Sharia Maqashid on the Fiscal Policy, the Urgency in the Modern Era

Any Setianingrum

Economics Faculty, YARSI University, Jakarta, Indonesia

anysetianingrum@yahoo.com, any.setianingrum@yarsi.ac.id

Keywords: District expenditures, district revenue, religions’ treasure, the level of benefits.

Abstract: The universality of shariah maqasid values is an instrument in designing economic policy according to current

human needs. Based on the results of Analytic Network Process (ANP), the ideal fiscal policy based on

maqashid shariah is the synergy of sources of income derived from existing APBD (regional income and

expenditure budgets) and religious property managed according to sharia. Sharia mechanisms requiring the

existence of special sources and allocations for the poor, the linkage of sources of income and allocation, the

separation of halal & haram sources, incentives on agricultural activities that contain technology and job

creation, and the implementation of priority-based spending based on the basic needs, infrastructure, MSMEs,

staff salaries and office buildings. The most recommended indicator of budget realization success is first gini

ratio, the second combined economic growth-gini ratio-volume of zakat. The next prospect of Islamic fiscal

will be able to improve equity distribution development, reduce expenditure irregularities, conflict of interest

and ultimately reduce dependence on taxes.

1 INTRODUCTION

The purpose of this research is to formulate the ideal

revenue and spending policy for modern governance

based on sharia maqashid. The purpose and target

above are due to the classic problem in almost all of

governments, including in Indonesia every year that

is the limited regional government budget and the

weaknesses in the system of spending priority in

dealing with many political conflict of interest.

Therefore tax incentives in social contributions by

individuals or households collected from various non-

profit organizations are an important source for the

basis of public finance (Bonke et al. (2011),

Carmichael (2012), Setianingrum, (2016)). The

pattern and philosophy of Islamic fiscal policy can be

empowered to minimize the limitations and

strengthen the benefits of conventional systems

(Afzalurrahman (1997), Chapra (2002, 1995, 1979),

Faridi (1995), Hafidhudhin (2002), Mannan (2000),

Metwally (1981&2008), Ra’ana (1997), Rahman

(1992), Sabzwari (1985), Yusoff (2006),

Setianingrum (2016)).

The maqashid shariah instrument can be used to

explore the pattern and philosophy. The universality

of sharia maqashid values is the instrument in

designing the economic policy to meet the needs of

modern people. Maqashid shariah will provide a

rational and substantial pattern of thought in

formulating economic policies and Islamic financial

products. Fiqh thinking alone will lead to a

formalistic and textual pattern of thought. It isshariah

only with the maqashid shariah approach that macro

and micro shariah policies can develop well and can

respond to the rapidly changing economic and

business progress (Auda (2011), Setianingrum,

2016)).

How to apply the pattern and philosophy of

Islamic fiscal policy required in the modern era?

Indeed, the financial policy of the local government

of Bekasi City cannot be compared to the Islamic

governance for apple-to-apple. However, the pattern

and philosophy of Islamic policy can be empowered

to strengthen the existing policy by synergizing both

systems and making it suited to the existing

regulation (Setianingrum, 2016). In Indonesia, the

step forward synergy has been marked by the law

number 38 of 1999 and number 17 of 2000. The law

states that zakah on income paid to official

institutions may be used as a deduction of taxable

income. The synergy of both must run in harmonious

and non-conflicting rules. The goals to be achieved

are determining the priority income instrument and

the scale of priorities of government spending in the

Setianingrum, A.

Sharia Maqashid on the Fiscal Policy, the Urgency in the Modern Era.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 5-9

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

maqashid sharia perspective in the modern era. The

management of criteria and sub criteria for

determining the priority of the revenue instrument

and the scale of the expenditure priorities, using the

analytical network process method.

2 RESEARCH METHOD

2.1 Analytic Network Process (ANP)

The stages in the ANP method are as follows ((Saaty

& Sodenkamp (2008), Yuksel & Dagdeviren (2007),

Gencer & Gurpinar (2006), Saaty et al. (2006),

Taslicali & Ercan (2006), Cheng & Li (2004)):

1) Interview Phase I: Conducting interviews to in-

depth informants on issues that are examined to

experts and practitioners who understand and

master the problem of government finances

comprehensively.

2) Decomposition: Decomposition to identify,

analyze, and structure the complexity of the

problem into the ANP network (details can be

seen in the ANP model constructs described

later).

3) Prepare the Questionnaire: Prepare a pair-wise

comparison based on ANP networks that have

been created.

4) Advanced Interview & Questionnaire Filling:

Conduct second interview in the form of

charging questionnaire to experts and

practitioners.

5) Informant ANP: Informants who fill the

questionnaire on the ANP method are: elements

of the Indonesian Ulema Council, as well as

academics, as many as 2 informants, the element

of National Amil Zakat as much as 1 informant,

the leadership element of Bekasi City

Government as much as 2 informants, local

legislative council, city of Bekasi as many as 3

people, academic elements as much as 1

informant.

3 RESULTS AND DISCUSSION

The results show the consensus from the experts and

practitioners on how to strengthen the system of

Regional Government Budget management ideally

(which should) based on sharia maqashid as follows:

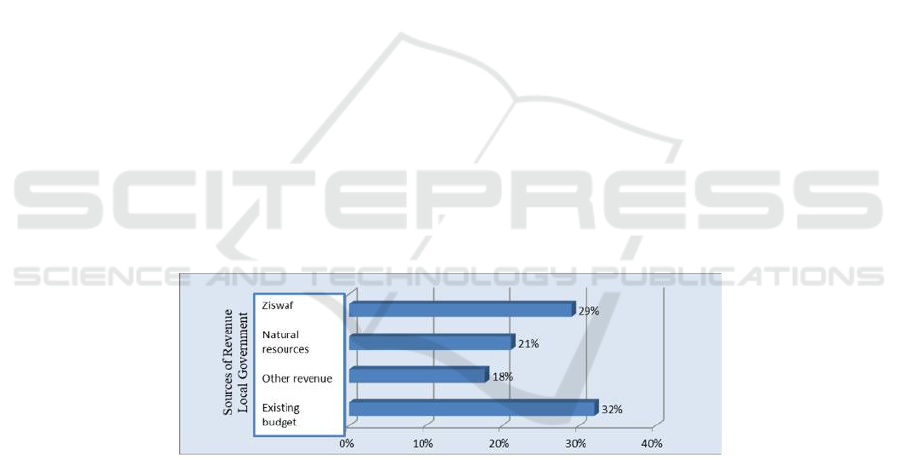

In Figure 3.1, the results of priority in the

intensification and extensification clusters of the

sources of revenue of local government show that, the

existing Regional Government Budget still becomes

the most influencing source for 32%, followed by

ZISWAF revenue (29%).

Figure 1: The Results of Synthesis in the Revenu in Strengthening the System of the Sharia Maqashid Based Regional

Government Budget Management.

The same part, the cluster of existing revenue

sources, the priorities in strengthening the system of

the sharia maqashid based regional government

budget are as follows: tax, retribution, duties (bea

perolahan) for 30%; followed by the central tax and

non-tax profit sharing (28%); Local companies,

Regional Owned Enterprises, Natural Resources

management (23%), profit sharing from Islamic bank

(11%), Conventional bank interest rate in the last

position (8%). For more results, it can be seen in

Figure 2.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

6

Figure 2: The Results of Synthesis of the Revenue in the Source of Revenue Aspect of Existing Regional Government Budget.

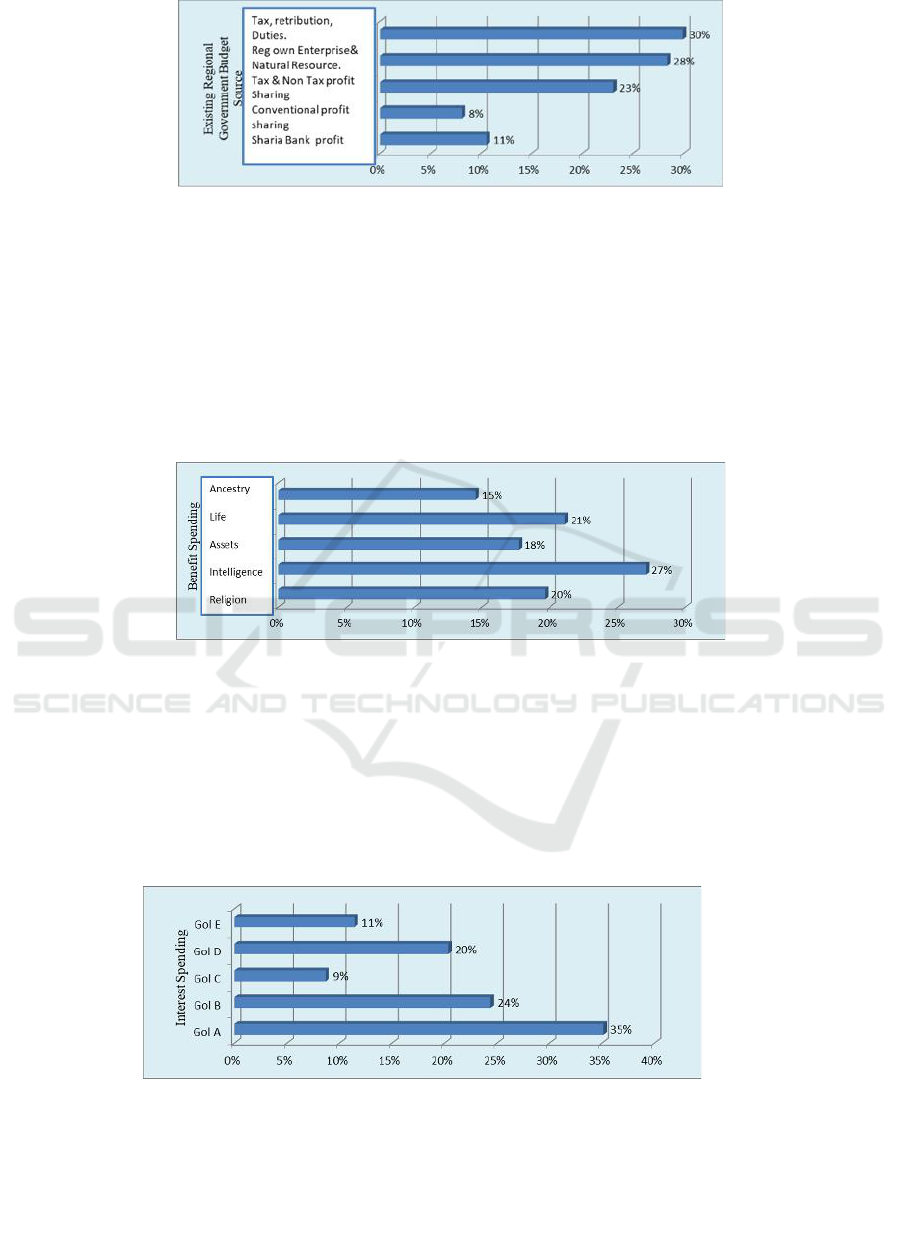

Based on the results of synthesis in this research,

the priority scales of the spending of local

government based on the ideal benefit, as seen in

Figure 3.6, are as follows: Intelligence spending

(belanja akal) (science and technology) 27%,

Followed by life spending (belanja jiwa) (Healthcare)

21%, Religion spending (belanja agama) (da’wah,

religion education) 20%, Assets spending (belanja

harta) (economic development) 18%, Ancestry

spending (belanja keturunan) (youth generation and

sustainable development). The results of consensus

from the ANP experts are different from the opinion

of Ash-Shatibi, who states that the order of benefit

priority, consecutively, is religion, life, intelligence,

ancestry, and assets.

Figure 3: The Results of Synthesis in Spending Based on the Level of Benefit

Meanwhile, in the aspect of priority scale, the

spending of local government based on the ideal

interest, as seen in Figure 3.7, are: Type A spending

(35%): General & Religion Education, Healthcare,

Poverty Reduction, Basic Needs Fulfillment. Type B

(24%): Public Infrastructures and Facilities. Type D

(20%): Economic Development, SME, Job

opportunity, Food Security, Living Environment,

Energy, Technology. Type E (11%): Employee

spending, Interest, Hibah (Grants), Social and

Financial Assistances. Type C (9%): Construction of

office building and infrastructures of the bureaucracy.

Figure 4: The Results of Synthesis in the Spending in Strengthening the System of Regional Government Budget Management

based on Sharia Maqashid.

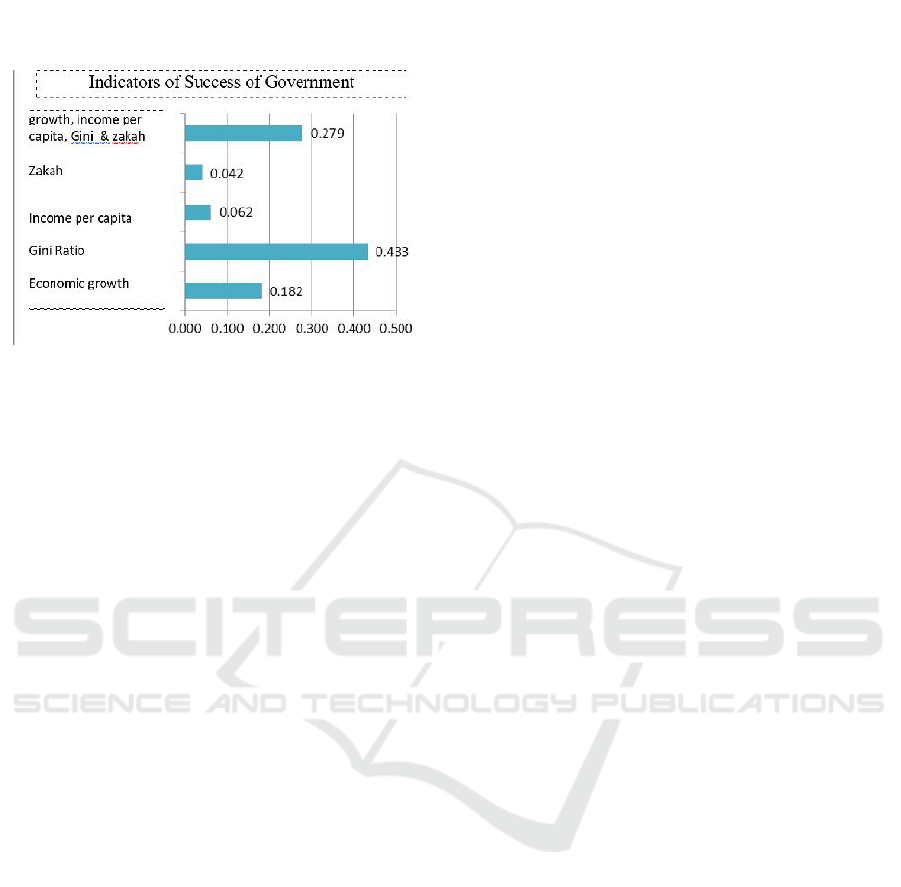

While the indicator of success of local

government (see Figure 3.8), the type of indicator that

is considered most appropriate according to the

experts is gini ratio (43.3%), then mixed indicators

consisting of economic growth, per capita income,

gini ratio and volume of zakat (27.9%). Other

Sharia Maqashid on the Fiscal Policy, the Urgency in the Modern Era

7

indicators are regional economic growth (18.2%), per

capita income (6.2%) and volume of zakat (4.2%).

Figure 5: Indicators of Success of Government.

4 CONCLUSION

In general, the sharia maqashid based on ideal

formulation of revenue and spending policy are as

follows: The instruments of revenue consist of

existing Regional Government Budget, Natural

Resources, and religion's treasures. Require a linkage

between the revenue and allocation in order to reduce

the deviation or misallocation and to improve the use

of Regional Government Budget. The benefit-based

spending priority is protection against religion, life,

intelligent, ancestry, and assets. The implementation

of sharia maqashid based spending priority is as

follow:1) General & Religion Education, Healthcare,

Poverty Reduction, Basic Needs Fulfillment; 2)

Public Infrastructures & Facilities; 3) Economic

Development, SME, Job opportunity, Living

Environment, Energy, Technology; 4) Employee

Spending, Interest, Grants, Social and Financial

Assistances; 5) The construction of the office

building and infrastructures of the bureaucracy

Indicators of successful development are: Gini

ratio as main incator, supporting indicators are

economic growth, income per capita, zakah volume.

A need to separate the halal and non-halal sources on

revenue and allocation.

Implementation of shari'ah maqashid values in

fiscal policy will have additional funding prospects

for development, increased community participation

through infaq, shadaqah, waqf (public fund

participation), and create more substantive spending

priority standards based on the benefit levels of

daruriyat, hajiyat and tahsiniyat. The prospect of

subsequent effects will be able to improve equity

distribution development, increased government

investment, MSME sector and employment, reduce

expenditure deviations, reduce dependence on taxes,

and controlling the tax rate so as not to disrupt the

business world.

REFERENCES

Afzalurrahman, 1997. Muhammad: Encyclopedia of

Seerah, volume II, London, The Muslim School Trust,

1982. Edisi Indonesia Muhammad sebagai Seorang

Pedagang. Yayasan Swarna Bhumi, Jakarta.

Auda, J., (2011). A Maqaside Approach To Contemporary

Application of The Share’ah. Intellectual

Discourse:Kuala Lumpur, Vol.19, Iss 2, 2011:193-217.

Bonke, T., Massarrat, N., Sielaff, M.C., 2011. Charitable

Giving in The German Welfare State:Fiscal Incentives

and Crowding Out. Journal Springer Science &

Business Media, LLC

Carmichael, C.M., 2012. Dispensing Charity:The

Deficiencies of An or Nothing Fiscal Concept.

Voluntas, Volume 23, Issue 2, Pages 392-414. Springer

Science & Business Media, Baltimore, Netherlands.

Chapra, M.U., 1979. The Islamic Welfare State and its Role

in The Economy. Leicester, UK: The Islamic

Foundation.

Chapra, M.U., 1995. Reading in Public Finance in Islam:

Goverment Borrowing Needs. IRTI, IDB, Jeddah,

Saudi Arabia

Chapra, M.U., 2002. The Future of Economics, An Islamic

Perspective, SEBI, Jakarta

Cheng, E.W.L, Li, H., (2004). Construction Selection

Using The Analytic Network Process. Construction

Management and Economics (December 2004) ISSN

0144-6193 print/ISSN 1466-433Xonline @2004,

Taylor & Francis Ltd. http://www.tandf.co.uk/journals

DOI:10.1080/0144619042000202852 . Department of

Building and Real Estate, The Hong Kong Polytechnic

University, Hunghom, Kowloon, Hong Kong

Faridi, F.R., 1995. Readings In Public Finance In Islam:

Theory of Fiscal Policy in an Islamic State. Islamic

Research And Training Institute, Islamic Development

Bank, , Jeddah, Kingdom of Saudi Arabia

Gencer, C., Gurpinar, D., 2006. Analytic NetworkProcess

in Suplier Selection: A Case Study in an Electronic

Firm. Applied Mathematical Modelling 31 (2007)

2475-2486. Gazi University, Faculty of Engineering

and Architecture, Department of Industrial

Engineering, 06570 Maltepe/Ankara, Turkey.

Hafidhuddin, D. (2002). Zakat dalam Perekonomian

Modern. Jakarta: Gema Insani Press

Mannan M.A. 2000. Effects of Zakah Assessment and

Collection on the Redistribution of Income in

Contemporary Muslim Countries, in Imtiazi et al (ed),

Management of Zakah in Modern Muslim Society.

Jeddah: IRTI-IDB.

Metwally, 1981. Macroeconomic Models of Islamic

Doctrines. JK Publisher

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

8

Metwally, 2008. Fiscal Policy in a Islamic Economy. Fiscal

Policy and Resourches Allocation in Islam, Edited by

Ahmed, Z., Iqbal, M., Khan, M. IRTI and Institute of

Policy Studies, Islamabad

Ra'ana, Irfan Mahmud, 1997. Ekonomi Pemerintahan

Umar ibn Al – Khattab, Pustaka firdaus, Cet ke-3,

Jakarta

Rahman A, 1992. Doktrin Ekonomi Islam Jilid 1. PT Dana

Bakti Wakaf, Yogyakarta.

Saaty, T.L and Sodenkamp, M, 2008. Making Decision In

Hierarchic And Network System. Journal of Applied

Decision Sciences, vol. 1, no. 1, pp. 24–79, 2008.

Saaty, Thomas L and Vargas, Louis G. 2006, Decision

Making with the Analitic Network Process. Economic,

Political, Social and Technological Applications with

Benefits, Opportunities, Costs and Risks. Springer.

RWS Publication, Pittsburgh.

Sabzwari, 1985. Economic and fiscal System During

Khilafat E-Rashida, dalam jurnal of Islamic Banking

and Finance, Karachi, Vol.2, No.4,1985.

Setianingrum, A., 2016. Dissertation: Strengthening of

Local Government Revenue and Spending Management

System based on Sharia Maqashid at Bekasi City, Post-

Graduate Program, Airlangga University, Surabaya,

Indonesia.

Taslicali, A.K., Ercan, S., 2006. The Analytic Hierarchy &

The Analytic Network Processes in Multicriteria

Decision Making: A Comparative Study. Turkish Air

Force Academy Aeronautics and Space Technologies

Institute Yesilyurt, Istanbul. Journal of Aeronautics

and Space Technologies, July 2006 Volume 2 Number

4 (55-65).

Yuksel, I and Dagdeviren, M, 2007. Using The Analytic

Network Process (ANP) In A SWOT Analysis: A Case

Study For A Textile Firm. Information Sciences, vol.

177, no. 16, pp. 3364–3382, 2007

Yusoff, M.B, 2006. Fiscal Policy in An Islamic Economy.

IIUM Journal of Economics and Management,Vol:

14/Issue: 2, 2006.

Sharia Maqashid on the Fiscal Policy, the Urgency in the Modern Era

9