Preferences Analysis of Business Executors in Choosing Access to

Conventional and Syariah Micro Financing

Anggi Lani Rahmawati, Arim Nasim and Firmansyah Firmansyah

Economics and Islamic Finance Department, Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi, Bandung, Indonesia

anggi.lani.rahmawati@student.upi.edu

Keyword: Preferences, Micro Financing, Islamic Financing, Small Medium Enterprise.

Abstract: Financing is one of the solutions to tackle the problem of capital for the business sector in particular micro,

small and medium enterprises (UMKM). However, the tendency of the majority muslim Indonesia

community towards sharia financial institutions for access to micro financing sharia still is quite low.

Therefore, this research aims to analyze the preferences of the community especially businessmen in

choosing access to micro financing to conventional or Sharia with financing products, levels of religiosity

and the quality of service as factors that influenced them. The research design used in this research is a

survey of the eksplanatori with descriptive causality research method. Testing data in this study using

multiple linear regression analysis with the help of IBM SPSS Statistics programme 23. As many as 70

Market Traders in Andir, Bandung City selected as respondents in this research because of its strategic

location and has excellent management. Results of the study showed variable product financing mainly from

the price factor is an influential variable significantly to Andir Market trader's preferences in choosing

access to micro financing conventional and Syariah. While the two other variables, namely the level of

religiosity and the quality of service has no effect significantly to Andir Market trader's preferences in

choosing access to micro financing conventional and Syariah.

1 INTRODUCTION

Indonesia is a country with the largest Muslim

majority population in the world. By 2016, the

number of Muslim populations in Indonesia reaches

85% of the total population of Indonesia (Putra,

2016). Based on these facts, the application of

Islamic values should be applicable in every line of

life including in bermuamalah especially in

transactions in economic activity.

The economy in Indonesia itself is currently

mostly supported by the growth of Micro, Small and

Medium Enterprises (MSMEs) sector. This sector

has contributed up to 60.34% of total GDP (Ministry

of Cooperatives and UMKM, 2013). Behind the

contribution, UMKM sector still has some obstacles

in developing its business. One of them is from the

capital side. As an alternative to overcome these

problems, business actors from the MSME sector

can borrow from external sources such as financial

institutions.

Given the total population of Muslims in

Indonesia who are the majority, should prefer

Muslims especially business actors are more aligned

to financial institutions that apply the principles of

sharia in its business activities. This is because the

rules of sharia have arranged muamalah activities in

such a way as to fit the rules contained in the Qur'an

and Sunnah. Sharia rules themselves have limited

that transactions in the economy must be free of

elements prohibited by the Qur'an and Sunnah such

as transactions containing maysir, gharar, usury, and

other illicit transactions

The principle of profit sharing is different from

the principle of interest applied in conventional

financial institutions. According to Adiwarman

(2004) the financing by profit-sharing method

undertaken by sharia banking is more profitable

when compared to conventional interest-based

financing. This is because interest-based financing

will burden the cost of production in terms of total

cost. Unlike the case with the profit sharing that will

not affect the total cost but will affect the total

revenue.

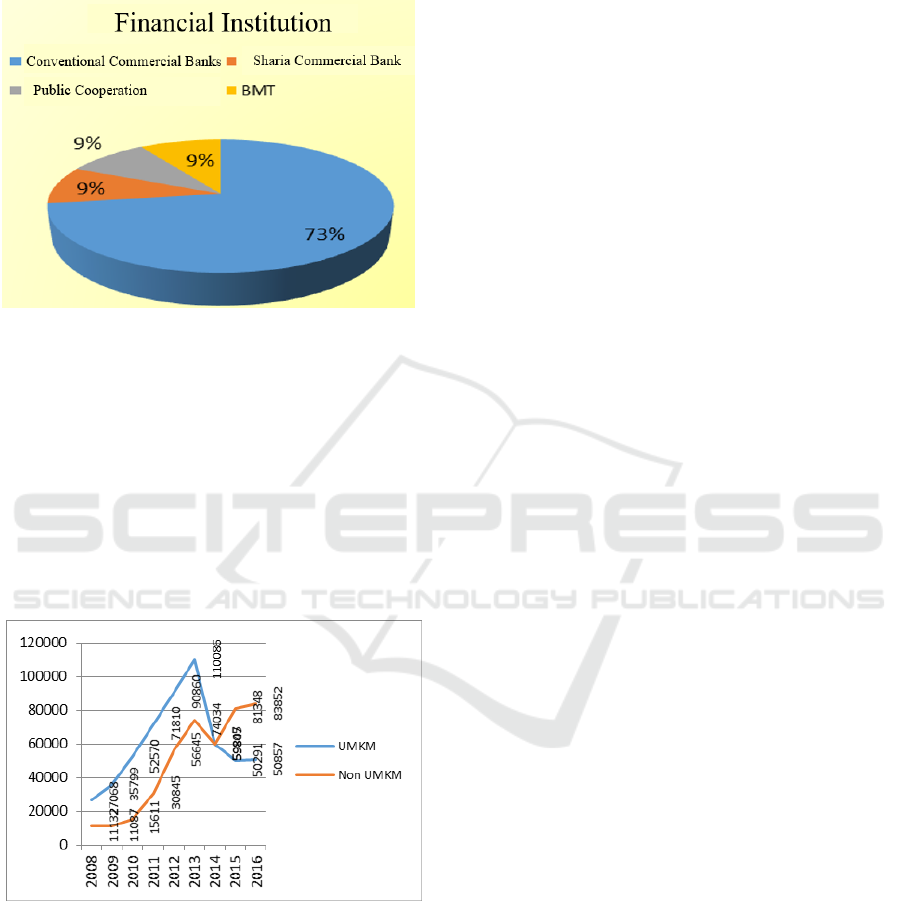

Behind the benefits of sharia financing, but the

number of SMEs who choose to apply for financing

in Islamic financial institutions can be said is still

minimal. This is supported by pre-research data of

authors who examine the preferences of MSMEs in

selecting access to finance to traders in Pasar Ranca

Rahmawati, A., Nasim, A. and Firmansyah, F.

Preferences Analysis of Business Executors in Choosing Access to Conventional and Syariah Micro Financing.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 281-285

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

281

Bentang Cimahi with the number of respondents 23

people, of the number of respondents, the number of

traders who had proposed new financing amounted

to 11 people.

Source: Research Result (2017)

Figure 1: UMKM Preferences to Financial

Institutions.

Preferences of business actors who are more

inclined to apply for financing to conventional

financial institutions also become one of the factors

decreasing the amount of financing provided to the

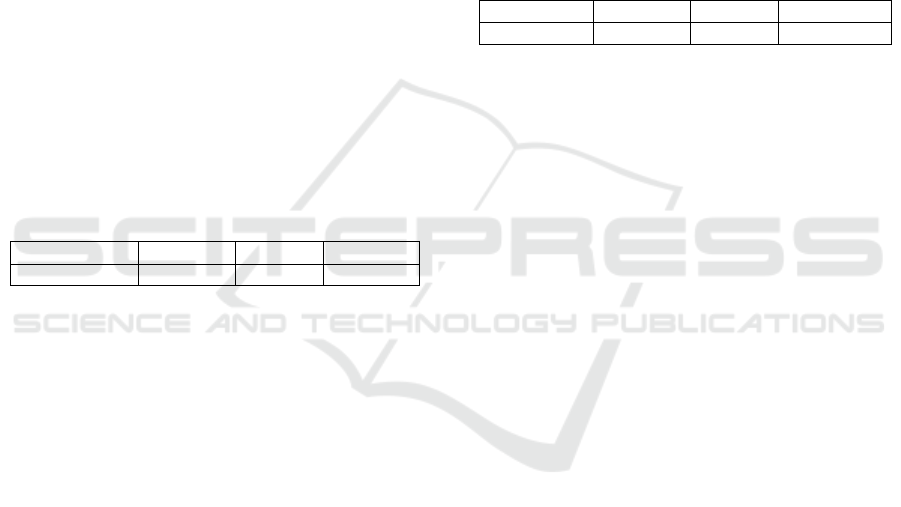

sector of SMEs by Islamic banking. This fact is

supported by data from the Financial Services

Authority which shows a decrease in the distribution

of financing by sharia banks in the last three years

Source: Research Result (2017)

Figure 2: Distribution of Financing to MSMEs Sector by

Sharia Banking.

More siding with business actors in the MSME

sector to apply for financing to conventional

financial institutions can be caused by several

factors. According Setiadi (2010) the factors that

influence the preference in making these decisions

can be influenced by internal factors and external

factors. These factors include personal factors such

as trust or religiosity and external factors such as

marketing factors 4P (product, price, place,

promotion).

Another study that examines the preference is

done by Masood (2009) who finds that the

preferences of customers in choosing their banking

and products are more influenced by the services

provided by these banking institutions at low prices.

In addition, based on research conducted by Aisyah

(2013) states that the factors that influence the

preferences of MSMEs in choosing access to

financing can be caused by several factors namely

product factors, service, religion, and education

level.

2 METHODOLOGY

The research method used in this research use

descriptive method of causality. Descriptive research

method is to get a general description of business

actors preferences on access to conventional and

syariah micro financing and methods of causality

research is to determine the extent to which the

influence of independent variables in this study are

microfinance products, the level of religiosity and

services affect the dependent variable that is

preference business actors in choosing access to

conventional and syariah micro financing.

In this study the object to be studied are the

variables used in this study. These variables include:

financing product, religiosity level and service

quality as independent variable to business

preferences in choosing access of conventional and

syariah micro financing as dependent variable.

Sampling technique used in this research is

purposive sampling. Purposive sampling was chosen

in this study because only business actors have

conventional and syariah micro financing that can be

used as sample research. Also in this study only

business actors who are Muslims who can be used as

sample research because to facilitate the

measurement of the level of religiosity. A total of 70

respondents were taken as samples of this study

consisting of customers of conventional financing

and sharia.

The model used in analyzing the data to find out

how the influence between independent variables to

the dependent variable and to test the truth of the

hypothesis include the classical assumption test such

as normality test, mulikolinearitas, and

heteroskesdastisitas. The hypothesis testing using

partial test (t test), simultaneous test (F test), and test

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

282

coefficient of determination (R2). Here is the model

used in this research are:

Y = β

0

+ β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ e

(1)

Explanation:

Y = Preferences of business actors in choosing

microfinance

β0 = Constants

β1-3 = Regression coefficient

X1 = Financing Products

X2 = Religiusity Level

X3 = Quality of Service

e = Variables Disorder

3 RESULTS

Based on the results of hypothesis testing it can be

known the influence or relevance of the independent

variable to the dependent variable. The acquisition

of t-count value and the level of significance on the

variable of financing products to the preferences of

business actors in choosing access to financing are

as follows.

Tabel 1: T-Variable Test Results X1.

Coefficient

t-hit

t-tab

Sig

0,551

4,009

1,99656

0,000

Source: Research Result (2017)

Hypothesis testing through t test on financing

product variables is done with a significance level of

5% or 0.05 at a confidence level of 95% with df = n-

k (70-4) = 66 so that the value of t table is equal to

1.99656. meaning that there is a significant influence

between financing products with the preferences of

business actors in choosing sharia financing access.

This is in accordance with previous research

conducted by Aisyah (2013) which shows that the

factor of financing product is the most significant

factor having an effect on the UMKM preference in

choosing access to finance.

In addition, research conducted by

Octavianingrum (2016) which states that the price

level is very influential on financing preferences, the

difference in this study investigated is the mortgage

financing (mortgage). In the context of business

actors in Bandung City Andir Market as described

earlier in the description that overall variable

financing products are in good category. However,

this is different from the business actors' preference

for sharia financing which is included in the medium

category.

This is in accordance with the theory put forward

by Yuswohady (2014) which suggests about four

types of Muslim consumers that are included in the

category apatist, rationalist, comformist and

universalist. Where in this study business actor in

Andir Market Bandung City included in rationalist

category. People belonging to the rationalist

category are those who are very critical in choosing

products with benefits are the main parameters

Furthermore, will be explained about the

acquisition of t-count value and significance level on

the variable level of religiosity to the preferences of

business actors in choosing access financing as

follows:

Tabel 2: T-Variable Test Results X2.

Coefficient

t-hit

t-tab

Sig

0,214

1,983

1,99656

0,051

Source: Research Result (2017)

Hypothesis testing through t test on this variable

religiosity level is done with significance level of

5% or 0,05 at trust level equal to 95% with df = n-k

(70-4) = 66 so that t value of table is equal to

1,99656. This means there is no significant influence

between the level of religiosity to the preferences of

business actors in choosing access to Islamic

finance. The results of this study in accordance with

research conducted by Nasrullah (2015) which

shows that the factor of religiosity as a moderating

variable even weaken the relationship of Islamic

branding with consumer purchasing decisions. This

is because the people of Indonesia who tend not to

make a religious factor as a way of life.

In contrast to the results of research conducted

by Gait and Worthington (2009) found that the

reason for religiosity is the main motivation of

society in Libya to use financing by Islamic

methods, followed by social services and profit. In

line with the study, Bley and Kuehn (2004) who

studied economics students in the UAE against

financing in sharia and conventional banks found

that Muslim students have a preference for services

in sharia banking because of the motive of

religiosity.

This is also in line with research conducted by

Rahayu et al (2016) who found that the factors that

most influence the urban community's preference to

Musharaka financing and Mudharabah are due to the

need factor for the benefits not only felt

economically but also spiritually.

When viewed from the facts in this study that

shows that the level of religiosity of business actors

in Andir Market is classified in high category. While

Preferences Analysis of Business Executors in Choosing Access to Conventional and Syariah Micro Financing

283

the preference for sharia financing included in the

category of being. This means that although the level

of religiosity in terms of obedience in worship has

been very good, but this is inversely proportional to

muamalah. This is in accordance with the research

Nasrullah (2015) which states that the people of

Indonesia has not made the value of Islamic values

as a way of life. Whereas Allah in the Qur'an has

ordered the Muslims to implement the rules of Islam

in kaffah.

Furthermore, the authors will describe the

acquisition of the t-count value and the significance

level of the service quality variable to the

preferences of business actors in choosing access to

finance. according to Parasuraman (1985) is the

quality of service is a measure of how well a service

is provided in accordance with customer

expectations. Providing quality service means

shaping customer expectations consistently.

Tabel 3: T-Variable Test Results X3.

Coefficient

t-hit

t-tab

Sig

0,101

0,910

1,99656

0,366

Source: Research Result (2017)

Hypothesis testing through t test on this service

quality variable is done with significance level of

5% or 0,05 at trust level equal to 95% with df = n-k

(70-4) = 66 so that t value of table is equal to

1,99656. meaning there is no significant influence

between the quality of service to the preferences of

business actors in choosing access to Islamic

finance. This is in contrast to previous research

conducted by Dusuki and Abdullah (2006) who

found that the quality of services, including staff

friendliness, competence, prompt and efficient

service are important factors in influencing the

selection of banks in Malaysia.

Tabel 4: Test Results -F and Coefficient of Determination

Test (R2).

F-Count

F-Table

Significance

R-

Squared

12,924

2,74

0,000

0,370

Source: Research Result (2017)

So it can be said that the total of all independent

variables are financing product, the level of

religiosity and service quality simultaneously affect

the dependent variable that is the preference of

business actors in choosing access of conventional

and syariah micro financing. Based on the

estimation result, it is found that the value of R2 is

0.370, meaning that the contribution of independent

variable to dependent variable is 37% and the

remaining 63% is influenced by other factors outside

the research model.

4 CONCLUSIONS

Financing products for business actor in Andir

market are included in good category, this is because

respondents are very selective in choosing financing

products especially in terms of price (interest / profit

/ margin). Then in terms of the level of religiosity of

business actors are included in the high category.

However, this high level of religiosity is not directly

proportional to the obedience of business actors in

terms of muamalah in accordance with sharia.

Furthermore, in terms of service quality obtained by

business actors in Andir Market included in either

category. This is because the majority of

respondents are customers of conventional financial

institutions that have excellent service quality.

The result of the research shows that the variable

of financing product especially from the price factor

is the variable which has significant effect to the

preference of trader of Andir Market in Selecting

Conventional and Sharia Micro Financing Access.

While the other two variables are the level of

religiosity and service quality has no significant

effect on market preferences Andir Market Traders

in Choosing Access Conventional and Sharia Micro

Financing.

REFERENCES

Adiwarman, K., 2004. Bank Islam: Analisis Fiqih dan

Keuangan, PT. Raja Grafindo. Jakarta.

Aisyah, S., 2013. Preferensi Usaha Kecil dan Mikro di

Pasar Baru Cikarang dalam Memilih Akses

Pembiayaan. Al Iqtishad. 1.

Bley, J., Kuehn, K., 2004. Conventional versus Islamic

finance: student knowlledge and perception in the

United Arab Emirates. International Journal of

Islamic Services. Vol. 5.

Dusuki, A. W., Abdullah, N. I., 2006. Why do Malaysian

customers patronise Islamic banks? International

journal of banking marketing.

Gait, A. H., Worthington, A. C., 2009. Attitudes,

Perceptions and Motivations of Libyan Retail

Consumers toward Islamic Methods of Finance. Asian

Finance Association 2009 International Conference.

Brisbane: Griffith University.

Kementerian Koperasi, UMKM, 2013. Perkembangan

UMKM dan Usaha Besar, Kemenkop. Jakarta.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

284

Masood, O., Aktan, B., Amin, Q. A., 2009. Islamic

banking: a study of customer satisfaction and

preferences in non-islamic countries. Journal

Monetary Economics and finance. Vol.2, 282.

Nasrullah, M., 2015. Islamic Branding, Religiusitas dan

Keputuasan Konsumen terhadap Produk. Jurnal

Hukum Islam.

Octavianingrum, Y., 2016. Analisis Preferensi Nasabah

terhadap Pembiayaan Kredit Kepemilikan Rumah

(KPR) antara Bank Umum Konvensioal dan Bank

Umum Syariah. Jurnal Universitas Brawijaya.

Parasuraman, 1985. A Conceptual Model of Service

Quality and Its Implications for Future Research.

Journal of Marketing. 41-50.

Putra, E. P., 2016. Persentase Umet Islam di Indonesia

jadi 85 persen, (Online) Retrieved from Republika:

http://nasional.republika.co.id/berita/nasional/umum/1

6/01/09/o0ow4v334-persentase-umat-islam-di-

indonesia-jadi-85-persen.

Rahayu, Y., Amaliah, I., Riani, W., 2016. Faktor-faktor

yang Menentukan Preferensi Masyarakat Kota

Bandung dalam Menggunakan Akad pembiayaan

Mudharabah dan Musyarakah di Lembaga Keuangn

Syariah. Jurnal Ilmu Ekonomi. Vol 2, 3.

Setiadi, N. J., 2010. Perilaku Konsumen: Perspektif

Kontemporer pada Motif, Tujuan dan Keinginan

Konsumen, Kencana. Jakarta.

Yuswohadi, 2014. Marketing to The Middle Class Muslim,

PT Gramedia Pustaka Utama. Jakarta.

Preferences Analysis of Business Executors in Choosing Access to Conventional and Syariah Micro Financing

285