A Multiagent Based Approach to Money Laundering Detection and

Prevention

Cl

´

audio Alexandre and Jo

˜

ao Balsa

LabMAg, Universidade de Lisboa, Lisboa, Portugal

Keywords:

Multiagent Systems, Intelligent Agents, Money Laundering.

Abstract:

The huge amount of bank operations that occur every day makes it extremely hard for financial institutions to

spot malicious money laundering related operations. Although some predefined heuristics are used they aren’t

restrictive enough, still leaving to much work for human analyzers. This motivates the need for intelligent

systems that can help financial institutions fight money laundering in a diversity of ways, such as: intelligent

filtering of bank operations, intelligent analysis of suspicious operations, learning of new detection and analy-

sis rules. In this paper, we present a multiagent based approach to deal with the problem of money laundering

by defining a multiagent system designed to help financial institutions in this task, helping them to deal with

two main problems: volume and rule improvement. We define the agent architecture, and characterize the

different types of agents, considering the distinct roles they play in the process.

1 INTRODUCTION

In the financial sector, one of the top priorities of any

government is the quest for the improvement of the

processes that try to prevent all illegal activities that

can lead to capital loss. One of these activities, money

laundering, has primordial importance since it is fre-

quently a transnational crime that occurs in close re-

lation to other crimes like illegal drug trading, terror-

ism, or arms trafficking.

Anti-money laundering (AML) regulations are

typically defined by a country’s monetary authority

(usually a central bank) and must be complied by all

financial institutions. Although corresponding to well

defined rules, due to the huge amount of information

that is available (namely, bank operations), and to the

fact that it takes too much time for financial institu-

tions to guaranty compliance with these AML regu-

lations, detect and report possible money laundering

activities, it is hard to track all suspicious transactions,

and to deal with them in due time.

Besides, not only the proportion of money laun-

dering related transactions is very small — about

0,05 % according to (US Congress – Office of Tech-

nology Assessment, 1995c) —, but also most occur-

rences of malicious behavior are a result of a set of

transactions that span over a long period of time (that

might be several months).

This motivates the need to develop tools that can

help institutions deal with these huge amount of infor-

mation, and filter what is relevant. These tools need

to incorporate not only the standard regulations pro-

duced by monetary authorities, but also the expertise

of human analyzers. On the other hand, it is cru-

cial to improve the decision process (and its subjacent

rules), taking into account the history that already ex-

ists on this matter, namely transactions and ultimate

decisions regarding their criminal nature.

In the following sections we will start by defin-

ing the problem in more detail (section 2), and re-

fer to some related work (section 3). Then we will

present our approach (section 4), and finally present

some conclusions and the plan for future work (sec-

tion 5).

2 PROBLEM DEFINITION

Turner (Turner, 2011) characterizes money launder-

ing as involving “the use of traditional business prac-

tices to move funds and the people that engages in

this activity are doing so to make money”. Tradi-

tional definitions characterize money laundering as a

set of commercial or financial operations that seek to

incorporate in a country’s economy, in a transient or

permanent way, illicitly obtained resources, goods or

values. These operations develop by means of a dy-

namic process that typically includes three indepen-

230

Alexandre C. and Balsa J..

A Multiagent Based Approach to Money Laundering Detection and Prevention.

DOI: 10.5220/0005281102300235

In Proceedings of the International Conference on Agents and Artificial Intelligence (ICAART-2015), pages 230-235

ISBN: 978-989-758-073-4

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

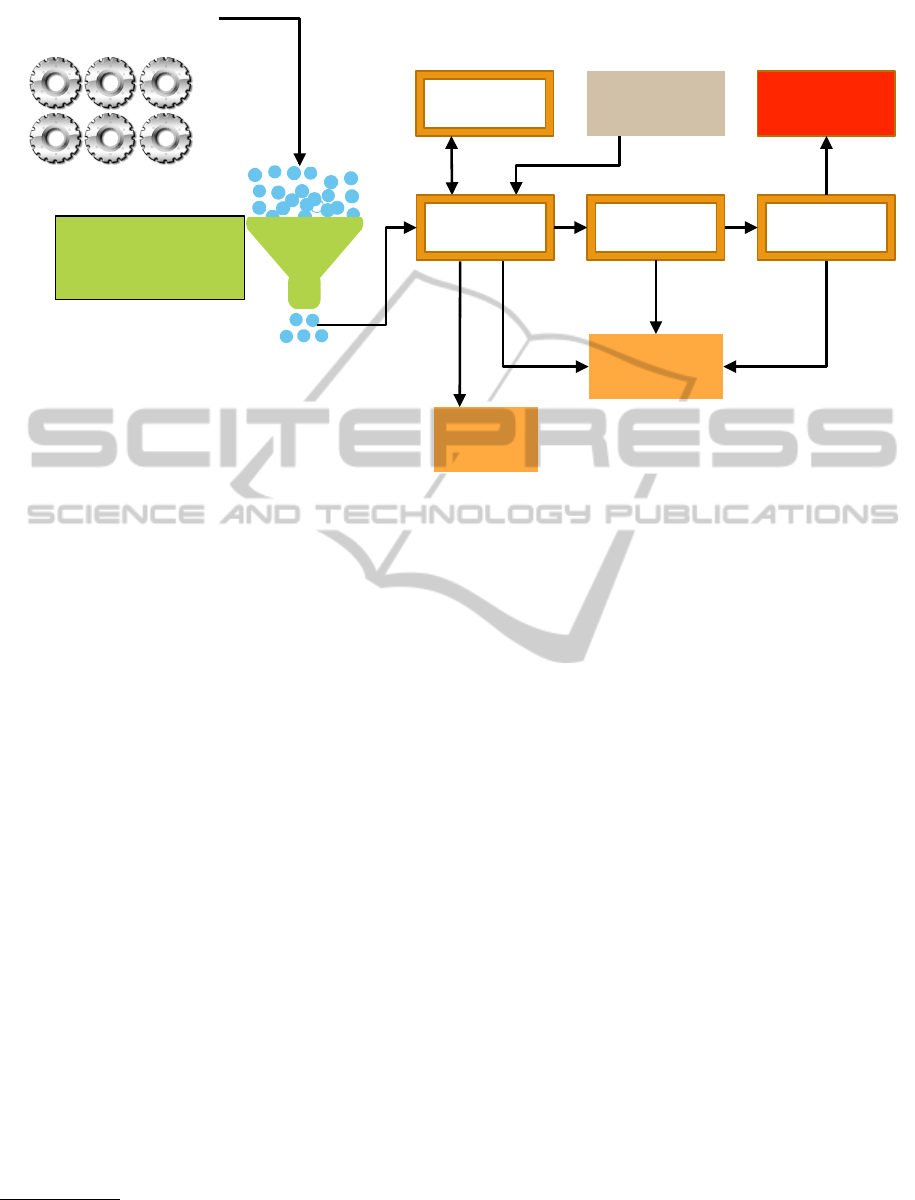

Suspicious

Transactions

Capturing System

Agency'

External

Signling

Authority'

Commi0ee'

Parameter

s

and

Rules

Analyst'

Analysed

Process

Directory'

Closed

Process

Business

Processes

Figure 1: The whole process.

dent stages — placement, occultation (or layering),

and integration — that might occur simultaneously.

Placement corresponds to the money introduction

in the financial system, usually made through discrete

bank deposits or small amount active purchases. Oc-

cultation corresponds to the carrying out of financial

operations with the goal of dissimulate the money

source. This is obtained through a diversity of trans-

fers between bank accounts that will ultimately be

concentrated in a single one. Finally, integration, is

the incorporation of the value in the economy, for in-

stance through goods acquisition.

So, the role of financial institutions is to find ways

of spotting, in the huge amount of operations that oc-

cur everyday, the ones that might be related to a sus-

picious operation and then investigate them.

As we can see in figure 1, where the whole process

is schematized, diverse financial business process pro-

duce huge amounts of transactions that are, in a first

step, filtered, using a set of parameters and rules

1

de-

fined in a capturing system. Some of these transac-

tions are then analyzed by a human analyst (the com-

pliance analyzer) that, considering additional external

signaling information and, if needed, additional infor-

mation from the bank agency, subsequently decides

whether to close the process, send it immediately to

a superior committee, or keep it marked for further

investigation. The process might ultimately be sent

1

These parameters and rules are typically based on a

mapping from the regulations imposed by the country’s

monetary authority, usually a central bank.

to the regulatory authority or might be closed. So,

the Analyst, the Committee, and the Directory repre-

sent three decision levels within a financial institution.

Any of them can recommend the process to be closed

or send it upwards.

Of course, the Central Authority receives informa-

tion from many institutions and must have a way to

process them and produce their own final decisions,

sometimes providing their own feedback to individual

institutions. But our focus here is in the process in-

side one institution, and on how to improve and make

more efficient the decision processes involved.

3 RELATED WORK

Regarding the analysis of bank transactions, accord-

ing to (US Congress – Office of Technology Assess-

ment, 1995c), there are four categories of technolo-

gies that are useful and that can be classified by the

task they are designed to accomplish: wire transfer

screening, knowledge acquisition, knowledge shar-

ing, and data transformation. These technologies

form the basis of the definition of a set of policy op-

tions that can be adopted in order to fight money laun-

dering (US Congress – Office of Technology Assess-

ment, 1995a). These options include, among others,

the definition on an automated informant, an AI based

system to monitor transfers, and a computer-assisted

examination of wire transfer records by bank regula-

tors.

AMultiagentBasedApproachtoMoneyLaunderingDetectionandPrevention

231

CST$

Product$A$

CST$

Product$B$

CST$

Product$C$

CST$

New$Product$

CCT$

Signalled$

Transac7ons$

Transac7on$

History$

Control$

Rules$

NRL$

New$rules$

proposals$

AST$

Decision$

making$

DNL$

Sugges7ons,$

Decision$

Matrix$

Group 1 Group 2

Published$

Norms$

Related$

Norms$

Data flow

Message flow

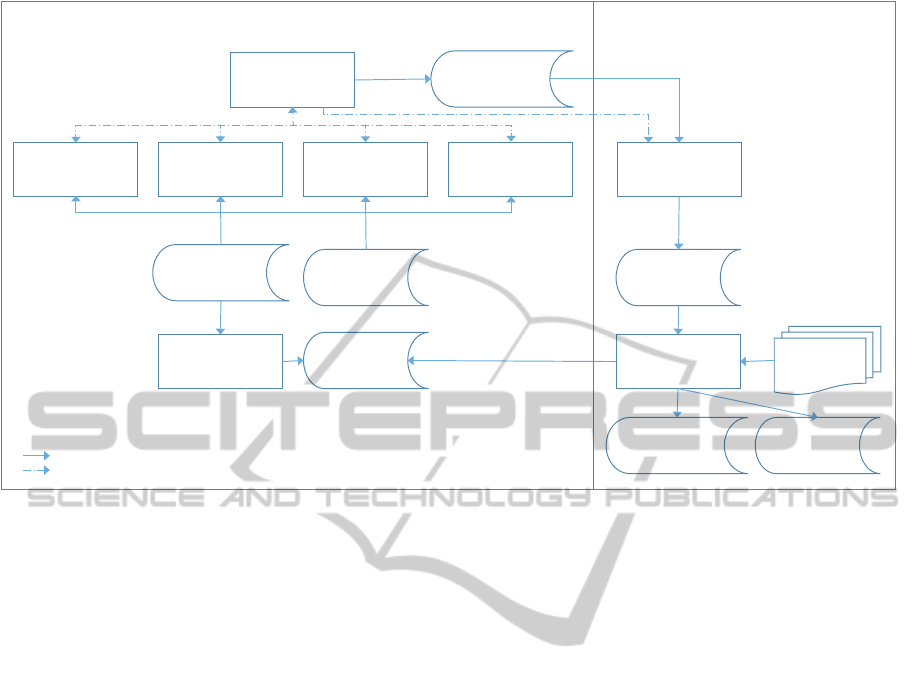

Figure 2: Agent Architecture.

Regarding the use of agent based approaches in AML,

there are very few authors that have considered them.

In (Gao et al., 2006), an agent architecture is defined

to include a set of specialized agents, such as data col-

lecting agents, monitoring agents, a behavior diagno-

sis agent, and a reporting agent. This last agent is re-

sponsible for issuing alerts regarding potential money

laundering operations.

Another approach (Gao and Xu, 2010) is sup-

ported in the definition of a Real-Time Exception

Management Decision Model that is used to inform

a multiagent based real-time decision support sys-

tem to detect money laundering operations. These

authors design their system defining three groups of

agents: the Intelligence group, with agents responsi-

ble for collecting data, profiling clients, and monitor-

ing transactions; the Design group, where the critical

analysis are made; and the choice group, responsible

for reporting and user interface.

Another agent-based approach is the one pre-

sented in (Xuan and Pengzhu, 2007). Besides the in-

clusion of reporting and user agents, much alike what

is done in the above mentioned works, these authors

include Negotiation and Diagnosing agents that ulti-

mately are responsible for the most critical decisions,

taken on the basis of information provided by two

other groups of agents: data collecting and supervis-

ing.

In (Kingdon, 2004), it is proposed that an artificial

intelligence approach should model individual clients

and look for unusual rather than suspicious behavior.

There are also statistical approaches, like the ones

described in (Liu and Zhang, 2010) and (Tang and

Yin, 2005), but we won’t go here into details regard-

ing this type of approaches.

4 AN AGENT-BASED APPROACH

The motivation for using an intelligent agent based

approach departs from the analysis of the problem

(figure 1), and from the observation that some of the

tasks that we want to automatize (at least partially)

match perfectly the principles behind multiagent sys-

tem definition (Wooldridge, 2009). We need a set of

entities (agents) with autonomy to perform specific

tasks and to engage in communication with others in

order to accomplish a certain set of goals. Each agent

has its own knowledge and must be able to reason

and decide in an intelligent manner. Besides, we aim

at flexibility and scalability which is obtained with

the architecture we propose. Agents also provide a

more natural way to model and program features like

communication, reasoning and decision making (De-

mazeau, 1995).

We consider two groups of agents, according to

their role in the process. The first corresponds mainly

to a group of agents responsible for the capture of sus-

picious transactions (CST), whilst the second corre-

sponds to the agents that perform the analysis of sus-

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

232

Table 1: Agent Characterization.

Agent Input Internal Processes Actions Properties

CST Set of transactions in a

time interval

Transaction-oriented

analysis. Signal trans-

actions. Client-oriented

analysis.

Communicate signaled

transactions. Communi-

cate suspicious clients.

Reliability

Precision

CCT Signaling message from

CST agent

Manage communication

with CST agents. Storage

signaled transactions.

Communicate suspicious

clients.

Agility

NRL Transaction history Data mining on existing

transactions.

Suggest new parameters

and rules.

Adaptability

AST Suspicious transactions Analyse signaled transac-

tions. Simulate compli-

ance officer. Decide sub-

sequent procedure.

Communicate decision.

Reliability

Autonomy

Precision

DNL Decision history. Pub-

lished norms and regula-

tions.

Learning based on com-

pliance officer decision

history. Infer new capture

parameters. Propose new

decision procedures. Rec-

ognize relevant norms.

Suggest new rules and pa-

rameters. Suggest novel

decision procedures.

Precision

picious transactions (AST) signaled by the agents of

the first group.

In figure 2 we present a schematic view of the

global agent architecture and system flow.

4.1 CST Agents

As previously mentioned (recall figure 1), data is orig-

inated in several business processes. We define an

agent for each product (current accounts, investment

funds, currency exchanges, . . . ). This approach has

two advantages. Firstly, this allows us to model each

agent’s knowledge according to the specificities each

product has. Secondly, it makes scalability easier, in

the sense that the creation of a new product can be in-

corporated in the system just by adding a new agent

specialized in it.

Besides these specialized agents, there is one that

is responsible for the communication of captured

transactions (CCT), as well as its storage for further

use.

Whenever a CST agent identifies a suspicious

transaction, it sends it to CCT that is responsible for

forwarding it to some other CST agents. So, CST

agents have two working modes:

transaction oriented In which agents try to capture

suspicious transactions with no assumptions re-

garding clients.

client oriented In which agents try to capture suspi-

cious transactions for clients that were signaled by

other CST agents.

Finally, this group has a third type of agents —

New Rule Learning (NRL) — that are responsible for

learning new capturing rules regarding each product.

4.2 AST Agents

These agents perform the analysis of the previously

signaled transactions. Agents of these group have au-

tonomy to decide amongst three possibilities regard-

ing a signalization: accept it, discard it, or send it for

further (human) analysis.

So, these agents assume the role of compliance of-

ficers in the analysis of suspicious transactions. They

have a learning component that contributes to the im-

provement of the control parameters and to the en-

largement of the set of situations that can be decided

automatically.

Also in this group, there is the decision and norms

learning agent (DNL). This agent is responsible for

the improvement of the decision matrix. Taking into

account all decisions made (namely, those produced

by human experts), it is responsible for finding possi-

ble refinements or new inclusions in the base parame-

ters. Additionally, in a different dimension, this agent

processes new regulations in order to find new norms

that need to be implemented.

AMultiagentBasedApproachtoMoneyLaunderingDetectionandPrevention

233

4.3 Agent Properties

In table 1 we summarize these agents’ main inputs,

their main internal processes, their actions, and some

desired properties. We characterize each type of

agents in terms of what are its inputs, its main inter-

nal processes, the actions they can perform, and some

agent related properties.

4.4 Agent Interaction

Cooperation among CST agents happens through

their direct interaction with the CCT agent, that coor-

dinates the tasks and receives the results. Interaction

amongst other agents (CCT, AST, DNL, NRL) has the

role to trigger in each of these agents the goal to per-

form the task under its responsibility. In other words,

all agents have their own specific expertise, and they

have independent and not conflicting goals. So, in

this model there isn’t the conflicting goals problem or

the need for negotiation among agents. On the other

hand, there is plenty of cooperation for the achieve-

ment of a common goal.

CST and AST agents learn and evolve to reduce

the false positive problem, common to systems based

only on a set of rules and patterns of behavior (Gao

et al., 2006; Le Khac and Kechadi, 2010).

5 CONCLUSIONS

The main goal of this contribution is to present a novel

approach to money laundering detection and preven-

tion. This is an ongoing research that has the ultimate

goal of contributing to AML process improvement in

a concrete organization.

It is consensual that the task is hard and far from

being solved, which establishes the relevance of this

work.

As mentioned in section 3, other authors have ex-

plored agent-based approaches to this problem. Nev-

ertheless, our work is distinguished from those, for

start, in the architecture we defined, namely on the

explicit integration of learning components, and in the

inclusion of product specific agents.

There are two main paths in this project. One re-

lates to the definition and implementation of the mul-

tiagent system that will be the basis of the new deci-

sion making process. The other relates to the learning

of new rules and parameters that will serve as valu-

able resources for the agents defined. This second part

relies heavily on real data concerning transactions in

financial institutions.

There is a lot of work still to be done in both paths.

We present the most relevant for now in the following

section.

5.1 Future Work

Regarding agent models, they still need to be refined.

Regarding CST agents, the first product to be included

is the “current accounts”, which is currently being

done. Then we will proceed to other products.

In another trend, we are also working on behav-

ior modeling (recall that suspicious behavior cannot

be found by looking at isolated operations). We are

building behavior patterns that consider large time

spans. This will allow the decision process of the

CCT agent.

Regarding NRL agents, apart from the identifica-

tion of product specific properties/rules, we’re trying

to find cross-product relations, that is, finding, for

each client, in what way are suspicious transactions

regarding a product related to transaction patterns in

the other products. The ultimate goal is to obtain new

parameters to be used by CTS agents.

REFERENCES

Demazeau, Y. (1995). From interactions to collective be-

haviour in agent-based systems. In Proceedings of

the 1st. European Conference on Cognitive Science.

Saint-Malo, pages 117–132.

Gao, S. and Xu, D. (2010). Real-time exception manage-

ment decision model (RTEMDM): Applications in in-

telligent agent-assisted decision support in logistics

and anti-money laundering domains. In System Sci-

ences (HICSS), 2010 43rd Hawaii International Con-

ference on, pages 1–10.

Gao, S., Xu, D., Wang, H., and Wang, Y. (2006). Intelligent

anti-money laundering system. In Service Operations

and Logistics, and Informatics, 2006. SOLI ’06. IEEE

International Conference on, pages 851–856.

Kingdon, J. (2004). AI fights money laundering. Intelligent

Systems, IEEE, 19(3):87–89.

Le Khac, N. A. and Kechadi, M.-T. (2010). Application

of data mining for anti-money laundering detection:

A case study. In Proceedings of the 2010 IEEE In-

ternational Conference on Data Mining Workshops,

ICDMW ’10, pages 577–584, Washington, DC, USA.

IEEE Computer Society.

Liu, X. and Zhang, P. (2010). A scan statistics based sus-

picious transactions detection model for anti-money

laundering (aml) in financial institutions. In Multime-

dia Communications (Mediacom), 2010 International

Conference on, pages 210–213.

Tang, J. and Yin, J. (2005). Developing an intelligent

data discriminating system of anti-money laundering

based on svm. In Machine Learning and Cybernetics,

ICAART2015-InternationalConferenceonAgentsandArtificialIntelligence

234

2005. Proceedings of 2005 International Conference

on, volume 6, pages 3453–3457 Vol. 6.

Turner, J. E. (2011). Money Laundering Prevention: Deter-

ring, Detecting, and Resolving Financial Fraud. Wi-

ley.

US Congress – Office of Technology Assessment (1995a).

Conclusions and policy options. In (US Congress –

Office of Technology Assessment, 1995b), chapter 7,

pages 119–144.

US Congress – Office of Technology Assessment (1995b).

Information Technologies for Control of Money Laun-

dering. US Government Printing Office.

US Congress – Office of Technology Assessment (1995c).

Technologies for detecting money laundering. In (US

Congress – Office of Technology Assessment, 1995b),

chapter 4, pages 51–74.

Wooldridge, M. (2009). An introduction to multiagent sys-

tems. John Wiley & Sons.

Xuan, L. and Pengzhu, Z. (2007). An agent based anti-

money laundering system architecture for financial su-

pervision. In Wireless Communications, Networking

and Mobile Computing, 2007. WiCom 2007. Interna-

tional Conference on, pages 5472–5475.

AMultiagentBasedApproachtoMoneyLaunderingDetectionandPrevention

235