Analysis Of Controlled Foreign Company (Cfc) Rules In Indonesia

To Prevent Tax Avoidance Practises

Nova Ratu Pietraya Sari, Ning Rahayu

Faculty of Economy and Business, University of Indonesia, Salemba Raya Street, Jakarta, Indonesia

noph752@gmail.com, ning.rahayu@yahoo.com

Keywords: CFC Rules, Controlled Foreign Company, Deemed Dividend, Tax Avoidance.

Abstract: To counter deferral tax payment as one of tax avoidance scheme, some countries have a set of rules called

CFC (Controlled Foreign Company) rules. On July 26 2017, Indonesia issued the latest regulation on CFC

rules which is Minister of Finance Regulation (MFR) number 107. This research aims to analyze how the

newest CFC rules in Indonesia, MFR No. 107/MFR.03/2017, can be used to counteract tax avoidance

practices and what are the constraints in implementing these newest CFC rules in Indonesia. This research

conducted with qualitative approach. Data collection using literature research and interview. This research

concluded that the latest CFC rules in Indonesia, MFR No. 107/MFR.03/2017, can be used to counteract tax

avoidance practices by already improve the deemed dividend mechanism, has covered provision on indirect

ownership, has covered provisions on trusts, and has covered provisions on foreign tax credit. The

constraints in implementing CFC rules in Indonesia, MFR No. 107/MFR.03/2017, are the scope about CFC

is too extensive so it become ineffective to implemented, complication in detecting indirect ownership and

joint ownership, complication in obtaining data and information on supervisory process by Directorate

General of Taxes (DGT), and the lack of awareness about CFC issue by DGT officials.

1 INTRODUCTION

Base erosion and profit shifting have become the

latest tax issues for countries around the world. The

shifting of income to countries that provide tax

advantages causes many other countries to

experience a stripping of tax base. This will affect

the economic conditions of a country, especially

countries whose most of their funding comes from

taxes.

Indonesia is one of the countries whose source of

the State Budget (APBN) mostly comes from taxes.

Table 1: State Budget of Indonesia

2017 2016 2015 2014

A. Government Revenue 1750,3 1822,5 1793,6 1667,2

I. Domestic Income 1748,9 1820,5 1790,3 1665,8

1. Tax Revenue 1498,9 1546,7 1380 1280,4

2. Non-Tax State Revenue 250 273,8 410,3 385,4

II. Grant Revenue 1,4 2 3,3 1,4

% tax revenue to total

g

overnment revenue

86% 85% 77% 77%

Based on the above table, more than 75% of the state

budget of Indonesia comes from taxes. It continues

to increase from year to year.

Tax avoidance practices that cause erosion of the

tax base in Indonesia should be prevented so as not

to disrupt the financing of the development process.

One of the ways of tax avoidance is done by defer

the payment of taxes using Controlled Foreign

Company (CFC). Some countries already have a set

of rules to counteract tax avoidance practices in the

form of deferral tax payments using CFC. This set of

rules is called CFC rules.

On July 26, 2017, the Directorate General of

Taxes (DGT) has issued the latest regulation as part

of CFC rules in Indonesia which is Minister of

Finance Regulation (MFR) number 107 (PMK

No.107/PMK.03/2017). This latest MFR about CFC

rules are expected can improve the weaknesses of

previous regulations (MFR No. 256/MFR.03/2017).

Some previous studies have concluded that

previous CFC rules in Indonesia have weaknesses

that used by taxpayers to conduct tax avoidance

practices. MFR No. 107/MFR.03/2017 is

implementation of BEPS Action Plan 3

recommended by OECD. Recommendation in BEPS

Action Plan 3 aims to assist tax authorities in a

country in order to be able to set up CFC rules that

strong enough to counteract tax avoidance practices

400

Sari, N. and Rahayu, N.

Analysis of Controlled Foreign Company (CFC) Rules In Indonesia To Prevent Tax Avoidance Practises.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 400-408

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in the form of deferral tax payments using CFC.

How does this new regulation work to be said strong

enough to counter tax avoidance practices? Is there

any constraint in implementing it?

This research aims to analyze how the latest

CFC rules in Indonesia can be used to counteract tax

avoidance practices and to find out what kind of

constraints encountered in its implementation. This

research is expected to provide input to the DGT in

preparing the next CFC rules policy tool. This

research also expected become additional literature

for the subsequent research.

2 LITERATURE REVIEW

2.1 Tax Avoidance and Tax Evasion

Frans Vanistendael (1997), Michael J. McIntyre and

Brian J Arnold (2000), Kessler (2004) in Hutagaol

and Tobing (2007) stated that tax evasion is a tax

savings made by taxpayers in a way that violate the

regulations. According to Sophar Lumbantoruan

(1996), Carlos A Silvani (1992), Erli Suandi (2003),

Kwaai Faat (2003), and James Kessler (2004) as

stated in Hutagaol and Tobing (2007) tax avoidance

is an effort of tax savings made by the taxpayer in

accordance with regulations. The difference between

tax avoidance and tax evasion lies in whether the tax

savings made by the taxpayer are violate the

regulation or not. If it is against the regulation then it

is included as tax evasion, whereas if the tax savings

made by the taxpayer is not violate to the prevailing

regulations then it is tax avoidance. Slamet (2007)

distinguishes tax avoidance into two categories,

acceptable and unacceptable.

2.2 Deferral Tax Payment Using CFC as

Tax Avoidance Scheme

According to Arnold in Rahayu (2008), Rohatgi

(2007), and OECD (2015), one of tax avoidance

mechanism commonly used by taxpayers is deferral

tax payments using CFC. This is done by, first,

establishing a controlled subsidiary abroad called

Controlled Foreign Company (CFC). CFC usually

establised in tax haven country. The next step is

shifting income from tax payer to CFC, then

postponed dividends distribution from the CFC for a

long term period. The advantages obtain from this

tax avoidance scheme is time value of money from

postponed paying taxes in residence country. The

impact of this tax avoidance scheme is shifting of

income to tax haven countries and the erosion of tax

bases in many other countries.

2.3 BEPS Action Plan 3: Designing

Effective Controlled Foreign

Company (CFC) Rules

Recommendation in BEPS Action Plan 3 aims to

assist tax authorities in a country in order to be able

to set up CFC rules that strong enough to counteract

tax avoidance practices in the form of deferral tax

payments using CFC. The recommendations

compiled by the OECD are organized into six parts:

1. The definition of CFC, including the definition

of control

It is recommended to includes transparent

entities and Permanent Establishment (PE). Not

only regulate controls legally but also

economically control. And most importantly the

CFC rules must include both direct and indirect

control.

2. Exemption and threshold

The OECD recommends that exemption and

threshold can be done in three ways establish a

minimum amount of ownership so that the

taxpayer jointly deemed to have ownership of a

CFC is limited to a certain amount of

participation, only applicable when known CFC

is established with the motive of tax avoidance,

and determine that CFC rules apply only to CFCs

in countries that have lower tax rates than the tax

rates on which the parent company is located

3. Definition of CFC income

The OECD recommends that CFC income be

clearly defined in CFC rules so as not to generate

multiple interpretations and consistent with

domestic policy.

4. Computing CFC income

The OECD recommends that CFC income be

calculated on the basis of the applicable

provisions of the country where the parent

company is located. It is also recommended that

the loss of a CFC can only be offset with income

from the same CFC or from another CFC

residing in the same country.

5. Attribution of earnings

The OECD recommends the atribution should be

tied to minimum control threshold, the amount of

income atributed to each shareholder calculated

referring to their proportion of ownership and

actual period of ownership, jurisdiction can

determine when income should included in tax

payer returns, and CFC rules should apply tax

rate of the parent jurisdiction.

Analysis of Controlled Foreign Company (CFC) Rules In Indonesia To Prevent Tax Avoidance Practises

401

6. Elimination of double taxation

A main consideration in setting up CFC rules is

to avoid double taxation among the jurisdictions

involved. The OECD recommends the

elimination of double taxation may be made by

including provisions concerning foreign tax

exemptions or credits tax.

2.4 Specific Anti-Tax Avoidance Rules

(SAAR) in Indonesia

There are several ways of tax avoidance that are

often used by taxpayers among others. Thin

Capitalization, deferral tax payment using CFC,

Transfer Pricing, Treaty Shopping, Special Purpose

Company, etc.

Against these specific tax avoidance forms, some

countries have rules to counter them. According to

Alhusnieka (2011), Indonesia also has a set of rules

to counter such specific tax avoidance practices. It is

regulated in Article 18 of the Income Tax Law.

Article 18 paragraph 1 is a provision to counter the

practice of tax evasion in the form of Thin

Capitalization, Article 18 paragraph 2 is a provision

to counter the practice of tax avoidance in the form

of deferral tax payment using CFC, Article 18

paragraph 3, 3 (a), and 4 is a provision to counteract

the practice tax avoidance in the form of Transfer

Pricing, Article 26 paragraph 1a is a provision to

counter the practice of tax avoidance in the form of

Treaty Shopping, and Article 18 paragraph 3b and

3c is a provision to counter the practice of tax

avoidance using special purpose company, and

Article 18 paragraph 3d is a provision to counteract

the practice of tax avoidance in the form of private

persons who have a special relationship with

employers abroad. Tax laws that are specifically

designed to counteract certain tax avoidance

schemes are called Specific Anti-Tax Avoidance

Rules (SAAR). Each of the provisions in the Income

Tax Law will then be made implementing

regulations as technical guidance and

implementation guidance in form i.e. Minister

Finance Regulation or Director General Regulation.

As mentioned above, CFC rules in Indonesia is

part of SAAR which stated in Article 18 paragraph 2

Income Tax Law. The latest implementation

guidance is MFR number 107/MFR.03/2017.

2.5 Deemed Dividend Mechanism

There are several mechanisms that can be used to

attain taxes from CFC schemes and schemes using

offshore holding companies as described by Gunadi

(2007) ie market to market approach, deemed rate of

return approach, deemed distributrion approach, and

deferral charge approach. The market to market

approach is done by incorporating the increase /

decrease in value of taxpayer investments in CFCs

into taxable income (capital gain accumulation per

accrual basis). The imputed income or deemed rate

of return approach is made by requesting tax payer

having a CFC to report CFC earnings on a certain

percentage regardless of the actual income of the

CFC. The deemed distributrion approach is made by

imposing a tax according to the percentage of capital

participation in CFC income whether the dividend

has been actually distributed or yet. The deferral

charge approach is conducted by delay the taxes of

domicile until dividend is actually distributed. Upon

receipt of actual dividend from CFCs will be added

with a certain amount of interest that will reduce the

profit from the delay of taxation.

CFC rules in Indonesia use the deemed

distribution mechanism to impose a tax on CFC

income. It is called deemed dividend.

3 RESEARCH METHODOLOGY

The research methodology is conducted to gathered

information and data, analyze it, and then draw

conclusions about how CFC regulations in Indonesia

are used to counteract tax avoidance practices and

constraint in the implementation.

3.1 Research Method

Qualitative methods views social reality as

something comprehensive, holistic, dynamic, full of

meaning, and the relationship of symptoms is

interactive (Sugiyono, 2017). In this study,

researchers used qualitative methods because the

researcher believes the application of a taxation law

and its relationship with the community is something

that comprehensive, holistic, interactive, and

dynamic relationship.

3.2 Data Collection

Data collection techniques used in this research are

literature studies and field studies. Literature studies

conduct by gathered information and data using

literature, books, articles, and journals on topics

related to international taxation, tax planning, tax

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

402

evasion, CFCs, BEPS Action Plan 3: Designing

Effective Controlled Foreign Company Rules, and

other topics related to CFCs. Field studies conduct

through in-depth interviews with key informants

which is competent in this topic study. According to

the researchers, competent key informant in this

topic are the parties from academics who knows

about international taxation, practitioners from tax

consultant especially international tax, and DGT.

3.3 Data Analysis

According Sarwono (2006), in research using

qualitative methods, conducting data analysis is to

process and analyze the data that has been collected

into data that is systematic, organized, structured,

and meaningful. It can be done by organizing the

data, by reading repeatedly the data collected so that

researchers find useful data for research and

eliminate useless data, then test the theory that

comes with the existing data, then give explanation

for the data collected, then write the report.

4 RESEARCH FINDING AND

DISCUSSION

4.1 Analysis of CFC Rules in Indonesia

in Countering Tax Avoidance

Practices

According to Arnold in Rahayu (2008), Rohatgi

(2007), and OECD (2015), one of tax avoidance

mechanism commonly used by taxpayers is deferral

tax payments using CFC. This is done by, first,

establishing a controlled subsidiary abroad called

Controlled Foreign Company (CFC). CFC usually

establised in tax haven country. The next step is

shifting income from tax payer to CFC, then

postponed dividends distribution from the CFC for a

long term period. The advantages obtain from this

tax avoidance scheme is time value of money from

postponed paying taxes in residence country. The

impact of this tax avoidance scheme is shifting of

income to tax haven countries and the erosion of tax

bases in many other countries.

In Indonesia, based on data from Investment

Coordinating Board/Badan Koordinasi Penanaman

Modal (BKPM) regarding Indonesian companies

that are established abroad or companies that doing

outward investment, there are as many as 631

companies. After comparison with the list of tax

haven countries, the result obtained is that most

companies abroad are established in tax-haven

countries or countries with lower tax rates than

Indonesia.

Table 2: List of Indonesian Companies Abroad

No. Country

Amount of

Companies

Tax Haven

Country

Tax

Rates

(2016)

Yes No

1 Australia 9 - V

2 Barbados 1 - V

3 Brazil 1 - V

4

British

Virgin Island

43 V - -

5

Cayman

Island

16 V - -

6 China 13 - V

7 Denmark 1 V - 22

8 France 1 - V

9 Germany 1 - V

10 Hong Kong 15 V - 16,5

11 Hongaria 1 V - 19

12 India 5 - V

13 Italia 2 - V

14 Japan 3 - V

15 Korea 1 V - 24,2

16 Liberia 3 - V

17 Luxembourg 1 - V

18 Malaysia 100 V - 24

19 Malta 1 - V

20

Marshall

Islands

5 - V

21 Mauritania 2 - V

22 Mauritius 10 V - 15

23 Myanmar 5 - V

24 Netherlands 41 - V

25 New Zealand 1 - V

26 Panama 15 - V

27 Phillippines 23 - V

28 Saudi Arabia 2 V - 20

29 Serbia 2 V - 15

30 Seychelles 9 - V

31 Singapore 100 V - 17

32 Taiwan 31 V - 17

33 Thailand 100 V - 20

Analysis of Controlled Foreign Company (CFC) Rules In Indonesia To Prevent Tax Avoidance Practises

403

No. Country

Amount of

Companies

Tax Haven

Country

Tax

Rates

(2016)

Yes No

34 Timor Leste 1 - V

35 Tortola 1 - V

36 Tunisia 1 - V

37 UAE 11 - V

38

United

Kingdo

m

4 V - 20

39 USA 10 - V

40 Uzbekistan 1 - V

41 Vanuatu 2 V - -

42 Vietnam 31 V - 20

43 Yemen 5 V - 20

Jumlah

Perusahaan

631 464 167

A total of 464 companies from 631 Indonesian

companies abroad or 74% were established in

countries with lower tax rates than Indonesia. While

the remaining 167 companies or 26% established in

countries whose tax rates are not lower than

Indonesia. This indicates that tax planning using

CFC scheme is commonly used by Indonesian tax

payer.

CFC rules are terms used for a specific tax

avoidance rule regarding a transaction. The specific

transaction targeted by this rule is a transaction for

the tax deferral payments using CFC. Indonesia also

has a set of rules regarding efforts to prevent tax

avoidance practices using CFC schemes. According

to Alhusnieka (2011) and Rahayu (2008) the

provisions to prevent the practice of tax avoidance

using the CFC scheme are regulated in Article 18

paragraph (2) of Law No. 36 of 2008 on Income

Tax. Anti tax avoidance stipulated in Article 18 of

Law Number 36 Year 2008 regarding Income Tax is

Specific Anti Tax Avoidance Rules (SAAR). SAAR

regulates the prevention of tax avoidance limited to

the forms mentioned in the provisions. How the

latest CFC rules in Indonesia are used to counteract

tax evasion practices will be described below.

4.1.1 Improved Deemed Dividend

Mechanism

The main characteristic of the CFC rules is to

immediately tax when tax payer already has income.

CFC rules in Indonesia used deemed distributrion

approach called deemed dividend (Gunadi, 2007). It

is made by imposing tax every year in set of time

regardless whether dividend has been actually

distributed or not. The amount of tax imposed

depends on the percentage of ownership in CFC and

the income after tax of the CFC.

In this latest CFC rules, PMK-

107/PMK.03/2017, the deemed dividend

arrangement is more consistent. Deemed dividends

that must be reported every year by Indonesian

taxpayer reflect real income of CFC which is income

after tax of the CFC and percentage of ownership of

the Indonesian taxpayer. This makes taxpayers

unable to avoid provision by distribute the dividend

in a insignificant amount before the set time as

happened before as a result of the weakness of the

previous CFC rules. The fact that there is actual

distribution of dividend before the set time does not

invalidate the obligation to report the deemed

dividend in that year.

At the same time, there is a provisions

concerning deemed dividend which can be

calculated for the period of 5 years back in a row

since the year of receipt of dividend. Indonesian tax

payer can also take the tax credit from the income

tax section of the deemed dividend. Given this

arrangement, the existing deemed dividend

mechanisms become more consistent. Taxpayers

also get certainty and clarity in the implementation

of this provision.

4.1.2 Includes indirect ownership

Fajriyan (2017) states that one of the

recommendations of the OECD to be adopted in

strengthening the CFC rules is the extension of the

definition of control which is not only limited to

direct controls but also indirect control. According

to the OECD (2015) when setting limits on control,

there are two things to be noted, the control type

and the control level. There are several types of

controls: legal control, economic control, de facto

control, and consolidated control. In preparing a

CFC rule in a country, the tax authorities are

expected to cover the whole type of control. PMK-

107 / PMK.03 / 2017 as latest CFC rules already

covered provision about indirect ownership. This

provision closes the gap for taxpayers who want to

exploit weaknesses on 'indirect control'

4.1.3 Includes Trust and Other Similar

Entities

According to interviewee, a trust is a type of entity

commonly used in countries with common law

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

404

systems that can be used as a means of controlling

the assets of a CFC. According to OEDC (2015)

recommendation should include permanent

establishment (PE) and transparent entity. Weakness

in the previous regulation used by taxpayers to avoid

tax obligation is by using intermediary of trust. In

the latest CFC rules in Indonesia, this weakness has

been fixed. Article 4 paragraph (8) of PMK No.

107/PMK.03/2017 stipulates that in the case of

equity participation in CFC do through trusts or

other similar entities abroad, such capital

participation shall be deemed performed by the party

participating in capital. This means that the use of

trust to avoid previous CFC rules is no longer

effective. The scheme using trust as CFC can be

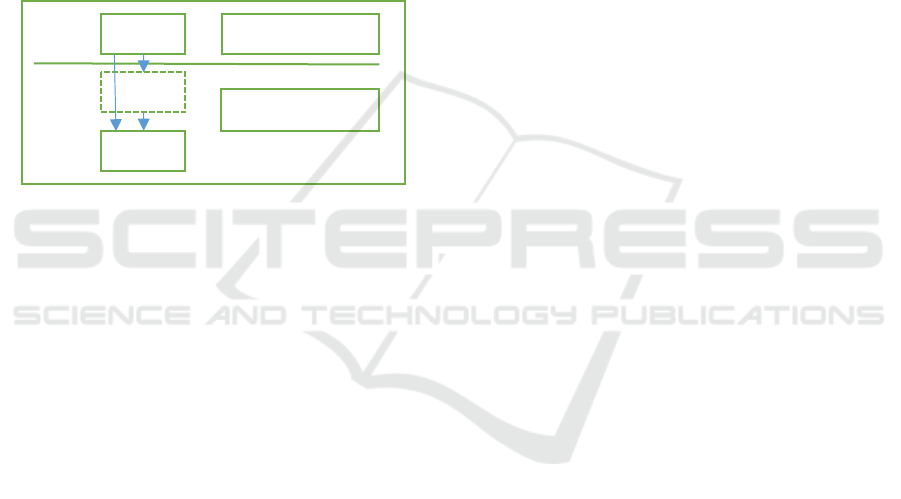

seen in the figure below.

Figure 1: CFC in Trust Form.

Based on the picture above, PT ABC has ownership in

XYZ Ltd. through trust. Under the terms of previous CFC

rules, PT ABC does not have to comply to reporting

deemed dividends on XYZ Ltd. because its direct

ownership is in trust entities. Under the latest CFC rules,

PT ABC shall report deemed dividends on its ownership

in XYZ Ltd. because its ownership in trust entity is

considered not existent and considered as if PT ABC has

direct ownership to XYZ Ltd.

4.1.4 Regulates provisions on Foreign Tax

Credits

A cross-border transaction involving two or more

countries has the potential to generate international

double taxation (Gunadi, 2007). For taxpayers, the

emerge of double taxation will become burden for

their business and investment activities. Therefore

international double taxation must be eliminated or

granted. In line with that, the OECD (2015) states

that the primary consideration in drafting the CFC

rules is not to create double taxation among

jurisdictions involved. The emergence of double

taxation can affect the competition, growth, and

economic development of countries in the world.

The potential for the inclusion of double taxation

may be made by including provisions concerning

foreign tax exemptions or credits. Double taxation

may arise from a number of conditions: one CFC

income is also subject to income taxes abroad, one

CFC income being the tax subject of several

countries that have CFC rules, and when the CFC

actually distributes dividends from earnings

previously imposed by deemed dividend. In

Indonesia the provision to avoid double taxation is

done by foreign tax credit mechanism. The

provisions concerning the crediting of income tax in

CFC rules in Indonesia are arranged in article 7

PMK No. 107/PMK.03/2017. With this provision

the taxpayer avoids from getting burden of double

taxation.

4.2 Constraints In Implementing CFC

Rules In Indonesia

4.2.1 The Scope is Too Extensive So It

Become Ineffective

CFC rules become too wide-ranging. CFCs as

SAAR should be more specifically targeted to

certain tax avoidance scheme only, in this case is in

scheme of deferral tax payments using CFC.

According Gunadi (2007) deferral payment of tax

using CFC is giving benefit if the tax rate in CFC

jurisdiction is lower than the tax rate in Indonesia.

One indication of tax avoidance intentions using

CFCs is to choose a country that provides tax

benefits or tax-haven state.

The OECD (2015) recommends setting limits on

who these CFC rules apply to:

a. Establish a minimum amount of ownership (de

minimis threshold)

b. Only applicable when known CFC is established

with the motive of tax avoidance

c. Determine that CFC rules apply only to countries

which has a lower tax rate than the country

where the parent is located.

This limitation aims to reduce administrative

burdens and make CFC rules more targeted and

more effective.

According to Gunadi (2007) there are two

approaches that can be used to limit the criteria of

anyone subject to the terms of the CFC by means of

designated jurisdiction approach and a transactional

approach. The designated jurisdiction approach is

conducted by determining which countries are

considered tax havens then made a list of these

countries in the rules. Determination of the criteria

of tax haven country can be done by comparing

Indonesian tax rate with state tax rate indicated as

tax haven. The comparable tax rate may be the

PT ABC

trust

INDONESIA

XYZ Ltd.

COUNTRY A

Analysis of Controlled Foreign Company (CFC) Rules In Indonesia To Prevent Tax Avoidance Practises

405

nominal tax or the effective tax rate. While the

transaction approach is done by differentiating the

category of income regardless whether the CFC is in

a country with lower tax rates or not.

In differentiating the category of income of the

CFC, can be used two approaches: entity approach

or certain earnings approach / tainted income. The

entity approach typically uses some exceptions such

as exceptions for earnings from actual businesses,

exceptions to certain percentages, exclusions for

listed companies, exceptions for companies that are

not intended to avoid taxes (have valid business

purposes). While certain income approaches specify

only the types of tainted income are considered CFC

income which is usually a passive income (dividend,

interest, royalty).

The terms of the latest CFC rules in PMK

No.107/PMK.03/2017 in Indonesia are not

differentiated by jurisdiction or by type of income.

CFC rules in Indonesia uses a global approach so

that all countries and all CFC income both active

income and passive income are included in the

CFC's terms. The use of global approach makes the

scope of this provision to be extensive.

The effect of the extent of the scope of this

provision is that if there is a CFC company that

actually undertakes business activities and assumes

business risks and resides in a country where the tax

rate is not lower than Indonesia, the company will

still be subject to the terms of this CFC. For such

CFCs and for existing capital owners in Indonesia

this may result in excessive tax burdens.

In the opinion of some key informans, the terms

of the CFC rules must be maintained to be targeted,

ie targeting CFCs located in countries with lower tax

rates than Indonesia or can also be more targeted on

the type of income that passive income only because

this type of income is widely used in tax avoidance

efforts.

Provisions on low tax jurisdiction can be set

forth in the form of implementing regulations under

the provisions of PMK-107 / PMK.03 / 2017, for

example in the Director General Regulation.

4.2.2 Difficulty in Detecting Indirect

Ownership and Joint Ownership

According to interviewee, one of the important

changes in PMK No. 107/PMK.03/2017 is the

regulation of indirect ownership. In the previous

provision, PMK No. 256/PMK.03/2017, indirect

ownership is not regulated. It is used by taxpayers to

avoid provision in CFC rules by creating ownership

schemes where income is put on a company that is

formally owned indirectly by Indonesian tax payer

but is actually a company controlled by Indonesian

tax payer. This is done solely to avoid the provisions

of CFC rules. By doing so Indonesian tax payer may

be spared from the obligation to report the deemed

dividend of its existing overseas company in

accordance with the provisions stipulated in PMK

No. 256/PMK.03/2017.

In the latest terms PMK No.

107/PMK.03/2017 taxpayers can not do such a thing

anymore. Indirect ownership schemes are already

regulated in PMK No. 107/PMK.03/2017,

exemplified by the scheme and how it is defined as a

direct and indirect controlled CFC. However, this

will lead to obstacles in the implementation process

later. The DGT will find it difficult to obtain data on

indirect ownership schemes as exemplified in the

PMK No. 107/PMK.03/2017. The more stratified the

scheme of ownership trees undertaken by Indonesian

taxpayer, the more difficult it is for the DGT to

detect the existence of the chain of ownership.

Moreover, the tree of ownership is information

about entities abroad. To obtain information about

foreign entities have certain obstacles because it

involves two jurisdictions. This requires a long and

complicated process through Exchange of

Information (EOI) activities. By improving EOI

processes and mechanisms, it is expected to assist in

detecting indirect ownership schemes.

Furthermore, in its recommendations, the

OECD (2015) provides restrictions on which CFC

rules apply, one of which is to set a minimum

threshold. In the terms of the minimum threshold,

the taxpayer jointly deemed to have ownership of a

CFC is limited to a certain amount of participation.

In Indonesia, the provisions on de minimis threshold

can not be implemented because it will limit the

powers granted to the Minister of Finance by Article

18 paragraph (2) of the Income Tax Act regarding

CFC rules.

Absence of minimum threshold in PMK No.

107/PMK.03/2017 in addition to not wanting to limit

the authority granted by Article 18 paragraph (2),

also used to avoid taxpayers who want to avoid the

regulation by doing fragmentation. Fragmentation is

done by deliberately splitting its ownership to be

below 50% so it is not considered to have CFCs

abroad. By performing fragmentation, tax payer

expect to avoid the provisions of the CFC rules

because of its ownership under 50% threshold

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

406

despite the fact that the taxpayer along with the other

party still has control over the CFC.

The absence of a minimum threshold will

increased administrative costs by the DGT, incurring

compliance costs for taxpayers, and also creates

difficulties in its oversight process. DGT as a party

exercising supervision over the implementation of

this provision shall have sufficient data and

information on anyone who has a share of the joint

investment of a CFC overseas. Whereas for the

exchange of data and information between Tax

Office (KPP), DJP is still having difficulties. If the

Indonesian taxpayer owning an overseas CFC and it

registered in different KPP, the DGT will find it

difficult to detect it.

4.2.3 Difficulty in Obtaining Data and

Information for The DGT Supervisory

Process

Oversee the implementation of this provision

requires accurate information and data on CFCs

owned by the taxpayer. As for the current, DGT

does not have a special tool to capture information

related to these matters. For now the provisions on

CFC are still highly dependent on self-assessment of

taxpayers.

Constraint to supervision by the DGT in

particular such data and information can be

addressed in several ways, namely the provision of

CbCR (Country by Country Report) in the Transfer

Pricing Rules. Information gathering conducted by

the DGT can also be done with the EOI (Exchange

of Information) mechanism. As well as the

consolidated financial statements reported by the

taxpayer may serve as a trigger for collecting CFC

related data and information in Indonesia.

4.2.4 Lack of Awareness of CFC Topic by

DGT Officials

Not all tax officers are aware and understand about

CFC topic. Moreover, because the CFC case is

usually found only in the Middle Tax Office and

Large Tax Office whose taxpayers are likely to do

outward investment. Limitations of knowledge and

understanding by tax officials on these CFC topics

can be overcome by providing regular socialization

and learning to tax officials on these CFC topics.

Socialization on CFC issues is also given to the

taxpayer so as to achieve the same understanding

between the taxpayer with the DGT.

5 CONCLUSIONS

5.1 Conclusions

From the analysis of CFC rules in Indonesia, it can

be concluded as follows:

1. CFC rules in Indonesia may be used to

counteract tax evasion practices by

improvements to deemed dividend mechanism,

including indirect ownership, include provisions

on trusts, and has regulated provisions on foreign

tax credits.

2. The constraints in implementing CFC rules in

Indonesia are:

a. the scope of this provision becomes too

extensive so it become ineffective to

implemented

b. difficulty in detecting indirect ownership and

joint ownership

c. difficulties in obtaining data and information

for monitoring process by DGT

d. lack of awareness of tax officials on CFC

topics

5.2 Recommendations

This research recommendation are:

1. In order for the provisions in the CFC rules to

give results as expected, it is recommended that

the DGT as a tax authority to create a special unit

of supervision to ensure that this provision is

strictly adhered by the taxpayer.

2. The constraints in implementing latest CFC rules

can be addressed by:

a. To overcome the ineffectiveness of CFC

rules due to their overly extensive coverage,

it is recommended that the provisions in the

CFC rules be targeted using a designated

jurisdiction approach. Provisions on low tax

jurisdiction can be set forth in the form of

implementing regulations under the

provisions of PMK No.107/PMK.03/2017,

for example in the Director General

Regulation,

b. To overcome the difficulties of detecting

indirect ownership and joint ownership it is

advisable to improve the Exchange of

Information mechanism to be more efficient

and effective and improve the exchange of

information between KPPs.

c. To overcome difficulties in obtaining data

and information for monitoring process by

DGT it is suggested to collect data from

Analysis of Controlled Foreign Company (CFC) Rules In Indonesia To Prevent Tax Avoidance Practises

407

CbCR, EOI, and taxpayer consolidated

financial statements.

d. To overcome the lack of understanding of tax

officers on CFC topics it is suggested to

provide continuous socialization to the

internal DGT and eksternal DGT in order to

achieve the same understanding within the

internal DGT and the same understanding

between the DGT and the taxpayer.

ACKNOWLEDGEMENTS

Indonesia Endowment Fund for Education (LPDP).

REFERENCES

Alhusnieka, Falih. (2011). Analisis Terhadap Ketentuan

Anti Tax Avoidance dalam Undang-Undang Nomor

36 Tahun 2008 Sebagai Upaya Pencegahan

Penghindaran Pajak Internasional. Jakarta: Tesis

Program Pascasarjana Program Studi Kajian

Ketahanan Nasional Kekhususan Kajian Intelijen

Stratejik.

Arnold, Brian J. (2016). International Tax Primer Third

Edition. The Netherlands: Kluwer Law International

B.V.

Arnold, Brian. J and Michael J. McIntyre. (2002).

International Tax Primer. The Hague: Kluwer Law

International.

Darussalam dan Ganda C. Tobing. (2014). Rencana Aksi

Base Erosion Profit Shifting dan Dampaknya terhadap

Peraturan Pajak di Indonesia. DDTC Working Paper:

International Taxation SeriesNo 0714, Juni 2014.

Fajriyan, Nur Afianti (2017). Analisis Rencana Aksi 3

Base Erosion and Profit Shifting Dalam Upaya

Memperkuat Regulasi Controlled Foreign Company

untuk Menangkal Penghindaran Pajak (Suatu Kajian

atas Regulasi CFC Indonesia dan Tiongkok). Jakarta:

Tesis Fakultas Ilmu Administrasi Kekhususan

Administrasi dan Kebijakan Perpajakan.

Gunadi. (2007). Internasional Taxation. Jakarta: Lembaga

Penerbit Fakultas Ekonomi UI

Hutagaol, John dan Tobing, Wilson. (September 2007).

SAAR dan GAAR dalam Menangkal Penghindaran

Pajak. Inside Tax, Edisi Perkenalan (16-18).

OECD (2015), Designing Effective Controlled Foreign

Company Rules, Action 3 - 2015 Final Report,

OECD/G20 Base Erosion and Profit Shifting Project,

OECD Publishing, Paris.

http://dx.doi.org/10.1787/9789264241152-en

Peraturan Menteri Keuangan Nomor 107/PMK.03/2017

tentang Penetapan Saat Diperolehnya Dividen dan

Dasar Penghitungannya oleh Wajib Pajak Dalam

Negeri atas Penyertaan Modal Pada Badan Usaha di

Luar Negeri Selain Badan Usaha yang Menjual

Sahamnya di Bursa Efek.

Rahayu, Ning. (2008). Praktik Penghindaran Pajak (Tax

Avoidance) pada Foreign Direct Investment yang

Berbentuk Subsidiary Company (PT. PMA) di

Indonesia (Suatu Kajian Tentang Kebijakan Anti Tax

Avoidance). Jakarta: Disertasi Fakultas Ilmu Sosial

dan Ilmu Politik Departemen Ilmu Administrasi

Universitas Indonesia.

Rohatgi, Roy. (2002). Basic International Taxation.

London: Kluwer Law International.

Rohatgi, Roy. (2007). Basic International Taxation

Volume 2 Practice of International Taxation. London:

BNA International Inc.

Slamet, Indrayagus. (September 2007). Tax Planning, Tax

Avoidance, dan Tax Evasion di Mata Perpajakan

Indonesia. Inside Tax, Edisi Perkenalan (8-10).

Sugiyono. (2017). Kuantitatif, Kualitatif, and R&D

Research Method . Bandung: Alfabeta.

Undang-Undang Nomor 36 Tahun 2008 tentang

Perubahan Keempat atas Undang-Undang Nomor 7

Tahun 1983 tentang Pajak Penghasilan.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

408