The Mediating Role of Religiosity in the Influence of Family

Education and Financial Socialization on The Islamic Financial

Literacy

Yureza Rian Wibowo , Ahmad Nurkhin and Kardoyo

Universitas Negeri Semarang, Semarang, Indonesia.

Keywords: Islamic Financial Literacy, Religiosity, Family Education, Financial Socialization.

Abstract: This study aims to determine the effect of family education and financial socialization on Islamic financial

literacy with religiosity as a mediation variable. The population of this study are students of State Madrasah

Aliyah on Semarang City who have received financial services materials. The numbers of samples in this

study as many as 205 students taken with proportional random sampling technique. Data collection method

used is questionnaire. Methods of data analysis using descriptive analysis techniques and structural equation

models. The results showed that family education has an influence on religiosity and Islamic financial literacy;

financial socialization has an influence on religiosity and Islamic financial literacy as well as religiosity able

to mediate family education and financial socialization toward Islamic financial literacy. Suggestions given

related to the results of this study are: activities related to financial socialization should be prioritized to form

Islamic financial literacy such as with the holding of discussion activities with peers, the procurement of

media such as books or magazines. Family education needs to be improved to maximize Islamic financial

literacy, this is due to the education of the family as the main educational environment for an individual and

the results of research indicate that the coefficient of family education is not greater than the coefficient of

other variables.

1 INTRODUCTION

In this era of globalization, the understanding of

financial literacy has grown so rapidly that financial

literacy began to be implanted to each individual from

an early age at school age. Every individual should

have a good level of financial literacy in order to

manage his finances well for the sake of achieving a

prosperous life goal. The existence of a changing

financial paradigm from time to time encourages the

importance of instilling an understanding of the

financial literacy that begins in school-aged children.

(Sina, 2014) argues that a very clear paradigm change

is felt to change from the past to the present: (1) the

need for investment is much needed today, while the

past is still oriented towards saving, (2) ) in the past,

insurance is less favourable, while now insurance is

favoured, (3) financial instruments today are more

numerous than in the past, (4) the community has

shared minded, but did not understand stocks, (5)

Financial literacy is still neglected, while it now needs

to be improved.

(Setyowati and Harmadi, 2018) states that

financial literacy provides information about the level

of public awareness about benefits and risks, as well

as their rights and responsibilities as users of financial

products and services. Another opinion, (Sohn et al.,

2012) says that financial literacy refers to the

knowledge and skills necessary to handle challenges

and decision-making in every life. In line with that

opinion. (Sundarasen et al., 2014) argues that the

current era of financial literacy has been linked to

saving and decision-making portfolios for its need for

financial education. Financial education can be

obtained through formal or informal activities.

(Bernheim, Garret and Maki, 2001; Varcoe et al.,

2005) argue that formal financial education is

believed to play an important role in financial

literacy. In addition, financial education is important

to equip yourself with financial literacy knowledge in

the early stages of a person's life because it affects

financial behaviour (Martin and Oliva, 2001; Beverly

and Burkhalter, 2005). While (Kardoyo and Nurkhin,

2018) argued that financial

294

Wibowo, Y., Nurkhin, A. and Kardoyo, .

The Mediating Role of Religiosity in The Influence of Family Education and Financial Socialization on The Islamic Financial Literacy.

DOI: 10.5220/0008411302940302

In Proceedings of the 2nd International Conference on Learning Innovation (ICLI 2018), pages 294-302

ISBN: 978-989-758-391-9

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

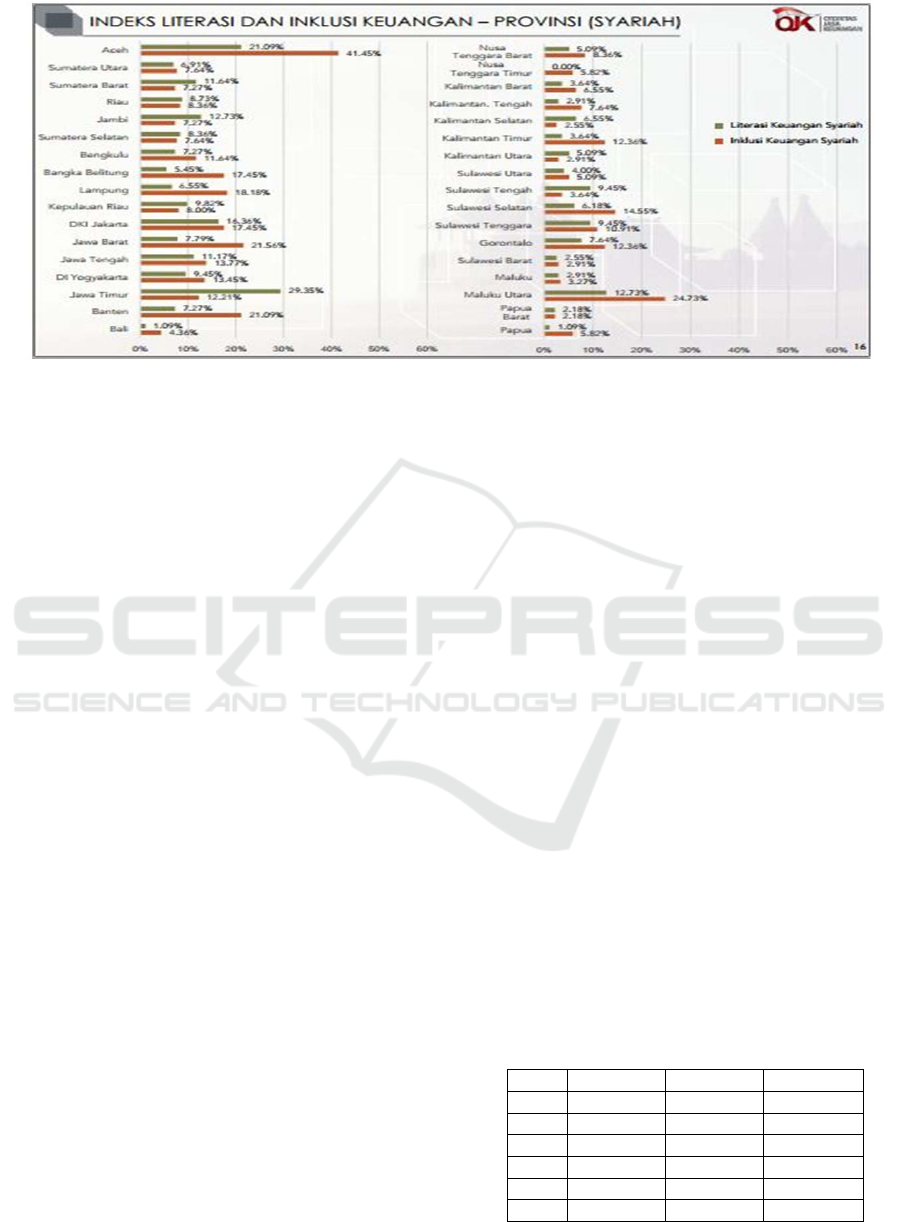

Figure 1: Financial literacy and inclusion index - Province (Islamic) Source: Survey of otoritas jasa keuangan (2016).

literacy is a process to increase one understands of

financial concepts through various information or

advice and economic activities every day.

Given that Indonesia is the biggest Muslim

country in the world, it should be directly

proportional to the level of religiosity as well as the

level of Islamic financial literacy. But in reality the

people of Indonesia do not have the level of Islamic

financial literacy that describes the situation that

Indonesia is the biggest Islamic country in the world.

Otoritas Jasa Keuangan (Otoritas Jasa Keuangan

(OJK), 2016) is a state financial institution tasked

with regulating and overseeing financial services

activities, with the Government of Indonesia paying

particular attention to financial literacy. The survey

conducted by (Otoritas Jasa Keuangan (OJK), 2016)

states that the average Indonesian people only have

Islamic financial literacy index at 8.11%, where the

number is considered very small when compared with

the number of people who embrace the flow of

Islamic faith that reaches 207 million people.

To be able to measure the level of one's financial

literacy, there are three aspects to note, namely

attitude, understanding and action. However, this

research focuses only on understanding constructs.

This is because the object in this study is still at a

young age. With these age limitations, the financials

held by the research object are still dependent on the

parents so that it is less relevant if the researcher

focuses on the three constructs in the financial

literacy.

In line with the results of a survey conducted by

(Otoritas Jasa Keuangan (OJK), 2016), the results of

a survey of researchers with the object of students

with specialization of Social Sciences at State

Madrasah Aliyah (MAN) in Semarang City showed

poor results, where as much as 53 per cent of MAN’s

students in the city of Semarang has the level of

financial literacy in the low category, even there are

still 10 per cent of students who are in very low

category. More deeply, those who are in the high

category only understand that Islamic finance is

fixated on interest or usury that is considered haram.

The results of a survey conducted by researchers

basically cannot be used as a guide to make

generalizations to all MAN’s students in Semarang

City regarding Islamic financial literacy. This is

because they have obtained a picture of Islamic

financial literacy through Economic subjects in

Money and Financial Institutions of Bank and Non-

Bank. Especially every learner has a diverse

environment such as organizational environment,

extracurricular or other environment that can affect in

terms of knowledge of Islamic financial literacy.

The low level of Islamic financial literacy among

learners of course must be repaired as early as

possible to create a prosperous society in accordance

with the Islamic teachings. Providing insight into

sharia finance is the first step that can be done. Giving

this insight can start from the simplest level, that is

education in the family.

Table 1: Financial literacy among students Source: Primary

data of researchers, processed (2018)

No Category Frequency Percentage

1 Very Low 3 10%

2 Low 16 53%

3 Medium 6 20%

4 High 4 13%

5 Very High 1 3%

Total 30 100%

The Mediating Role of Religiosity in The Influence of Family Education and Financial Socialization on The Islamic Financial Literacy

295

Based on the background of the problem

described, the formulation of the problem in this

study is:

Is there an effect of education in the family on

religiosity on students of the State Aliyah Madrasah

in Semarang City?

Is there any effect of financial socialization on

religiosity on students of the State Aliyah Madrasah

in Semarang City?

Are there effects of religiosity on Islamic

financial literacy on students of the State Aliyah

Madrasah in Semarang City?

Does education in the family have a direct

influence on Islamic financial literacy for students

of the State Aliyah Madrasah in Semarang City?

Does financial socialization have a direct

influence on Islamic financial literacy for students

of the State Aliyah Madrasah in Semarang City?

Does education in the family affect Islamic

financial literacy through religiosity on students of

the State Aliyah Madrasah in Semarang City?

What is the financial dissemination of Islamic

financial literacy through religiosity to students of

the State Aliyah Madrasah in Semarang City?

2 METHOD

This type of research is a quantitative research. The

population in this study are all students of State

Madrasah Aliyah in Semarang city who have received

material describing the services of financial

institutions amounting to 417 students. The sample in

this study amounted to 205 students taken using

proportional random sampling technique. Data

collection techniques used is questionnaires. Methods

of data analysis using descriptive statistical analysis

and using research model Structural Model Equation

(SEM) with the help of AMOS v.22 analysis tool.

The variables used in this study are divided into

three types, namely (1) dependent variable (endogen)

is syariah financial literacy, (2) independent variable

(exogen) that is family education and financial

socialization, and (3) mediation variable that is

religiosity. Each variable used is measured using

several indicators. Furthermore, from each indicator

is revealed to be a statement item in the questionnaire.

Table 2 summarizes the operational definition of the

variables accompanied by each inductor to measure

them.

3 RESULT AND DISCUSSION

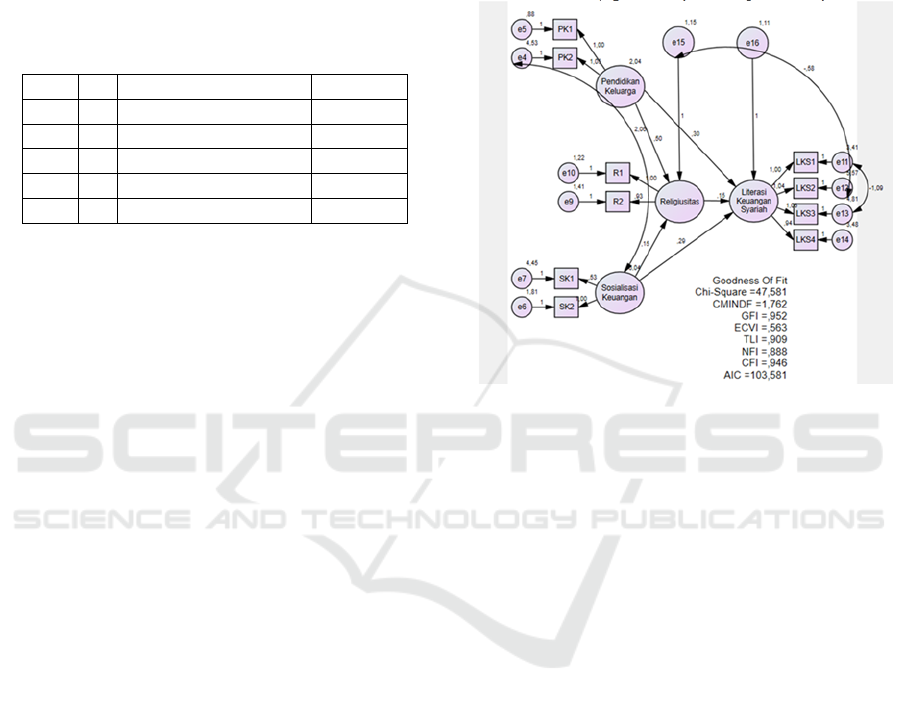

To be able to answer the problem hypothesis in this

research, the first proposed model must have criteria

in testing Goodness of Fit. Based on the above table

it can be seen that the proposed fit model is very good.

This situation can be said that there is no significant

difference between the theoretical models developed

with the research data. It can even be said that the

model has good suitability.

Once the proposed model has passed the

Goodness of Fit test, then the formulation of the

problems contained in the research in the study can be

answered. By looking at the probability (P) column in

the Regression Weights table, the results of the

proposed hypothesis are shown.

The first hypothesis in this study that there is

influence of Family Education on Religiosity. The

results obtained in the calculation show that the

probability value is marked ***. The sign can be

translated that Family Education can affect religious

significantly. With the coefficient value of 0.531

obtained from Standardized Regression Weight table,

indicating that there is a positive relationship between

the two variables. If there is an increase in Family

Education for one unit, it will lead to a rise in

religiosity of 0.531 units. Thus it can be concluded

that the first hypothesis in this study is accepted,

where there is a positive and significant influence

between Family Education on Religiosity.

The influence of Financial Socialization on

Religiosity is the second hypothesis in this study. The

results obtained in the calculation show that the

probability value of 0.007. The value is not more than

0.05 which can be translated that Financial

Socialization can affect religiosity. With the

coefficient value of 0.276 obtained from Standardized

Regression Weight table, indicating that there is a

positive relationship between the two variables. If

there is an increase in the Financial Socialization of

one unit, it will cause a rise in religiosity of 0.276

units. Thus it can be concluded that the second

hypothesis in this study accepted, where there is

influence between the Financial Socialization of

Religiosity.

The influence of Religiosity on Islamic Financial

Literacy is the third hypothesis in this study gets the

result of probability value of 0.304. A hypothesis will

be accepted if it has a probability value not greater

than 0.05 in accordance with the level of significance

or predictability that can still be tolerated. Since the

probability value obtained exceeds the level of

significance, the third hypothesis is rejected. This

ICLI 2018 - 2nd International Conference on Learning Innovation

296

indicates that religiosity has no effect on Islamic

Financial Literacy.

Table 2: Operational definition of variables.

No Variable Definition of Operational Indicator

Scale /

Measurement

1 Islamic

Financial

Literacy

A set of knowledge, abilities, attitudes and skills of a person

in financial activities that include analyzing, managing and

communicating based on Islamic law which is the

implementation of the content of the Al-Qur'an to achieve

happiness in the world and the hereafter.

1.Financial

Records

2. Savings

3. Investment

4. Insurance

Likert /

Questionnaire

2 Family

Education

The smallest unit of social life that is part of a social order

that greatly affects the personality of an individual is due to

act as the first and foremost educational environment since

the individual is born

1. The Way

Parents Educate

2. Relation

Between Family

Members

3. Home

Atmosphere

4. Family

Economic

Condition

5. Background of

Culture

Likert /

Questionnaire

3 Financial

Socializatio

n

One's way of developing financial values through the

learning process derived from the skills, knowledge, and

attitudes of the surrounding environment in order to

maximize financial management

1. Peers

2. Media

Likert /

Questionnaire

4 Religiosity An individual's belief in a creature called a god can be judged

by the extent to which knowledge, practice and appreciation

of what they believe.

1. Religious

Obedience

2.Religious

Responsibility

3. Religious

Affiliation

Involvement

Likert /

Questionnaire

Table 3: Result of goodness of fit. source: amos, data processed (2018).

No Goodness of Fit Index Nilai Coeffisien Cut-Off Value Description

1 CMIN/DF 1,762 < 2,00 Fit

2 GFI 0,952 ≥ 0,90 Fit

3 RMSEA 0,064 ≤ 0,08 Fit

4 ECVI Default = 0,563 Saturated = 0,598 Default < Saturated Fit

5 TLI 0,909 ≥ 0,90 Fit

6 CFI 0.946 ≥ 0,90 Fit

7 AIC Default = 103,581 Saturated = 110,000 Default < Saturated Fit

Table 4: Regression weight: (Group number 1 – Default model) Source: AMOS, data proccesed (2018).

Estimate S.E. C.R. P

Religi <--- Family Education ,498 ,125 3,984 ***

Religi <--- Financial Socialization ,150 ,056 2,692 ,007

IFL <--- Religi ,149 ,145 1,027 ,304

IFL <--- Financial Socialization ,293 ,083 3,543 ***

IFL <--- Family Education ,301 ,039 2,161 ,031

The Mediating Role of Religiosity in The Influence of Family Education and Financial Socialization on The Islamic Financial Literacy

297

Table 5: Regression weight: (Group number 1 – Default

Model) Source: AMOS, data processed (2018).

Estimate

Religi <--- Family Education ,531

Religi <--- Financial Socialization ,276

IFL <--- Religi ,140

IFL <--- Financial Socialization ,507

IFL <--- Family Education ,302

Fourth hypothesis in this research that there is

influence of Financial Socialization to Islamic

Financial Literacy. The results obtained in the

calculation show that the probability value is marked.

The sign can be translated that Financial Socialization

can affect the Islamic Financial Literacy with a very

significant. With the coefficient value of 0.507

obtained from Standardized Regression Weight table,

indicating that there is a positive relationship between

the two variables. If there is an increase in the

Financial Socialization of one unit, it will lead to an

increase in Islamic Financial Literacy of 0.507 units.

Thus it can be concluded that the fourth hypothesis in

this study is accepted, where there is a positive and

significant influence between the Financial

Socialization of the Islamic Financial Literacy.

The influence of Family Education on Islamic

Financial Literacy is the fifth hypothesis in this study.

The results obtained in the calculation show that the

probability value of 0.031. The value is not more than

0.05 which can be translated that Family Education

can affect the Islamic Financial Literacy. With the

coefficient value of 0.302 obtained from Standardized

Regression Weight table, indicating that there is a

positive relationship between the two variables. If

there is an increase in Family Education for one unit,

it will cause an increase in Islamic Financial Literacy

of 0.302 units. Thus it can be concluded that the fifth

hypothesis in this study is accepted, where there is an

influence between Family Education on the Islamic

Financial Literacy.

Answering the hypothesis of indirect influence,

quoted from danielsoper.com, it is known that the

value of p-value of 0.00 is smaller than the value of

p-value specified is 0.05 which indicates a significant

influence. Furthermore, count of 3,724 and ttable

value with significance level 5% and df as much as

185 is 1,97. This indicates that thitung is larger than

the ttable value. So it can be said that there is

significant positive indirect influence of family

education on Islamic financial literacy through

religiosity. These results indicate that religiosity may

mediate the influence of family education on Islamic

financial literacy positively and significantly.

Figure 2: Output Results Research Model. Source : AMOS,

data processed (2018).

The result of calculation from danielsoper.com, it

is known that the value of p-value equal to 0.00 is

smaller than the value of p-value which is determined

that is 0, 05 which shows significant influence.

Furthermore tcount of 3,835 and ttable value with

significance level 5% and df as much as 185 is 1,97.

This indicates that thitung is larger than the ttable

value. So it can be said that there is a significant

positive indirect effect of financial socialization on

Islamic financial literacy through religiosity. These

results indicate that religiosity can mediate the effect

of financial socialization on Islamic financial literacy

positively and significantly. Here is the final result of

the structural equation model in this study which is

derived from AMOS v.22 analysis tool can see in

Figure 2.

4 DISCUSSION

4.1 The Effect of Family Education

against Religiosity

The first hypothesis in this study is the influence of

family education on religiosity. From the results of

data processing performed shows that the influence of

ICLI 2018 - 2nd International Conference on Learning Innovation

298

family education variables on religiosity has a

parameter value of 0.531 with a value of p-value of

0.001. This can be interpreted that the dependency

relationship occurs significantly because the value of

p-value is less than 0.05, thus family education has

positive and significant influence on religiosity. This

shows that the first hypothesis is accepted, so the

greater the existence of family education the level of

religiosity will be greater as well.

The variables of family education in this study

were measured by five indicators, namely the way

parents educate, relationships between family

members, home atmosphere, family economic

situation, and cultural background. The way parents

educate has an average that is in very good category

and signifies that parents have been optimal in

educating their children. Parents have instilled

discipline, set a good example, and paid attention to

their children. The second indicator is the relationship

between family members who have averages in either

category. Harmonious relationships in the family,

telling each other when they have problems, and often

discuss with family members to form good relations

between family anggota. The home atmosphere being

the third indicator is in very good category. The

atmosphere of a very good home can provide comfort

to family members. While the fourth indicator is the

state of the family economy is in very good category.

With a very good family circumstances make

fulfilment of the needs in the family environment is

met and support the child's education so children are

no exception religious education. The last indicator is

cultural background which is also in very good

category. Religious families and instilling religious

values in life have an impact on the religiosity of a

child.

4.2 The Effect of Financial

Socialization on Religiosity

The second hypothesis in this study is that there is

influence of financial socialization on religiosity.

From the results of data processing performed shows

that the effect of financial socialization variables on

religiosity has a parameter value of 0.276 with p-

value of 0.007. This value is significant because the

value of p-value is less than 0.05, thus it can be

interpreted that financial socialization has a positive

and significant influence on religiosity. It shows that

the second hypothesis is accepted, so the bigger the

existence of financial socialization hence the level of

religiosity will be bigger also.

Peers who became the first indicator in measuring

financial socialization had averages that were in

enough categories. This indicates that learners have

not optimized peers as a socialization agent that can

provide information about spirituality or religiosity.

Socialization that can be done with peers, among

others, is to discuss, follow religious activities such

as pengajian, tasyakuran, majelis taklim, or islamic

financial seminar activities, where in socializing with

peers in addition to obtaining islamic financial

science will also increase the religiosity of a learner.

Similarly, a peer, another indicator used to

measure financial socialization is the medium that has

an average in enough categories. It can be interpreted

that learners have not been able to optimize media to

improve religiosity. In the current millennial era

should learners can easily obtain religiosity related

information using various sources. In the madrasah

environment, learners should be able to easily access

literature books in the library. Or in accordance with

technological developments, students should be able

to take advantage of their own devices to improve

their level of religiosity, for example the installation

of Al-Qur’an applications in which they can improve

their faith by reading the Al-Qur’an more easily and

practically or can run a five-time prayer appropriately

by using an adhan alarm on their device.

This study is directly proportional to the existing

theory; financial socialization has an influence on

religiosity. As a process, socialization is often used as

a learning resource for each individual. This

socialization process will be part of an individual's

development. Their intensity in socializing will bring

them into their true identity. Those who often perform

socialization activities in religious matters will form

a high religious spirit as well.

Financial socialization that can shape the level of

religiosity of an individual can be found anywhere.

The socialization done in the recitation, tasyakuran or

khutbah jumat will form the religiosity of an

individual. Activities exploring the media of fiqih or

the like will also have an effect on the improvement

of religiosity. The process of socialization through

how to interact and discuss with peers can also add

insight into one's religiosity.

4.3 The Influence of Religiosity on

Islamic Financial Literacy

The third hypothesis in this research is there is

influence of religiosity to Islamic financial literacy.

From the results of data processing performed shows

that the influence of religious variables on Islamic

financial literacy has a parameter value of 0.140 with

a value of p-value of 0.304. It shows that value is not

significant because the value of p-value is greater

The Mediating Role of Religiosity in The Influence of Family Education and Financial Socialization on The Islamic Financial Literacy

299

than 0.05, thus the third hypothesis is rejected, it can

be interpreted that religiosity has no effect on Islamic

financial literacy.

The results of hypothesis testing on this third

hypothesis contradict the theory that has been

described earlier. Shariah financial literacy is a

combination of two backgrounds in the field of

science, the science of finance and the science of

Islam. In the field of Islamic religious science, clearly

taught how an individual is led to be able to

implement the principles of Islam contained in Al-

Quran, Hadis or science Fiqih where within the

principle either implicitly or explicitly there is that the

life of an individual must be balanced between the

purpose of the world and the hereafter.

In theory should an individual who can apply the

science of Islam should also be able to practice the

principles of Islamic. This means that someone who

has a high level of religiosity should have

implications for his life including applying Islamic

finance literature well. But with the rejection of this

hypothesis appears the presumption that the level of

religiosity owned by students (MAN) is only oriented

to the purpose of the hereafter so they only emphasize

the practice of worship. This may be the case if

teachers in the madrasah are less emphasizing the

worldly purpose to learners so that they are

indoctrinated to promote religiosity aimed only at

eternal life in the afterlife.

Another thing that the researchers suspect that

religiosity does not affect the Islamic financial

literacy that every individual who has a high level of

religiosity then they will tend to feel comfortable and

safe and believe in everything that has been

predestined by the Creator so that the indicators used

by researchers on this research does not form a good

Islamic financial literacy for learners. Learners who

have a high level of religiosity and believe in the

destiny of Allah SWT less or even will not be

interested in the indicators used are savings in Islamic

banks, Islamic investment and Islamic Insurance.

They will have the idea that without any savings in

Islamic bank, Islamic investment or Islamic

insurance, the life they live will keep going according

to the plan of Allah SWT.

4.4 Effect of Financial Socialization on

Islamic Financial Literacy

The fourth hypothesis in this study is that there is

influence of financial socialization directly to islamic

financial literacy. From the results of data processing

performed shows that the effect of financial

socialization variables on religiosity has a parameter

value of 0.507 with p-value of 0.007. This value is

significant because the value of p-value is less than

0.05, thus it can be interpreted that the socialization

of finance has a direct and positive direct effect on the

Islamic financial literacy. It shows that the fifth

hypothesis accepted so that the greater the financial

socialization, the level of Islamic financial literacy

will be greater as well.

Financial socialization is one of the factors that

affect the ability of learners in managing finances. In

this case the financial socialization reflects the

financial knowledge obtained by the students and the

amount of knowledge gained that will encourage

learners in managing finance or financial literacy

especially in the field of Islamic.

Given the results of the existing descriptive

analysis, it is necessary to pay attention to the

socialization of finances that are among students.

This is because the financial socialization is the

exogenous variables in this study have a direct

influence on the endogenous variables of Islamic

financial literacy with the greatest coefficient value.

Nevertheless the results of descriptive analysis

indicator of financial socialization show that the level

of financial socialization among learners is still in the

category enough. Looking at these results, it would be

better if the financial socialization among learners is

continuously improved in order to form a better

Islamic financial literacy.

4.5 The Effect of Family Education on

Islamic Financial Literacy

The fifth hypothesis in this study is that there is

influence of family education directly to Islamic

financial literacy. From the results of data processing

performed shows that the effect of financial

socialization variables on Islamic financial literacy

has a parameter value of 0.302 with a value of p-value

of 0.001. This value is significant because the p-value

value is not greater than 0.05, thus it can be

interpreted that family education has a direct and

positive direct effect on Islamic financial literacy.

This shows that the fourth hypothesis is accepted,

where the greater the existence of family education,

the level of Islamic financial literacy will be greater

as well.

Five indicators are used to measure financial

education. The way parents educate is the first

indicator and has an average that is in very good

category. This indicates that parents have been

optimal in educating their children. Parents have

taught their children to give charity, introducing to

their children about usury that supports children's

ICLI 2018 - 2nd International Conference on Learning Innovation

300

knowledge in terms of Islamic financial literacy. The

second indicator is the relationship between family

members who have a good category average.

Families who have good relationships with each other

and exchange thoughts about financial information

also beperan in a child's financial literacy. Next is the

home atmosphere that has an average in the category

of very good indicating that the atmosphere of the

house is considered an important part in family

education that forms the Islamic financial literacy.

The state of the family economy is the fourth

indicator in family education that has an average in

very good category. From a family's economic

situation, one learns about how to share their finances

for consumption, savings, and alms and so on. The

latter is a cultural background that has an average in

very good category. Families who have a good

cultural background will install good life values as

well as no exceptions about Islamic finance.

As a primary and primary source of education it is

natural that family education can affect the literacy of

Islamic finance. As an individual, a lot of life

activities that they get from activities that are in the

family. The indicators used in family education

variables also in this study can in fact measure and

prove empirically that family education is

instrumental in influencing Islamic financial literacy.

4.6 The Effect of Family Education on

the Islamic Financial Literacy

through Religiosity

The sixth hypothesis in this study is that there is

influence of family education on Islamic financial

literacy through religiosity. Based on the test results

by using the test sobel and obtained the results of the

value of p-value of 0.00 is smaller than the value of

p-value specified that is 0.05 which indicates a

significant influence. Furthermore, the tcount value

of 2.74 and the value of ttable is 1.97, where t count

is greater than the ttable value. The sixth hypothesis

in this study is accepted, it shows that religiosity plays

a role in mediating the influence of education on

Islamic financial literacy.

Family education as the first environment is a very

decisive factor in shaping one's Islamic financial

literacy. Families who provide education well then

the achievement of one's financial literacy will be

good too. Family education can be done by parents

from the way they nurture, relationships between

family members, home atmosphere and even the

economic situation and the background of family

culture should be a source of education in the family.

While religiosity can be shaped with obedience to

religion, doing things that are governed by religion in

discipline, following religious activities and so forth.

If education in the family has been well coupled with

a high religiosity it will form a good level of financial

literacy as well.

In line with the theory that has been described

earlier, education in the family is undeniably very

influential on the growth of an individual's flower.

The education created in the family environment is

nothing but to achieve the welfare of every member

of both physical and spiritual well-being. The welfare

of the individual can be judged by the degree of

religiosity. This is closely related to the purpose of

life hereafter that indirectly helps the achievement of

financial welfare with the application of Islamic

principles obtained from the family or from religious

or Islamic principles. If religiosity is closely related

to the afterlife, then Islamic finance is closely related

to the life of the world. So it is not a remarkable thing

when religiosity in fact serves as mediation in the

influence of family education on Islamic financial

literacy.

4.7 The Effect of Family Education on

the Islamic Financial Literacy

through Religiosity

The last hypothesis in this study is that there is

influence of financial socialization on islamic

financial literacy through religiosity. Based on the

test results by using the test sobel obtained p-value of

0.00 is smaller than the value of p-value specified that

is 0.05 which indicates a significant influence.

Furthermore, the tcount value of 2.74 and the value of

ttable is 1.97, where tcount is greater than ttable. The

seventh hypothesis in this study is accepted, it shows

that religiosity plays a role in mediating the financial

socialization of Islamic financial literacy

The attitude of socializing has a great influence in

Islamic financial literacy. Socializing activities can be

done by discussing with peers, join on seminar

activities, tasyakuran, majelis taklim, and utilization

of media and technology available. By maximizing

financial socialization and supported by a high level

of religiosity due to religious worship, religious

responsibility and engaging in religious activities, the

level of financial literacy of learners will increase as

well.

This socialization of financial activities either

directly or indirectly has a role in shaping a person's

financial literacy both conventionally and islamic.

Socialization that is often found in everyday activities

is rarely associated with the principles of Islamic. But

by being in the Madrasah environment, students are

The Mediating Role of Religiosity in The Influence of Family Education and Financial Socialization on The Islamic Financial Literacy

301

possible in exploring the principles of Islamic finance

through the process of socialization either directly

with peers or through existing media. The madrasah

environment closely related to religious relations will

undoubtedly affect the principles of Islamic finance

as well. Thus this is in line with the acceptance of this

hypothesis which states that religiosity becomes a

mediator in the influence of financial socialization of

Islamic financial literacy.

5 CONCLUSION

This study aims to analyse whether there is an

influence of exogenous variables, namely family

education and financial socialization on endogenous

variables, namely Islamic financial literacy both

directly and indirectly through mediating variables,

namely religiosity among students of State Madrasah

Aliyah (MAN) throughout Semarang City. This

research was conducted using Structural Equation

Modelling (SEM) with the help of SPSS AMOS 22

application. Based on the results of the testing and

discussion that have been presented, the following

conclusions can be drawn:

There is a positive and significant influence on

family education on religiosity among students

of Semarang City Aliyah Madrasah.

There is a positive and significant influence on

financial socialization of religiosity among

students of the Semarang City Aliyah

Madrasah.

There is no effect of religiosity on Islamic

financial literacy among Semarang City Aliyah

Madrasah students.

There is a direct and positive influence of

family education on sharia financial literacy

among Semarang City Aliyah Madrasah

students.

There is a direct positive and significant

influence of financial socialization on Islamic

financial literacy among Semarang City Aliyah

Madrasah students.

There is an indirect influence on family

education on Islamic financial literacy through

religiosity among students of the Semarang

City Aliyah Madrasah.

There is an indirect influence of financial

socialization on Islamic financial literacy

through religiosity among students of the

Semarang City Aliyah Madrasah.

REFERENCES

Bernheim, B. D., Garret, D. M. and Maki, D. M. (2001)

‘Education and Saving: The long-term effects of high

school financial curriculum mandates’, Journal of

Public Economics., 80(3), pp. 435–465.

Beverly, S. G. and Burkhalter, E. K. (2005) ‘Improving the

Financial Literacy and Practices of Youth’, Children &

School., 27(2), pp. 121–124.

Kardoyo, H. S. and Nurkhin, A. (2018) ‘Program

Peningkatan Literasi Keuangan Syariah Bagi Guru

Taman Pendidikan Alquran (TPQ) Di kota Semarang’,

Jurnal Pengabdian Kepada Masyarakat, 24(2), pp.

662–667.

Martin, A. and Oliva, J. C. (2001) ‘Teaching Children about

Money: Applications of Social Learning and Cognitive

Learning Developmental Theories’, Journal of Family

and Consumer Sciences: From Research to Practice,

33(2), pp. 271–284.

Otoritas Jasa Keuangan (OJK) (2016) Survei Nasional

Literasi dan Inklusi Keuangan 2016.

Setyowati, A. and Harmadi, S. (2018) ‘Islamic Financial

Literacy and Personal Financial Planning: A Socio-

Demographic Study’, Jurnal Keuangan dan

Perbankan, 22(1), pp. 63–72.

Sina, P. G. (2014) Melek Keuangan ‘Perjalanan Menuju

Kebebasan Keuangan’2014a. V. Agata. Jakarta: PT

Bhuana Ilmu Populer.

Sohn, S. H. et al. (2012) ‘Adolescents’ financial literacy:

The role of financial socialization agents, financial

experiences, and money attitudes in shaping financial

literacy among South Korean youth’, Journal of

Adolescence, 35(4), pp. 969–980.

Sundarasen, S. D. D. et al. (2014) ‘Cradle to Grave,

Financial Literacy Programs and Money Management’,

International Journal of Economics and Finance, 6(6),

p. 240.

Varcoe, K. et al. (2005) ‘Using A Financial Education

Curriculum for Teens’, Journal of Financial

Counseling and Planning, 16(1), pp. 63–71.

ICLI 2018 - 2nd International Conference on Learning Innovation

302