Value Added Human Capital and Firms’ Financial Performance

Ria Arum Oktavina and Sedianingsih Sedianingsih

Universitas Airlangga, Jl. Airlangga No. 4 – 6, Surabaya, Jawa Timur, Indonesia

{ria.arum-13, sedianingsih}@feb.unair.ac.id

Keywords: Firm’s Financial Performance, Intellectual Capital, Return on Asset (ROA), Value Added Human Capital

(VAHU).

Abstract: This study aims is to analyze the influence of value added human capital (VAHU) as one of the intellectual

capital components on firms’ financial performance. Samples used are 299 manufacturing companies listed

in Bursa Efek Indonesia (BEI) that complies with certain criteria in the period of 2013-2015. This research

uses a quantitative approach with linear regression analysis for the hypothesis test. The result shows that

value added human capital is influencing positively and significantly on firms’ financial performance. It is

proved that total expenditures for employees, including salaries, allowances, bonuses, education and

training has the ability to create an added value, which then increase the firms’ financial performance that is

measured by ROA. It provides a practical contribution for companies as one of the considerations in human

capital decision-making.

1 INTRODUCTION

Current competition era with fast changes in the

quality of technology, the impacts of global markets,

and closed competition can create threats while

providing opportunities for companies (Hosseini and

Sheikhi, 2012). Therefore, it is necessary to develop

the business to help maintain and increase the

company’s competitive advantage in the current

global business competition.

Knowledge and expertise are some examples of

soft asset, which is one of the intellectual capital.

Intellectual capital is intangible resources that the

companies use to generate profit and value (Djamil

et al., 2013). Intellectual capital (IC) enables

companies to compete globally and face the

turbulent international environment. The businesses

nowadays need not only tangible assets, but also

intangible assets to gain sustainable competitive

advantages. Broadly speaking, intellectual capital

can be categorized into three; human capital,

structural capital, and relational capital. VAICTM

approach which was triggered by the police (1998)

is often used to assess and measures the intellectual

capital. This approach calculates the efficiency of

intellectual capital value in generating some added

value. Some advantages of this concept are the ease

of data acquisition and the data can be compared

among several companies. Human capital can create

some added value for the company because the

knowledge of the employees is able to create

effectiveness and efficiency to improve the

company’s productivity when responding to changes

in consumer needs. Several previous studies have

already proven the relationship between human

capital as one of the components of intellectual

capital with the company's financial performance

(Chen et al., 2005; Gogan et al., 2016).

The existence of human capital reflects the

company's collective ability to produce the best

solution. Human capital in a company is formed

from human resources it owned. Bontis et al (1999)

describes human capital as the resource of

innovations and strategies realized by brainstorming

in research labs, thinking in the office, composing

new structures, improving personal skills or

developing sales. Based on the knowledge-based

theory, people change their knowledge into routines,

job descriptions, plans, and strategies (Starbuck,

1992) to become the leading role of their business.

The value added human capital coefficient (VAHU)

indicates how much value added has been created by

one financial unit invested in employees (Zeghal and

Maaloul, 2010). VAHU measures the added value

generated by company's human capital. The higher

the VAHU, the more efficient the cost is incurred by

the company to improve employees’ productivity

when managing corporate resources. Effective and

312

Oktavina, R. and Sedianingsih, S.

Value Added Human Capital and Firms’ Financial Performance.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 312-315

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

efficient resource management can create some

added values that will impact on the company’s

profitability and ultimately impact on improving the

company's financial performance.

2 METHOD

The type of data used in this research is quantitative

data. The population of this study is manufacturing

companies listed on the Indonesia Stock Exchange

during the period of 2013-2015. The sample is

selected by using purposive sampling. In the end, we

got 299 manufacturing companies that have met

some criteria. The secondary data sources used in

this research, including the list of manufacturing

companies listed on the Indonesia Stock Exchange

during the period 2013-2015 are from

www.sahamok.com and financial statements of the

companies from www.idx.co.id.

The data collection procedures in this study

consist of literature study and documentation.

Literature study is done by reading and recording

important information, understanding, and reviewing

information from reading sources, while

documentation is obtained from the data acquisition

from the previous secondary data sources.

The method used in this study is a quantitative

method with an explanatory approach that aims to

explain the relationship between variables by using

hypothesis testing. Value added human capital is

measured by using VAICTM method and company's

financial performance is measured using ROA

(Return on Assets), while linear regression analysis

is used to process the data.

Data analysis of linear regression is used to

measure the influence of VAHU on financial

performance, which is depicted on ROA, at

manufacturing company listed in Indonesia Stock

Exchange during the period of 2013-2015. After

that, the data are processed with SPSS program

version 20.0. The regression model in this research

can be written as follows:

Model 1: ROA = a

0

+ a

1

VAHU + e……………… (1)

3 RESULTS AND DISCUSSION

Total manufacturing companies listed on the BEI

during the period of 2013-2015 amounted to 424

companies, but the sample obtained after the

enactment of purposive sampling or sampling with

certain criteria is 299 companies (unbalance

samples). The data are processed using regression

analysis after being tested by using classical

assumptions.

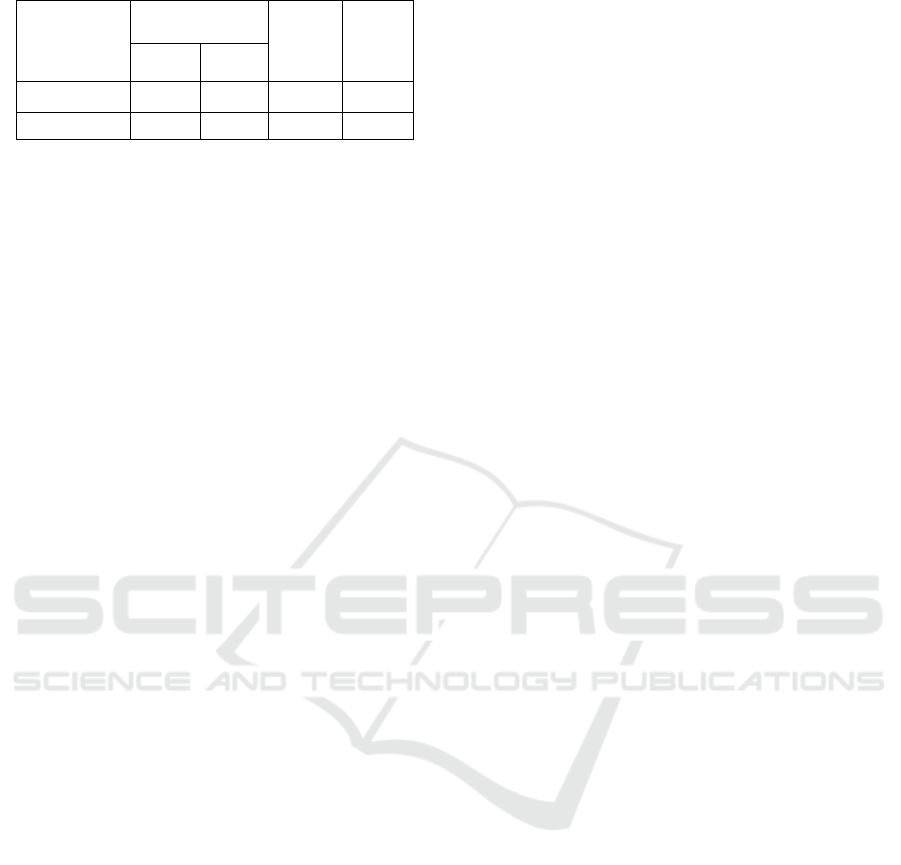

Descriptive statistical results in both variables

can be explained as follows:

Table 1: Descriptive statistical results.

N

Min

Max

Mean

Std.

Deviation

ROA

299

0.0056

79.6825

8.153051

9.3426220

VAHU

299

0.7304

19.3377

2.034988

1.4456455

Valid N

(listwise)

299

Return on Assets (ROA) is the effectiveness of

the company's ability to generate profits by

optimizing the assets owned. Based on the Table, the

highest ROA value of 79.6825 is owned by PT.

Semen Gresik, Tbk in 2015, while the lowest ROA

of 0.0056 is owned by PT. Indofood Sukses

Makmur, Tbk in 2014. The average value of ROA in

all sample companies is 8,153051 with the standard

deviation of 9.3426220. The level of data

distribution on Return on Assets (ROA) has

114.59% level of variation. This shows that the

distribution of ROA values generated by companies

in this research is relatively different

(heterogeneous), with the rate of ROA ratio changes

between manufacturing companies are relatively

different during the observation period. This

indicates that there are differences in the ability of

one company with the others to generate profits with

their assets.

Highest Value Added Human Capital (VAHU) in

this study is amounted to 19.3377, which is owned

by PT Pelangi Indah Canindo in 2014, while the

lowest value of 0.7304 is owned by PT Berlina Tbk

in 2015. The average VAHU value generated in this

research is equal to 2.034988 with a standard

deviation of 1.4456455. The level of data

distribution for companies’ Value Added Human

Capital (VAHU) has a level of variation of 71.04%.

This explains that the distributions of the value of

VAHU generated by manufacturing companies in

this research is homogeneous. The ability of one

manufacturing company to generate some added

values by total employees' expenditures such as

salary, allowances, bonus, education and training

when compared to other company is relatively the

same.

Value Added Human Capital and Firms’ Financial Performance

313

Table 2: Result of the regression analysis.

Model

Unstandardized

Coefficients

t

Sig

B

Std.

Error

(Constant)

-5.632

0.191

-29.433

0.000

VAHU

1.320

0.175

7.551

0.000

Based on result of regression analysis, we can

establish an equation as follows:

ROA = - 5,632 + 38,431 VACA + ε

Based on Table 2, we can draw a conclusion that

VAHU affects the companies’ financial performance

that is measured by ROA. The significant value of

VAHU which is 0.000 is smaller than the error rate

of 0.05 or 5% shows that VAHU has a significant

effect on financial performance at 95% confidence

level.

VAHU’s (value added human capital) regression

coefficient value is 1.320. It means that any increase

in the value of human capital will make the value of

ROA as a proxy of financial performance also

increase by 1.32 times with the assumption that

other variables are constant. Based on that result, it

can be concluded that VAHU can improve ROA and

will impact positively to the companies’ financial

performance. The significance value and regression

coefficient above show that VAHU has a significant

and positive effect on firms’ financial performance

and. Therefore, a decision can be made that

hypothesis 1 (one) which states that there is a

positive relationship between value added human

capital (VAHU) on the firms’ financial performance

is not rejected.

This result is consistent with previous studies by

Chen et al. (2005) and Gogal et al. (2016). The

results of these studies also prove that VAHU has a

positive and significant influence to the companies’

financial performance, which is depicted by ROA.

VAHU generated in this research is a value

added from expenditures for the human capital in a

company. Such expenses include salaries, benefits,

and other expenses such as education and training

provided to employees. Based on the results of this

study, it can be concluded that VAHU is a

manifestation of corporate expenditures for human

capital, and VAHU is also able to generate some

added values while improving the sample

company’s financial performance. These

expenditures create some added values because they

increase employees’ knowledge, motivations, and

collective abilities in producing the best solution for

the company.

The importance of the role of human capital is

believed to be associated with the company's goal to

generate profit. Good knowledge will increase cost

efficiency because more decisions will be made by

considering their costs and benefits. In addition,

companies will be able to create better products

through innovations generated by human capital,

thus leads to increasing company’s sales and profit.

Therefore, human capital is believed to be one of the

company’s intangible resources that can improve the

financial performance of the company.

4 CONCLUSIONS

Value Added Human Capital (VAHU) has a positive

and significant impact on the financial performance

of the 299 sample companies, which is projected in

their Return on Assets (ROA). The result of this

study supports the previous studies done by Chen et

al. (2005) and Khanqah et al. (2012).

There are several research limitations in this

study. First, there are many manufacturing

companies listed on the Indonesia Stock Exchange

that do not disclose the value of intellectual capital

they owned. Measurement of the appropriate

intellectual capital needs accurate data to measure

VAHU (value added human capital) as one of the

components of intellectual capital. Other than that,

only ROA (Return on Assets) is used to measure

companies’ financial performances, so we only able

to assess the companies’ ability to generate profits

using assets owned.

It is the author's hope that many manufacturing

companies will disclose their value of intellectual

capital, as it will also help the investors to make

their investment decisions. The disclosure of

company’s intellectual capital to the public will

enable the market to assess the actual performance

of the company's intellectual capital, and it will

improve the market perception on the overall

performance of the firm. In addition, independent

variables should be added as a proxy to the

company's financial performance, so it can reflect

the influence of actual intellectual capital on the

company's financial performance.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

314

REFERENCES

Bontis, N., Chua Chong Keow, W., Richardson, S., 2000.

Intellectual capital and business performance in

Malaysian industries, Journal of intellectual capital,

1(1), 85-100.

Chen, M. C., Cheng, S. J., Hwang, Y., 2005. An Empirical

Investigation of the Relationship between Intellectual

Capital and Firms' Market Value and Financial

Performance, Journal of Intellectual Capital, 6(2),

159-176.

Djamil, A. B., Razafindrambinina, D., Tandeans, C., 2013.

The Impact of Intellectual Capital on a Firm's Stock

Return: Evidence from Indonesia. Journal of Business

Studies Quarterly, 5(2), 176.

Gogan, L. M., Artene, A., Sarca, I., Draghici, A., 2016.

The Impact of Intellectual Capital on Organizational

Performance. Procedia - Social and Behavioral

Sciences, 221, 194-202.

Halim, S., 2010. Statistical Analysis on the Intellectual

Capital Statement. Journal of Intellectual Capital,

11(1), 61-73.

Hosseini, S. M., Sheikhi, N., 2012. An Empirical

Examination of Competitive Capability's Contribution

toward Firm Performance: Moderating Role of

Perceived Environmental Uncertainty. International

Business Research, 5(5), 116.

Starbuck, W. H., 1992. Learning by

Knowledge‐ Intensive Firms. Journal of Management

Studies, 29(6), 713-740.

Zeghal, D., Maaloul A., 2010. Analysing value added as

an indicator of intellectual capital and its

consequences on company performance. Journal of

Intellectual Capital, 11(1), 39-60.

Value Added Human Capital and Firms’ Financial Performance

315