Qualitative Analysis of Financial Reporting Post Adoption of

International Financial Reporting Standard

Comparative Study in South East Asia

Nyi Raden Handiani Suciati

Accounting Department Economic and Business Faculty, Universitas Padjadjaran Bandung, Indonesia

handiani.suciati@unpad.ac.id

Keywords: Financial Reporting Quality, International Financial Reporting Standard, Qualitative Characteristics.

Abstract: The Implementation of Association of East Asian County Economy Community has increased the

competition between countries, including the capital market competition. In the other hand, investor will

analyze the information on the financial statement in making investment decision. The adoption of

International Financial Reporting Standard belief will increase the financial reporting quality as it requires

more disclosure, thus providing more understandable and comparable information. This study aims to

analyze whether there are any changes in financial reporting quality post adoption of International Financial

Reporting Standard (IFRS). We use listed companies at Indonesia Stock Exchange, Kuala Lumpur Syock

Exchange and Singapore Stock Exchange as the subject in this research. We measure the financial reporting

quality using qualitive measurement developed by Nijmegen Centre for Economics (NiCE), such as

relevance, faithful representation, understandability, comparability, and timeliness. This study uses paired

sample test for analysing the data. Based on the test, we found that qualitative characteristics of relevance,

understandability and comparability are increased after the adoption, as more information being disclosed.

Meanwhile the faithful representation is decreased as the new standard use principle base, which is involve

more judgement. Thus, the international financial reporting standard will increase the financial reporting

quality, except for representation faithfulness which involves many accounting judgment, so the financial

statement user need to analyze its appropriateness, carefully.

1 INTRODUCTION

The Implementation of Association of East Asian

County Economy Community has increased

competition between countries, including

competitions to attract the foreign capital. Many

countries adopting the International Financial

Reporting Standards (IFRS), which will elevate the

quality of financial report, including Indonesia,

Singapore and Malaysia. IFRS adoption will provide

more qualified information by providing more

comparable and understandable information, among

companies. Formerly each country has different

accounting treatment, as the accounting standard is

adjusted with the needs a condition of the country.

To increase the financial statement comparability

and quality in the global market, we need to set an

international accepted accounting standard.

Previous study on the impact of International

Financial Reporting Standard adoption in the

financial statement quality by Healy and Wahlen

(1999), Leuz and Verrechia (2000), Daske et al.

(2008), and Amstrong et al. (2008), found that the

quality of financial statement is increased after the

adoption. They measure the financial statement

quality using quantitative measurement. However,

research by Barth et al. (2008), Daske et al. (2008),

Karampinis and Hevas (2011), Alali and Foote

(2012), found that the financial statement will have

more relevance quality after adoption of IFRS since

its widely use the fair value measurement. Yurisandi

and Puspitasari (2015) research on the quality of

financial reporting after the IFRS adoption in

Indonesia, using Nijmegen Centre for Economics

qualitative measurement found that the financial

reporting was increased. This study also used the

qualitative measurement to analyze the financial

reporting quality post the IFRS adoption in several

South East Asia Countries.

Previously, Indonesia adopted the Financial

Accounting Standard of US (US GAAP) into

316

Suciati, N.

Qualitative Analysis of Financial Reporting Post Adoption of International Financial Reporting Standard - Comparative Study in South East Asia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 316-320

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Standar Akuntansi Keuangan (SAK). At the

beginning of 2012, as a commitment of G-20

member (Daske et al., 2008), Indonesia adopted

International Reporting Standard (IFRS). The IFRS

convergence in Malaysia into Malaysian Financial

Reporting Standard (MFRS) begun on January 1,

2012. In 2009, the Singapore Accounting Standards

Council (ASC) announced to conduct full

convergence with IFRS in 2012.

This study aims to analyze whether there are any

changes in financial reporting quality after

International Financial Reporting Standard adoption

in Indonesia, Malaysia and Singapore. We use

paired sample test to analyse the data. We found that

financial reporting quality is increased, for the

relevance, understandability and comparability

characteristic. As for representation faithfulness

characteristic quality, it was decreased after the

adoption.

2 LITERATURE REVIEW

Positive accounting theory (Watts and Zimmerman,

1986), says that policy and estimates for the

management interest, which was supported by the

study result by Healy and Wahlen (1999), and the

management has intention to apply certain

accounting Sweeney (1994). Therefore, we assume

that after the IFRS adoption, the company will have

more opportunity to apply the flexible accounting to

fulfil their interest.

However, study by Healy and Wahlen (1999),

Leuz and Verrechia (2000), Daske et al. (2008), and

Amstrong et al. (2008), found that the asymmetry

information after the IFRS adoption was decreasing,

due to the increasing of the financial statement

quality. Karampinis and Hevas (2011), Alali and

Foote (2012), study found that implementing the

IFRS will increase the information relevance on the

financial statement as it uses fair value

measurement, widely.

Iatridis and Rouvolis (2010), Lin and Paananen

(2007), Ewart and Wagenholf (2013) performed the

financial statement quality study by measuring the

earnings management, before and after IFRS

adoption. Ewart and Wagenholf (2013) found that

more rigid accounting standard could decrease the

earnings management and increase the financial

statement quality. Yacoob and Ahmad (2011) found

the timeliness in Malaysia was decreasing after IFRS

adoption, which meant more time needed to issue

the financial statement.

This research aims to evaluate whether there is

any increasing in financial reporting quality after the

IFRS adoption, in Indonesia, Singapore and

Malaysia, use the NiCE qualitative approach. NiCE

developed the comprehensive index of quality

measurement based on qualitative characteristic such

as relevance, faithful representation,

understandability, comparability, and timeliness.

3 RESEARCH METHOD

3.1 Empirical Design

The purpose of this research is to empirically

evaluating the financial reporting quality before and

after the IFRS adoption, in each country. We

perform mean comparation test using paired sample

test. We use this model in order to find the level of

significance of the financial reporting quality

changes before and after IFRS adoption. We use

SPSS program and Microsoft excel to run the data.

As we state earlier, researcher use the NiCE

qualitative approach in measuring the financial

reporting quality. NiCE developed the

comprehensive financial reporting quality

measurement in a form of index quality

measurement based on the IASB (2008) and FASB

(2008) each qualitative characteristic such as

relevance, faithful representation, understandability,

comparability, and timeliness. Here is the Nice

measurement that we use in evaluating the financial

reporting quality:

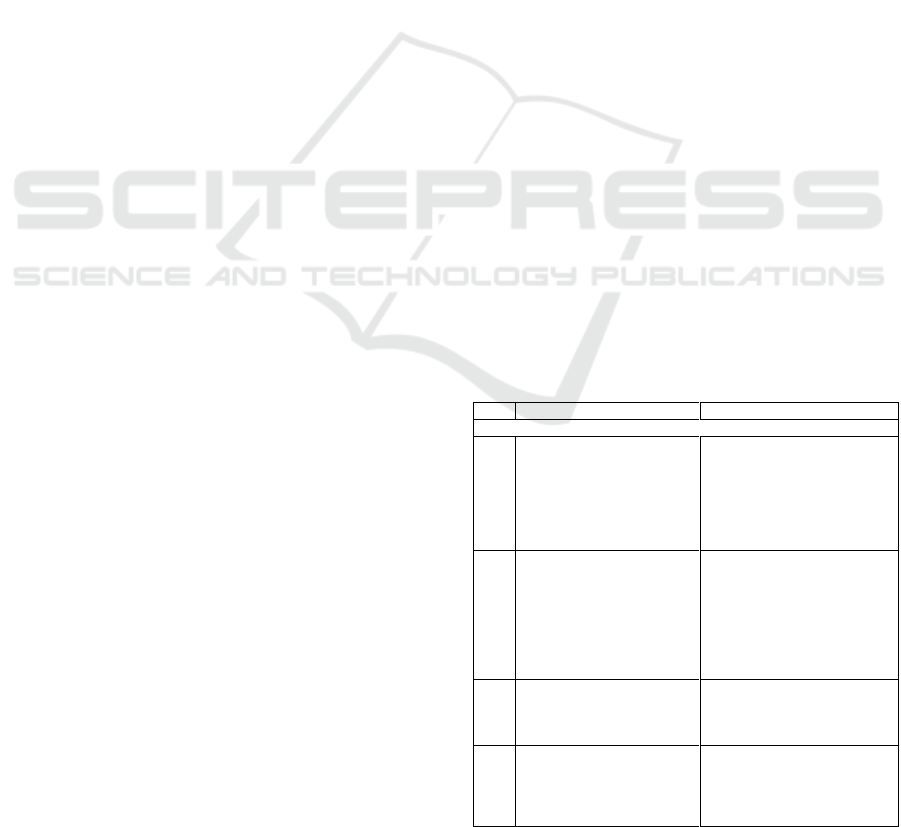

Table 1: NiCE quality measurement.

No

Question

Operationalization

Relevance

R1

To what extent does the

presence of the

forwardlooking statement

help forming expectations

and predictions concerning

the future of the company

1=no forward looking

information; 2=forward looking

information not an apart

subsection; 3=apart subsection;

4=extensive predictions ;

5=Extensive predictions useful

for making expectations

R2

To what extent does the

presence of non financial

information in terms of

business opportunities and

risks complement the

financial information

1=No non-financial

information; 2=little non-

financial information, no useful

for forming expectations;

3=useful non-financail

information; 4=useful non

financial information, helfpul

for developing expectations

R3

To what extent does the

company use fair value

instead of historical cost

1=Only Historical cost (HC);

2=Most HC; 3=Balance Fair

value (FV)/HC; 4=Most FV;

5=Only FV

R4

To what extent do the

reported results provide

feedback to the users of the

annual reports as to how

various market events and

1=No feedback; 2=Little

feedback on the past;

3=Feedback is present;

4=Feedback helps

understanding how events and

Qualitative Analysis of Financial Reporting Post Adoption of International Financial Reporting Standard - Comparative Study in South East

Asia

317

No

Question

Operationalization

significant transactions

affected the company

transactions influenced the

company; 5=Comprehensive

feedback

Faithful Representation

F1

To what extent are valid

arguments provided to

support the decision for

certain assumptions and

estimates in the annual report

1=Only described estimations;

2=General explanations;

3=Specific explanation of

estimations; 4=Specific

explanation, formulas

explained, etc;

5=Comprehensive

argumentation

F2

To what extent does the

company base its choice for

certain accounting principles

on valid arguments

1=Changes not explained;

2=Minimum explanation;

3=Explained why; 4=Explained

why + consequences- 5=No

changes or comprehensive

explanation

F3

To what extent does the

company, in the discussion

of the annual results, highliht

the positive events as well as

the negative events

1=Negative events only

mentiond in footnotes;

2=Emphasize on positive

events; 3=Emphasize on

positive events, but negative

events are mentioned; no

negative events occured;

4=Balance positive/negative

events; 5=Impact of

positive/negative events is also

explained

F4

Which type of auditors’

report is included in the

annual report

1=Adverse opinion;

2=Disclaimer of opinion;

3=Qualified opinion;

4=Unqualified opinion:

Financial figure; 5=Unqualified

opinion: Financial figures +

Internal Control

F5

To what extent does the

company provie information

on corporate governance

1=No description CG;

2=Information on CG limited,

not in apart subsection;

3=Apart subsection; 4=Extra

attention paid to information

concerning CG;

5=Comprehensive description

of CG

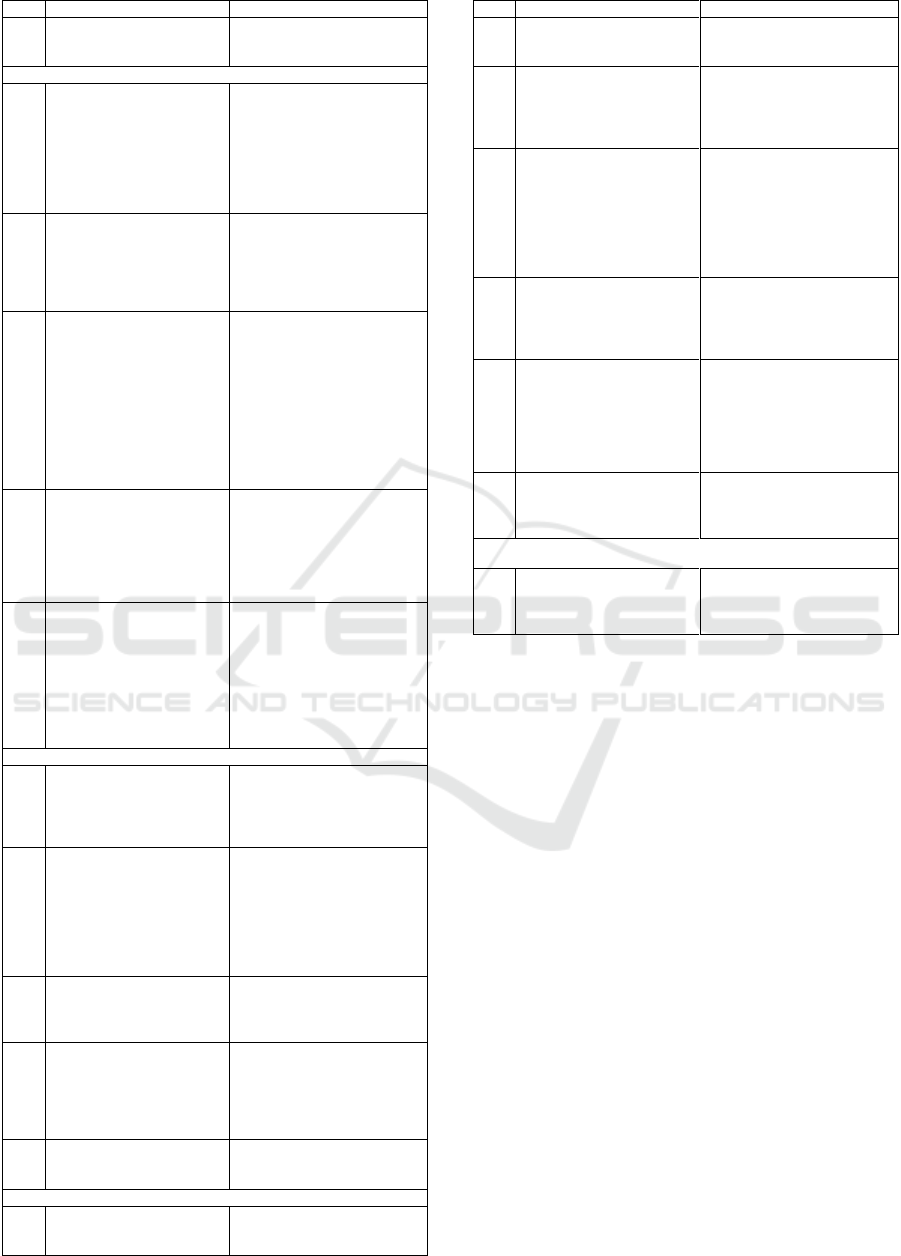

Continue

Understandability

U1

To what extent is the annual

report presented in a well

organized manner

Judgment based on: -Complete

tabel of contents; -Headings; -

Order of components; -

Summary/conclusion at the

each subsection

U2

To what extent are the notes

to the balance sheet and the

income statement

sufficiently clear

1=No explanation; 2=Very

short description, difficult to

understand; 3=Explanation that

describes what happens;

4=Terms are explained (which

assumptions etc); 5=Everything

that might be difficult to

undertand is explained

U3

To what extent does the

presence of graphs and tables

clarifies the presented

information

1=No graphs; 2=1-2 graphs;

3=3-5 graphs; 4=6-10 graphs;

5=>5graphs

U4

To what extent is the use of

language and technical

judgment in the annual

report easy to follow

1=Much jargon (industry), not

explained; 2=Much jargon,

minimal explanation; 4=Not

much jargon or well explained;

5=No jargon or extraordinary

explanation

U5

What is the size of the

glossary

1=No glossary; 2=Less than 1

page; 3=Approximately one

page; 4=1-2 pages; 5=>2 pages

Comparability

C1

To what extent do the notes

to changes in accounting

policies explain in the

1=Changes not explained;

2=Minimum explanation;

3=Explained why; 4=Explain

No

Question

Operationalization

informations of the change

why + consequences; 5=No

changes or comprehensive

explanation

C2

To what extent do the notes

to revisions in accounting

estimates and judgements

explain the implications of

the revision

1=Revision withount notes;

2=Revision with few notes;

3=No revision/clear notes;

4=Clear notes + implications

(past); 5=Comprehensive notes

C3

To what extent did the

company adjust previous

accounting periods figures

for the effect of the

implementation of a change

in accounting policy or

revisions in accounting

estimates

1=No adjustments;

2=Described adjustments;

3=Actual Adjustments (one

year); 4=2 Years; 5=>2 years +

notes

C4

To what extent does the

company provide

comparation of the current

accounting periode with

previous accounting period

1=No comparation; 2=Only

with previous year; 3=With 5

years; 4=5 years + description

of implications; 5=10 years +

description of implications

C5

To what extent is the

information in the annual

report comparable to

information provided by the

other organizations

Judgment based on: -

accounting policies; -structure

-explanations of events; In

other words: an overall

conclusion of comparability

compared to annual reports of

other organizations

C6

To what extent does the

company presents financial

index numbers and ratios in

the annual reports

1=No ratios; 2=1-2 ratios; 3=3-

5 ratios; 4=6-10 ratios

5=>10ratios

Timeliness

T1

How many days did it take

for the auditor to sign the

auditors’ report after

bookyear end

Natural logarithm of amount of

days

1=1-1,99; 2=2-2,99; 3=3-3,99;

4=4-4,99; 5=5-5,99

Source: Nice Working Paper 09-108

3.2 Sample

Companies stock which is included in LQ-45 index

at Indonesian Stock Exchange, most active stock at

Kuala Lumpur Stock Exchange (KLSE), and

Singapore Stock Exchange (SGX) for the period

2009 - 2013 are used as the subject in this research.

These listed companies consist of the companies

with the highest market capitalization. We are using

these companies as the sample with the

consideration that they could work as a

representation for the implementation of the IFRS

adoption.

The financial reporting quality before the IFRS

adoption is represented by the period 2009-2010,

while the financial reporting quality after the

adoption is represented by the period 2012-2013.

The research is excluding 2011 period with the

consideration it is the starting point of IFRS

implementation. We also use the data provided in

the company annual report.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

318

4 RESULTS

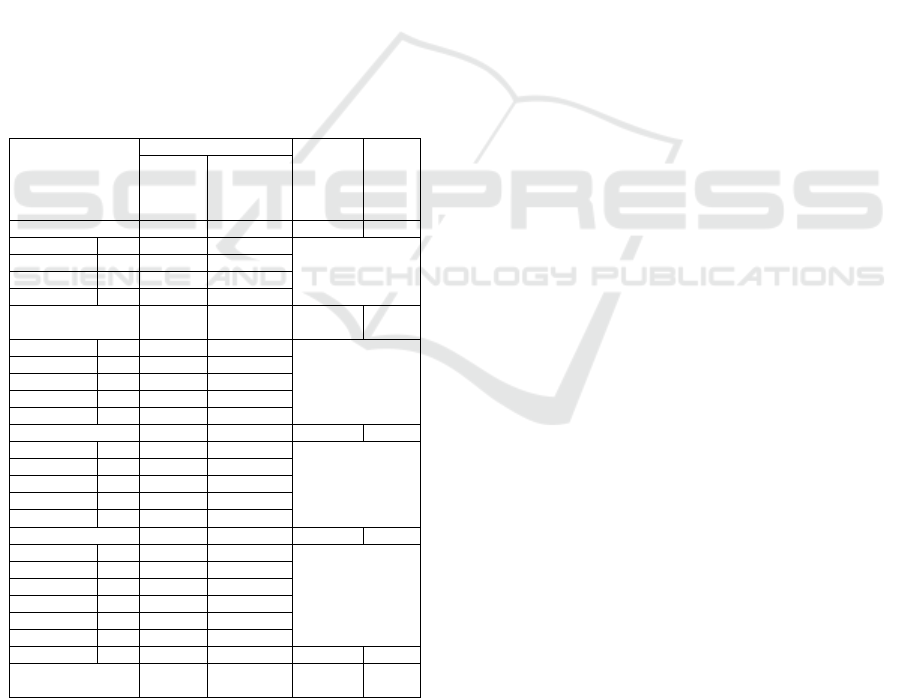

Table 2 displays the mean of the financial reporting

quality before and after IFRS adoption, the paired

sample test result for LQ 45 stock, which being used

as a sample.

From the table we found that the mean for

relevance, understandability and comparability

characteristic post IFRS adoption are increased. The

mean for representational faithfulness characteristic

is decreased after the adoption. Meanwhile for the

timeliness characteristic, the mean is almost the

same, before and after the adoption.

The study in Singapore Stock exchange and

Kuala Lumpur Stock Exchange found that the mean

for qualitative characteristics of relevance,

understandability and comparability is increased,

post IFRS adoption. Meanwhile for faithful

representation and timeliness, the mean post IFRS

adoption are relatively the same with the pre-

adoption.

Table 2: Financial reporting quality result & t-test for LQ

45.

Quality

Mean

T test

Sig

Before

IFRS

Adoptio

n

After

IFRS

Adoption

Relevance

3.2105

4.1058

-12.380

0.000

R1

3.0455

4.0818

R2

3.6091

4.6909

R3

2.7636

3.5909

R4

3.4182

4.0545

Representational

Faithfulness

3.4055

3.0618

6.129

0.000

F1

2.8182

3.7909

F2

2.9091

3.8364

F3

3.1000

3.6636

F4

4.0364

4.0182

F5

4.1636

4.7727

Understandability

3.4455

3.8618

-9.662

0.000

U1

4.1727

4.7727

U2

3.5455

4.3818

U3

4.0273

4.4727

U4

3.9455

4.2000

U5

1.5364

1.5273

Comparability

3.0798

3.8351

-11.753

0.000

C1

2.9636

3.7545

C2

3.1364

3.9909

C3

2.2091

3.8818

C4

1.9091

2.3818

C5

4.2182

4.7000

C6

4.0455

4.3000

Timeliness

T1

2.6785

2.7347

-1.082

0.284

Financial Reporting

Quality

3.2941

3.8827

-16.166

0.000

0

Source: Data Calculation

5 DISCUSSION

The overall financial reporting quality after the IFRS

adoption has increased the result is significant with

the level 1% significance. We found the quality of

financial reporting post IFRS adoption is increased

for qualitative characteristics of relevance,

understandability and comparability. However, we

found that faithful representation is decrease and for

timeliness it relatively the same. We presumed this

empirical result for the timeliness is caused by the

increasing demand for disclosures under IFRS,

which make the company may need longer time in

preparing the financial information. As for the

representational faithfulness, we found the

decreasing trend which we believe caused by the

extensive use of the estimation and fair value in

presenting financial information using the IFRS. The

result is in accordance with the Barth et al. (2008),

Yurisandi and Puspitasari (2015) study which

revealed that there was an elevating in the

accounting quality after the implementation of the

IFRS. By using the IFRS, the relevance of the

financial reporting is increasing compared to the use

of the US GAAP.

Completing the previous study, this research

found evidence that the comparability and

understandability is higher after the IFRS adoption.

The researchers presumed this happens because the

company is required to provide more disclosures. In

other word, our study proves that there is an

increasing in the financial reporting quality after

IFRS adoption. Further, the use of the principle-

based standard is elevating the quality of the

financial reporting by extending the disclosures.

6 CONCLUSIONS

This research aims to evaluate whether there is any

increasing in financial reporting quality after the

IFRS adoption, measured by the Nice measurement.

From the test result we concluded that IFRS

adoption increased the quality of financial reporting,

for qualitative characteristics of relevance,

understandability and comparability. Yet, faithful

representation level is decreased and timeliness level

remain the same, before and after IFRS adoption.

We conclude that IFRS adoption did increase the

quality of financial reporting. In the future, we

suggest other researchers to expand this research by

involving some other variables, such as involving

the professional judgments in evaluating the

financial reporting quality.

Qualitative Analysis of Financial Reporting Post Adoption of International Financial Reporting Standard - Comparative Study in South East

Asia

319

REFERENCES

Alali, F. A., Foote, P. S., 2012. The Value Relevance of

International Financial Reporting Standards: Empirical

Evidence in an Emerging Market. The International

Journal of Accounting, 47, 85-108.

Amstrong, C., Barth, M. E., Jagolinzer, A. D., Riedl, E. J.,

2008. Market Reaction to The Adoption of IFRS in

Europe. Working Paper. 09-32.

Barth, M. E., Landsman, W. R., Lang, M. H., 2008.

International accounting standards and accounting

quality. Journal of Accounting Research 46:467-498.

Daske, H., Hail, L., Leuz, C., Verdi, R., 2008. Mandatory

IFRS Reporting Around the World: Early Evidence on

The Economic Consequences. Journal of Accounting

Research, 46, 1085–1142.

Ewart, R., Wagenhofer, A., 2013. Accounting Standards,

Earnings Management, and Earnings Quality.

University of Graz. Working Paper.

FASB, 2008. Financial Accounting Series, Statement of

Financial Accounting Standards No. 1570-100:

Exposure Draft on an Improved Conceptual

Framework for Financial Reporting. Norwalk.

Healy, P., Wahlen, J., 1999. A review of the earnings

management literature and its implications for

standard settings. Accounting Horizons, 13(4), 365-

383.

IASB, 2008. Exposure Draft on an improved Conceptual

Framework for Financial Reporting: The Objective of

Financial Reporting and Qualitative Characteristics

of Decision-useful Financial Reporting Information.

London.

Iatridis, G., Rouvolis, S., 2010. The Post Adoption Effects

of The Implementation of IFRS in Greece. Journal of

International Accounting, Auditing and Taxation,

Volume 19, 55-65.

Karampinis, N., Hevas, D., 2011. Mandating IFRS in an

Unfavourable Environment: The Greek Experience.

The International Journal of Accounting, 46, 304-332.

Leuz, C., Verrechia, R. E., 2000. The Economic

Consequence of Increased Disclosures. Journal of

Accounting Research 38 (supplement 2000), 91-124.

Lin, H., Paananen, M., 2007. The Development of Value

Relevance of IAS and IFRS Overtime: The Case of

Germany. Working Paper.

NiCE Working Paper

http://www.ru.nl/economics/research/nice_working_p

apers/. Accessed at May 20, 2017

Sweeney, A. P., 1994. Debt Covenant Violations and

Managers’ Accounting Responses. Journal of

Accounting & Economics, 17, 281-308.

Watts, W., Zimmerman, Z., 1986. Positive Accounting

Theory, Prentice Hall.

Yacoob, N. M., Ahmad, C. A., 2011. IFRS Adoption and

Audit Timeliness: Evidence from Malaysia. The

Journal of American Academy of Business,

Cambridge, 17.

Yurisandi, T., Puspitasasri, E., 2015. Financial Reporting

Quality - Before and After IFRS Adoption Using NiCE

Qualitative Characteristics Measurement. Procedia,

Social and Behavioral Science.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

320