SPARKING EMPLOYEES’ INTEREST IN SIX SIGMA

Transferring a Paper-based Simulation to a Workflow Management Application

René Börner

ProcessLab, Frankfurt School of Finance & Management, Sonnemannstr. 9-11, 60314 Frankfurt am Main, Germany

Andreas Uremovic

Cirquent GmbH, Zamdorfer Str. 120, 81677 München, Germany

Keywords: Employee Motivation, Business Process Management, Six Sigma, Workflow Management System.

Abstract: In today’s management approaches, quality improvement focused on a company’s business processes plays

an ever more important role. Methodologies like Six Sigma are used to improve quality, cut costs and save

time by improving processes. Support and commitment of a company’s employees are crucial success

factors, so that training and motivation is essential. Role plays are a training method suitable for stimulating

employee involvement. The article describes how the paper-based role play KreditSim has been transformed

to a workflow management system. It shows how utilization of software can broaden the scope and

sometimes shift the focus of trainings. By delivering impressive results in process performance the software

inspires and motivates employees to learn Six Sigma tools and apply them to their daily business.

1 EMPLOYEE INVOLVEMENT

IN BUSINESS PROCESS

IMPROVEMENT PROJECTS

Organizational theory has seen a trend to business

process orientation in the last couple of years. The

improvement and management of a company’s

business processes form a competitive advantage

and are fundamental to its success (Becker, Kugeler

& Rosemann, 2004). On the one hand, there are

radical approaches to business process management

such as Business Reengineering (Hammer &

Champy, 1993). They are implemented top-down by

a company’s management. On the other hand,

evolutionary approaches follow a bottom-up

procedure that stresses the importance of employee

involvement. Six Sigma belongs to the latter

methodologies accentuating the importance of

employee commitment.

Service providers in particular face the challenge

that factors which are difficult to control, such as

human behaviour (e. g. friendliness and willingness

to help), have a decisive impact on the quality of the

final product, namely the actual service delivery

(Antony, 2004). Hence, well-trained and motivated

employees play an even more crucial role in the

execution of service providers’ process flows.

In a study conducted by Heckl and Moormann in

2008, more than 70 percent of the respondents

indicated that extensive and qualitatively excellent

training initiatives were required to increase the

chances of success for Six Sigma projects. The

success of such projects does thus not depend solely

on the Six Sigma methodology itself but on the

motivation and the commitment of employees.

Since Six Sigma originated in the production

sector, Six Sigma training often focuses on examples

from manufacturing industries or the logistics sector.

Subsequently, employees in the financial services

industry have a hard time identifying with these

processes. They find it very difficult to apply Six

Sigma to the (from their perspective) highly

individualized processes within the financial

services industry (Börner, Heckl & Hilgert, 2009).

In order to convince employees and senior managers

of financial service providers of the importance of

process management, ProcessLab at the Frankfurt

School of Finance & Management developed the

role play simulation KreditSim. In this role play,

participants simulate processing a loan application

and actively utilize Six Sigma tools to improve the

overall process. Observations to date indicate that

participants are highly receptive to the role play

203

B

¨

orner R. and Uremovic A. (2010).

SPARKING EMPLOYEES’ INTEREST IN SIX SIGMA - Transferring a Paper-based Simulation to a Workflow Management Application.

In Proceedings of the 2nd International Conference on Computer Supported Education, pages 203-210

Copyright

c

SciTePress

simulation, because the elements of active

participation and first-hand experience serve to

highlight the relevance and applicability of the Six

Sigma tools for their day-to-day responsibilities.

Since a growing number of participants argued

that – in reality – different kinds of information

technology could be facilitated to improve the given

process, the idea of using software to enhance

KreditSim was born. In cooperation with jCOM1, a

workflow management systems provider, software

able to support the loan approval process has been

developed.

The following section describes the use of role

plays as a training methodology and their effect on

employee motivation. Section 3 explains the

underlying idea and the procedural implementation

of the role play KreditSim. Section 4 describes how

a workflow management system (WfMS) is used to

support employee training. The final section

consolidates observations and outlines particularities

of computer supported trainings. This article

demonstrates that software solutions, such as a

WfMS, that actively involve employees are highly

suited to supplementing methodological skills

training.

2 A PEDAGOGIC PERSPECTIVE

OF ROLE PLAYS AS TRAINING

INSTRUMENTS

Employee training represents a key to success for

Six Sigma. Simulations, including role plays, serve

as one possible instrument for employee training.

Typically, role plays are used as one of various

different teaching methods within the course of a

training seminar and are a widely used method for

training employees. Role plays represent a specific

type of simulation in which participants assume

particular responsibilities, i.e. a “role.” The

following discussion analyzes the suitability of role

plays in support of achieving different learning

objectives.

Whenever companies send employees to training

courses or seminars, they are interested in having

their employees learn something. The exact nature

of this “something,” i.e. what is actually learnt,

always depends on the particular context. Moreover,

one specific training activity may actually aim at

meeting multiple objectives. The training initiators

may not have explicitly articulated these objectives

and may not even be fully aware of them. For

example, in order to convey information about and

know-how of new legislation, the head of a loan

department could easily provide each employee with

a book outlining regulatory changes in the financial

services industry. But why would the manager send

the employees to a training seminar instead? This

question can be best answered by looking at the

different types of learning. Learning is generally

divided into four categories (Klippert, 2007):

• Content and factual learning: The acquisition of

knowledge and facts, understanding explanations

and phenomena, recognizing relationships and

evaluating hypotheses provide together the basis

for all other types of learning.

• Methodological and strategic learning: The focus

is on structuring, organizing, and arranging the

acquired knowledge. This entails the ability to

independently apply, reflect, or further develop

learnt lines of reasoning, working techniques,

problem-solving or learning strategies within a

subject-matter or cross-functional context

(Hechenleitner & Schwarzkopf, 2006).

Employers are increasingly expecting this type of

methodological competence, in addition to

subject-matter competence, from prospective

employees.

• Social and communicative learning: Utilizing the

learnt facts and knowledge as a basis for

argumentation and discussion with other

members in society, social competence can be

developed. Central to this type of learning is a

rational and responsible discourse, as such

behaviour fosters teamwork, which in turn serves

to enhance social-communicative abilities.

• Affective learning: The so-called self-

competence encompasses the development of

self-confidence, commitment, and motivation.

Affective learning enables the individual to

recognize and bring out his or her own talents

and abilities and to develop reasoned ethical

values and moral concepts (Hechenleitner &

Schwarzkopf, 2006).

Referring back to the example above, handing a

book to each employee would certainly suffice to

enable content and factual learning. However, the

other three types of learning usually occur

automatically during any training seminar and thus

positively influence employees’ willingness and

ability to perform. Moreover, these four types of

learning are typically highly interrelated.

Role plays support especially the three latter

types of learning. Commonly articulated objectives

of role plays include the ability to deal with difficult

CSEDU 2010 - 2nd International Conference on Computer Supported Education

204

situations, developing self-assurance, improving

auto-perceptive and self-reflection skills, increasing

motivation, and raising communicative effectiveness

(Bliesener, 1994). However, it is important not to

pursue too many objectives with a role play, as an

overload of differing objectives may unsettle

participant groups with little previous role play

experience and thus inadvertently result in a

defensive attitude towards the role play (Broich,

1994). Cognitive Load Theory (Sweller, 1988)

provides one explanation for this phenomenon.

Particularly the usage of software, as described in

section 4, can lead to a cognitive overload on the

participants’ side (Brünken, Plass & Leutner, 2003).

The role play KreditSim which will be described

in the following section originally targeted

methodological and strategic learning. However,

experience shows that it covers social and

communicative as well as affective learning, too.

Therefore, employee motivation has become another

core aspect of trainings in which KreditSim is used.

3 IDEA AND IMPLEMENTATION

OF KREDITSIM

The Six Sigma simulation KreditSim has been

developed in order to sensitize employees from the

financial services industry to process problems and

corresponding process improvements. KreditSim is a

paper-based role play in which participants simulate

the processing of a loan application from a new

customer, i.e. the loan approval process. Simulation

participants assume the roles of loan processing

specialists, department head, controller, and

managing director of the fictitious Home Loan Bank

Ltd., and they have to process loan applications in

accordance with their given job descriptions. Since

each participant is responsible for handling only a

small portion of the entire process, it becomes

quickly apparent that while each participant fulfils

his or her process tasks at their very best, the entire

process nevertheless yields an unsatisfactory result.

Eliminating errors on the loan applications as well as

reducing the long overall processing time can only

be accomplished through a holistic, cross-functional

analysis. Six Sigma offers the methodological

support for conducting such an analysis. The starting

point and subsequent phases of the role play

KreditSim are illustrated in the following.

3.1 Initial Situation in the Role Play

The role play KreditSim is typically conducted as as

part of a one-day or multiple-day training seminar.

At the very beginning, the moderator introduces the

current situation that serves as a starting point for the

role play KreditSim, providing the following

overview: “Home Loan Bank Ltd. is a regional bank

that specializes in real estate financing. The bank

maintains four branch offices. In these branch

offices, sales specialists for real estate loans and

financing advise potential customers. The decision

whether or not to approve a loan application is made

at headquarters. Sales specialists attach particular

importance to timely and accurate processing of the

applications they have submitted to headquarters.

Their requirements are expressed with the following

quality criteria:

• Processing of the loan application with an

approval or rejection decision within four days

(in the role play this equates to four minutes),

• Determination of the correct credit rating, and

• Consideration of customer requirements (e.g.

interest rates or payment terms).”

The moderator prepared the process for the first

simulation round and therefore knows that based on

conducting and thus experiencing the loan approval

process at Home Loan Bank Ltd. participants

quickly realize that these requirements cannot be

met. In most cases, the decision concerning a

particular loan application will take nine or ten days

(i.e. minutes). In addition, there will be frequent

errors in the credit rating, resulting in incorrect

decisions concerning the approval of loan

applications. Finally, very often specific customer

requirements will not have been sufficiently

addressed during the processing of the loan

application. Therefore, the moderator can easily

convince participants of the necessity to analyze and

optimize the loan approval process.

To support the first-hand experience of the loan

approval process and its subsequent optimization,

moderators often divide the seminar into three

phases: The first phase consists of conducting the

simulation of the pre-described loan approval

process of Home Loan Bank Ltd., i.e. the current

process. This phase is standardized and

predetermined through the use of the game materials

and adherence to the role play instructions. The

second phase focuses on optimizing the existing

process. The moderator guides the participants in the

use of the tools within the DMAIC (Define,

Measure, Analyze, Improve, Control) cycle, which

is the central procedural method of Six Sigma

(Pande, Neuman & Cavanagh, 2000). This approach

serves as the foundation for developing a new and

SPARKING EMPLOYEES' INTEREST IN SIX SIGMA - Transferring a Paper-based Simulation to a Workflow

Management Application

205

optimized loan approval process. In phase three,

participants simulate the optimized process design.

Results from the new process are captured and

compared with the results from the original process.

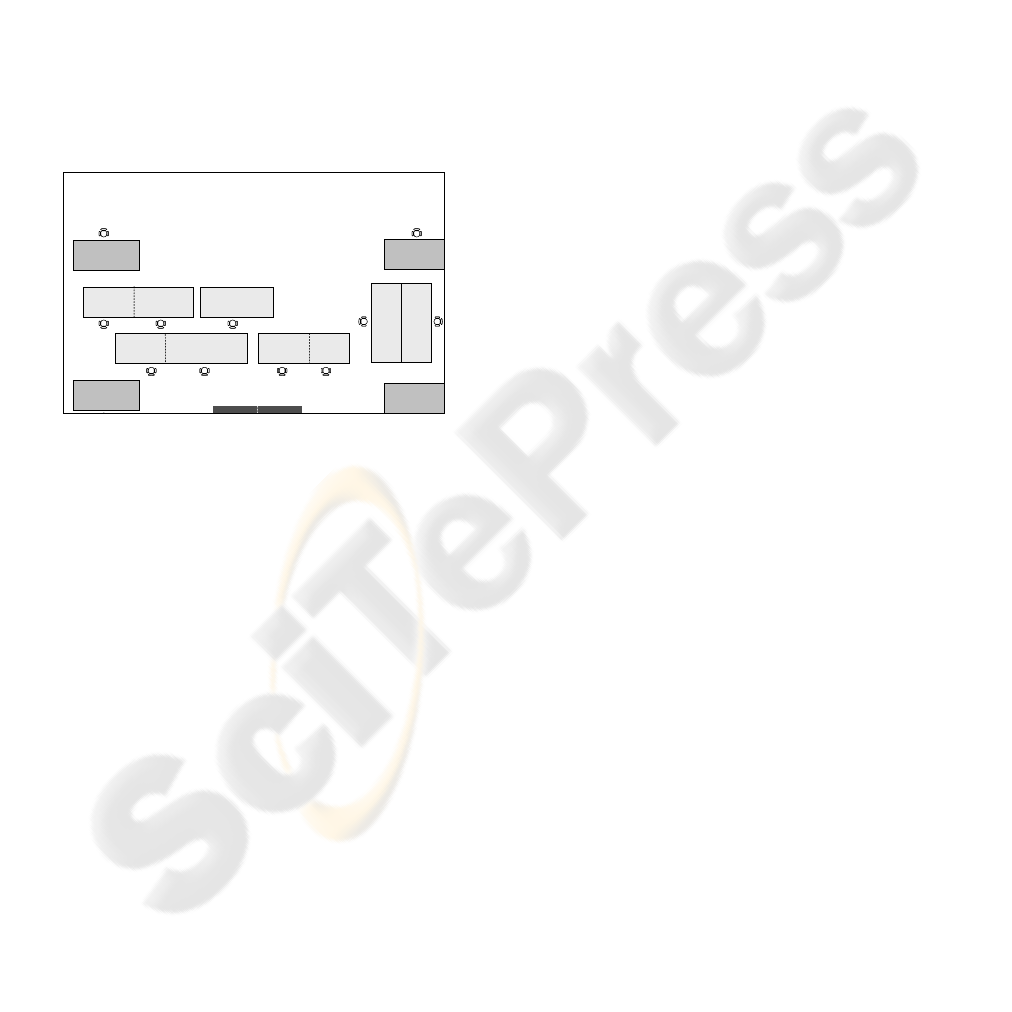

3.2 Phase I: Simulation of the Loan

Approval Process

In phase I, the loan approval process of the Home

Loan Bank is simulated. Prior to starting phase I, the

moderator has to prepare the simulation room. He

arranges the work stations in the predefined floor

layout (Fig. 1) and distributes the job descriptions.

Each participant chooses one of the prepared work

stations randomly. The job descriptions help the

participants to become familiar with their working

tasks.

Branch North

Branch West

Branch South

Branch East

DM Loan

Approvals

DM

Refinancing

Interoffice

Messenger

Collateral

Rating

Credit

Rating

Interest

Calculation

Loan Approvals

Service Quality

Management

Courier

2

3

4

5

6

8

10

9

7

Application

Routing

11

Controller

12

Sales

Manager

14

Managing

Director

13

1

1

1

1

without fixed position

= Chair

= Table

DM = Department Manager

Branch North

Branch West

Branch South

Branch East

DM Loan

Approvals

DM

Refinancing

Interoffice

Messenger

Collateral

Rating

Credit

Rating

Interest

Calculation

Loan Approvals

Service Quality

Management

Courier

2

3

4

5

6

8

10

9

7

Application

Routing

11

Controller

12

Sales

Manager

14

Managing

Director

13

1

1

1

1

without fixed position

= Chair

= Table

DM = Department Manager

Figure 1: Floor plan.

In order to address potential start-up problems

and to avoid any misunderstanding, a trial run of the

simulation is conducted first. Then, the actual

simulation of the loan approval process begins. The

objective is to process as many error-free loan

applications within 20 minutes as possible. This

objective has to be achieved within the requirements

of the quality criteria, namely time (a maximum of

four minutes per application), correct credit rating,

and consideration of additional customer

requirements. Each minute the branch offices submit

loan applications via a branch courier to

headquarters. Within a short time, it becomes

apparent that the given process results in significant

problems.

Subsequent to the simulation run, the moderator

leads participants in the analysis of the process. In a

first step, the incorrect loan applications are

analyzed and documented according to quantity and

types of errors.

Generally, most applications will contain a time

error, i.e. their processing required more than the

allotted four minutes. An incorrect credit rating

occurs frequently as well. An analysis of “Work-in-

Process” provides an indication of how many

incomplete loan applications have accumulated at

each step of the process, highlighting bottlenecks

within the process. An analysis of the processing

times provides insights concerning the individual

processing times of each function within the overall

loan approval process (e.g. Collateral Rating). An

optional analysis can be conducted for the total

processing time for each loan application, since such

data has been captured on each loan document. The

significant differences in the processing times echo

participants’ perception that some colleagues were

unable, in spite of greatest work efforts, to handle

the volume of incoming loan applications while

other colleagues spent a significant amount of time

waiting for work to arrive.

In accordance with the moderator’s expectations,

seminar participants easily recognize the need for

process optimization when looking at the large

number of processing errors and the long processing

times. The moderator can then move on to phase II,

the optimization of the loan approval process.

3.3 Phase II: Optimization of the Loan

Approval Process

The moderator can freely decide how to conduct the

optimization of the loan approval process. In

principle, the optimization can utilize the entire

spectrum of available Six Sigma tools. Especially

those tools that are most frequently applied in the

financial services industry (Heckl & Moormann,

2008) can be nicely illustrated through KreditSim. If

seminar participants are already familiar with Six

Sigma, they should be given their free choice

concerning which of the tools to use.

Very often, participants use the Project Charter

and SIPOC (Supplier, Input, Process, Output,

Customer) from the Six Sigma toolbox to define the

framework for the project. The CTQ/CTB (Critical

to Quality/Critical to Business) matrix plays an

important role in the exact determination of the

requirements and subsequent calculation of the

Sigma level. These three tools have proven to be

especially useful during the Define-Phase. Process

measurement and analysis can be conducted on the

basis of the data that were collected during the first

phase of the simulation (quantity and types of error

analysis, Work-in-Process analysis, processing time

analysis). Additional suitable tools are the Ishikawa-

Diagram and the Value Stream Map (Lunau et al.,

2007). After the analysis, participants should be

given sufficient time for the Improve-Phase to

CSEDU 2010 - 2nd International Conference on Computer Supported Education

206

optimize the loan approval process. It is important to

note that there is not “one correct” solution for the

redesigned process, but that participants instead

learn to identify causes for process deficiencies,

such as duplicate tasks, redundant tasks, or

unnecessary transportation and idle times, and that

participants are in a position to accordingly adjust

and thus improve the process. Besides designing a

new process flow, participants also develop new job

descriptions and a different floor plan.

3.4 Phase III: Simulation of the

Optimized Loan Approval Process

The newly developed loan approval process is

validated by a new simulation. Now, the participants

prepare the simulation room, arrange the floor layout

of working places, and distribute the new job

descriptions. The new simulation only needs to take

10 minutes this time. The participants are now able

to measure to what extent they have been able to im-

prove the process by counting the amount of correct

loan approvals within the given time frame and

comparing the results to the previous simulation.

Experience shows that in every case a significant

improvement in process performance can be

observed. Participants are usually extremely pleased

with their results. Oftentimes, additional ideas for

further improvement are generated during or after

the second simulation run, resulting in lively and

fruitful discussions among participants.

4 COMPUTER SUPPORT BY A

WORKFLOW MANAGEMENT

SYSTEM

After successfully applying KreditSim in multiple

scenarios of employee training, trainers and

participants came up with the idea of enhancing the

simulation by software. Thus, the authors of the role

play decided to develop a tool that simulates the

process and manages workflows electronically

instead of paper-based. In cooperation with a

workflow management systems provider, software

able to support the loan approval process described

in the above section has been developed. The

application of the software impressively shows how

automation of routing work items (which is only one

possibility of process improvement) and providing

work lists for the respective roles can radically

improve processes.

4.1 Technical Infrastructure

The software program is designed as a client-server

application. Three elements of the program are

installed on the server:

• The workflow engine controls the sequence of

the single workflow items that are currently in

the workflow.

• An administration tool is used to set e.g. the

number of loan approvals that enter the process

in a given time interval.

• A graphical user interface for modelling business

processes enables the trainer to customize the

loan approval process individually. Changes

made to the process are automatically translated

into executable code and enacted by the

workflow engine.

The training participants can use either

computers provided in the training room or their

own laptops. Users can access the program by using

internet browsers such as Internet Explorer or

Mozilla Firefox, i.e. there is no need for the

installation of any software on the client computer.

Access to the server can be realized through the

Internet or a specially set up (wireless) local area

network (LAN). In both cases the clients have to be

connected to the network or the Internet

respectively. If computers are provided in the

training room these can be pre-configured so that

users can open their internet browsers and continue

with the log-in without configuring their network

access. Usually, the use of laptops needs some more

effort and time to enable all participants to access

the network. Although establishing this connection

should not pose a problem in most cases, difficulties

might occur due to the configuration of firewalls.

Once the network connection is established,

users can enter the IP address of the server hosting

the workflow engine. Now, they have to enter their

user name and password which are provided by the

trainer in their role description. If default browser

configurations are used (i.e. JavaScript activated,

etc.) no problems concerning the log-in procedure

are to be expected. The unlikely event of an

interruption of the client-server connection can lead

to a log-off from the system.

The server applications such as the

administration tool can be hosted on a traditional

server running at the training provider’s premises.

Alternatively, they can be run on the trainer’s laptop

serving as a host. The advantage of the latter is that

the trainer can easily use the modelling and

administration tool and solve technical problems

directly at the laptop.

SPARKING EMPLOYEES' INTEREST IN SIX SIGMA - Transferring a Paper-based Simulation to a Workflow

Management Application

207

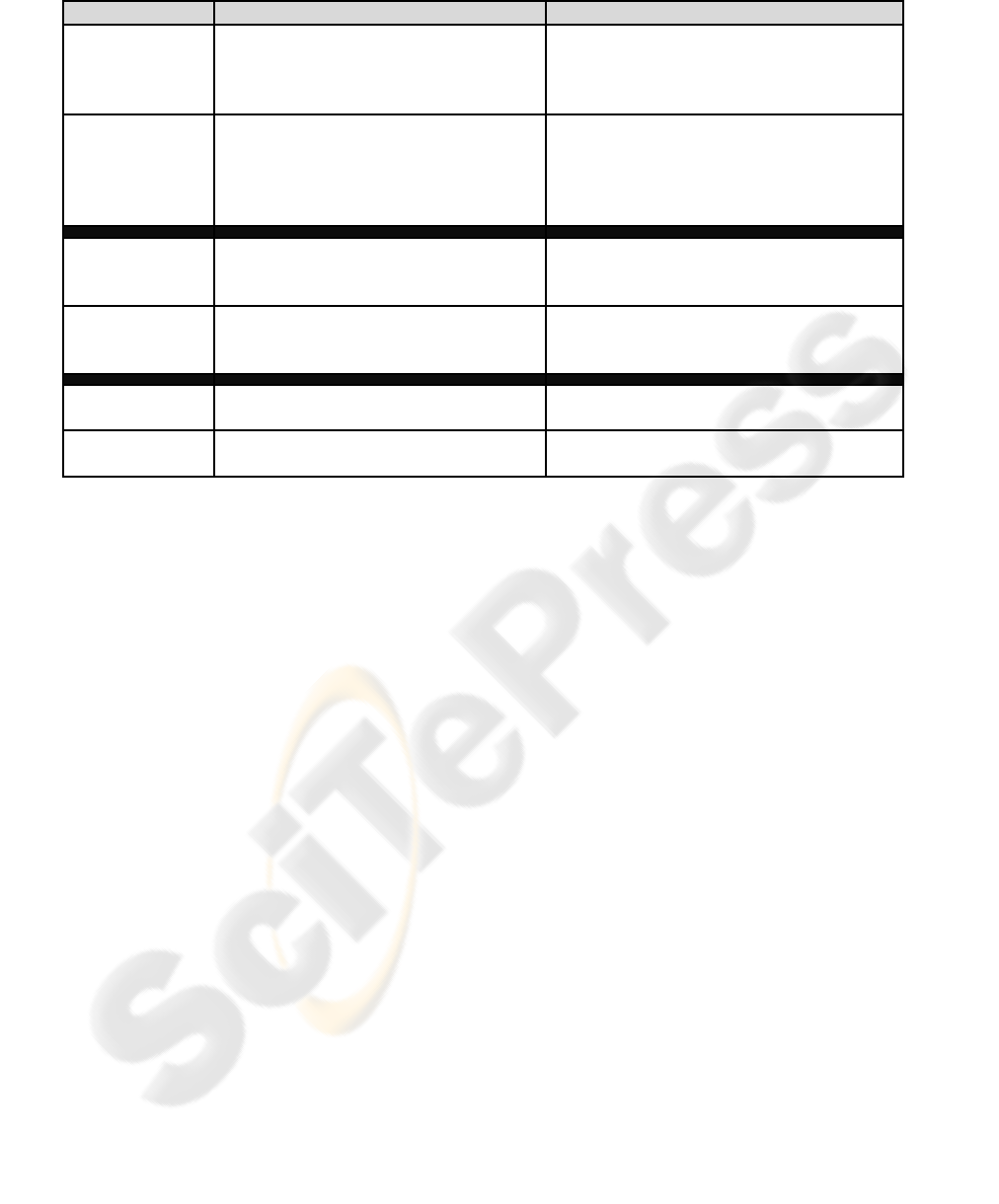

Table 1: Comparison of different implementation choices.

Advantage

Disadvantage

Desktops provided

at training site

- Pre-configuration makes network/internet

access easy

- Same infrastructure makes usage more

predictable

- Due to different floor plans from earlier

simulations, a separate room with desktops has to be

provided

Laptops

- The trainer’s effort is relatively small

- Configuration problems due to firewalls and

different browsers

- Usability problems due to different screen

resolutions

- All participants have to bring a laptop

-

-

(Wireless) LAN

- Enhanced controllability

- Less security issues

- Guaranteed performance

- Trainer has to provide hardware, i.e. hub or access

point respectively

- Trainer needs technical skills to set up a network

Internet

- No special hardware needed for training

session

- Most firewalls configured for internet access

- External factors can influence performance and

overall functionality

- Security related issues have to be considered

Host on server

- No performance problems arising from

insufficient processing power

- Administration requires remote control procedures

Host on laptop

- Hosting of server applications on training site

- Performance problems may increase response time

while running simulation

The usage of the trainer’s laptop might, however,

lead to performance problems while simulating the

process when approximately 15 users access the

server application simultaneously.

Table 1 compares three main types of

implementation choices. Each of the implementation

possibilities can be chosen independently from one

another. However, there are typical combinations.

For instance, when a server in a remote location is

used for hosting the work-flow engine the Internet

would typically be used to connect the users to the

server. When desktops are provided at the training

site there is usually a LAN in place that can be used.

4.2 Roles and Workflows in the

Automated Process

Once all clients are successfully connected to the

network, all users can log on to the system with their

individual user names and passwords. Job

descriptions are provided to all participants as

described in section 3 for phases I and III. The

former entail the log-on information. Most likely,

there will be a number of participants whose roles

differ from those in phases I and III. Thus, the

trainer will have to allow a couple of minutes for

reading the job descriptions. Again, one loan

application file should be used for a trial run so that

all users are familiar with their screen form.

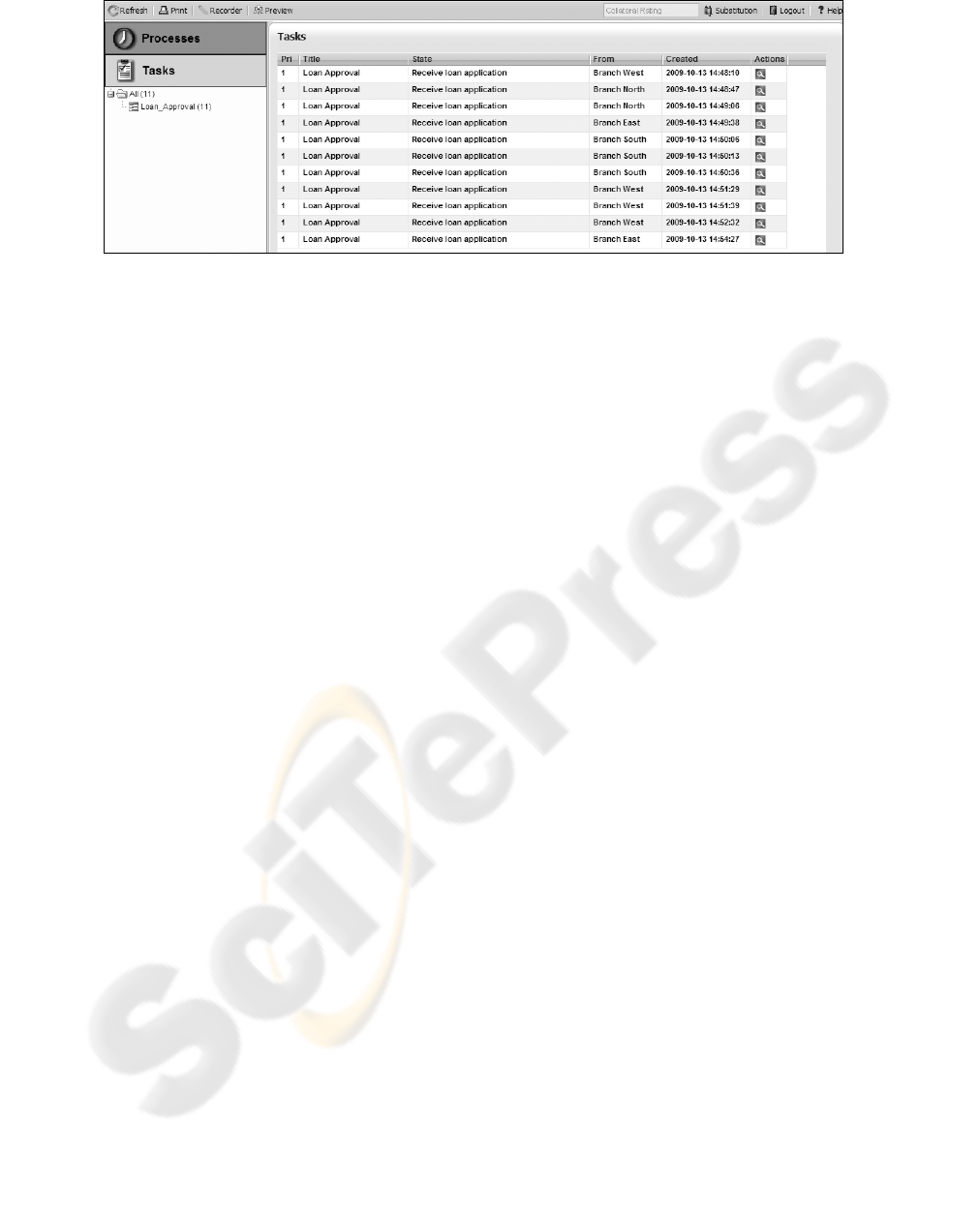

The workflow management system is responsible

for routing each loan application (so called

instances) in the correct sequence to each role in the

process. Thus, the system replaces the interoffice

messenger. Whenever one role has processed an

application, the latter is automatically routed to the

electronic inbox of the appropriate role that has to

execute the next task (Figure 2). The system keeps

track of every instance in the workflow until it is

processed completely and returns it to the original

“virtual” branch office.

Some tasks of the loan approval process take

more time than others. Often, participants consider

this by assigning two or more employees to one task

in phase III. Taking this into account, there are some

roles in the workflow management tool (e.g. staff

member “collateral rating”) that have more than one

user assigned to them. These users have a shared

electronic inbox so that each of them who has

finished one loan application can pick any one

waiting for processing. That way, the system avoids

both, employees waiting for work that is not

transported to their private inbox and loan

applications lying idle in inboxes of overstrained

employees. The software can be modified in so far

that items in the inbox cannot be picked by users but

loan applications are automatically assigned to users

once they finish the previous one (pull vs. push).

This solves the problem of items being processed in

CSEDU 2010 - 2nd International Conference on Computer Supported Education

208

Figure 2: Electronic inbox of the role “Collateral Rating “.

the wrong order (First-in-First-out vs. Last-in-First-

out). However, the feeling of choosing freely

between different items in a pool might improve

employees’ motivation to some degree.

The administration tool running on the server

replaces the branches when it comes to issuing loan

applications. Thus, applications are issued by and

returned to “virtual” branches respectively.

Whenever the sales manager decides to increase or

decrease the frequency of applications issued this

has to be entered into the administration tool.

Furthermore, the workflow management system

logs all waiting and processing times of each loan

application. Hence, the role of a controller is not

needed any more. All kinds of analyses (e.g. Work-

in-Process, quantity and errors, processing time,

etc.) can be generated automatically, immediately

after the simulation is stopped by the moderator.

4.3 Creating Additional Value for

Participants through Software

Application

So far, changes brought about by the application of

software to the simulated process were described.

But is it worth while the effort? Does it create any

additional value for training participants and their

employers?

The most obvious and probably most impressive

feature of implementing software (i.e. a WfMS) to

support an already improved process is automation.

Independent from their role all participants

experience a number of different advantages

automation brings to the process. First and foremost,

loan applications are routed to the respective inbox

immediately and correctly. The chaos caused by an

overburdened interoffice messenger ceases. Second,

users have a perfect overview over all items in their

(shared) electronic inbox. They could even alarm

managers if waiting queues get too long so that

additional users can be assigned to certain roles to

resolve bottlenecks. Since this is difficult to realize

“real time” while simulating the process, capacity

management is one of the improvements often

proposed afterwards by participants. Third, a

parallelization of two or more tasks can be realized

by the application. This leads to an additional

reduction of processing time. Fourth, the number of

processed loan applications is further increased and

the variance of processing time is reduced

significantly. Particularly the latter is an important

element of Six Sigma. Fifth, the quality of processed

loan applications is improved although a larger

number is processed in a shorter time. Sixth, a broad

data analysis regarding throughput and processing

time is immediately available. This leads to a real

time reporting and enables a powerful and flexible

capacity management by the management.

An important part of the optimization in phase II

was the development of a new floor plan in order to

improve the transportation of loan applications.

Thus, the layout in which the participants’ tables and

seats were organized played an important role.

Interestingly, usage of software provokes the

opposite, i.e. the location of users does not matter

any more. Participants will therefore experience how

information technology in general and WfMS in

particular influence both the operational level

(automation, capacity management, etc.) as well as

the strategic level (e.g. offshoring) of business

process management.

Another advantage of software application is that

it can serve different purposes. Not only the

methodology Six Sigma and its tools can be taught

using KreditSim. A general understanding of

business process management is also conveyed and

further supported by software. Finally, demonstra-

ting a WfMS joined with a well-known process that

has been improved by the participants themselves

proves how valuable such a system can be.

SPARKING EMPLOYEES' INTEREST IN SIX SIGMA - Transferring a Paper-based Simulation to a Workflow

Management Application

209

5 CONCLUSIONS

Role plays are a recognized methodology to support

methodological and strategic learning. Hence, they

are well-suited for trainings focused on Six Sigma

and the application of its tools. Since role plays also

encompass social and communicative learning as

well as affective learning, they also foster

involvement and motivation of employees

participating in trainings.

As shown in section 4, software can support and

enhance employee training. However, it might not

be useful to replace the paper-based simulation in

every case. For the purpose of teaching Six Sigma

tools and a general understanding of business

process management, use of the paper-based

simulation is strongly recommended before moving

on to the computer-based simulation. Participants

are usually impressed how powerful simple tools

and changes made to the process can be even

without using information technology. The

subsequent facilitation of the software entrenches

this experience. If the purpose of the training is to

show the value of automation through a WfMS, the

software can replace phase III of the original

simulation. After the analysis of the process

experienced in phase I, participants can directly

move on to simulate the computer-supported loan

application process.

Thanks to its structure, the simulation KreditSim

can be used to target management and staff members

alike. For a successful implementation of Six Sigma

it is indispensable to gain both management’s

support and employees’ commitment. Usually, the

former is easier to achieve than the latter. Most staff

members overcome an early scepticism and feel

enthusiastic about the improvements in time, costs

and quality of the optimized process. However,

some are afraid of falling victim of another cost

cutting initiative. They are anxious of loosing their

job once the process is optimized. Both the original

paper-based simulation and the computer-based

simulation tackle this problem in prohibiting any

layoffs so that all participants have a (new) role in

the improved process. Still, using the software

makes the abundance of certain activities (e.g.

interoffice manager, controller) even more visible.

Therefore, the trainer should be well-prepared to

argue that process improvement does not lead to

layoffs. A failure to convey this message convin-

cingly could lead to a loss of employees’ support

and commitment to a Six Sigma project or a process

improvement initiative in general.

The case of KreditSim shows that software can

complement existing non-electronic training

instruments such as paper-based role plays. Thus, it

can support already pursued educational goals (like

teaching Six Sigma tools) and add other aspects (like

introducing WfMS). Alternatively, it can replace

parts of the training and thus shift the focus from the

former to the latter. Depending on the intention of a

training, the moderator can deliberately choose how

to utilise the software. If the software is used for a

third run of the simulation it can be presented as an

independent alternative to the previously simulated

runs. If the training covers more than one day the

moderator could incorporate the participants’ ideas

from day one into the workflow and thus build the

third (computer-based) run of the simulation on the

findings of the first day’s improvement phase.

REFERENCES

Antony, J., 2004. Six Sigma in the UK service

organizations, In: Managerial Auditing J, Vol. 19, No.

8, pp. 1006-1013.

Becker, J., Kugeler, M., Rosemann, M., 2004. Process

Management, Springer.

Bliesener, T., 1994. Authentizität in der Simulation, In:

Bliesener, T., Brons-Albert, R (Eds.): Rollenspiele in

Kommunikations- und Verhaltenstrainings, West-

deutscher Verlag, pp. 13-32.

Börner, R., Heckl, D., Hilgert, M., 2009. Erfahrungen mit

dem Schulungsinstrument KreditSim, In: Moormann,

J., Heckl, D., Lamberti, H.-J. (Eds.): Six Sigma in der

Finanzbranche, 3rd ed., Frankfurt School Verlag.

Broich, J., 1994. Rollenspiele mit Erwachsenen, Maternus,

5th edition.

Brünken, R., Plass, J.L., Leutner, D., 2003. Direct

Measurement of Cognitive Load in Multimedia

Learning, In: Educational Psychologist, Vol. 38, No.

1, pp. 53-61.

Hammer, M., Champy, J., 1993. Reengineering the

Corporation, Harper Business.

Hechenleitner, A., Schwarzkopf, K., 2006. Kompetenz –

ein zentraler Begriff im Bildungsbereich, In: Schulma-

nagement, No. 1, pp. 34-35.

Heckl, D., Moormann, J., 2008. Six Sigma in der

Finanzbranche, Frankfurt School Verlag.

Klippert, H., 2007. Methoden-Training, Beltz, 17th ed.

Lunau, S., Mollenhauer, J.-P., Staudter, C., Meran, R.,

Hamalides, A., Roenpage, O., von Hugo, C., 2007.

Design for Six Sigma+Lean Toolset, Springer.

Pande, P., Neuman, R., Cavanagh, R., 2000. The Six

Sigma Way, McGraw-Hill.

Sweller, J., 1988. Cognitive load during problem solving,

In: Cognitive Science, Vol. 12, No. 2, pp. 257-285.

CSEDU 2010 - 2nd International Conference on Computer Supported Education

210