Identification of Variables That Improve the Reveneus of

Entertainment Tax in the City of Batam City with GRDP Price Apply

as Moderating Variable

Haposan Banjarnahor

1

and Syarif Hidayah Lubis

1

1Faculty of Sosial Sciences and Humanities, Universitas Putera Batam, Batam –Indonesia

Keywords: Entertainment Taxpayer, Number of Population, Number of Foreign Tourists, Inflation

Abstract: This study aims to examine and analyze the effect of the number of entertainment taxpayers, the number of

population, the number of foreign tourists and inflation rate on entertainment tax revenues and the Gross

Regional Domestic Product (GRDP) at current market price as a moderating variable. This study uses

quantitative research by obtaining secondary data while the technique of collecting data is documentation

which is recording and copying the data. The population number of this study is obviously unlimited and the

sampling method is non probability sampling. The data observed are based on the publication data in the

year of 2015 to 2017 which comprises of 36 different data. The study applies multiple linear regression test

models. The study found that all independent variables simultaneously have a positive and significant effect

on dependent variable. The study also found that inflation rate is the only variabel that partially does not

have a significant effect on the dependent variable while the GRDP) at current market price can moderate

each variable towards entertainment tax revenues.

1 INTRODUCTION

Regional autonomy provided by the central

government give the independence and flexibility

for local government to govern and manage

community within its administrative area in

accordance with regulations which in the end is

expected to improve people's welfare. This is

indicated by the issuance of Law No. 32 /2004

which was revised into Law No. 23/2014 concerning

Regional Government (Republik Indonesia, 2014).

The municipality of Batam is one of the regions

that is given the autonomy right to manage its own

government affairs even the city itself is assisted by

the Batam Development Agency (BP Batam) as an

extension of the central government to govern the

city. In carrying out regional autonomy or

governance, the municipal government requires

funds for the operations of its activities as adopted in

the budget for regional expenditure (APBD). The

genuine regional income itself is a very potential

financial source and it must be increased to finance

the expenditure or operations of the government.

The role of regional taxes and levies as the main

source of regional income beside the balance funds

obtained from the exploitation of natural resources

will greatly determine the strength of the Regional

Budget (APBD) (Darwin, 2010). With the existence

of these funding sources, regional communities will

also enjoy their development while in the same time

every citizen must be aware that by increasingly

enjoying the results of development the people's

responsibility for taxes in the implementation of

development is even greater (Wardani and Asis,

2017).

The obligation of a country is to serve the needs

of its people as well as the region. To be able to

serve the needs of the people of the region, the

regions need to be given authority both in terms of

government politics and finance to finance their

activities (Darwin, 2010). Therefore, Law No. 33

/2004 concerning Financial Balance between the

Central Government and the Regional Government

and Law No. 28/2009 concerning Regional Taxes

and Regional Retributions as a source of regional

finance even supported by the existence of the MPR

Decree Number XV/MPR/1998.

Banjarnahor, H. and Lubis, S.

Identification of Variables That Improve the Reveneus of Entertainment Tax in the City of Batam City with GRDP Price Apply as Moderating Variable.

DOI: 10.5220/0009500910111019

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1011-1019

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1011

The Law No. 33/2004 states that every region

has a regional regulation (Perda) under the central

laws or even bound by the central law (Republik

Indonesia, 2004). The municipal governmeny of

Batam issued Perda No. 15/2001 concerning the

regional tax of the municipal as an alternative

financing for the government to implement regional

autonomy (Pemerintah kota Batam, 2001).

In the tax context, considering that Batam

geographical area is an industrial city where the

majority of the population is industrial workers, it

requires entertainment place and facilites to reflect

their mind. The subject of entertainment tax is an

individual who enjoys entertainment and a business

entity that organizes entertainment. Therefore the

large number of residents both domiciled or regional

and foreign tourists have a contribution in

entertainment tax revenues. Even the municipal

governmet itself wants the city to be placed not only

for industrial side but also for tourist destination so

that the increase in taxpayers, residents and tourists

is a potential object for the municipal government to

increase its local income. The size of the central

tax and regional tax revenues will be largely

determined by the population (Musgrave in Lubis,

2017). (Wardhono, Indrawati and Gema, 2012) In

the results of Musgrave’s research, it was stated that

one of the potential taxes is entertainment tax.

"Taxes that are very potential are derived from the

hotel and restaurant tax, entertainment tax, public

street lighting tax and class C mining tax".

The municipal city of Batam is also an area that

is very close to Singapore and Malaysia. The high

number of tourist visitors outside of the region and

abroad as well as the great number of people

working in the city work requires entertainment

faciliies and the tourism sector is expected to

increase the city genuine income (PAD) from the

entertainment tax sector.

Macroeconomic stability is one of the important

conditions for maintaining sustainable growth and

achievement of development targets so that the

inflation rate and per capita income also bring

contribution in entertainment tax revenues. The

inflation rate is one of the important components in

influencing economic stability since inflation and

income are related to the prices of basic and general

goods. Inflation is a process of increasing prices that

prevail in an economy (Sukirno, 2002). Therefore

the public will be more inclined to choose to

withhold financial expenses even for entertainment

and travel if income and expenses are not balanced.

The following data is the target and realization of

the revenues from the entertainment tax in the

municipal city of Batam for the year of 2015-2017.

Table 1: Target & Realization Revenues of

Municipal City of Batam in 2015-2017

Year Realization Target

2015 14,959,000,000 17,471,447,712

2016 20,645,400,000 19,995,079,994

2017 24,608,000,000 23,806,496,302

Source: Dispenda Kota Batam (2018)

2 THEORICAL FRAMEWORK

Local Tax

The definition of tax according to Rochmat

Sumitro in Darise (2009) is “the contribution of the

people to the state treasury based on the law (which

is forced) by not receiving reciprocal services

(counter-achievements) which can be directly shown

and used to pay for public expenditure” (Darise,

2009). While Darwin in a book entitled “regional tax

and regional retribution (2010)”, proposed the

regional taxes in general are taxes those are

collected by the regions based on tax regulations

stipulated by the regions for the benefit of local

government household financing as public legal

entities (Darwin, 2010).

From the above mentioned definition, it can be

concluded that regional taxes have these elements:

obligatory contributions or coercion to the, indirect

or reciprocal benefit for paying taxes and it used for

public or public purposes.

Entertainment Taxpayer

Darise (2009) defines entertainment as all types of

shows, games, dexterity games, and/or crowds with

any name and form, which is watched or enjoyed by

everyone with a fee, not including the use of

facilities for exercise (Darise, 2009). In the local

government regulation, Perda No. 7/2017 on article

17/2 states that “entertainment taxpayers are

individuals or bodies that organize

entertainment”.The object of entertainment tax is

entities or institution that organizes entertainment

and picks up and or receives fees from the business

(Pemerintah kota Batam, 2017). The Perda No.

7/2017 furthermore states the entertainments ranging

from film show; performances of art, music, dance;

bodybuilding, and the like; exhibition; circus,

acrobatics, and magic; billiard game; bowling game;

horse racing/motorized vehicles; fitness center;

sports match; fashion shows, beauty counters;

discotheques, karaoke, night clubs, and the like;

massage parlor, reflection, steam bath/spa; and

dexterity game (Pemerintah kota Batam, 2017).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1012

Number of Population

Population is a number of legitimate people who

inhabit an area or country and obey the provisions of

that region or country. The amount of regional

genuine income can be influenced by the population,

if the population increases, the income drawn will

also increase (Asmuruf, Rumate and Kawung,

2015).

Foreign Tourists

The word "tourist" comes from Sanskrit "wisata"

which means "travel" which can be equated with the

word "travel" in English. Tourists are the same as

the word "traveler" which is a person who travels

(sihotang, 2015). The large number of tourists both

foreign and domestic tourists who visit tourism

objects (Nugraha, 2014).

Inflation

Inflation is a measure of the economy that gives an

idea of the rising average prices of goods and

services produced in an economic system (Yulianti

and Suratno, 2015).

GRDP at Current Market Price

Measuring the progress of an economy requires the

right measuring instrument, in the form of a measure

of economic growth for instance Gross Domestic

Product (GDP) or at the regional level called Gross

Regional Domestic Product (GRDP) which is the

amount of goods or services produced by an

economy within time of one year and stated in

market prices (Supartoyo, Tatuh and Sendouw,

2013).

3 RESEARCH METHOD

Types and Data Sources

The data used in this study are secondary data on

entertainment tax revenues for 3 different years

with monthly observations (time series) from

January 2015 to December 2017. The data consists

of reports on entertainment tax revenues, the number

of entertainment taxpayers, residents, foreign

tourists, inflation and GRDP at market prices in the

municipal city of Batam.

To test the classic assumption on this secondary

data, the researcher conducted a normality test,

multicollinearity test, and autoclaving test.

a. Normality Test

The normality test aims to test whether in the

regression model, the independent variable and the

dependent variable both have a normal distribution

or not (Ghozali, 2013). Normality testing in this

study uses the Kolmogrov-Smirnov testing method

and histogram diagram. The decision making criteria

are:

1. If the value is sig. or probability> 0.05, then the

data is normally distributed.

2. If the value is sig. or probability <0.05, then the

data is not normally distributed.

It can also be seen on the histogram diagram

where the basis for decision making is that if the

histogram chart is not leaning left and right, the

research data is normally distributed, and vice versa.

b. Multicolliearity Test

The multicollinearity test was conducted with the

aim to find out whether the regression model found a

correlation between the independent variables. To

detect whether a regression model has

multicollinearity, it can be checked b using VIF.

VIF stands for Variance Inflation Factor. VIF value

<10 means that there is no serious multicollinearity

in the regression model.

c. Heterocedasticity Test

Heterocedasticity is a residual variant that is not

constant in regression so that the accuracy of the

predicted results becomes dubious. The model used

is to use a scaterplot graph. Multiple linear

regression models are said to have no

heterocedasticity if the physical residue does not

form a pattern so the data is free from assumptions

about heterocedasticity.

d. Auto Correlation Test

The auto correlation test aims to test whether in the

model, linear regression there is a correlation

between disturbing errors in period t with errors in

period t-1 (before). This problem arises because the

residuals are not free from one observation to

another. Detection of the presence or absence of

autocorrelation in this study is by looking at the

calculated value of Durbin Watson by selecting the

following autocorrelation test:

a. If d <dL, there is autocorrelation

b. If d> dU there is no autocorrelation

If dL <d <dU then the test is not convincing or there

are no definite conclusions.

Multiple Regression Test

To find out the influence of the independent

variables partially and simultaneously has a

significant effect on the dependent variable; the

statistical analysis used is to use multiple regression

analysis. The testing of the moderating variable uses

the residual test, where the multiple regression

Identification of Variables That Improve the Reveneus of Entertainment Tax in the City of Batam City with GRDP Price Apply as

Moderating Variable

1013

equation in model I and residual test in model II,

namely:

Y =

0

+ β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ ε…….

Y = Entertainment Tax Receipt Report

b0 = Intercept

b1=Regression Coefficient Number of entertainment

taxpayers

b2 = Population Regression Coefficient

b3 = Regression coefficient of foreign tourists

b4 = Inflation Regression Coefficient

X1 = Number of entertainment taxpayers

X2 = Number of residents

X3 = Number of foreign tourists

X4 = Inflation

Y = Entertainment tax review report

E = error

Research Hypothesis Test

The method used to test the first hypothesis uses

multiple regression analysis. The first hypothesis is

tested by determining the level of significance with

the simultaneous test (F test and R2 Test) and the

partial test (t- test) as follows:

a. Determination Test (R

2

)

Determination Test (R2) is used to measure the

extent of the ability of the model to explain the

variation of the dependent variable. The coefficient

of determination is between zero and one. A value

close to one means that the independent variables

provide almost all the information needed to predict

variations in the dependent variable. From the above

research using more than 2 variables, then adjusted

R square is used because it is more accurate than R2.

b.Test F Statistic (Simultaneous Significance

Test)

F test aims to determine the effect of independent

variables and the dependent variable simultaneously.

To find out whether there is a significant effect of

each independent variable on a dependent variable.

Significantly free at 0.05, can be concluded

(Ghozali, 2013). Guidelines used to accept or reject

hypotheses, which is: The hypothesis is accepted if

F-count> F-table, or p-value in the sig column.

<level of significant (α) 5%. The hypothesis is

accepted if F-count <F-table, or p-value in the sig

column. > level of significant (α) 5%.

c. Statistical test t (Partial Significance Test)

The t statistical test basically shows how far the

influence of one explanatory variable individually in

explaining the dependent variables (Kuncoro, 2013).

This test is used to determine the effect of the

number of taxpayers, population numbers, number

of foreign tourists, the number of variable inflation

towards variables, namely entertainment tax

receipts. Guidelines used to accept or reject

hypotheses, which is: The hypothesis is accepted if t

count> t-table or p-value in the sig column <level of

significant (α) 5%. The hypothesis is accepted if t

count <t-table or p-value in the sig column. > level

of significant (α) 5%.

d. Moderation Test (Residual Test)

Moderation Test (residual test) is used to test

whether the variable Z (GRDP) is able to moderate

the relationship between variables X to variable Y.

The calculation in this study, first calculated the

correlation coefficient using SPSS 19 with model I

as follows:

Z = α + bıXı + b2X2 + b3X3 + b4X4 + e ... (1)

| e | = α + b5Y .... (2)

4 ANALYSIS

To test the classic assumption on this secondary

data, the researcher conducted a normality test,

multicollinearity test, and autoclaving test.

a. Normality Test

The normality test aims to test whether in the

regression model, the independent variable and the

dependent variable both have a normal distribution

or not (Ghozali, 2013). Normality testing in this

study uses the Kolmogrov-Smirnov testing method

and histogram diagram. The decision making criteria

are:

1. If the value is sig. or probability> 0.05, then

the data is normally distributed.

2. If the value is sig. or probability <0.05, then

the data is not normally distributed.

It can also be seen on the histogram diagram where

the basis for decision making is that if the histogram

chart is not leaning left and right, the research data is

normally distributed, and vice versa.

b. Multicolliearity Test

The multicollinearity test was conducted with the

aim to find out whether the regression model found a

correlation between the independent variables. To

detect whether a regression model has

multicollinearity, it can be checked b using VIF.

VIF stands for Variance Inflation Factor. VIF value

<10 means that there is no serious multicollinearity

in the regression model.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1014

c. Heterocedasticity Test

Heterocedasticity is a residual variant that is not

constant in regression so that the accuracy of the

predicted results becomes dubious. The model used

is to use a scaterplot graph. Multiple linear

regression models are said to have no

heterocedasticity if the physical residue does not

form a pattern so the data is free from assumptions

about heterocedasticity.

d. Auto Correlation Test

The auto correlation test aims to test whether in the

model, linear regression there is a correlation

between disturbing errors in period t with errors in

period t-1 (before). This problem arises because the

residuals are not free from one observation to

another. Detection of the presence or absence of

autocorrelation in this study is by looking at the

calculated value of Durbin Watson by selecting the

following autocorrelation test:

a. If d <dL, there is autocorrelation

b. If d> dU there is no autocorrelation

c. If dL <d <dU then the test is not convincing or

there are no definite conclusions.

Multiple Regression Test

To find out the influence of the independent

variables partially and simultaneously has a

significant effect on the dependent variable; the

statistical analysis used is to use multiple regression

analysis. The testing of the moderating variable uses

the residual test, where the multiple regression

equation.

Research Hypothesis Test

The method used to test the first hypothesis uses

multiple regression analysis. The first hypothesis is

tested by determining the level of significance with

the simultaneous test (F test and R2 Test) and the

partial test (t- test) as follows:

a. Determination Test (R2)

Determination Test (R2) is used to measure the

extent of the ability of the model to explain the

variation of the dependent variable. The coefficient

of determination is between zero and one. A value

close to one means that the independent variables

provide almost all the information needed to predict

variations in the dependent variable. From the above

research using more than 2 variables, then adjusted

R square is used because it is more accurate than R2.

b.Test F Statistic (Simultaneous Significance

Test)

F test aims to determine the effect of independent

variables and the dependent variable simultaneously.

To find out whether there is a significant effect of

each independent variable on a dependent variable.

Significantly free at 0.05, can be concluded

(Ghozali, 2013: 98 ) Guidelines used to accept or

reject hypotheses, which is: The hypothesis is

accepted if F-count> F-table, or p-value in the sig

column. <level of significant (α) 5%. The hypothesis

is accepted if F-count <F-table, or p-value in the sig

column. > level of significant (α) 5%.

c. Statistical test t (Partial Significance Test)

The t statistical test basically shows how far the

influence of one explanatory variable individually in

explaining the dependent variables (Kuncoro, 2013).

This test is used to determine the effect of the

number of taxpayers, population numbers, number

of foreign tourists, the number of variable inflation

towards variables, namely entertainment tax

receipts. Guidelines used to accept or reject

hypotheses, which is: The hypothesis is accepted if t

count> t-table or p-value in the sig column <level of

significant (α) 5%. The hypothesis is accepted if t

count <t-table or p-value in the sig column. > level

of significant (α) 5%.

d. Moderation Test (Residual Test)

Moderation Test (residual test) is used to test

whether the variable Z (GRDP) is able to moderate

the relationship between variables X to variable Y.

The calculation in this study, first calculated the

correlation coefficient using SPSS 19.

5 RESULTS AND DISCUSSION

The result of the study are described as follows:

Classical Assumption Test Results

a. Normality test

The above normality test table found a significance

value of 0.986 so that it can be said explicitly that

the dependent variable has been normally

distributed.

Tabel 2: Normality test

One-Sample Kolmogorov-Smirnov Test

Entertainment

Tax Receipt

N 36

Normal Mean 1702028443

Identification of Variables That Improve the Reveneus of Entertainment Tax in the City of Batam City with GRDP Price Apply as

Moderating Variable

1015

Parameters

a,b

Std. Deviation 254709276.3

Most

Extreme

Differences

Absolute 0.076

Positive 0.076

Negative -0.068

Kolmogorov-Smirnov Z 0.453

Asymp. Sig. (2-tailed) 0.986

a. Test distribution is Normal.

b. Calculated from data.

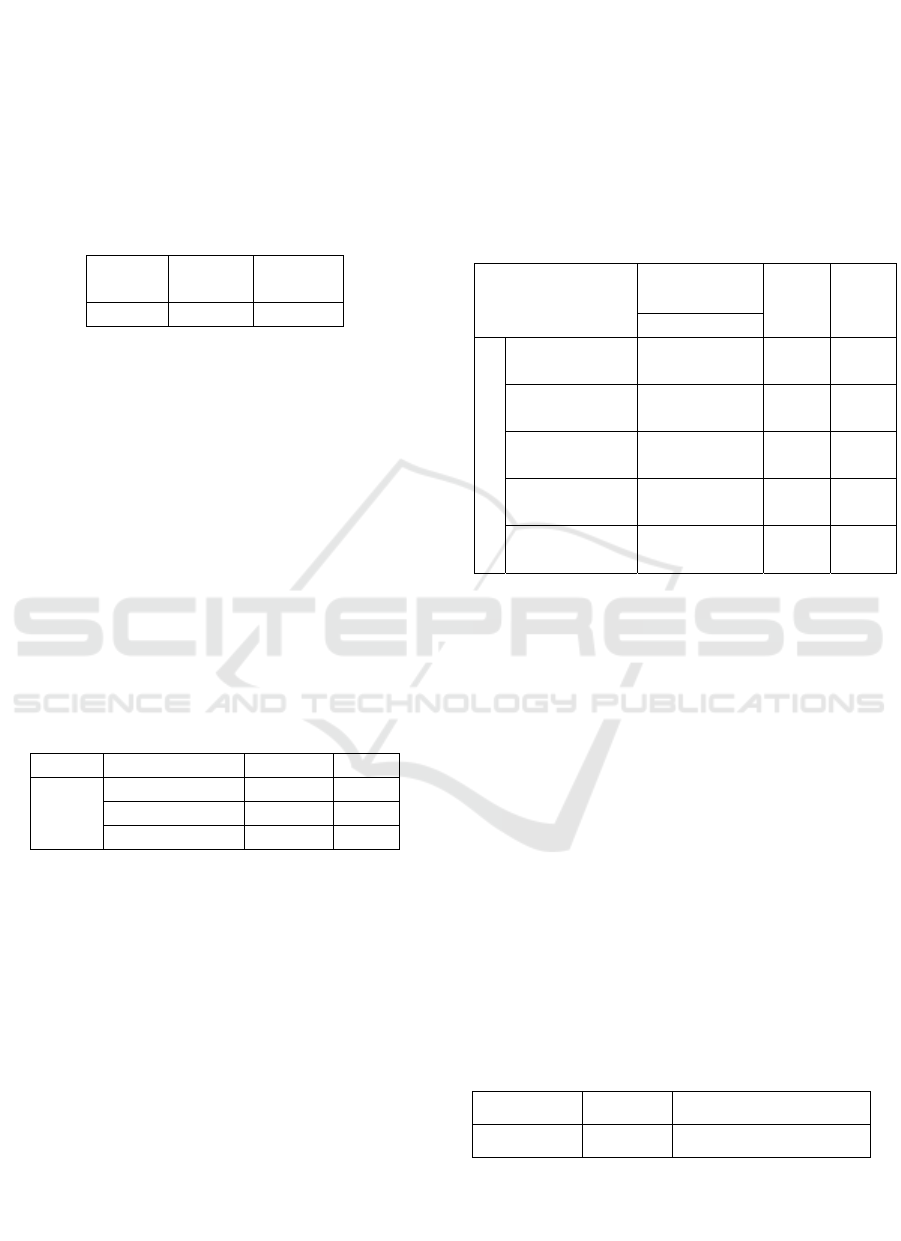

b. Multicolliearity Test

Table 3: Multicolliearity Test

Coefficients

a

Model

Collinearity Statistics

Tolerance VIF

entertainment

taxpayer

0.944 1.059

number of

population

1.000 1.000

Number of foreign

tourists

0.960 1.042

inflation 0.979 1.022

GRDP prices apply 1.000 1.000

a. Dependent Variable: entertainment tax revenue

Based on the table above, it shows that the tolerance

value of statistics is ≤ 0.10 and VIF ≤ 10. So it can

be concluded that there is no multicolliearity or

correlation between independent variables.

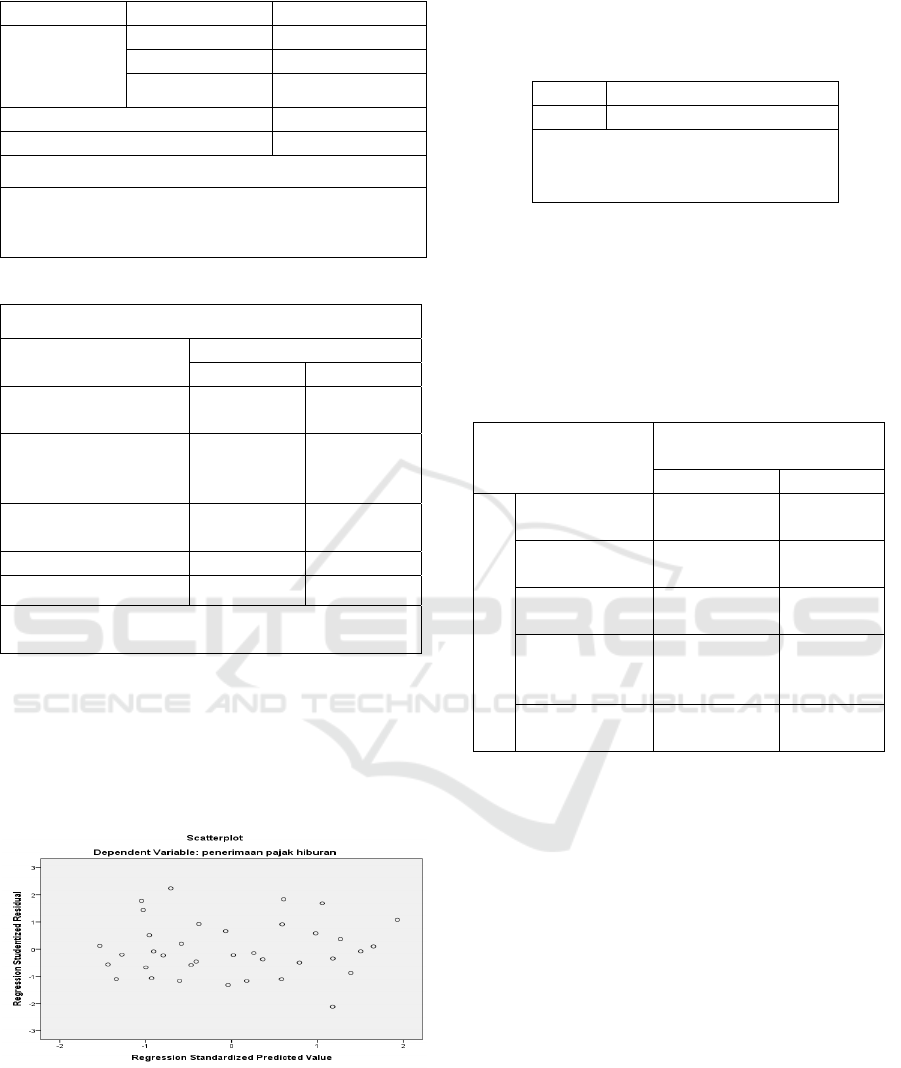

c. Heteroscedasticity

Figure 1: Scatterplot Heteroscedasticity

Based on the scatter plot above it can be seen

that there are spots that spread randomly, do not

form a certain pattern or are irregular so that the

linear regression model can be said to have no

heterocedasticity.

d. Autocorrelation Test

Table 4: Autocorrelation Test

Model Durbin-Watson

1 2.187

b. Dependent Variable:

entertainment tax revenue

In the above test results there is a Durbin-Watson

value of 2.187 while the sig 5% table value with n =

36 and the number k = 5 dU = 1.799 and dL = 1.175

means that in this table d> dU or 2.187> 1.799

means that autocorrelation does not occur.

Multiple Regression Test

Table 5: Multiple Regression Test

Model

Unstandardized

Coefficients

B Std. Error

1

(Constant) -987263383

79806896

77

entertainment

taxpayer

4585907.06

652159.0

92

Number of

population

5204.509 561.447

Number of

foreign

tourists

799.267 1577.955

Inflation -46873988

76185015

.6

a. Dependent Variable: Penerimaan

Based on the equation above, we can explain the

results of multiple linear regression tests as follows:

1. If the taxpayer (X1) experiences an increase of

one taxpayer, entertainment tax revenue (Y) has

increased by Rp. 4,585,907. In other words, if

there is an increase in entertainment tax

revenues, this is due to the increase in taxpayer

objects.

2. If the population (X2) has increased by one

person, then entertainment tax revenue (Y) has

increased by Rp. 5.204 In other words, if there is

an increase in entertainment tax revenues, this is

due to the increase in the number of residents

who enjoy every entertainment held.

3. If foreign tourists (X3) experience a one-person

increase, entertainment tax revenue (Y) will

increase by Rp. 799. In other words, if there is an

increase in entertainment tax revenues, this is

due to the increase in the number of foreign

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1016

tourists who come and enjoy every entertainment

held.

4. If inflation (X4) experiences a one percent

increase, entertainment tax revenue (Y) has

decreased by Rp. 46,883,988. In other words, if

there is a decline in entertainment tax revenues,

this is due to rising inflation.

Test of Research Hypothesis

Table 6: Coefficient of Determination

Model Summary

Model R

R

Square

1 .827

a

0.683

a. Predictors: (Constant), (Constant), inflation,

Foreign tourists, entertainment taxpayer, total

population

Based on the table above, the value of the coefficient

(R) is 0.827 which shows the relationship between

the variables that are strong, with the coefficient of

determination (R square) of 0.683 in the medium

category. This value means that the variable number

of taxpayers, population growth, number of vehicles

and inflation can explain the variable of

entertainment tax receipts of 68.3%. While the rest

is influenced by other variables those are not

examined in the study.

Test F (Test Simultaneously)

Table 7: F Test (Test Simultaneously)

ANOVA

a

Model F Sig.

1

Regression 11.332 .000

b

Residual

Total

a. Dependent Variable: entertainment tax

revenue

b. Predictors: (Constant), inflation, Foreign

tourists, entertainment taxpayer, number of

population

In the table above, it can be seen that the

calculated F value is 11.332 with a significance of

0.000. With the use of a significance level (α) of 5%.

Based on the table obtained significant 0,000 <0.05

with a ratio of significant levels (α) of 5% shows

that simultaneously the variable number of

taxpayers, population, number of foreign tourists,

and inflation have a significant effect on

entertainment tax revenue. The results are

strengthened by comparing between F = 11.332

which is far greater than F

table

which is 2.53 where

F

table

is calculated using the provisions of a

significance level of 5%, with df = nk-1 (in this

study df = 36-5-1 = 30) , so that the obtained value

of F

table

is 2.53, then F

count

> F

table

or 11.332> 2.53 so

that it can be concluded that simultaneously all

independent variables have a positive and significant

effect or H

1

is accepted.

T test (Partial Test)

Table 8: T Test (Partial Test)

Coefficients

a

Model

Standardized

Coefficients

t Sig.

Beta

1

(Constant)

-

0.124

0.903

entertainment

taxpayer

0.821 7.032 0.000

Number of

population

0.846 9.270 0.000

Foreign

tourists

0.063 0.507 0.618

inflation -0.078

-

0.615

0.545

Based on the regression table above can be

explained as follows:

1 t

count

value (7,032)> t

table

(2,042) and significant

value (0,000) <0,05, then the number of

taxpayers has a significant effect on

entertainment tax revenue

2 t

count

(9.270)> t

table

(2,042) and significant value

(0,000) <0.05, then the population has a

significant effect on entertainment tax revenue.

3 t

count

(0.507) <t

table

(2,042) and significant value

(0,618)> 0.05, then the number of foreign

tourists does not significantly influence

entertainment tax revenue

Value of t

count

(-0.615) <t

table

(2,042) and

significant value (0,545)> 0.05, then inflation does

not have a significant effect on entertainment tax

revenue.

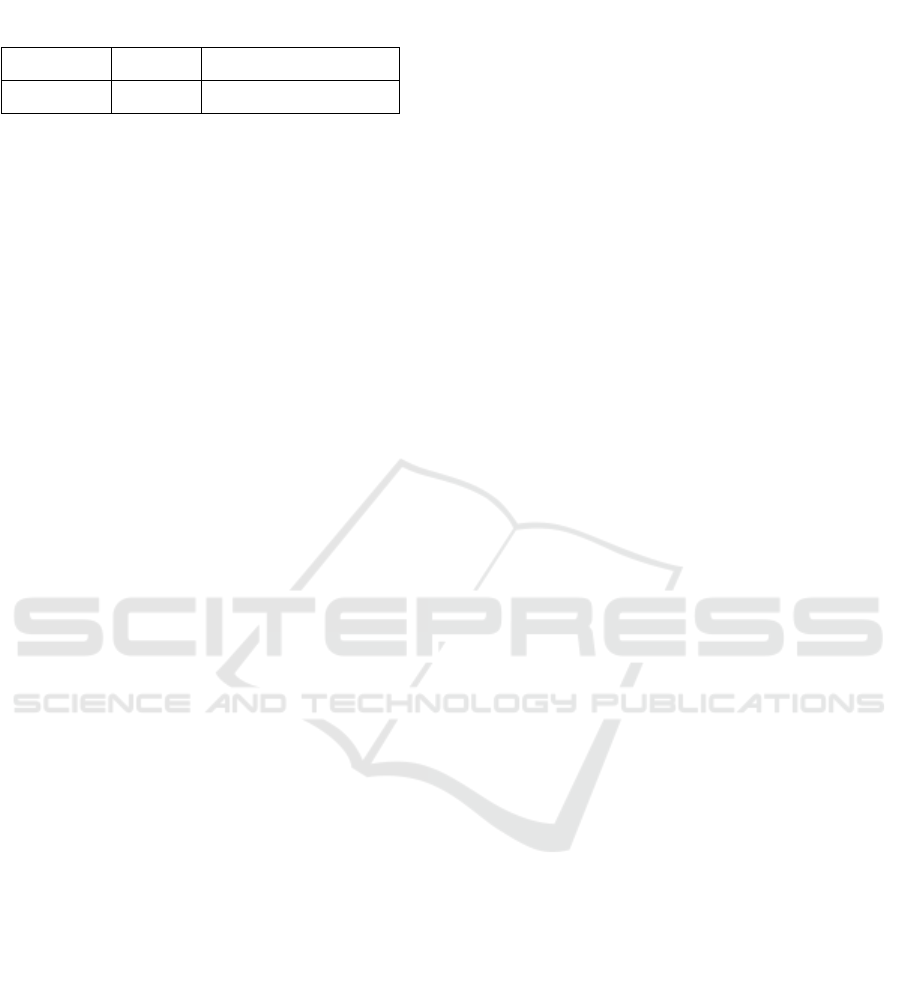

Moderation Test (Residual Test)

Table 9: Residual Test Model 1

Model Summary

Model R R Square

1 .827

a

.683

a. Predictors: (Constant), (Constant), inflation,

Foreign tourists, entertainment taxpayer, total

populationa. Predictors: (Constant), Inflasi,

WISMAN, WP Hiburan, Jumlah Penduduk

Identification of Variables That Improve the Reveneus of Entertainment Tax in the City of Batam City with GRDP Price Apply as

Moderating Variable

1017

Table 10: Residual Test Model 2

Model Summary

Model R R Square

1 .833

a

.693

a. Predictors: (Constant), PDRB Harga Berlaku,

WISMAN, Inflasi, WP Hiburan, Julmalah Penduduk

The first R Square value is 0.827 or 82.7%

while after the second equation R2 increases to

0.833 or 83.3%. Thus it can be concluded that the

presence of price GDP applies moderating variable

(Z) will be able to strengthen the relationship

between the number of residents, the number of

entertainment taxpayers, inflation, and the number

of foreign tourists to entertainment tax revenues.

Based on the data analysis above, this study

present findings as follows:

1 The results of the partial test shows that the

influence of the number of entertainment

taxpayers has a significant effect on entertainment

tax revenue which is the significant value of

0,000 smaller than α = 0.05. The results are in line

with the study conducted by Iranti Ratna Susanto

which states that the object of entertainment tax

has an effect on entertainment tax revenues. This

is also in accordance with the theory that the more

tax objects, the more revenues.

2 The results of the partial test shows that the

influence number of population has a significant

effect on entertainment tax revenue. This can be

seen with a significant value of 0,000 smaller than

α = 0.05. The results are in line with the cohesive

study which states that population growth has a

significant effect on economic growth in Demak

Regency.

3 The number of foreign tourists has no significant

effect on entertainment tax revenues. A significant

value of 0.618 is greater than the value of α =

0.05. This is because the municipal city of Batam

was originally initiated by as an industrial city, but

lately the government has also initiated to become

a tourist city.

4 Inflation does not have a significant effect on

entertainment tax revenues. A significant value of

0.545 is greater than the value of α = 0.05. This is

because the average inflation is still in the low

category so that inflation does not give a bad

effect to the economy but encourages the economy

to be better. This result is not in line with the

research conducted by Olivia & Ivan Yudianto

which states that inflation has a significant

positive influence.

The results of the analysis of the value of the first R

Square are 0.722 or 72.2% while after the equation

the second R2 has risen to 0.727 or 72.7%. Thus it

can be concluded that the presence of price GDP

applies moderating variable (Z) will be able to

strengthen the relationship between the number of

residents, the number of entertainment taxpayers,

inflation, and the number of foreign tourists to

entertainment tax revenues.

6 CONCLUSIONS

The study concludes that all independent variables

simultaneously have a positive and significant effect

on entertainment tax revenue. Meanwhile the

taxpayers, population and number of foreign tourists

also partially have a significant effect on

entertainment tax revenues but inflation has no

significant influence. The GRDP at current market

price is able to moderate the influence of the

number of taxpayers, population, number of foreign

tourists and inflation on entertainment tax revenues.

REFERENCES

Asmuruf, M. F., Rumate, V. A. and Kawung, G. M. .

(2015) ‘Pengaruh Pendapatan dan Jumlah Penduduk

Terhadap Pendapatan Asli Darah (PAD) Di Kota

Sorong’, Jurnal Berkala Ilmiah Efisiensi, Vol, 15 No.

Darise, N. (2009) Pengelolaan Keuangan Daerah. 2nd edn.

Jakarta: Indeks Permata Puri Media.

Darwin (2010) Pajak Daerah & Retribusi Daerah. Jakarta:

Mitra Wcana Media.

Ghozali, I. (2013) Aplikasi Analisis Multivariate dengan

Program SPSS. Edisi 5. Semarang: BP Undip.

Kuncoro, M. (2013) Metode Riset untuk Bisnis dan

Ekonomi. Jakarta: Erlangga.

Musgrave in Lubis (2017) Faktor-Faktor yang

Mempengaruhi Penerimaan Pajak Parkir Di Kota

Medan dengan PDRB Sebagai Variabel Moderating.

Universitas Sumatera Utara.

Nugraha (2014) Pengaruh Jumlah Kunjungan Wisatawan

Terhadap Pajak Hiburan , Pajak Hotel, Pajak Restoran

dan Pendapatan Asli Daerah Kota Bandung Tahun

2005. Universitas Pendidikan Indonesia.

Pemerintah kota Batam (2001) ‘Perda No. 15 Tahun 2001

Tentang Pajak Daerah Kota Batam’, in.

Pemerintah kota Batam (2017) Peraturan Daerah Kota

Batam No 1 Tahun 2017. Batam.

Republik Indonesia (2004) ‘Undang-undang No. 33 Tahun

2004 Tentang Perimbangan Keuangan Antara

Pemerintah Pusat dan Pemerintah Daerah’, in.

Indonesia.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1018

Republik Indonesia (2014) ‘Undang-Undang No. 23

Tahun 2014 Tentang Pemerintahan Daerah’, in.

sihotang, Y. (2015) ‘Kaitan Jumlah Wisatawan Terhadap

Pendapatan Asli Daerah Provinsi DKI Jakarta Tahun

2009-2013’, Jurnal Riset Akuntansi Universitas

Komputer Indonesia, Volume VII.

Sukirno, S. (2002) Makro Ekonomi Teori Pengantar.

Supartoyo, Y. H., Tatuh, J. and Sendouw, R. H. E. (2013)

‘The Economic Growth and The Regional

Charactheristic: The Case of Indonesia’, Sekolah

Pasca sarjana Institut Pertanian Bogor. JEL

Classification: O47, C23, R11.

Wardani, D. K. and Asis, M. R. (2017) ‘Pengaruh

Pengetahuan Wajib Pajak, Kesadaran Wajib Pajak,

Dan Program Samsat CornerTerhadap Kepatuhan

Wajib Pajak Kendaraan Bermotor’, Jurnal Akuntansi,

5(1), p. 15. doi: 10.24964/ja.v5i1.253.

Wardhono, A., Indrawati, Y. and Gema, C. (2012) ‘Kajian

Pemetaan Dan Optimalisasi Potensi Pajak Dalam

Rangka Meningkatkan Pendapatan Asli Daerah (Pad)

Di Kabupaten Jember’, VII(2), pp. 69–76.

Yulianti, E. B. and Suratno (2015) ‘Return on Equity ,

Debt to Equity Ratio, Price Earning Ratio, Assets

Growth, Inflasi dan Return Saham Perusahaan

Property dan Real Estate’, Jurnal Riset Akuntansi dan

Perpajakan JRAP, Vol. 2, No.

Identification of Variables That Improve the Reveneus of Entertainment Tax in the City of Batam City with GRDP Price Apply as

Moderating Variable

1019