The Influence of Tax Aggressiveness on the Disclosure of Corporate

Social Responsibility: A Study of Manufacturing Firms Listed on the

Indonesian Stock Exchange 2011–2015

Distya Prasita Setyoari and Heru Tjaraka

Department of Accounting, Faculty of Economics and Businessy, Universitas Airlangga, Surabaya, Indonesia

heru_tjaraka@yahoo.co.id

Keywords: Disclosure Of Corporate Social Responsibility (CSR), Tax Aggressiveness (ETR).

Abstract: This study aims to examine the influence of tax aggressiveness on the disclosure of corporate social

responsibility (CSR) and is a replica of a previous study carried out by Lanis and Richardson (2013). Tax

aggressiveness is measured by using the effective tax rate (ETR), which serves as the independent variable,

while corporate social responsibility (CSR) serves as the dependent variable. Variables such as company

size (SIZE), leverage (LEV), capital intensity (CAPINT), market-to-book ratio (MKTB), and return on

assets (ROA) are used as the control variables. Manufacturing companies listed on the Indonesian Stock

Exchange (IDX) for the period 2011–2015 made up the sample for this study, which yielded a total of 175

companies. Hypothesis testing in this study was done by using multiple regression analysis, with the

assistance of SPSS software (version 20). The results show that tax aggressiveness is significantly related to

the disclosure of corporate social responsibility (CSR). Companies that have a higher level of tax

aggressiveness are therefore inclined to make greater CSR disclosures.

1. INTRODUCTION

Government effort alone is far from adequate if

Indonesia is to eradicate or alleviate poverty. In

2014, the Asian Development Bank reported that

11.2% of the Indonesian population was living

below the poverty line, leaving it as the fifth poorest

country in the Southeast Asian region. In regard to

poverty alleviation, the Indonesian government has

sought to develop policies to lessen poverty, yet it

remains pervasive; one reason for this is that poverty

alleviation ought to be the concern of all parties and

not only the state apparatus. According to Radyati

(2008, p. 6), companies, through CSR disclosure

programs, could help to reduce national poverty. In

this regard, Untung (2009, p. 2) explains that, in an

era of decentralization, the momentum towards CSR

disclosure programs can be seen as a form of private

sector involvement in empowering the poor to climb

the social ladder.

In order to improve the efficacy of poverty

alleviation and encourage the role of the private

sector in this regard, the Indonesian government has

taken the initiative by issuing several regulations on

CSR in Indonesia: Law no. 40 (2007) Article 74,

concerning limited liability companies, and Law no.

25 (2007) Article 15(b), concerning investment, as

well as the implementation of CSR disclosures,

which are regulated by Government Regulation no.

47 (2012) Article 4 (on corporate social

responsibility and the environment). With regard to

the above regulation, it is clear that every limited

liability company is required to disclose its CSR

program.

Furthermore, there are several perspectives

regarding CSR disclosure. According to Wibisono

(2007, p. 79), the reason that companies apply CSR

can be classified into three categories. The first

reason is the simple aim to boost the company’s

image, for example, as experienced by PT Lapindo

Brantas, which fulfilled its social responsibility to

victims as compensation for the mudflow disaster it

caused. The second reason is the fulfilment of

obligations, since CSR disclosure requirements are

enshrined in regulations, laws, and other rules,

which exist to compel companies to comply.

Concrete examples of this are certain states in the

USA that have begun implementing eco-labeling for

furniture products, in addition to lending by banks in

Europe to companies that implement CSR well. The

Setyoari, D. and Tjaraka, H.

The Influence of Tax Aggressiveness on the Disclosure of Corporate Social Responsibility - A Study of Manufacturing Firms Listed on the Indonesian Stock Exchange 2011–2015.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 235-240

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

235

third reason is because of a genuine impulse arising

from within (i.e. an internal driver). In this sense, the

company realizes that, for business continuity,

financial health is not the only requirement for

ensuring the sustainable growth of the company, but

that social and environmental responsibility are also

important. In the end, the three reasons outlined

above result in a positive impact on the formation of

corporate image. On the other hand, companies face

political costs and are in the spotlight of the

government and the wider community. Thus, any

reason motivating companies to disclose their CSR

can be considered appropriate.

Understanding the need to contribute to the

surrounding community in the form of CSR, firms

are also subject to the obligation of paying taxes for

all business facilities and licenses that the

government have provided and which have

contributed to the success of the business. The

greater the income generated by the company within

a certain period, the greater the tax that must be paid

to the state. However, for profit-oriented firms, taxes

are a burden that will reduce corporate profits. In

this regard, companies budget for the funds for these

two important burdens, i.e. tax and CSR, in addition

to seeking ways to reduce the tax burden by being

aggressive with regard to taxation. Corporate tax

aggressiveness, therefore, relates to reducing taxable

income through tax planning, either by means of tax

avoidance or tax evasion (Frank et al., 2009).

In spite of its profitable outcome in reducing tax

for the firm, aggressiveness towards the tax burden

is counterproductive with regard to the expectations

of society and the government, and it is contrary to

the theory of legitimacy. Corporate tax

aggressiveness can be considered as a socially

irresponsible activity (Erle & Schon, as cited in

Lanis & Richardson, 2012). However, according to

Winda et al. (2015), companies who have an

aggressive tax strategy can still act in accordance

with the theory of legitimacy by disclosing

additional information related to CSR in order to

restore the company’s reputation.

Several previous studies have discussed the

relationship between CSR disclosure and tax

aggressiveness. Lanis and Richardson (2013)

suggest that the effective tax rate (EFT) is one of the

proxies used as a tax aggressiveness tool. In

addition, firm size, leverage, capital intensity, the

market-to-book ratio, and return on assets can be

used as control variables to measure corporate CSR

disclosure. The results of the regression analysis

indicate that the higher the level of corporate tax

aggressiveness, the higher the level of CSR

disclosure of a company.

Moreover, manufacturing firms were chosen as

the sample for this study because, compared to other

sectors, they constitute a larger proportion of the

economy; in addition, in their activities,

manufacturing companies need a high level of

effective management, which is demonstrated by the

resulting profits. In addition, problems in

manufacturing firms are more complex and have a

considerable impact on the surrounding

environment, which is an aspect of CSR disclosure.

However, the most important reason for the five-

year data retrieval in this study is the absence of

previous research using 2015 manufacturing

company data. The study period was determined for

this time period on the grounds that 2015

represented the most recent data available to the

researchers in the form of annual reports. In this

sense, while the study was completed in 2017, the

latest BEI database was updated in 2015, containing

annual reports and financial statements for 2015. In

addition, the annual reports and audited annual

financial statements on the Indonesian Stock

Exchange are only published four–five months after

the end of the calendar year. Further, tax laws,

which are amended every year, are another reason

for using data from this particular period. It is also

hoped that the results generated from this research

can represent the most up-to-date information for the

development trends of manufacturing companies

that take aggressive tax action and make social

responsibility disclosures.

Understanding the need to examine the

correlation between tax aggressiveness and the level

of corporate social responsibility disclosure, this

research aims to examine the question of how tax

aggressiveness influences the disclosure of corporate

social responsibility.

2 THEORETICAL BASIS AND

HYPOTHESIS DEVELOPMENT

2.1 Theoretical Basis

2.1.1 Legitimacy Theory

Legitimacy theory states that, in order for a firm to

obtain legitimacy, corporate management must align

with society, the government, and community

groups (Gray et al., 1995). Legitimacy can be

regarded as a benefit or potential source of survival

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

236

for a company, so when there is a difference

between corporate values and social values, which is

often called a “legitimacy gap,” it can affect the

company’s ability to continue its business activities

in addition to threatening the company’s position.

Furthermore, O’Donovan (as cited in Ghozali &

Chariri, 2007, p. 413) suggests that if a legitimacy

gap arises, firms need to evaluate their social value

and harmonize with the existing values in society or,

if necessary, change according to legitimacy tactics.

Thus, in order to reduce the legitimacy gap,

companies are required to identify activities under

their control that impact on the public and that have

the power to legitimize the company (Neu et al., as

cited in Ghozali & Chariri, 2007, p. 413).

In the context of this study, legitimacy theory

underlies the influence of the wider community that

can determine the activities of a company.

Companies that tend to follow aggressive tax

policies will be perceived negatively by the public,

which companies would consider as damaging. For

this reason, the company will then disclose its social

responsibility information in order to provide

legitimacy for their corporate activities in the eyes of

society.

2.2 Hypothesis Development

Several studies have examined the relationship

between corporate social responsibility disclosure

and tax aggressiveness. Guthrie and Parker (as cited

in Lanis & Richardson, 2013) undertook research in

relation to the tax aggressiveness of mining

companies in Australia. According to the theory of

legitimacy, companies that engage in tax

aggressiveness require the disclosure of additional

information about CSR in order to meet people’s

expectations. However, the results of the study

suggest no correlation between tax aggressiveness

and CSR disclosure.

A similar study was conducted by Deegan et al.

(as cited in Lanis & Richardson, 2013), who

analyzed the annual reports of tax-aggressive

companies in Australia. The results of this study,

which related CSR disclosure to media coverage,

show that there is a relationship between the

community, with regard to certain social and

environmental issues, and CSR disclosures in annual

reports Therefore, this study contradicts the research

of Guthrie and Parker (1989).

Deegan et al. (2002) conclude that there is a

relationship between theories of legitimacy and the

act of tax aggressiveness. Moreover, Lanis and

Richardson (2013) examined the effect of tax

aggressiveness on CSR disclosure in order to test the

theory of legitimacy and found significant results.

In testing the theory of legitimacy, the absence of

consistent results regarding the relationship between

tax aggressiveness and CSR disclosure leads us to

propose the following hypothesis:

H

1

: Tax aggressiveness has a significant

influence on corporate social responsibility

disclosure.

3 RESEARCH METHODOLOGY

3.1 Types and Data Sources

Secondary data was utilized in this study, which was

taken from several sources, including financial

reports and annual reports of manufacturing

companies listed on the Indonesian Stock Exchange

for the period 2011 to 2015. Data used in this

research was retrieved from www.idx.co.id, and

information regarding the daily stock prices of

manufacturing companies was retrieved from

www.finance.yahoo.com. In order to calculate the

market-to-book value ratio, stock prices at the end or

beginning of the fiscal year were used.

3.2 Operational definition and

measurement of variables

3.2.1 Disclosure of corporate social

responsibility

Disclosure of corporate social responsibility relates

to the process of disclosing information associated

with the activities of the company and its effects on

society and the environment. CSR disclosure is

measured using the Global Reporting Initiative (GRI

3.1), an indicator with 84 disclosures, including

economic performance (9 indicators), environmental

performance (30 indicators), labor performance (15

indicators), human rights performance (11

indicators), social performance (10 indicators), and

performance (9 indicators). The formula for CSR

disclosure measurement is:

CSRI

J =

ΣXij

nj

The Influence of Tax Aggressiveness on the Disclosure of Corporate Social Responsibility - A Study of Manufacturing Firms Listed on the

Indonesian Stock Exchange 2011–2015

237

3.2.2 Tax aggressiveness

Tax aggressiveness relates to the act of minimizing,

in a legal or illegal way, a company’s tax burden.

The main proxy in this study is the effective tax rate

(ETR). The ETR proxy can be calculated as follows:

ETR =

Incometaxexpense

Earningsbeforetax

A low ETR indicates that the income tax expense

is smaller than the income before taxes, which

means the level of tax aggressiveness of a company

is high because, as taxpayers, they are paying a

small amount of tax (not taxable).

3.2.3. Company size

Company size relates to the size of a company as

measured by the total assets owned. According to

Lanis and Richardson (2013), company size can be

measured by the total natural logarithm of the assets

because it will have a better stability level than using

other proxies, and it is more likely to be continuous

across periods. The formula for company size is as

follows:

Size = Naturallogoftotalassets

3.2.4 Leverage

Leverage is a ratio that demonstrates the ability of

the company to meet its obligations, whether long-

or short-term debt. The approach used by Lanis and

Richardson (2013) to calculate leverage is as

follows:

LEV =

Totalamountofdebt

Totalassets

3.2.5 Intensity of capital

Intensity of capital is a description of how much of a

company’s wealth is invested in its fixed assets

according to how much assets the company owns.

For Lanis and Richardson (2013), capital intensity

can be calculated as follows:

CAPINT =

Totalnetfixedassets

Totalassets

3.2.6 Market-to-book ratio

The market-to-book ratio measures the company’s

growth in the future. This ratio makes a comparison

between the value/price of the stock market and the

book value of the company, which is obtained from

the difference between the value of the assets held

by the company and the value of its liabilities. In

Lanis and Richardson (2013), the market-to-book

ratio is measured as follows:

MKTB =

Marketvalue

Bookvalue

3.2.7. Return on assets

Return on assets (ROA) relates a company’s

profitability before tax to total assets (Hakston &

Milne, 1996). In this sense, profitability refers to

how much of a company’s profits are generated

from the total assets owned by the company. For

Lanis and Richardson (2013), ROA is measured as

follows:

ROA =

EarningsbeforetaxEBIT

Totalassets

3.3 Research Model

The methods of data analysis employed in this

study are as follows:

= 0 1 2 3

45

6

Information:

TCSR : Total CSR disclosed by

the company on the

company’s financial

statements

Α0 : Constants

Β1, β2, β3, β4, β5, β6 : The coefficients of each

variable

ETR : Corporate tax

aggressiveness

SIZE : Company size

LEV : Leverage

CAPINT : Intensity of capital

MKTB : Market-to-book ratio

ROA : Return on assets

e : error

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

238

4 RESULT AND DISCUSSION

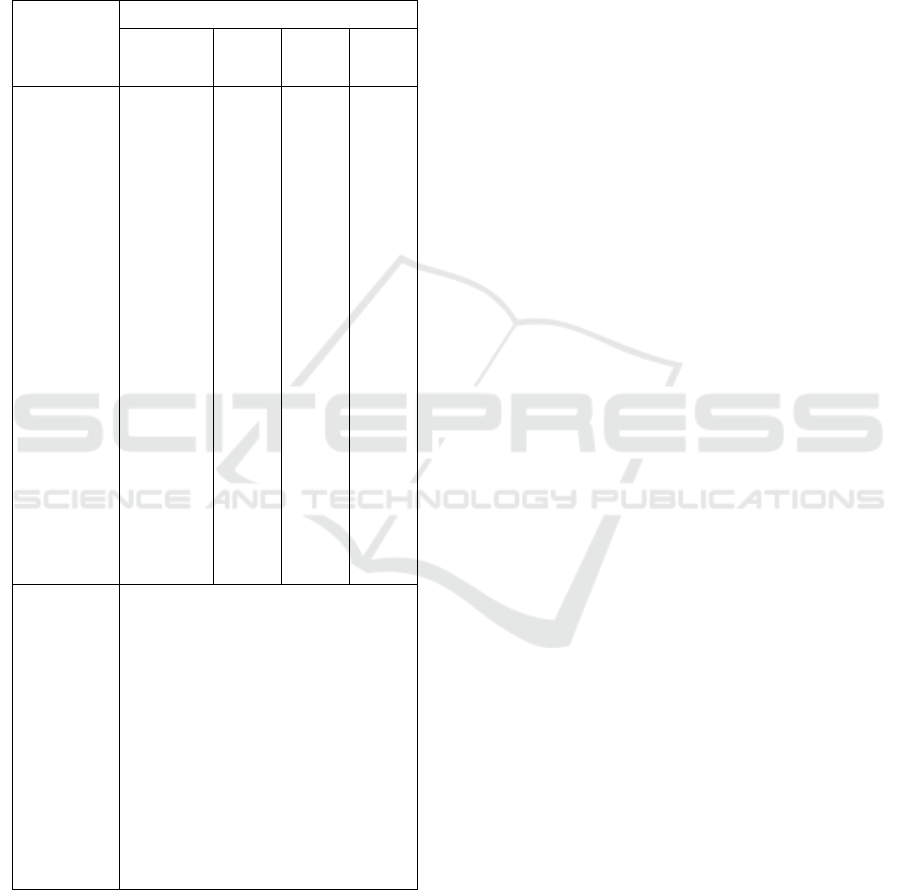

The results of the hypothesis testing by using

multiple regression analysis, as well as a

simultaneous hypothesis test (F-test) and a partial

test (T-test), can be seen in Table 2.

Table 2: Multiple Linear Regression Results

Variable

REGRESSION MODEL

Coefficien

t

Std.

Error

T Sig.

Constant -0,461

0,12

7

-

3,63

7

0,00

0

ETR -0,202

0,10

0

-

2,03

0

0,04

4

SIZE 0,135

0,01

7

7,97

6

0,00

0

LEV -0,128

0,07

3

-

1,74

7

0,08

3

CAPINT 0,186

0,06

5

2,87

5

0,00

5

MKTB 0,005

0,00

2

2,90

0

0,00

4

ROA -0,125

0,10

6

-

1,17

6

0,24

1

The

correlation

coefficient

(R)

0,638

Coefficient

of

determinatio

n (R2)

0,407

Test F 19,246

Significance

F

0,000

Source: SPSS Data Results

Based on the results of the calculations in Table

2, the multiple linear regression equation can be

formulated as follows:

TCSR = - 0,461 - 0,202 ETR + 0,135 SIZE - 0,128

LEV + 0,186 CAPINT + 0,005 MKTB - 0,125 ROA

+ 0,153

The T-test value for the tax aggressiveness

variable (ETR) is -2.030, with a significance level of

0.044. The value of the t table is 1.97419, and since -

2.030 > 1.97419, this meets the criteria of t test > t

table. The value of this significance is also smaller

than 0.05, so it can be concluded that tax

aggressiveness significantly influences corporate

social responsibility disclosure, which is in

accordance with the research hypothesis that tax

aggressiveness has an influence on corporate social

responsibility disclosure. The research results are

also consistent with those of Lanis and Richardson

(2013), which suggest that tax aggressiveness

significantly influences corporate social

responsibility disclosure. Furthermore, this indicates

that companies involved in tax aggressiveness will

disclose CSR in order to gain legitimacy from the

public. In this sense, the aim of greater CSR

disclosures is to alleviate any public concerns that

may arise from the negative impact of the

company’s tax aggressiveness on society, in addition

to demonstrating that they meet the expectations of

society in another way, i.e. by fulfilling their social

responsibilities.

5 CONCLUSION

The regression results in this research are in

accordance with the initial hypothesis proposed, i.e.

tax aggressiveness influences corporate social

responsibility disclosure. Moreover, the control

variables employed, including firm size, leverage,

capital intensity, market-to-book ratio, and return on

assets, displayed both significant and non-significant

results with regard to CSR disclosure. More

specifically, firm size, capital intensity, and market-

to-book ratio have a significant impact on corporate

social responsibility disclosure, while leverage and

return on assets have no effect on corporate social

responsibility disclosure.

REFERENCES

Andreas, Lako. 2011. Dekonstruksi CSR dan Reformasi

Paradigma Bisnis dan Akuntansi. Jakarta: Erlangga.

Arief, Subyantoro, dan Fx, Suwartono. 2007. Metodik dan

Teknik Penelitian Sosial. Yogyakarta: Andi.

The Influence of Tax Aggressiveness on the Disclosure of Corporate Social Responsibility - A Study of Manufacturing Firms Listed on the

Indonesian Stock Exchange 2011–2015

239

Badan Pusat Statistik. 2015. Realisasi Penerimaan

Negara 2011-2015. (www.bps.go.id, diakses 25

Februari 2016)

Bursa Efek Indonesia. Laporan Keuangan dan Tahunan.

http://www.idx.co.id/id/beranda/perusahaantercatat/lap

orankeuangandan tahunan.aspx. Diakses tanggal 17

Oktober 2015 - 9 Desember 2015.

Cho, C. H. 2010. The language of US corporate

environmental disclosure. Accounting Organizations

and Society Journal, 35, (4): 431-443.

Deegan, Craig., et al. 2002. An Examination of The

Corporete Social Environmental Disclosure of BHP

From 1983-1997: A Test of Legitimacy Theory.

Accounting, Auditing and Accountability Journal, Vol.

15, No. 3: 312-343.

Desai, M. A., dan Dharmapala, D. 2006. Corporate Tax

Avoidance and High Powered Incentive. Journal of

Financial Economics, 79: 145-179.

Effendi, S. 2010. Evaluasi Aspek CSR Dalam Perpajakan

Indonesia. Indonesia Tax Review, Vol. III/Edisi

19/2010.

Frank, M. M., Lynch, L.J., dan Rego, S.O. 2009. Tax

Reporting Aggressiveness and its Relation to

Aggressive Financial Reporting. The Accounting

Review, 84, (2), 467-496.

Freeman, R. E., dan McVea, J. 2001. Strategic

Management: A Stakeholder Approach.

http://papers.ssrn.com/paper.taf?abstract_id=263511.

SSRN. Diakses tanggal 6 Agustus 2016.

Ghozali, Imam dan A., Chariri. 2007. Teori Akuntansi.

Semarang: Badan Penerbit Universitas Diponegoro.

Global Reporting Initiative Generation 3.1. 2015.

www.globalreporting.org. Diunduh tanggal 21

September 2016.

Harari, M., Sitbon, O., dan Donyets, R. 2012. The Missing

Billions: Aggressive Tax Planning and Corporate

Social Responsibility in Israel. http://visar.csustan.edu.

Diakses tanggal 18 Juli 2016.

Hlaing, K. P. 2012. Organizational Architecture of

Multinationals and Tax Aggressiveness.

www.google.co.id. Diakses tanggal 19 Juli 2016.

Ikatan Akuntan Indonesia. 2012. Standar Akuntansi

Keuangan. PSAK. Cetakan Keempat, Buku Satu.

Jakarta: Salemba Empat.

Jiménez, Carlos Eriel. 2008. Tax Aggressiveness, Tax

Environment Changes, And Corporate Governance.

University Of Florida. www.google.co.id. Diakses

tanggal 19 Juli 2016.

Landolf, Urs. 2006. Tax and Corporate Responsibility.

International Tax Review. Diakses tanggal 26 Agustus

2016.

Lumbantoruan, Sophar. 2005. Akuntansi Pajak. Edisi

Revisi. Jakarta: PT. Gramedia Widiasarana Indonesia.

Maria, Ulfa. 2009. Pengaruh Karakteristik Perusahaan

Terhadap Corporate Social Responsibility Disclosure.

Skripsi. Universitas Islam Indonesia.

Nazir. 2005. Metode Penelitian. Jakarta: Ghalia Indonesia.

Octaviana, Natasya Elma. 2014. Pengaruh Agresivitas

Pajak Terhadap Corporate Social Responbility: Untuk

Menguji Teori Legitimasi. Skripsi. Fakultas

Ekonomika dan Bisnis. Universitas Diponegoro,

Semarang.

Pearce, dan Robin. 1997. Manajemen Strategis. Jakarta:

Binarupa Aksara.

Purwono, H. 2010. Dasar-Dasar Perpajakan dan Akuntansi

Pajak. Jakarta: Erlangga.

Resmi, Siti. 2009. Perpajakan : Teori dan Kasus. Jakarta:

Salemba Empat.

Richardson, G., Lanis, R., dan Taylor, G. 2013. Corporate

Social Responsibility and Tax Aggressiveness: A Test

of Legitimacy Theory. Accounting, Auditing, &

Accountability Journal, 26: 75-100.

Riyanto, Bambang. 2001. Dasar-dasar Pembelanjaan

Perusahaan. Edisi Empat. Yogyakarta: Yayasan Badan

Penerbit Gajah Mada.

Scott, William R. 2011. Financial Accounting Theory.

Edisi Enam. Canada: Person Prentice Hall.

Sembiring, E.R.. 2005. Karakteristik Perusahaan dan

Pengungkapan Tanggung Jawab Sosial Studi Empiris

Pada Perusahaan yang Tercatat di Bursa Efek Jakarta.

Makalah Simposium Nasional Akuntansi VIII. Solo.

15-16 September.

Sugiyono. 2011. Metode Penelitian Bisnis. Bandung:

Penerbit CV Alfabeta.

Untung, Hendrik Budi. 2009. Corporate Social

Responsibility. Jakarta: Sinar Grafika.

Watson, Luke. 2011. Corporate Social Responsibility and

Tax Aggressiveness: An Examination of Unrecognised

Tax Benefits. American Accounting Association

Annual Meeting. www.google.co.id. Diakses tanggal

18 Juli 2016.

Wibisono, Yusuf. 2007. Membedah Konsep dan Aplikasi

Corporate Social Responsibility. Gresik: Fascho

Publishing.

Winda, A.P., dan Pancawati, H.. 2015. Pengaruh

Agresivitas Pajak dan Media Eksplosure Terhadap

Corporate Social Responsibility. Dinamika Akuntansi,

Keuangan dan Perbankan, Vol. 4 No. 2: 136 – 151.

www.adb.org (Asian Development Bank)

www.saham.ok

www.finance.yahoo.com

Zain, Mohammad. 2008. Manajemen Perpajakan. Jakarta :

Salemba Empat.

Zeng, Tao. 2012. Corporate Social Responsibility and Tax

Aggressiveness.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=21

90528. SSRN. Diakses tanggal 21 Agustus 2016.

Zulaikha. 2014. Pengaruh Size, Leverage, Profitability,

Capital Intensity Ratio dan Komisaris Independen

Terhadap Effective Tax Rate (ETR). Skripsi Fakultas

Ekonomika dan Bisnis. Universitas Diponegoro.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

240