Analysis and Design of Internal Control on Revenue Cycle in Order

to Optimize Enrollment Fees Collection in Non-Profit Organization:

Case Study on ABC Foundation

Ceicilia Astri Hartanti

and Malik

Magister of Accounting, Faculty of Economics and Business, Universitas Indonesia, Jakarta, Indonesia

ceicilia.astri@gmail.com,

\

malik01277@gmail.com

Keywords: Agency Theory, Competitive Advantage, Information Technology, Internal Control, Non-Profit

Organization, Revenue Cycle, Value.

Abstract: Information technology utilization could promote more efficient business process. However, if it is not

supported by adequate internal control activities, management will lose control its operational activities.

Fraud, loss of trust from stakeholders, and reputation declining are risks that must be borne due to the lack

of internal control. By using a qualitative approach with a case study approach at ABC Foundation, a non-

profit organization in education industry, this study aims to analyse and design the internal control activities

in its new student admission business process. The research was conducted by observation, series of

interviews with its management, and analysis on the internal documents. The results show that there are

some weaknesses on procedures in optimizing its billing process which due to lack of procedures’

adjustment to current business processes and unstructured implementation of internal control activities. It

impacts the balances of accounts receivable and the value of the recorded income being inaccurate and the

number of complaints from the parents of students due to inappropriate billing amount. Therefore, this study

provides recommendations for improvements in company’s financial administration procedures and internal

control activities that can be applied to solve existing problems while improve company’s performance and

reputation.

1 INTRODUCTION

This research is aim to analyse the internal control

on non-profit organisation engaged in educational

services in Indonesia. Even though there are no

regulations required the non-profit entity in

Indonesia should have an internal control system,

Jeffrey (2008) writes that a strong internal control

system creates a separate competitive advantage for

an entity regardless of whether the entity is profit-

oriented or non-profit. An entity that has strong

internal control will be able to respond to

encountered risks faster and better (Jeffrey, 2008).

Strong internal control system will also maximize

the value delivered to customers, since it is part of

entity’s value chain. It also can be view as part of

management’s strategic plan to achieve company’s

target performance (Mawanda, 2008).

Porter (1985) explained that competitive

advantage grows out of value a firm is able to create

for its buyers that exceeds the firm's cost of creating

it. Value, as explained by Porter (1985), is what

buyers are willing to pay. Value also described as

price-quality ratio of a product (Lindič and Silva,

2011). In the education industry, the value offered

by education providers will affect parents in

deciding where their children will be enrolled in.

Consumer loyalty towards a product will

increase when the value received by consumers are

deemed to be greater than the cost incurred. This

becomes important as part of a company's marketing

strategy, especially in the education industry that

relies on its marketing strategy through word of

mouth. Jiewanto, Laurens, and Nelloh (2012) in his

research explains that the excellent quality of service

from an educational institution will have a positive

impact on the consumer's satisfaction and image of

the educational institution, and it will also increase

the intention of its customers to disseminate

information or provide good testimonies based on

their experience.

In Indonesia, Law Number 20 of 2003 on

National Education System, Article 53 stipulates that

338

Hartanti, C. and Malik, .

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization (Case Study on ABC Foundation).

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 338-347

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the provider and /or formal education units shall be

non-profit educational legal entities. Although non-

profit principled, it does not mean that a non-profit

entity can override the internal controls in its

operations. The internal control is posited to be used

to address agency cost by mean ensuring

information efficiency between principal and agent

(Namazi, 2013).

The Committee of Sponsoring Organizations of

the Treadway Commission (COSO) (2013) defines

internal control as a process influenced by the

entity’s board of directors, management, and other

personnel, designed to provide reasonable assurance

regarding the achievement of objectives in the

categories of effectiveness and efficiency of

operations, reliability of reporting, and compliance

with applicable law and regulations.

The Association of Certified Fraud Examiners

(ACFE) (2016) in its publication explains that lack

of internal control is one of the biggest factors

causing fraud within an organization. Furthermore,

ACFE (2016) in the research also found that fraud

occurred in organizations operating in the education

industry is largely associated with assets

misappropriation. A total of 25% of frauds are

related to skimming in which incoming payment is

stolen from an organization before it is recorded on

the organization's books and records.

Based on research conducted on 27,495 public

charities from 1999 to 2007, some of the causes of

internal control issues in public charities are poor

financial conditions, growing organizations, and

complex or small organizations (Petrovits,

Shakespeare and Shih, 2011). This research also

concluded that the disclosure of a problem in

internal control negatively affects the support from

the next donors. Synder, Andersen, and Zuber

(2017) in their paper stated that based on research

conducted by the Association of Certified Fraud

Examiners (ACFE) in 2014, an estimate losses

suffered by non-profit entities due to fraud has

reached 5% of their annual income or about US

$108,000. The magnitude of these losses does not

take into account the impact of reputation damage

and the loss of public trust towards the entity’s

performance, which will undermine income in the

short term.

Burtseva, Vokina and Schneider (2015)

explained that the continuity of an educational

institution business depends on its ability to identify

risks. Implementation of this task required the

involvement of employees who work in internal

control functions within the organization.

Yayasan ABC (the Foundation) is an entity that

operates as a provider of educational services.

Currently, there are 1,300 registered students in 6

school branches under the management that located

in Jakarta, Tangerang Selatan and Surabaya. In the

near future, the management also plans to open 2

(two) new school branches outside of Jakarta. With

this expansion plan, the management targets an

increase in the number of students to more than

50%.

Since 2014, the Foundation implements a web-

based application as a tool for new student

admission. Then, in order to improve the company's

internal control and to support the Foundation's

expansion plan, by mid-2017, the board decided to

centralize most of the school's supporting activities.

With changes to the organizational structure and

the way of work, there is the risk that Foundation’s

financial statements could not provide the reliable

information to decision makers. Errors of numbers

presented can occur due to intentional or accidental

elements. Based on the results of interviews between

the researcher and the Finance Division team, the

Foundation's accounting team is facing several

problems that arise in the Foundation's revenue

cycle, especially in admission process, such as:

1. Discrepancies are found between the balance of

accounts receivable in the financial statements

with the list of students who still have

outstanding balance;

2. Total income from new students enrolled

recorded in the income statement for the period

ended in 31 December 2016 has a significant

fluctuation compare to prior period, which was

difficult to explain.

3. Prospective parents are complaining because the

registration fees they have been charged with are

inconsistent to the information provided

beforehand.

The problem raised may be indicated there are

some weaknesses on company’s accounting

information system, especially related to its internal

control system. This research will analyze current

condition of internal control system on ABC

Foundation revenue cycle, especially related to its

new student’s admission process. This study does

not just extend the current finding of the effect of

internal control system to company’s financial

performance and its going concern, but also propose

a recommendation to improve company’s financial

administrative procedures and internal control

activities that can be applied to solve existing

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization

(Case Study on ABC Foundation)

339

problems. The value delivered to its consumer and

company’s reputation also expected to be improved.

2 LITERATUR REVIEW

2.1 Agency Theory

Agency theory postulates that as a contract

under which principal (founders) engage agents

(managers) to perform services on their behalf

(Jensen and Meckling, 1976). This theory, assumes

that agents have more information than principals

which lead to asymmetric information and adversely

affect the principals’ ability to monitor whether their

interest are being properly served by agents (Adams,

1994). It also premiss that principals and agents act

rationally to use the nexus of contract to maximise

their own wealth. By adapting the agency theory, the

principals can design and implementing effective

control mechanism. One of this role is to ensure

informational efficiency by using accounting

information in establishing control system (Namazi,

2013). It also provides a delegate model to explain

why control is important, thus it should be exerted in

entity (Namazi, 2013).

2.2 Porter’s Theory

Competitive advantage grows out of value a firm is

able to create for its buyers that exceeds the firm's

cost of creating it (Porter, 1985). There are 3 (three)

generic strategies to company gain the advantage,

i.e. company offer unique value to its consumers,

company sets out to become lower cost producer,

and company decide to serve segmented market.

The strategy chosen then is reflected in the series

of activities in delivering the value to the consumers,

namely value chain (Porter, 2015). Value is

explained as what buyers are willing to pay (Porter,

2015). One of activities in value chain is related to

firm infrastructure which accounting information

system is under its activities. Internal control is one

of accounting information system component

(Romney, 2015). Therefore, better internal control in

organization could promote better company’s value

chain and increase value delivered to its customers.

2.3 Internal Control

The Committee of Sponsoring Organizations of the

Treadway Commission (COSO) (2013) defines

internal control as a process, effected by an entity’s

board of directors, management, and other

personnel, designed to provide reasonable assurance

regarding the achievement of objectives in the

categories of effectiveness and efficiency of

operations, reliability of reporting, and compliance

with applicable law and regulations. Romney (2015)

defines it as the process implemented to provide

reasonable assurance that the following control

objectives are achieved, in such as safeguard assets,

provide accurate and reliable information, and

prepare financial reports in accordance with

established criteria. Therefore, it can be concluded

that internal control is a process that is interrelated,

designed and effected by the entity’s management in

order to achieve operational effectiveness, financial

reporting reliability, and compliance with

regulations and applicable law.

There are five component on COSO Framework

component, i.e. control environment as the

foundation, risk assessment as a dynamic and

iterative process, control activities as the series of

actions established by policies and procedures,

information and communication, and monitoring

activities as ongoing and separate evaluations

process (COSO, 2013).

Internal control has become a requirements to

organizations to achieve either its business

objectives or financial performance, including in

education institution (Mawanda, 2008). Any internal

control weaknesses, especially on control

environment component, accounting policies and

procedures, or control design, will have negative

impact on company’s performance (Lai, Li, Lin,

Wu, 2017). It will also lead to unreliable financial

data that may impact to accuracy of financial

forecast (Clinton, Pinello, and Skaife, 2014).

Therefore, it is imperatives for organizations, either

profit or non-profit oriented, to assess, design,

develop and monitor its control system. It will turn

allows the organizations to operate effectively

(Maguire, 2014).

Romney (2015), in his book, stated that revenue

cycle is exposed some of the risks, i.e. inaccurate

order, invalid order, uncollectible accounts, loss of

customers, shipping errors, failure to bill, billing

errors, posting errors in accounts receivable, theft of

cash and cash flow problems. Those risks can be

mitigated by implemented control activities, such as

restriction access to master data, segregation of

duties, aging A/R preparation, reconciliation

between sales order, bill-of-lading, and invoice,

proper authorization, and system configuration.

Romney (2015) also explained that those internal

controls activities perform preventive, detective, or

corrective functions.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

340

3 RESEARCH METHODOLOGY

3.1 Research Methods

This research is a descriptive qualitative research

which is used to gaining a deep understanding to

make a conclusion of the pattern or phenomenon

that occurs (Wahyuni, 2015). The data obtained and

processed are not numerical, but instead flowcharts

and interview results, as well as observations

(Wahyuni, 2015). In this study, the phenomenon to

be analysed is the design of ABC Foundation

internal control system.

This research using case study approach on 1

(one) research object. The object of this research is

ABC Foundation, an entity engages as education

service providers. The foundation was selected as

the place to conduct the research because, in general,

there is limited access to financial information of a

non-profit entity.

Considering the main purpose of conducting this

research this research utilized primary data sources

that are directly obtained from the Finance division

and Sales division of the Foundation. Data collection

techniques used in this research is observation of

usage of web-based application system, interviews

with finance and sales division, and with the finance

director as the management’s representative, as well

as analysing the company’s internal documents.

The observation will conducted on one branch of

the school owned by the Foundation. This

consideration was taken because the particular

school branch has the most number of students

compared to other school branches. Income recorded

by the school branch by 31 December 2016 reached

88% of the total income recorded by ABC

Foundation. Of the total income accounted for by the

school's branches, 19% of them came from the

enrolment of new students. In addition, another

consideration is that, since it was decided to

centralize in July 2017, business processes

uniformity between branches of the school. Hence,

the results of this research will be utilized and

implemented in other branches or could be a

blueprint to be used by the management when they

are opening another branch.

3.2 Data Analysis

This research will use the data obtained to analyse

ABC Foundation control environment, risk

assessment process and internal control practices in

new student’s admission process at ABC

Foundation. The analysis will produce information

on the conformity of internal control practices in the

field with the existing procedures. This research will

also develop a framework to adjust internal control

activities therein. The results of interviews,

observations, and analysis of the company’s internal

documents will generate an overview of operational

activities in the field as well as system development

plans that will form the basis for the preparation of

the internal controls adjustment framework.

3.3 Scope of Research

In order to make this research focused, the scope of

this study will be limited to analysis until

designation of internal control activities on revenue

cycle which is related to new student’s admission

activities.

4 RESEARCH OUTCOME

4.1 Control Environment

Company’s code of conduct has been communicated

regularly to all employees. In its notarial deed also

stated duties and responsibilities of Foundation’s

organ, i.e. founder, controller, and management.

Foundation’s financial statements regularly

reviewed and presented to controller and founder as

part of management’s accountability. Its

organisation structure has been developed to

represent each function and line of command. Each

employee also has key performance indicator which

related to admission and students retention ratio.

Company also give appreciation to employee who

has more than 10 service years.

Even though company has communicated its

code of conduct regularly, ABC Foundation has no

internal audit division or whistle blowing system as

a tool to mitigate fraud risk. Management rely on

supervisor review for any code of conduct violation.

4.2 Risk Assessment

In general, based on interview with Finance

Director, ABC Foundation has neither risk

assessment tool nor risk control matrix. She stated

that new student’s admission process is exposed low

risk of skimming, since all the cash receipt

transactions was done directly through company’s

bank account. ABC Foundation is also exposed low

environment significant changes risk, since better

government support and people awareness on

education.

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization

(Case Study on ABC Foundation)

341

4.3 Control Activities

In the company’s web-based application system, the

prospective parents will register independently if

they want their children enrolled in ABC School.

There are 3 (three) division involved in the

admission process, i.e. sales, finance, and academic

division.

During the research, researcher identify that

there are some threat on the admission process.

Furthermore, researcher paired it to internal control

activities to mitigate the risk. The activities will

classified by its functions, i.e. preventive, detective,

or corrective actions. And at the end, based on

observation and interviewing process, researcher

assess whether the finance and sales team do the

activities.

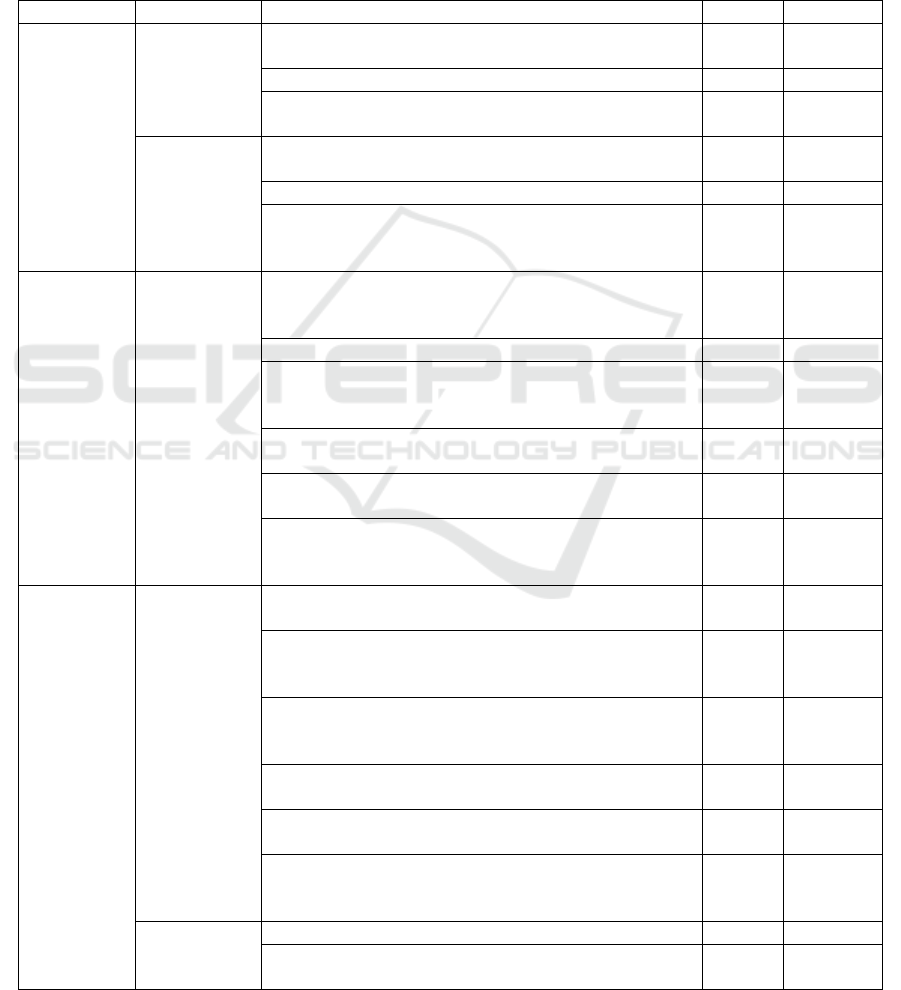

Table 1: Risk and Internal Control Activities on Admission Process.

Process

Risk

Internal Control Activities

P/D/C

*)

Checklist

Registration

Invalid order

Registration can only process through admission system,

including if the parents is Foundation’s employee.

P

√

Sales team verify validity of registration data.

P

√

Access limitation to student information in academic

system.

P

√

Loss of

customer

Record and resolve complaints from customers in a

timely manner

C

√

Follow up unpaid invoice exceed the due date.

P

√

Cancel registration process if the parent does not response

our follow-up actions properly or settle the enrolment bill

before maturity date.

P

√

Billing

Billing error

System configuration to automatically identify discount

criteria, based on employee ID, or e-mail address, or

student ID.

P

×

System configuration to automatically enter pricing data

P

×

Do proper socialization to sales and finance team related

to enrolment fee, early bird price, and instalment

mechanism before admission period started.

P

√

Access limitation to pricing data, only can be accessed by

Finance Manager.

P

√

Access limitation to employee data, only can be accessed

by HRD Manager.

P

√

Proper authorization and documentation up to GM

Marketing and Sales level to approve special enrolment

fee discount.

P

×

Failure to bill

Registration can only process through admission system,

including if the parents is Foundation’s employee.

P

√

Reconcile number of new students enrolled per academic

year between finance division and sales division

periodically.

D

×

Instalment application should be documented properly, in

written documentation, between parents and school

(approved by Finance Director).

P

√

Prepare manual register of the name of parents, name of

students, and the enrolment fee instalment value.

P

√

Develop integrated system to issued enrolment fee

instalment invoice automatically.

P

×

Reconcile of enrolment fee instalment invoice issued to

manual register of outstanding enrolment fee instalment,

periodically.

D

×

Uncollectible

account from

the enrolment

Prepare aging account receivable.

D

×

Reconcile of enrolment fee instalment invoice issued to

manual register of outstanding enrolment fee instalment,

D

×

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

342

Process

Risk

Internal Control Activities

P/D/C

*)

Checklist

fee

instalment.

periodically.

Follow up receivables aged more than 30 days.

P

√

Close access to admission system if the student or sibling

still has unpaid invoice.

P

√

Cash receipt

Theft of cash

Cashier prohibited to receive payment in cash.

P

√

Socialization and persuade parents to utilize payment

channel via virtual account or, if any, payment gateway.

P

√

Segregation of duties between cashier and the person who

do accounting record.

P

√

Daily reconcile between EDC machine transactions

listing to bank statement.

D

√

Do bank reconciliation periodically and in timely manner.

D

√

Investigate long outstanding account receivables.

D

×

Pre-numbered payment receipt form.

P

√

Develop payment receipt system that can’t be edited or

cancelled by the cashier without the supervisor's

authorization.

P

√

Cash flow

problem

In cooperation with banks to provide credit card

instalment facility.

P

√

Prepare cash flow budget

P

×

Providing

service

Provide

services to

students who

have unpaid

enrolment fee

bill.

Close access to admission system if the student or sibling

still has unpaid invoice.

P

√

Ensure payment of the enrolment fee instalment

completed before the beginning of school year.

P

√

In case of the enrolment fee instalment schedule

exceeding the stipulated period, proper authorization and

documentation from Finance Director and/ or HRD

Director (if the parent is Foundation’s employee) is

needed.

P

√

Reconcile payment of the enrolment fee instalment to

invoice amount and manual register of outstanding

enrolment fee instalment, periodically.

D

√

Accounting

record

Revenue

recorded and

balance of

account

receivable at

the end of

period is

inaccurate.

Ensure to record the invoice issued to accounting

information system through Account Receivable menu.

P

√

If invoice recorded to accounting information system in

batch, do batch total check and compared to computer

generated total, to ensure no data missing out.

P

√

Reconcile accounts receivable sub-ledger to general

ledger at the end of month.

D

×

Reconcile total invoice amount issued to revenue

recorded at general ledger at the end of month.

D

×

Do bank reconciliation in timely manner and periodically.

D

√

Daily reconcile between EDC machine transactions

listing to bank statement.

D

√

Accounting manager perform analytical review of

revenue amount recorded periodically.

D

√

Send monthly statement to parents.

D

×

Investigate long outstanding account receivables.

D

×

*) P = Preventive, D = Detective, C = Corrective.

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization

(Case Study on ABC Foundation)

343

4.4 Discussion

Based on the results of observations and interviews

conducted, this research concluded that there are

some weaknesses in internal control activities in the

process of admission of new students in the ABC

Foundation. The weaknesses are compared to related

control objectives. The weaknesses are shown in the

table below.

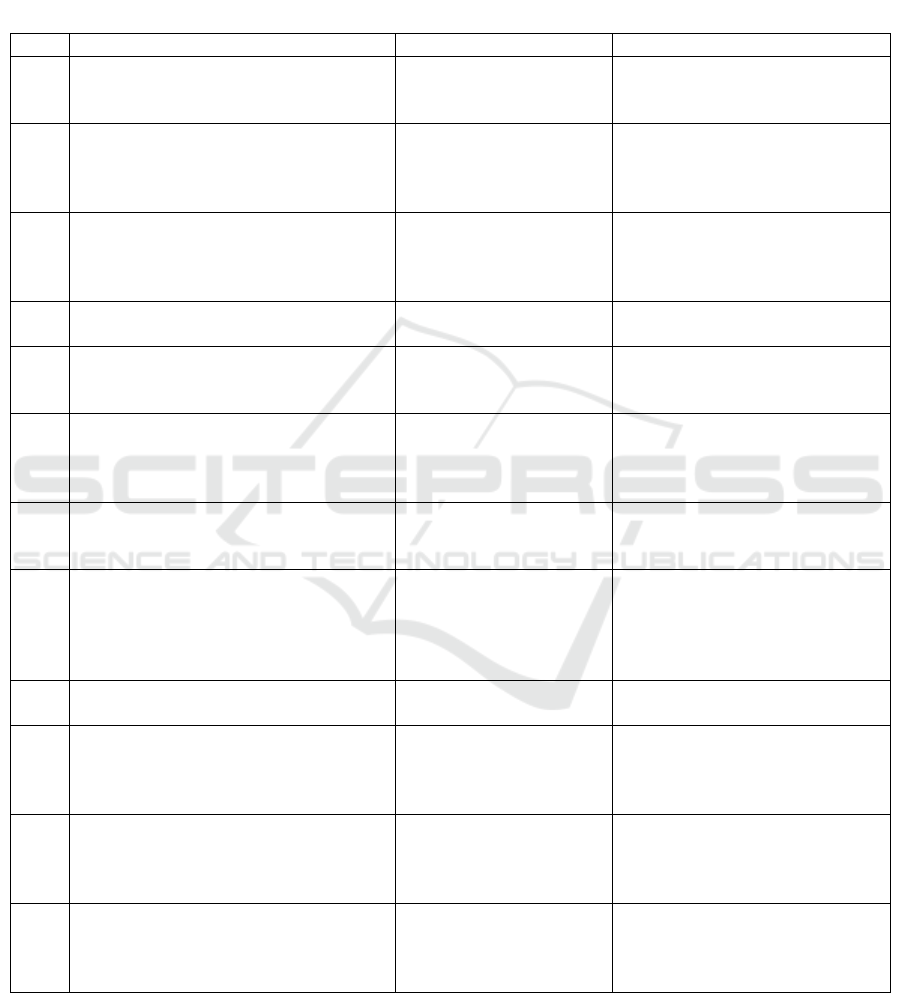

Table 2: Proposed Addition of Internal Control Activities of Admission Process.

No

Internal Control Activities

Risk

Control Objectives

1

Prepare aging account receivable.

Uncollectible account

from the enrolment fee

instalment.

As management’s tool to monitor

outstanding receivables.

2

Reconcile of enrolment fee instalment

invoice issued to manual register of

outstanding enrolment fee instalment,

periodically.

Failure to bill;

Uncollectible account

from the enrolment fee

instalment.

To detect unbilled enrolment fee

instalment in timely manner.

3

System configuration to automatically

identify discount criteria, based on

employee ID, or e-mail address, or

student ID.

Billing errors.

To avoid error during identification

process.

4

System configuration to automatically

enter pricing data

Billing errors.

To avoid error or fraud in enter

pricing data.

5

Proper authorization and documentation

up to GM Marketing and Sales level to

approve special enrolment fee discount.

Billing errors.

To prevent total discount amount is

larger than budgeted amount.

6

Reconcile number of new students

enrolled per academic year between

finance division and sales division

periodically.

Failure to bill.

To ensure all students enrolled

have settle all enrolment fee bill.

7

Develop integrated system to issued

enrolment fee instalment invoice

automatically.

Failure to bill.

To ensure completeness of

enrolment fee instalment invoice

issuance

8

Investigate long outstanding account

receivables.

Theft of cash;

Revenue recorded and

balance of account

receivable at the end of

period is inaccurate.

To detect skimming practice.

9

Prepare cash flow budget

Cash flow problems

To ensure company cash flow

stability

10

Reconcile accounts receivable sub-ledger

to general ledger at the end of month.

Revenue recorded and

balance of account

receivable at the end of

period is inaccurate.

To ensure accuracy and

completeness of account receivable

balance at the end of period.

11

Reconcile total invoice amount issued to

revenue recorded at general ledger at the

end of month.

Revenue recorded and

balance of account

receivable at the end of

period is inaccurate.

To ensure accuracy and validity of

revenue recorded during the

period.

12

Send monthly statement to parents.

Revenue recorded and

balance of account

receivable at the end of

period is inaccurate.

To ensure accuracy, completeness

and existence of account receivable

balance at the end of period.

Based on the above proposed table, researcher

conclude that the problems occurred in Foundation

admission process was due to lack of control

activities during billing process. Thus the control

objectives did not met. Finance team never do

reconciliation number of new students enrolled per

academic year between finance division and sales

division. The reconciliation also not done between

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

344

total invoice amounts issued to revenue recorded at

general ledger at the end of month. They also never

reconcile accounts receivable sub-ledger to general

ledger at the end of month. There are also some lack

of control on instalment of enrolment fee billing and

its payment. As a result, management can’t state that

the account receivables balance and revenue

recorded at the end of year is complete, exist,

accurate, and valid.

In addition, since the verification procedures to

identify whether the potential new students are

entitled to a discount was done manually by sales

team, there are some failure risk to identify the

entitled students. Therefore, some of prospective

parents complain about the billing amount.

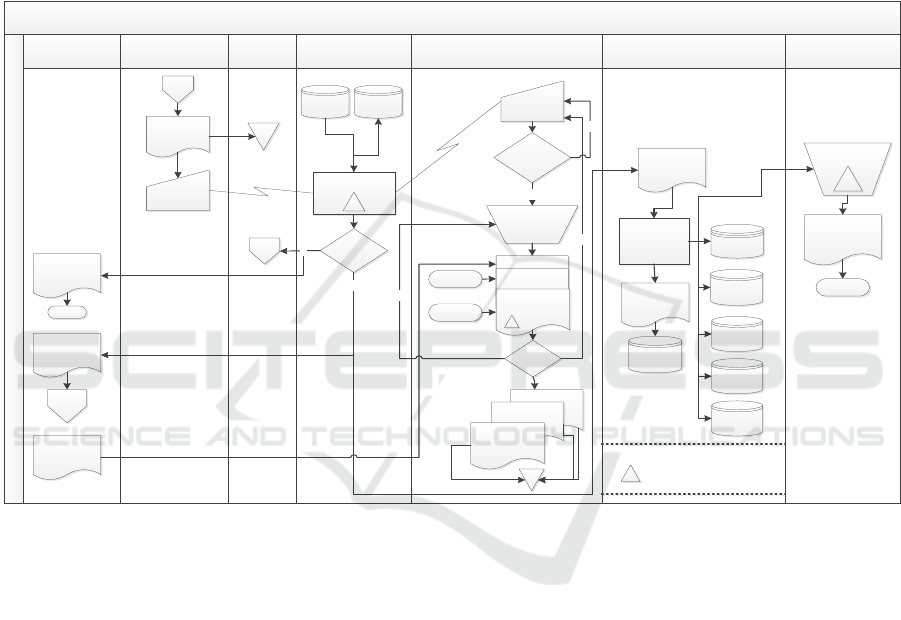

Based on the table 2, this research then re-

describes the second enrolment fee billing process

that occurs in the new students admission step with

the addition of internal control activity proposal in it.

Second Enrollment Fee Billing Process

Parent Academic Divison Admission System FTA Operation Staff Accounting Staff

Accounting

Manager

Sales

Phase

Discount Voucher

Employee Discount

Memo

B

Admission Test

Result

Terminal

Admission System

Terminal – Pilih

Nilai Tagihan

Discount or

Installment?

Installment Request

Approval

Collect

supporting

document

Y

T

Pricing Data Quota Data

A

Second

Enrollment Fee

Invoice

A

Second

Enrollment Fee

Invoice

GL Update

General

Ledger

Account

Receivable

Data

Sales Data

Second

Enrollment Fee

Invoice

Email

Total Enrollment

Fee Revenue &

Analysis

Management

Unearned

Revenue

Data

A

Accepted?

C

Y

Y

T

Not Accepted

Result Letter

T

Finish

Discount Voucher

Management

HRD

Complete?

Discount Voucher

Employee Discount

Memo

Installment

Request Approval

Y

T

5

Report

Preparation

2, 6,

10, 11

3,4

Legenda Simbol

Internal control activities as per Tabel 2.

Installment

Data

Figure 1: Second Enrolment Fee Billing Process

5 CONCLUSIONS

This research was conducted to evaluate the internal

control activities in the revenue cycle in order to

optimize enrolment fees collection within ABC

Foundation. Based on the outcome of the research, it

was found that the problems experienced by ABC

Foundation’s financial division were caused by the

lack of a reconciliation process between the number

of students enrolled and the invoice value billed to

parents according to the finance division and the

sales division. In addition, the reconciliation process

between the value of revenues and account

receivables recorded in the ledger with the related

sub-ledger has not been done consistently and

structurally. The lack of control activities has

resulted in the management losing control of the

value of income recorded in the financial statements.

In addition, the above mentioned causes a number of

complaints from the parents due to frequent errors in

issuing the bill.

5.1 Research Limitations

This research only covers revenues sourced from the

enrolment of new students. In the future, other

researchers may conduct research on other sources

of income that are not included within the scope of

this research.

5.2 Recommendations

Based on the conducted research, here are

suggestions for improvements that can be

implemented by the company and the next research:

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization

(Case Study on ABC Foundation)

345

1. For ABC Foundation, based on the deficiency in

the process of enrolment of new students, it is

necessary to improve the administrative

procedures of school finance along with the

addition of internal control activities in the form

of data reconciliation between related divisions

in the revenue cycle. Formal improvement of

this procedure is expected to facilitate the

management in enforcing existing regulations

consistently and structurally. In addition, given

the growing number of transactions and the

company's plans to continue to expand, it is

better if the Foundation perform a cost-benefit

analysis to build an integrated registration and

billing system that facilitates payment through

instalments. This is necessary to improve the

efficiency of the company's operational

activities and improve services for its

customers.

2. For the next researchers, it is advisable to

evaluate on other business processes within the

revenue cycle of ABC Foundation, such as the

collection process of school fees or club fees.

REFERENCES

Adams, Michael B. (1994). Agency Theory and The

Internal Audit. Managerial Auditing Journal, 1994,

Vol. 9, Issue: 8, pp. 8-12. Retrieved from

https://doi.org/10.1108/02686909410071133

Association of Certified Fraud Examiners. (2016). Report

to The Nations on Occupational Fraud and Abuse

2016 Global Fraud Study.

Burtseva, K. Y., Vokina, E. B., and Schneider, O. V.

(2015). Interconnection Between Internal Control and

The Assessment of Risk of Financial Stability Loss By

Educational Institutions. Aktual'Ni Problemy

Ekonomiky = Actual Problems in Economics, (172),

410-418. Retrieved from

https://search.proquest.com/docview/1754518879?acc

ountid=17242

Commitee of Sponsoring Organizations of the Treadway

Commission. (2013). Internal Control - Integrated

Framework Executive Summary.

Jeffrey, C. (2008). Internal control at private companies

and nonprofits. The CPA Journal, 78(9), 52-54.

Retrieved from

https://search.proquest.com/docview/212274426?acco

untid=17242

Jensen, M.C., and Meckling, W.H. (1976). Theory of The

Firm: Managerial Behavior, Agency Cost and

Ownership Structure. Journals of Financial

Economics, Vol. 3 No.3, 1976, pp. 305-60.

Jiewanto, A., Laurens, C., and Nelloh, L. (2012).

Influence of Service Quality, University Image, and

Student Satisfaction toward WOM Intention: A Case

Study on Universitas Pelita Harapan Surabaya. In

Procedia - Social and Behavioral Sciences, Volume

40, 2012, Pages 16-23, ISSN 1877-0428, Retrieved

from

https://doi.org/10.1016/j.sbspro.2012.03.155.(http://w

ww.sciencedirect.com/science/article/pii/S187704281

2006222)

Lai, S., Li, H., Lin, H., & Wu, F. (2017). The influence of

internal control weaknesses on firm performance.

Journal of Accounting and Finance, 17(6), 82-95.

Retrieved from

https://search.proquest.com/docview/1967314575?acc

ountid=17242

Lindič, Jaka., and Carlos Marques da Silva. (2011). Value

proposition as a catalyst for a customer focused

innovation. Management Decision, Vol. 49 Issue: 10,

pp.1694-1708. Retrieved from https://remote-

lib.ui.ac.id:4611/10.1108/00251741111183834

Maguire, K. A. (2014). Best practices for nonprofits'

internal control self-assessment. Advances in

Management and Applied Economics, 4(1), 41-87.

Retrieved from

https://search.proquest.com/docview/1501427856?acc

ountid=17242

Mawanda, S.P., (2008). Effects of Internal Control System

on Financial Performance in an Institution of Higher

Learning in Uganda: A Case of Uganda Marytrs

University. Retrieved from

http://www.academia.edu/4812543/EFFECTS_OF_IN

TERNAL_CONTROL_SYSTEMS_ON_FINANCIAL

_PERFORMANCE

Namazi, M. (2013). Role of the agency theory in

implementing management’s control. Academic

Journals Vol. 5(2), pp 38-47, July 2013, ISSN 2141-

6664. Retrieved from

http://www.academicjournals.org/journal/JAT/article-

full-text-pdf/12339F31292.

Petrovits, C., Shakespeare, C., and Shih, A. (2011). The

Causes and Consequences of Internal Control

Problems in Nonprofit Organizations. The Accounting

Review, 86(1), 325-357. Retrieved from http://remote-

lib.ui.ac.id:2059/stable/2978

Porter, M. E. (1980) Competitive Strategy: Techniques for

Analyzing Industries and Competitors. New York:

Free Press.

Porter, M. E. (2015). Shared Value and Strategy. Harvard

Business School. Paper presented at Shared Value

Leadership Summit, New York.

Romney, M. B., and Steinbart, P.J. (2015) Accounting

Information System 13

th

Edition Global Edition.

England: Pearson Education Limited

Clinton, S.B., Pinello, A. S., Skaife, H.A. (2014). The

implications of ineffective internal control and SOX

404 reporting for financial analyst. Journal of

Accounting and Public Policy, Vol. 33, Issue 4, 2014,

Pages 303-327, ISSN 0278-4254,

https://doi.org/10.1016/j.jaccpubpol.2014.04.005.

Snyder, H., Andersen, M., and Zuber, J. (2017, Maret).

Nonprofit Fraud How Good Are Your Internal

Controls?. Strategic Finance, 55-61

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

346

Indonesia Government. (2003). Law of the Republic of

Indonesia Number 20 Year 2003 on National

Education System.

Wahyuni, S. (2015). Qualitative Research Method: Theory

and Practice 2nd Edition. Jakarta: Salemba Empat.

Analysis and Design of Internal Control on Revenue Cycle in Order to Optimize Enrollment Fees Collection in Non-Profit Organization

(Case Study on ABC Foundation)

347