A Fuzzy Cognitive Map System to Explore Certain Scenarios

on the Cyprus Banking System

Maria Papaioannou

1

, Costas Neocleous

2

, Charalambos Papageorgiou

3

and Christos N. Schizas

1

1

Department of Computer Science, University of Cyprus, 1 University Avenue, 2109, Nicosia, Cyprus

2

Department of Mechanical Engineering and Materials Science and Engineering,

Cyprus University of Technology, 30 Archbishop Kyprianou Str., 3036, Limassol, Cyprus

3

The School of Humanities and Social Sciences, European University of Cyprus, P.O. Box: 22006, 1516, Nicosia, Cyprus

Keywords: Fuzzy Cognitive Maps, Intelligent Systems, Private Sector Involvement.

Abstract: The model of Fuzzy Cognitive Maps (FCMs) allows a user to investigate how the influencing parameters of

a cause-effect system behave under the implementation of desired scenario. Human knowledge and

experience is used to define the structure and the parameters of a FCM model. This paper proposes a

methodology which smoothly directs the steps that the experts should take in building an FCM system in

order to reduce the subjectivity which characterizes such expert systems. Furthermore, an update rule for the

parameters during the simulation phase is presented. Finally, the novel FCM construction methodology and

the proposed FCM update rule are tested on a real-life system to investigate the repercussions of the

combination of the Greek private sector involvement (PSI) with the decrease of people’s confidence

towards the Cyprus banking system. The results resemble what actually happened to the Cyprus economy a

short period after the implementation of the Greek PSI.

1 INTRODUCTION

A wide variety of realistic socio-politico-economic

systems are dynamic and may be characterized by

the intra-system causality of their interrelated

constituent components. Their dynamic behaviour

makes their modelling, manipulation and handle

difficult. Hence, investigating how these systems

respond to different scenario cases regarding their

parameters is crucial for the right and beneficial use.

Fuzzy Cognitive Maps (FCM) modelling offers an

alternative approach for the building of intelligent

systems, through the use of interactive influencing

parameters (Koulouriotis et al., 2001; Carvalho,

2013; Andreou et al., 2005).

An FCM system is constituted by a set of certain

concepts of the system and a set of the concepts’

interconnections. By using the FCM technology one

can apply the changes he/she wishes to any of the

parameters, and then observe the effects on any

other parameters or subsystem. After a change is

applied to selected initial states of the concepts of

interest, the system is let to evolve for a number of

steps until the concept states converge to stable

values. Further analysis and work can be done on the

converged final states of the system for

understanding how indirect cause – effect relations

drive the system’s behaviour.

The success of the process strongly depends on

the proper set-up of the FCM system. Even though

in the last decade, efforts have been made to extract

the structure of an FCM system by using machine

learning methods, the predominant FCM

construction procedure is highly depended on

integrating experience and knowledge from human

experts (Stach et al., 2010). The human expert based

FCM building methodology is very suitable

modelling socio-politico-economic FCM systems,

especially when there no historical data available

that could be used in order to employ machine

learning processes to construct the system

(Papageorgiou, 2011).

Hence, since the construction of FCM systems

highly relies on targeted knowledge that is extracted

from experts, it is substantially crucial to establish a

certain methodology for developing qualitative FCM

models. Thus, the success of the FCMs’

developmental phase is based on an accurate

extraction of expert knowledge or experience. A

framework of such a methodology was presented

103

Papaioannou M., Neocleous C., Papageorgiou C. and Schizas C..

A Fuzzy Cognitive Map System to Explore Certain Scenarios on the Cyprus Banking System.

DOI: 10.5220/0005039701030110

In Proceedings of the International Conference on Fuzzy Computation Theory and Applications (FCTA-2014), pages 103-110

ISBN: 978-989-758-053-6

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

analytically in Papaioannou et al. ( 2013).

The parameters and their interrelations of an

FCM system constitute veritable semantic terms of

the modelled system. Hence, they can be interpreted

by whoever builds the system in an explicit manner.

Additionally, the update rule describes the degree of

influence between different parameters of a cause –

effect system which basically comprises the

cornerstone of the Fuzzy Cognitive Maps.

Furthermore, in order to satisfy the limitation of

keeping the concept state values in the range of [0,

1] (Stylios and Groumpos, 2004) the update rule

uses a transformation squashing function (e.g.

logistic function) which basically squashes each new

concept state value into the desired limited range.

However, the use of the transformation function

cannot be explained using semantics from FCM

background theory and hence it cannot be

interpreted. The idea behind the FCM technology is

the modelling of how real cause-effect systems

work. All FCM modelling elements can be described

using causality semantics, except the update

function. For avoiding any squashing functions

when updating the parameters’ state value in every

running iterations of the FCM system, a novel

update rule is used which is described in a later

section of this paper.

Our work takes FCM modelling technology a

step forward since both the FCM construction

methodology and the novel update function rule are

implemented and applied to a real life, strongly

intricate system describing the interacting concepts

of the Cyprus banking system and economy.

It is well known, that in 2008 a new global

financial crisis emerged. This crisis was transmitted

to the European economies and especially the

weakest of them in the southern European belt,

evolving into “national debt crises”. Greece was the

first country which had to deal with the possibility of

a national bankruptcy in 2009. As a result of the

continuous and strong increase in Greek government

debt levels, Greece’s sovereign debt was

downgraded by the International Credit Rating

Agencies to junk status in April 2010. There was a

fear that other countries could be affected by the

Greek economic crisis. This forced Europe to take

important and decisive corrective actions under the

pressure of time. In May of 2010, the Troika which

is a tripartite committee constituted by the European

Commission, the International Monetary Fund

(IMF) and the European Central Bank, agreed to

give Greece a three-year €110 billion loan. As part

of the deal with Troika, the Greek government

implemented a series of austerity measures. These,

led Greece to an even deeper recession. As a result,

in February of 2012, Troika decided to provide

Greece a second bailout package accompanied with

a restructuring agreement by enforcing losses on the

private sector holders of Greek sovereign debt, a

process known as “private sector involvement”

(PSI). The debt restructuring deal declared that

private holders of Greek government bonds had to

accept a 53.5% so-called “haircut” to their nominal

values. Eventually, in March 2012, the bond swap

was implemented with an approximately 75%

effective write-off.

The Cypriot and Greek economies are strongly

related and connected. As a consequence the Greek

PSI agreement had serious repercussions to the

Cyprus economy. More specifically, the Cypriot

banking system was strongly impacted by the Greek

PSI, since it was highly exposed to the Greek

government bonds. Cypriot banks lost the equivalent

of 20% of Cyprus GDP in this unfortunate

investment. At the same time the Cyprus economy

was dealing with other serious economic problems

such as a stagnating economy and an increasing

fiscal deficit.

Added to this, the revelation of such

unsuccessful and injurious investments on the Greek

government bonds led people to lose their faith in

the Cypriot banking sector. The future of the Cypriot

economy and especially its banking system seemed

uncertain.

In this work, an attempt has been made to model

the dynamics of the above problem and general

situation using the technology of fuzzy cognitive

maps. That is, once we manage to produce an FCM

model of the situation, to study the long term

impacts the banking system as a result of the Greek

PSI in combination with the decline in confidence

towards the Cypriot banking system.

For the purposes of this work, four basic

scenarios were implemented and tested. Namely,

introducing to the system a 75% Greek PSI and

decreasing the level of confidence of people to the

Cypriot banking system by 25%, 50% and 75%.

2 THE FCM MODEL

Dynamical systems and in particular political–

economic–social systems which are characterized by

causality tend to reach steady states. A change to the

initial state vector describing such a system

stimulates a series of subsequent influencing

changes to the parameters of the system which

eventually settles to stable state vector. For real life

FCTA2014-InternationalConferenceonFuzzyComputationTheoryandApplications

104

systems, it is crucial for the decision makers to have

an estimate on the cost of changing a state of a

concept and how will that change affect other

concepts of interest.

FCMs are a soft computing methodology of

modelling such dynamic systems, which constitute

causal relationships amongst their parameters. They

manage to represent human knowledge and

experience, in a certain system’s domain, into a

weighted directed graph model and apply inference

presenting potential behaviours of the model under

specific circumstances. The parameters are led to

interact until the whole system reaches equilibrium.

FCMs allow a user to observe intricate and hidden

causal relationships and to take advantage of the

causal dynamics of the system in order to observe

the effects of a possible action scenario.

Most of the times, human experts in the system’s

domain are used to identify the important parameters

and their interactions in the system. However,

although the experts might be characterized by a

great expertise, it is difficult for them to make a right

prognosis of the future states under different

scenarios, mainly due to the high complexity of the

systems.

2.1 FCM Novel Building Methodology

In order to reach meaningful conclusions, the FCM

model must be built based on knowledge regarding

the system that is distilled from several experts. For

that reason, the proposed FCM building

methodology (Papaioannou et al., 2013) using

experts’ knowledge and experience was applied to

the system described in the present work.

By following the proposed steps of this novel

FCM construction procedure the experts define and

set the parameters of the system (called concepts in

the standard FCM formalism) and the

interconnections between the concepts (called

weights or sensitivities in FCM theory).

2.1.1 Step 1: Define Time Period

The very first thing the experts were called to do

was to accurately define the time period in which

they wish to study the system. Specifying the time

horizons in which the experts were asked to describe

the system helped to limit the amount of information

that was needed to properly define the system. For

example, in this work, the experts were asked to

study the economic consequences of Greek PSI in

combination with the decrease of people’s

confidence in Cyprus banking sector as they were

performed in April 2012. Therefore, the valuation of

the parameters’ states will be done based on

material, statistics or any other information

describing them in the specified time window. In

this case the experts defined the time window at +/-

3 months from April 2012.

2.1.2 Step 2: Identification of the

Parameters of the System

Having defined the time period, the experts

proceeded to the identification of the principal

parameters of the system and their special features.

In order to enhance the experts’ perception about the

actual and up-to-date interpretation of each concept

without semantic confusion, they were asked to fill a

table of different fields describing the system’s

parameters.

Specifically, the experts had to conclude to a

formal description of each parameter, the

measurement units describing each parameter, the

maximum and the minimum value that each

parameter scored in the pre-specified time window

and the degree of variation of each concept that the

experts believed it would happen by the

implementation of the scenario to be tested.

Finally, the experts had to consider the actual

value characterizing each parameter in April 2012.

These values comprised the reference point for the

definition of the initial states of the concepts. In the

context of the formal FCM theory, the concept states

are described by a value in the range of [0,1]. Hence,

the initial activation value of each concept was

normalized to scale [0%, 100%], just like the

conventional FCM models.

2.1.3 Step 3: Calculation of the Sensitivities

(Weights) of the FCM Interrelations

In the next phase, the calculation of the sensitivities

values of the system’s interrelations followed, which

is different from the traditional way of defining them

in the FCM bibliography. The reasoning behind this

deviation from the conventional FCM, is because we

have a different apprehension of what substantially a

sensitivity value means in the context of FCM.

Thereafter it is important to clarify the definition of

the sensitivity. A sensitivity value indicates the

degree of the influenced concept’s change in respect

to the change of the influencing concept’s state. The

sensitivity of the relation describes the impact of

changing the state of Ai on the concept Aj. The

above statement can be mathematically formulated

into Equation (1):

AFuzzyCognitiveMapSystemtoExploreCertainScenariosontheCyprusBankingSystem

105

1

1

1

t

i

t

i

t

i

t

j

t

j

t

j

ij

A

AA

A

AA

S

(1)

In Equation (1), t is the iteration counter.

Furthermore,

1t

i

A

is the initial activation state of

the influencing concept whereas

t

j

A

is the initial

activation state of the influenced concept. A change

happens in the state of the influencing concept

which is depicted in

t

i

A

. This change stimulates the

change of the influenced concept state which drives

to a new state

1t

j

A

. The change of a concept’s state,

between two discrete consecutive time cycles, is

measured as a percentage to the concept’s initial

state. Indeed, the sensitivities of the modelled

system described in this work were calculated by

using Equation (1).

For each parameter, a simple scenario of

changing its initial state was developed. The degree

of that change was based on the corresponding

degree of variation as the experts had already

defined in the previous FCM developmental stage.

For better understanding, an example of a sensitivity

calculation is given. Consider the relation between

the STOCK MARKET VALUE (concept 7, C7) and

the RECAPITALIZATION BY PRIVATE EQUITY

(C6). The experts defined the initial states of C7 and

C6 as 40% and 20% respectively. Furthermore, they

expected a negative relationship of high intensity of

the degree of variation for the STOCK MARKET

VALUE as a result of the implementation of the

Greek governmental bonds “haircut”. Therefore the

question for this sensitivity was finally formed as:

“If the level of the parameter STOCK MARKET

VALUE gets reduced from 40% to 0%, what will be

the new state of the concept RECAPITALIZATION

BY PRIVATE EQUITY if now is 20%?”. For this

example the experts answered 0%. However,

measuring the change of the two consequent states

of a concept, as a percentage of its initial value gives

a better feeling about the strength of the variation.

Therefore by applying the Equation (1) the resulting

sensitivity between the concepts C7 and C6 is:

1

4.0

4.00

2.0

2.00

6,7

S

(2)

In that way, each expert forms his own sensitivity

matrix reflecting his own beliefs about the system’s

structure and behaviour. By using this sensitivity

matrix along with the already set initial values, the

FCM system is let to “run” until it reaches

equilibrium. At this point, the number of iterations

the system needs to converge is regarded as the

duration period the system needs to reveal the total

impact on each concept. Hence, in order to calculate

the effect that each concept receipts per iteration, the

sensitivities are divided by that number of iterations

(needed by the system to settle to stable values the

very first time). For this system this number was 10

and thus the final value of S

7,6

= 0.1. That is called

the “absolute sensitivity”.

2.2 FCM Update Rule Function

A set of concepts and their interrelations are

necessary to form the structure of an FCM system.

An activation function in FCMs defines the way the

system will process causality for simulation

purposes. An activation function calculates the

updated state values for each concept after

interacting with its influencing neighbours.

The traditional FCM activation function

approach has been slightly modified. The modified

version was first presented in Papaioannou et al.

(2013). This modified activation has been used in

the present study. The central idea of this novel

activation function is that an impact is created onto

the FCM system when and only when a parameter

changes its equilibrium state value. Therefore it is

the change itself that causes the system perturbation

and forces it to reach a new equilibrium state.

Consequently, the concept state should be updated

by taking into account, the changes that happened

during each iteration to its influencing neighbours.

Besides, this was the main idea of the way the

sensitivities were calculated, as described in the

previous section.

At each iteration the new activation state value

must be calculated for each influenced concept,

where in Equation (1) the term

1t

j

A

stands exactly

for that. Thus, solving Equation (1) for

1t

j

A

and

aggregating this change with the existing influence

concept state will result in Equation (3) where t is

the iteration counter, A

j

is the activation strength of

the concept of interest and s

ij

is the sensitivity

(weight) which is a measure on how much a change

in the current standing of concept A

i

affects the

changes in the standing of concept A

j

.

FCTA2014-InternationalConferenceonFuzzyComputationTheoryandApplications

106

n

i

t

i

t

j

t

i

t

iij

t

j

t

j

A

A

AAsAA

1

1

11

(3)

Summarizing, a change to the initial states of an

FCM system, stimulates the interaction of its

parameters leading to an iterative process of

updating their states using the activation function

given by Equation (3) until the system converges to

a stable state. Then the user of the system may

observe and make conclusions on the direct or

indirect effects of that change reflected on the final

states of the system.

3 THE FCM EXAMPLE OF

CYPRUS BANKING SYSTEM

AND ECONOMY

FCM model has been around in scientific area for

more than 25 years. However, there is a lack of

FCM applications in real-life complex systems. In

order to contribute towards the empirical

justification of the usability of this model, a system

taken from the Cypriot economic and banking reality

was chosen to test the novel FCM building

methodology and update activation function. More

specifically, we used the proposed FCM technology

to investigate how the Cypriot banking system is

impacted by the combination of the Greek PSI with

the decrease in people’s confidence to the Cypriot

banking sector during the April of 2012. Two

experts in political and economic fields were called

to contribute in building an FCM model as

previously described in this work (Papaioannou et

al., 2013).

Through a series of discussions, the experts

decided that the 15 influencing parameters

adequately and appropriately represent the system to

run the aforementioned scenarios. The parameters

are: Cost of Money (COM), Liquidity of Cyprus

Banks (LCB), Degree Of PSI of Greek Government

Bonds (PSI), Degree of Deposits of Greek Citizens

and Companies in Cyprus Banks (GDCB), Degree

of Deposits of Cypriot Citizens and Companies in

Cyprus Banks (CDCB), Degree of Success of Bank

Recapitalization by Private Equity (BRPE), Stock

Market Value of Banks (SMVB), Evaluation of the

Cyprus Economy by Authoritative Rating Agencies

(ECEARA), Confidence of People and Companies

in Cyprus Banking System (CCBS), Level of Greek

Economic Crisis (GEC), Level of Greek Workforce

that Comes to Cyprus for Work (GWC), Degree of

Bank Recapitalization Done by the Republic of

Cyprus (BRRC), State of Cyprus Economy (CE),

Probability of the Republic of Cyprus Entering EU

Support Mechanism (PESM) and Probability of

Cutoff of the Cypriot Bank Branches that Operate in

Greece (PCCB).

Following that, the experts completed the desired

information about each system’s parameter. They

collected, studied and properly evaluated the

relevant material regarding the system’s set

parameters (e.g. scientific articles, press articles,

statistical analysis results and other sources). This

FCM building methodology demands from the

experts to get involved in this procedure to refresh

their knowledge about the specific parameters of the

system in order to be updated about the parameters’

details. Especially so, when setting their initial

values and the interconnection sensitivities.

Further on, in order to calculate the initial values

of the FCM system, the actual values of the concepts

were normalized, as defined by the methodology, in

the range of [0%, 100%]. However, it is important to

note that there are some parameters that cannot be

approximated based on raw numbers but rather using

some kind of fuzziness. For example, it is difficult to

be exact in quantifying the concept of the State of

Cyprus Economy which encompasses characteristics

like GDP, unemployment rate, housing, Consumer

Price Index, stock market prices, industrial

production, etc. In such cases the experts had to

define the state of the concept based only on their

“feeling” and their understanding of the dynamics of

the system.

The final stage of the proposed FCM

construction methodology was about setting the

sensitivities of links between the concepts.

Therefore, each expert had to go through the process

of calculating the sensitivities amongst the causal

relationships of the systems. The whole process was

implemented through expert-computer interaction.

For each possible interrelation of the system the

computer screen presented to the expert the initial

value of the potential affecting concept and how this

is altered after applying the corresponding degree of

variation (a factor of the table the experts created

during prior construction phase). The computer also

presented the initial value of the potential affected

concept and right after the expert was asked to give

the resulting new activation value of the potential

affected concept. For each interrelation, the experts

inserted their own estimations and the computer

automatically calculated their sensitivities using the

formula given by Equation (1).

As a result each expert created his/her own

sensitivity matrix. Inevitably, there were some

AFuzzyCognitiveMapSystemtoExploreCertainScenariosontheCyprusBankingSystem

107

discrepancies between the values given by each

expert. Finally, the average of the sensitivities was

used to form the final sensitivity matrix.

4 RESULTS

Four different scenario cases were implemented and

tested using FCM technology as described in

previous sections. The first scenario was about

observing how a 75% Greek PSI affects core factors

of the economy of Cyprus. The other three scenarios

involved the implementation of the 75% Greek PSI

along with a gradually scaled decrease of confidence

of people and companies in the Cyprus banking

system and the way this combination affects the

other parameters of the system.

During simulations, the changed values of the

concepts of interest were “locked” in such a way that

they would not be further changed during the

simulation period as a result of interference with

their causality neighbours, but rather remain

constant. Hence, in the context of the first

aforementioned scenario, the state value of the

concept of Greek PSI would remain 75% through

the whole process of simulation.

The remaining parameters were allowed to

interact through causality paths using the update rule

presented in Equation (3), leading the system to an

iterative behaviour until it converged to steady state

value. That means until the concept state vector was

the same between two consecutive iterations. The

values of the steady state concept vector were taken

as the future response of the modelled system to the

actions implemented in the concepts of interests.

It is emphasized that the objective when

analysing the results of a FCM system is to carefully

observe the trends rather than the actual final state

values of the concepts. Hence, the absolute values

are rather meaningful for the system’s analysis,

whereas the relative changes are the ones which can

shed some light on the decisions needed to be made.

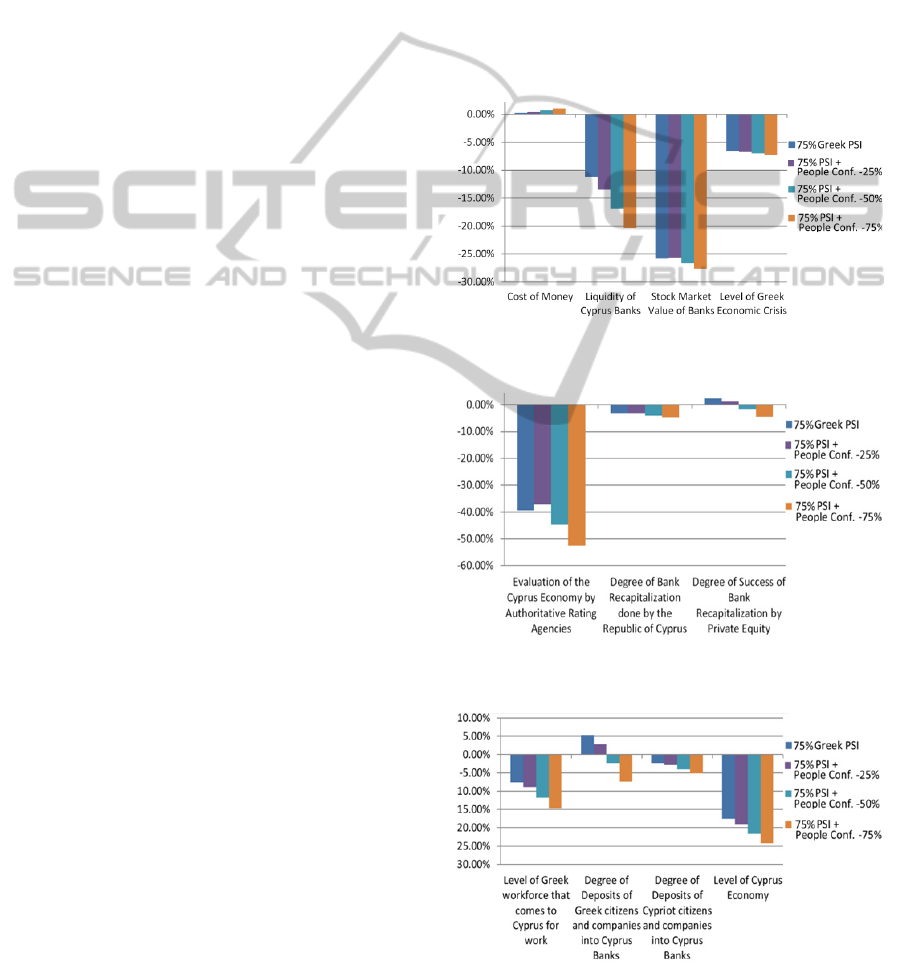

The results of this work are graphically presented

in Figures 1 to 4. In these Figures, the percentage

change between the final state value of the concepts

and their corresponding initial values, which

happened in response to a certain scenario

implementation, is presented. The blue colour

columns represent the results of the scenario where

only the 75% Greek PSI takes place. The other three

columns (purple, green and orange) present the

results corresponding to the scenarios where the

Greek PSI is implemented in parallel with a fall of

people’s trust in the Cypriot banking system by

25%, 50% and 75% respectively. In all of the

figures, the horizontal axis exposes the parameter

names. The vertical axis is showing the resulting

percentage changes in the system’s parameters lying

in the horizontal axis, which are due to the

implementation of the aforementioned scenarios.

The results as shown in Figures 1 to 4 were given

back to the experts to analyse them and make

conclusions about the particular simulations of the

system.

As expected, the higher the decrease of the

people’s confidence to the Cyprus banking system

the more unfavourable is the effect on the Cyprus

economy and the banking sector.

Figure 1: The impact of the four scenarios on the

parameters COM, LCB, SMVB and GEC.

Figure 2: The impact of the four scenarios on the

parameters ECEARA, BRRC and BRPE.

Figure 3: The impact of the four scenarios on the

parameters GWC, GDCB, CDCB and CE.

FCTA2014-InternationalConferenceonFuzzyComputationTheoryandApplications

108

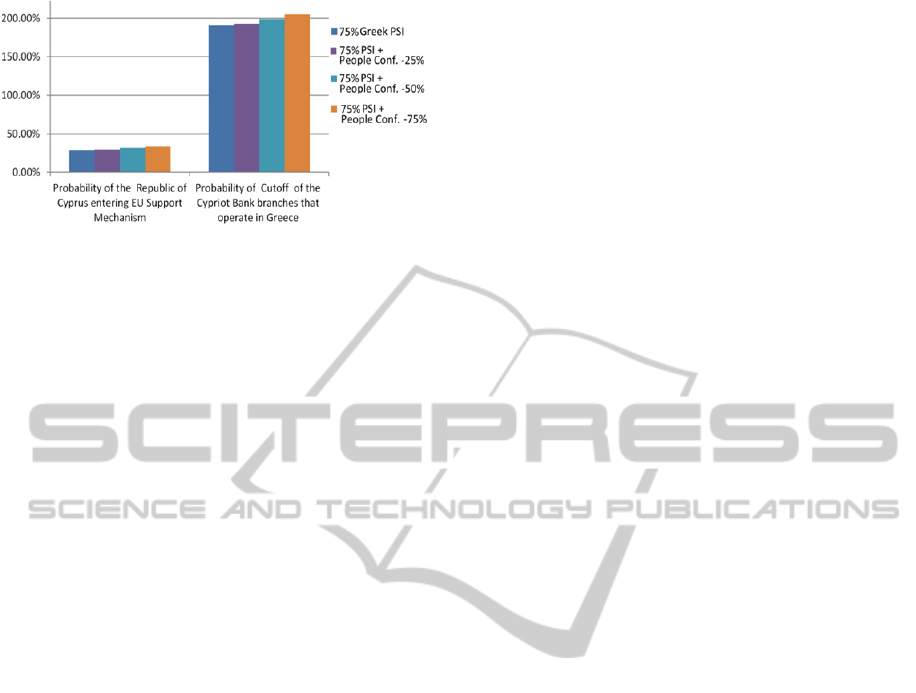

Figure 4: The impact of the four scenarios on the

parameters PESM and PCCB.

The most interesting outcomes from the

simulations of the four run scenarios will be

presented further on. The State of the Cyprus

economy is negatively affected as a response to the

scenarios where only the Greek PSI takes place.

Things become gradually worse for Cypriot

economy as the confidence of people is decreased in

the following scenarios. Also, the lack of people’s

trust to the banking sector would motivate people to

withdraw their money from banks. Such a case

would be decisive for the Cypriot banks which

already had to deal with liquidity problems due to

the Greek PSI. This totally justifies the results for

the factor “liquidity of the Cypriot banks” which

decreases when the Greek PSI is implemented alone.

Furthermore, when the confidence of the people is

decreased by 75% the liquidity of the banks present

a 50% extra decrease. The response of the

parameter Level of deposits of Greek citizens in

Cypriot banks in the four scenarios was also very

interesting. When the Greek PSI is implemented, an

increase to the level of the Greek deposits in Cyprus

is observed according to the system. However when

the Greek PSI is accompanied with a decrease of

people´s confidence in the Cypriot banking system a

decrease of the people´s confidence in the Cypriot

banking system this increase is diminishing and

finally becomes a decrease. Similarly, the tendency

of the Greek citizens to move to Cyprus for work is

decreased when the Greek PSI is done and continues

to decline in parallel with the decline in the

confidence of people and companies in the Cypriot

banking system. More specifically, when the Greek

PSI is followed by a 75% decrease of people´s trust,

the decrease in Greek workforce coming to Cyprus

for work is almost double the decrease in the case

that only the PSI takes place.

Overall though, the parameter which exhibited

the largest scale impact was the Probability of a cut-

off of the Cypriot bank branches that operate in

Greece. A higher than 190% increase of this

parameter was observed in all scenarios. Such

probability is significantly increased in either the

case the Greek PSI is implemented alone or with

people´s confidence in the Cypriot banking sector

being decreased by 25%, 50% or 75%. In other

words, the results of the modelled system state that

the probability of cutting off the Cypriot bank

branches that operate in Greece is mostly unaffected

by the strength of the people´s faith in the banking

system. This observations lead to the remark the

Cypriot banking system could not escape from the

decision of selling the Cypriot bank branches in

Greece. In fact, in March of 2013 the Marfin Popular

Bank and the Bank of Cyprus, the two largest banks

in Cyprus, were forced to sell their branches in

Greece. Thus, the system revealed the existence of

strong causal paths connecting the concept of the

Greek PSI and the Probability of cut-off of the

Cypriot bank branches that operate in Greece.

Analogous conclusions can be drawn about the

parameters, Stock Market Value of Banks and

Probability of the Republic of Cyprus entering the

EU Support Mechanism. Specifically, these

parameters presented adverse responses to all

scenarios. The Stock Market Value of Banks

deteriorates by approximately 26% for the first two

scenarios and 27% for the last ones. Similarly, the

probability for Cyprus entering the EU Support

Mechanism appears to increase by 29%-33%

respectively in these scenarios. Hence, it can be

argued in conformity with the modelled system, that

the Greek PSI implementation was a significant

factor in Cyprus having to ask for EU mechanism

support.

The results of the system indicate that the

damage done to the Cyprus banks by the

implementation of the PSI was serious. This

damaged was magnified by the loss of people’s trust

to the banking system. Unfortunately for Cypriot

economy and banking sector, the last point was

confirmed a year later. On the 16th of March of

2013, the Eurogroup forced the Cypriot government

to impose a “bail in” as a precondition to receiving

loans from the European Support Mechanism.

Practically, this amounted to imposing a loss to

deposit holders of the two biggest banks. The

Cypriot government took appropriate measures to

avoid massive withdrawal of remaining deposits, as

people lost faith to the banking system. Cyprus then

sunk into a severe recession from which it still

struggles to recover.

AFuzzyCognitiveMapSystemtoExploreCertainScenariosontheCyprusBankingSystem

109

5 DISCUSSION

The verification of the results of the pre-described

FCM system by later history enhances the belief in

the constructive role that the FCM model approach

can play in decision making for socio-political-

economic systems.

The whole system reflects how the experts

understood the core factors of the Cyprus economy

in April of 2012. The presented model does not

necessarily represent fully the Greek and Cypriot

economies or their interrelations, but it can be a

valuable forecasting tool in the hands of the experts.

In summary, FCM models can act like decision-

making indicators helping the handlers of the

modeled system to consider all relevant impacts

when taking a certain actions on their system. Thus,

the involvement of a larger number of experts as

well as the incorporation of the public opinion could

enhance this work’s reliability and objectivity.

Nevertheless, this work comprises another

positive sign that FCMs can be used as a tool for

helping humans to make wiser and more pragmatic

decisions. That is why future work, currently in

progress, is addressing the open issues concerning

FCMs such as the real time dependency of the

parameters, in an effort to increase their credibility

and fine-tuned operation.

ACKNOWLEDGMENTS

This research was partly supported by the University

of Cyprus, the Cyprus University of Technology,

and the Cyprus Research Promotion Foundation

structural funds (ΤΠΕ/ΟΡΙΖΟ/0308(ΒΕ)/03).

REFERENCES

Andreou, A., Mateou, N. & Zombanakis, G. 2005, Soft

computing for crisis management and political

decision making: the use of genetically evolved fuzzy

cognitive maps, In Soft Computing - A Fusion of

Foundations, Methodologies and Applications.

Carvalho, J. 2013, On the semantics and the use of fuzzy

cognitive maps and dynamic cognitive maps in social

sciences, In Fuzzy Sets and Systems.

Koulouriotis, D., Diakoulakis, I. & Emiris, D. 2001, A

fuzzy cognitive map-based stock market model:

synthesis, analysis and experimental results, In FUZZ-

IEEE '01, The 10th IEEE International Conference on

Fuzzy Systems.

Papageorgiou, E. 2011, Learning Algorithms for Fuzzy

Cognitive Maps---A Review Study, In SMCS, IEEE

Transactions on Systems, Man and Cybernetics Part

C: Applications and Reviews.

Papaioannou, M., Neocleous, C., Papageorgiou, C. &

Schizas, C. 2013, A fuzzy cognitive map model of the

repercussions of greek PSI on cypriot economy, In

CINTI'13, 14th IEEE International Symposium on

Computational Intelligence and Informatics.

Papaioannou, M., Neocleous, C. & Schizas, C. 2013, A

fuzzy cognitive map model for estimating the

repercussions of Greek PSI on Cypriot bank branches

in Greece, In AIAI2013, 9th International Conference

on Artificial Intelligence Applications and

Innovations.

Stach, W., Kurgan, L. & Pedrycz, W. 2010, Expert-Based

and Computational Methods for Developing Fuzzy

Cognitive Maps, Fuzzy Cognitive Maps: Advances in

Theory, Methodologies, Tools and Applications,

Springer. Chennai, 1

st

edition.

Stylios, C. & Groumpos, P. 2004, Modeling Complex

Systems Using Fuzzy Cognitive Maps, In SMCS,

IEEE Transactions on Systems, Man, and Cybernetics

Part A:Systems and Humans.

FCTA2014-InternationalConferenceonFuzzyComputationTheoryandApplications

110