Institutionalization of Sharia Financial Norms in Indonesia

Muhammad Hasanuddin and Sofian Al-Hakim

Program Studi Ekonomi Syariah, UIN Sunan Gunung Djati Bandung, Jl. A.H.Nasution No.105, Bandung, Indonesia

sofyanalhakim@uinsgd.ac.id, hasanuddinmuhammad1@gmail.com

Keywords: Sharia finance, norm, islamic law.

Abstract: A norm can be institutionalized, if it is known, understood, obeyed, and respected. This happens with the

institutionalization of Islamic finance in Indonesia. The norms of Islamic financial institutions in Indonesia

were originally sourced from Al-Qur’an and al-Hadith are then understood, adhered to, valued and

institutionalized into shariah financial institutions. Institutionalization of norms into Islamic financial

institutions in Indonesia is not only determined by the awareness of the community in complying the norm,

but the extent to which awareness to comply with norms can be consolidated into cultural strength that can

affect the structural strength. This is where the institutionalization of Islamic finance is formed.

1 INTRODUCTION

A new era of Islamic finance in Indonesia originated

from the establishment of Bank Muamalat Indonesia

(BMI) on November 1, 1991, operating in 1992.

Externally, the establishment of BMI is inseparable

from OIC encouragement through IDB supporting the

establishment of Islamic Bank in Muslim majority

countries. Internally, BMI was founded on the

contribution of civil society gathered in Indonesian

Ulama Council (MUI) and Ikatan Cendikiawan

Muslim Indonesia (ICMI) which encouraged the

government to establish sharia bank in Indonesia.

In the other hand, the initiative of sharia banking

establishment in Malaysia and some other countries

was not initiated from the lower society (bottom-up).

The establishment of sharia banking in Malaysia

was the result of a government push (top down) which

is then accepted by the people. While in Indonesia,

the establishment of sharia banking was the result of

the initiatives of the moslem people as layman. This

argument is revealed from Atang Abd Hakim's

research which says that MUI and ICMI are important

elements that determine the establishment of sharia

banking in Indonesia. Both are civil society

representations, not representations of government

(Atang Abd Hakim, 2010).

The presence of BMI initiated by the MUI and

driven by ICMI turned out to provide a new pattern in

the national financial system, from which previously

only conventional finance alone became colored with

the existence of Islamic finance. In addition, the

presence of BMI has stimulated the development of

other Islamic financial institutions, namely: sharia

banking, sharia insurance, shariah financing, shariah

venture capital, sharia guarantee, sharia pawnshops,

sharia pensions, sharia mutual funds, and sharia

bonds.

2 THE NORMS OF SHARIA

FINANCE

Before becoming an institution, Islamic finance was

shaped as norm (Mahmud Muhammad Balily, 1990).

Norms are generally contained in the Qur'an and al-

Hadith. However, these norms are not described in

detail in the Qur'an and al-Hadith. Although it was not

explained in detail, the Qur'an and al-Hadith have

given guidance on the value and norms about the

provisions that may and should not be done in Islamic

financial activities.

Riba is an Arabic word, derived from the verb

raba that literally means ‘to grow’ or ‘expand’ or

‘increase’ or ‘inflate’ or ‘excess’(Al-Raghib Al-

Isfahani, 186-187). The same literary meaning has

occurred in many places of al-Qur’an as well. It is,

however, not every growth or increase, which falls in

the category of riba prohibited in Islam. It is generally

translated into English as “usury” or “interest”, but in

fact it has a much broader sense in the Shari`ah. Riba

in the Shari`ah, technically refers to the ‘premium’

that must be paid by the borrower to the lender along

106

Hasanuddin, M. and Al-Hakim, S.

Institutionalization of Sharia Financial Norms in Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 106-111

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

with the principal amount as a condition for the loan

or for an extension in its maturity. (M. Umar Chapra,

56-57) In fiqh terminology, riba means an increase in

one of two homogeneous equivalents being

exchanged without this increase being accompanied

by a return. The term riba is, however, used in the

Shari`ah in two senses. The first is riba al-nasi’ah

and the second is riba al-fadl. Some Muslim scholars

attempt to define riba which seems to be closer to the

sense implied in the verses of the Qur’an and ahadith

related to it. They define riba as an increase or excess

which, in an exchange or sale of a commodity,

accrues to the owner (lender) without giving in return

any equivalent counter-value or recompense to the

other party (Zia-ul Haque, 16).

Prohibition of gharar in sharia financial business

institutions, more visible in Takaful insurance. So far,

it is alleged that in conventional insurance contains

elements of gharar. The gharar element in

conventional insurance lies in the uncertainty about

the source of funds used to cover claims. Funds

received by participants as payment of claims are

unclear. Because of this lack of clarity, conventional

insurance is exposed to gharar elements.

The word gharar is sometimes interpreted as

‘uncertainty’ rather than deception. With regard to

gharar, Islamic Law is clear that it should not be

present in contractual agreement. One cannot for

example sell what one does not own, because this is

regarded as a form of deception. Similarly, one

cannot sell an item of uncertain quality, an unborn

calf for example, since the buyer and the seller do not

know exactly what it is that they are trading. As far as

maisir is concerned, it is regarded in Islam as one

form of injustice in the appropriation of others’

wealth and therefore has much in common with the

concept of riba.

The act of gambling, sometimes referred to

betting on the occurrence of a future event, is

prohibited and no reward accrues for the employment

of spending of wealth that an individual may gain

through means of gambling. Under this prohibition,

any contract created, should be free from uncertainty,

risk and speculation. Contracting parties should have

perfect knowledge of the counter values intended to

be exchanged as a result of their transactions. Also,

parties cannot predetermine a guaranteed profit. This

is based on the principle of ‘uncertain gains’, which,

on a strict interpretation, does not even allow an

undertaking from the customer to repay the borrowed

principal plus an amount to take into account

inflation. The rationale behind the prohibition is the

wish to protect the weak from exploitation. Therefore,

options and futures are considered as not Islamic and

so are forward foreign exchange transactions because

rates are determined by interest differentials (Abu

Umar Faruq, 18-20).

The next norm, the prohibition against waste on

the use of property. This prohibition is based on the

idea that waste of property will have a negative

impact on the economic life of the community. The

consequences of waste will lead to inefficiency of

economic resources. At the same time, Islam also

prohibits the accumulation of property (ikhtikar).

Treasure hoarding occurs due to the monopoly of

wealth by a group of people. The consequences of

monopoly impact price volatility in the market.

Conditions such as this will surely burden the public.

According to Afzalur Rahman Prophet

Muhammad before being appointed as Prophet,

known as al-amin (a beloved man), his reputation as

an al-amin encourages Siti Khadijah to invest her

funds to be managed by Prophet Muhammad. Siti

Khadijah's position as an investor (shahibul maal)

and Prophet Muhammad as the entrepreneur

(mudharib). This then initiated the creation of

mudaraba institution, which is a principle of

cooperation in business that appreciates the principle

of profit sharing (Afzalur Rahman, 1997).

3 SHARIA FINANCIAL

INSTITUTIONALIZATION

According to Juhaya S. Pradja, social institutions are

shaped by the growing norms of norms that are rooted

in society. The norms found in people's lives have

different bonding power. There is a weak norm of

binding force. There is also norm with a strong

binding form. The bound ability of this norm will

depend on the level of public understanding of the

norm. If people's understanding of the norm is high,

then the binding power becomes stronger, in contrast,

if the society's understanding of the norm is weak,

then its binding strength becomes weak.

From this thought, Juhaya divided the norm into

four parts. First, norms are defined as a means

(usage), i.e. irregularities on the way will not get

severe punishment, but only reproach; second, norms

are defined as folkways, which are repetitive acts

that’s becoming into habits. Habits have binding

strength compared to ways. If not done, it is

considered to deviate from the common practice and

society; third, the norm is defined as a behaviour, a

habit that is considered not only as a behaviour only,

but accepted as regulatory norms; Fourth, norms are

defined as customs, which is a behaviour that

integrates with the patterns of community behaviour

Institutionalization of Sharia Financial Norms in Indonesia

107

and has more binding power. If violated, one will get

hard sanction from the community (Juhaya, 2014)

In line with the above phrase, according to

Sukanto (1987) that the prerequisite of institutions

become social institutions if they have rules or norms

that live and thrive in society. Therefore, according to

Philip Gillin that the norm can become an institution,

it must be known, understood, obeyed, and respected.

In this context, the establishment of Islamic

financial institutions does not grow in a vacuum. It

grows through an evolutionary process stages.

Sociologically, sharia finance institutions, initially

the sharia-economic norms of the new business

understood only on the surface alone, so that the

attachment of norms in the community is relatively

weak.

Norms about prohibition in economic practice

containing elements of maysir (gambling), gharar

(uncertainty), dharar (harm), ikhtikar (monopoly),

iktinaz (hoarding), and riba (usury). The prohibited

norms are abbreviated as "maghadir." These norms

are, in fact, already known in the community, but

because the level of public understanding of the norm

is still weak, the violation of the norm is not

accompanied by severe sanctions. Thus, the

economic activities of Muslims that are contrary to

the economic norms of sharia-business are seen as

commonplace. As in the practice money lender that

occur in society. The practice is contrary to Islamic

norms, but this is considered normal, due to the

public's lack of understanding of the norms of sharia-

business economics.

However, after the islamic proselytizing (da'wah)

and education (tarbiyah) of Islam increasingly

developed by Muslims, the level of public

understanding of the economic norms-sharia business

is getting better. Growing public awareness of

economic norms-sharia business, it will increase the

knowledge Of the consequences from disobeying the

norm. In these conditions, the norms of sharia-

economic business become the norms that bind the

behaviour of Muslims. The economic activity of loan

sharks can be minimized as much as possible. Even

in Islamic societies, economic activity is seen as

something that is blameworthy. In this case, the norm

of prohibiting usury has been embedded among

Muslims, so that the perpetrators get a stronger social

sanction compared with the first stage in the process

of establishing norms into an institution.

The above incidents became a driving force

among Muslims to realize the Islamic teachings about

economic norms-business in accordance with the

principles of sharia. In 1968 the Majelis Tarjih

Muhammadiyah conducted an in-depth study of

usury and bank interest. The study concluded that

bank interest given by state banks to its customers

include syubhat (Pusat Pimpinan Muhammadiyah,

2011).

In 1985 Assembly Assessment (study forum)

under the Majelis Ulama Tk. I Sumatera Utara and

Baitul Makmur Foundation Medan held a study of

banks and non-bank financial institutions. The study

concludes that: 1) banking and non-banking

institutions are one sub-system and economic system

that is difficult to avoid, 2) usury which is adh'afan

mudha'afan (multiply) the law is haram (prohibition),

3) bank interest is the problem That sparks different

opinion from scholars (Ibrahim Lubis, 1995).

In 1990 the discourse of sharia economy grew

stronger with the focus of the establishment of

Islamic banks organized by the Indonesian Ulama

Council (MUI) on 19-22 August 1990. The workshop

still has not resulted in a unified agreement on bank

interest. However, the passion for building an

alternative banking system became a unanimously

agreed decision. At the 5th National Assembly

(MUNAS) of the 5th Indonesian Ulama Council

(MUI), the results of the workshop were discussed in

depth. At the end of the MUNAS, MUI recommended

to establish a Sharia Bank in Indonesia. The

recommendations then received a positive response

from the Association of Indonesian Muslim

Intellectuals (ICMI). MUI and ICMI formed a joint

team to establish a sharia bank. On first of November

1991, Bank Muamalat Indonesia (BMI), the first bank

based on sharia, has established.

The establishment of BMI is seen as a new round

of institutionalization process of sharia-economic

business in Indonesia From this, the sharia economic

institutions started to emerge, both in the financial

sector of sharia and non-sharia financial sector. In the

sharia financial sector, emerging sharia banking,

sharia insurance, sharia pawnshops, syariah venture

capital, sharia guarantee, and sharia pension. While in

the non-syariah financial sector appears, syariah

tourism, sharia hotels, sharia restaurants, sharia

fashion, and sharia-based business companies.

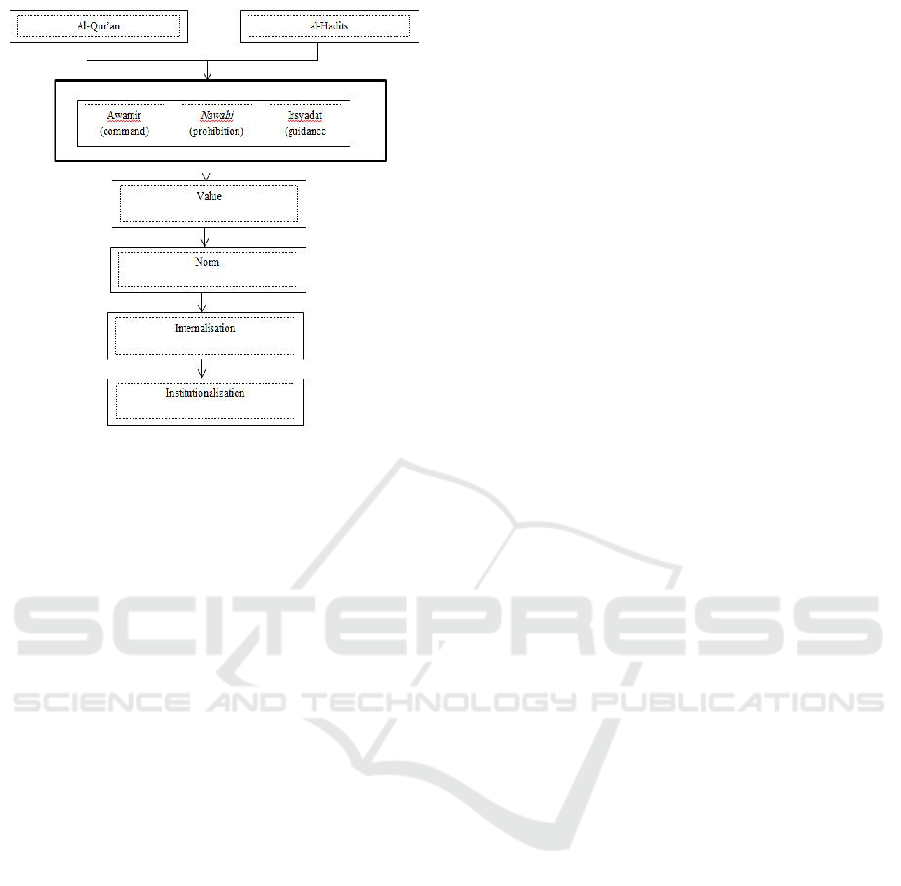

From the above explanation, it can be seen that

the process of institutionalization of Islamic business-

economy in Indonesia begins with the public

awareness of economic norms-sharia business.

Sociologically, these norms are then absorbed and

internalized in the economic activities of society. So

that the weak norms become stronger and have a

stronger binding power. The process of establishing

norms into economic institutions-sharia business can

be seen in the Figure below

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

108

Figure 1: The Process of Establishing Norms into Sharia

Financial Institutions.

According to some scholars, such as Anas bin

Malik (d.795), al-Shafi'i (d.820), al-Tabari (d.926),

ibn Qutaibah (d.892), Ibn Abd al-Bar (d. 1076), Ibn

Arabi (d.1159), the religious rule composed of

Awamir (commands) is the commandment of Allah

whose perpetrators will reward the Hereafter. Nawahi

(prohibitions) is a prohibition of God who will be

sinners in the afterlife. Meanwhile, irsyadat

(guidelines) are good instructions of God in the form

of orders or restrictions that imply on the benefit in

the world. (Kholah Mohammad Omar Bazmool,

1435/2014).The human understanding of those values

is manifested in the norms internalized by a number

of experts in consciousness to implement the whole

teaching comprehensively. The form of awareness of

the implementation of Islamic teachings leads to the

institutionalization of norms. The framework above

could describe how sharia financial institution in

Indonesia born.

4 FACTORS AFFECTING THE

ESTABLISHMENT OF SHARIA

FINANCIAL INSTITUTIONS IN

INDONESIA

The process of establishing an economic institution-

sharia business is influenced by various factors, the

most dominant factors are: 1) theological factors, 2)

sociological factors, 3) cultural factors, 4) economic

factors, and 5) political factors of economic law.

4.1 Theological Factor

The theological factor here is a factor influencing the

formation of the religious consciousness of Muslims

in doing business who wishes to implement economic

practices in accordance with the principles of sharia.

This factor appears to be motivated by the notion

that conventional financial business institutions are

seen to be in conflict with the provisions of sharia. In

practice the institution contains elements of maysir

(gambling), gharar (uncertainty), dharar (harm),

ikhtikar (monopoly), iktinaz (hoarding), and riba

(usury) or abbreviated as maghadir. On that basis,

Muslims are eager to have an economic institution-

sharia business that can shelter their activities in

doing business .

4.2 Sociological Factors

Sociologically, the emergence of sharia-economic

economic institutions is based on the idea that the

majority of Indonesians are Muslim. Therefore, it is

considered reasonable if there is a desire of Muslims

who in economic activities run in accordance with the

principles of sharia.

However, it is not denied that there is an

ambivalent attitude in the society. On the one hand,

he believes that the interest is haram, but on the other

hand he still interacts with the conventional bank,

dealing with this condition also affects the MUI fatwa

which states that bank interest is forbidden because

usury (MUI Fatwa No. 1, 2014), but on the other hand

MUI also allows doing business with conventional

banks for people to whom the sharia bank do not

available at their area.

4.3 Cultural Factors

Culturally, it is found that in the economic transition

that occurs in the society who apply maro system

(revenue/profit share), mertelu (revenue share of one

third two-thirds), and nengahkeun (a half-profit

share). The system highlights the principles of profit

sharing as practiced in sharia banks. The long-term

revenue-sharing pattern in the community, actually

leads to the creation of justice and the balance of

economic players with their environment. Not only

that, the profit-sharing pattern also keeps the spirit of

partnership between business actors, rather than just

the relationship between employer and subordinate.

The spirit of partnership is what will lead business

actors, not just business relationships that are profit

oriented, but in essence is a humanitarian

Institutionalization of Sharia Financial Norms in Indonesia

109

cooperation; each other will care for each other and

help each other.

The existences of cultural relation of economic

activity of society with sharia economy encourage the

emergence of Islamic economic-business institution.

This is in line with Max Weber's saying that to

understand the real community how we understand

social action between social relationships, where

"meaningful action" is interpreted to arrive at a causal

explanation (George Ritzer, 1975). Thus, in fact that

culture can be created, culture does not form

naturally. Cultures are built on the basis of a

consensus of values that develop in common and are

driven by universal consciousness. (Hans-Dieter

Evers, 2003).

However, the thing that is often forgotten in the

development of business institutions is a lack of

understanding of the culture of the community in

which the business institutions are located, not least

the Islamic bank which is part of the business entity

itself. Understanding of community culture and local

wisdom is one of the significant factors as a

prerequisite for designing, aligning and developing

the business we are running. Thus, a business

institution is not only corporate oriented, but it has

socio-cultural harmony and corporate social

responsibility.

4.4 Economic Factors

Economically, every human being doing economic

activity can hardly be released from financial

institution either bank or non-bank. Financial

institutions serve as intermediary financing, which

brings between surplus units (excess funds) with

deficit units (lack of funds). In this context, Muslims

are in a deficit unit position. Therefore, in this

position Muslims need financial institutions. In this

framework, Muslims need the presence of Islamic

financial institutions.

4.5 Legal Political Factors

Political law plays an important role in the

institutionalization of Islamic financial norms in

Indonesia. This role is carried out by civil society,

such as ICMI, MUI, and campus community through

its cultural movement. This movement then

encourages the political forces of Islam in parliament

to support the ratification of Law no. 21 of 2008

concerning sharia banking. At first, the political

power in parliament was limited to Islamic political

parties only. However, in its proliferation, this

movement is influential on political parties that have

no historical traditions and roots with Islam.

There are 9 factions supporting the ratification of

Law no. 21 of 2008 concerning Sharia Banking. Of

the nine, 6 factions of which represent the political

power of Islam, namely: 1) Fraction of United

Development Party (FPPP), 2) National Mandate

Party Faction (FPAN), 3) Reform Star Party Fraction

(PBR), 4) National Awakening Party (PKB), 5)

Prosperous Justice Party Faction (FPKS), 6) Fraction

of Pioneer Stars of Democracy (FBPD). And three

factions of the nationalist element, namely: 1) Faction

of Democratic Party of Struggle, 2) Golkar Party

Faction, and 3) Democratic Party Faction. And there

is only one faction that refused, the Prosperous Peace

Party Faction (FPDS). (Djawahir Hejazziey-121)

The existence of political party support in the

parliament of both Islamic political parties and

nationalist political parties, indicates the legal

political efforts carried by civil society into a model

in institutionalizing Islamic legal norms into Islamic

financial institutions. Thus, the institutionalization of

norms into sharia financial institutions must combine

cultural movements with structural movements.

(Younes Soualhi, 2012) With the enactment of Law

no. 21 Year 2008 is the result of legal politics initiated

by civil society.

5 CONCLUSIONS

Philip Gillin said that for a norm to become an

institution, it must be known, understood, obeyed,

and respected. The phrase seems to correlate with the

phenomenon of Islamic financial institutionalization

in Indonesia. Islamic financial institutions in

Indonesia were originally the norms sourced from al-

Qur'an and al-Hadith which are then understood,

adhered to, valued and institutionalized into shariah

financial institutions. Institutionalization of norms

into Islamic financial institutions in Indonesia is not

only determined by the awareness of the community

in complying with the norm, but the extent to which

awareness to comply with norms can be consolidated

into cultural strength that can affect the structural

strength. This is where the institutionalization of

Islamic finance is formed.

REFERENCES

Abu Umar Faruq, (n.d). Riba and Islamic Banking, Jurnal

of Islamic Economics, Banking and Finance.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

110

Atang Abd Hakim, 2010. Transformasi Fiqh Muamalah

kedalam Peraturan Perundang-Undangan, Disertasi.

Al-Raghib Al-Isfahani, Al-Husain, 1961. Al-Mufradat Fi

Gharaib Al-Qur’an, Cairo.

Afzalur Rahman, Muhammad as Trader, Jakarta: Yayasan

Swarna Bhumi, 1997.

Bazmool, Kholah Mohammad Omar. 1435/2014. al-

Awamir wa al-Nawahi wa al-Irshadiyah fi al-Sunnah

al-Nabawiyah: jam’an wa Takhrijan wa Dirasah

Thesis Umm al-Qura University Faculty of al-Da’wah

wa al-Ushuludin. (accessed in http://b7oth. com/?p

=1837).

Chapra, M. Umar, 1986. Towards a Just Monetary System,

Leicester.

Djawahir Hejazziey, (n.d). Konfigurasi Politik Hukum

Perbankan Syariah di Indonesia, (Ahkam, 2012).

Fatwa MUI No. 1 Tahun 2014, http://garisbuku. com/shop/

himpunan-fatwa-mui/

Hans-Dieter-Ever. 2003. Transition towards a Knowledge

Society: Malaysia and Indonesia in Comparative

Perspective. in Comparative Sociology, Volume 2, issue

2(2003) 313-373 Koninklijke Brill NV, Leiden DOI

10.1163/156913303100418816.

Ibrahim K. Lubis. 1995. Ekonomi Islam. Jakarta; Kalam

Mulia

George Ritzer, 1975. Sociology, A Multiple Paradigm

Science, American Journal.

Juhaya S. Pradja, 2014. Filsafat Hukum antar Madzhab-

Madzhab Barat dan Islam, Juhaya S. Pradja Centre.

Mahmud Muhammad Balily, 1990. Etika Bisnis: Studi

Kajian Konsep Perekonomian menurut al-Qur’an dan

as-Sunnah. Solo; Ramadhani.

PP Muhammadiyah, 2011. Putusan Majelis Tarjih,

Yogjakarta: MTT PP Muhammadiyah

Sukanto, 1987. Sosiologi. Jakarta: Rajawali Press.

Soualhi, Younes. 2012. Bridging Islamic Juristic

Differences in Contemporary Islamic Finance” Arab

Law Quarterly 26 (2012) 313-337 © Koninklijke Brill

NV, Leiden, 2012 DOI: 10.1163/15730255-12341235.

Zia-ul Haque, 1995. Islam and Feudalism: The Moral

Economics of Usury, Interest and Profit, Kuala

Lumpur.

Institutionalization of Sharia Financial Norms in Indonesia

111