Determinants of Capital Structure and Its Impact on Firm Value on

Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

Diana Dwi Astuti, Isti Fadah, Hari Sukarno, Nurhayati

Faculty of Economic and Business, University of Jember, Jember, Indonesia

diana@stie-mandala.ac.id, istifadah1966@gmail.com, {harisukarno, nurhayati}@unej.ac.id

Keywords: Capital Structure, Firm Value, Macro Variabel, Micro Variable.

Abstract: Aims of this study are to analyze the direct effect of macro variables on capital structure and firm value; to

analyze the effect of capital structure on firm value, and to analyze the indirect effect of macro and micro

variable to firm value through the capital structure as intervening variable. The analysis method is path

analysis. Samples are 34 and 39 manufacturing companies in IDX and SET in 2010-2015. Novelty: Makro

and mikro variable, Capital Expenditure, Cost of Financial Distress, and path analyst. The result shows that

macro variable has no significant effect to capital structure and firm value in IDX and SET, ROA has a

significant negative effect to capital structure and have a significant positive effect to firm value. CAPEX

has the significant effect on the capital structure and firm value, Non-Debt Tax Shield only have the

significant effect on firm value in IDX. NDTS significant effect on capital structure while capital

expenditure and asset structure have an effect on Significant to firm value in SET; Capital structure has

significantly influences the value of firms in IDX and SET; Inflation, ROA, NDTS, asset structure, CFD has

significant influence to firm value through capital structure in IDX, in SET that has significant influence to

firm value through capital structure is the exchange rate, NDTS and CFD.

1 INTRODUCTION

In 2015 Indonesia and other Asian countries face

challenges in the economic sector due to the

normalization of China's economic growth,

continued slowdowns in the Japanese economy,

falling commodity prices, and the possibility of

rising US Federal Reserve's benchmark interest rate.

The impact of this recession on Asian countries is

the interest rate increase the local currency exchange

rate against the value of the dollar weakened, so that

also affects the price (value) shares weakened.

Following the development of economic growth in

Southeast Asian countries (Indonesia, Malaysia,

Singapore, Thailand, and Philippines) for 5 years

(2010-2014).

Table 1: Economic growth of ASEAN countries

(Percent/year).

ASEAN

Country

2010 2011 2012 2013 2014

Indonesia

Malaysia

Filipina

Singapura

Thailand

6,23

7,55

7,68

15,40

7,90

6,50

5,20

3,70

5,30

0,20

6,25

5,63

6,80

2,50

6,75

5,78

4,70

7,23

3,85

2,90

5,00

6,00

6,05

2,90

0,65

average 8,95 4,18 5,59 3,54 4,12

From the Table 1, we can see that Indonesia's

economic growth continues to decline and Thailand

tends to experience a very fluctuating decline.

Astuti, D., Fadah, I., Sukarno, H. and Nurhayati, .

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and Thailand Stock Exchange (SET).

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 43-53

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

43

Following the inflation rate of Southeast Asian

countries for 5 years.

Table 2 Inflation rate of ASEAN countries

(Percent/year).

ASEAN

Country

2010 2011 2012 2013 2014

Indonesia

Malaysia

Filipina

Singapura

Thailand

5,33

1,73

3,73

3,13

3,23

5,13

3,23

4,75

5,30

3,68

3,93

1,55

3,05

4,88

3,28

6,60

2,30

3,18

2,10

2,03

6,73

3,03

3,85

0,93

1,73

average 3,43 4,42 3,4 3,24 3,25

From the data above that Indonesia's inflation

rate tends to increase and Thailand has decreased.

With the instability of economic growth and

inflation rate, it will affect the condition of corporate

financial management that will affect the stock price

(firm value).

The goal of a go public company is to maximize

shareholder wealth. Increased shareholder wealth is

achieved by increasing the value of the company.

Jansen (2001) explains that maximizing the value of

a firm is a trade-off of a firm's value received over a

long period. The firm value will be reflected in the

stock price, where the stock price decreases then the

firm value will also decrease so that will affect the

decrease prosperity shareholders.

Factors affecting firm value are macro and micro

factors. Macro factors are seen in economic factors

such as inflation, interest rates, exchange rates,

economic growth. Micro factors derived from

financial management policies, including investment

policy, funding policy, and dividend policy. Funding

policy is a very important factor in determining the

firm value because the funding policy is used for

corporate activation activities for the company to run

continuously in the future. The funding policy is

concerned with determining the right capital

structure for the company, the funding decision is

how the company determines the optimal funding

source to fund various investment alternatives, so as

to maximize the firm value reflected in the stock

price. The debt usage policy in the capital structure

provides a signal or sign to investors that with the

company's funding policy affecting firm value

(Masdar Mas'ud, 2008: 59). High firm values lead to

increased investment and increased capital structure.

The optimal capital structure according to Napa I.

Awat and Muljadi (2006: 34) is a capital structure

that can maximize the market value of the company

by minimizing the average cost of capital. Therefore,

in order for these conditions to be achieved, it is

necessary to consider the variables affecting the

capital structure.

The funding decision is related to determining

the right capital structure for the company, the

funding decision is how the company determines the

optimal funding source to fund various investment

alternatives, so as to maximize the value of the

company reflected in the stock price. The debt usage

policy in the capital structure provides a signal or

sign to investors that with the company's funding

policy affecting firm value (Masdar Mas'ud, 2008:

59). High firm values lead to increased investment

and increased capital structure. The optimal capital

structure according to Napa I. Awat and Muljadi

(2006: 34) is a capital structure that can maximize

the market value of the company by minimizing the

average cost of capital. Therefore, in order for these

conditions to be achieved, it is necessary to consider

the variables affecting the capital structure.

The determinants of capital structure (DAR) and

firm value (PBV) in this study are: Micro variable

(inflation, interest rate, exchange rate, gross

domestic product (GDP)) and micro variable

(Profitability / ROA, Non Debt Tax Shield / NDTS,

Capital Expenditure / Capex, asset structure, Cost of

Financial Distress / CFD).

The theory of conventional capital structure

(Mayers, 1997; Jensen 1986) states that the firm's

optimal capital structure is related to the costs and

benefits associated with debt and equity financing.

The trade-off Theory, states that a company subject

to taxes should increase its debt level to the marginal

value of the tax limit from the cost of any possible

financial difficulties. The tradeoff theory in capital

structure theoretically balances the tax advantages of

borrowing to cover the costs of financial difficulties.

Another study by Mayers and Majluf, 2001, in

Packing Order Theory (POT) is based on

asymmetric information problems. Myers and

Majluf predict that firms prefer internal financing to

finance investments and if they use external funding

it will use debt in advance of equities.

Profitability is a variable affecting the capital

structure. In this research, profitability is represented

by Return On Assets (ROA), that is by comparing

net income with total assets of company. According

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

44

to Weston and Brigham (2001:713), firms with high

ROA, generally use relatively small amounts of

debt. This is due to the high return on assets,

allowing the company to capitalize with retained

earnings only. This research has been done by

Deesomsak, et al (2004), Delcoure (2006) and

Huang & Song (2006) which resulted that

profitability negatively affect the capital structure.

However, not only that, another assumption says that

high return on assets means that the company's net

profit is high, so if the company uses large debt it

will not affect the capital structure, because the

company's ability to pay interest is also high. High

returns make it possible to finance most of the

funding needs with internally generated funds. It has

also been conducted empirical research by Titman

(1988), Moh'd (1998), Ekstrom and Kanaporyte

(2015), and Hossain (2015) which shows that

profitability has a positive effect on the company's

capital structure.

The theory proposed by Weston and Copeland

(1999: 35) sales growth is a variable affecting the

capital structure. Brigham and Houston (2004: 39)

also say that firms with relatively stable sales can be

safer to get more loans and bear a higher fixed

burden than companies with unstable sales.

Empirical research by Krishnan (1996), Badhuri

(2002), Mohamad (1998), and Majumdar (1999)

indicate that the growth of sales (growth of sales) is

one variable that affect the capital structure of the

company. The higher the asset structure the higher

the capital structure means the greater the fixed

assets that can be used as debt collateral by the

company. Conversely, the lower the asset structure

of a company, the lower the ability of the company

to be able to guarantee its long-term debt. This is in

accordance with the theory of Weston and Brigham

(2001: 713), that firms that have assets as debt

collateral tend to use larger amounts of debt. Assets

referred to as collateral for debt are fixed assets.

Financial Distress is a condition where

companies are experiencing financial difficulties and

are threatened with bankruptcy. If the company goes

bankrupt, there will be bankruptcy costs incurred by:

the forced selling of assets below market prices, the

cost of corporate liquidation, the destruction of fixed

assets eaten before selling, etc. These costs include

Direct Cost of Financial Distress. In general, the

likelihood of occurring financial distress increases

with the increasing use of debt. Cost of Financial

Distress is the variability of earnings and can be a

measure of a company's business risk, then the

prospective creditor tends to lend to companies that

have relatively stable earnings. The higher the

company's earning variability, the lower the

company's debt utilization. Research Chen (2004)

found a not significant relationship between

financial distress and laverage.

Tax Shields Effects by using Non-Debt Tax

Shield (NDTS) is the amount of non-cash costs that

lead to tax savings and can be used as capital to

reduce debt. The tax savings can come from

depreciation and amortization. Depreciation and

Amortization are non-cash expenses, so the greater

the depreciation and amortization the greater the

income tax savings. Thus the tax rate and debt to

equity ratio are hypothesized to have a positive

relationship, this is in line with Trade Off Theory.

Research conducted by Chen (2004) and Akhtar

(2005) shows a non-significant relationship between

Non-Debt Tax Shield and laverage.

Capital Expenditure (CAPEX) is a cost or fund

intended to benefit future periods and is reported as

an asset (Carter and Usry, 2002: 539). Assets here

are assets that have long-term benefits. According to

the Financial Accounting Standards (SAK) of 2015

states that fixed assets are tangible assets acquired in

ready-to-use or pre-built form, used in company

operations, not intended for sale in the framework of

the normal activities of the enterprise and have a

benefit of more than one year . Jansen (1989) in his

research argues that the more cash available the

more investors will invest.

Not much research on the influence of capital

expenditure and cost of financial distress on capital

structure and firm value. There is no consistency

from previous researchers about inflation variables,

interest rates, exchange rates, GDP, profitability,

firm size, asset structure, and NDTS on the capital

structure and firm value. No research has been found

to compare the manufacturing firms listed on the

Indonesia Stock Exchange (IDX) and the Thai Stock

Exchange (SET) from external and internal factors

to the capital structure and firm value.

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

45

2 RESEARCH METHODS

2.1 Conceptual Framework

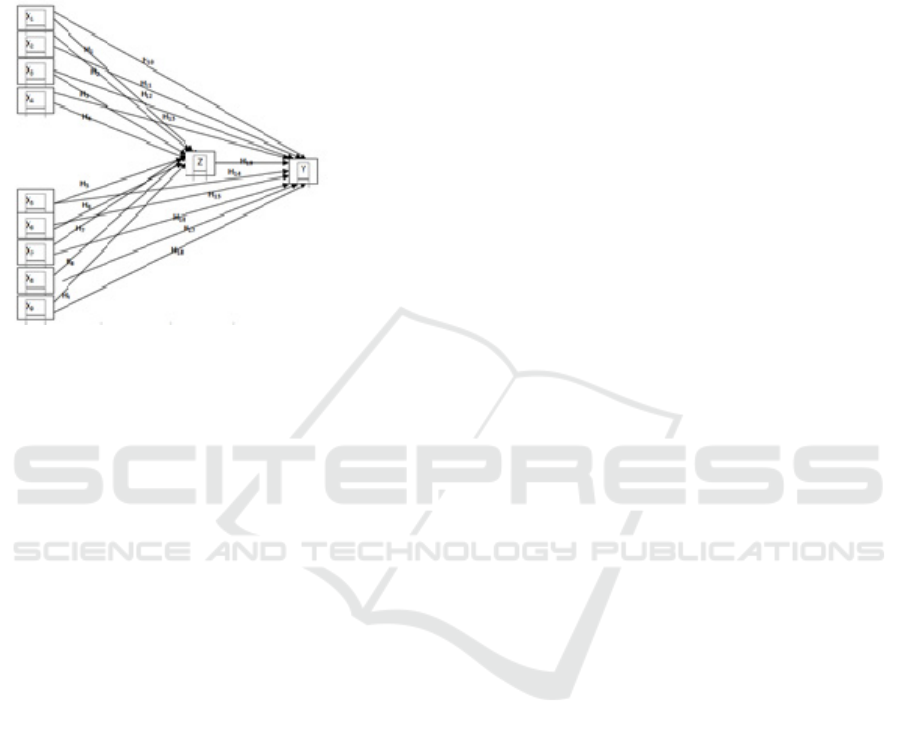

Figure 1: Conceptual framework.

2.2 Hypothesis

Hypothesis in this research as follows:

2.2.1 Inflation Influence on Capital

Structure and Firm Value

Understanding Inflation according to some sources

are: Inflation is a price increase continuously (Joel G

Siegel, 1999: 253). According to Ibbotson and

Brinson (1993: 241) say inflation is a sustained

increase in the general price level over time.

Thuesen and Fabrycky (2001: 125) say that inflation

and deflation are conditions that describe changes in

price levels in an economy. Furthermore Yuswar

and Mulyadi (2003: 21) say inflation is a state of

monetary value declined openly due to price

increases of goods. Some definitions can be

concluded that inlasi is a state of decline in the value

of a country's currency and the rising prices of goods

that take place systematically. The definition can be

understood that inflation is a dangerous condition for

the economics of a country. The high inflation will

decrease people's purchasing power on goods and

services, so that the economy of a country will

deteriorate which will result in decreasing profit

level of the company and will result in the

movement of stock price becomes less competitive.

So that inflation will affect the capital structure and

firm value.

Influence Inflation on Capital Structure.

Research conducted by Aris and Giorgi (2014),

Riana (2014), Natalia Makhova (2014) states that

inflation has a significant influence on capital

structure. Hypothesis in this research are:

H1: Inflation has a significant influence on

capital structure.

Influence Inflation on Firm Value. Research

conducted by Eduardus (1997), Dewi (2001), Siti

(2004), (Bambang S (2010) that inflation has a

significant influence on the firm value because the

higher the inflation will be lower the firm value.

Hypothesis in this study are:

H2: Inflation has a significant influence on firm

value.

2.2.2 Influence of Interest Rate on Capital

Structure and Firm Value

The interest rate used is the interest rate of Bank

Indonesia. Interest rates are an important factor in

making investment decisions, as interest rates can be

used as a barometer of costs as well as income for

businesses. Increasing interest rates will cause prices

to rise so will affect the structure of capital and firm

value.

Influence of Interest Rate on Capital Structure.

Research conducted by Taoulaou and Giorgi

Burchuladze (2014), Natalia Mokhova (2014) states

that interest rates have a significant influence on

capital structure. Hypothesis in this research are:

H3: Interest rates have a significant influence on

the structure capital.

Influence of Interest Rate on Firm Value.

Research conducted by Suryanto (1998), Sudjono

(2002) states that interest rates have a significant

influence on the firm value. Hypothesis in this

research are:

H4: Interest rates have a significant influence on

firm value.

2.2.3 Effect of Exchange Rate on Capital

Structure and Firm Value

The exchange rate used is the Rupiah exchange rate

against the US Dollar. A strong exchange rate

indicates that the value of the rupiah appreciates or

rises against the dollar ($), and vice versa. The

exchange rate represents the foreign sector in

affecting the company's capital structure and firm

value. The higher the value of the rupiah against the

dollar (exchange rate) the higher the capital structure

the lower the firm value.

Effect of Exchange Rate on Capital Structure.

Research conducted by Ana Mufida (2012) states

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

46

that the exchange rate has a significant influence on

capital structure. Hypothesis in this research are:

H5: Exchange rate has an influence on capital

structure.

Effect of Exchange Rate on Firm Value.

Research conducted by Sudjono (2002), Siti (2004),

Robiatul and Ardi (2006), and Achmad ATH

Thobarry (2009) stated that the exchange rate has a

significant influence on firm value. Hypothesis in

this research are:

H6: Exchange rate has a significant influence on

firm value.

2.2.4 Influence of GDP on Capital Structure

and Firm Value

GDP (Gross Domestic Product) is a barometer of

economic growth. If economic growth increases /

high, then an indication that the prospect of

investment is good. Economic growth with firm

value will move in the same direction as increasing

economic growth will be caught as a signal of

increased investment activity so that the firm value

will increase.

Influence of GDP on Capital Structure. Research

conducted by Ana Mufida (2012) states that GDP

has a significant influence on capital structure

Hypothesis in this study are:

H7: GDP has a significant influence on capital

structure.

Influence of GDP on Firm Value. Research

conducted by Nieuwerburgh (2005) and Robiatul

and Ardi (2006) states that GDP has a significant

influence on firm value. Hypothesis in this research

are:

H8: GDP has a significant influence on firm

value.

2.2.5 Effect of ROA on Capital Structure

and Firm Value

Return On Assets (ROA), according to Weston and

Brigham (2001: 713) companies with high levels of

profitability (ROA), generally use a relatively small

amount of debt. This is due to high profitability

(ROA) is possible for companies to capitalize with

retained earnings only. The greater the retained

earnings the greater the need for funds being met

from within the enterprise, and reducing the use of

funds from debt, which will further reduce the

company's capital structure. Packing Order Theory,

states that the sequence of funding in the capital

structure is retained earnings, debt, and stocks

emissions. Based on Packing Order Theory,

profitability (ROA) has a negative effect on capital

structure. The more efficient the financing and the

maximum the investment the higher the profit

earned. The higher the profit the higher the stock

price, meaning profitability has a positive effect on

the firm value.

Effect of Profitabiltas on Capital Structure. The

results of research conducted by Mayangsari (2000),

Deesomsak, et al (2004), Kartini and Arianto (2007),

Naomech (2012), Md Faruk Hosain and Prof.

Dr.Md.Ayub Ali (2012) Alam (2013), Akinyomi

(2013), Safitri (2014), Pedro Proenca, at al (2014),

Anshu Handoo and Kapil Sharma (2014), and

Shirley Chen Ye Ekstrom and Indre Kanaporyte

(2015), stated that Profitability has a significant

influence on capital structure. Hypothesis in this

research are:

H9: ROA has a significant influence on capital

structure.

The Effect of Profitability on Firm Value. The

results of research conducted by Sari (2005), Sri

Hermuningsih (2013), and Safitri (2014), states that

profitability has a significant influence the firm

value. Hypothesis in this research are:

H10: ROA has a significant influence on firm

value.

2.2.6 Effect of Tax Shields on Capital

Structure and Firm Value

Tax Shields measured by Non-Debt Tax Shield

(NDTS) indicate the availability of internal funds

derived from tax savings on depreciation and

amortization. The higher the NDTS the lower the

debt, meaning the NDTS has a significant effect on

the capital structure. The higher the NDTS, the

greater the source of internal funds, mean NDTS has

a significant effect on the firm value.

The Effect of Tax Shields on Capital Structure.

The results of research conducted by Deesomsak

(2004), Akinyomi (2013), Anshu Handoo (2014),

DR.R.Kavitha (2014), Siti Salimah Hussain and

Hassan Miras (2015), and Shirley ChenYe Ekstroom

and indre Kanaporyte (2015) . states that NDTS has

a significant influence on capital structure.

Hypothesis in this research are:

H11:NDTS has a significant influence on capital

structure

The Effect of Tax Shields on Firm Value. The

results of research conducted by Deesomsak (2004),

Anshu Handoo (2014), states that NDTS has a

significant influence on firm value. Hypothesis in

this research are:

H12: NDTS has a significant influence on firm

value.

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

47

2.2.7 Effect of Capital Expenditure on

Capital Structure and Firm Value

Jansen (1989) in his research argues that the more

cash available the more investors will invest

regardless of whether the investment is good or bad.

If the company's capital expenditure gets bigger then

the capital requirement of the company will also be

bigger to fulfill the requirement so that company

will seek fund from outside, so will increase

laverage company. So the higher the capital

expenditure will increase the debt of the company,

the capital expenditure has a positive influence on

capital structure and firm value.

The Influence of Capital Expenditure on Capital

Structure. The results of research conducted by

Boodhoo Roshan (2009), states that Capital

Expenditure has a significant influence on capital

structure. Hypothesis in this research are:

H13: Capital Expenditure has a significant

influence on capital structure

The Influence of Capital Expenditure on Firm

Value. The results of research conducted by Coles,

et al (2004), Desak and Ni Wayan (2007), Sarpi

(2009), Rahmiati and Widya Sari (2013), stated that

Capital Expenditure has a significant influence on

firm value. Hypothesis in this research are:

H14: Capital Expenditure has a significant

influence on firm value.

2.2.8 Effect of Asset Structure on Capital

Structure and Firm Value

Increased The asset structure means that the firm's

fixed assets will increase, resulting in working

capital and the ability of the company to meet its

maturing corporate liabilities to decrease so that the

company will need capital from the stock as a result

the firm value will decrease.

Influence of Asset Structure to Capital Structure.

Research conducted by Anastasia, Gunawan, and

Wijaya (2011), Mayangsari (2000), Naomech

(2012), Akinyomi and Olagunju (2013), Anshu

Handoo (2014), Pedro Proenca, et al (2014), Aris

Taoulaou and Giorgi Burchuladze (2014), Siti

Salimah Hussain and Hassan Miras (2015), and

Shirley ChenYe Ekstroom and the Kanaporyte indre

(2015). states that the Structure of Assets has a

significant influence on capital structure. Hypothesis

in this research are:

H15: The structure of the asset has a significant

influence on the structure capital

Effect of Asset Structure on Firm Value. Research

conducted by Anastasia, Gunawan, and Wijaya

(2011), states that the Asset Structure has a

significant influence on the firm value. Hypothesis

in this research are:

H16: Asset Structure has significant influence on

firm value.

2.2.9 Influence of Cost Financial distress on

Capital Structure and Firm Value

The earning variability can be a measure of a

company's business risk, so prospective creditors

tend to lend to companies that have relatively stable

earnings. Thus the higher the earning variability of a

company, the lower the debt utilization by the

company. So Cost Financial distress has a

significant influence on capital structure and firm

value.

Influence of Cost Financial distress on Capital

Structure. Research conducted by Ratnawati (2001),

Chen (2004), Teddy (2005) states that Cost

Financial distress has a significant influence on

capital structure. Hypothesis in this research are:

H17: Cost Financial distress has a significant

influence on capital structure.

The Influence of Cost Financial distress on Firm

Value. Research conducted by Chen (2004), states

that Cost Financial distress has a significant

influence on the firm value. Hypothesis in this

research are:

H18: Cost Financial distress has a significant

influence on the firm value.

2.2.10 Effect of Capital Structure on Firm

Value

The capital structure in influencing firm value is

reinforced by Modigliani-Miller (MM) theory

assuming there is a tax. This theory according to

Luke (2003: 259) states that "MM concludes the use

of debt (laverage) will increase the firm value

because the cost of debt interest is the cost that

reduces tax payments (a tax deductible expense).

Increase in the value of perisahaan occurs because of

the cost of debt interest that reduces tax payments,

so the operating profit becomes the investor's rights

will be greater. So an increase in debt along with an

increase in capital structure will increase the value

of the firm. This research is supported by Masdar

researchers (2008) and Rahmawati (2013). So that

can be formulated hypothesis as follows:

H19: The capital structure has a significant

influence on the firm value.

Sample selection using proposive sampling with

criteria active company (providing financial

statements) in trading on stock exchanges in

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

48

Indonesia and Thailand during 2011-2015;

Manufacturing companies do not perform Stock

Splite during 2011-2015 on the Indonesia Stock

Exchange (IDX) and Stock Exchange Thailand

(SET).

Test the hypothesis using path analysis, the

equation:

Z = 〉

zx1

X

1

+ 〉

zx2

X

2

+ 〉

zx3

X

3

+ 〉

zx4

X

4

+ 〉

zx5

X

5

+ 〉

zx6

X

6

+ 〉

zx7

X

7

+〉

zx8

X

8

+ 〉

zx9

X

9

+ ε

1 (1)

Y = 〉

yx1

X

1

+〉

yx2

X

2

+ 〉

yx3

X

3

+ 〉

yx4

X

4

+ 〉

yx5

X

5

+ 〉

yx6

X

6

+ 〉

yx7

X

7

+ 〉

yx8

X

8

+ 〉

yx9

X

9

+ 〉

yz

Z + ε

2 (2)

Caption:

Z = Capital structure, Y = Firm Value

X

1

= inflation, X

2

= rate of interest

X

3

= exchange rate, X

4

= PDB

X

5

= ROA, X

6

= NDTS

X

7

= CAPEX, X

8

= Asset structure

X

9

= Cost of Financial Distress

ε

1,,2

= errors

2.3 Operational Definition

The capital structure measured by Total Debt to

Total Assets, is how much of the total assets are

provided to guarantee the corporate debt. The

measurement scale uses the ratio. The value of the

firm is measured by Price to Book Value (PBV).

PBV is the ratio of market price per share at a

closing price to book value per share. The

measurement scale uses the ratio.

Inflation, is the relative real value of changes in

the prices of goods on the market. Inflation was

measured by the inflation rate in each country during

the study period. The measurement scale uses the

ratio. The interest rate, the real interest rate or the

risk-free interest rate is the policy interest rate of the

central bank. Measurement scale using ratio.

The

exchange rate is the real conversion value of money

(Rupiah and Bath) against US Dollar. This study

uses the exchange rate measured by the real spot

exchange rate of Indonesian Rupiah (IDR) and Bath

(THB) against US dollar. The measurement scale

uses the ratio.

Gross Domestic Product, Economic growth is a

change in the value of real Gross Domestic Product

(GDP). Economic growth is measured by changes in

real GDP over at constant prices. The measurement

scale uses the ratio. Profitability is measured by

Return on Assets (ROA), i.e. the company's ability

to profit from the assets that have been invested in

the company's business for one year. The

measurement scale uses the ratio.

No Debt Tax Shields is the availability of

internal funds derived from tax savings on

depreciation and amortization. The scale of

measurement uses the ratio. Capital Expenditure is

the capital spent on financing the company's assets

for corporate investment purposes. The

measurement scale uses the ratio.

Asset Structure is how much-fixed assets

dominate the composition of company-owned

company's wealth. The measurement scale uses the

ratio. Cost of Financial Distress is the risk that will

be faced by the company due to variable profit

before tax of the company to earnings before interest

and tax with profit before tax. Scale measurement

using the ratio.

3 THEORIES

3.1 Agency Cost

Agency Cost is a cost incurred because the company

uses debt and involves a relationship between the

owner of the company and the creditor. If a

company uses debt, it is possible that the company

owner is doing harmful actions, such as investing in

high-risk projects. The cost of bankruptcy there is

two that is directly and indirectly. Direct costs are

cash issued in relation to bankruptcy administration

and proceedings. Indirect costs are costs associated

with the bankruptcy process but not in the form of

cash disbursements.

3.2 Trade-Off Model

Consider financial distress and agency Cost into the

MM model with taxes. The use of debt will increase

the firm value but only to a certain point. After that

point, the use of debt will actually lower the value of

the company because the increase in profit from the

use of debt is not comparable with the increase in

the cost of financial distress and agency Cost.

3.3 Asymmetric Information Theory

Asymmetric information is a condition in which a

party has more information than the other

(Donaldson, 1950). Asymmetric information,

company management knows more about the

company than investors in the capital market.

Gardon Donaldson concludes that the company

prefers to use funds in order of retained earnings,

Debt, and Sale of new stocks.

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

49

3.4 Pecking Order Theory

Pecking order theory is a mechanism for selection of

funding sources related to the transaction cost issue

of new external funding sources. This theory plays

an important role in the capital structure of the

company. The company's capital structure policy in

the determination of funds is related to the

determination of the best balance in terms of internal

and external funding sources. Meeting the needs of

internal sources relates to performance and financial

ratios while the fulfilment of external sources is

related to inflation, exchange rate, interest rate,

economic growth and asymmetric information.

3.5 Firm Value

Firm value describes how management manages

corporate wealth that can be seen from the

measurement of financial performance. According to

Mariano (2012: 40), the value of stock price is the

most commonly used as an indicator in assessing the

firm value, because the value of the stock price is

considered to represent the performance of the

company. The increase in firm value is marked by

an increase in stock prices in the market. The high of

the firm value will be followed by an increase in

shareholder value.

4 RESULTS

Using purposive sampling, sample manufacturing

firms at IDX is 34 of 143companies, and at SET

there are 39 of 127 companies. The result of

linearity test, all variables show linear correlation.

There is multicollinousas exchange rate and GDP in

IDX, inflation and interest rate in SET, so that

variable is eliminated from the model.

4.1 Hypothesis Testing Manufacturing

Companies in IDX

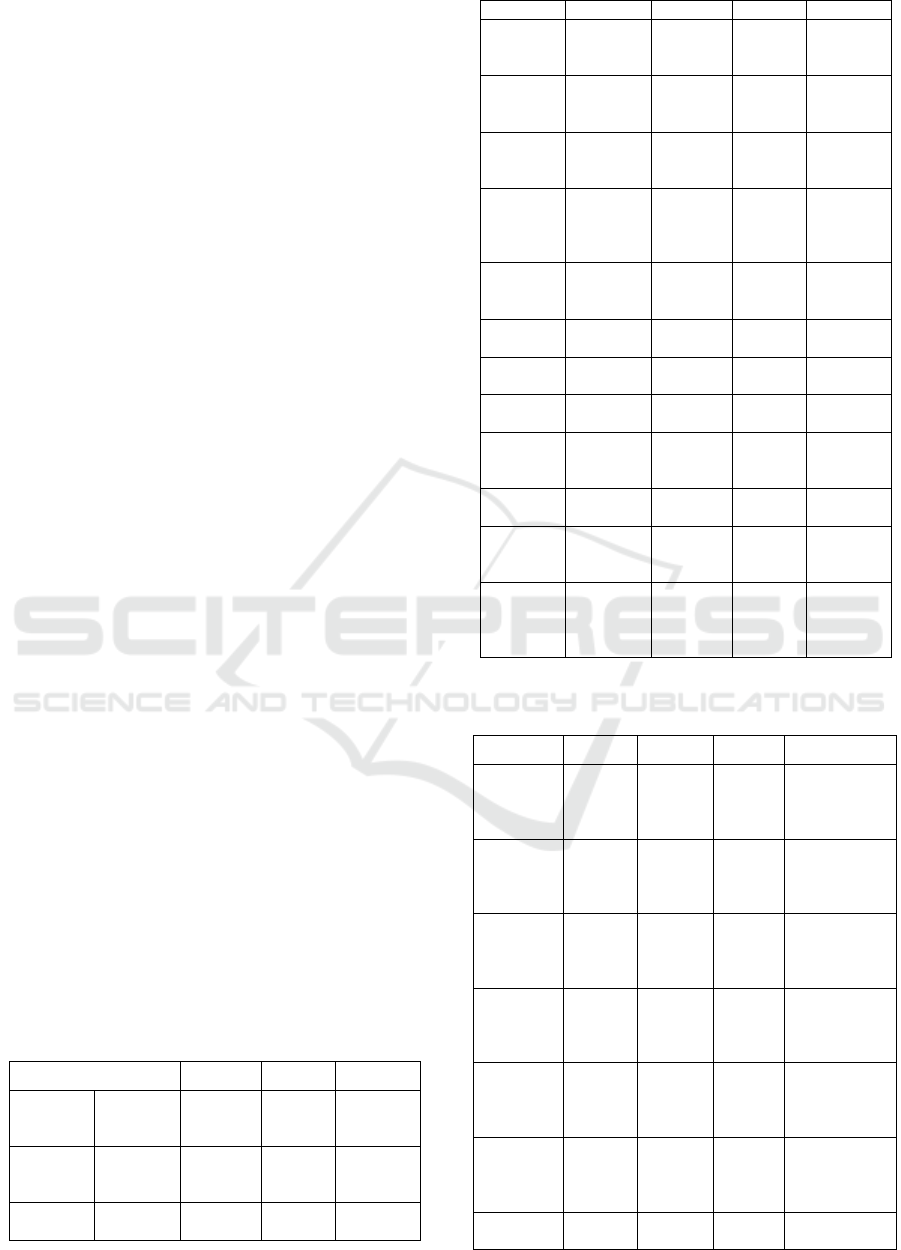

Table 3: Test Results Hypothesis Model Direct Influence

on Manufacturing Companies in IDX.

Relevancy between

variables

Path

Coefficient

ρ-value Evidence

Inflation

(X1)

Capital

Structure

(Z)

-0,032 0,805

No

Significant

Interest

rate(X2)

Capital

Structure

(Z)

0,050 0,700

No

Significant

ROA

(X3)

Capital

Structure

-0,301 0,034**

Significant

(Z)

Tax

Shield

(X4)

Capital

Structure

(Z)

-0,078 0,347

No

Significant

CAPEX

(X5)

Capital

Structure

(Z)

0,234 0,006**

*

Significant

Asset

Structure

(X6)

Capital

Structure

(Z)

0,023 0,793

No

Significant

Cost of

Financial

Distress

(X7)

Capital

Structure

(Z)

0,080 0,317

No

Significant

Capital

Structure

(Z)

Firm

Value(Y)

-0,127 0,015**

Significant

Inflation

(X1)

Firm

Value(Y)

-0,014 0,868

No

Significant

Interest

rate(X2)

Firm

Value(Y)

0,130 0,130

No

Significant

ROA

(X3)

Firm

Value(Y)

0,678 0,000**

*

Significant

Tax

Shield

(X4)

Firm

Value(Y)

-0,226 0,000**

*

Significant

CAPEX

(X5)

Firm

Value(Y)

0,126 0,029**

Significant

Asset

Structure

(X6)

Firm

Value(Y)

-0,026 0,658

No

Significant

Cost of

Financial

Distress

(X7)

Firm

Value(Y)

-0,037 0,481

No

Significant

Table 4: Indirect Effect of Manufacturing Companies at

IDX.

Variable Direct Indirect Total Conclusion

Inflation

(X1)

-0,014 0,00406 -0,00994 Capital

Structure as

variable

intervening

Interest

rate(X2

0,130 -

0,00635

0,12365 Capital

Structure not

as variable

intervening

ROA (X3) 0,678 0,03823 0,71623 Capital

Structure not

as variable

intervening

Tax

shields

(X4)

-0,226 0,00991 -0,21609 Capital

Structure as

variable

intervening

CAPEX

(X5)

0,126 -0,02972 0,09628 Capital

Structure not

as variable

intervening

Asset

Structure

(X6)

-0,026 -0,00292 -0,02892 Capital

Structure as

variable

intervening

Cost of

Financial

-0,037 -0,01016 -0,04716 Capital

St

r

ucture as

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

50

Distress

(X7)

variable

intervening

The result of the determination R

2

M

is 71%,

meaning that the diversity of the data can be

explained by the model described and the sizes of

29% explained by other variables outside the study.

4.2 Hypothesis Testing Manufacturing

Companies in SET

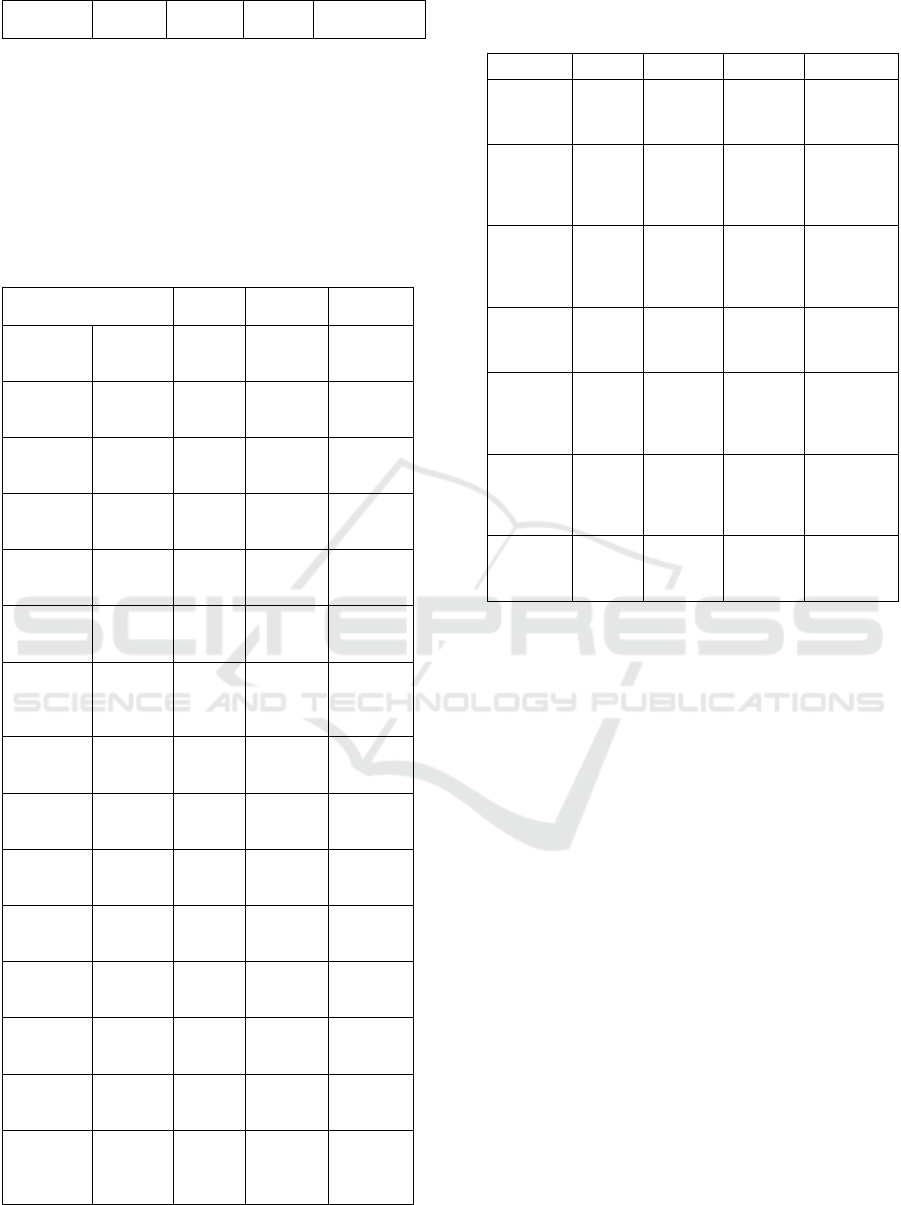

Table 5: Test Results Hypothesis Model Direct Effect on

Manufacturing Companies in SET.

Relevancy

between variables

Path

Coeff.

ρ-value Evidence

Exchange

rate

(X1)

Capital

Structure

(Z)

0,102 0,123 No

Significa

n

t

PDB (X2) Capital

Structure

(Z)

0,104 0,116 No

Significa

n

t

ROA (X3) Capital

Structure

(Z)

-0,515 0,000*** Significa

nt

Tax

Shield

(X4)

Capital

Structure

(Z)

0,122 0,090* Significa

nt

CAPEX

(X5)

Capital

Structure

(Z)

0,062 0,408 No

Significa

n

t

Asset

Structure

(X6)

Capital

Structure

(Z)

0,051 0,550 No

Significa

n

t

Cost of

Financial

Distress

(X7)

Capital

Structure

(Z)

-0,052 0,424 No

Significa

nt

Capital

Structure

(Z)

Firm

Value

(Y)

-0,404 0,050** Significa

nt

Exchange

rate (X1)

Firm

Value

(Y)

-0,070 0,374 No

Significa

n

t

PDB (X2) Firm

Value

(Y)

0,008 0,921 No

Significa

n

t

ROA (X3) Firm

Value

(Y)

0,268 0,003*** Significa

nt

Tax

Shield

(X4)

Firm

Value

(Y)

-0,071 0,408 No

Significa

n

t

CAPEX

(X5)

Firm

Value

(Y)

0,903 0,007*** Significa

nt

Asset

Structure

(X6)

Firm

Value

(Y)

0,248 0,016** Significa

nt

Cost of

Financial

Distress

(X7)

Firm

Value

(Y)

-0,041 0,599 No

Significa

nt

Table 6: Testing Indirect Effect on Manufacturing

Companies in SET.

Variable Direct Indirect Total Conclusion

Exchange

rate (X1)

-0,070 -0,04121 -0,11121 Capital

Structure as

variable

inte

r

venin

g

PDB (X2) 0,008 -0,04202 -0,03402 Capital

Structure

not as

variable

intervenin

g

ROA (X3) 0,268 0,20806 0,47606 Capital

Structure

not as

variable

intervenin

g

Tax

shields

(X4)

-0,071 -0,04929 -0,12029 Capital

Structure as

variable

intervenin

g

CAPEX

(X5)

0,903 -0,02505 0,87795 Capital

Structure

not as

variable

intervenin

g

Asset

Structure

(X6)

0,248 -0,02060 0,22740 Capital

Structure

not as

variable

intervenin

g

Cost of

Financial

Distress

(

X7

)

-0,041 0,02101 -0,01999 Capital

Structure as

variable

intervenin

g

The result of coefficient of determination: R2M

equal to 67%, meaning that the diversity of the data

can be explained by the model described, while the

rest of 33% is explained by other variables outside

the research.

5 DISCUSSION

Inflation has no effect on the capital structure and

firm value in IDX. This is because the company

believes that the government will continue to control

the country's inflation, so inflation does not affect

the debt and stock price of the company. This study

supports Ekstrom's research (2015).

Interest rates have no significant effect on the

capital structure and firm value. High-interest rates

will lead to the high risk that leads to financial

distress. In accordance with the trade-off model that

theoretically balances the tax advantages of lending

(debt) to cover the financial difficulties. This study

supports Ekstrom's research (2015).

Interest rates do not affect the value of the firm;

it indicates that the change of interest does not cause

changes in the firm value. The results support

research from George (2008).

The exchange rate does not affect the capital

structure and firm value in SET. Changes in the

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

51

exchange rate did not because a change in the value

of the firm since the company in Thailand used the

bath currency in its operations. The results support

the study of Taoulaou (2014).

GDP does not affect the capital structure and

firm value in SET. If economic growth rises / high,

then an indication that the prospect of investment is

good. Economic growth with firm value will move

in the same direction as increasing economic growth

will be caught as a signal of increased investment

activity so that the firm value will increase. This

study supports Ekstrom's research (2015).

ROA in IDX and SET shows that ROA has the

negative and significant effect on capital structure.

The results of this study are consistent with the

Packing Order Theory, Myers (1984) states that in

conducting a funding policy the company prioritizes

the use of retained earnings, then the use of debt and

new stock emissions. This study supports the

research of Pendy (2001), Nagano (2003),

Deesomsak, at.al (2004), Delcoure (2006), Huang &

Song (2006), Eni Safitri (2012), and Md Faruk H

(2012). ROA has a positive and significant impact

on the firm value in IDX and SET. The greater the

profitability, the higher the stock price in the firm

value. This study supports the research of Titman

and Tsyplakov (2005).

Non-Debt Tax Shields have no significant effect

on capital structure in IDX. Not influencing NDTS

shows that the value of depreciation and

amortization of existing companies in Indonesia is

not enough to increase the company's cash flow so it

is not taken into account in reducing the proportion

of debt. This study supports the research of Chen

(2004) and Akhtar (2005). The results of the SET

study show that NDTS has a positive and significant

effect on capital structure. This indicates that the

increase in NDTS can be used as a substitute for

debt. This study supports the research of Delcour

(2006), and Md Faruk H (2012). NDTS has a

negative and significant effect on the value of the

company in IDX. This indicates that the greater the

depreciation and amortization the greater the tax

savings so that the greater the accumulation of

resources will increase the firm value. This study

supports Deesomsak's research (2004), and Anshu

Handoo (2014). NDTS has no significant effect on

firm value in SET. This indicates that the amount of

depreciation and amortization is not significant

enough to increase the company's cash flow so as

not to affect the firm value.

The result of research in Indonesia shows that

CAPEX has the significant effect on capital

structure. The bigger the CAPEX the greater the

capital requirement of the company to meet its

needs, so that the company will seek funds from

outside that is by adding debt. This study supports

the research of Boodhoo Roshan (2009). The result

of research in SET shows that CAPEX has no

significant effect on capital structure. This is

because in Thailand in enlarging its fixed assets

using internal funds of the company. The results of

research on IDX and SET shows CAPEX has a

significant influence on firm value. The more long-

term investments (fixed assets) that provide benefits

in the future will increase the stock price or firm

value. This research supports the research of Coles,

et al (2004), Desak and Ni Wayan (2007), Sarpi

(2009), Rahmiati and Sari (2013).

The asset structure has no significant effect on

capital structure in IDX and SET. No effect on the

structure of assets on the capital structure because of

manufacturing firms in Indonesia and Thailand

because most of the fixed assets except land is

already on the watch in insurance or companies

prefer margins to minimize risk. So the size of the

company's asset structure does not affect the debt.

This study supports Nagano's (2003) and Taou you

(2014) research. The results of the research on IDX

show that the asset structure has no significant effect

on firm value. This result is not in accordance with

the hypothesis that predicts the greater the asset

structure the higher the value of the firm. This

research supports Solechan's research (2009). The

number of tangible fixed assets is not a prospect to

increase the firm value but stock holders in investing

capital will look at the prospect of companies that

earn a promising profit, thereby increasing the firm

value. While in Thailand, the asset structure has a

significant influence on the firm value. This research

supports the research of Fama (1978) and

Harmuningsih (2013).

The results of research on IDX and SET shows

CFD has no significant effect on capital structure.

This indicates that with the use of debt in the capital

structure is not affected by financial risk, it can be

said that debt to manufacturing companies in

Indonesia and Thailand is still at a level that can be

controlled by the company. This study supports the

research of Chen (2004), Teddy (2005). The results

of the research at IDX and SET show that CFD has

no significant effect on firm value. This indicates

that the use of debt can still be controlled with the

benefits obtained by the company so as not to affect

the firm value.

The results of the research on IDX and SET

shows the capital structure has a negative and

significant effect on firm value. Negative influence

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

52

means that the higher the capital structure will be the

smaller the firm value, so in accordance with the

packing order theory. This research supports the

research of Masdar (2008) and Rahmawati (2013).

6 CONCLUSIONS

Based on the results of research that has been done

can be concluded that:

1. Macro factors manufacturing companies in

Indonesia and Thailand have no effect on the

capital structure and firm value. Profitability,

CAPEX has the significant effect on capital

structure, while NDTS, asset structure, and CFD

have no significant effect on capital structure in

IDX. Profitability, NDTS has a significant

effect on capital structure, while CAPEX, asset

structure, and CFD have no significant effect on

capital structure in SET. ROA, NDTS, CAPEX

have the significant influence on firm value,

while asset structure and CFD have no

significant effect on firm value at IDX.

Profitability, CAPEX, asset structure have an

effect on significant to firm value, while tax

shields and cost of financial distress have no

significant effect on firm value in SET.

2. The capital structure directly affects the IDX

and SET.

3. Inflation, NDTS, asset structure has a

significant effect on firm value if it is mediated

by the capital structure in IDX. The exchange

rate, NDTS, CFD has a significant effect on

firm value if it is mediated by the capital

structure in SET.

4. Further research development can be

conducted on companies other than

manufacturing companies; external variables

plus political variables, technology, etc.; period

may be more than 5 years; and research objects

developed for example researching all ASEAN

countries.

REFERENCES

Boodho, R. (2009). Capital Structure and Ownership

Structure: A Review Literatur. The Journal of Online

Education. New York. P 1-8

Brigham, F. and Joel F. (2013). Dasar-Dasar Manajemen

Keuangan 2. Edisi 11. Salemba Empat, Jakarta.

Bank Indonesia. (2016). Perkembangan Ekonomi

Keuangan Dan Kerjasama International. Jakarta

Chen, L. and Xinlei C. (2004). Profitability, Mean

Reversion Of Leverage Ratios, and capital Structure

Choices. P. 1-26.

Deesomsak et al. (2004). The Determinants of Capital

Structure: Evidence From The Asia Pacific Region.

Journal of Multinational Financial Management 14,

387-405.

Delcoure, N. (2006). The Determinants of Capital

Structure in Transitional Economics. International

Review of Economics and Finance.

Ekstrom et al. (2015). The Determinants of Capital

Structure: Comparison of listed Large capitalization

Non-Financial Companies in the USA and Sweden.

Degree Project in Corporate and Financial

Management. Lund University.

Frank, Z. and Vidhan, K. (2003). Capital Structure

Decisions. Journal of Financial Economics. P.1-49.

Geroge, L. (2008). Long-Term Return Reversals:

Overreaction or Taxes. Journal of Finance. 62. 2865-

2896.

Handoo, A. (2014). A Study On Determinants Of Capital

Structure In India. IIMB Management Review Journal

Elsevier. 26: 170 – 182.

Huang et al. (2006). The Determinants of Capital

Structure: Evidence From China. Journal of Financial

Economics. P.1-24.

Jansen, C. (2001). Value Maximixation Stakeholder

Theory, and The Corporate Objection Function.

Journal of Finance.

Mas'ud, M. (200)8. Analisis Faktor-Faktor Yang

Mempengaruhi Capital structured Hubungannya

Terhadap Nilai Perusahaan. Jurnal Manajemen dan

Bisnis, Vol 7, Nomor 1, hlm.82-99.

Mayer et al. (2004). A New Test of Capital Structure.

Journal Of Economics.

Moh'd, R. (1998). The Impact of Ownership Structure on

Corporate Debt Policy: A Time Series Cross-sectional

Analysis. The Financial Review. 33.P :85 – 98.

Myers et al. (1984). Corporate Financing and Investment

Decisions When Firms Have Information That

Investors Do Not Have. Journal Of Financial

Economics. 13: 187-221.

Pandey, M. (2003). Capital Structure and the Firm

Characteristics: Evidence From An Emerging Market.

Journal of Financial Economics. P.1-16.

Taoulaou, A. and Giorgi, B. (2014). How Do

Macroeconomic Factors Effect Capital Structure The

Case Of Swedish Firms?. Master Thesis. Lund

University.

Titman et al. (1988). The Determinants of Capital

Structure Choice. Journal of Finance. Vol 42. P. 1-19.

Determinants of Capital Structure and Its Impact on Firm Value on Manufacturing Companies at Indonesia Stock Exchange (IDX) and

Thailand Stock Exchange (SET)

53