years (2007-2017) because of the limitation of R&D

data in CSMAR and SIPO. The sample of firms was

drawn from the Shanghai Stock Exchange (SHSE)

and Shenzhen Stock Exchange (SSE). After removing

observations without R&D investment data and

granted patents, such as R&D investment, R&D

personnel, and R&D outputs, it yields a total of

13,516 firm-year observations. Our sampling strategy

is consistent with existing studies (e.g., Li et al.,

2020a; Sial et al., 2018).

We use the DEA and SFA procedures as our main

efficiency measurement method to reconcile the

measurement indicators and measure the level of

innovation productivity. Indicators of innovation

efficiency measurement are determined by

identifying and integrating innovation-related

literature, characteristics, and activities (Duran et al.,

2016). This research used two variables to measure

innovation input. The first is R&D investment,

including typical resources and funds that initiate,

support and maintain innovation activities (Classen et

al., 2014). The second input is the number of R&D

personnel. Recruiting the right number of researchers

with the right skills (i.e., using emerging technologies

and knowledge of present research) in a firm's R&D

department is critical for motivating and helping

firms formulate and implement innovation activities.

This group of researchers is directly involved in

productivity and value-creation activities (Wang et

al., 2016).

The output of innovation is identified as technical

knowledge, mainly those codified in patents. Thus,

patents are an essential variable for innovation. As in

several existing studies (Zhang et al., 2014; Wang et

al., 2016), the patent is considered the primary

innovation output in this study. It is worth mentioning

that not all R&D investment necessarily leads to

patents, and not all innovation products or activities

can be patented. Nevertheless, the number of patent

applications is one of the most frequently used

measures of innovation output. Wang et al. (2013)

view the number of granted patents as an indicator of

organizational knowledge, potentially influencing

organizational financial performance. We choose the

number of granted patents as an innovation output in

this study for these reasons.

Table 1: Definition of variables included in the regression

models.

Table 2: Descriptive Statistics.

Table 1 displays definitions of all variables. Table

2 shows statistic descriptions of all variables. As

shown in Table 2, the efficiency means are 31% in

DEA and 26% in SFA. On average, firms in this study

tend to invest $169 million and recruit 610 staff to

work in R&D-related activities and have an output of

about 167 granted patents. The results consistent with

Wang et al. (2016) imply that the sample firms have

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China

47

not been performing at an optimal level of efficiency.

For firm-level control variables, sample firms' age is

about 15 years, meaning the sample firms are

relatively new to the stock market. The leverage is

36.3% with 3.4% ROA, on average. Tobin's Q is

53.2% on average. In the CEO network size variable,

the mean value of additional board positions that a

CEO hold is 1.9, which is consistent with Rathod

(2018).

Table 3: Correlation Metrix.

Table 3 presents the results of the Pearson

correlation matrixes of all variables. One point is

noteworthy, DEA is highly correlated with SFA (0.9),

but these two dependent variables are in a separate

regression model. Otherwise, the relatively low

absolute values (less than 0.8 thresholds) of Pearson

correlation coefficients indicate no multicollinearity

issue (Hair et al., 2017).

After a Hausman test, a board data analysis fixed

impacts regression is used to examine the three

hypotheses. Additionally, a two-step SGMM (System

Generalised Method of Moments) is used as a

robustness test to control endogeneity and fix

econometric problems for the dynamic panel models

(Mangena et al., 2012; Wintoki et al., 2012). Several

studies have used SGMM in corporate governance

and innovation literature (see Waweru et al., 2019).

In sum, we use both OLS and SGMM to examine

our baseline model:

Innovation Efficiency

i,t

= CEO Network

Size

it

+ Control Variables

i

t

+ ε

i,

t

(1)

4 RESULTS, DISCUSSION, AND

IMPLICATIONS

4.1 Results

We use the multiple regression analysis to test the

network effects of CEO’s outside directorships, CEO

transition and the diminishing effects on innovation.

Results in Table 4 Column 1 show support for H1,

confirming positive and significant network effects of

CEO on innovation efficiency (β = 0.00121, p <

0.05). This result may reflect that crucial external

information and resources can be accessed if a CEO

holds multiple directorships. More specifically, these

CEOs could potentially replicate innovation activities

or alternative sources of ideas across their connected

firms (Doz, 2020). This finding is aligned with social

capital theory and previous evidence (Han and Li,

2015; Sariol and Abebe, 2017). It has been

particularly challenging for China in recent years due

to the COVID-19 global crisis and the US-China

trade war with growing technology protectionism and

isolationism (Boylan et al. 2020). Our study shows

that social networks seem important amongst the

Chinese high-tech firms to learn the domestic and

overseas experience of an innovation ecosystem and

work coordinately to de-escalate the trade war and

COVID-19 impacts.

To help us further understand a CEO’s network

effects on innovation efficiency, we use CEO

transition as an event study to investigate the

difference in innovation efficiency before and after

the transition. Since we anticipate a positive

correlation between CEO innovation efficiency and

network size in H2, we posit that the innovation

efficiency increases when the incoming CEO is with

more outside directorships than his/her predecessor.

We separate the firms into two sub-groups (see Table

5), one sub-group with a new CEO having fewer

outside directorships (87 observations) and the other

sub-group with new CEO having more outside

directorships than the predecessor (194 observations).

The data one year before and one year after the CEO

transition are used in the analysis. 281 transition

events remained after excluding events with the same

number of outside directorships before and after

transitions and events with missing data before or

after transitions.

Table 4: Base Models & Robustness Checks.

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

48

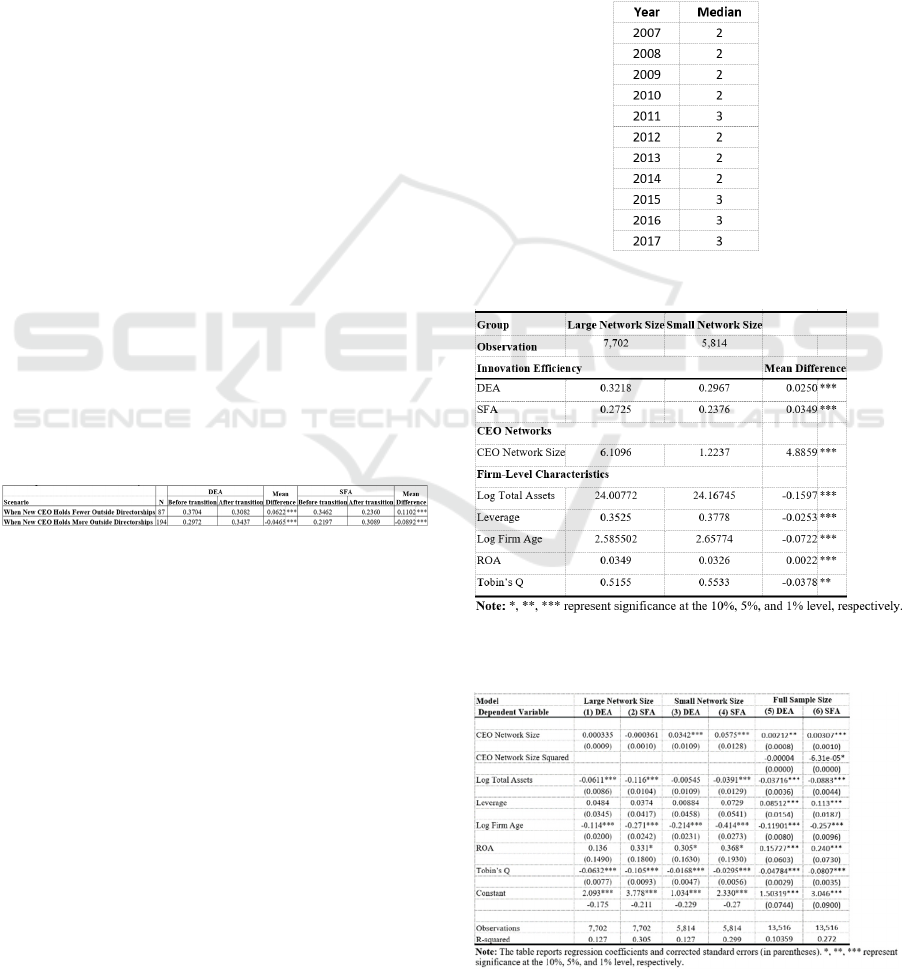

The DEA Column in Table 5 shows that when a

new CEO has fewer outside directorships, the

innovation efficiency score (0.3082) after the

transition is lower than that before the transition

(0.3704). In contrast, when the incoming CEO has

more outside directorships, the innovation efficiency

score (0.3437) after the transition is higher than that

before the transition (0.2972). Therefore, H2 is

supported. This event study provides us with another

evidence that there is a positive relationship between

CEO network size and innovation efficiency. Our

results are consistent with Srinivasan et al. (2018),

and we explain that the CEOs having multiple board

appointments is vital for firms because of its network

effects. In developing countries, such as China,

governmental regulations, policies, and laws evolve

(Zhang et al., 2014), and concerns of risks and

uncertainties in relation to the interpretation and

application of these regulations, policies and laws

(Laux and Stocken, 2018). Jia et al. (2012) specify

that scholars in the management and organization

literature use guanxi to build relationships with other

firms and the concept of guanxi is China-specific.

Therefore, we argue that firms will benefit from

appointing a new CEO with more outside

directorships than the predecessor because a well-

connected COE can act as an information conduit

(Wu et al., 2013) between firms. The CEO could

familiarize himself/herself with various policies and

perhaps political processes and help the focal firm

grow and expand in the long term.

Table 5: Impact of CEO Transition to Efficiency.

In H3, we hypotheses that there is a negative effect

of CEO network size on digitalization after reaching an

optimal level. Following Tosi et al. (1994), we first

separate the sample firms into large network size

(7,702 observations) and small network size (5,814

observations) sub-groups using the annual median

number of CEO outside directorships as a cut-off point

(See Tables 6 and 7). Univariate analysis is used to

compare the key variables between the two sub-

groups, and the results are recorded in Table 7. The

results in Table 7 confirm that the efficiency scores

(DEA and SFA) of the large network group are

significantly larger than those of the small network

group, supporting H3. We further conduct regression

analysis on these two sub-group data (see results in

Table 8). The regression coefficients for CEO outside

directorships are significantly positive (β = 0.0342 for

DEA and β = 0.0575 for SFA) in the small network size

sub-group (in Columns 3 and 4) but are insignificant in

the large network size sub-group (in Columns 1 and 2).

We added a square term of CEO network size to

our baseline model (Table 4 Columns 1 and 2) and the

regression results are recorded in Table 8 Columns 5

and 6. The negative coefficients on the square term (β

= 0.00004 for DEA and β = 0.0000631 for SFA)

indicate an inverted U-shape relationship between

CEO network size and firm efficiency.

Table 6: The Annual Median Number of CEO Outside

Directorships.

Table 7: Univariate Analysis at the Firm-Year Level.

Table 8: Comparison of Impacts of Large- & Small-

Network Size on Efficiency (Panel Data, Fixed Effects).

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China

49

4.2 Robustness Check

First, the SGMM approach is used to check the results

of the correlation between innovation efficiency and

CEO outside directorships. According to Wintoki et

al. (2012), the Sargan-Hansen test and the Chi-Square

test are carried out to assess the reliability of the

estimates and ensure the results are free from

methodological issues. As indicated in Table 4, the

models of DEA and SFA under the SGMM column,

the Sargan-Hansen tests generate p-values of 1

(Roodman, 2006), implying that the additional subset

of instruments is not econometrically exogenous.

Additionally, the SGMM column results are

consistent with the Panel Data FE column, thus

confirming that our results have persisted. Second, an

alternate set of efficiency scores (i.e., SFA) is used,

and the analyses again yield results similar to those

using DEA efficiency scores (see Tables 4 and 7).

4.3 Discussion and Implication

In many firms, digitization is driven by the need to

counter rivals and foresee yet unidentified

competitors. However, many firms either struggle or

fail to tackle digital disruption (Chan et al., 2019).

Most of the time, the cause of the unsuccessfulness is

that firms set unrealistic objectives or try to maintain

a business strategy that is not flexible during

uncertainty (e.g., COVID-19). Digitalization needs to

be applied as an all-inclusive change plan to achieve

a balance between sustaining constant business

processes and innovation and preserving enough

opportunity for strategic agility. In an extremely

dynamic and volatile environment, increasing firm

agility is an important success factor for businesses

(e.g., high-tech firms, family firms, and MNEs). For

a successful introduction of new services or products

in the marketplace, it is important to build an agile

culture at both the firm and individual levels. It would

help use simplified and efficient processes to increase

innovation efficiency. Additionally, corporate leaders

(e.g., CEOs) could inspire their workers to act and

think in an even more innovative way and extend the

individual scope for both private and public

policymaking (Vecchiato, 2015). As Doz (2020) has

mentioned, the CEO is more a facilitator to unite

workers and business partners to maximize the

outcome of network effects.

Our results show that the CEO outside

directorships positively impact firm efficiency when

the CEO network size is below the annual median

value. CEO outside directorships may be observed as

a two-edged sword provided their learning

advantages on the one hand and the prospective of

disrupting CEOs from their focal firm’s

responsibilities on the other hand. Compared to other

board members, CEOs are the most demanded leader

because of their direct experience with strategic

leadership. Therefore, there is a shift from reactive to

creative and from traditional to agile approaches that

give CEOs a competitive edge. Altogether, outside

board experiences remain a valuable leadership

instrument to prepare managers for CEO positions

and keep their executive skills up to date.

The asymmetric effect between the large and

small network size has prompted us to investigate

further the possible nonlinear relationship between

the CEO network size and the innovation efficiency.

A positive relationship has been found in our study.

Additionally, as discussed in the literature,

digitalization allows strategically agile practices.

Digitalization, such as big data analysis, could assist

in predicting change. Because of its exceptional

interconnectivity could simplify coordination and

communication with multiple or even large groups of

stakeholders (Jagtap and Duong, 2019). However, we

should not ignore the possible negative effect

regarding privacy concerns and, hence, conflict with

societal sustainability (Miceli et al., 2021).

Our results also indicate that the network effects

become weaker when the network size reaches an

optimal point. The results are consistent with the

social capital theory that when a CEO sits on more

external boards, it tends to improve the firm's

innovation efficiency using his/her network, agility,

resources, or previous work experience. However, if

the network size is too large, it tends to lower the

efficiency of innovation when the busyness

phenomenon occurs. In this case, according to Khan

and Mauldin (2020), a busy CEO could potentially

focus on personal benefits (e.g., reputations, social

status and personal career progression) from external

directorships rather than on contribution to the

productivity of knowledge transfer to the focal firms

(Boivie et al., 2016).

The control mechanisms in corporate governance

and policymakers may view external board executive

posts as a tool to advance managerial interests at the

cost of stakeholder interests. However, our study

argues that being agile could help CEOs learn how to

use their time wisely and effectively. It would speed

in responding to crises and uncertainties rather than

focusing too much on solving day-to-day operational

issues.

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

50

5 LIMITATIONS AND

RECOMMENDATIONS

We identify some limitations that will provide future

research opportunities. First, while investigating the

benefits and risks of CEO network effects is

undoubtedly valid, we should study the disruption

and changing environment. The aim is to observe the

increased flexibility and mobility, unlocking more

agile time for the CEO, other board members, or even

the employees in general (Chaston and Sadler-Smith,

2012; Yang and Wang, 2014). Digital transformation

is rising in firms at all levels to the challenges of

COVID-19. We recommend board activities to

embrace digitalization to maximize the wealth that

firms derive from the board. Our result shows that in

China, one CEO holds about two outside board

positions averagely, not to mention the multiple

directorships of other board members. This means

that they are very busy people with rich experience

and a high profile in society. Digital transformation

with agile leadership could reduce reliance on time-

consuming activities (e.g., admin work and traveling

for business) by embracing agile working practices

and achieving the balance between busyness and

effectiveness (Doz, 2020; Lee and Yang, 2014). As a

result, the inverse U-shape inflection point could be

increased to a higher level in the innovation

efficiency score (see Figure 2). For example, making

information securely available online 24/7 indicates

that the directors can access and review information

without time limits and geographic restrictions.

Additionally, directors can manage their time more

effectively by concentrating on corporate governance

and strategic insight that enhance high organizational

performance to build an agile business through digital

board solutions (Noyes, 2020; Rathod, 2018).

Second, future studies could adopt other

measurements of CEO networks and investigate the

relationship between CEO network effects,

digitalization transformation, and innovation

efficiency. Due to the unpredictable and competitive

business environment, shareholders put heavy

pressure on the board and push firms to be on top of

digitalization. They expect positive results from their

investment and a future-proof, forward-looking

digital business. However, ZoBell (2018) reports that

70% of the investment in digital transformation

initiatives failed to reach their goals. That is $900

billion out of $1.3 trillion misaligned tech

investments and went to waste. To face this

challenge, we recommend future studies to consider

how CEOs could work with their networks and apply

an agile approach to work efficiently and effectively,

enabled by the right digital tools. This can then

effectively use their time and maximize the network

effects, in turn, pushing innovation efficiency from

Inflection Point 1 line a to a new high (see Inflection

Point 2, line b in Figure 2).

Figure 2: Accelerating Innovation Efficiency through

Agility.

6 CONCLUSIONS

A leader's agility has a substantial influence on firm

digitalization. The CEO's network effects are an

essential determinant in relation to our findings

between agility and digitalization. Our empirical

findings show that the number of CEO outside

directorships positively affects innovation efficiency,

even when other company-level features are

regulated in a Chinese context. We theorize that the

positive network effects occur due to the information

transmission and power status. Moreover, influence

channels from an intensive CEO network allow the

facilitation of innovation to satisfy the interests of

individuals and firms. Based on our empirical results,

we argue that the benefits of appointing CEOs with

multiple outside directorships can surpass the

potential risks and uncertainty that come with

innovation activities. Doing so helps innovative firms

form agility and overcome project failures or

overestimated R&D investment, in turn maximizing

productivity. Well-connected CEOs send signals to

potential investors that they can efficiently estimate

R&D investment, manage researchers, and enhance

the quality of innovation outputs (i.e., patents). We

also find that a better-connected CEO may have fewer

re-employment concerns in the labor market.

Additionally, when the network size is too big to be

handled, our results indicate a dark side of an over-

boarding CEO regarding innovation efficiency.

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China

51

However, CEOs may flee before the dark side by

embracing digitalization and agility.

Our empirical results present strong evidence for

policymakers to implement and design towards

industry or national digitalization. We also provide

empirical evidence to support managers in

maintaining a balance of their external networks to

increase agility, in other words, enhancing innovation

efficiency. To researchers, we are the first study using

the CEO's network effects as another alternative to

measure agility and provide an in-depth study. We

build a starting point to investigate the linkage

between agility and digitalization and use Chinese

firms to illustrate our research contributions.

Digitalization determinants demonstrated in the paper

will eventually motivate researchers to develop new

methods for firm agility and digitalization

measurement.

ACKNOWLEDGEMENTS

This work is partly supported by VC Research (VCR

0000089) for Prof. Chang.

REFERENCES

Akhtar, P., Khan, Z., Tarba, S., & Jayawickrama, U. (2018).

The Internet of Things, dynamic data and information

processing capabilities, and operational agility.

Technological Forecasting and Social Change, 136,

307-316.

Aklamanu, A., Degbey, W. Y., & Tarba, S. Y. (2016). The

role of HRM and social capital configuration for

knowledge sharing in post-M&A integration: a

framework for future empirical investigation. The

International Journal of Human Resource

Management, 27(22), 2790-2822.

Bhandari, A., Mammadov, B., Shelton, A. and Thevenot,

M. (2018). It is not only what you know, it is also who

you know: CEO Network Connections and Financial

Reporting Quality. Auditing: A Journal of Practice &

Theory, 37(2), pp.27-50.

Boivie, S., Graffin, S. D., Oliver, A. G., & Withers, M. C.

(2016). Come aboard! Exploring the effects of

directorships in the executive labor market. Academy of

Management Journal, 59(5), pp.1681– 1706.

Boylan, B.M., McBeath, J. and Wang, B. (2020). US–China

Relations: Nationalism, the Trade War, and COVID-19,

Fudan Journal of the Humanities and Social Sciences,

pp.1-18.

Cao, Q., Simsek, Z. and Jansen, J. J. (2015). CEO social

capital and entrepreneurial orientation of the firm:

Bonding and bridging effects, Journal of Management,

41(7), pp. 1957-1981.

Chan, C.M., Teoh, SY, Yeow, A. and Pan, G. (2019)

Agility in responding to disruptive digital innovation:

Case study of an SME. Information Systems Journal,

29(2), pp.436-455.

Chaston, I. and Sadler‐Smith, E. (2012). Entrepreneurial

cognition, entrepreneurial orientation and firm

capability in the creative industries, British Journal of

Management, 23(3), pp.415-432.

Classen, N., Carree, M., Van Gils, A. and Peters, B. (2014).

Innovation in family and non-family SMEs: An

exploratory analysis, Small Business Economics, 42(3),

pp. 595-609.

Custódio, C. and Metzger, D. (2014). Financial expert

CEOs: CEO׳ s work experience and firm׳ s financial

policies. Journal of Financial Economics, 114(1),

pp.125-154.

Dabić, M., Stojčić, N., Simić, M., Potocan, V., Slavković,

M. and Nedelko, Z. (2021). Intellectual agility and

innovation in micro and small businesses: The

mediating role of entrepreneurial leadership, Journal of

Business Research, 123, pp.683-695.

Debellis, F., De Massis, A., Petruzzelli, A. M., Frattini, F.,

& Del Giudice, M. (2020). Strategic agility and

international joint ventures: The willingness-ability

paradox of family firms. Journal of International

Management, 100739.

Doz, Y. (2020). Fostering strategic agility: How individual

executives and human resource practices contribute.

Human Resource Management Review, 30(1), 100693.

Duran, P., Kammerlander, N., Van Essen, M. and

Zellweger, T. (2016). Doing more with less- Innovation

input and output in family firms, Academy of

Management Journal, 59(4), pp. 1224-1264.

e Cunha, M. P., Gomes, E., Mellahi, K., Miner, A. S., &

Rego, A. (2020). Strategic agility through

improvisational capabilities: Implications for a

paradox-sensitive HRM. Human Resource

Management Review

, 30(1), 100695.

Ferraris, A., Degbey, W.Y., Singh, S.K., Bresciani, S.,

Castellano, S., Fiano, F. and Couturier, J. (2021).

Microfoundations of strategic agility in emerging

markets: empirical evidence of Italian MNEs in India.

Journal of World Business, p.101272.

Harymawan, I., Nasih, M., Ratri, MC and Nowland, J.

(2019). CEO busyness and firm performance: evidence

from Indonesia. Heliyon, 5(5), p.e01601.

Han, Y. and Li, D. (2015). Effects of intellectual capital on

innovative performance, Management Decision, 53(1),

pp. 40-56.

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., &

Thiele, K. O. (2017). Mirror, mirror on the wall: A

comparative evaluation of composite-based structural

equation modeling methods, Journal of the Academy of

Marketing Science, 45(5), pp.616-632.

Helmers, C., Patnam, M. and Rau, P.R. (2017). Do board

interlocks increase innovation? Evidence from a

corporate governance reform in India, Journal of

Banking & Finance, 80, pp.51-70.

Hernández-Lara, A.B. and Gonzales-Bustos, J.P., (2019).

The impact of interlocking directorates on innovation:

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

52

the effects of business and social ties. Management

Decision, 57(10), pp. 2799-2815.

Hung, C. H. D., Jiang, Y., Liu, F. H., Tu, H. and Wang, S.

(2017). Bank political connections and performance in

China, Journal of Financial Stability, 32, pp. 57-69.

Jagtap, S., & Duong, L. N. K. (2019). Improving the new

product development using big data: A case study of a

food company. British Food Journal. 121(11),

pp.2835-2848.

Jia, L., You, S. and Du, Y. (2012). Chinese context and

theoretical contributions to management and

organization research: A three‐decade review,

Management and Organization Review, 8(1), pp.173-

209.

Khan, S. and Mauldin, E. (2020). Benefit or burden? A

comparison of CFO and CEO outside directorships,

Journal of Business Finance & Accounting, 48(7-8),

pp.1175-1214.

Laux, V. and Stocken, P. C. (2018). Accounting standards,

regulatory enforcement, and innovation, Journal of

Accounting and Economics, 65(2-3), pp. 221-236.

Lee, J. M., Kim, J. and Bae, J. (2020). Founder CEOs and

innovation: Evidence from CEO sudden deaths in

public firms. Research Policy, 49(1), pp. 103862.

Lee, Y.M. and Yang, C. (2014). The relationships among

network ties, organizational agility, and organizational

performance: A study of the flat glass industry in

Taiwan. Journal of Management & Organization,

20(2), pp.206-226.

Lin, H., Zeng, S. X., Ma, H. Y., Qi, G. Y. and Tam, V. W.

(2014). Can political capital drive corporate green

innovation? Lessons from China. Journal of Cleaner

Production, 64, pp. 63-72.

Mangena, M., Tauringana, V. and Chamisa, E. (2012)

Corporate boards, ownership structure and firm

performance in an environment of severe political and

economic crisis. British Journal of Management, 23,

pp. S23-S41.

Martínez-Climent, C., Rodríguez-García, M., & Ribeiro-

Soriano, D. (2019). Digital transformations and value

creation in international markets. International Journal

of Entrepreneurial Behavior & Research, DOI:

https://doi.org/10.1108/IJEBR-11-2019-820.

Miceli, A., Hagen, B., Riccardi, M. P., Sotti, F., &

Settembre-Blundo, D. (2021). Thriving, not just

surviving in changing times: How sustainability, agility

and digitalization intertwine with organizational

resilience. Sustainability, 13(4), 2052.

Noyes, K. (2020). Why companies struggle with digital

disruption. The Wall Street Journal. [online] available

at: https://deloitte.wsj.com/cio/2020/01/28/why-

companies-struggle-with-digital-disruption/ (Accessed

on 7th July 2021).

Rathod, L. (2018) ‘UK: Are the days of “overboarding”

numbered as expectations of board of director

commitment increase?’ Diligent. [online] available at:

https://diligent.com/en-gb/blog/days-overboarding-

numbered-expectations-board-director-commitment-

increase/ (Accessed on 8 April 2021).

Roodman, D. (2006) ‘How to do xtabond2: An introduction

to difference and system GMM in Stata’, Center for

Global Development Working Paper, p. 103.

Sariol, A. M. and Abebe, M. A. (2017) ‘The influence of

CEO power on explorative and exploitative

organizational innovation’, Journal of Business

Research, 73, pp. 38-45.

Scuotto, V., Santoro, G., Bresciani, S., & Del Giudice, M.

(2017) Shifting intra‐and inter‐organizational

innovation processes towards digital business: an

empirical analysis of SMEs. Creativity and Innovation

Management, 26(3), 247-255.

Shams, R., Vrontis, D., Belyaeva, Z., Ferraris, A., &

Czinkota, M. R. (2021) Strategic agility in international

business: A conceptual framework for “agile”

multinationals. Journal of International Management,

27(1), 100737.

Shead, S. (2021). China’s spending on research and

development hits a record $378 billion, CNBC. [online]

available at: https://www.cnbc.com/2021/03/01/chinas-

spending-on-rd-hits-a-record-378-billion.html

(Accessed on 5 April 2021).

Shi, X. and Wu, Y. (2017). The effect of internal and

external factors on innovative behaviour of Chinese

manufacturing firms. China Economic Review, 46, pp.

S50-S64.

Škare, M. and Soriano, D.R. (2021) A dynamic panel study

on digitalization and firm's agility: What drives agility

in advanced economies 2009–2018. Technological

Forecasting and Social Change, 163, p.120418.

Srinivasan, R., Wuyts, S. and Mallapragada, G., (2018).

Corporate board interlocks and new product

introductions. Journal of Marketing, 82(1), pp.132-

148.

Spencer Stuart. (2019). 2019 U.S. Spencer Stuart Board

Index. Chicago, IL: Spencer Stuart.

Talavera, O., Yin, S. and Zhang, M. (2018). Age diversity,

directors' personal values, and bank performance.

International Review of Financial Analysis, 55, pp. 60-

79.

Behnam, T., Lam, E., Girard, K and Irvin, V. (2019).

Digital Transformation is not about Technology.

Harvard Business Review. [online] available at:

https://hbr.org/2019/03/digital-transformation-is-not-

about-technology (Accessed on 10 April 2021).

Teece, D., Peteraf, M., & Leih, S. (2016). Dynamic

capabilities and organizational agility: Risk,

uncertainty, and strategy in the innovation economy.

California management review, 58(4), 13-35.

Tosi Jr, HL and Gomez-Mejia, L.R., (1994). CEO

compensation monitoring and firm performance.

Academy of Management journal, 37(4), pp.1002-1016.

Trost, A. (2019). Human Resources Strategies: balancing

stability and agility in times of digitization. Springer

Nature

Vecchiato, R., 2015. Creating value through foresight: First

mover advantages and strategic agility. Technological

Forecasting and Social Change, 101, pp.25-36.

Wang, C. H., Lu, Y. H., Huang, C. W. and Lee, J. Y. (2013).

R&D, productivity, and market value: An empirical

The Impacts of the CEO’s Network Effect on Digitalization and Agile Leadership in China

53

study from high-technology firms. Omega, 41(1), pp.

143-155.

Wang, Q., Hang, Y., Sun, L. and Zhao, Z. (2016). Two-

stage innovation efficiency of new energy enterprises in

China: A non-radial DEA approach. Technological

Forecasting and Social Change, 112, pp. 254-261.

Wintoki, M. B., Linck, J. S. and Netter, J. M. (2012).

Endogeneity and the dynamics of internal corporate

governance. Journal of Financial Economics, 105(3),

pp. 581-606.

Waweru, N., Mangena, M. and Riro, G. (2019). Corporate

governance and corporate internet reporting in sub-

Saharan Africa: the case of Kenya and Tanzania.

Corporate Governance: The international journal of

business in society, 19(4), PP. 751-773.

Yang, L. and Wang, D. (2014). The impacts of top

management team characteristics on entrepreneurial

strategic orientation: The moderating effects of

industrial environment and corporate ownership.

Management Decision, 52(2), pp. 378-409.

Zhang, Z.X., Chen, Y.R. and Ang, S. (2014). Business

leadership in the Chinese context: Trends, findings, and

implications. Management and Organization Review,

10(2), pp.199-221.

Zobell, S. (2018). Why Digital Transformations Fail:

Closing the £900 Billion Hole in Enterprise Strategy.

Forbes. [online] available at: https://www.forbes.com/

sites/forbestechcouncil/2018/03/13/why-digital-transf

ormations-fail-closing-the-900-billion-hole-in-enterpri

se-strategy/?sh=2b8758cf7b8b (Accessed on 10 April

2021).

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

54