The Relationship between Corporate Social Responsibility,

Environmental Performance and Financial Performance

at Mining Companies listed in Indonesia Stock Exchange

Kencana Dewi, Harun Delamat, and Mukhtarudin

Fakultas Ekonomi, Universitas Sriwijaya

Keywords: corporate social responsibility, environmental performance, financial performance, mining companies

Abstract: The objective of this study is to examine the relationship between corporate social responsibility,

environmental performance, and financial performance. The sample of this research is the mining sector at

Indonesia Stock Exchange especially coal mining companies.The data is the period of 2015-2017 from the

annual report from Indonesia stock exchange or company website. The stakeholder theory and resource

based view theory use in this study. The results research show corporate social responsibility have a positive

and significant effect on financial performance. Environmental performance has a positive and significant

link on financial performance. The limitation of this study uses only one sector, mining sector, from

Indonesia Stock Exchange. This study also use two variables such as corporate social responsibility and

environmental performance as independent variables. The suggestion for future research uses other

variables such as firm value, corporate governance. Another suggestion is to conduct the research in other

sectors such as banking, manufacturing etc.

1 INTRODUCTION

Corporate social responsibility is a process with

the aim of embracing responsibility for the actions

of the company and encouraging a positive impact

through its activities on the environment, consumers,

employees, communities, stakeholders and all other

parties members of the public space who may also

be considered stakeholders (Tai & Chuang, 2014).

Furthermore, Kabir & Thai (2017) revealed that

corporate social responsibility activities are

increasingly attracting the attention of investors,

customers, suppliers, employees and governments

around the world (Kabir & Thai, 2017).

The relationship between corporate social

responsibility and financial performance are still

debatable until now (Beck, Frost, & Jones, 2018).

Previous reseach related to this relationship showed

mixed results.

Researchs on corporate social responsibility

influences financial performance debates still occur

(Lu, Chau, Wang, & Pan, 2014) Results that show a

positive influence between corporate social

responsibility and financial performance (Reverte,

Gómez-Melero, & Cegarra-Navarro, 2016;Wang &

Sarkis, 2013). However, the results also show no

significance (Barnett & Salomon, 2012).

This study examines the relationship between

corporate social responsibility, environmental and

financial performance at mining companies that are

listed on the Indonesia Stock Exchange. The reason

why this study chooses the mining companies as a

sample is that they refer to several laws. First, Law

No. 40 of 2007 concerning Limited Liability

Companies. In the Law, there is an obligation for all

companies that relate to and / or natural resources to

carry out social and environmental responsible

activities. Second, Law No. 25 of 2007 concerning

Investment. This law also has an obligation for all

investors to carry out corporate social responsibility

(article 15 b). Finally, Law No. 32 of 2009

concerning Environmental Protection and

Management. There is an obligation for all

businesses and / or activities that affect the

environment to have an Analysis of Environmental

Impacts (article 22 paragraph 1).

Previous reseach related to corporate social

responsibility, environmental performance and

financial performance from different countries.

Turkey (Aras, Aybars, & Kutlu, 2010); Brazil

Dewi, K.

Relationship between Corporate Social Responsibility, Environmental Performance and Financial Performance at Mining Companies Listed in Indonesia Stock Exchange.

DOI: 10.5220/0008438001690174

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 169-174

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

169

(Crisostomo, Freire, & Vasconcellos, 2011); Nigeria

(Uadiale & Fagbemi, 2012); Jordan (Alafi & Al

Sufy, 2012);Pakistan (Mujahid & Abdullah, 2014);

South Africa Chetty, Naidoo, & Seetharam, 2015);

Romania (Dobre, Stanila, & Brad, 2015); United

States (Kim, Kim, & Qian, 2015;Lu & Taylor,

2018).Indian(Das & Bhunia, 2015;Maqbool &

Zameer, 2018); Spanish (Rodriguez-Fernandez,

2016); Nigeria (Dlamini, 2016); Indonesia(Firli &

Akbar, 2016;Handayani, Wahyudi, & Suharnomo,

2017); Vietnam (Kabir & Thai, 2017; Australia,

Hong Kong, and United Kingdom (Beck, Frost, &

Jones, 2018); United Kingdom (Ramanathan, 2016);

This research focuses on three relationships

among corporate social responsibility,

environmental performance and financial

performance on Indonesia mining companies listed

in Indonesia Stock Exchange.

2 LITERATURE REVIEW

2.1 Corporate Social Responsibility

Corporate Social Responsibility (CSR) is

recognized as one of the most important components

in the company's strategy to ensure long-term value

and sustainable growth of a company(Suto &

Takehara, 2016).Furthermore, Kabir & Thai (2017)

revealed that corporate social responsibility (CSR)

activities increasingly attract the attention of

investors, customers, suppliers, employees and

governments throughout the world(Kabir & Thai,

2017).

2.2 Stakeholder Theory

This theory is a theory that illustrates all parties

related to corporate responsibility (Freeman,

1984).There are two models in stakeholder theory,

namely business policy and planning models and

corporate social responsibility models of stakeholder

management. In this policy and business planning

model, the focus is on developing and evaluating the

agreement of corporate strategic decisions with

groups whose support is needed for the continuity of

the business. The model shows ways to manage the

relationship between the company and its

stakeholders. This second model has external

influences in corporate planning and analysis.

Groups that can be opposite are the government with

special interests related to the pain of social

problems. Companies need to disclose in meeting

information needs for stakeholders(Donalson &

Preston, 1995).

The shareholder theory supporting argument can

be fulfilled in a way that companies that implement

the concept of corporate social responsibility work

for stakeholders such as customers, employees and

the environment in which they operate that

contribute to long-term success and profitability

because customers are the basic source of profit-

making companies effectively (Mujahid &

Abdullah, 2014).

2.3 Resource Based View Theory

The resource based view theory in explaining the

relationship between environmental performance

and company financial performance (Russo & Fouts,

1997). Based on this theory, resource based view

theory, environmental performance has a positive

link with financial performance(Russo & Fouts,

1997).They find evidence environmental

performance has a relationship with financial

performance strengthens the industries with higher

growth. Thus, the higher environmental

performance, the higher financial performance.

The Resource Based View helps in

understanding the development of newer, proactive

technologies by companies who want to improve

their Environmental Performance. Even if the

technology is obtained from the market (which

might not directly result in a competitive advantage

because the same technology will be available to

competitors as well), the Resource Based View will

help explain the efforts of operationally efficient

companies to adopt technology to increase

efficiency(Russo & Fouts, 1997).

Based on the Resource Based View theory, the

literature studying the relationship between

Environmental Performance and financial

performance always highlights examples when

increasing knowledge about Environmental

Performance can lead to more effective investment,

which in turn leads to further improvements in

financial performance(Ramanathan, 2016).

2.4 Hypotheses Development

2.4.1 Corporate social responsibility and

financial performance

Based on stakeholder theory, the stakeholders of

companies improve their reputation and also

financial performance(Donalson & Preston, 1995).

Based on stakeholder theory describes that

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

170

stakeholders both inside and outside the company

give pressure on the company to disclose their

corporate social responsibility (Donalson & Preston,

1995).Stakeholder theory pays attention to the

interests, rights, and needs of various stakeholders of

a business as a good way to instill social

responsibility behavior among companies(Alafi &

Al Sufy, 2012).The shareholder theory supporting

argument can be fulfilled in a way that companies

that implement the concept of corporate social

responsibility work for stakeholders such as

customers, employees and the environment in which

they operate that contribute to long-term success and

profitability because customers are the basic source

of profit-making companies effectively (Mujahid &

Abdullah, 2014).

Previous studies have different result research.

The result research showed a positive effect between

corporate social responsibility and financial

performance (Alafi & Al Sufy, 2012;Moser &

Martin, 2012;Mujahid & Abdullah, 2014;Kim et al.,

2015; Rodriguez-Fernandez, 2016;Firli & Akbar,

2016;Famiyeh, 2017; Handayani, Wahyudi, &

Suharnomo, 2017;Kabir & Thai, 2017;Beck, Frost,

& Jones, 2018; Maqbool & Zameer, 2018).Several

studies showed corporate social responsibility have a

negative impact on companies financial performance

(Guidry & Patten, 2012;Lungu, Caraiani, & Dascalu,

2011;Lu & Taylor, 2018). Following studies

showed corporate social responsibility did not

impact on financial performance (Das & Bhunia,

2015;Chetty, Naidoo, & Seetharam, 2015;Dlamini,

2016).

Based on the 203 respondents from banks’

customers in Jordanian Housing banks(Alafi & Al

Sufy, 2012). Alafi & Al Sufy (2012)research reveal

corporate social responsibility impact on financial

performance. The research in Pakistan, Mujahid &

Abdullah, 2014 reveal that corporate social

responsibility has a positive and significant with

financial performance. From 113 companies listed

the United States from software industry (Kim et al.,

2015). Kim et al., 2015found positive corporate

social responsibility increase financial performance,

it is high, but negative corporate social responsibility

improves financial performance, it is low.

Rodriguez-Fernandez, 2016 the result research from

companies listed in the Madrid Stock Exchange,

Spanish, showed that corporate social responsibility

is profitable. Firli & Akbar, 2016 research in

Indonesia telecommunication industry show that

corporate social responsibility impact positively on

financial performance (Return on Asset).

Famiyeh, (2017) research in Ghana show the

result that corporate social responsibility support

financial performance in term of return on

investments. Based on 173 respondents from

manufacturing of large scale (Handayani, Wahyudi,

& Suharnomo, 2017). Handayani, Wahyudi, &

Suharnomo (2017) reveal corporate social

responsibility has a positive and significant on firm

performance. The result of research from

Vietnamese listed companies (Kabir & Thai,

2017).Kabir & Thai (2017) reveal corporate social

responsibility relationship with financial

performance.Maqbool & Zameer (2018) research 28

commercial banks listed in Bombay stock exchange,

India. Their finding gave a great insight for

management of banks to integrate corporate social

responsibly with the strategic of business (Maqbool

& Zameer, 2018).Beck et al., (2018)reveal the

positive relationship between corporate social

responsibility and financial performance from three

reporting jurisdiction include Australia, Hong Kong,

and the United Kingdom.

H1: Corporate social responsibility has a positive

impact on companies financial performance.

2.4.2 Environmental performance

and financial performance

Previous studies that found a positive

relationship between Environmental Performance

and companies Financial Performance include(Lisi,

2015; Ramanathan, 2016; Beck, Frost, & Jones,

2018;Lu & Taylor, 2018). The following studies

reported that have a negative impact between

environmental performance and companies financial

performance include (Crisostomo, Freire, &

Vasconcellos, 2011;Dobre, Stanila, & Brad, 2015).

The following research found did not have a

significant effect between environmental

performance and financial performance (Aras,

Aybars, & Kutlu, 2010;Chetty, Naidoo, &

Seetharam, 2015).

The result shows the positive link between

environmental performance and corporate

performance. This results from 91 companies in

Italy (Lisi, 2015).The survey comes from 135

respondents from manufacturing companies in the

United Kingdom. The higher environmental

performance, the higher company performance

(Ramanathan, 2016).

However, from 450 sample show a negative

impact between environmental performance and

financial performance (Lu & Taylor, 2018). Based

on the content analysis, environmental performance

Relationship between Corporate Social Responsibility, Environmental Performance and Financial Performance at Mining Companies Listed

in Indonesia Stock Exchange

171

has a negative impact on firm value (Crisostomo,

Freire, & Vasconcellos, 2011). Dobre, Stanila, &

Brad (2015) show a negative impact between

environmental performance and financial

performance.

Based on 100 index companies in Istanbul Stock

Exchange (ISE) show does not significant between

corporate social responsibility and financial

performance(Aras, Aybars, & Kutlu, 2010).This

result similar to the previous research from Chetty,

Naidoo, & Seetharam (2015) revealed corporate

social responsibility do not significant with financial

performance.

The resource based view theory in explaining the

relationship between environmental performance

and company financial performance (Russo & Fouts,

1997). This theory supports the resources in the

company are used to achieve a competitive

advantage. This relates to the relationship between

environmental performance and financial

performance(Russo & Fouts, 1997).

Based on the explanation above, thus our

hypothesis is in the following:

H2: Environmental performance has a positive

impact on companies financial performance.

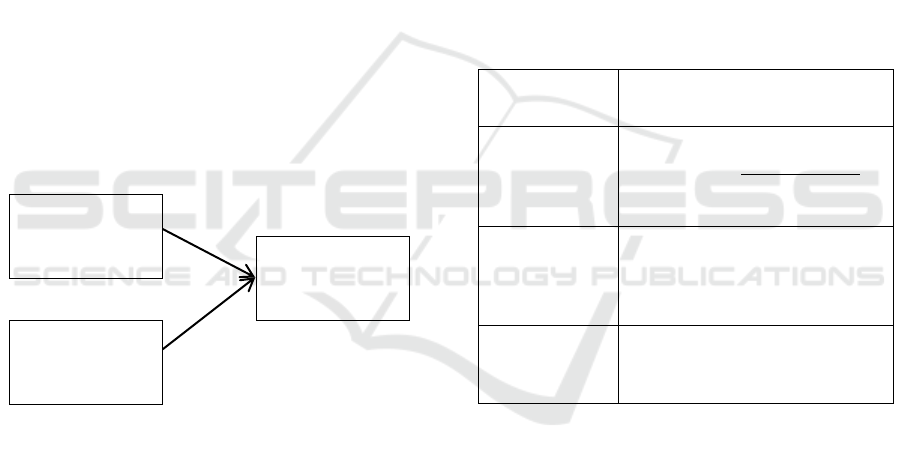

Figure 1: The Research of Framework

3 METHOD

3.1 Sample

This study uses all mining companies listing on

the Indonesia Stock Exchange, especially coal

mining companies. The reason why researchers

choose mining companies.Thus, this research refers

to several laws. First, Law No. 40 of 2007

concerning Limited Liability Companies. In the Act,

there are obligations for all companies relating to

and/or natural resources to carry out social and

environmental accountability activities. Second,

Law No. 25 of 2007 concerning Investment. Finally,

Act No. 32 of 2009 concerning Environmental

Protection and Management. There is an obligation

for all businesses and/or activities that affect the

environment to have an Environmental Impact

Assessment (article 22 paragraph 1). All in mining

companies, especially coal mines, are used as

samples. The data taken is the period of 2015-2017

from the Indonesia Stock Exchange. The data is

about 66 observation.

3.2 Data Collected Technique

The collection technique is by collecting all the

data. Data obtained from Indonesia stock exchange

related to our framework. The data is obtained from

Indonesia Stock Exchange via the internet or obtain

data from each the annual report of mining

companies.

Table 1: Definition of Variables

Variables

Measurement

Corporate

Social

Responsibility

% Disclosure = Item Disclosure

Total item Disclosure.

Environmental

performance

1 = good related environmental

performance; 0 = do not have any

information related environmental

Financial

performance

Ratio of return on asset

3.3 Analysis

The hypotheses developed were examined by

using Partial Least Square (PLS).

The model of this study is:

ROA

it

= α + β1 CSR

it

+ β2 EP

it

+ t

Where:

i, t = sector i, Year t,

= intercept

Β = independent variable coefficient

=error term

CSR = Corporate social responsibility

EP = Environmental performance

ROA = Return on Assets

Corporate

Social

Responsibility

Environmental

Performance

Financial

Performance

H1

H2

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

172

4 RESULT AND DISCUSSION

4.1 Result

The results research show that all hypotheses

proposed are accepted. The first hypothesis is

accepted (p= 0,04), it is less than 5%. However, the

second hypothesis is accepted (p = 0.08), it is less

than 10%. It can be seen from table II.

Table 2: The hypothesis Result

Hypothesis

Coefficient

p Value

Result

H1

0,48

0,04

Accepted

H2

0,15

0,08

Accepted

4.2 Discussion

The first hypothesis (H1) which states Corporate

social have a positive effect on financial

performance. Result research shows H1 is

accepted.It is accepted (p= 0,04), it is less than 5%.

This finding inline with (Alafi & Al Sufy, 2012;

Moser & Martin, 2012; Mujahid & Abdullah,

2014;Kim et al., 2015; Rodriguez-Fernandez, 2016;

Firli & Akbar, 2016;Famiyeh, 2017; Handayani,

Wahyudi, & Suharnomo, 2017; Kabir & Thai, 2017;

Beck, Frost, & Jones, 2018; Maqbool & Zameer,

2018). Previous studies revealed that corporate

social has a positive effect on financial performance.

They reveal that the more their disclose corporate

social responsibility, improve their financial

performance. This theory support companies to

disclose their corporate social responsibility affect

positively on financial performance. This finding

support stakeholder theory. Based on the

stakeholder theory, corporate social responsibility

has a positive and significant affect on financial

performance.

The second hypothesis (H2) which states

environmental performance has a positive effect on

financial performance. The result of research shows

H2 is accepted. Itis accepted (p = 0.08), it is less

than 10%. This result suport previous research

showed the same result (Lisi, 2015; Ramanathan,

2016; Beck, Frost, & Jones, 2018).This finding

support the resource based view theory. Based on

the resource based view theory, environmental

performance has a positive and significant on

financial performance.

5 CONCLUSION

The results from this study indicate evidence

regarding the relationship between corporate social

responsibility, environmental performance and

financial performance at mining companies listed in

Indonesia Stock Exchange. This study indicates the

corporate social responsibility in Indonesia effect on

financial performance. The environmental

performance effect on financial performance.

The limitation of this study uses only one sector,

mining sector, from Indonesia Stock Exchange. This

study also use two variables such as corporate social

responsibility and environmental performance as

independent variables. The suggestion for future

research uses other variables such as firm value,

corporate governance. Another suggestion is to

conduct the research in other sectors such as

banking, manufacturing etc.

ACKNOWLEDGMENT

Authors thank to Universitas Sriwijaya give

Competitive Research grant in 2018.

REFERENCES

Alafi, K., & Al Sufy, F. J. H. (2012). Corporate Social

Responsibility Associated With Customer Satisfaction

and Financial Performance a Case Study with Housing

Banks in Jordan. International Journal of Humanities

and Social Science, 2(15), 102–115.

Aras, G., Aybars, A., & Kutlu, O. (2010). Managing

corporate performance Investigating the relationship

between corporate social responsibility and financial

performance in emerging markets. International

Journal of Productifity and Performance

Management, 59(3), 229–254.

Beck, C., Frost, G., & Jones, S. (2018). CSR disclosure

and financial performance revisited : A cross- country

analysis. Australian Journal of Management, (March),

1–21. https://doi.org/10.1177/0312896218771438

Chetty, S., Naidoo, R., & Seetharam, Y. (2015). The

Impact of Corporate Social Responsibility on Firms ’

Financial Performance in South Africa. Contemporary

Economics, 9(2), 193–214.

https://doi.org/10.5709/ce.1897-9254.167

Crisostomo, V. L., Freire, F. de S., & Vasconcellos, F. C.

De. (2011). Corporate social responsibility , firm value

and financial performance in Brazil. Social

Responsibility Journal, 7(2), 295–309.

https://doi.org/10.1108/17471111111141549

Das, L., & Bhunia, A. (2015). How Does Corporate Social

Responsibility Affect Financial Performance

Indicators? Scholars Journal of Economics, Business

and Management, 2(7), 756–760.

Relationship between Corporate Social Responsibility, Environmental Performance and Financial Performance at Mining Companies Listed

in Indonesia Stock Exchange

173

Dlamini, B. (2016). The impact of corporate social

responsibility on Company Profitability in Zimbabwe:

A Case of a Listed Telecommunication Company.

International Journal of Social Science and

Economics Invention, 9(16), 9–16.

Dobre, E., Stanila, G. O., & Brad, L. (2015). The

Influence of Environmental and Social Performance

on Financial Performance: Evidence from Romania’s

Listed Entities. Sustainability, 7(3), 2513–2553.

https://doi.org/10.3390/su7032513

Donalson, T., & Preston, L. (1995). The Stakeholder

Theory of Corporations: Concept, Evidence and

Implication. Academy of Management Review, 20(1),

65–91.

Famiyeh, S. (2017). Corporate Social Responsibility and

Firm Risk : Theory and Empirical Evidence Corporate

Social Responsibility and Firm Risk : Social

Responsibility Journal, 13(2), 16–33.

Firli, A., & Akbar, N. (2016). Does Corporate Social

Responsibility Solve ROA Problem in Indonesia

Telecommunication Industry ? American Journal of

Economics, 6(2), 107–115.

https://doi.org/10.5923/j.economics.20160602.03

Freeman, R. E. (1984). Stakeholder Theory of Modern

Corporation, Boston, Pitman.

Guidry, R. P., & Patten, D. M. (2012). Voluntary

disclosure theory and financial control variables: An

assessment of recent environmental disclosure

research. Accounting Forum, 36(2), 81–90.

https://doi.org/10.1016/j.accfor.2012.03.002

Handayani, R., Wahyudi, S., & Suharnomo, S. (2017).

The effects of corporate social responsibility on

manufacturing industry performance: the mediating

role of social. Business Theory and Practice, 18, 152–

159.

Kabir, R., & Thai, H. M. (2017). Does corporate

governance shape the relationship between corporate

social responsibility and financial performance?

Pacific Accounting Review, 29(2), 227–258.

https://doi.org/10.1108/PAR-10-2016-0091

Kim, K.-H., Kim, M., & Qian, C. (2015). Effects of

Corporate Social Responsibility on Corporate

Financial Performance. Journal of Management,

XX(X), 014920631560253.

https://doi.org/10.1177/0149206315602530

Lisi, I. E. (2015). Translating environmental motivations

into performance: The role of environmental

performance measurement systems. Management

Accounting Research, 29, 27–44.

https://doi.org/10.1016/j.mar.2015.06.001

Lu, L. W., & Taylor, M. E. (2018). A study of the

relationships among environmental performance,

environmental disclosure, and financial performance.

Asian Review of Accounting, 26(1), 107–130.

https://doi.org/10.1108/ARA-01-2016-0010

Lungu, C. I., Caraiani, C., & Dascalu, C. (2011). Research

on Corporate Social Responsibility Reporting.

Amfiteatru Economic, 13(29), 117–131.

Maqbool, S., & Zameer, M. N. (2018). Corporate social

responsibility and financial performance: An empirical

analysis of Indian banks. Future Business Journal,

4(1), 84–93. https://doi.org/10.1016/j.fbj.2017.12.002

Moser, D. V., & Martin, P. R. (2012). A broader

perspective on corporate social responsibility research

in accounting. Accounting Review, 87(3), 797–806.

https://doi.org/10.2308/accr-10257

Mujahid, M., & Abdullah, A. (2014). Impact of Corporate

Social Responsibility on Firm’s Financial Performance

Ayub Mehar and Farah Rahat *. European Journal of

Business and Management, 6(31), 181--187.

https://doi.org/10.5296/ijld.v4i2.5511

Ramanathan, R. (2016). Understanding Complexity : the

Curvilinear Relationship Between Environmental

Performance and Firm Performance. Journal of

Business Ethics, (2008), 1–11.

https://doi.org/10.1007/s10551-016-3088-8

Rodriguez-Fernandez, M. (2016). Social responsibility and

financial performance: The role of good corporate

governance. BRQ Business Research Quarterly, 19(2),

137–151. https://doi.org/10.1016/j.brq.2015.08.001

Russo, M. V., & Fouts, P. A. (1997). A Resource-Based

Perspective on Corporate Environmental Performance

and Profitability. The Academy of Management

Journal, 40(3), 534–559.

https://doi.org/10.2307/257052

Suto, M., & Takehara, H. (2016). Estimating the hidden

corporate social performance of Japanese firms. Social

Responsibility Journal, 12(2), 348–362.

https://doi.org/10.1108/SRJ-08-2015-0106

Tai, F., & Chuang, S. (2014). Corporate Social

Responsibility. IBusiness, 6, 117–130.

Uadiale, O. M., & Fagbemi, T. O. (2012).

Corporate Social Responsibility and

Financial Performance in Developing

Economies : The Nigerian Experience.

Journal of Economic and Sustainable

Development, 3(4), 44–55.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

174