Analysis of Separation the Functions of Account Representative

to Increase Tax Revenues and Compliance of Taxpayers

A Case Study at Serpong Tax Office, Jakarta Duren Sawit Tax Office

and Jakarta Matraman Tax Office

Merda Listana Leonyca and Christine Tjen

Economic and Business Faculty, University of Indonesia, Jakarta, Indonesia

merdainzaghi@gmail.com, indivara_devi@yahoo.com

Keywords: Account Representative, Compliance, Functions, Tax Revenues, Taxpayer.

Abstract: This research aimed to know the level of tax revenues and taxpayer compliance and problems that are still

encountered after the separation of Account Representative functions. Separation of this functions is done

because of the dualism of Account Representative functions in the implementation of daily tasks so that less

optimal in increasing tax revenue and taxpayers compliance. Research method used in this research is

qualitative method with case study approach in Serpong Tax Office, Jakarta Duren Sawit Tax Office and

Jakarta Matraman Tax Office. Data used in this research is Tax Revenues, especially form disbursement

letter of appeal issued by Account Representative and Compliance in Submission of Annual Tax Return at

2014 when the start of the implementation of the trial separation of Account Representative functions until

2016 after the separation of AR functions is implemented in all the tax office. The result of this research is

that after the separation of Account Representative functions, Tax Revenues and Compliance in Submission

of annual tax return has not increased optimally. In addition, there is still a problem faced by Account

Representative after the separation of this functions.

1 INTRODUCTION

Taxes have an important role to play in governance

as it is one of the largest sources of financing in the

State Budget. The target of tax revenues always

increase year by year, but not followed by the

percentage of tax revenues realization. Based on

Financial Report of Central Government data known

that within last ten years from 2007 to 2016, tax

revenues just once reached target in 2008 which

amounted 108.12% due to the sunset policy that

helps increase tax revenues.

Because the tax role is very important, therefore

the tax system is required in order to perform

supervision and provide good service to the

Taxpayer so that it can to increase tax revenue. Due

to the demand for increased taxpayer compliance

and tax revenues as well as other improvements in

the tax administration system, it is necessary to do

tax reform through modernization of taxation. In

2002, Directorate General of Taxes (DGT) was

performed the modernization of taxation, one of

them is forming Account Representative (AR). AR

is a front guard in the supervision and improvement

of taxpayer compliance and provision of services to

taxpayers.

Increasing the revenue target of DGT from year

to year requires the role of AR in improving

taxpayer compliance, but the demands have not been

followed by the management and structuring of good

tasks so that AR often face difficulties in the

implementation of their daily tasks. Some of these

difficulties are the number of clerical jobs that

actually dominate the main job, there is a dualism of

work where on the one side an AR must become a

taxpayer partner by providing services in carrying

out the consultation function, while on the other side

must be assertive to the Taxpayer to perform the

functions of supervisory and explore the potential of

the taxpayer in fulfilling his tax obligations. This

often leads to conflict of interest between AR and its

taxpayers. In addition, the ratio between the amount

of AR compared with the number of taxpayers who

become his responsibility has not been balanced so

that the AR work does not maximal (Rahayu and

Lingga, 2009). Therefore, it is deemed necessary to

382

Leonyca, M. and Tjen, C.

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at Serpong Tax Office, Jakarta Duren Sawit Tax

Office and Jakarta Matraman Tax Office.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 382-391

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

separate the AR duties and functions between the

functions of consultation and service with the

supervision and explore of the potential taxpayers.

With the separation, AR is expected to work more

optimally in accordance with their respective

functions. Therefore, in accordance to the Minister

of Finance Regulation number 206.2 / PMK.01 /

2014 stated that in order to improve the good

administrative, effectiveness, and performance of the

vertical organization in DGT, it is necessary to

improve the organization and work procedures of the

vertical institution in DGT, one of the point stated in

article 61 that in Tax Office there is separation

between Section of Supervision & Consultation I

with functions of service & consultation and Section

Supervision & Consultation II, III, and IV with

functions of supervision and exploring potential

taxes. This research trying to analyze tax revenues

and taxpayer’s compliance by comparing the

conditions at the time before and after the separation

functions of Account Representative.

Based on the background of problems that have

been described, the purpose of this research are to

know the level of tax revenues and taxpayer’s

compliance with the separation of Account

Representative functions and the problems that are

still encountered after the separation of Account

Representative functions. Hopefully, it can increase

the tax revenues and taxpayer’s compliance.

2 LITERATURE REVIEW

2.1 Modernization of Tax Administration

System

Tax administration aims to build and maintain good

relationships with taxpayers and assist and facilitate

them in fulfilling taxation obligations. The tax

administration is responsible for reporting the

performance and achievement of organizational

objectives, including the responsibility for

overseeing taxpayer compliance and the impact of

such efforts on improving taxpayer compliance

(Alink and Kommer, 2011)

The increasing target of government revenues

and the low level of public trust in Indonesia's tax

system encourages the government to undertake

reforms in taxation.

Tax reform begins with the implementation of

Self Assessment as a tax collection system in

Indonesia. With the system, the taxpayer is entrusted

with calculating, calculates his own tax payable and

then repays and reports it to the registered Tax

Office. By providing good service to the taxpayer is

expected to be a motivation for taxpayers to pay

taxes.

2.2 Account Representative

One form of tax reform is by the establishment of

AR in the Large Taxpayer Tax Office. In accordance

with the Minister of Finance Decree number. 98 /

KMK.01 / 2006 concerning AR in Tax Office that

has Implemented Modern Organization, that has

been assigned AR who take the task in the field of

taxation intensification through the provision of

guidance / consultation, analysis and supervision of

taxpayers. According to KMK 98 / KMK.01 / 2006,

AR is an officer appointed in each Section of

Supervision and Consultation at Tax Office which

has implemented Modern Organization. In the early

modernization of tax administration in 2002, AR

acts as liaison officer of Taxpayer Office Taxpayer

in communicating taxpayers' obligations and rights

in the field of taxation (Hutagaol, 2007)

In other countries, for example on the Internal

Revenue Service (IRS) there are tax officers who

have functions such as AR in the DGT that perform

compliance monitoring performed by the Tax

Compliance Officer. In carrying out its functions,

the main task of a Tax Compliance Officer is to

ensure that the taxpayer has paid taxes correctly. In

addition there are also tax officers with functions in

providing services and consultation to taxpayers

conducted by Contact Representative. In carrying

out its functions, the main task of a Contact

Representative is to help taxpayers in consultation

about taxation either by phone or face to face

directly.

2.3 Tax Revenues

Tax revenue is the largest contributor to government

revenues. Tax revenues is the dominant source of

government financing for both routine and

development expenditures (Suryadi, 2006). In

general, tax revenues can be grouped into routine

and extra-effort revenues. Routine revenues mean

revenues that come from paying periods that is

usually obtained without any extra-effort by

Account Representative, because the income will

certainly receive every month, but still require strict

supervision. Revenue of extra-effort activities

requiring more effort that is derived from the

disbursement Letter of Appeal or Letter of Request

Explanation of Data or Information (SP2DK)issued

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at

Serpong Tax Office, Jakarta Duren Sawit Tax Office and Jakarta Matraman Tax Office

383

by AR, examination, collection of tax receivables

and extensification of taxation activities.

As mentioned above, that one of the tax revenues

from the extra-effort activities is derived from the

disbursement Letter of Appeal or Letter of Request

Explanation of Data or Information issued by AR if

found any data about the property (tax potential) of

the Taxpayer who has not been reported in the

Annual Tax Returns. In terms of supervisory

functions, AR will oversee tax payments from

taxpayers primarily from routine revenues. While

the explore potential taxes is done through

intensification activities by maximizing the data of

existing taxpayers from reporting data of Tax

Return, tax payments, data from third parties and

direct observation results in the field.

According to Rahayu (2010), there are several

factors in optimizing the government revenue

through tax collection, that is:

1. Clarity, certainty, and simplicity of tax laws and

regulations.

2. Government policy in implementing tax laws.

3. Appropriate tax administration system.

4. Service.

5. Awareness and understanding of citizens.

6. Quality of tax officer (intellectual, skill,

integrity, high moral).

2.4 Compliance of Taxpayers

It cannot be denied that compliance is a major

problem faced by all income authorities, for example

the IRS in the United States difficulties in estimating

tax income (James and Alley, 2004). Similarly in

Indonesia, where the low compliance of taxation is

still a problem in tax administration in Indonesia.

Even people prefer to pay more to get a product and

avoid taxes than to pay less. This non-compliance is

called as a "tax gap". Tax gap can be used to

measure the performance of a country's tax income,

that is how far the tax authorities are able to make

the taxpayers obedient to carry out tax obligations in

accordance with applicable tax provisions. The

increased ability of the tax authorities to access the

data and increase the voluntary compliance of the

Taxpayer is one way of reducing the existing tax

gap.

According to Nowak in Zain (2005) taxpayer’s

compliance is defined as a climate of awareness and

compliance fulfillment of tax obligations, where

taxpayers understand all the provisions of tax laws

and regulations, can fill out the tax form clearly and

completely, calculate correctly the amount of tax

payable as well pay them on time. While Nurmantu

in Rahayu (2010) defines compliance taxation as a

condition in which the taxpayer to fulfill obligations

and implement taxation rights. According to

Nasucha in Rahayu (2010), Taxpayer compliance

can be identified

from:

1. Compliance to register

2. Compliance to report the Tax Return

3. Compliance to calculate and pay the tax payable

4. Compliance to pay the tax arrears

Tax administration in Indonesia still needs to be

improved in the hope of providing better service to

Taxpayers so that Taxpayers are motivated to meet

their tax obligations. Good administration is also

marked by the imposition of strict sanctions for

taxpayers who attempt to smuggle their taxes. In

addition, taxpayer’s compliance will also increase if

they get a good consulting service.

Table 1 : Previous Research

Researchers Title of the

research

Result of

research

Basalamah,

Anies Said

M. et

al.(2016)

Separation of

AR Functions

for Better

Service and Tax

Revenue.

Research Object

is Serpong Tax

Office.

there is an

increase in

service quality

after the

separation of

functions but

there are still

elements that

need to be

improved

Janson

Nicholas

Samosir

(2015)

Evaluation of

Taxpayer

Compliance and

Tax Receipts

Before and

After Trial

Arrangement of

Duties and

Functions of

AR at Medan

Timur Tax

Office

There is no

significant

difference in

taxpayer

compliance and

tax revenues

between before

and after the

trial of

structuring tasks

and functions

AR

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

384

3 RESEARCH METHODOLOGY

Research method used in this research is qualitative

method with case study approach in Serpong Tax

Office, Jakarta Duren Sawit Tax Office and Jakarta

Matraman Tax Office. Creswell (2014) states that

qualitative research is an approach to explore and

understand the meaning of individuals or groups that

are perceived as a social or humanitarian problem.

Furthermore, according to Creswell that this study

involves questions and procedures, data, data

analysis is built inductively and then the authors

make interpretation of meaning over the data. The

case study was chosen because to answer three

conditions: "how" or "why" questions, the least

supervision of an event, and to focus on real-life

phenomena (Yin, 2009). Serpong Tax Office was

chosen as the object of research because it is one of

Tax Officer pilot project at the time of trial of

separation of AR functions which will be compared

with Jakarta Duren Sawit Tax Office and Jakarta

Matraman Tax Office. This research is different

from the previous research because the object of

research is not only one of Tax Office which become

the pilot project, but also compared with other Tax

Office that have implemented the separation of AR

functions and to see tax revenue and taxpayer

compliance and problems still encountered after the

separation of AR functions.

Data used in this research are primary data and

secondary data. Primary data obtained from

interviews and questionnaires with related parties to

obtain an overview of the implementation of policy

arrangement of tasks and functions of Account

Representative through the separation of Account

Representative functions. The interview was

conducted to Section Head of Institutional Design

Development - Directorate of Internal Compliance

and Transformation of Apparatus Resources, Head

of Supervision & Consultation Section I and IV

Jakarta Duren Sawit Tax Office, and Head of

Supervision & Consultation Section I and II Jakarta

Matraman Tax Office. While the questionnaires

distributed to Account Representative Jakarta Duren

Sawit Tax Office and Jakarta Matraman Tax Office.

Secondary data obtained through data in the form of

compliance data and tax income, especially from the

realization of disbursement of appeal by the

Taxpayer. In addition, secondary data can also be

obtained through documents, journals, articles and

other data related to the arrangement of tasks and

functions of Account Representative.

Serpong Tax Office was chosen as the research

object because it is one of Tax Office which became

the pilot project during the trial of separation of

Account Representative functions. Serpong Tax

Office was formed in 1994 with working area

covering four districts namely: Pondok Aren,

Pamulang, Serpong and Ciputat.

Jakarta Duren Sawit Tax Office was established

in accordance with the Minister of Finance

Regulation Number 55/PMK.0 / 2007 dated May 31,

2007, commencing operation on October 2, 2007

based on the Decree of the Director General of

Taxes No. KEP-86 / PJ / 2007 dated 11 June 2007.

The working area of Jakarta Duren Sawit Tax Office

covers 7 village namely: Pondok Bambu, Duren

Sawit, Malaka Jaya, Pondok Kelapa, Pondok Kopi,

Malaka Sari and Klender.

In accordance with the Decree of the Director

General of Taxes No. KEP-86 / PJ / 2007 dated June

11, 2007, then on July 3, 2007 Jakarta Matraman

Tax Office started to operate. The Working Area of

Jakarta Matraman Tax Office covers Matraman Sub

District consisting of 6 Village namely: Pisangan

Baru, Utan Kayu Utara, Utan Kayu Selatan, Kebon

Manggis, Pal Meriam, and Kayu Manis.

4 ANALYSIS

As has been explained earlier that tax income comes

from regular and extra-effort revenues. Regular

revenues come from revenues where we do not need

to excessive effort, the tax income will be obtained.

While the revenues from extra-effort activities, more

efforts are needed in order to increase tax income.

The following graph shows the data of overall tax

revenues, disbursement SP2DK and compliance

submission of Annual Tax Returns of Serpong Tax

Office, Jakarta Duren Sawit Tax Office and Jakarta

Matraman Tax Office. Then will be described the

analysis and discussion of overall tax revenues as

well as reveue from disbursement SP2DK which is

one source of revenues from extra effort in 2014

until 2016. The discussion of SP2DK can also be

seen from the development of the number of SP2DK

publishing along with the nominal amount of tax

potential listed in SP2DK. Meanwhile, what is

meant by compliance here is compliance in

submission of Annual Tax Return by taxpayer with

year of delivery 2014 until 2016. As mentioned

before, that taxpayer compliance can be identified

one of them as compliance in submitting Tax

Return. Therefore, the limitation of this research is

only submission of Annual Tax Return.

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at

Serpong Tax Office, Jakarta Duren Sawit Tax Office and Jakarta Matraman Tax Office

385

4.1 Serpong Tax Office

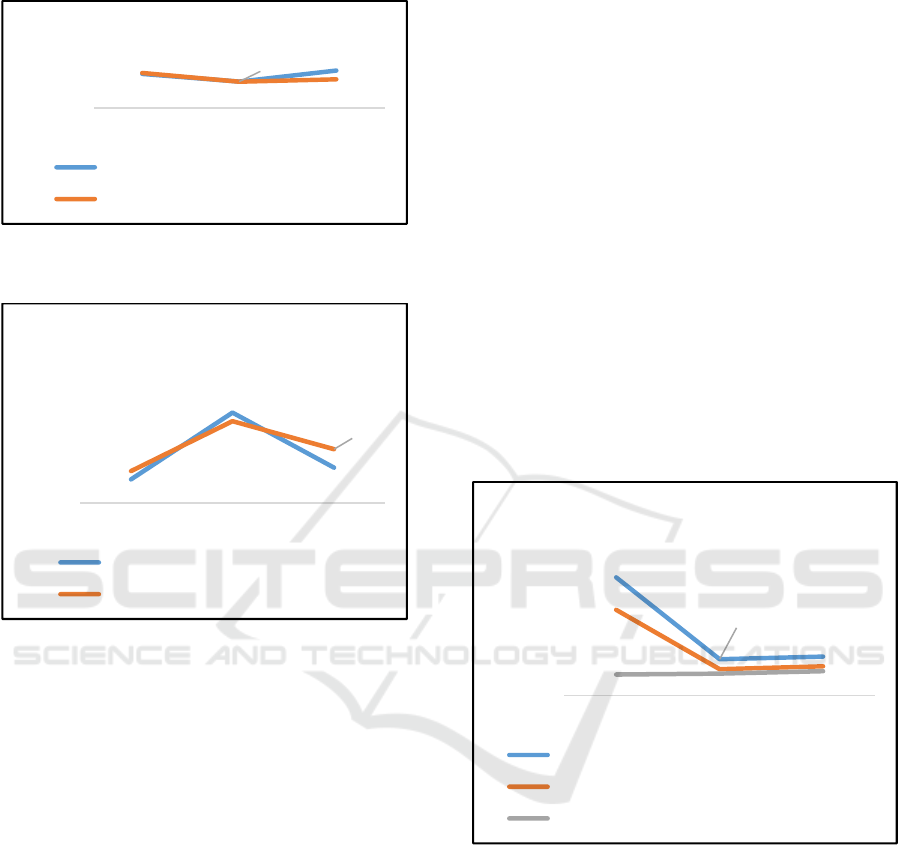

Graph 1 Target and Realization of Revenues Serpong Tax

Office (2014 -2016)

Graph 2 Potential and Realization of SP2DK

Disbursement Serpong Tax Office (2014 - 2016)

Based on the graph 1 and 2, it can be seen that

the acceptance of Serpong Tax Office in the year

when the trial of separation of AR functions 2014

reached 103.02% as well as SP2DK disbursement in

2014 that exceeded the potential targeted in SP2DK.

From the graph above it is known that the realization

amount of SP2DK disbursement is Rp.80.86 Billion

with initial potential amount of Rp.59.84 Billion.

The realization of SP2DK disbursement becomes

one of the factors of achieving revenues exceeding

100%. However, in 2015, the decrease of revenues

target due to Serpong Tax Office experienced the

breakdown of Tax Office with Pondok Aren Tax

Office in October 2015. While the nominal value of

SP2DK potential is increased by Rp.229.44 Billion

with the realization of Rp.207.55 Billion. The

increase in SP2DK nominal value is due to an

increase in the number of SP2DK issued due to the

increase of Account Representative Controlling

efforts in the potential exploring. Acceptance in

2015 of Rp.2,826.27 Billion or 99.44% of the target

revenues of Rp.2,842.27 Billion. Target revenues

increased again in 2016 to Rp.4,035,58 Billion with

realized revenues of 3,089.13 or only 76.55% of the

target revenues. However, the nominal value of

SP2DK is decreased by Rp.89.60 Billion with the

realization of Rp.136.36 Billion. This decrease is

due to the Amnesty Tax program in the middle of

2016, so that the focus of Account Representative

Supervision at that time was split between exploring

potential by appealing to taxpayers to utilize Tax

Amnesty program. Therefore, in the middle of 2016,

Account Representative's task of is more focused on

Tax Amnesty activities. Based on SP2DK reception

and disbursement data above, during the

implementation of the Account Representative

functions separation trial, the realization of SP2DK

disbursement may exceed the potential value in

SP2DK. Similarly, when the separation of Account

Representative functions started to be applied in all

Tax Office, there has been a significant increase in

SP2DK in both quantity and potential value, but it

has not been followed by significant increase of

SP2DK disbursement realization.

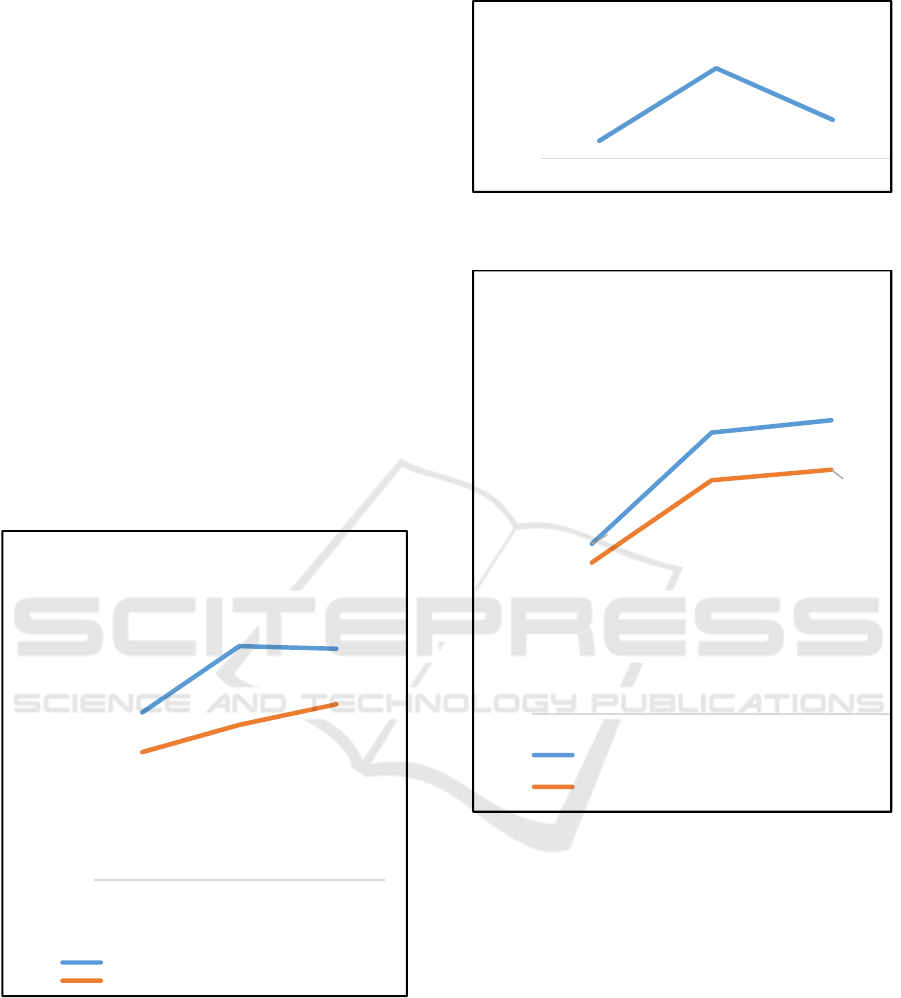

Graph 3 Submission of Annual Tax Return Serpong Tax

Office (2014 - 2016)

While based on compliance data seen from the

graph 3, it is known that in 2015 there was a

decrease in the number of taxpayers who must

submit annual tax returns to 59.282 taxpayers from

193,206 taxpayers in 2014. This decrease is due to

the cleansing data from the Head Office of DGT

which aims to improve master file taxpayer in order

to realize the orderly administration of taxation and

the formation of relevant data and relevant

information and taxpayer related. Cleansing of data

is done by eliminating positions on double Taxpayer

Identification Number, taxpayer who has no tax

3.668,65

2.842,27

4.035,58

3.779,48

2.826,27

3.089,13

0,00

5.000,00

2014 2015 2016

Target and Realization of Revenue

Target of Revenue (Billion Rp)

Realization of Revenue (Billion Rp)

59,84

229,44

89,60

80,86

207,55

136,36

0,00

100,00

200,00

300,00

2014 2015 2016

Potential in SP2DK and

Realization of SP2DK Disbursement

Nominal in SP2DK (Billion Rp)

Realization of SP2DK (Billion Rp)

193.206

59.282

63.622

140.074

42.979

47.717

34.245

35.773

39.789

0

50.000

100.000

150.000

200.000

250.000

2014 2015 2016

Submission of Annual Tax Return

Taxpayers must submit Annual Tax Return

Target of Annual Tax Return

Realization of Annual Tax Return

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

386

transaction in the last 3 (three) years consecutively

or against Taxpayer Identification Number with non-

effective status in the last 5 (five) years. The target

of sum the Annual Tax Return in 2015 is 42,979

taxpayers with a delivery rate of 72.5%. Realization

of Annual Tax Returns in 2015 is 35,773 taxpayers

or reaches 83.23% of the target ratio, an increase

over the previous year. In 2016 there is an increase

of the number of registered taxpayers to 98,312

taxpayers with the number of taxpayers who are

required to submit the annual tax returns 63,622

taxpayers. The target of submission the Annual Tax

Return is increased to 47,717 taxpayers with a

delivery rate of 75%. While the realization of 39,789

taxpayers or reach 83.39% of the target ratio. Based

on these data, the separation of Account

Representative functions in 2015 can improve the

compliance of Annual Tax Returns if compared to

the year of trial although the realization is still below

the target ratio.

4.2 Jakarta Duren Sawit Tax Office

Graph 4 Target and Realization of Revenues Jakarta

Duren Sawit Tax Office (2014 -2016)

Graph 5 Number of SP2DK issuance Jakarta Duren Sawit

Tax Office (2014 - 2016)

Graph 6 Potential and dan Realization of SP2DK

Disbursement Jakarta Duren Sawit Tax Office (2014 -

2016)

Based on the graph of data of Jakarta Duren

Sawit Tax Office, from 2014 to 2016, the

achievement of Jakarta Duren Sawit Tax Office has

not reached 100%. In 2014 the realization of

revenues of Rp.900.60 Billion or reach 76.35% of

the target. Then in 2015 the target of revenues

increased by Rp.1,646.30 Billion with the realization

of Rp.1,092.60 Billion or only reached 66.37%,

down compared to the previous year. In 2016,

revenues target decreased to Rp.1.627,30 Billion

with the realization of Rp.1,237.19 Billion or reach

76% of the target, experiencing an increase in

achievement over the previous year.

1.179,59

1.646,30

1.627,97

900,60

1.092,60

1.237,19

0,00

400,00

800,00

1.200,00

1.600,00

2.000,00

2014 2015 2016

Target and Realization of Revenue

Target of Revenue (Billion Rp)

Realization of Revenue (Billion Rp)

959

4.942

2.109

-

2.000

4.000

6.000

2014 2015 2016

Number of SP2DK issuance

38,11

63,03

65,83

33,91

52,37

54,74

0,00

10,00

20,00

30,00

40,00

50,00

60,00

70,00

2014 2015 2016

Potential in SP2DK and

Realization of SP2DK Disbursement

Target of Revenue (Billion Rp)

Realization of Revenue (Billion Rp)

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at

Serpong Tax Office, Jakarta Duren Sawit Tax Office and Jakarta Matraman Tax Office

387

As well as the number of SP2DK publishing in

2014 amounting to 959 SP2DK with the amount of

potential in SP2DK in 2014 of Rp.38.11 Billion with

realization of SP2DK disbursement of Rp.33.91

Billion. Then in 2015 SP2DK publishing increased

dramatically to 4,942 SP2DK with the amount of

potential in SP2DK of Rp.63.03 Billion with the

realization of Rp.52,37 Billion. The increase of

SP2DK issuance is mainly due to the separation of

Account Representative functions, so Account

Representative Supervision focuses their work more

on exploring of tax potential. However, by 2016 the

number of SP2DK issuance has decreased to 2,109

SP2DK with the increase of potency amount in the

amount of Rp.65.83 Billion with the realization of

Rp.54,74 Billion. This decrease occurred because of

Amnesty Tax Program in the middle of 2016. Based

on the data of SP2DK disbursement and realization

of the above disbursement, when the separation of

Account Representative functions started to have

been applied in all Tax Office, there was a

significant increase to SP2DK both the amount and

the potential value, but not followed by the

significant increase of SP2DK disbursement

realization.

Graph 7 Submission of Annual Tax Return Jakarta Duren

Sawit Tax Office (2014 - 2016)

In 2014 the number of taxpayers registered on

Jakarta Duren Sawit Tax Office as much as 145,492

taxpayers. While the number of taxpayers who must

submit the Annual Tax Return is 86.978 taxpayers.

The target of delivering the Annual Tax Return is

63,059 taxpayers with a target ratio of 72.5%.

Realization of Annual Tax Returns as much as

50,101 taxpayers or reach 79.45% of the target ratio.

In 2015 the number of registered taxpayers increases

to 152,309 taxpayers, but there is a decrease in the

number of taxpayers who must submit annual tax

returns accompanied also with a decrease in the

annual tax return targets. According to Section Head

of Supervision & Consultation Section IV Jakarta

Duren Sawit Tax Office, the decline in the target is

due to the cleansing of data of taxpayers by the DGT

Head Office. Based on that, then in 2015 the target

of submission of Annual Tax Returns to 60,247

taxpayers and target ratio of 72.5% while the

submissing of Annual Tax Return increased by

53,452 taxpayers or reached 88.72% of the target

ratio.

Meanwhile, there is a significant increase in the

number of registered taxpayers in 2016, one of

which is because there are several programs of the

DKI Jakarta Provincial Government for the lower

and lower middle class which require having

Taxpayer Identification Number. So that the number

of taxpayers registered in Jakarta Duren Sawit Tax

Office increased to 161.183 taxpayers with the

number of taxpayers who must submit annual Tax

Return of 86.650. The target of annual Tax Return

submission is 64,988 and the target ratio is 75%.

Realization of Annual Tax Return submission

increased to 54,801 taxpayers or reached 84.33% of

the target ratio, a decrease over the previous year.

Based on these data, the separation of Account

Representative functions can improve the

compliance of Annual Tax Return, although the

realization is still below the target ratio.

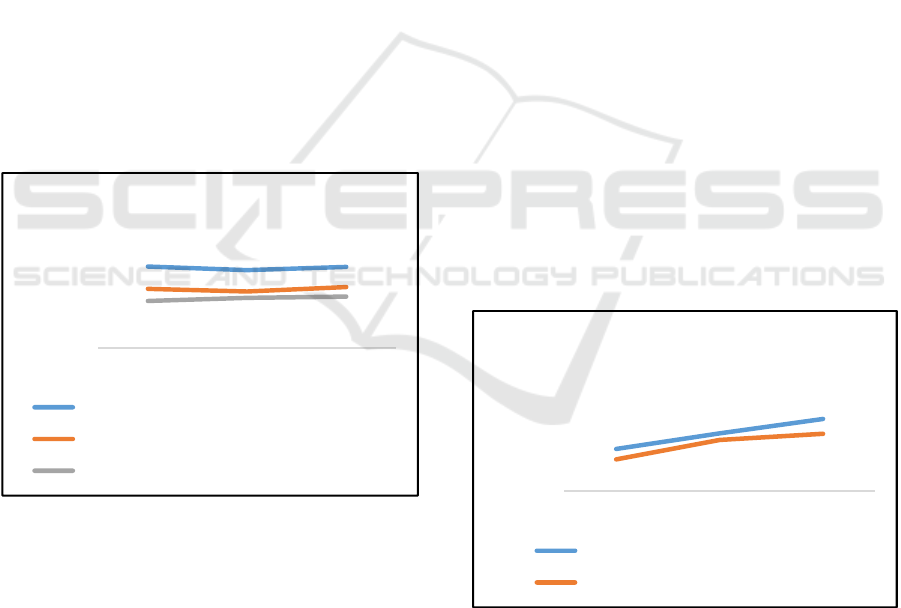

4.3 Jakarta Matraman Tax Office

Graph 8 Target and Realization of Revenues Jakarta

Matraman Tax Office (2014 -2016)

86.978

83.099

86.650

63.059

60.247

64.988

50.101

53.452

54.801

-

50.000

100.000

2014 2015 2016

Submission of Annual Tax Return

Taxpayers must submit Annual Tax Return

Target of Annual Tax Return

Realization of Annual Tax Return

641,12

877,60

1.097,19

482,44

777,64

871,77

0,00

500,00

1.000,00

1.500,00

2014 2015 2016

Target and Realization of Revenue

Target of Revenue (Billion Rp)

Realization of Revenue (Billion Rp)

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

388

Graph 9 Number of SP2DK issuance Jakarta Matraman

Tax Office (2014 – 2016)

Graph 10 Potential and Realization of SP2DK

Disbursement Jakarta Matraman Tax Office (2014 - 2016)

Based on the data of Jakarta Matraman Tax

Office, in 2014 the revenues target of Rp.641.12

Billion with the realization of Rp.482.44 Billion or

reach 75.25%. Likewise in 2015 the target of

Rp.877.60 Billion with the realization of Rp.777.64

Billion or up 88.6%, an increase in percentage of

achievement compared to the previous year. In 2016

the revenues target of Rp.1079.19 Billion with the

realization of Rp.871.77 Billion or reached 79.45%,

decreased percentage of achievement compared to

the previous year.

Similarly with Jakarta Duren Sawit Tax Office,

SP2DK publishing in Jakarta Matraman Tax Office

in 2015 increased drastically to 3,727 SP2DK

compared to 2014 which only published as many as

891 SP2DK. The increase of SP2DK issuance is also

mainly due to the separation of Account

Representative functions. However, in 2016 the

number of SP2DK publishing has decreased to 2,130

SP2DK. This decline is due to the Amnesty Tax

Program in the middle of 2016.

The amount of potential in SP2DK in 2014 is

Rp.21.36 Billion with realization of SP2DK

disbursement of Rp.18,20 Billion. In the year 2015

increase of SP2DK issuance amount followed by

increasing amount of potency in SP2DK that is

become Rp.60.51 Billion with the realization of

Rp.64.81 Billion, it exceeds the potential in SP2DK.

This became one of the contributes tax revenues

Jakarta Matraman Tax Office up to 82.58%. But in

2016 as the number of SP2DK decreases, the

amount of potential in SP2DK also decreased

drastically to Rp.28.50 Billion with realization of

SP2DK disbursement of Rp.27.46 Billion. Based on

the revenues data, then when the separation of

Account Representative functions occurs a

significant increase to SP2DK both the amount and

potential value, but not yet accompanied by

significant increase in SP2DK disbursement

realization.

Graph 11 Submission of Annual Tax Return Jakarta

Matraman Tax Office (2014 - 2016)

Based on data number of registered taxpayer

Jakarta Matraman Tax Office increase the number of

registered taxpayers every year starting from 2014

until 2016. In 2014 taxpayers registered in Jakarta

Matraman Tax Office as many as 74,797 taxpayers

with the number of taxpayers who must submit

annual tax return as much as 41.003 taxpayer. While

the target submission of Annual Income of 29.727

with target ratio of 72.5%. Realization of Annual

Tax Return submission of 23,680 taxpayers or reach

79.66% of the target ratio.

891

3.727

2.130

-

2.000

4.000

2014 2015 2016

Number of SP2DK issuance

21,36

60,51

28,50

18,20

64,81

27,46

0,00

10,00

20,00

30,00

40,00

50,00

60,00

70,00

2014 2015 2016

Potential in SP2DK and

Realization of SP2DK Disbursement

Nominal in SP2DK (Billion Rp)

Realization of SP2DK (Billion Rp)

41.003

39.865

42.324

29.727

28.902

31.743

23.680

25.881

27.225

-

10.000

20.000

30.000

40.000

50.000

2014 2015 2016

Submission of Annual Tax Return

Taxpayers must submit Annual Tax Return

Target of Annual Tax Return

Realization of Annual Tax Return

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at

Serpong Tax Office, Jakarta Duren Sawit Tax Office and Jakarta Matraman Tax Office

389

In 2015 there is a decrease in taxpayers who

must submit annual tax returns to 39,865 taxpayers,

despite an increase in the number of registered

taxpayers. Similarly with Jakarta Duren Sawit Tax

Office, this decline occurs because of the data

cleansing conducted by the Head Office of DGT.

Likewise with the number of targets submission of

annual tax returns that fell to 28,902 taxpayers.

However, there was an increase in the realization of

the Annual Tax Return of 25,881 taxpayers or

89.55% of the target ratio.

In 2016, an increase in the number of registered

taxpayers to 82,941 taxpayers with the number of

taxpayers who must submit the Annual Tax Return

of 42,324 taxpayers. Similarly, the target of Annual

Tax Returns increased to 31,743 taxpayers with a

target ratio of 75%. Realization of Annual Tax

Return submission of 27,225 taxpayers or reach

85.77% of the target ratio, decreased compared to

the previous year.

The increase in the Annual Income Tax

submission target of 9.8% in 2016 is not followed by

the realization of the Annual Tax Return which only

increased by 5.2% from 25,881 in 2015 to 27,225 in

2016. This increase occurred because of the program

Tax Amnesty. So the effect of separation of Account

Representative functions was not too visible. If the

realization is compared to the target, there is a

decrease in the percentage from 64.9% in 2015 to

64.3% in 2016. Based on these data, the separation

of Account Representative functions can improve

the compliance of Annual Tax Returns, although the

realization is still below the target ratio.

After the separation of Account Representative

functions is running still found some problems, both

from the Account Representative Service and

Account Representative Supervision. Some of these

problems are:

1. The overlapping of consultation work between

Account Representative Service and Account

Representative Supervision. Inconsistent

Standard Operating Procedures (SOP) and Job

Description and supporting applications

2. Directorate at Head Office managing Account

Representative Service still deemed

inappropriate

3. Selection of human resources that are still not in

accordance with the competence,

4. Lack of training or training provided by Head

Office or DGT Regional Offices,

5. Additional work for Account Representative

Supervision as Tax Inspector,

6. The amount of taxpayer supervised is not

proportional to the amount of Account

Representative available.

5 CONCLUSION

From the results of the analysis and discussion in

chapter 4, this research yields the following

conclusions are seen from the overall tax revenues

after the separation of Account Representative

functions in 2015 at the time of separation of AR

function has not significantly increased. Moreover in

2016 there was a decrease in SP2DK issuance due in

middle 2016 DGT launched Tax Amnesty Program.

During the Amnesty Tax Program, the DGT is intent

on socializing the program. So Account

Representative Supervision focus to issue a letter of

appeal to taxpayers to take advantage of Tax

Amnesty program. Likewise, compliance

submission Annual Tax Return has not increased

significantly. Realization of Annual Tax Return is

still below the target of Annual Tax Return.

In addition, after the separation of Account

Representative functions is still found some

problems, both experienced by Account

Representative Supervision and Account

Representative Service, both task and functions

problems, human resources and SOP or Job

Description. So that required improvement for the

achievement of tax revenues and compliance

taxpayers better.

Because the study period is limited and restricted

only from the implementation of the trial in 2014

until 2016 plus the Amnesty Tax program, so it does

not illustrate the optimization of Account

Representative functions separation. It is hoped for

further research to have longer research period and

add research object.

REFERENCES

Books:

Alink, M and Kommer,V (2011). Handbook on Tax

Administration. Netherland: IBFD.

Creswell, J. W. (2014). Research Design :

Qualitative, Quantitative, and Mixed Methods

Approaches (4

th

ed.). California: SAGE

Publications, Inc.

Hutagaol, J. (2007). Taxation: Contemporary Issues.

Yogyakarta: Graha Ilmu

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

390

Rahayu, S. K. (2010). Taxation Indonesia: Concepts

and Formal Aspects. Yogyakarta: Graha Ilmu

Samosir, J. N. (2015).

Evaluation of Taxpayer

Compliance and Tax Receipts Before and After Trial

Arrangement of Duties and Functions of AR at Medan

Timur Tax Office

. Medan: University of North

Sumatera

Yin, R. K. (2009). Case Study Research : Design

and Methods, 4th edition

Zain, M. (2005). Tax Management (2

nd

ed.). Jakarta:

Salemba Empat.

Journal Article:

Alley, S. J. (2004). Tax Compliance. Self -

Assessment and Tax Administration. Journal of

Finance and Management in Public Services.

Volume 2 Number 2, pp. 27 - 42.

Basalamah, et al. (2016). Separation of AR

Functions for Better Service and Tax Revenue.

Financial Economics Review Vol. 20 No. 1 April

2016.

Lingga, S. R. (2009). Influence of Modernization of

Tax Administration System to Taxpayer

Compliance. Accounting Journal Vol. 1 No. 2

November 2009, pp. 119 - 138.

Ngadiman. (2008). Modernization and Reform of

the Tax Service. MIIPS Vol 7 No. 2 September

2008, pp. 165 - 175.

Suryadi. (2006). The Causal Relationship Model of

Awareness, Services, Taxpayer‘s Compliance

and Its Effect on The Performance of Tax

Revenue: A Survey in East Java. Public Finance

Journal Vol. 4, No. 1, April 2006, pp. 105-121.

Regulations

Directorate General of Taxes. (2007). Decision of

the Director General of Tax No. KEP-86 / PJ /

2007 concerning the implementation of the

Organization, Work Procedures, and Time of

Operation of KPP Pratama and KP2KP in the

Regional Offices of DGT in the Special Capital

Region of Jakarta Other than the Regional Office

of DGT of Central Jakarta. Jakarta.

Minister of Finance Decree. (2006). Decree of the

Minister of Finance of the Republic of Indonesia

number 98 / KMK.01 / 2006 concerning Account

Representative at Tax Office that has

Implemented Modern Organization

Minister of Finance Decree. (2007). Regulation of

the Minister of Finance No. 55 / PMK.01 / 2007

concerning Amendment to Regulation of the

Minister of Finance No. 132 / PMK.01 / 2006

concerning Organization and Working

Procedures of Vertical Institutions of the

Directorate General of Taxes.Jakarta.

Minister of Finance Decree. (2014). Regulation of

the Minister of Finance No. 206.2 / PMK.01 /

2014 on the Organization and Working

Procedures of Vertical Institutions of the

Directorate General of Taxes. Jakarta.

Analysis of Separation the Functions of Account Representative to Increase Tax Revenues and Compliance of Taxpayers - A Case Study at

Serpong Tax Office, Jakarta Duren Sawit Tax Office and Jakarta Matraman Tax Office

391