Does Investment in Digital Technologies Yield Digital Business

Value? The Digital Investment Paradox and Knowledge Creation as

Enabling Capability

Christian Riera

1

and Junichi Iijima

2

1

Department of Industrial Engineering and Management, Tokyo Institute of Technology,

Ookayama 2-12-1-W9-66, Meguro, Tokyo, Japan

2

Department of Industrial Engineering and Economics, Tokyo Institute of Technology,

Ookayama 2-12-1-W9-66, Meguro, Tokyo, Japan

Keywords: Digital Investment Paradox, Digital Business Value, Knowledge Creation Processes, Balanced SECI.

Abstract: This paper explores whether the investments in Digital Technologies relate to Business Value in

organizations and the role of Knowledge Creation. To evaluate this, data collected from Japanese Small and

Medium Enterprises from “Competitive IT Strategy SME Selection 100” list of 3 years was analysed by

correlation, regression and general linear model analysis. The direct effect that investment in Digital

Technologies had on Business Value was observed for Learning & Growth objectives. The influence that

the four processes of Knowledge Creation (SECI Model) had was explored and found that Combination

process was positively related with the investment in Digital Technologies for Financial and Learning &

Growth objectives. Externalization had a negative relationship with the investment in Financial objectives.

Although not verified statistically, a trend showed organizations with higher Knowledge Creation

Capabilities gained higher benefits from investment in Digital Technologies as the investment increased and

vice versa. Although the limitations of this study are related to the population characteristics and responses’

reliability, it was considered that the potential insights were valuable enough to overcome such limitations.

With this empirical study the concern of “Digital Investment Paradox” is raised and the debate is initiated

with Knowledge Creation as an enabling capability.

1 INTRODUCTION

Over the last decade there has been a shift on the

research agenda from what could be consider the

classical IT and Business alignment paradigm

towards an environment where business is more

digitalized and the organizations aim to transform

their business through Digital Technologies

(Bharadwaj et al., 2017). A change in focus from the

scenario where in order to achieve benefits from

technology it was required that Business strategy

shaped IT Strategy, towards a concern in how to

effectively use the available and emerging Digital

Technologies in a way organizations can enhance

their value proposition (Bharadwaj et al., 2017).

The increasing availability of Digital

Technologies such as SMACIT (Social, Mobile,

Analytics, Cloud and Internet of Things) brings a

new paradigm to organizations. Digital Technolo-

gies bring risks to organizations that have been

successful in the past and at the same time provide

new opportunities to combine their existing

competences with capabilities from the new

technologies (Ross et al., 2016b). Organizations face

challenges in order to do this effectively for example

choosing the right investment from the potential

opportunities and, synchronizing the activities of the

business units and people engaged in the delivery of

the new technology-based services (Ross, Sebastian

and Fonstad, 2015).

What started in the late 1980’s as the IT

Productivity Paradox (Brynjolfsson and Hitt, 1998)

was first explored from a input-output viewpoint

where the effort focused in linking IT investment

with organizational performance. The inconclusive

results led to look at the organizational

characteristics.

This study explores the “Digital Investment

Paradox” as the question: Is investment in Digital

208

Riera, C. and Iijima, J.

Does Investment in Digital Technologies Yield Digital Business Value? The Digital Investment Paradox and Knowledge Creation as Enabling Capability.

DOI: 10.5220/0006958202080215

In Proceedings of the 10th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2018) - Volume 3: KMIS, pages 208-215

ISBN: 978-989-758-330-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Technologies producing value for the organizations?.

The role of Knowledge Creation is considered as

evaluating Knowledge Management performance

has become an issue for the organizations in Europe,

Asia and America (Chen and Chen, 2006).

The terms business value and digital business

value are used in this study with the same meaning

and refer to the achievement of business objectives

by the use of Digital Technologies. Business

objectives use the categories from the Balanced

Scorecard: Financial-related objectives, Customer-

related objectives, Learning & Growth (L&G)

objectives (Kaplan and Norton, 1996).

The theoretical background of the research

comes from the Dynamic Capabilities Theory and

Knowledge-based view. Dynamic Capabilities

acknowledge that the market is dynamic and that

organization’s resources need to change over a

period of time to make them relevant to the changing

market condition (Teece, Pisano and Shuen, 1997).

Dynamic capabilities allow organizations to acquire,

shed, integrate and recombine their resources in

order to generate new value-creating strategies or

new sources of competitive advantage (Eisenhardt

and Martin, 2000; Grant, 1996; Pisano, 1994; Teece,

Pisano and Shuen, 1997). Such capabilities also

include knowledge creation routines that allow new

thinking to be created in the organization (Helfat,

1997). The role of Knowledge Creation theory from

Nonaka and Takeuchi’s SECI Model (Nonaka and

Takeuchi, 1995) was evaluated in this context as

knowledge is being considered one of the key

strategic assets for the organizations (Grant 1996)

and both knowledge creation phase and integration

also considered key assets for the organizations

(Lewin and Massini, 2004; Grant, 1996). The SECI

Model, an acronym for Socialization,

Externalization, Combination and Internalization, is

a model of organizational knowledge creation based

on the actions and interactions between tacit and

explicit knowledge. Knowledge Creating

Capabilities (KCC) derived from it emphasize the

importance of the balance between the 4 knowledge

processes (Riera, Senoo and Iijima, 2009).

This research revealed that:

The investment in Digital Technologies for a

certain type of business objectives was

positively related with the objective

achievement of such objectives.

Specific processes from the SECI Model

influenced the investment in Digital

Technologies. Both positive and negative

relationships were found.

The main contributions are as follows.

Provide insights suggesting that organizations

with higher Knowledge Creation Capabilities

gain higher benefits from investment in

Digital Technologies as the investment

increases and vice versa.

Identified evidence on the importance to

consider the type of business objectives when

investing in Digital Technologies.

Raised the “Digital Investment Paradox”

concern in the academia. The debate is

initiated by leveraging experiences from the

IT Paradox and explored Knowledge Creation

Capabilities as enabling capabilities.

2 FRAMEWORK AND

HYPOTHESES

This study explores the challenge that organizations

face on how to achieve value from Digital

Technologies. Knowledge Creation is proposed as

enabling capabilities for such relationship. The

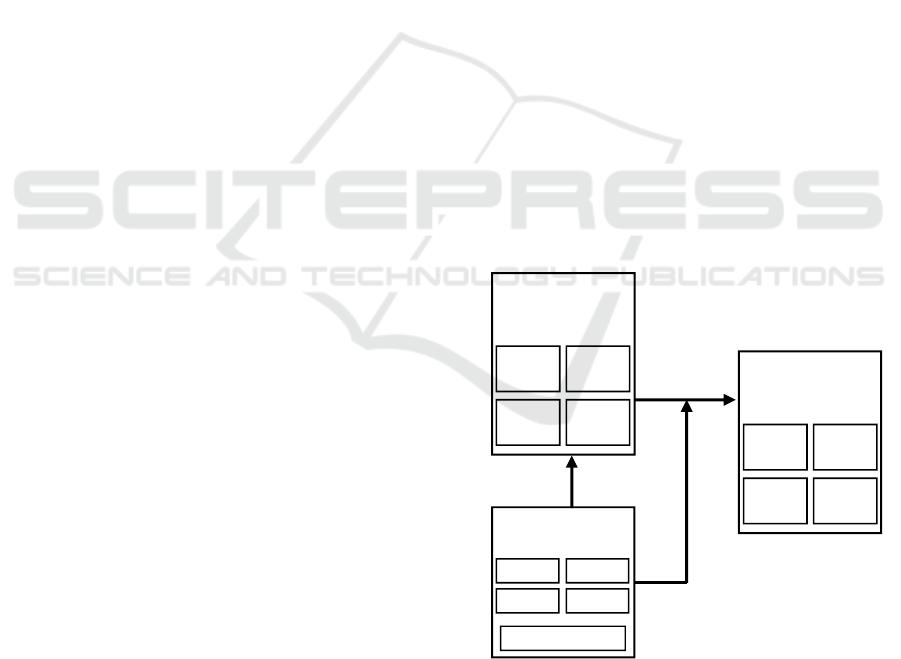

model is presented in Figure 1.

Figure 1: Model and Hypotheses.

Investment

in Digital

Technologies

Knowled

g

e

Creation

Di

g

ital

Business

Value

FI

CU

BP

LG

- FI: Financial-related business objectives

- CU: Customer-related business objectives

- BP: Business Process-related business objectives

- LG: Learning & Growth-related business objectives

- S: Socialization, E: Externalization, C: Combination,

I: Internalization

S E

CI

H1 (+)

H2 (+)

H3 (+)

FI

CU

BP

LG

Balanced SECI

Does Investment in Digital Technologies Yield Digital Business Value? The Digital Investment Paradox and Knowledge Creation as

Enabling Capability

209

The Hypotheses are described below.

H1: The investment in Digital Technologies is

positively related with the achievement of

business objectives.

H2: Knowledge Creation is positively related with

the investment in Digital Technologies.

H3: Knowledge Creation leverages the effect of

Investment in Digital Technologies on the

achievement of business objectives.

3 DATA AND MEASURES

3.1 Sample and Data Collection

The dataset was collected from Japanese Small and

Medium Enterprises awarded by The Ministry of

Economy, Trade and Industry “METI” in the list of

“Competitive IT Strategy SME Selection 100” in

2015, 2016 and 2017 (METI, 2017). SMEs in this

selection nominated themselves with concrete

examples of how with the use of technology

business had growth. Later on the Ministry selects

and publishes the list. The characteristic of self-

nomination together with the proven effective use of

technology made them an appropriate target for this

study and resulted in high response rate.

A questionnaire on the investment in Digital

Technologies, SECI and the achieved Business

Value from Digital Technologies was used.

A high response rate of 34% (34 out of 100

organizations answered the survey). The industry

composition came mainly from Manufacturing

(32%), Service (18%), Printing (12%), Wholesale

(12%), Construction (9%), and with few

participation from: Information and Communication,

Transportation, Gravel sampling, Food & Beverage,

Dental technology and other industries (3%).

A similar data set has been used previously

(Riera, Senoo and Iijima, 2009; Riera and Iijima,

2017).

3.2 Measuring the Investment in

Digital Technologies

The questionnaire included a section to capture the

percentage of investment in Digital Technologies

across four types of business objectives: Financial,

Customer-related, Business Process, Learning and

Growth. The organizations were first requested to

divide the total investment in IT for the past 3 years

into each of the four objective types using

percentage. Then from such investment they were

required to identify how much of the investment was

put on Digital Technologies. The list of Digital

Technologies included: SNS, Mobile, Analytics &

Big Data, Cloud, IoT, Artificial Intelligence, 3D

printing and a category as others.

The data collected was:

Percentage of investment in IT for the 4 types

of business objectives.

From that value, the % of investment in

Digital Technologies in each type of objective.

3.3 Measuring Digital Business Value

The organizations were asked to identify the

achieved objective level from investments in Digital

Technologies for each of the objective types. A four

level Likert scale was used: Not Achieved, Partially

Achieved, Highly Achieved and Fully Achieved.

Examples for each of the objective types were given

to provide concrete examples of each type. The input

variables collected were:

Level of business objectives achievement

from the investments in Digital Technologies

for: Financial, Customer, Business Process

and L&G objectives.

3.4 Measuring Knowledge Creation

Process (SECI Model)

The four knowledge processes from SECI Model

were assessed using 24 questions in which

behaviours from each knowledge conversion process

were described. 6 behaviours correspondent to each

knowledge process: Socialization, Externalization,

Combination and Internalization. The evaluation

consisted in asking the organizations to select 12 of

the 24 behaviours which most represent their

organization culture. The score for each knowledge

conversion process was the number of items selected

by the organizations for the process behaviours.

Finally, the concept of Knowledge Creation

Capabilities or “Balanced SECI” (Riera, Senoo and

Iijima, 2009) was calculated. This is done by taking

the minimal score between the four knowledge

conversion processes and focuses on the importance

of the balance to avoid knowledge bottlenecks in the

knowledge creation cycle or over-focus in a

particular knowledge conversion process.

The input variables collected were:

Score of Socialization, Externalization,

Combination and Internalization.

KCC (Balanced SECI) score was calculated as

the minimal score.

KMIS 2018 - 10th International Conference on Knowledge Management and Information Sharing

210

4 ANALYSIS AND FINDINGS

All the relationships were tested first by correlation

analysis (parametric and non-parametric tests) and

later on with regression analysis for the cases where

a relationship was suggested. The analysis was done

at overall and component level.

4.1 H1: Digital Investment Yields

Positive Digital Business Value

The correlation analysis did not identify a

relationship between the overall Digital Investment

and Digital Business Value. This suggested that the

achievement of business objectives with Digital

Technologies is not related with the investment

itself.

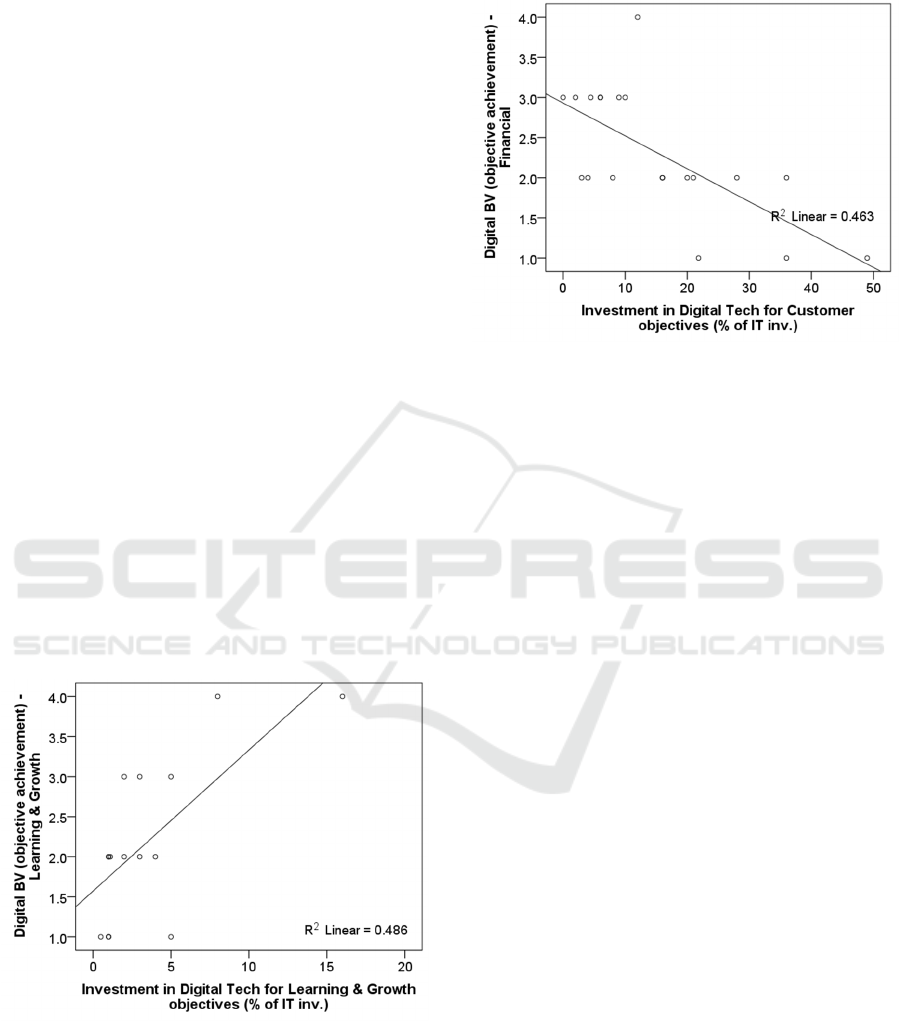

The exploration at the four business objectives

found results linking both the investment in Digital

Technologies and the objective achievement.

Correlation analysis identified a relationship

(r=0.697, sig=0.003, n=15) between the investments

in Digital Technologies for L&G objectives with the

level of achievement of such objectives. This was

confirmed by regression where a significant

equation was found (F(1,13)= 12.315, p<0.005),

with an R

2

of 0.486. Figure 2 shows the results.

The finding indicates that the more an

organization invests in Digital Technologies for

L&G objectives it would be likely that they would

be able to achieve such objectives.

Figure 2: Digital Investment in L&G objectives and its

achievement.

Additionally, a negative relationship was identified

between the digital investments for customer

objectives and the achievement of financial

objectives (r=-0.680, sig<0.001, n=20). This was

verified by regression (F(1,18)= 15.517, p<0.005),

with an R

2

of 0.463. Figure 3 show the results.

Figure 3: Digital Investment in Customer business

objectives and Financial objective achievement.

Such negative relationship suggests that the more

SMEs invest onto Digital Technologies in order to

achieve Customer business objectives; the

organization will see a decrease in the achievement

of Financial objectives and few or no impact on the

achievement of Customer objectives.

4.2 H2: Knowledge Creation Is

Positively Related with the

Investment in Digital Technologies

On an overall level the tests did not find a

relationship between KCC and Investment in Digital

Technologies.

Analysis of variance between the organizations

with Low, Medium and High KCC and the

investment in Digital Technologies did not produce

significant results. This implied that the score of

KCC was not related to the level of overall

investment in Digital Technologies.

The analysis by Knowledge Creation Processes

(S, E, C, I) against all of the four business objectives

types yielded the following results.

First of all, the correlation analysis identified a

negative relationship (r=-0.462, sig=0.017, n=26)

between SECI’s Externalization process and the

investments in Digital Technologies for Financial

objectives. This was found by Pearson’s correlation

analysis but not under Spearman’s tests. Regression

analysis found a significant regression equation

(F(1,24)=6.526, p=0.017), with an R

2

of 0.214. The

results can be seen in Figure 4.

Does Investment in Digital Technologies Yield Digital Business Value? The Digital Investment Paradox and Knowledge Creation as

Enabling Capability

211

Figure 4: SECI’s Externalization and Digital Investment in

Financial business objectives.

This suggests that the more an SME focuses on

the conversion of tacit onto explicit knowledge

(SECI’s Externalization); the more likely it will

route its Digital investments to financial objectives.

Secondly, positive relationships were found between

SECI’s Combination and the level of investments in

Digital technologies for Financial (r=0.398,

sig=0.044, n=26) and L&G (r=0.545, sig=0.005,

n=24) objectives. Regression confirmed such

relationship (F(1,24)=4.514, p=0.044) with an R

2

of

0.158 for investment in Financial objectives while a

regression (F(1,22)=9.319, p=0.006), with an R

2

of

0.298 for investments in L&G objectives (Figure 5).

Figure 5: SECI’s Combination and Digital Investment in

Learning & Growth business objectives.

Although weak, they indicate that the more an SME

is focused on integration or combination of explicit

knowledge in order to create new knowledge

(SECI’s Combination); the more likely it will route

investments in Digital Technologies to achieve

Financial or L&G objectives.

4.3 H3: Knowledge Creation Leverages

the Effect of Investment in Digital

Technologies on the Achievement of

Business Objectives

First of all an analysis on the overall effect that

Knowledge Creation Capabilities had on Digital

Business Value was tested with General Linear

Model. Although there were not significant results, a

positive trend can be seen in Figure 6.

Digital Business Value (Y-axis) scale is

represented by: 1 - Not achieved, 2 - Partially

achieved, 3 - Highly achieved and 4 - Fully achieved.

Figure 6: Influence of KCC (Balanced SECI) on Digital

Investment and Digital Business Value.

The figure show that when SME have low KCC the

benefits they get from Digital investment actually

decrease when investment increases. On the other

hand, when organizations have higher KCC the

benefits from investment in Digital Technologies

increase when the investment increases.

The analysis at component level was done based on

results from H1 and H2 and aimed to identify the

combined effects of KCC and Digital Investment on

L&G business objectives.

Digital BV on L&G objectives was the dependent

variable for the models. As the independent

variables first the level of investment in Digital

Technologies to achieve L&G objectives is used (1).

Then, the score of the Combination process from the

SECI Model becomes the independent variable in

the next model (2). Afterwards the independent

variables are combined in the last model (3). The

following equations specify the models. Table 1

summarizes the results.

KMIS 2018 - 10th International Conference on Knowledge Management and Information Sharing

212

DI_BV_LG =α + β×DI_Inv_LG

(1)

DI_BV_LG = α + β×Combination

(2)

DI_BV_LG = α + β×Combination +γ×DI_Inv_LG

+ δ×(Combination ×DI_Inv_LG)

(3)

The values for Adj. R

2

in (3) show no improvement

from the combined effects. This indicates that

although Combination score of an organization was

found to be related with the level of Investment in

Digital Technologies for various types of objectives

as identified by H2; it certainly does not have major

effect with the achievement of the objectives or

Digital BV. Multicollinearity tests confirmed no

collinearity (VIF=1.440) between the dependent

variables.

Table 1: Results of Hypothesis 3.

Model (1) (2) (3)

Constant 1.666*** 2.111*** 1.476***

DI_Inv_LG 0.190** 0.245**

Combination 0.450* 0.249

DI_Inv_LG *

Combination

-0.067

R

2

0.486 0.218 0.539

Adj. R

2

0.447 0.169 0.414

*, **, *** indicates sig. at the 90%, 95%, and 99% level

4.4 Updated Model

Figure 7: Updated Model.

5 DISCUSSION

5.1 Position of the Article

This study is built on the Dynamic Capabilities

theory and Knowledge-based view. This research

focused on Knowledge Creation process (Nonaka

and Takeuchi, 1995) since within this view

knowledge creation and integration are considered

perhaps the most important strategic organization

assets (Lewin and Massini, 2004).

With the main research question focused on the

challenge that organizations face from the risks and

opportunities that Digital Technologies bring (Ross,

Sebastian and Fonstad, 2015; Ross et al., 2016a;

Ross et al., 2016), this research first explored if level

of investment in Digital Technologies was related

with the benefits from them. This reflects a

phenomenon that has been explored largely as part

of the IT Productivity Paradox in which the returns

from IT investments were challenged (Brynjolfsson

and Hitt, 1998; Weill, 1992; Weill and Aral, 2007).

This study uses the term “Digital Investment

Paradox” to refer to the same challenge experienced

before for IT Paradox but this time focusing on the

investment of Digital Technologies.

5.2 Interpretation of the Results

H1 initially did not identify a relationship between

Digital Investment and the level or achievement of

objectives using such technologies (Digital BV).

These results are aligned with literature of IT

Paradox (Weill, 1992). This was nevertheless the

case when the analysis was done at the objective

type level. For the L&G objective type this

relationship was positive, suggesting that the more

investment in Digital Technologies would results in

a higher level of achievement of such objectives.

This could be explained by considering that in

one hand objectives in the L&G area are highly

dependent on people such as education, development

capability, retention and; in the other that some of

the most widely used Digital Technologies like

social and mobile rely on and connect people

facilitating their interaction. By this particular

people centred characteristic, the investment in

Digital Technologies on such objectives may

directly lead to the achievements. It could be easy to

acknowledge for example that if an organization

invests in social networking to increase

collaboration and knowledge sharing, the delivery

itself of such platform may result in such

collaboration increase.

(-.680*)

Digital Business Value

Investment in Di

g

ital Tech.

Knowled

g

e Creation

S E C I

FI

CU

BP

LG

FI CU

BP

LG

(.545**)

(.398*)

(-.462*)

H1

H2

(.697**)

- FI: Financial-related business objectives

- CU: Customer-related business objectives

- BP: Business Process-related business objectives

- LG: Learning & Growth-related business objectives

- S: Socialization, E: Externalization, C: Combination,

I: Internalization

Does Investment in Digital Technologies Yield Digital Business Value? The Digital Investment Paradox and Knowledge Creation as

Enabling Capability

213

It would be harder to justify similar direct

relationship between investment in Digital

Technologies and achievement of objectives for the

other three types of business objectives (Financial,

Customer and Business Process-related) as the

objectives may have several dimensions for example

if the objective is improving customer loyalty; it

may be not be achieved by the only deployment of a

digital technology but it may require a set of

additional factors that influence the customer

behaviour. This was confirmed by the empirical data

as no direct relationship was identified between the

investments on Digital Technologies on Financial,

Customer and Business Process-related objectives

and their achievement.

The negative relationship identified between the

investments in Digital Technologies for Customer-

related objectives with the level of achievement of

Financial objectives using Digital Technologies

could indicate an opposition between customer

centred-approach vs financial-centred approach that

organizations may take while deciding on

investments in Digital Technologies.

H2 explored if the Knowledge Creation

Processes from the SECI Model were able to

influence the digital investments decisions. The

results positioned the SECI Processes as influencer

on the Digital Technology investment results. At an

overall level the Balanced SECI was found to be

related with the level of investments on L&G

business objectives. This suggests that the higher

balance an organization has on its knowledge

creation process it is more likely that the level of

investments on Digital Technologies for L&G

objectives increase. This is a relationship worth to

note since it was already identified by H1 that the

investment in Digital Technologies in such

objectives type was actually related to its

achievement. Thus organizations may consider

increasing their knowledge creation process in order

to increase the achievement of L&G objectives using

Digital Technologies.

From the analysis of each Knowledge Creation

process, there were 2 processes from SECI Model

which had an impact on the digital investments.

Externalization and had a negative impact on the

investments in Digital Technologies for Financial-

related objectives. Such relationship indicates an

opposite focus in organizations between the aim to

make tacit knowledge available thru the conversion

to explicit in a way that can be shared within the

organization and the pursuit of Financial objectives.

Combination showed a positive relationship with

the investment in Digital Technologies to achieve

Financial and L&G objectives. From the nature of

the Combination process in which the knowledge

gathered both from outside and inside the

organization is processed to form new knowledge, it

could be expected that it relates to investment in

Digital Technologies of all objective types. Since the

empirical evidence found that relationship only with

two of the four objective types; it suggests that the

organizations with high score of Combination invest

more on Financial and L&G objectives.

H3 showed the effects that KCC had on the

relationship of Digital Investment and Digital BV. A

trend showed that when organizations with low KCC

invest in Digital Technologies, the benefits

decreased as the level of investment increased.

Similarly, the benefits increased as the level of

investment increased when organizations had high

KCC. Although this was not confirmed statistically,

it provides insights on the role of KCC.

On individual SECI processes, the combined

effects of SECI Model Combination and Digital

Investment on the achievement of L&G business

objectives were explored. The results instead

suggested that the combined effect did not differ

much from the scenario of sole effect.

The interpretation of all hypotheses is then that

KCC are related to the level of investment in Digital

Technologies in some types of business objectives.

And at the same time it was verified that the level of

investment in Digital Technologies for L&G

objectives and its achievement are related.

5.3 Further Work and Limitations

Additional organizational capabilities like Effective

Decision Making, Delivery Excellence, etc. may

enhance the understanding of the Digital Paradox.

The limitations of this study can be grouped into

two categories. The first relates to the target

population. All organizations belong to a selected

population embed in a country, culture and business

practices which could affect the answers. In addition,

the number of observations could be considered small

for a quantitative study. This was acknowledged but it

was considered that the benefits of selecting such

group would actually enrich the study findings.

The second resides on the accuracy of the data

collected as the data is as much as reliable as the

reliability of the participants. This study is

vulnerable to errors as the accuracy of the

responders could only be ensured as the participants

were in most cases the CEO or owners of the

organizations. Finally, qualitative exploration may

refine the findings.

KMIS 2018 - 10th International Conference on Knowledge Management and Information Sharing

214

6 CONCLUSION

The empirical evidence unveiled the relationship

between investment in Digital Technologies and the

Business Value under categories of objectives.

The exploration started in H1 by considering if

the investment itself can provide such value. The

results provided a positive answer but only for a

particular type of business objective: L&G.

Then H2 considered if Knowledge Creation

Process influenced the level of investments in

Digital Technologies. The answer was positive for

two types of business objectives: Financial and L&G.

H3 analysed the combined effects of Knowledge

Creation Process and Investment onto the Business

Value. The response this time was a negative answer.

The findings indicate the importance of

considering the type of business objectives Digital

Technologies support. Another contribution is

considering the Digital Investments not as

technology assets by themselves but actually linking

such investments with business goals.

The concern of “Digital Investment Paradox” is

raised and opens doors for new research. This debate

is initiated with Knowledge Creation as an enabling

capability and it deserves attention in order to

understand how to achieve business value from

Digital Technologies.

REFERENCES

Bharadwaj, A., El Sawy, O., Pavlou, P. A., Venkatraman,

N., 2013. Digital Business Strategy: Toward a Next

Generation of Insights. MIS Quarterly (37:2), pp. 471-

482.

Brynjolfsson, E., Hitt, M., 1998. Beyond the productivity

paradox. Communications of the ACM (41:8),

pp.49-55.

Chen, M., Chen, A., 2006. Knowledge management

performance evaluation: a decade review from 1995 to

2004. Journal of Information Science (32:1), pp. 17-

38.

Dedrick, J., Gurbaxani, V., Kraemer, K. L., 2003.

Information Technology and Economic Performance:

A Critical Review of the Empirical Evidence. ACM

Computing Surveys (35:1), pp. 1-28.

Eisenhardt, K. M., Martin, J., 2000. Dynamic Capabilities:

What Are They?. Strategic Management Journal (21),

pp. 1105-1121.

Grant, R. M., 1996. Prospering in Dynamically-

Competitive Environments: Organizational Capability

as Knowledge Integration. Organization Science (7:4),

pp. 375-387.

Helfat C., 1997. Know-how and asset complementarity

and dynamic capability accumulation. Strategic

Management Journal (18:5), pp. 339-360.

Kaplan, R., Norton, D., 1996. The Balanced Scorecard -

translating strategy into action, Harvard Business

Review Press. Boston.

Lewin, A., Massini, S., 2004. Knowledge Creation and

Organizational Capabilities of Innovating and

Imitating Firms. In: Organizations as Knowledge

Systems, Palgrave Macmillan. UK, pp. 209-237.

Ministry of Economy, Trade and Industry of Japan, 2017.

Competitive IT Strategy SME Selection 100. Available

at:http://www.meti.go.jp/english/press/2017/0531_003

.html (English) [Accessed 17 Feb 2018].

Nonaka, I., Takeuchi, H., 1995. The Knowledge-Creating

Company. Oxford University Press, New York, NY.

Pisano, G., 1994. Knowledge, integration, and the locus of

learning: an empirical analysis of process development.

Strategic Management Journal, Winter Special (15) pp.

85-100.

Riera, C., Senoo, D., Iijima, J., 2009. A Study of the

Effect of Knowledge Creating Capabilities on

Corporate Performance. International Journal of

Knowledge Management Studies. 3(1/2), pp. 116-133.

Riera, C., Iijima, J., 2017. Linking Knowledge Creating

Capabilities, IT Business Value and Digital Business

Value: An Exploratory Study in Japanese SMEs. In:

Proceedings of the 9th International Joint Conference

on Knowledge Discovery, Knowledge Engineering and

Knowledge Management (IC3K 2017 KMIS) (3), pp.

29-40, Funchal, Portugal.

Ross, J., Sebastian, I., Beath, C., Mocker, M., Moloney, K.,

Fonstad, N., 2016a. Designing and Executing Digital

Strategies. In ICIS 2016 Thirty Seventh International

Conference on Information Systems. Dublin.

Ross, J., Sebastian, I., Beath, C., Scantlebury, S., Mocker,

M., Fonstad, N., Kagan, M., Moloney, K., Krusell,

S.G., and the Technology Advantage Practice of The

Boston Consulting Group, 2016b. Designing Digital

Organizations. Working paper No.406. Centre for

Information Systems Research, Massachusetts Institute

of Technology. Cambridge MA.

Ross, J., Sebastian, I., Fonstad, N., 2015. Define Your

Digital Strategy - Now. Research Briefing (15:6).

Centre for Information Systems Research,

Massachusetts Institute of Technology. Cambridge.

Teece, D. J., Pisano, G., Shuen, A., 1997. Dynamic

capabilities and Strategic Management. Strategic

Management Journal 18(7), pp. 509-534.

Weill, P., 1992. The Relationship between Investment in

Information Technology and Firm Performance: A

Study of the Value Manufacturing Sector.

Information Systems Research (3:4), pp. 307-333.

Weill, P., Aral, S., 2007. IT Assets, Organizational

Capabilities and Firm Performance: How Resource

Allocations and Organizational Differences Explain

Performance Variation. Organizational Science 18(5),

pp. 763-780.

Does Investment in Digital Technologies Yield Digital Business Value? The Digital Investment Paradox and Knowledge Creation as

Enabling Capability

215