Analysis Weak Form Efficiency in Indonesia Stock Exchange Period

2011-2016

Evida Rahimah

1

, Indra Maipita

1

and Sri Fajar Ayu

2

1

Department of Economic Science, State University of Medan, Medan, Indonesia

2

Department of Agribusiness, University of Sumatera Utara, Medan, Indonesia

Keywords: LQ 45, random walk, weak form efficiency

Abstract: Stock market efficiency is a very important study, because an inefficient market allows the

market authorities to consistently obtain an abnormal return indicated by stock returns showing

predictable behavior or not following a random walk pattern. The purpose of this study is to find

out whether stock returns on the Indonesia Stock Exchange are random walk evidenced from

non-parametric tests (runs test) and parametric tests (unit root test). This study uses 34 samples,

namely the issuer in the LQ45 index, with the study period from January 2011 to December

2016. The data used in this study is the LQ45 index weekly stock closing price from January

2011 to December 2016 obtained from the publication report Indonesia stock exchange. This

study using a significance level of 5%. The analytical method used is non-parametric test (run

test and phillips perron test) and parametric test (unit root test and autocorrelation function test).

The result of the research shows that stock return of Indonesia Stock Exchange are not random

walk or inefficient in weak form.

1 INTRODUCTION

Disclosure of information is a reflection of an

efficient capital market. Where the efficient market

theory proposed by fama defines the efficiency of

the capital market as a market where prices fully

reflect all available information (Fama, 1970). The

faster the new information is reflected in the price,

the more efficient the capital market. Thus the

presence of information has an important role in

stock trading in capital markets conducted by

investors. This information is needed in making

decisions related to the selection of investment

portfolios that provide the highest level of profit

with a certain level of risk (Setiawati, 2013).

If the equity markets work efficiently, the price

would indicate the intrinsic value of the shares and

in exchange, limited savings will be allocated to

productive investment sector in an optimal way in a

way that will provide a stream of benefits for

individual investors and the national economy as a

whole (Copeland and Weston, 1988). Thus there is

no opportunity to obtain information that allows

market authorities to consistently gain an abnormal

return, because market returns show unpredictable

behavior (Khairunnisa, 2015). Conversely, if an

inefficient capital market can complicate various

parties (Rahman, 1991), ie issuers difficulty in

measuring the maximum shareholder wealth.

Whereas for investors, of course, many will suffer

because inefficient market conditions make a lot of

manipulation that can be done to increase stock

prices. Lastly, with this can prompt investors to

reduce their investment in the stock market because

they would have had difficulty detecting the return,

risk and liquidity of the company's stock is traded.

Therefore it becomes very important to make

efficient capital markets, efficient capital market can

be created with a lot of competition among

investment analysis for investment analysis leads to

a situation where at any time, the stock price

indicates that the actual value. The more the number

of financial analysts and the competition between

them will make the price of the securities fair and

reflect all the relevant information in which the

analyst will attempt where the analyst will attempt to

obtain as comprehensive information as possible

compared to other analysts with the closest possible

analysis that will make the price of the securities fair

or in other words, the stock prices reflect all

442

Rahimah, E., Maipita, I. and Ayu, S.

Analysis Weak Form Efficiency in Indonesia Stock Exchange Period 2011-2016.

DOI: 10.5220/0009500704420446

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 442-446

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

available information and make adjustments to fully

and rapidly to new information (Husnand, 2005).

The idea of testing the efficiency of the market

as the information contained in efficient market

hypothesis. Fama divides the efficient market

hypothesis into three categories: first, the strong

form market efficiency hypothesis is to answer the

question of whether investors have private

information that is not reflected in the price of

securities. Second, the semi strong form efficiency

market hypothesis is how quickly the price of a

security reflects the published information. Third,

the weak form efficiency market hypothesis is how

strongly historical information can predict future

returns. This hypothesis is known as Random Walk

Hypothesis (RWH) states that the current price of

securities fully reflects the information contained in

the historical price. Therefore, the best predictor of

future prices is the current price. It is not possible for

investors to design profitable strategies based on the

prices of securities in the past. The capital market

will be more efficient in a weak form if the

prediction rate is lower, so the current stock market

price is independent of the stock market prices in the

past. In other words, the efficient market forms weak

if the stock price follows a random walk process. To

test the efficiency of weak form, it is necessary to do

random walk hypothesis (RWH) test considering the

relation between current and past stock price

(Fawson. et.al, 1996; Ananzeh, 2016; Arora, 2013;

Okpara, 2010; Borges, 2010; Shaker, 2013)

From three forms of testing efficiency in the

information market, the discussion in this study

focused on the weak form market efficiency testing

or return predictability test, because most of the

research in the market efficiency hypothesis (EMH)

focuses on the weak form level, because if the

research results do not support weak form market

efficiency, testing at the next level is useless

(Gimba, 2010; Ikechukwu, 2015; Phan & Zhou,

2014). The Indonesian capital market is a capital

market that was established since the Dutch

occupation in Indonesia under the name Vereniging

Voor de Effekteenhundel in 1912 in Batavia with the

aim of raising funds to support the expansion of the

Dutch Colonial plantation business. But it stopped

when World War I and II happened and was

reactivated in 1977 and a few years later the capital

market experienced growth. Indonesian capital

market over the last 5 years have improved

performance. This is reflected in the JCI, which is

shown in Figure 1.

Figure 1: JCI Developments for the Last 5 Years

In theory emerging countries tend to be inefficient.

Claessens et al believe that there are several

motivations behind attempting to test efficiency in

emerging countries (Claessens et al, 1993). First,

domestic and foreign investors do not really like to

invest in the stock market in emerging countries

because there are inefficiencies. For example, the

thin market in Africa is often considered the subject

of insider manipulation and consequently makes

foreign investors lose [Magnusson and Wydick,

2002). If the inefficiency of the market continues to

the stage only individuals or certain companies are

entitled to exclusive information or insider trading,

certainly not encouraging domestic and foreign

investors to approach the market. Second, the

efficiency test is trying to give an assessment of the

effectiveness of the role played by the market, as an

example of a role in asset allocation.

2 METHODS

The type of research used in this study is

explanatory research. In this study the researchers

tested a theory that has been tested empirically by

previous researchers. In this context, the variables

tested related to the weekly stock price movement of

the period January 1, 2011 to December 31, 2016.

The data used in this study is the weekly data from

the stock exchange LQ45 index from January 2011

until December 2016. The sampling technique was

conducted by purposive sampling method are taken

based on certain criteria, that are:

1. Number of issuers listed in the LQ 45 Index.

2. Issuers are not consistently listed in the LQ 45

Index during the year 2011-2016

3. Issuers incomplete publish weekly stock price

LQ 45 Index during the year 2011-2016

4316.69

4274.18

5226.95

4593.01

5296.71

5949.7

0

1000

2000

3000

4000

5000

6000

7000

2012 2013 2014 2015 2016 2017

IH…

Analysis Weak Form Efficiency in Indonesia Stock Exchange Period 2011-2016

443

Based on the criteria established, then obtained 34

sample data with the number of observations is 8160

obtained from 34 x 240 (multiplication of the

number of samples with the study period ie weekly

during the year 2011-2016). The main variable in

this study is a weekly return of stocks from 34

companies listed in the LQ-45 for the period January

2011 to December 2016, by formula:

!

"

#

$

%

&$

%'(

$

%'(

)*++

,

(1)

Description:

Z

t

= return

P

t

= current close price

P

t-1

= previous stock closing price

2.1 Data analysis method

Data analysis method used in this research non

parametric test (runs test) and parametric test (unit

root test and autocorrelation function test).

2.2.1 Non parametric test

1. Runs Test

Runs test is non parametrik test for serial

dependence in the stock returns, which designed to

examine whether or not an observed sequences is

random (campbell et al,1997; Gujarati, 2003). With

the following equation:

- #

.

/

.01

2

&

3

4

5

6

7

58(

.

(2)

9 #

:

;<=>?&@

A

B

C

(3)

Description:

N = total number of observations

n

i

= the number of price changes (returns) in each

category

Z= standard normal Z-statistics

r = number of actual runs;

µ = number expectations of runs,

Hypothesis testing criteria:

H

0

: market is weak form efficiency

H

1

: market is not weak form efficiency

If the Z-statistic is less than 1% and ρ value also

less than 5% level of significance, then we reject the

null hypothesis which mean market is not weak form

efficiency.

2. Phillips perron (PP) test

PP test is a non parametric test from the unit root test

conception. The PP test forces a non paremetric

correction to the t-test statistic and corrects for any

serial correlation and heterocedasticity in the error

term (εt) of the regression test by directly modifying

the tests statistic (Hasan, 2015).

DE

F

=

GHI

"

HJK

"&1

H

L

F

(4)

Where, α = constants, β = coefficient of time trend,

and Y is parameter and ε_t= error term.

Hypothesis testing criteria:

H0: stock returns are not stationary (random)

H1: stock returns are stationary (not random)

If the value of Phillips perron test statistic (tα)

Statistics greater than 1%, 5% & 10% of critical

value and ρ value greater than 5% then we accept

the null hypothesis which mean stock returns are

random (market is weak form efficiency).

2.2.2 Parametric test

1. Unit root test

Unit root test is used to see whether the data random

or not. With the following equation:

DE

F

= α

H

β

"

H

γ

K

"&1

H

M

F

DE

F&1

+

M

N

DE

F&N0

L

F

(5)

Description:

G

= constants

I # OPQRRSOSQTUVPRVUSWQVUXQTY

M # Z[X[WQUQX

\

= lag order of the autoregressive process

DK

= First Difference series of Y

]

= error term

Hypothesis testing criteria:

H

0

: stock returns have a unit root (random)

H

1

: stock returns have not a unit root (not random)

If the value of Augmented Dickey Fuller test

statistic (t

α

) greater than 1%, 5% & 10% critical

value and

\

value greater than 5% then we accept

the null hypothesis which mean stock returns are

random (market is weak form efficiency).

1. Autocorrelation function test (ACF).

Auto autocorrelation function test is examine to

identify the degree of autocorrelation in a time

series. With the following equation:

\

^

#

_

`

_

a

V

(6)

Where

\

^

is autocorrelation function,

b

^

is

covariane on laq k and

b

=

is variance.

Hypothesis testing criteria:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

444

H

0

: no autocorrelation for stock returns of LQ45

index (market is weak form efficiency)

H

1

: there is autocorrelation for stock returns of

LQ45 index (market is inefficient in weak form)

If the autocorrelation function (AC) value heading to

zero and ρ value is less than 5% level of

significance, then the null hypothesis is rejected.

Therefore the historical returns can be used to

predict future returns and this element indicates that

the weak form of market efficiency does not hold.

3 EMPERICAL RESULT

In data analysis method used in this research are

testing the weak form efficiency on the Indonesia

Stock Exchange, this study uses non-parametric test

that is runs test & phillips perron test and parametric

test that is unit root test and autocorrelation function

test.

1. Runs test

Runs test is a non parametric test for serial

dependence in stock return, designed to test whether

the sequence observations are random or not.

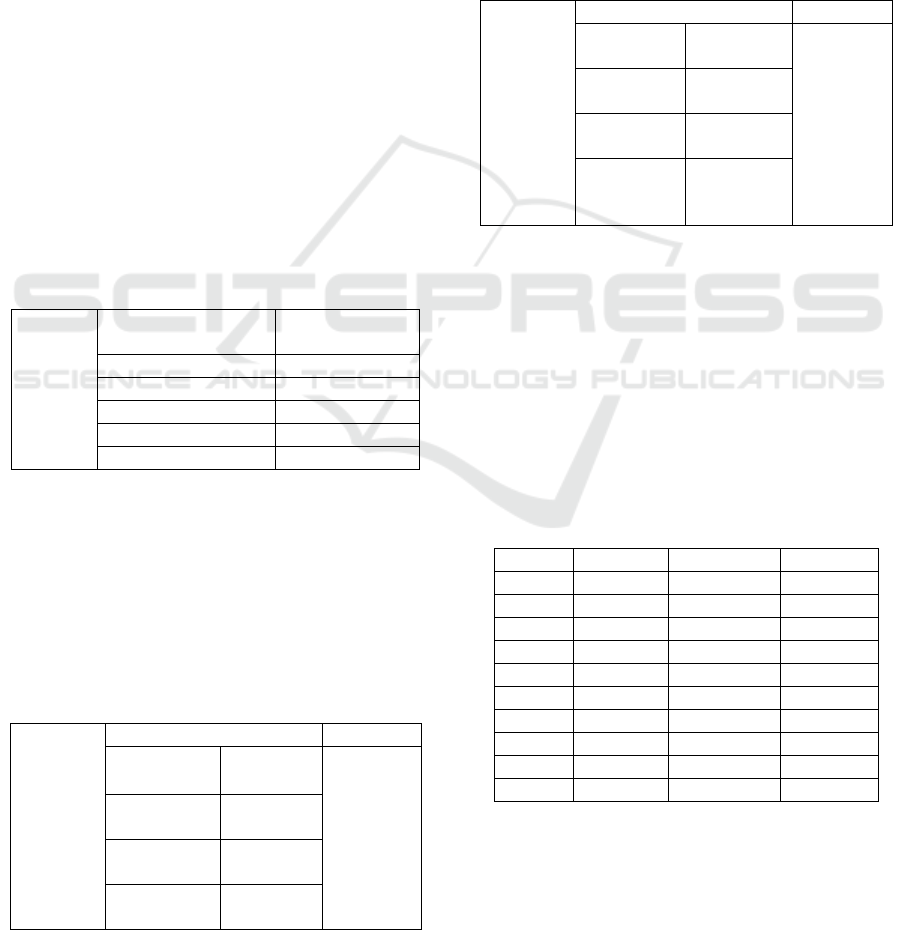

Table 1: Results of runs test LQ45index

Result

(average

)

Number of

Observation

10469

Cases < Test Value

153.2059

Cases >= Test Value

154.7059

Number of Runs

642

Z

-15.5346

\ value

0,00

Based on table 1 it shows that the output result show

that Z-statistic less than 1% and ρ value also less

than 5% level of significance, then we reject the null

hypothesis which mean the market is not weak form

efficiency.

2. Phillips perron (PP) test

PP test is a non parametric test from the unit root test

conception.

Table 2: Results of phillips peron test LQ45index

Result

(Average)

Level 1

st

Difference

Probability

The ADF

statistic

-19.915

0,00

Critical

value at 1%

-3,451561

Critical

value at 5%

-2,870774

Critical

value at 10%

-2,571761

Based on table 2 that the output result show the

Phillips perron test statistic (tα) less than critical

value at the 1%, 5% & 10% level of significance and

ρ value also less than 5% level of significance, then

we reject the null hypothesis which mean stock

returns are stationary (market is not weak form

efficiency).

3. Unit Root Test

This test is used to see whether the time series data

being analyzed is stationary (not random) or not

stationary (random). The results of unit root test

show in table 2.

Table 3: Results of unit root test LQ45ind

Result

(Average)

Level 1

st

Difference

Probability

The ADF

statistic

-19.77776

0,00

Critical

value at 1%

-3,451561

Critical

value at 5%

-2,870774

Critical

value at

10%

-2,571761

Based on table 3 that the output result show the

ADF-statistic (tα) less than critical value at the 1%,

5% & 10% level of significance and ρ value also

less than 5% level of significance, then we reject the

null hypothesis, this gives the same conclusion to the

previous test is the market is not weak form

efficiency.

4. Autocorrelation function test (ACF)

Auto autocorrelation function test is parametric test

examine to identify the degree of autocorrelation in

a time series.

Table 4: Results of autocorrelation test LQ45index

laq

AC

Q-Stat

Prob

1

0.941

275.66

0.000

2

0.895

525.61

0.000

3

0.856

755.19

0.000

4

0.824

968.61

0.000

5

0.804

1172.4

0.000

6

0.786

1367.5

0.000

7

0.762

1551.8

0.000

8

0.743

1727.4

0.000

9

0.725

1895.3

0.000

10

0.710

2056.8

0.000

Based on table 4 it shows that AC value towards

zero and ρ value less than 5%, then we reject the

null hypothesis which is mean the market is not

weak form efficiency or the historical returns can be

used to predict future returns.

Analysis Weak Form Efficiency in Indonesia Stock Exchange Period 2011-2016

445

4 CONCLUSIONS

The result of this study shows that the testing of

weak form efficiency market on Indonesia Stock

Exchange (BEI) during the period of January 2011

to December 2016 by using non parametric test is

runs test & phillips perron test and parametric test is

unit root test and autocorrelation function test,

jointly reject the null hypothesis or in other word

Indonesia Stock Exchange is inefficient in weak

form, this indicates that investors who use technical

analysis can exceed the market returns because

future return can be predicted by historical return.

REFERENCES

Ananzeh, Izz eddien N, (2016). Weak Form Efficiency

of the Amman Stock Exchange: An Empirical

Analysis (2000-2013), “International Journal of

Business and Management”, 11 (1): 173-180.

Arora, Haritika, (2013). Testing Weak Form of

Efficiency of Indian Stock Market, “Pacific

Business Review International”, 5 (12): 16-23.

Borges, Maria Rosa. (2010). Efficient market hypothesis

in European stock market, “’The European Journal

of Finance”, 16 (7): 711–726.

Campbell, L.,&MacKinlay, C., (1997). The econometrics

of financial markets (1st ed).New Jersey: Princeton

University Press.

Claessens, Stijn, Susmita Dasgupta, and Jack Glen.

(1993). "Stock Price Behavior in Emerging

Markets." In Stijn Claessens and Sudarshan

Gooptu, eds. Portfolio Investment in Developing

Countries. “World Bank Discussion Paper” 228.

Washington, D.C.

Copeland, T, & J, F, Weston, (1988). “Financial Theory

and Corporate Policy”, 3

th

ed, N,Y, Addison–

Wesley Publishing Company.

Fama, Eugene F, (1970). “Efficient market: A review of

theory and empirical work”, “Journal of Finance”,

25 (2) : 383-417.

Fawson, Chris, Terry F, Glover, Wenshwo Fang and

Tsangyao Chang, (1996). The weak-form efficiency

of the Taiwan share market, “Article in Applied E

conomics Letters”, (3) : 663–667.

Gimba, Victor K, (2010), Testing the Weak-form

Efficiency Market Hypothesis:

Evidence from Nigerian Stock Market,“CBN

Journal of Applied Statistics”, 3 (1): 117-136.

Gujarati, D. N., 2003. Basic econometric. New York:

McGraw-Hill.

Hasan, Md.Abu, (2015).”Testing Weak form Market

Efficiency of Dhaka Stock Exchange”,”Global

Disclosure ofEconomics and Business”, 4 (2) : 1-

30.

Husnan, Suad, 2005. Dasar-Dasar Teori Portofolio dan

Analisis Sekuritas, Edisi 5, UPP STIM YKPN:

Yogyakarta.

Ikechukwu & Kelikume, (2015) “New Evidence From

The Efficient Market Hypothesis For The Nigerian

Stock Index Using The Wavelet Unit Root Test

Approach, “Proceedings of the Asia Pacific

Conference on Business and Social Sciences 2015,

Kuala Lumpur (in partnership with The Journal of

Developing Areas)”.

Khairunnisa, (2015). “Efficient Market Hypothesis

Revisited: Indonesia Stock Exchange” Seminar

Nasional & Call For Paper, “Forum Manajemen

Indonesia (FMI) ke-7 “Dinamika dan Peran Ilmu

Manajemen Untuk Menghadapi AEC “Jakarta.

Magnusson, Magnus Arni & Bruce Wydick . (2002).

How Efficient Are Africa’s Emerging Stock

Market?, “Journal of Development Studies”, 38 (4)

: 41-156.

Okpara, Godwin Chigozie, (2010). Stock market prices

and the random walk hypothesis: Further evidence

from Nigeria, “Journal of Economics and

International Finance”, 2 (3) : 49-57.

Rahman, Herman Noer, (1991). Capital Market

Efficiency Tests Study and the Relevance of

Dividend Policy “Thesis Faculty of Economics UI

"

Setiawati, Rike, (2013). Hipotesis Pasar Efisien Menuju

Keuangan Perilaku (Suatu Kajian Literatur),

“Jurnal Return”, vol.8

Shaker, Abu Towhid Muhammad, (2013). Testing the

Weak Form Efficiency of the Finnish And Swedish

Stock Markets, “European Journal of Business and

Social Sciences”, 2 (9) : 176-185.

Zhou, Jian & Khoa Cuong Phan, (2014). Market

efficiency in emerging stock markets: A case study of

the Vietnamese stock market, “IOSR Journal of

Business and Management (IOSR-JBM)”, 16 (4): 61-

73.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

446