Effort Allocation in Taxation Task: An Effort Experiment

Alfa Rahmiati

Departemen Akuntansi, Fakultas Ekonomi dan Bisnis, Universitas Airlangga, Surabaya, Indonesia

alfa@feb.unair.ac.id

Keywords: Effort Allocation, Task Performance, Taxation Experiment.

Abstract: As the AEC (Asean Economic Community) starts to be applied in the ASEAN region, there are changes in

the domestic and global tax landscape. Domestic tax issues suddenly become global and addressed by many

countries in the ASEAN. Particularly, Indonesia is challenged to be competitive and to improve the capacity

of its tax administrative officers and employees because, during the AEC era, the ASEAN market will be

looking for tax experts who are ready to work and apply their tax knowledge directly. We argue in this

paper that the method of effort allocation in doing taxation clerical tasks can influence one’s task

performance. We perform an experiment that focuses on two questions. First, does effort allocation

influence task performance in taxation? Second, how can we explain this influence? We conduct the

experiment on accounting students as a surrogate for tax experts. We report a result that shows there are no

significant differences between the subjects’ performance under both effort allocation methods to do some

taxation tasks. Overall, this result could contribute to many companies mainly for strategic or policy

formulation in doing taxation clerical tasks. Some suggestions about avenues for future research are also

presented.

1 INTRODUCTION

Globalization is not a new phenomenon. The

“boundaries” between countries began to disappear.

The business environment demands more disclosure

of information as trading volume increases and this

is largely performed by the taxpayer and

multinational agencies. There are changes in the

domestic and global tax landscape. Domestic tax

issues suddenly become global and are addressed by

many countries.

Moreover in the ASEAN community, by the end

of 2015, AEC starts to be applied. This means five

pillars, namely that the flow of goods, services,

capital, investment and skilled labor will be freely

moving around the ASEAN region. As a

consequence, this will influence the taxation aspect

among the ASEAN. Sulistyo (2014) states that

withholding tax and double taxation issues between

ASEAN countries should be considered carefully

because of certain reasons.

For the Indonesian government, particularly the

Directorate General of Tax and Fiscal Policy

Agency (the tax authoritiry in Indonesia), it is a

challenge to harmonize the rules and the expansion

of the avoidance of double taxation. AEC policy is

also of increasing attention to stakeholders, mainly

in managing their corporate taxation policy

appropriately according to state and international tax

stipulations. The objective is to avoid the risk of bad

reputation due to tax penalty. Governments also

reform their tax policies. Some countries in the

ASEAN community have started to have lower tax

rates and more tax incentives. This is a form of tax

competition, to improve the competitiveness of a

country.

Meanwhile, Indonesia is challenged to increase

its tax ratio. In order to do this, the capacity of tax

administration should be improved. In fact,

currently, tax experts who work in some government

institutions are people who do not always understand

accounting and tax law sufficiently. During the AEC

era, the ASEAN market will be looking for tax

experts who are ready to work and apply their tax

knowledge directly. As international taxation

regulations are dynamic, it will not be easy to obtain

such a tax expert because such experts are currently

scarce and there will even be a shortage in the labor

market. This means organizations must spend more

in having a tax expert in their human resources;

moreover, a tax expert (tax accountant) is one of

Rahmiati, A.

Effort Allocation in Taxation Task: An Effort Experiment.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 31-36

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

31

eight professions that will compete more during the

AEC era (Idris, 2016).

Evidence on tax performance from experimental

research is still limited and has been criticized for

low generalizability (Gangl et al., 2014). However,

the experimental method allows deeper analysis of

the causal relationship as the researcher could

control variables being researched and picture the

real process of taxation clerical tasks. This is one of

the reasons why this research is important.

Moreover, to our knowledge, taxation researches in

Indonesia using an experimental design are still very

rare.

The literature of the resource-based view (RBV)

theory was addressed to account for this

phenomenon. An organization was described as a set

of resources, including its human resources, such as

the tax experts. From the variety of activities and

services of these resources, an organization was able

to create uniqueness. A tax expert possesses specific

tax skills, including managerial and entrepreneurial

skills. Competition occurs due to differences in such

ownership and resource profiles that exist within

organizations. This profile will determine the

organization’s ability to achieve competitive

advantage in running its business strategy (Brahma

& Chakraborty, 2011).

This paper considers the response to a subject

from an experiment designed to investigate the

performance under various effort allocation policies.

The subject consists of students who have taken a

taxation course. This course is aimed to provide

them with knowledge and competency in taxation

clerical work (i.e. calculating, paying and reporting

tax liable). This paper will report the result of the

subject in different experimental treatments. The

first setting investigates the effects on the corporate

effort allocation method in which the subject must

perform a taxation clerical task while the second

setting introduces the self-effort allocation method.

Section 2 presents theoretical considerations and

hypotheses about the effect of the effort allocation

method on taxation task performance. Section 3

introduces the design of the experiment, while the

results are explained in section 4. This paper ends

with some discussion and conclusions in section 5.

2 LITERATURE REVIEW

The Resource Based-View theory was developed by

Penrose in 1959. There are two basic assumptions in

this theory, namely: 1) the resources and capabilities

of an organization are distributed heterogeneously;

2) resources and capabilities cannot be mobilized

easily. The resources and capabilities basically will

be worth more to produce a competitive advantage.

Factors that can make a resource have high value are

their demand, scarcity and appropriability. These

factors are important but not sufficient for

organizations to gain a sustainable competitive

advantage. Therefore, from a strategic perspective,

RBV theory suggests that organizations should

identify the resources and capabilities that are

relevant to the exercise of the strategy by taking into

account various factors that cause a resource, and

organizational abilities have more value (Collis &

Montgomery, 2005).

Prior researches have reported that effort

allocation influences task performance. Ward (1992)

argues that the fitness of effort allocation will create

competitive advantages, thus helping an

organization to retain its competitive position, i.e.

the best performance. Bhargava et al. (2001)

evaluated the equity manager’s performance in the

international market. When the manager allocates

their effort using asset as the proxy, it increases their

performance. This means effort allocation can

positively influence performance.

On the other hand, Lee et al. (2015) explored

how individuals with high and low intelligence

allocate their cognitive resources when they are

presented with various task difficulties. The result

shows that the allocation strategy is influenced by

the type and difficulty of the task. In the case of

mathematical tasks (e.g. taxation calculation in this

research), it found that all level of intelligent

individuals had no significant differences in

allocating their effort compared to the case of a

visuo-spatial task.

Despite a large amount of research on the topic

of effort allocation, few empirical studies on effort

allocation have been conducted in the taxation field.

The effort allocation in taxation is a particularly

important topic of research, as mentioned earlier, as

the effort of tax experts has become more valuable.

We hypothesize that the self-effort allocation

method will improve a tax expert’s performance

better than will the corporate effort allocation

method, and the null hypothesis is that the

performance would be equal under both allocation

methods. The explanation is as follows. The effort

allocation method is one form of corporate strategy

implemented on an individual level in an

organization. Many studies have proven that strategy

will influence performance. The self-effort

allocation method is a strategy formulated by the tax

expert him or herself, while the corporate effort

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

32

allocation method is formulated by a corporate

entity. If someone is involved in formulating a

strategy, he or she would have better understanding

and be more motivated to execute it, and thus have a

higher probability to achieve the objective, for

example, to make best job performance.

3 METHODOLOGY

To test the hypotheses, an experiment was set up in

2017. The advantages of an experiment design are

the possibility to create certain situations from

experiment procedures, observe and then make an

interpretation of the result (Nahartyo, 2012). The

experiment was conducted in the Faculty of

Economics & Business, and 40 subjects participated

in it.

Subjects were students as a surrogate for tax

clerks. They are undergraduate accounting students

(Strata 1, bachelor degree) who possess taxation

competency from the subject Taxations. According

to Chang et al. (2002), competency or knowledge

obtained from the academic environment will give

more influence to task performance. Thus, students

are also appropriate to be elected as the subjects in

this experiment.

We conducted a between subject experiment to

address the first question, which is to identify the

effect of different effort allocation methods on

individual performance in taxation tasks. Firstly, the

subject will be presented with three rounds of

taxation tasks. Some subjects were given specific

times to finish tasking. We call this treatment the

corporate allocation method. They should comply

with the timing policy as the proxy of effort

allocation. The other subjects can decide how much

time they will consume to do the taxation tasks. We

call this treatment the self-allocation method.

3.1 Material and Instrument

Each subject in the experiment is playing role as a

tax expert. Every tax expert is assigned to do three

rounds of taxation clerical tasks. These consist of

calculating tax liable, paying the amount of tax, and

tax reporting to tax authority. This setting

implements the fundamental elements of self-

assessment of most tax collection systems in

Indonesia. All tasks are given in paper-based case

material. A hypothetical company profile named PT

ABQ is presented. This company has three branches,

ABQ1, ABQ2, and ABQ3. Each branch has a certain

amount of monthly sales revenue.

An experiment instrument is prepared for each

subject, which provides some items to be chosen by

the subject as their responses to the case material.

The first task is calculating company tax liability.

Some tax calculating steps are provided in the

instrument. The subject must choose which step

should be taken in order to derive tax liable. The

second round is paying the tax. The subject must

choose to which place the tax will be paid. Finally,

the last task is reporting the tax to the chosen tax

authority.

3.2 Procedure and Treatment

The experiment was conducted in 2017. This

research analysis is based on data collected from

subjects during that period. These subjects were

invited to perform the experiment on a voluntary

basis. Forty subjects were invited to a classroom.

The experiment is begun by providing them with

some briefing instructions. These instructions

explained the treatment during the experiments.

The experiment procedures can be described as

follows. The subjects were brought into a classroom,

told that they are performing as tax experts in a

company, and they are assigned a tax clerical task.

Each subject was seated individually, and then a

booklet of material and instrument was provided.

The experimenter read the instructions before the

experiment was begun and subjects were given an

opportunity to ask questions to make sure they

understood the process. By the end of the

experiment, subjects had to fill in a paper form with

a pencil concerning their identity and opinion about

the experiment.

There are two treatments of effort allocation in

the experiment: 1) corporate method; and 2) self-

effort method. Under the corporate allocation

method, the task effort is determined by the

corporate entity, while the other method allows

subjects to do self-planning in their task effort. For

treatment of the corporate allocation method,

subjects were assigned to do some taxation tasks

under a certain time allocation to reflect their effort.

They must do the task by filling the answer in the

instrument provided. After they have completed the

task, the experimenter will measure their task

performances. For treatment of the self-allocation

method, firstly each subject is asked to allocate time

based on their judgments to complete the task, and

then after they have completed the task, the

Effort Allocation in Taxation Task: An Effort Experiment

33

experimenter will measure their task performances.

Each subject was asked to state which allocation

method they preferred. Then, they must do the task

according to each allocation method’s description.

4 EXPERIMENT RESULTS

Data are drawn from 40 subjects (students). To

verify that tax performance had been implemented

as expected, a manipulation check is conducted by

using a post-experiment interview. This method is

the best way to ask for a self-performance report

(Foschi, 2014). The result of the manipulation check

is that no participants should be excluded from the

data analysis because all participants know exactly

what tax performance and tax clerical task must be

done.

The data evaluation will be analyzed with a

conventional statistical method, as the number for

observation is only small. Since the hypothesis is to

compare between different subjects’ tax

performances, we use a t-test as the main statistical

analysis method. However, for robustness in the

result, we also perform ANOVA to reconfirm the

result of the t-test.

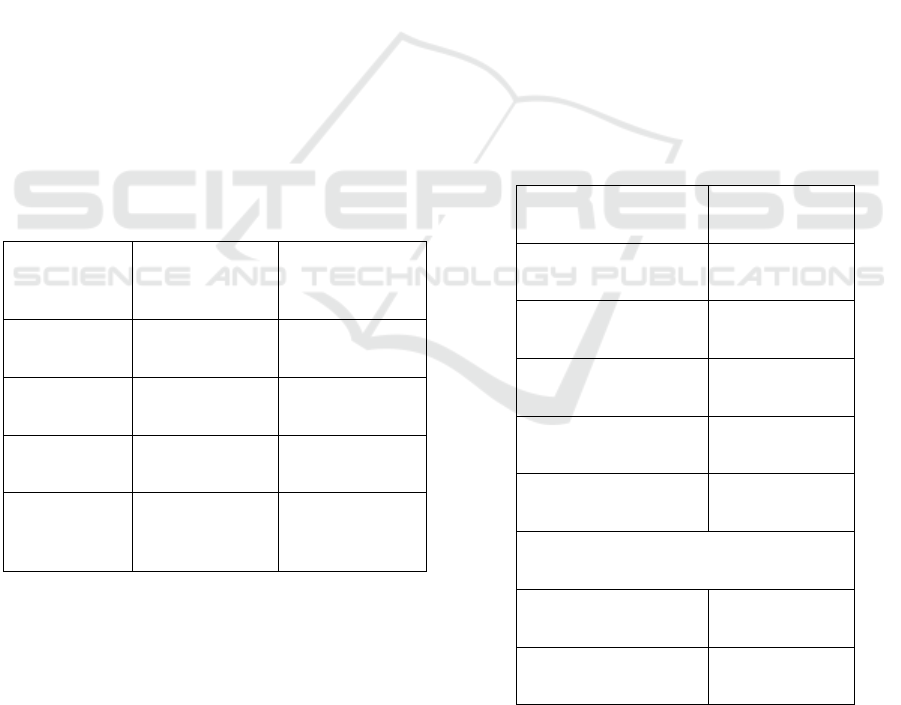

Table 1: Descriptive statistics of tax performance.

Effort

Allocation

Corporate

Self

N

21

19

Mean

3.6667

3.3684

Std. Deviation

1.0165

1.2565

Std. Error

Mean

0.2218

0.2882

Table 1 summarizes the descriptive statistics of

40 subjects’ performance (total N = 40). The

allocation method column presents both conditions

in the experiment; means of each participant’s

performance, standard deviation and standard error

under both methods are also displayed in other

columns. Twenty-one subjects preferred to do the

task based on the corporate allocation method, while

19 subjects preferred the other method. As we can

see in table 1, subjects under the corporate allocation

method have a higher performance mean (3.667 >

3.368). It seems the strategy of using the self-

allocation method does not create positive

motivation for the subject to accomplish the task.

However, the means difference still must be tested

statistically to confirm the statistical significance of

the experiments conducted in 2017. This research

analysis is based on data collected from subjects

during that period. These subjects were invited to

perform the experiment on a voluntary basis. Forty

subjects were invited to a classroom. The

experiment is begun by providing them with some

briefing instructions. These instructions explained

the treatment during the experiments.

An independent samples test is performed to

compare both means. Data assumes equal variance

because the result of the Levene test for equality of

variance is not statistically significant (p = 0.158).

Therefore, we use the result of the t-test on equal

variance assumed. Table 2 reports the result of the t-

test. The value of p is greater than 0.05. This means

the effect is not significant at 5% level for tax

performance in all task rounds. As the result of the t-

test is not significant, we do not perform ANOVA.

Table 2: Result of t-test (Tax Performance).

Description

Value

T

0.829

Df

38

Sig. (2-tailed), p value

0.412

Mean difference

0.29825

Std. Error difference

0.35986

95% Confidence Interval of the Difference

Lower

-0.4303

Upper

1.02675

After the experiment, subjects had to fill in a

paper form in pencil concerning their identity and

opinion about the experiment. There are some

questions to gauge their opinion about the tax

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

34

clerical task and distrust level of the tax authority in

handling tax revenue. Interestingly, subjects in both

allocation groups have different distrust levels (see

table 3). In the table, the mean of subjects in the

corporate allocation method is higher (2.5714 >

1.6842) and in table 4 we can see the mean

difference is statistically significant (p < 0.05).

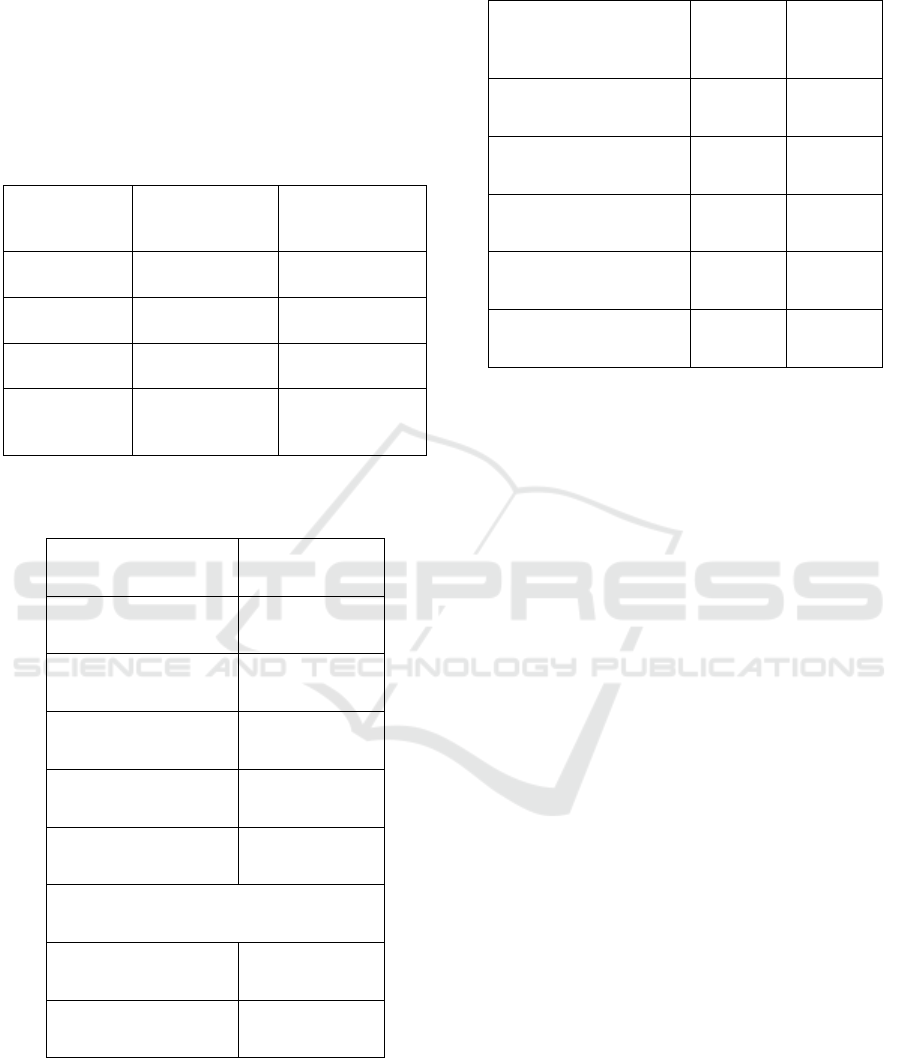

Table 3: Descriptive statistics of Distrust Level.

Effort

Allocation

Corporate

Self

N

21

19

Mean

2.5714

1.6842

Std Deviation

1.32557

1.10818

Std. Error

Mean

0.28926

0.25423

Table 4: Result of t-test (Distrust Level).

Description

Value

T

2.283

Df

38

Sig. (2-tailed), p value

0.028

Mean difference

0.88722

Std. Error difference

0.38863

95% Confidence Interval of the Difference

Lower

0.10048

Upper

1.67395

Table 4 reports the result of t-test for Distrust

Level. The value of p is < 0.05. As the result of the

t-test being significant, we also perform ANOVA for

robustness. The ANOVA test result is presented in

Table 5.

Table 5: ANOVA (Distrust Level).

Description

Corrected

Model

Intercept

TIII Sum of Square

7.852

180.652

Df

1

1

Mean square

7.852

180.652

F

5.212

119.913

Sig.

0.028

0

5 DISCUSSION AND

CONCLUSION

The purpose of this experiment was to test the

hypothesis that the corporate effort allocation

method will improve individual performance in

taxation tasks. In order to do so, this experiment

utilized an effort allocation manipulation to

demonstrate that the effort allocation method affects

the performance of tax experts. To our knowledge,

this is the first study to examine how effort

allocation influences people in doing their taxation

clerical tasks in Indonesia.

Based on preferences, some subjects in the

experiment were asked to obey the corporate timing

policy for completing all taxation tasks or were

given the authority to arrange the time taken

themselves. In this experiment, however, we cannot

find evidence that effort allocation method affects

taxation task performance. The effects we observed

were not consistent with Cheng and Yang (2013),

who found that the self-allocation method improved

the task performance.

Despite a policy implemented by a company,

apparently an effort allocation method does not

influence performance in taxation clerical tasks.

Hence, from the RBV point of view, it is not an

appropriate tool for achieving competitive advantage

(in taxation) because it has no abilities to create

more value or performance to an organization

(Collis & Montgomery, 2005). Therefore, this

experiment is not consistent with Ward (1992) and

Bhargava et al. (2001). As a tax expert is allowed by

the corporation to decide his own effort allocation,

Effort Allocation in Taxation Task: An Effort Experiment

35

he will consider that the company trusts him well to

do the task according to his way. However, taxation

is not just a matter of trust from the employer, but

also the level of trust to the tax authority.

Meanwhile, the step of taxation clerical task has

been regulated by the authority, so it cannot be

modified against the stipulation.

In conclusion, our experiment result suggests

that the effort allocation method could not provide

any effect on taxation task performance. This

experiment provides different evidence that tax

experts do not regard effort allocation as an

important method in doing their taxation tasks,

suggesting that their work effort cannot influence

their performance. According to the result of the

debriefing discussion stage with subjects, most of

them have the opinion that tax is a law, enforced by

the tax authority. It is a forced obligation, which

might bring tax sanctions or fines if one does not

comply. Therefore, people tend to comply with the

tax regulations, and would not make excuses to try

and bargain.

The effort allocation in taxation tasks is

apparently more associated with the level of trust in

the tax authority, mainly on how the tax authority

handles the tax revenue. In this experiment, subjects

who preferred to do taxation clerical tasks under the

corporate allocation method have more expectation

that the government will more effectively manage

the tax revenue.

A limitation of this study is that effort allocation

is regarded as the main factor that affects each

subject’s performance. Thus, the finding of this

experiment cannot fully reflect the real situation in

the taxation division of a company. It is possible that

a further experimental study will analyze the real

taxation situation more deeply by adding other

factors or treatments such as bookkeeping period

(near the end of a month, or beginning of a month),

resource heterogeneity, gender, tax knowledge, tax

training, aspect of tax authority, etc.

In order to strengthen the generalizability level

or external validity, this experiment can be

replicated or even extended to other subjects.

Findings on different opinions about tax from other

subjects in doing taxation clerical tasks would be a

potential and interesting topic for further analysis.

REFERENCES

Bhargava et al. (2001). The Performance, Asset Allocation

and Investment Style of International Equity

Managers, Review of Quantitative Finance and

Accounting 17 (4) 377.

Brahma, S and Chakraborty, H. (2011). From Industrry to

Firm Resources: Resource-Based View of

Competitive Advantage, IUP Journal of Business

Strategy 8(2).

Chang et al. (2002). Managers Resource Allocation:

Review and Implication for future research, Journal of

Accounting Literature 21, 1-37.

Cheng, C. and Yang, L. (2013). The influence of

budgetary participation by R&D managers on product

innovation performances: The effect of trust, job

satisfaction and information asymmetry. Asia Pacific

Management Review.

Collis, D. and Montgomery, C. (2005). Corporate

Strategy: A Resource Based Approach; McGraw-Hill

International Edition.

Foschi, M. (2014). Chapter 11 - Hypotheses,

Operationalizations, and Manipulation Checks,

Editor(s): Murray Webster, Jane Sell, In Laboratory

Experiments in the Social Sciences (Second Edition),

Academic Press, 2014, Pages 247-268.

Gangl et al. (2014). Effects of supervision on tax

compliance: Evidence from a field experiment in

Austria, In Economics Letters, Volume 123, Issue 3,

2014, Pages 378-382.

Idris, M. (2016). 8 Profesi Bebas Bekerja Lintas ASEAN,

http://finance.detik.com/, (accessed Online September

2016).

Lee, G. (2015). Modulation of resource allocation by

intelligent individuals in linguistic, mathematical and

visuo-spatial tasks, International Journal of

Psychophysiology, Volume 97, Issue 1.

Nahartyo. E. (2012). Desain dan Implementasi Riset

Eksperimen, Yogyakarta, UPP STIM YKPN

Sulistyo, B. (2014). Pajak Bersiap Hadapi Kawasan Bebas

ASEAN, https://www.kemenkeu.go.id/media/4425

(accessed online November 2017).

Ward, K. (1992). Strategic Management Accounting,

(accessed online November 2017).

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

36