The Effect of Human Resources, Management and Capital

Performance toward Return on Asset

Case Study on Islamic Bank 2011-2015

Dian Filianti and Dina Fitrisia Septiarini

Islamic Economy Department-Economy and Business Faculty-Airlangga University, Indonesia

dianfilianti@feb.unair.ac.id, dinafitrisia@feb.unair.ac.id

Keywords: CAR, Good Corporate Governance, iB-VAIC, Intellectual Capital, Islamic Banking, Return on Asset.

Abstract: The purpose of this study is to determine the effect of intellectual capital partially and simultaneously with

iB-VAIC, the quality of GCG implementation, and capital adequacy level towards ROA (a case study Islamic

bank during 2011-2015). The results showed that partially intellectual capital with iB-VAIC and capital

adequacy level significantly affect the ROA, while the GCG quality do not significantly affect ROA.

Simultaneous research results showed that intellectual capital with iB-VAIC, quality of GCG implementation

and the capital adequacy level significantly affect ROA. Therefore, the management of intellectual capital or

resource management with a good knowledge and quality management of GCG supported by sufficient capital

to support the operations of the company will be able to increase the ROA of Islamic banks.

1 INTRODUCTION

Islamic banks are banks which have different

operational from the conventional bank. One of the

Islamic bank characteristics is not receiving or

burdening their customer with interest, however

receiving or burdening profit sharing and other

rewards according to the covenant. The concept of

Islamic Bank is based on Quran and hadith. All the

products and services offered must not be in

contradiction with Quran and hadith from Rasulullah

SAW (Ismail, 2011: 29).

1.1 Stakeholder Theory

In the context of explaining about IC concept, the

stakeholder theory must be seen from both sector,

either ethics (moral) or managerial sector. The ethics

sector argued that every stakeholder has the right to

be treated equitably by the organization, also manager

must manage the organization for the importance of

every stakeholder (Deegan, 2004 in Ulum, 2009:

5&6). In the context of a relationship between IC and

financial performance, the stakeholder theory is more

appropriate as the main basis to explain the

relationship of IC and company performance. From

the stakeholder theory point of view, the company has

stakeholders, not only shareholder (Riahi-Belkaoui,

2003 in Ulum, 2009: 8).

1.2 Resource-Based Theory

According to Resource-Based Theory, IC fill the

criteria as unique resources to create competitive

superiority for the company by creating value added.

The value added is in the form of the better

performance in the company.

1.3 Intellectual Capital

According to Sawarjuwono and Kadir (2003), IC is

the amount of what is produced by the three main

elements of an organization (human capital, structural

capital, customer capital) which is related to

knowledge and technology that enables the company

to provide more value to a company in the form of

organization competitive superiority.

Frequently, the term of intellectual capital is

treated as a synonym of intangible assets.

Nevertheless, the definition proposed by OECD is

quite different by putting intellectual capital as a

separate part from the intangible asset basic

determination as for the overall company. Therefore,

there are items of an intangible asset which logically

is not a part of the intellectual capital of the company.

124

Filianti, D. and Septiarini, D.

The Effect of Human Resources, Management and Capital Performance toward Return on Asset - Case Study on Islamic Bank 2011-2015.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 124-130

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

One of it is company reputation. Company reputation

may be the side result (or a consequence) from IC

wisely utilization in the company, but it is not a part

of intellectual capital (Ulum, 2009: 21).

1.4 iB-VAIC (Islamic Banking Value

Added Intellectual Coefficient)

On his research, Ulum (2013) formulated IC

performance assessment model for Islamic banking

which will be named iB-VAIC (Islamic Banking

Value Added Intellectual Coefficient) which is

important to be generated as a modification of an

existing model, VAIC (Value Added Intellectual

Coefficient). VAIC is designed to measure the

intellectual capital performance of companies with

common types of transactions. Meanwhile, Islamic

banking has their own type of transactions which are

quite different from common or conventional

banking. The three formula to calculate iB-VAIC as

follows:

The first stage is calculating Islamic Banking

Value Added (iB-VA). iB-VA is calculated as the

difference between output and input. Output (OUT)

is presented as revenue and covers the entire product

and services that sale on market, however input (IN)

cover all the load used to gain revenue. The most

important thing on this method is the labor expenses

are not included on IN. As their active role in the

value creation process, the intellectual potential

(which is represented with labor expenses) is not

calculated as cost and not included on IN component.

iB-VA=OUT– IN.......................................(1)

Notes:

OUT (Output): Total income, obtained from Islamic

activity net income = Islamic activity main operation

income + other operational income - third parties'

right on sharing profit and temporary syirkah funds.

The second stage, calculating Islamic Banking

Value Added Capital Employed (iB-VACA). The

formula used is:

iB-VACA=

........................................(2)

Notes:

CE: Capital Employee: available funds (total

liquidity)

The third stage, calculating Islamic Banking

Value-Added Human Capital (iB-VAHU).

iB-VAHU =

........................................(3)

Notes:

HC: Human capital: labor expenses

The fourth stage, calculating Islamic

Banking Structural Capital Value Added (iB-STVA).

iB-STVA =

.......................................(4)

Notes:

SC: Structural Capital: iB-VA - HC

The fifth stage, calculating iB-VAIC:

iB-VAIC = iB-VACA + iB-VAHU + iB-

STVA...............................................................(5)

Kamath in Ulum (2009: 92) classifying bank

performance according to the Intellectual Capital into

four categories:

Table 1: Category VAIC

TM.

VAIC value Cate

g

or

y

>3 To

p

Per

f

ormers

2.00-2.99 Good Per

f

ormers

1.50-1.99 Common Performers

<1.5

B

ad Performers

Source: Ulum (2013).

1.5 Good Corporate Governance (GCG)

Bank Indonesia Regulation (PBI) No.

11/33/PBI/2009 defines GCG as a bank governance

that applies transparency, accountability,

responsibility, professionalism, and fairness.

1.6 Islamic Corporate Governance

According to Muneeza and Rusni (2014) the

definition of shariah corporate governance or

commonly referred to Islamic corporate governance

is:

"Shari'ah corporate governance is the Islamic

version of corporate governance. This is the

simplest way to explain what Shari’ah corporate

governance is.”

The purpose of definition aforementioned about

shari’ah corporate governance is Islamic corporate

governance. This is the simplest way to explain what

is Shari’ah corporate governance.

1.7 Islamic Bank Capital Management

Capital is the most important factor for bank

development and improvement also maintain the

The Effect of Human Resources, Management and Capital Performance toward Return on Asset - Case Study on Islamic Bank 2011-2015

125

public trust. Every creation of assets, as well as

potentially making a profit also potentially causing a

risk. Therefore, the capital has to be used to maintain

the possibility of risk of loses on assets investment,

especially funds from third parties or public

(Muhammad, 2004: 210).

1.8 Bank Capital Adequacy

Capital adequacy is the most important thing on

business banking. Banks who have good capital

adequacy level indicates a healthy bank. Because

bank capital adequacy indicating its state that

represented by a specific ratio called capital adequacy

ratio (CAR).

1.9 Islamic Bank Finance Performance

On traditional management, the size of performance

which often used is finance performance, because it

is a easiest factor to measure. Profitability is the most

appropriate indicator to measure the bank

performance. The size of profitability on banking

industry which often used is Return on Assets (ROA)

(Rivai, 2009: 686).

1.10 Model Analysis

Figure 1: Model Analysis. Source: Various sources,

processed.

Based on the explanation above, the regression

equation:

Y = a + b1X1 + b2Xz + b3X3 ........................ (6)

2 METHODS

This research was conducted with a quantitative

approach where the research data in the form of

numbers and analyzed using statistic tool.

According to the hypothesis and model analysis, the

variable in this research consists of the dependent

variable and independent variable, i.e.:

The independent variable in this research is the

intellectual capital with iB-VAIC (X1), GCG

Implementation Quality (X2), and capital adequacy

level (X3).The dependent variable in this research is

Return on Asset (Y).

The types of data used in this study are

secondary data. The data comes from an annual report

from 2011 to 2015 that have been published on the

website of each of the selected banks. The samples

are selected using purposive sampling technique.

There are 10 selected Islamic banks in total.

After selecting the sample and determining the

variables used in this study, the next step that should

be done is processing the data using regression

analysis to test the hypothesis. To assist the research,

the researcher will process the statistical data using

software Eviews version 8. The data analysis

technique in this research is regression models for

panel data analysis. The regression models for panel

data analysis is a combination of time series and

cross-section data.

According to Wibisono (2005) in Ajija, et al

(2011: 51), pooled data is a combination of time

series and cross-section data. By accommodating the

information either related to the cross-section

variables or time series, panel data substantially

reduces the omitted-variables problems, which

disregards the relevant variable.

According to Ajija, et al (2011:51) there are 3

approaches used to estimate the regression model for

panel data, i.e.: Common Effect/Polled Least Square

(PLS), Fixed Effect Model (FEM), and Random

Effect Model (REM). There are 2 approaches which

frequently used to determine the best model for this

research, i.e.: Chow test and Hausman test.

3 RESULTS AND DISCUSSION

3.1 Panel Data Estimation Model

Selection

Steps to get the precise model by conducting the

Chow Test and Hausman Test

Intellectual Capital

with iB-VAIC

The quality of GCG

Implementation

Capital Adequacy

Level

ROA

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

126

Table 2: Chow Test.

Effects

Test

Statistic d.f Prob.

Cross-

section F

9.288185 (9,37) 0.0000

Cross-

section

Chi-s

q

uare

59.075444 9 0.0000

Source: Eviews 8.

The probability value (Cross-section F) obtained

from Table 2 of 0,0000 which means that probability

value (Cross-section F) less than α (0,05) so H0 is

rejected and H

1

is accepted.

Table 3: Hausman Test.

Test

Summary

Chi-Sq.

Statistic

Chi-Sq. d.f. Prob.

Cross-

section

random

57.387396 3 0.0000

The probability value (Cross-section random)

obtained according to Table 3 of 0,0000 which less

than α (0,05) means that H

0

is rejected and H

1

is

accepted, can be concluded that Fixed Effect Model

(FEM) is the best model to use better than Random

Effect Model (REM).

Based on the selection result of panel data model

above, it can be concluded that the best analysis

method to analyze panel data on this result is Fixed

Effect Model (FEM). The result from Fixed Effect

Model (FEM) can be explained in Table 5.

(FEM) better than Pooled Least Square/Common

Effect Model (CEM).

Rejected and H1 is accepted, it can be concluded

that the best temporary model to use is Fixed Effect

Model

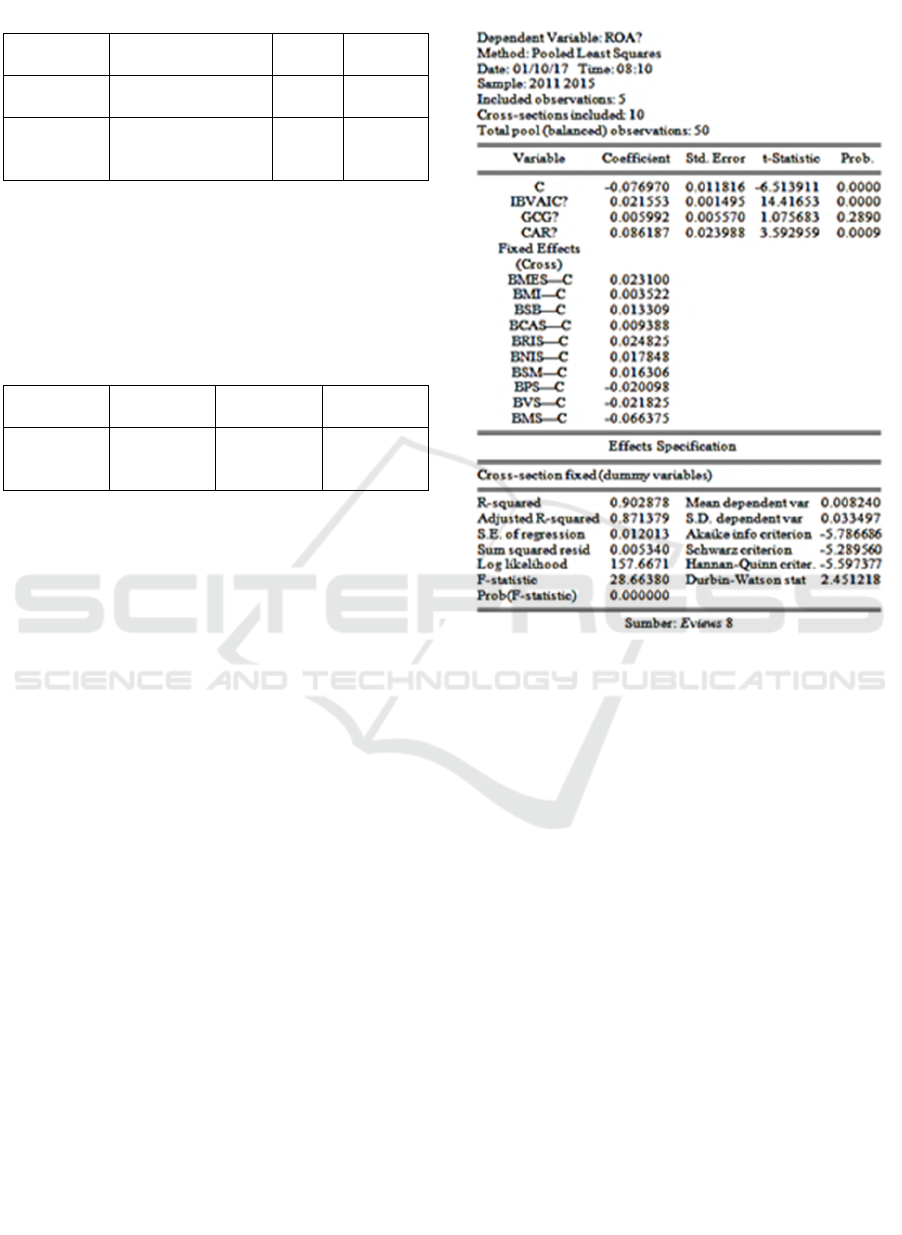

Table 4: Fixed Effect Model (FEM) Estimation Result.

Based on the estimation result in Table 4, the

linear equation can be written as follow:

ROA=-0,076970 + 0,021553IBVAIC +

0,005992GCG + 0,000862CAR ........................... (7)

3.2 The Effect of Partially Intellectual

Capital with iB-VAIC toward

Return on Asset of Islamic Bank

The result showed that intellectual capital variable

which is calculated using iB-VAIC partially

significant difference toward return on asset of

Islamic bank in Indonesia. It can be seen from the

probability value (t-statistic) that the number is

0,0000. The significance value is less than 0,05 so the

H01 is rejected an Ha1 is accepted and can be

concluded that intellectual capital variable with iB-

VAIC is partially significant difference toward the

return on asset of Islamic bank period 2011-2015.

This indicates that intellectual capital with iB-

VAIC has an important role to improve the return on

asset of an Islamic bank. The higher the value of

intellectual capital with iB-VAIC (Islamic Banking

The Effect of Human Resources, Management and Capital Performance toward Return on Asset - Case Study on Islamic Bank 2011-2015

127

Value Added Intellectualgv Coefficient) of an Islamic

bank, the higher it will create a value-added for the

bank. Value added is a competitive superiority which

able to improve the return on assets of the bank.

This strengthens the stakeholder theory by Ulum

(2009: 6), who states that when the manager able to

manage the organization maximally, especially in the

attempt to create value for the company, it means that

manager has been filling the aspect of both ethics and

theory. The context of value creation is by utilizing

all the company's potential, either employee (human

capital), physical capital, or structural capital. The

well the management of all this potential, the more it

will create value added for a company which able to

encourage the company financial performance for the

importance of stakeholder. The result of this study

also support the resource-based theory that the good

resource management will increase the value added

of company in order to compete in business industry.

This result supports the research conducted by

Ulum (2007) who concluded that intellectual capital

positively significant difference toward the company

performance now and in the future (ROA, ATO, and

GR). This research also support the research

conducted by Chen et al. (2005) in Ulum (2009:101)

if the utilization of intellectual capital is good, the

company profitability will increase so the company

performance will be better. Therefore, the company

ability to gain profit with the total assets owned will

increase if the company able to maximizing the

intellectual capital performance.

The knowledge into company's resources are

inherent knowledge and owned by each people on the

company which able to use to the importance of

company. Those knowledge resources are abstract

and often called as intangible assets or intellectual

capital. Those resources are more potentially provide

the competitive superiority than tangible resources

(Nasih, 2012). Nowadays in order to facing the

competition, knowledge has an important role. As

already explained by Quran on surah Ar-Rahman 33:

Ya

̅

ma

̒

syaral-jinni wal-insiinistata

̒

tum an tanfużu

̅

min

aqta

̅

ris-sama

̅

wa

̅

tiwal-ardifanfużu

̅

,

la

̅

tanfużu

̅

nailla

̅

bisulta

̅

n

O jinn and mankind if you are able to pass beyond

the regions of heavens and earth, then pass. You will

not pass except by authority from Allah (Ministry of

Religious Affairs, 2010: 532).

3.3 The Effect of Partially Good

Corporate Governance

Implementation toward the Return

on Asset of Islamic Bank.

This result showed that GCG implementation

variable calculated from self-assessment result of

GCG implementation in the form of composite value

is not partially significant difference toward return on

assets of Islamic bank in Indonesia. It can be seen

from the probability value (t-statistic).

According to the data, it can be seen that the

probability level (t-statistic) of 0,2890. That

significance value is higher than 0,05 so H01 is

accepted and Ha1 is rejected. According to

Permatasari and Retno (2014), the GCG composite

value had no significant difference on ROA of

Islamic bank so it can be concluded that good

implementation of the bank did not guarantee the

improvement of the bank performance.

This research also supports the research which

already conducted by Permatasari and Retno (2014).

The research conducted by Permatasari and Retno

showed that GCG implementation quality does not

affect the bank performance. Meanwhile, this result

rejects the research conducted by Tjondro and Wilopo

(2011) who stated that GCG had a positive effect

toward the profitability of the banking company.

The GCG implementation quality will be better if

the GCG composite value is low. It means, the better

of bank governance implementation then the better of

bank performance. However, the good GCG

implementation does not guarantee the bank ROA

performance as the result of this research which

showed that the quality of GCG implementation does

not partially significant difference toward ROA of an

Islamic bank.

For instance, Victoria Islamic Bank on 2014 had

a composite value of 1,930 and already applied the

good GCG implementation. However, the ROA of

Victoria Islamic Bank on 2014 suffered loss of -

0,0187. This loss because too cautious in distributing

fund so its distribution is not frontal which led to the

decline of profit. Furthermore, Victoria Islamic Bank

on 205 had a high composite value of 3,000 it means

the GCG implementation of Victoria Islamic Bank is

quite good. However, the ROA of Victoria Islamic

Bank on 2015 suffered loss of -0,0236. The decline of

ROA because the less of cautious in distributing

funds, so a lot of financing problems which led to the

decline of profit.

The implementation GCG quality is a company

operational activity mechanism to run in accordance

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

128

with the company mechanism. From the research

above, the good GCG implementation is not

guaranteed to improve the ROA of the bank. The

ROA improvement affected by several factors, one of

it is profit. If there are a lot of Islamic Bank which is

lost during this period also the possibility about other

factors and variables that are not examined make this

research is not significant.

3.4 The Effect of Capital Adequacy

Level Partially Toward the Return

on Assets of Islamic Bank

The result showed that capital adequacy level variable

which is calculated using CAR had partially

significant difference toward ROA of Islamic bank in

Indonesia. It can be seen from the probability value

(t-statistic). According to the data, it can be known

that probability level (t-statistic) of 0,0009. That

significance value is higher than 0,05 so H01 is

rejected and Ha1 is accepted. Therefore, the higher

CAR of Islamic bank the higher Bank capital ability

to maintain the possibility of business activity loss

risk so the ROA of Islamic bank will increase.

This research also supports the research which

already conducted by Pasaribu and Rosa (2011). The

research result conducted by Pasaribu and Rosa

showed that the capital adequacy level by Capital

Adequacy Ratio (CAR) was significant difference

toward the return on assets. However, it is not

accordance with research conducted by

Widyaningrum (2015). The research conducted by

Widyaningrum showed that CAR was not significant

difference toward ROA.

CAR is the most important thing for a bank in

order to develop its business and accommodate the

loss also reflect the health of bank which aims to

maintain the public trust about banking, protect the

public funds and to fulfill the Islamic Bank

standard.The most important capital factor to run the

bank operational activity and for support their needs,

with the quality of management to maintain the

banking activity to get the expected profit level. With

a proper management, the bank will keep increasing

their capital and pay attention to capital health

indicator, i.e.: CAR, so that the profitability will

increase.

In the implementation of a business or good

resources management also the good company

governance without support from sufficient capital

make business will not run properly. Capital is one of

the important things on Islamic bank. Without capital,

the bank can not to run they're daily operational, the

public trust and support their needs.

3.5 The Influence of Intellectual Capital

with iB-VAIC, GCG

Implementation, and Capital

Adequacy Level Simultaneously

toward the Return on Assets of

Islamic Bank

This result showed that intellectual capital with iB-

VAIC, GCG implementation quality, and capital

adequacy level are simultaneously significant

difference toward ROA. It can be seen from the

probability value (F-statistic). According to the data,

it can be known that probability level (F-statistic) of

0,000000. That significance value is higher than 0,05

so H01 is rejected and Ha1 is accepted.

The intellectual capital with iB-VAIC, GCG

implementation quality, and capital adequacy level

which well and consistently maintained able to

improve the return on asset of a company. It showed

that intellectual capital which efficiency maintained

to indicate that such bank able to well maintain their

resources, the well-maintained resources will

increase the employee ability so this ability will

contribute to enhancing the company performer and

the competitive superiority for the company will be

achieved.

The company will be able to compete if it has a

good management inside it. The GCG

implementation quality is a way to actualize the good

management of a bank. The big impact of a company

performance is the company itself, how the

management able to maintain a good company for its

main reason. With a good knowledge management

and also good quality of management if it is not

supported with sufficient capital so the company will

not able to run. As capital is the most important thing

in the development and improvement of a company.

Capital also used to support the daily activities in

order to enhance the public trust. With a proper

management, the bank will keep increasing their

capital and pay attention to capital health indicator,

i.e.: CAR, so that the ROA will also increase.

4 CONCLUSION

According to the result and the discussion, it can be

concluded that:

1. The intellectual capital with iB-VAIC is the

partially significant difference to the ROA of

Islamic bank period 2011-2015.

The Effect of Human Resources, Management and Capital Performance toward Return on Asset - Case Study on Islamic Bank 2011-2015

129

2. The GCG implementation quality variable is not

partially significant difference to the ROA on

Islamic bank period 2011-2015.

3. The capital adequacy level is the partially

significant difference to the ROA on Islamic bank

period 2011-2015.

4. This intellectual capital with iB-VAIC, GCG

implementation quality, and capital adequacy

level are the simultaneously significant difference

to the ROA of Islamic bank period 2011-2015.

The suggestion from this research as follows:

1. For Islamic bank

This result can be used as a tool to reform

according to the maintaining the knowledge

resource, GCG implementation, and capital

adequacy level. This result indicates that IC that

calculated using iB-VAIC, GGC implementation

quality, capital adequacy level, and ROA are

connected. It is no doubt that knowledge resource

is a lifeblood for the bank to success. The IC

existence should be considered in order to create

value-added in a company because the result

obtained in this research emphasize that

intellectual capital is positively connected to the

ROA. The good knowledge resource

maintenance able to improve the employee ability

in implementing GCG so the bank can fill their

responsibility to supplying minimum capital.

However, if a bank implementing GCG well

should be followed by financing improvement in

a bank, then improving a profit and consequently

improving ROA of the bank.

2. For the next researcher

For the next researcher is able to expand the

sample research, increase the number of research

period to get the better result, and also use other

indicators in terms of Islamic bank performance

measurement.

REFERENCES

Ajija Shochrul R et al. 2011. Smart way to mastering

Eviews. Jakarta: SalembaEmpat.

Ismail. 2011. Islamic Banking. First Edition. Jakarta:

Kencana.

Ministry of Religious Affairs. 2010. My Quran with Color

Block Tajwid with Translation. Jakarta: Lautan Lestari.

Muhammad. 2004. Islamic Bank Management.First

Edition. Jogjakarta. Ekonisia.

Muneeza, Aishath and Rusni Hassan. 2014.

Shari'aCorporate Governance: The Need for A Special

Governance Code. International Journal of Business in

Society. Vol. 14 No. 1, pp. 120-129.

Nasih, Moh. 2012. Human as Determinant Creator of Value

and Banking Company Performance in Indonesia.

Community, Culture, And Politic Journal, Vol. 25 No.

4.

Pasaribu, Hiras, and Rosa Luxita Sari. 2011. The Analysis

of Capital Adequacy Level and Loan to Deposit Ratio

Toward the Profitability. Study and Accounting

Research Journal. Vol. 4 No. 2. Page 114-125.

Permatasari, Ika and Retno Novitasary. 2014. The Effect of

Good Corporate Governance Implementation Toward

the Capital and Banking Performance in Indonesia:

Risk Management as The Intervening Variable. The

Application of Quantitative Economics Journal. Vol. 7

No. 1.

Rivai, Veithzal. 2009. Islamic Human Capital from Theory

to Practice of Islamic Resources Management. Jakarta:

PT Raja GrafindoPersada.

Sawarjuwono, Tjiptohadi and Agustine Prihatin Kadir

2003. Intellectual Capital, Treatment, Measurement,

and Report (A Library Research). Accounting and

Financial Journal. Vol. 5, No.1. May 35-57.

Tjondro, David and R. Wilopo. 2011. The Effect of Good

Corporate Governance (GCG) Toward the Profitability

and Banking Stock Performance that Recorded in

Indonesia Stock Exchange. Journal of Business and

Banking. Vol 1, No 1.page 1-14.

Ulum, Ihyaul 2007. The Effect of Intellectual Capital

Toward the Banking Financial Performance in

Indonesia. Publication Thesis. Semarang: Diponegoro

University Post Graduate Program.

Ulum, Ihyaul. 2009. Intellectual Capital: Concept and

Empirical Study. Jogjakarta. Graha Ilmu.

Ulum, Ihyaul. 2013. "iB-VAIC: The Model of Islamic

Banking Intellectual Capital Measurement in

Indonesia," Inference Journal (Accredited). Vol 7 No.

1, page 185-206. ISSN: 1978-7332.

Widyaningrum, Linda 2015. The Effect of CAR, NPF,

FDR, and OER Toward ROA of Islamic Financing

Bank in Indonesia Period January 2009 to May 2014.

JESIT. Vol. 2 No. 12.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

130