The Effect of Islamic Financing, Indonesia Sharia Stock Index

(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS)

on Economic Growth in Indonesia

Fera Widyanata, Sa’adah Yuliana

Economic Faculty, Sriwijaya University, Palembang-Prabumulih street KM 32 OI, South Sumatera, Indonesia

Keywords: Islamic Financing, Indonesia Sharia Stock Index (ISSI), Zakah Infaq and Sadaqah (ZIS), Economic Growth,

GDP, Error Correction Model (ECM)

Abstract: This research aims to analyze the effect of the short-run and long-run of Islamic Financing, Indonesia Sharia

Stock Index (ISSI), and the distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic Growth during the

period 2011 to 2015. This research uses secondary data, it is a quarterly time series data with 24 quarterly

observation period, since the first quarter of 2010 until the fourth quarter of 2015. The analysis techniques

of this research is Error Correction Model (ECM). The result of the research shows that there is effect or an

equilibrium between the short-run towards the long-run of the independent variable Islamic Financing on

the dependent variable GDP. While the independent variable Indonesia Sharia Stock Index (ISSI) only gives

long-run effect on the dependent variable GDP. Conversely, the independent variable Zakah, Infaq and

Sadaqah (ZIS) only gives short-run effect on the dependent variable GDP. Thus, Islamic Financing and

distribution of Zakah, Infaq and Sadaqah contribute to the increase of economic growth in the short-run.

Indonesia Sharia Stock Index (ISSI) and Islamic Financing contribute to the increase of economic growth in

the long-run.

1 INTRODUCTION

Economic growth is the development of

activities in the economy where goods and services

produced in the community grows. The high

economic growth is the desires and goals for each

country. When a country's economic growth has

increased by a certain time, it can be said that the

country's economy is increase or has a positive

value. Economic growth calculated through the GDP

(Gross Domestic Product) might be an indicator of

the rate of the economy, in terms of demand and

aggregate supply, consumption and saving, as well

as the level of investment (Todaro, 1997). Economic

growth is strongly influenced by the policies of the

government in order to balance the economic

condition of a country. The government policy can

be either monetary or fiscal policy.

Bank is an institution that has an important role

in monetary policy. When the Islamic banks funding

the community through Islamic financing for the

productive economic sectors, this will increase the

capital of economic sectors to increase its

productivity in order to support economic growth.

There is a significant character of Islamic financing

that has positive impact on the real sector and

economic growth, Islamic financial institutions put

more emphasis on improving productivity. Islamic

financial institution is financial institution that

emphasize the concept of asset and production based

system as the main idea. Through that financing

pattern then the real sector and the financial sector

will move in a balanced manner. The greater the

performance of Islamic banking, the greater the

contribution to economic growth (Habibullah &

Eng, 2006).

Besides the banking sector, the existence of

capital market in a country has very important role

as economic driving force. It is because the capital

markets function provides the facility to ease

companies and emitens to raise funds, and for

investors to distribute funds with the expectations of

356

Widyanata, F. and Yuliana, S.

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic Growth in Indonesia.

DOI: 10.5220/0008440203560367

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 356-367

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

gaining profit sharing. The Islamic capital market

investment in Indonesia is become more lively with

the presence of Indonesia Sharia Stock Index (ISSI).

It is published by Bapepam-LK and the National

Sharia Council of Indonesian (DSN-MUI) on May

12, 2011. ISSI is Islamic stocks consisting of all

shares listed on Indonesia Stock Exchange and

incorporated in the List of Islamic Securities. When

it was first established, the number of ISSI shares is

214 stocks. These days the development of ISSI for

each period is significant.

The government has also an important role in

running the economy by setting policy. One of the

government policy to boost the economy is fiscal

policy. In the Islamic economic system, the fiscal

policy has been applied since the ancient time of

Prophet Muhammad. In the reign of Rasulullah, the

income of the country not only came from tax, but

also from the Zakah, Infaq and Sadaqah. Revenue

from Zakah, Infaq and Sadaqah is different from tax,

and is not treated like a tax. Zakah is a Muslim

obligation, it is part of The Five Pillars of Islam.

Infaq and Sadaqah is a reflection observance of a

Muslim to Allah. Zakah, Infaq and Sadaqah is a

fundamental element in Islam which is the

imperative of the pillars of Islam. In the reign of

Rasulullah and Khulafaurrasyidin Zakah was the

main state revenue as an obligation of Muslim

people, while the non-muslim people was required

to pay tax. The effective of state revenue and the

efficient of allocation of state assets have led to

prosperity and peaceful among the people at that

time.

Based on Baznas and IPB research in 2015, the

annual potential zakah is estimated to reach Rp 217

trillion nationwide (Asworo, 2015). This number is

based on GDP in 2010. As GDP rises, the potential

of Zakah increases as well.

Table 1 and 2 show the growth of GDP, the total

of Islamic Financing, the total capitalization of

Indonesia Sharia Stocks Index (ISSI), and the total

distribution of Zakah, Infaq and Sadaqah (ZIS)

within the last five years.

Table 1: The Growth of GDP and Islamic Financing 2011-

2015

Year

GDP (Rp, billion)

Islamic Financing

(Rp, billion)

2011

7.287.635

102.655

2012

7.727.083

147.505

2013

8.158.194

184.122

2014

8.568.116

199.330

2015

8.976.932

212.996

Source: BPS, BI 2016

Table 2: The Growth of ISSI and ZIS 2011-2015

Year

ISSI (Rp, billion)

ZIS (Rp, billion)

2011

1.968.091

38,5

2012

2.451.334

39,8

2013

2.557.847

44,3

2014

2.946.893

55,9

2015

2.600.851

26,5

Source: OJK, BAZNAS 2016

Table 1 and 2 show that during the period 2011-2015

the growth of GDP, Islamic Financing, ISSI, and ZIS

tends to increase significantly each year. Any increase in

economic instruments whether it is big or small will have

an impact on the economy of the country. The increase in

total Islamic Financing, Indonesia Sharia Stocks Index

(ISSI), and the total distribution of Zakah, Infaq and

Sadaqah (ZIS) either directly or indirectly will have an

impact on the economy in Indonesia. This study aims to

analyze more deeply the effect of Islamic Financing,

Indonesia Sharia Stocks Index (ISSI), and the total

distribution of Zakah, Infaq and Sadaqah (ZIS) on

Economic Growth.

2 THEORITICAL FRAMEWORK

2.1 Economic Growth

Generally, economic growth is defined as an

increase in the ability of an economy to produce

goods and services. Economic growth refers to the

change in quantitative and is usually measured by

using data of Gross Domestic Product (GDP) or

national income or output per capita. GDP is the

total market value of all goods and services

produced by all economy units of a country in a

certain period (Nanga, 2001).

GDP calculation using the two kinds of prices,

the GDP at current prices (nominal GDP) and GDP

at constant prices (Real GDP). GDP at current prices

describe the value added of goods and services

which is calculated by using the prevailing price

every year, while the GDP at constant prices

calculated using prices in a certain year as the base

year. GDP at constant prices used to determine

economic growth from year to year, while the GDP

at current prices used to see economic shifts and

economic structure. There are three approaches in

calculating GDP. They are expenditure approach,

income approach and production approach (Nanga,

2001).

The calculations of GDP by Expenditure

Approach is the amount of expenses incurred for

household consumption and private non-profit

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

357

institutions, government consumption, gross fixed

capital formation, changes in inventories/stocks, and

changes in net exports (exports minus imports).

Calculations of GDP by the Income Approach is

the amount of compensations received by production

factors which participate in the production process in

a country in a certain period of time (usually one

year). The compensations and benefits include

wages and salaries, rent for land, capital interest, and

profit, all before income tax and other direct taxes.

In this definition, GDP includes depreciation and net

indirect taxes (indirect taxes minus subsidies).

The calculation of GDP by Production Approach

is the added value of final goods and services

produced by the various production units (total

output) in the territory of a country in a certain

period of time (usually one year). The calculation

method with this approach is to divide the economy

into sectors of production. Total output of each

sector is the output of the entire economy. To avoid

double counting or even multiple counting. So that,

calculation of GDP by production method is the total

sum of value added in each sector. Value added is

the difference between the output values with

inbetween-value.

Conceptually, the calculation of GDP by these

three approaches will give the same result. Thus, the

amount of expenditure will be equal to the amount

of final goods and services produced and should be

equal to total income for the factors of production.

In practice, the calculation of GDP that is often used

is the expenditure approach.

2.2 Economic Growth According to

Islamic Economics

Economic growth in Islam is not only about

material production activities, but it is overall

production activity which is closely related to the

justice of distribution. Moreover, economic growth

is not only measured by economic aspects, but

human activity aimed to growth and progress of

material and spiritual sides at once. In Islam known

as the real welfare concerning the happiness of the

world and the hereafter. Islamic Economics in the

sense of an economic system (Nidhom al-Iqtishad) is

a system that can take humanity to the real Falah or

real welfare. Therefore, in analysing the economic

welfare in Islam must recognize how the interaction

of instruments waqf, Zakah, infaq and Sadaqah in

improving the welfare of the people. In essence,

Islamic economy should be able to provide a way to

measure economic prosperity and social welfare

based on moral and social system of Islam

(Sudarsono, 2003).

In the perspective of Islamic economics,

guidance how to achieve material prosperity within

the framework of Islamic values requires (Chapra,

1998):

1. Not to be achieved through the production of

goods and services that are not in accordance

with Islamic moral standards.

2. Not widen the social gap between the rich and

the poor.

3. Not pose a danger to present and future

generations with the physical and moral

damage to the environment.

In the paradigm of Islamic economics, economic

growth must be consistent with justice and equitable

distribution of income. Islam emphasizes social-

economic justice in economic growth. So that the

wealth is not concentrated in certain people because

a high economic could be only in the hands of a

particular conglomerate. This is in accordance with

the Quran surah Al-Hashr verse 7 which means:

"Wealth should not be only continuously circulated

among rich people".

2.3 Islamic Financing

Islamic financing is banking product that is

based on Islamic principles. Financing instrument in

Islamic bank is different from conventional bank.

Islamic financing apply interest-free financing

instrument based on two principles, the profit and

loss-sharing and the principle of additional margin

(mark-up margin). Meanwhile, the conventional

bank apply loan based on the interest (riba’) (Rivai

& Arifin, 2009).

The significant character of Islamic financing

that has positive impact on the real economy sector

and economic growth is Islamic financial institutions

put more emphasis on increasing production. Islamic

financial institutions are financial institutions that

emphasize the concept of asset and production based

system. Through the financing pattern, then the real

economy sector and the financial sector can move in

a balanced manner.

The theory of The Growth-Led Finance

Hypothesis or The Demand-Following View

developed by Robinson explains that the

development of the financial sector following the

economic growth, or entrepreneurial activity

(enterprise) encourage the growth of the financial

sector (Robinson, 2003). If the economy expanded,

the demand for banking products and services will

also increase, so the banking sector will also

increase by itself. One of the empirical research

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

358

supports this hypothesis is the research conducted by

Habibullah and Eng in Asian countries found that

Malaysia, Myanmar and Nepal support The Growth-

Led Finance Hypothesis (Habibullah & Eng, 2006).

2.4 Islamic Stocks

Islamic stocks are securities that represent equity

into a company. The equity inclution conducted on

the companies which business activities and the

management is not contrary to Islamic principles.

The stock is halal if the stocks issued by a

companies whose business activities are in line with

Islamic principles and/or the intention of the stock

purchase is for investment, not for speculation

(Soemitra, 2009).

Rules and norms of Islamic stocks trading

guideline refers to buying and selling goods in

Islamic trade. The fulfilment of the pillars, terms and

conditions, aspects of 'an taradhin, protected from

the elements maysir, gharar, riba’, haram and

najasy. The transaction practice such as forward

contracts, short selling, options, and insider trading

are not allowed in Islamic stocks trading.

Furthermore, the concept of preferred stock is also

not allowed because of the fixed gain

(predeterminant revenue) is categorized as riba’.

Another reason is that the owner of preferred stock

get the privilege, especially when the company is

liquidated. It is considered as injustice (Andri

Soemitra, 2016).

Generally buying and selling stocks in the capital

market has two main functions, the economic

function and financial functions. In the function of

the economy, the stocks market provides a facility to

reconcile the two interests, those who have excess

funds (investors) and those who need the funds

(emiten). At the capital markets, the parties that have

excess funds may invest with expectation of gaining

halal profit and appropriate with Islamic law, while

the emiten may use the funds for the benefit of the

company's operations. In the function of the

financial, the stocks markets provide the possibility

and the opportunity to obtain a compensation for

investors in accordance with the characteristics of

the selected investments. The capital market is

expected to boost economic activity, because the

capital market is an alternative to long term

financing for the company, so the company can

operate with a larger scale and eventually will

increase its profit and prosperity of the wider society

(Sholahuddin, 2004).

2.5 Zakah, Infaq and Sadaqah

Etymologically the word Zakah means evolve

(an-namaa), purify (at-thabaratu) and blessing (al-

barakatu). In terminology, the concept of Zakah is

giving some treasure to poor people (mustahik) with

certain requirements (Hafidhuddin, 2011). Zakah is

an obligation for muslims who are grown-up

(baligh), sensible and already have sufficient tresure

(nishab) in 12 months (haul).

According to Hidayat the concept of Infaq is

someone’s voluntary donation every time he gets

sustenance as much as he pleases (Hidayat, 2014),

while according to Hafidhuddin Infaq comes from

the word "anfaqa" which means give out something

valuable (treasure) for certain interest, e.g., the

construction of mosques, school, home-library etc

(Hafidhuddin, 2011).

Sadaqah is a voluntary donation from people to

others, especially to the poor (Hidayat, 2014).

Sadaqah is sunnah, therefore, to distinguish it from

zakah (obligation), the fuqaha use the term sadaqah

or an ash shadaqah nafilah (Hafidhuddin, 2011).

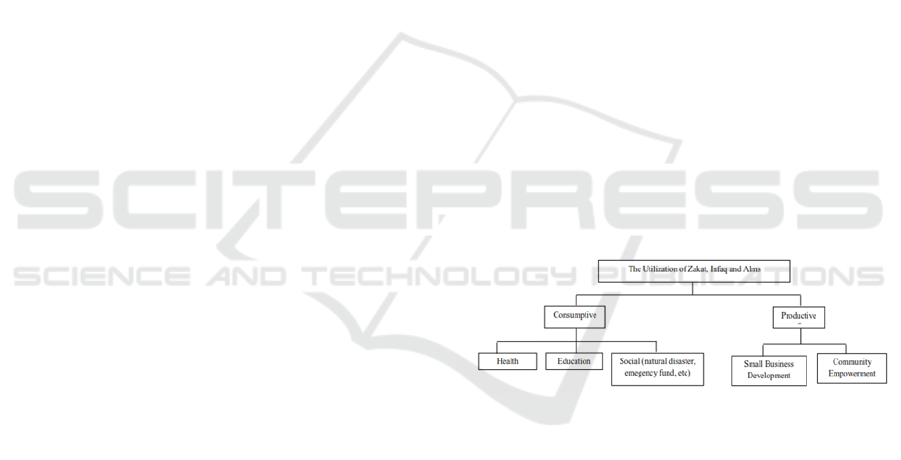

ZIS funds can be distributed on two activities,

consumptive activities and productive activities.

Productive activity is the provision of funds for

productive business activities so that it could give

medium and long-term impact for mustahik

(Antonio, Hermawan, Hendri, & Ghofur, 2017).

Figure 1: The Utilization of Zakah, Infaq and Sadaqah

ZIS can play a very significant role in the

distribution of income and wealth in muslim society.

The implications of Zakah is the growing wealth due

to zakah can be explained through its influence on

income, consumption, savings, investment and labor.

Another implication of Zakah is the multiplier effect

to the whole economy (Pramanik, 2002).

ZIS contribute to economic growth both through

aggregate demand and aggregate supply lines. The

combination of ZIS impact on consumption and

investment will boost aggregate demand through the

multiplier effect in the economy, this will lead to an

increase in national income. The purchasing from

ZIS will increase the consumption of the poor,

which would trigger an increase in the production of

goods and services. The increase in production will

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

359

certainly drive the economy broadly a demand for

input factors of production such as labor, physical

capital, energy, raw materials and demand for

intermediary input, especially the basic needs of

goods and services which are generally produced by

domestic manufacturers. Application of the ZIS will

also have a positive effect on the savings of the poor

and at the same time giving a neutral impact on the

savings of the rich. Thus, in aggregate, national

savings will increase. The increase of savings will

encourage an increase in investment. The increase in

investment eventually will result an increase

production of goods and services, lower the prices

and increase the real incomes of society

(Mohammed Yusoff, 2010).

3 REVIEW OF THE LITERATURE

Yunan in his research entitled "Analysis of

Factors Affecting Economic Growth in Indonesia"

concluded that GDP of Indonesia GDP will increase

significantly if the banking credit, government

spending and the labor force increased (Yunan,

2009).

Hidayati in her research entitled "Analysis of

Financial Systems Performance Relationship

(Banking and Capital Markets) towards Indonesian

Economic Growth Period 1990-2008". The results

indicate the bi-directional causality or correlation

interplay between economic growth and

development of the volume of bank credit, as well as

a one-way causal relationship between the

development of the stock market capitalization and

economic growth (Hidayati, 2008).

Densumite and Yusoff conducted a study entitled

"Zakah Distribution and Growth in the Federal

Territory of Malaysia". By using Granger causality

test and VECM concluded that Zakah has a long-

term relationship positively to real GDP and

indicates that zakah could boost GDP in the federal

territory of Malaysia both for short term and long

term (Yussof & Densumite, 2012).

Research conducted by Rachmawati and Laila

entitled "The Macroeconomic Factors Affecting

Stock Price Movement in Indonesia Sharia Stock

Index (ISSI) at the Indonesia Stock Exchange (BEI)"

concluded that the exchange rate gives significant

negative effect on ISSI (Racmawati & Laila, 2015).

Research conducted by Noverianto and

Ratnawati, entitled " Analysis of Effectiveness of

Islamic Financing towards GDP of Small and

Medium Enterprises in Indonesia" by the method of

Vector Auto Regression (VAR) concludes that

Islamic financing contributed the most to the

increase in GDP of Small and Medium Enterprises

(Noverianto & Ratnawati, 2014).

Juita, Wardi and Aimon in their study about

"Analysis of the Economic Growth and IHSG in

Indonesia" by using the method of simultaneous

equations. The result concluded that (1) Investment

and exchange are simultaneously significant effect

on economic growth in Indonesia; (2) Exchange

rate, money supply, SBI interest rates and economic

growth are significant effect on IHSG (Juita, Wardi,

& Aimon, 2014).

Research conducted by Hamzah and Syahnur

entitled "The Impact of Productive Zakah on

Poverty Alleviation in North Aceh”. The results of

the study revealed that the provision of productive

zakat in the form of venture capital had a positive

impact and could reduce the poverty rate in North

Aceh Regency by 0.02% (Hamzah & Syahnur,

2013).

Kader, Harun and Suprayitno in their research

entitled "The Impact of Zakah on Aggregate

Consumption in Malaysia" concluded that zakah has

a positive impact on aggregate consumption, but the

effect is only short-run (Suprayitno, Kader, &

Harun, 2013).

Furthermore, Yusoff conducted a study entitled

"Zakah Expenditure, School Enrolment and

Economic Growth in Malaysia" by using panel data

methods. The result concludes that zakah and the

increase of school enrolment are important factor of

economic growth in Malaysia (Yusoff, 2011).

Furkani in his research entitled "Improving

Indonesia's Gross Domestic Product through Zakah

Empowerment" with a qualitative descriptive

approach. The result concluded that zakah can

improve Indonesia's GDP through income,

consumption and production approach (Furkani &

Islam, 2010).

Research conducted by Muttaqiena entitled

"Productive Zakah Optimization as an Effort to

Solve Inequality of Income Distribution" with a

qualitative descriptive approach resulted in the

conclusion that optimizing zakah can increase

aggregate demand, aggregate supply, expanding

employment, improving output and eventually

encourage the social balance (Muttaqiena, 2010).

Yusoff conducted a study entitled "An Analysis

of Zakah Expenditure and Real Output: Theory and

Empirical Evidence". By using a data panel

regression method gives results that zakah

significantly increase production, zakah is a

potential instrument of fiscal policy in stabilizing the

macro-economic conditions (Yusoff, 2010).

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

360

Suprayitno’s research, entitled "The Effect of

Zakah on Indonesia Macroeconomic Variables" by

using a simultaneous equation model and the

aggregated data across the province in the year 2000

concluded that the amount of zakah distributed by

BAZ/LAZ in each province gives positive and

significant impact on the increase of aggregate

consumption as well as reducing the number of poor

people in the area (Suprayitno & Si, 2004).

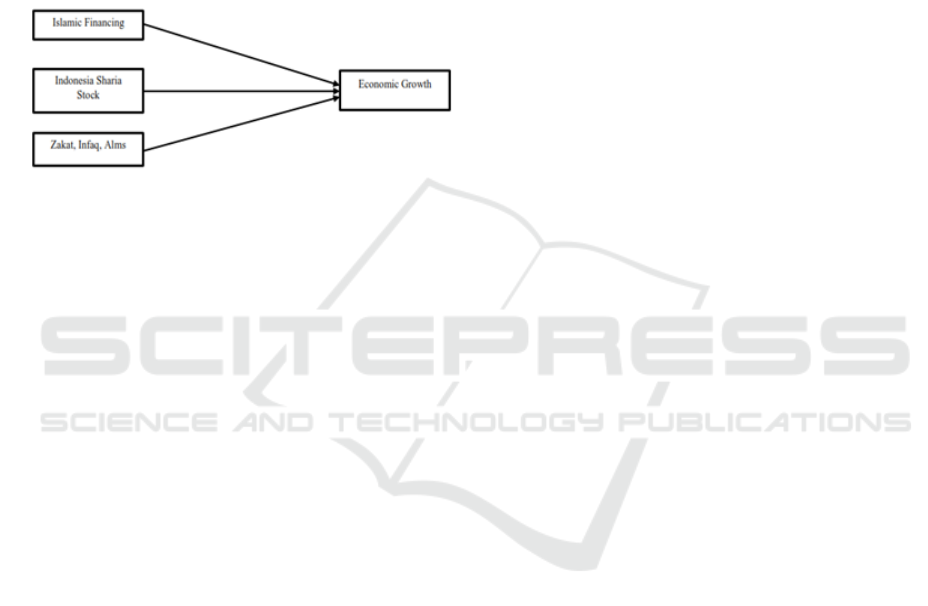

The Model Framework of the research

Figure 2: The Framework Scheme

Islamic financing that emphasize the concept of

asset and production based system where the funds

is used for business purpose may increase capital

investment in the productive sectors of the

economy. Through the financing pattern like that

then the real economy sector and the financial sector

will rise together in a balanced manner, which will

eventually increase the GDP.

Indonesia Sharia Stock Index (ISSI) can role as

driving force for national economy by facilitating

the companies that need funds (emitens) and

investors who have excess funds. So that companies

obtain long term financing that can be used to

increase working capital and production.

Furthermore, investors also gain profit sharing for

the funds invested. This can increase the activity of

the national economy that would contribute to an

increase of GDP.

Distribution of Zakah, Infaq and Sadaqah (ZIS)

can be used for consumptive and productive

activities. ZIS in Indonesia is more widely used for

consumptive activities. ZIS for consumptive

activities contribute to the improvement of both

aspects of consumption in GDP (aggregate demand)

as well as from the aspect of investment (aggregate

supply) through a multiplier effect in the economy.

The purchasing from ZIS will increase the

consumption of the poor, which would trigger an

increase in the production of goods and services.

The increase in production will certainly drive the

economy broadly a demand for input factors of

production such as labor, physical capital, energy,

raw materials and demand for intermediary input,

especially the basic needs of goods and services

which are generally produced by domestic

manufacturers. This will eventually increase the

GDP.

4 METHODOLOGY

The scope of this study to analyse the effect of

Islamic Financing, Indonesia Sharia Stock Index

(ISSI), Zakah, Infaq Zakah and Sadaqah (ZIS) on

Economic Growth. The data used in this research is

secondary data in the form of quarterly time series

with 24 quarters observation period during the first

quarter of 2010 until the fourth quarter of 2015. The

type of secondary data to be processed include GDP

at constant prices in 2010; total Islamic Financing;

Indonesian Islamic stocks total capitalization of

ISSI; total distribution of ZIS. Due to limited data

published of ZIS, the observation period can only be

carried out until 2015. Source of data is obtained

from various official publications, they are BPS,

Bank Indonesia, OJK, and BAZNAS.

This study uses Error Correction Model (ECM)

in order to see the effect of short-run and long-run.

Error Correction Mechanism is the analysis of time

series data is used for variables that have a

dependency that is often referred to cointegration.

ECM method used to balance short-run economic

correlation between variables that have had long-run

economic correlation. Cointegration test between

variables intended to indicate a long-run

correlation/balance of the independent variable on

the dependent variable. However, in the short-run

there is a possibility that an imbalance between these

variables. The imbalance is often encountered in

economic behaviour due to the inability of economic

agents to quickly adjust the changes that occur in the

behaviour of economic variables. Because of this

imbalance, the Error Correction Model mechanism

is used. ECM mechanism using residual/error of

long-run to balance short-run. Error Correction

Model (ECM) dividing equation of mutually-

cointegrated variables into two equations, they are

long-run equation and short-run equation (Nachrowi

& Usman, 2002).

This study uses an ECM Domowittz-Elbadawi

model, it is based on the fact that the economy is in a

state of imbalance. This ECM model assumes that

economic agents will always find that what is

planned is not always the same as reality. This

deviation is likely to occur because of the shock

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

361

variable, so the variable Y is not always equilibrium

with X (Widarjono, 2013).

ECM Domowittz-Elbadawi used in this

study is:

∆Y

t

= β

0

+ β

1

∆X

t

+ β

2

X

t-n

+ β

3

ECT

(1)

Changes of Y or ΔY

t

present (t) is affected by

changes in the variables X or ΔX

t

present and

previous changes of variable X (X

t-n

), and also by

errors imbalance or error correction term (ECT).

Equation (1) is ECM model that can be adjusted on

the first difference (

t-1

) or to continue formulate

ECM on a second difference (

t-2

), depending on the

stationary test and cointegration test earlier.

According to this model, the model ECM is valid if

the sign of ECT coefficient is positive and lies

between 0 and 1.

The coefficient β in equation (1) is a short-run

analysis. While the coefficient on the level which is

the level of long-run coefficients (equilibrium) are as

follows:

Y

t

= h

0

+ h

1

X

t

(2)

h

0

= B

0

/B

3

h

1

= (B

2

+B

3

)/B

3

The period of time in variables that have a short-

run balance is adjusted to the time intervals of time

series data observed. While the period of time on a

variable that has a long-run balance is above 5 or 10

years for monthly or quarterly time series data.

The Empirical Model

This study describes the effect of long-run and

short-run between Islamic Financing (IF), Indonesia

Sharia Stock Index (ISSI) and Zakah, Infaq, Sadaqah

(ZIS) on Economic Growth (GDP). The model is

formed into a dynamic model that includes a lag,

known as Model ECM Domowittz-Elbadawi, as

follows:

LnGDP

t

= β

0

+ β

1

DIF

t

+ β

2

DISSI

t

+ β

3

DZIS

t

(3)

+ β

4

IF

t-2

+ β

5

ISSI

t-2

+ β

6

ZIS

t-2

+β

7

ECT

GDP = Gross Domestic Product

IF = Islamic Financing

ISSI = Indonesia Sharia Stock

ZIS = Zakah, Infaq and Sadaqah

β

0

= Constants

β

1

– β

7

= Regression Coefficients

D = Short-run Effect

(t-2) = Long-run balance adjustment or

backward lag operator

ECT = Error Corection Term

In the model above, the changes of IF, ISSI and

ZIS to GDP in the long-run would be offset by ECT.

In the equation DP, DSSI, DZIS describe

'interference' short-run of IF, ISSI and ZIS, and t-2 is

an adjustment to the long-run balance. Thus, if the

coefficient β4, β5, β6 significant, the coefficient will

be the adjustment of the variables were observed

between short-run leading to long run correlations.

5 RESULT AND DISCUSSION

5.1 Result

By discovering there is phenomenon of long-run

relationships to each variable (see Appendix) then

the next step is to approach Error Correction Model

(ECM) to see whether there is any relationship

between variables in the short-run. ECM is an

approach to analyse the time series model that is

used to see consistency between the short-run

relationships with a long-run relationship of the

variables tested. To determine whether the ECM

model is valid or not, the coefficient of Error

Correction Term (ECT) should be significant.

From the results of ECM data processing, Table

2 shows that the ECT coefficient is 0.123450 with

probability 0.0384. The sign is positive and is

between 0 and 1, as well as significant at confidence

level of α 0.05. Therefore, the model of ECM is

valid.

Table 3: The Result of Error Correction Model Test

Dependent Variable: D(GDP)

Method: Least Squares

Sample (adjusted): 2011Q1 2015Q4

Included observations: 20 after adjustments

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

0.062954

0.045841

1.373317

0.0419

D(IF)

1.046657

6.84E-07

1.531159

0.0151

D(ISSI)

8.382811

6.24E-09

1.343751

0.2039

D(ZIS)

0.003856

0.001091

3.534841

0.0041

IF(-2)

3.269057

1.76E-07

1.860594

0.0375

ISSI(-2)

1.699364

4.60E-09

0.369240

0.0284

ZIS(-2)

0.004922

0.001334

3.688057

0.7031

ECT

0.123450

6.06E-09

1.854443

0.0384

R-squared

0.632282

Mean dependent var

0.013373

Adjusted R-

squared

0.417780

S.D. dependent var

0.024549

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

362

S.E. of

regression

0.018732

Akaike info criterion

4.827990

Sum squared

resid

0.004211

Schwarz criterion

4.429697

Log

likelihood

56.27990

Hannan-Quinn criter.

4.750239

F-statistic

2.947670

Durbin-Watson stat

2.438460

Prob(F-

statistic)

0.048234

The coefficient of ECT also indicates that the

difference between the actual values of current GDP

with short-run equilibrium value of 0.123450 will be

adjusted within 3 months. It is adapted to the

interval period of the observed time series data.

Furthermore, the amount of long-run regression

coefficients are as follows:

Table 4: The Result of ECM Coefficient Calculation

Variable

Symbol

Coefficient

Short-run

Long-run

Constants

C

0.062954

0.50995545

Islamic

Financing

IF

1.046657

27.4808181

Indonesia

Sharia Stock

ISSI

8.382811

14.7656055

Zakah,

Infaq,

Sadaqah

ZIS

0.003856

1.0387039

Based on Table 4, the ECM regression equation

in the short-run and long-run are as follows:

D(GDP)=0.062954+1.046657D(IF)+8.3828

11D(ISSI)+0.003856D(ZIS)+27.

4808181IF(

-2

) +14.7656055ISSI(

-

2

)+1.0387039ZIS(

-2

) + 0.123450

ECT

(4)

Short-run constant value of 0.062954 indicates if

the value of the independent variables constant, the

amount of revenue for the short-run GDP increased

by 0.062954 percent. Long-run constant value of

0.50995545 indicates if the value of the independent

variables constant, the amount of revenue for long-

run GDP increased by 0.50995545 percent.

5.1.1 The Effect of Islamic Financing on

GDP

Short-run : The coefficient of D(IF) is 1.046657

with a probability 0.0151 which means significant at

α 0.05 implies that there is a short-run equilibrium

correlation between variables Islamic Financing and

GDP, where the increase of one percent Islamic

Financing will affect to GDP in the short-run by

1.046 657 percent within 3 months.

Long-run : From the calculation of the ECM

coefficient on IF (

-2

), the results 27.4808181 with the

probability 0.0375 which has been significant at α

0.05. This implies that there is a long-run

relationship between the variables Islamic Financing

and GDP, which if Islamic Financing increased by

one percent will increase long-run GDP by 27,

4808181 percent within a period of 10 years.

Thus, there are significant short-run and long-

run. In other words, there is consistency or the

balance between short-run leading to long-run

correlations of variables Islamic Financing and

GDP. Where in the long-run Islamic Financing gives

significant positive effect on GDP.

5.1.2 The Effect of Indonesia Sharia Stock

Index (ISSI) on GDP

Short-run : The coefficient of D (ISSI) is

8.382811 with a probability 0.2039 which means the

probability is not significant at α 0.05 implies that

there are no short-run equilibrium correlation

between variables ISSI and GDP.

Long-run : From the calculation of the ECM

coefficient on ISSI (-

2

), the results 14.7656055 with

the probability 0.0284 which has been significant at

α 0.05. This implies that there is a long-run

relationship between the variables ISSI and GDP,

which if ISSI increased by one percent will increase

long-run GDP by 14.7656055 percent within 10

years.

Thus there is only long-run effect between

variables ISSI and GDP. Where ISSI gives

significant positive effect on GDP in the long-run.

5.1.3 The Effect of Distribution of Zakah,

Infaq and Sadaqah on GDP

Short-run: The coefficient of D (ZIS) is

0.003856 with a probability 0.0041, which means

significant at α 0.05 implies that there is a short-run

equilibrium relationship between variables ZIS and

GDP, where the increase of one percent Zakah,

Infaq and Sadaqah will affect to GDP in the short-

run by 0.003856 percent within 3 months.

Long-run: From the calculation of the ECM

coefficient of ECM on ZIS (

-2

), the results

1.03987039 with probability 0.7031 which means

not significant at α 0.05. This implies that there are

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

363

no long-run relationship between the variables of

Zakah, Infaq and Sadaqah on GDP.

Thus, there is only short-run effect between

variables ZIS and GDP. Where in the short-run

Zakah, Infaq and Sadaqah gives significant positive

effect on GDP.

5.2 Discussion

Islamic Financing gives significant positive

effect both in short-run and long-run on economic

growth. This means if Islamic Financing increases

both in the short-run and long-run, the economic

growth will also increase, and vice versa, if there is a

decrease on the Islamic Financing, the economic

growth will decline. This is consistent with the

theory of The Growth-Led Finance Hypothesis by

(Robinson, 2003), which states entrepreneurial

activity encourages the growth of the financial

sector, followed by a rise in economic growth. This

results are consistent with the results of (Habibullah

& Eng, 2006) which concluded that the financing in

Islamic banking is more positive impact on the

growth of the real sector in Malaysia, Myanmar and

Nepal. This results are also consistent with research

conducted by (Noverianto & Ratnawati,

2014),(Yunan, 2009) and (Hidayati, 2008) which

concluded that the Islamic and conventional

financing contributed to revenue growth of small

and medium enterprises (SMEs) and the economy.

ISSI or Indonesia Sharia Stock Index is not

significantly affect on economic growth in the short-

run. This means that the increase or decrease in the

short-run of ISSI does not give any effect on

economic growth in the short-run, while in the long-

run there is an effect on economic growth. This

means that if buying and selling of ISSI increased in

a long-run, economic growth will rise, and vice

versa, if the buying and selling of ISSI decline,

economic growth will decline as well. ISSI can

contribute to economic growth due to the emitens

that have listed their shares on Indonesia Stock

Exchange obtain substantial funding from investors

who are interested to invest in these companies. This

fund is an alternative to long run funding that is

sufficient to increase company productivity and to

improve the company's operations. The results are

consistent with the theory of economic growth stated

by many economist. Harrod-Domar, Solow and

Romer agreed that investment has a very important

role in increasing productivity, especially affecting

on economic growth for the long-run.

The distribution of Zakah, Infaq and Sadaqah

(ZIS) gives a significant positive effect on economic

growth only in the short-run, although the effect is

not as big as on the Islamic Financing and ISSI. If

the distribution of ZIS increases in the short-run then

economic growth will also increase, and vice versa,

a decrease in the distribution of ZIS will affect the

decline of economic growth in the short-run. While

in the long-run ZIS does not effect on economic

growth. Distribution of ZIS is divided into two: for

consumptive and productive activities. They have an

impact on both aggregate demand and aggregate

supply, so the ZIS has a multiplier effect in the

economy. Consumptive activities from distribution

of ZIS effect on economic growth in the short-run

through aggregate demand, while productive

activities from distribution of ZIS effect on

economic growth in the medium to long-run through

aggregate supply. In this study, ZIS effect in the

short-run due to the distribution of ZIS in Indonesia

are mostly used for consumptive activities, so that

the mechanism of multiplier effect in increasing the

economic growth is effectively limited to only short-

run. The result of this study is not consistent with the

research of (Yussof & Densumite, 2012) that zakah

has a positive long-run correlation on real GDP. Yet,

this study is consistent with the research of

(Suprayitno et al., 2013) that the distribution of

zakah only has small influence in short-run. This

research is also in accordance with the theory

presented by Mark Skousen in (Yusoff, 2010) and

(Pramanik, 2002) that ZIS has a multiplier effect in

the economy.

6 CONCLUSION

The positive and significant effect of Islamic

Financing on the economic growth both in the short-

run and long-run, so it is suggested that Islamic

banks keep continuing to improve its performance

on funding, so that the contribution of Islamic

banking to economic growth is more obvious and

noticeable.

The positive effect of Indonesia Sharia Stock

Index on economic growth in the long-run shows

that ISSI is an alternative to long-term funding, so it

is suggested that IDX–as an intermediary for Islamic

stock exchange–collaborates with DPS and DSN-

MUI need to increase socialization to community

regarding to investment in Islamic stock exchange.

The more emitens included in ISSI, the more

investors to join. Thus, ISSI can be a driving force

for national economic growth.

There is an interesting finding that zakah does

not give effect on economic growth in the long run,

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

364

whereas the major population of Indonesia is

Muslim. It means the awareness to pay zakah still

needs to be improved. Another factor is because

most mustahik uses ZIS as consumptive zakah. This

means Badan Amil Zakat Nasional (BAZNAS) as an

official institution which is authorized by the

government to collect and distribute ZIS has a big

task to increase the potential and distribution of ZIS

in Indonesia, because the effect will be great on

economic growth. BAZNAS should be actively

socialize and establish BAZNAS provincial,

district/city and Lembaga Amil Zakat (LAZ), as well

as disseminate to the Muslim in Indonesia to

distribute ZIS through BAZNAS or LAZ.

It is suggested that BAZNAS and LAS should

perform actively on fundraiser of ZIS and promoting

the utilization productive zakah for mustahik, so the

effect on economic growth is greater. It is can be

done by innovation and creativity through unique

programs to attract muzakki, IT infrastructure

support, an excellence management of ZIS, a

transparent and accountable of ZIS financial reports,

the bureaucratic system, administrative system,

monitoring and regulation system which is able to

ensure the management of ZIS funds is entirely for

the benefit of the people (ummat).

There are three pillars of the sector should be

built so that the economy is getting stronger and

growing. They are the real sector; financial sector

and zakah, infaq, sadaqah and waqaf sectors. The

inequality one of these three sectors will hamper the

entire economic development. It would be better if

the government could create an Islamic economic

national committee to connect these sectors, so that

the economy in Indonesia is becoming increasingly

strong. This committee is expected to provide

direction for the development of economic and

Islamic finance in Indonesia, so that all sectors of

the economy and Islamic finance can be integrated

and connected to one another.

Due to the limited data available, future research

is suggested to be able to extend the observation

period, especially on ZIS and ISSI. Further, the data

coverage can be added to ZISWAF (Zakah, Infaq,

Sadaqah and Waqaf) because the discussion on

ZISWAF and ISSI from a macroeconomic

perspective is still rare.

REFERENCES

Andri Soemitra. (2016). Higher Objectives of Islamic

Investment Products: Islamizing Indonesian Cap...:

KRISALIS DISCOVERY. Studia Islamika.

https://doi.org/DOI: 10.15408/sdi.v23i2.2408

Antonio, S., Hermawan, Hendri, A., & Ghofur, A. (2017).

Pemikiran Ekonomi Islam MUhammad Syafi’i

Antonio (Analisis Perbankan Syariah Indonesia), 181–

194.

Asworo, H. T. W. (2015). Potensi Zakat Nasional. E-

Paper Bisnis Indonesia.

https://doi.org/10.1109/ISQED.2011.5770706

Chapra, M. U. (1998). Islam and economic development:

A discussion within the framework of Ibn Khaldun’s

philosophy of history. In Proceedings of the Second

Harvard University Forum on Islamic Finance:

Islamic Finance into the 21st Century.

https://doi.org/ben11046_fm [pii]

Furkani, A., & Islam, E. (2010). Menigkatkan PDB

Indonesia melalui Pemberdayaan Zakat Penghasilan,

11–22.

Habibullah, M. S., & Eng, Y. K. (2006). Does financial

development cause economic growth? A panel data

dynamic analysis for the Asian developing countries.

In Journal of the Asia Pacific Economy.

https://doi.org/10.1080/13547860600923585

Hafidhuddin, D. (2011). Peran Strategis Organisasi Zakat

Dalam Menguatkan Zakat Di Dunia. Jurnal Ekonomi

Islam Al-Infaq.

Hamzah, R., & Syahnur, S. (2013). Analisis Dampak

Pemberian Modal Zakat Produktif terhadap

Pengentasan Kemiskinan di Kabupaten Aceh Utara.

Jurnal Ilmu Ekonomi Pascasarjana Universitas Syiah

Kuala.

Hidayat, M. (2014). ULASAN BUKU - Islamic

Economics, Banking and Finance: Concepts and

Critical Issues. Jurnal Syariah.

Hidayati, S. (2008). Analisis hubungan kinerja sistem

keuangan ( perbangkan dan pasar modal ) terhadap

pertumbuhan ekonomi indonesia periode 19990 -2008,

124624.

Juita, P. C., Wardi, Y., & Aimon, H. (2014). Analisis

Pertumbuhan Ekonomi, Dan Indeks Harga Saham

Gabungan Di Indonesia. Jurnal Kajian Ekonomi, 2(4),

1–19. Retrieved from

http://ejournal.unp.ac.id/index.php/ekonomi/article/vie

w/3321/2749

Mohammed Yusoff. (2010). An Analysis of Zakat

Expenditure and Real Output : Theory and Evidence.

Journal of Economics and Management, 2(2), 139–

160.

Muttaqiena, A. (2010). Productive Zakah Optimization as

An Effort to Solve Inequality of Income Distribution,

1–10.

Nachrowi, N., & Usman, H. (2002). Penggunaan teknik

ekonometri: pendekatan populer dan praktis

dilengkapi teknik analisis dan pengolahan data dengan

menggunakan paket program. Radja Grafindo

Persada. Jakarta.

https://doi.org/10.1038/oby.2007.598

Nanga, M. (2001). Makro Ekonomi Teori, Masalah, dan

Kebijakan. Jakarta: Rajawali Pers.

Noverianto, F., & Ratnawati, N. (2014). Analisis

Efektifitas Jalur Pembiayaan Syariah terhadap PDB

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

365

UMKM di Indonesia, 73, 73–92.

Pramanik, A. H. (2002). Islam and Development Revisited

with Evidences from Malaysia. Islamic Economic

Studies.

Racmawati, M., & Laila, N. (2015). Faktor Makro

Ekonomi yang Mempengaruhi Pergerakan Harga

Saham ISSI di BEI, 2(11), 928–942.

Rivai, V., & Arifin, A. (2009). Islamic Leadership.

Islamic Bankin and Leadership.

https://doi.org/10.1007/s13398-014-0173-7.2

Robinson, J. (2003). The Generalization of The General

Theory, In The Rate of Interest and Other Essays.

Futures. https://doi.org/10.1016/S0016-

3287(03)00039-9

Sholahuddin, M. (2004). Risiko Pembiayaan dalam

Perbankan Syariah. Benefit.

Soemitra, A. (2009). Bank & Lembaga Keuangan Islam.

Jurnal Islamika. https://doi.org/10.1007/BF01041590

Sudarsono, H. (2003). Bank dan lembaga keuangan

Syari’ah, Deskripsi dan Ilustrasi. Ekonisia.

https://doi.org/10.1016/j.ijrobp.2010.08.022.A

Suprayitno, E., Kader, R. A., & Harun, A. (2013). The

Impact of Zakat on Aggregate Consumption in

Malaysia. Journal of Islamic Economics, Banking and

Finance, 9(1), 1–24.

Suprayitno, E., & Si, M. (2004). “ Pengaruh Zakat

Terhadap Variabel Makro Ekonomi Indonesia ,” (17).

Todaro, M. (1997). Theories of Development : A

Comparative Analysis. Economic Development.

Widarjono, A. (2013). Econometrics. Jurnal Bisnis Dan

Ekonomi. https://doi.org/10.1002/mop

Yunan. (2009). Analisis Faktor-Faktor yang

Mempengaruhi Pertumbuhan Ekonomi Indonesia.

Analisis Faktor-Faktor Yang Mempengaruhi

Pertumbuhan Ekonomi Indonesia.

https://doi.org/10.1186/1471-230X-14-139

Yusoff, M. B. (2010). An Analysis of Zakat Expenditure

and Real Output : Theory and Evidence. Journal of

Economics and Management, 2(2), 139–160.

Yusoff, M. B. (2011). Zakat Expenditure, School

Enrollment, and Economic Growth in Malaysia.

International Journal of Business and Social Science,

2(6), 175–181.

https://doi.org/10.1017/S1876404511200046

Yussof, M. B., & Densumite, S. (2012). Zakat Distribution

and Growth in the Federal Territory of Malaysia.

Journal of Economics and Behavioral Studies.

APPENDIX

Stationarity Test (Unit Root Test)

Based on the table of ADF Unit Root Test, it can be

seen that almost all data (at Current Level) are not

stationary, except for the ZIS. So it can be concluded

that there are unit root problems on variables at the

Current Level (the original data), so the data needs

to go to next level of Degree of Integration Test on

the first or second difference.

Table of Unit Root Test (Augmented Dickey-Fuller)

on Current Level

Varia

ble

ADF test

ADF Mc.

Kinnon

CV 5%

Probabil

ity <

0.05

Explanati

on

GDP

-1.296877

-2.998064

0.6130

Not

Stationary

IF

-1.497554

-3.004861

0.5161

Not

Stationary

ISSI

-1.361096

-2.998064

0.0051

Not

Stationary

ZIS

-3.240607

-2.998064

0.0304

Stationary

Degree of Integration Test

Based on the table of ADF Unit Root Test on

First Difference, it can be seen that variable GDP,

ISSI and ZIS are stationary. It is proved by the

absolute value of the ADF test is greater than Mc.

Kinnon Critical Value 5% and also the probability is

less than 0.05. However, the variable IF is not

stationary, because the absolute value of the ADF

test is smaller than Mc. Kinnon Critical Value 5%

and the probability is greater than 0.05.

Table of Unit Root Test (Augmented Dickey-Fuller)

on First Difference

Varia

ble

ADF test

ADF Mc.

Kinnon

CV 5%

Probab

ility <

0.05

Explanati

on

GDP

-14.21517

-3.012363

0.0000

Stationary

IF

-2.102834

-3.004861

0.2454

Not

Stationary

ISSI

-3.582688

-3.004861

0.0150

Stationary

ZIS

-9.233006

-2.91263

0.0000

Stationary

The conclusion of the data processed that H

0

is

accepted, because variable IF is not stationary at the

level of the first difference, so it needs to go to the

next level (Second Difference).

Table of Unit Root Test (Augmented Dickey-Fuller)

on Second Difference

Varia

ble

ADF test

ADF Mc.

Kinnon

CV 5%

Probab

ility <

0.05

Explanati

on

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

366

GDP

-10.14272

-3.020686

0.0000

Stationary

IF

-5.738628

-3.012363

0.0001

Stationary

ISSI

-4.636657

-3.020686

0.0017

Stationary

ZIS

-10.61563

-3.020686

0.0000

Stationary

Based on the table of ADF Unit Root Test on

Second Difference, it can be seen that all variables

are stationary. It is proved by the absolute value of

the ADF test is greater than Mc. Kinnon Critical

Value 5% and also the probability is less than 0.05.

The conclusion of the data processed that H

0

is

rejected which all variables are stationary at the

Second Difference, so the test can go to the next test.

It is Cointegration Test.

Cointegration Test

This Cointegration Test is to see long-run correlation

from the model. In this study used the method of

Engle-Granger cointegration.

Table of Cointegration Test

Null Hypothesis: D(RESIDCOINTEGRATION,2)

has a unit root

Exogenous: Constant

Lag Length: 1 (Automatic - based on SIC,

maxlag=1)

t-Statistic

Prob.*

Augmented Dickey-Fuller test

statistic

-7.385041

0.0000

Test critical

values:

1% level

-3.808546

5% level

-3.020686

10% level

-2.650413

*MacKinnon (1996) one-sided p-values.

Cointegration Test shows that the absolute

value of the ADF test > Critical Value 5% .

It is│-7.385041 │> │-3.020686│, with a

probability of 0.0000 so H

0

is rejected. This means

the residual of the equation has been stationary on

the second degree of integration. So that each

variable is cointegrated, in other words, there are

indications of long-run correlations.

The indication of long-run correlations cannot

be used as evidence that there is an equilibrium

correlation between the variables in the short-run

and to determine which variable cause changes in

another variable, then using Error Correction Model.

The Effect of Islamic Financing, Indonesia Sharia Stock Index(ISSI), and Distribution of Zakah, Infaq and Sadaqah (ZIS) on Economic

Growth in Indonesia

367