Interpreting The Public Accountants’ Code Of Ethics From The

Perspective Of Javanese Culture In East Java: An Ethnographic

Study

Zulkarnain Rizal Pahlevie and B. Basuki

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga, Indonesia

zulkarnainrizal40@yahoo.com, basuki@feb.unair.ac.id

Keywords: Ethics, Ethnography, Independence, Javanese Culture, Public Accountants’ Code of Ethics, Value.

Abstract: This research attempts to explain how the practice of the public accountants’ code of ethics can be upheld

from the perspective of the local culture and discusses the implementation of this code in the Javanese

cultural environment. By engaging with the ethnographic method in a gradual chronological plot, the

researchers show that Javanese cultural ethics strengthen the implementation of the five principles in the

professional ethics of public accountants. Although some incorrect understanding related to these Javanese

cultural ethics are an obstacle to establishing the public accountant code of ethics in the Javanese cultural

environment, this research could be a practical guide for those Javanese who are already or would be

involved in the public accounting profession to uphold the public accountant code of ethics in the Javanese

cultural environment of East Java.

1 INTRODUCTION

Every social interaction has different values and

norms in each territory because of geographical

factors. These geographical based values and norms

are embedded in members of various societies and

will affect their personalities, such as those from a

Javanese culture. The social harmony must be kept

because it is fundamental to life. There is principle

of always to avoid conflicts, and always respect to

others in the society as well as in a business entity,

government agencies, or independent institutions

(Leiwakabessy, 2009). These principles improved

the behavior of Ewuh Pakewuh in Javanese

Indonesian (disinclined or reluctant).

Bringing together auditor independence and local

culture is an interesting problem to be researched.

As stated in the Profession Standard of Public

Accountant (Standar Profesi Akuntan Publik or

SPAP (IAPI, 2006), independence is a reflection of

the accountant’s obedience to the public

accountant’s code of ethics so that every auditor

practitioner must hold firmly to their independence

to do their job. The manifestation of independence is

sceptical and assertive behavior. On the other side,

every person (including auditor practitioners) cannot

be separated from the values and norms that exist in

local culture because it affects the personalities of

people who live in that culture (Magnis-Suseno,

1997). The local culture discussed in this research is

Javanese culture. Javanese culture has dominant

ethical values regarding Javanese faith, behavior,

ethos, principles of respect, and principles of

harmony (Endraswara, 2015). As mentioned earlier

that there is behavior of disincline or reluctant in the

Javanese culture’s ethics. This behavior is a

contradiction to the behavior of auditor’s

independence and it could induce an ethical dilemma

for Javanese auditors.

There are several studies discussed by

Christiawan (2002(, Kalana, et al., (2012), Chariri

(2009), and Randa (2011) concerning auditor

professionalism, public accountant code of ethics,

and accounting related to culture. Kalana, Ngumar,

and Budi (2012) conducted a study on the influence

of social and cultural interaction on the application

of auditor independence. Chariri (2009) conducted a

study on the social construction of the practice of

financial reporting from PT Asuransi Bintang Tbk

from a Javanese cultural perspective. Randa (2011)

conducted research on the accountability of the

Catholic Church in Tanah Toraja from the

perspective of Toraja culture. Christiawan (2002)

conducted research on the competence and

Pahlevie, Z. and Basuki, B.

Interpreting The Public Accountants’ Code Of Ethics From The Perspective Of Javanese Culture In East Java: An Ethnographic Study.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 323-329

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

323

83

929

9

15

16

1

38

326

8

7

8

1

Sumatra Java Borneo Bali & ENT Sulawesi Papua

Distribution of Public Accountants and CPA Firm in 2014

Public Accountants CPA Firms

independence of public accountants and found that

culture can influence the independence of public

accountants.

This research is different from previous research

because it interprets the public accountant’s code

ethics from the perspective of local culture,

particularly Javanese culture, the dominant culture in

Indonesia (Magnis-Suseno, 1997). This research

used an interpretive research approach with a

developmental research sequence ethnographic

method to focus on the description and interpretation

of the public accountant’s code of ethics so it can

naturally improve the practice of the public

accountant’s code of ethics in an organization or

region.

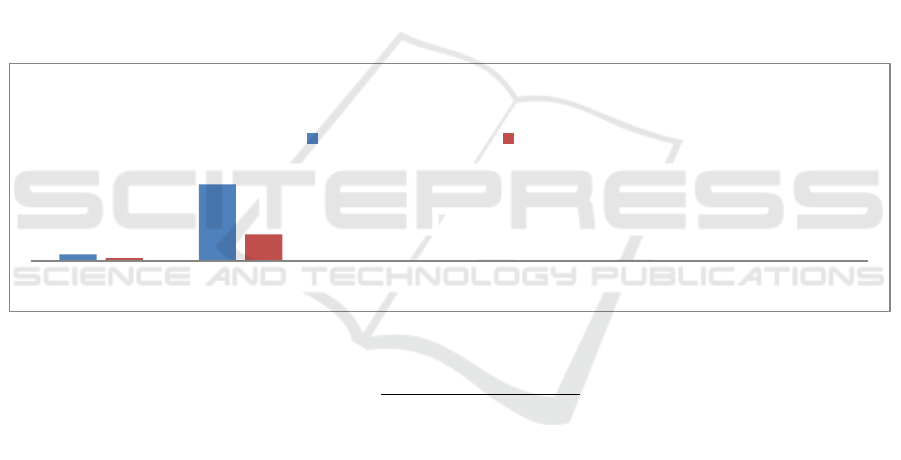

This consideration is substantiated by the rapid

development of the profession of public accountants

in Indonesia. More than 95% of public accountants

and CPA firms are located in Java. This can be seen

through the distribution chart of public accountants

and CPA firms in Indonesia in figure 1.

The rapid growth of the public accountant

profession in Java gave rise to a friction of ethics

between the public accountant profession and

Javanese culture. Even though not all of the auditors

in Java are of Javanese ethnicity, the ethical friction

still occurs through interactions between auditors

and auditees. The research focused on East Java

because Javan culture has more influence here than

in Greater Jakarta, despite the broad distribution of

public accountants there. The determination of the

city for the research is Surabaya because it is the

second largest city after Jakarta and the number of

public accountant offices has increased faster there

compared to other cities in East Java. This research

does not discuss Javanese culture as a whole but is

focused on Javanese culture in East Java.

This research aims to interpret the public

accountants’ code of ethical practices in the

Javanese culture of East Java so that it can be the

guidelines to uphold the public accountants’ code of

ethics in a Javanese cultural environment,

particularly in East Java.

2 RESEARCH METHOD

This research used a developmental research

sequence ethnographic method that consists of five

principles: determining the research technique,

identifying the levels of research, conducting the

research, practicing research in an original way, and

finding a solution to show that the output of the

research has practical benefits (Spradley, 1979).

Hereafter, Spradley (1997) divided those

ethnographic principles into twelve steps: selecting

the informant, interviewing the informant, creating

an ethnographic record for further analysis,

proposing descriptive questions for the informant,

performing an interview analysis, creating a domain

analysis, proposing structural questions, creating a

taxonomy analysis, proposing contrasting questions,

creating a component analysis, discovering a cultural

theme, and creating an ethnography.

This research does not use all of the twelve steps,

so the selected steps depend on the availability and

the meaningfulness of the information and other

requirements necessary. The utilization of this

method could provide descriptions and meanings for

the reality of the practice of public accountants’

code of ethics with ethnic Javanese auditors and

lecturers who are the domain of the interpretive

paradigms.

The main focus of this research is restricted to

interpreting public accountants’ code of ethics from

Figure 1. Distribution of public accountants and CPA firms in 2014

Source: http://pppk.kemenkeu.go.id

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

324

the perspective of Javanese culture in East Java,

particularly Mataram Javanese culture. This research

generates an understanding that can be used as

guidelines for auditors in formulating strategies to

cope with ethical dilemmas that appear because of

Javanese culture’s impact on society. Data was

obtained by direct interviews of the research

subjects, both structured and unstructured (Randa,

2011), with auditor practitioners, audit academics,

and Javanese humanists and is documented with the

results compared with ethics from the auditor’s point

of view.

In order to help the researcher to interpret the

public accountant code of ethics, the researcher

conducted interviews with the heads of public

accountant offices that are based in Surabaya. They

are Mr. Pamudji from KAP Budiman, Wawan,

Pamudji & Associates and Professor Parwoto

Wignjohartojo from KAP Hadori, Sugiharto, Adi &

Associates. This selection was based on a few

considerations. The associates and heads of both

KAP are ethnic Javanese residents, so that simplifies

the interpretation of the public accountant code of

ethics according to Javanese culture’s ethical values.

These KAPs also once occupied the top 20 of all

KAPs throughout Indonesia.

Based on this achievement, it is expected that

these KAPs will be able to provide a profound

interpretation of the public accountants’ code of

ethics considering their wealth of experience. Mr

Pamudji of KAP Budiman, Wawan, Pamudji &

Associates is the former retired at Financial and

Development Supervisory Board or Badan

Pemeriksa Keuangan Pembangunan (BPKP), and his

experiences obtained from his duties in BPKP could

be related to the implementation of a public

accountant code of ethics for independent agencies

in the government environment. Mr. Wignjohartojo,

the heads and partners in KAP Hadori, Sugiharto,

Adi & Associates, is professor at the Faculty of

Economics and Business in the Universitas

Airlangga, so hopefully, they can provide an

interpretation of the public accountant from an

academic perspective.

The researcher also selected one of the

accounting professors at Airlangga University as the

informant for an academic perspective as they are

not working as a public accountant. The informant

will provide the interpretation of the public

accountant code of ethics from an academic

perspective. The researcher also selected a local

humanist to be an informant in describing and

interpreting the Mataram Javanese culture in East

Java. The local humanist was selected for their

function in cultural activities.

3 DATA ANALYSIS

Data analysis was performed based on the results of

the ethnographic records. The stages of data analysis

involve domain analysis that identifies and describes

the ethical values of Javanese culture (performed by

the humanist) and the public accountant code of

ethics (performed by the accountant). In this stage,

we proposed some questions like a general

description of Javanese culture, the advantages and

disadvantages of Javanese culture, and the

characteristics of Javanese culture.

A taxonomy analysis was conducted through a

deep interview in order to find the fundamental

elements for each category representing Javanese

cultural ethics and the public accountant code of

ethics. Also, some questions like the fundamental

aspects of Javanese culture and the meaning behind

these aspects were included. The elements are

further elaborated on in order to obtain an

interpretation of each category and are used to find

the similarities and differences between Javanese

ethical values and the public accountant code of

ethics.

A component analysis was conducted by

proposing contrasting questions to the informant to

discover the similarities and differences between the

research categories obtained from the previous

analysis. This category comparison showed the

elements of Javanese cultural ethics that “amplify”

and/or “weaken” the public accountant code of

ethics. The final result of these stages is the

conclusion, which will later become the guidelines

for auditor practitioners to overcome the ethical

dilemma influenced by Javanese cultural ethics.

4 DISCUSSION

Faith is the aspect that shapes Javanese culture. This

aspect became the dominant ethical foundation in

Javanese culture and includes behavior, ethos,

principles of harmony, and principles of respect. The

Javanese believe that everything they do is based on

the spiritual doctrine that puts humanity and nature

first.

The public accountant code of ethics has five

basic principles that must be upheld by auditors,

they include integrity, objectivity, professional

Interpreting The Public Accountants’ Code Of Ethics From The Perspective Of Javanese Culture In East Java: An Ethnographic Study

325

competence and due care, confidentiality, and

professional behavior. These basic principles must

be upheld by auditors because they have a

responsibility to their clients that they must be free

from a conflict of interest that would influence them

to break the rules; it is the foundation of auditor

independence.

The contradiction between the public accountant

code of ethics and Javanese culture lies in Javanese

behavior and ethos, principles of harmony, and

principles of respect. There are two doctrines of

Javanese life behavior and ethos: you should not

highlight your superiority in front of others and

human nature is wrong and flawed so every human

should accept their own flaws and those of others.

While an auditor must be assertive and uphold the

profession’s due diligence, the principles of

harmony teach us to avoid conflict and build a

harmonious relationship with each other in all

circumstances. Meanwhile, auditors must control

their relationship with the auditee to maintain their

independence, if the auditor is not objective, this

could lead to conflict with the auditee. The

principles of respect can make accountants too

obedient so they will obey every instruction from

their leader or employer. Meanwhile, auditors or

accountants must be firm. In this matter, auditors or

accountants must comply with all the regulations

from the International Financial Reporting Standard

(IFRS) and the American Institute of Certified

Public Accountants (AICPA) Professional Standard,

not to the employer.

The nature of eling (to remember), waspada (to

be alert), and Javanese faith (eling and waspada) are

important as they are the ground rules for how the

Javanese are supposed to act and to create a peaceful

atmosphere. If we correlate with the five principles

in the public accountant code of ethics, Javanese

faith tends to reinforce the implementation of public

accountant code of ethics. Javanese faith will make

the auditor more assertive in establishing right and

wrong in the procedures performed by the auditee.

Other than that, the auditor will also uphold fairness

while carrying out their professional duties. All of

these are performed so that the Javanese ethnic

auditor will be removed from matters that will

compromise the auditor’s dignity. The auditor will

also be more objective in providing opinions on

financial reports audited by following Javanese faith.

Objectivity is necessary while performing

professional duties because it affects the opinions

given on the financial report. The opinions on the

financial report will be the auditor’s responsibility

toward the user of the financial report. If there is a

subjective side to the opinions provided, then it will

potentially damage the auditor’s reputation in front

of the financial report users, so that could dishonor

the auditor and damage their reputation. The

principle of competence, professional precision, and

caution will also be reinforced by an ethnic Javanese

auditor because this principle teaches the auditor to

be vigilant. These actions cannot be viewed

negatively by the financial report user. Professional

skepticism will be achieved by Javanese faith. The

principle of secrecy will be performed because

ethnic Javanese auditors understand that they have

been given the auditee’s trust to keep their

information private from third parties. Preserving

this trust also forms a noble character that is part of

Javanese faith. It will make an auditor behave more

professionally in performing their duties because it

teaches people to avoid any behavior that could

make an auditor dishonorable. Ethnic Javanese

auditors will obey every professional regulation and

behave in a professional manner in each assignment

in order to avoid matters that could discredit the

profession.

Javanese life behavior tends to reinforce the

public accountant code of ethics. Javanese behavior

teaches people to have a noble character and obey

God’s every command. This matter will encourage

ethnic Javanese auditors to be more honest upright

in order to perform their professional duties so that a

principle of integrity can be achieved. The principle

of objectivity will also be achieved if Javanese life

behavior is performed. Objectivity is a necessary

quality because it affects opinions. These opinions

will be noted in financial reports seen by general

society. If there is a conflict of interest in providing

opinions, this will benefit only one side of the party

but it will not be advantageous for the financial

report user and will damage the relationship between

the auditor and general society. The achievement of

the principle of peacefulness will not be made

between the individual and society, which is not part

of the values taught by Javanese life behavior.

Javanese life behavior also reinforces the principle

of professional competence, precision, and caution

because Javanese life behavior teaches prudence so

that someone will be cautious when performing

actions that could make the performer ashamed of

those actions. The principle of secrecy can be

reinforced because Javanese behavior teaches the

value of good; it means people must do good to

others. By doing good, people will maintain people’s

trust. Javanese behavior teaches the auditor to

preserve the trust given by the auditee to not divulge

the auditee’s information to a third party.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

326

Professional behavior clearly will be achieved by

emulating Javanese life behavior because the auditor

will be afraid to do something that might discredit

the profession in the eyes of the public. However,

Javanese life behavior could weaken the profession

if it is interpreted that someone cannot accentuate

their superiority in front of other people. This matter

will affect the rigidity of the auditor when finding

mistakes committed by the auditee because of the

fears of being called arrogant.

The ethos of Javanese life tends to reinforce

rather than weaken the public accountant code of

ethics. The ethos of Javanese life teaches someone to

not be too highly ambitious in life because high

ambition is one of the big reasons for corruption.

The ethos of Javanese life teaches someone to use

their skills or superiority to help other people. This

matter will reinforce the principle of competence

because the auditor will keep trying to improve his

skills relating to the accountancy profession, and

that encourages the auditor to help the financial

report user in improving its quality, which affects

the decision making. The ethos of Javanese life also

reminds us that humans are flawed and they make

mistakes. This matter will remind the auditor to be

cautious in performing any actions. Do not let the

actions negatively affect the profession’s reputation.

So, the principle of precision and professional

caution could be achieved. The ethos of Javanese

life could be weakened if it is interpreted that every

person should accept their own flaws and those of

others. This matter will affect the auditor’s firmness

in addressing problems made by the auditee. So, it

makes the auditor overly trust the reason of the

mistake performed by the auditee as the form of

other people’s flaw acceptance.

The principle of harmony can reinforce and

weaken the public accountant code of ethics

depending on the auditor’s comprehension of this

principle. The principle of harmony can reinforce

the public accountant code of ethics if it is used to

establish a good relationship between the auditor and

financial report user. The principle of harmony

makes the auditor afraid to do actions that could

damage the profession’s reputation or discredit it in

the public’s eyes. So, the principle of professional

behavior, competence, precision, and professional

caution can be achieved. The principle of harmony

teaches someone gotong royong or teamwork. If it is

interpreted correctly, this principle will reinforce the

audit team’s cooperation in investigations, so that a

good quality financial report can be achieved.

However, the principle of harmony can weaken the

profession if it is understood that one should

preserve a good relationship with anyone in any

condition. This matter will probably cause a conflict

of interest between the auditor and auditee while the

investigation is undergoing. For the achievement of

a good relationship with the auditee, the auditor

should comply with every request from the auditee

even if it is a violation of professional regulations

such as Financial Accounting Standard or Standar

Akuntansi Keuangan (SAK) and SPAP. This matter

will damage the principle of objectivity because it

negatively affects opinions in published financial

reports. Other than that, the principle of integrity

will also be destroyed because the auditor has

violated professional regulations because of

indecision and dishonesty while performing their

duties. Therefore, the principle of good professional

behavior cannot be achieved because the auditor has

violated the professional regulation that might

discredit the profession in the eyes of the public. The

principle of secrecy also cannot be achieved if the

auditor divulges information to a third party for the

reason of preserving a good relationship with the

third party. This matter can be advantageous to the

third party who accepts information but it can be

disadvantageous for the auditee. The principle of

objectivity will also be achieved if the auditor

understands that objectivity is important when

giving opinions, which is the auditor’s responsibility

toward the financial report users, both internal and

external users. So, the auditor will avoid a conflict of

interest that benefits only one side of the party but is

not advantageous for other parties (general society),

and negatively affects the profession’s good

relationship with general society.

The principle of respect teaches someone to

always appreciate others’ point of view and opinions

despite their social level and position. The outlook

that social relations in a structured society are

hierarchical for the realization of harmony

corresponds with the ethics of manners and is

fundamental to the principle of respect (Endraswara,

2015). Javanese people believe that every matter in

this world is connected to each other a unity of life

and that its harmony should be preserved. As well as

the principle of harmony, the principle of respect can

weaken or reinforce the public accountant code of

ethics. If the principle of respect is interpreted

correctly, it will make an auditor an obedient

personality toward the accountant profession

regulations and it makes the auditor afraid to do

actions that might violate the professional

regulations. This matter will make the auditor’s

personality turn into an honest and emphatic

personality. Therefore, the principle of professional

Interpreting The Public Accountants’ Code Of Ethics From The Perspective Of Javanese Culture In East Java: An Ethnographic Study

327

behavior will be achieved because it can have a

positive effect on general society and the auditor.

The principle of competence will be achieved

because the auditor will keep improving their

knowledge of the professional regulations. They will

not violate the regulations because of their

ignorance. The principle of precision and

professional caution will also be achieved because it

makes the auditor cautious and alert when taking

actions during their investigative duties. They will

not violate professional regulations by accident

because they will be vigilant. The principle of

respect might weaken the profession if the auditor

positions themselves as an obedient employee in

relation to their superior, which sometimes violates

professional regulations. If principle of respect

weakens the profession, then it will reduce the

auditor professionalism. The principle of respect

should be understood correctly so that it will not

negatively affect the implementation of the public

accountant code of ethics. Other than gotong royong

(teamwork) and unggah-ungguh (respect), there is

an identical philosophy in Javanese culture, ewuh

pekewuh. Ewuh pekewuh is a manifestation of the

implementation of two fundamental rules, the

principles of harmony and respect (Endraswara,

2015). In Indonesia, ewuh pekewuh means

disinclined and uncomfortable feelings. According

to Tobing (2010) ewuh pekewuh is interpreted as an

uncomfortable feeling that almost resembles the

feeling of disinclination. This feeling of fear of

causing someone offence. Ewuh pekewuh makes

someone cautious when taking actions or saying

something in order to avoid conflict and to establish

a good relationship. Ewuh pekewuh usually happens

to someone who is about to interact with older

people as a sign of respect, but it also occurs if

someone owes a lot to others, so the person tends to

follow the command or even the opinion of those

people.

The above explanation shows that Javanese

culture’s ethical values actually reinforce the public

accountant code of ethics. The reinforcement of the

public accountant code of ethics is dominated by

Javanese spirituality and the wisdom of the local

Javanese culture. While the weakening of the public

accountant code of ethics can be caused by the

misunderstanding of Javanese culture, such as the

implementation of ewuh pekewuh. Initially, ewuh

pekewuh was viewed as weakening the public

accountant code of ethics, but the research’s results

show otherwise. Therefore, every Javanese person

who has decided to be an accountant must uphold

their independence in the Javanese cultural

environment. The accountant needs to understand

that their responsibility is to the public interest,

which is in accordance with Javanese cultural ethical

values. An accountant should fix their personal

character, especially graduates who tend to pursue

material matters at the beginning of their careers

because every individual’s character will weaken the

establishment of independence within the

accountant’s personality. Javanese people should be

able to adapt to another environment by following

the norms and rules in it, as long as those norms and

rules have the right purpose. However, Javanese

people should perform these norms and rules in the

proper way according to Javanese ethics, which is

polite and refined behavior that decreases the

occurrence of conflict. This means that Javanese

people should not lose their identity by obeying the

norms and rules of the different environment.

5 CONCLUSION

Initially, Javanese culture was viewed as contrary to

the public accountant code of ethics. Independence,

as a manifestation of the public accountant code of

ethics, requires someone to be assertive, while

Javanese culture prioritizes ewuh pekewuh. The

result of this research shows things that contradict

with the initial assumption. The research provides a

conclusion that the dominant Javanese cultural

values of Javanese faith, life behavior, work ethic,

and the principles of harmony and respect help the

accountant practitioner to uphold the public

accountant code of ethics. However, these values

could be obstacles to the reinforcement of the public

accountant code of ethics if someone misinterprets

and implements those values.

The result of the adaptation of Javanese culture

with the public accountant code of ethics is that first,

Javanese faith, which recognizes eling and waspada,

will reinforce the implementation of the public

accountant code of ethics. Javanese faith teaches

humans to have a noble character and avoid

behavior that could negatively impact upon a

person’s dignity. Second, the principle of harmony

could reinforce or weaken the public accountant

code of ethics, particularly toward the principle of

integrity, objectivity, and professional behavior. The

principle of harmony could be reinforced if the

auditor understands that negative behavior will

damage the relationship with the financial report

user. The principle of harmony could be weakened if

it is used as a reason to perform a violation to

preserve good relations. Other than that, the

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

328

principle of harmony could be the reason for

divulging information to preserve a good

relationship with a third party and thus weaken the

principle of secrecy. Third, the principle of respect is

related closely to the implementation of the principle

of integrity and professional behavior.

The principle of respect could be reinforced

because it will make the auditor obedient to all

professional regulations. The principle of respect

could be weakened if the auditor positions

themselves as an employee or partner that should

follow their superior’s command, even though it

violates the professional regulations. Fourth,

Javanese life behavior and work ethics tend to

reinforce the public accountant code of ethics

because it makes the auditor unambitious in

pursuing material matters, which are usually the

main causes for violating the code.

This matter reinforces the principle of

professional behavior. However, these ethical values

could weaken the principle of integrity and

professional caution if the auditor considers that

humans are flawed and make mistakes, so it affects

the auditor’s firmness in dealing with the auditee.

Therefore, Javanese cultural and ethical values

should be understood correctly in order to not have a

bad influence on the implementation of the public

accountant code of ethics.

This research has limitations because of several

factors encountered while conducting the research.

Here are the limitations of the research:

1. This research does not discuss Javanese culture

as a whole. It is only discussed regarding

Javanese culture in East Java, particularly

Mataram Javanese culture. The result of this

research will be different if both sides of

Javanese culture, which have different

characteristics, are included.

2. This research does not discuss Javanese culture

in detail because of the lack of time for

discussing such culture between the researcher

and the humanist. This matter means Javanese

culture, particularly Mataram Javanese, cannot

be interpreted in a detailed manner.

REFERENCES

Chariri, A. 2009. Social Construction of Financial

Reporting Practice in anIndonesian Insurance

Company: Javanese Culture Perspective.Simposium

Nasional Akuntansi. Semarang: Diponegoro

University.

Christiawan, Y. J. 2002. Kompetensi dan Independensi

Akuntan Publik : RefleksiHasil Penelitian Empiris.

Jurnal Akuntansi & Keuangan, 4 (2), 79-92.

Endraswara, Suwardi. 2015. Etnologi Jawa: Penelitian,

Perbandingan, dan Pemaknaa Budaya. Yogyakarta:

Center of Academic Publishing Service (CAPS).

Kalana, I., S. Ngumar, & I. Budi R. 2012. Independensi

Auditor Berbasis Kulturdan Filsafat Herbert Blummer.

Simposium Nasional Akuntansi XV.Banjarmasin, 1-32

Leiwakabessy, A. 2010. Pengaruh Orientasi Etis dan

Budaya Jawa Terhadap Perilaku Etis Auditor. Jurnal

MAKSI, 10 (1): 1-15

Magnis-Suseno, F. 1997. Javanese ethics and world-view:

The Javanese idea of the good life. Jakarta: Gramedia

Pustaka Utama.

Pusat Pembinaan Profesi Keuangan. 2015. Profil Akuntan

Publik dan KantorAkuntan Publik 2014. Jakarta:

Ministry of Finance Republic

Indonesia(http://pppk.kemenkeu.go.id, accessed

Agustus, 23 2016).

Randa, F. 2011. Rekonstruksi Konsep Akuntabilitas

Organisasi Gereja (Studi Etnografi Kritis Jnkulturatif

pada Gereja Katolik di Tana Toraja). Simposium

Nasional Akuntansi 14. Banda Aceh: Universitas

Syiah Kuala.

Spradley, J.P. 1997. The Ethnographic Intervew. Elisabeth

M.Z. (penterjemah) Metode Etnografi. Yogyakarta:

Tiara Wacana Yogya.

Tobing, D. H. 2010. Asertivitas Perokok Pasif Dalam

Budaya Ewuh Pakewuh. Thesis. Yogyakarta: Program

Magister Psikologi Fakultas Psikologi Universitas

Gadjah Mada

Interpreting The Public Accountants’ Code Of Ethics From The Perspective Of Javanese Culture In East Java: An Ethnographic Study

329