Effect of the Quality of Human Resource, Information System of Re

g

ional

Financial Management, and Regional Asset Management toward the

Quality of Financial Statement of Regional Staff Organization in the Deli

Serdang Regency Government

Haryanto

1

, Khaira Amalia Fachrudin

1

and Yeni Absah

2

1

Graduate Program in Management, Universitas Sumatra Utara, Medan, Indonesia

2

Faculty of Economics and Business, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Human Resource, Information System, Asset, Financial Statement

Abstract: This research aims to find out and analyze the effect of the quality of human resource, information system

of regional financial management, and regional asset management toward the quality of financial statement

of regional staff organization in the Deli Serdang Regency Government. This is a causal research that uses

primary data. The research population is all regional staff organizations in the Deli Serdang Regency

Government which amounts to 54 organizations. The research sampling takes all populations to be the

samples. The Research Analysis Unit is the Officials of Financial Administration in the regional staff

organization in the Deli Serdang Regency Government consisting of 54 people. The data collection method

of the research was conducted by distributing questionnaires. The hypothesis testing was carried out using

multiple linear regression analysis. The findings showed that the quality of human resource, information

system of regional financial management and regional asset management simultaneously has significant

effect on the quality of financial statement of regional staff organization. Partially, the quality of human

resource and information system for regional financial management has significant effect on the quality of

financial statement of regional staff organization. Meanwhile, the regional asset management does not have

a significant effect on the quality of the financial statement of regional staff organization.

1 INTRODUCTION

(Law No 23 of 2014) and (Law No 33 of 2004),

concerning regional government and central and

regional financial balances, provide broad authority

to regions to organize good and clean government.

The delegation of authority is accompanied by the

submission and transfer of funding, facilities and

infrastructure, and human resources (HR) within the

framework of Fiscal Decentralization.

The quality of financial statement can explain

four qualitative characteristics of financial statement

(reliable, relevant, understandable and comparable);

i.e. financial statement that meets normative

requirements in the presentation to local

governments so that they can meet the expected

quality.(Bastian, 2005) stated that the financial

statement of the regional government is part of the

financial reporting process that presents a structured

financial position of transactions carried out by a

regional government entity. The Financial Statement

of Regional Government (LKPD) basically is a joint

or consolidated result from the financial statement of

Regional Staff Organization (OPD).

The quality of good financial statement requires

the quality of human resource that can apply the

accounting logic to the preparation of financial

statement of regional government. The quality of

human resource is the ability of human resources to

carry out their duties and responsibilities with the

provision of adequate education, training and

experience (Husna, 2013).Furthermore, Werther and

Davis in (Sutrisno, 2011)suggested that human

resources are employees who are ready, capable, and

alert to achieving organizational goals.

Based on preliminary observations of Human

Resources in the Deli Serdang Regency

Government, there were still agency employees,

1020

Haryanto, ., Fachrudin, K. and Absah, Y.

Effect of the Quality of Human Resource, Information System of Regional Financial Management, and Regional Asset Management toward the Quality of Financial Statement of Regional

Staff Organization in the Deli Serdang Regency Government.

DOI: 10.5220/0009501110201027

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1020-1027

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

who were in charge of the financial and asset sub-

sections, especially those who held positions as

Financial Administration Officers (PPK), were not

supported by accounting education. This condition is

contrary to good management principles that adhere

to the principle of ‘the right man in the right place’.

The Deli Serdang District Government has

utilized a computer-based information system of

regional financial management through financial

applications made by the Financial and

Development Supervisory Agency (SIMK) named

the Information System of Regional Management

(SIMDA) since 2014. By the use of SIMDA

application, every financial management within the

Deli Serdang Regency Government ran quickly in

obtaining data; for instance, how much is the

percentage of fund absorption for each activity in the

Deli Serdang Regional Government from time to

time. The final results of the information system of

regional financial management can be in the forms

required by regional organizational financial

managers (OPD); among others, periodic reports and

annual reports.

At the 2016 examination of Deli Serdang

Regency LKPD by the Supreme Audit Agency of

the Republic of Indonesia (BPK RI) from North

Sumatra representatives, they still found a fixed

asset inventory that was problematic and was not in

accordance with government accounting standards in

the OPD of Education Office, Public Works Agency

and Spatial Planning and Office of Housing and

Settlement Areas. The Head of Accounting

Subdivision of the Regional Financial and Asset

Management Agency of Deli Serdang Regency

mentioned that the findings of the problematic

inventory of assets in the OPD were land under the

road and irrigation of the working area of Deli

Serdang Regency which had not yet been certified

and had poor asset order which means that the asset

records still overlap among the OPDs.

2 RESEARCH METHOD

This research was conducted through a scientific

approach using theoretical structures to construct

one or more hypotheses that require quantitative

testing and statistics. This research examines the

Effect of Quality of Human Resource, Information

System of Regional Financial Management and

Regional Asset Management toward the Quality of

Financial Statement of Regional Staff Organization

(OPD) in Deli Serdang Regency Government. The

authors applied causal research using quantitative

approach. Causal research is conducted to

investigate causal correlation by observing the

consequences that occur and the factors (causes) that

cause the possibility of these consequences. In this

research, the independent variable (cause) is the

variable that affects dependent variable and vice

versa (Sinulingga, 2017).

This research was conducted at the Regional

Staff Organization (OPD) within the Deli Serdang

Regency Government from March 2018 to June

2018. The research population was the Regional

Staff Organization (OPD) within the Deli Serdang

Regency Government which amounted to 54 OPDs.

The research sampling applied the Census Method.

Saturated sampling or census method is a sampling

technique used when all members of the population

are used as samples (Sugiyono, 2004).The research

sampling took all populations as the samples as

many as 54 respondents. The Research Analysis

Unit is the Officials of Financial Administration

(PPK) of OPD in the Deli Serdang Regency

Government, amounted to 54 people.

2.1 Transforming Ordinal Data into Interval

Data using the Method of Successive Interval

(MSI)

(Erlina, 2011) mentioned that parametric statistical

analysis requires at least an interval measuring scale.

Meanwhile, field data is mostly in the form of data

with ordinal measuring scales. Interval data occupies

“higher” level of measurement of data than ordinal

data because in addition to being multilevel, the

sequence can also be quantified. Interval data has

nominal (classification) and ordinal (sequence)

characteristics. The advantage of interval data is that

it can be compared in absolute terms, which is not

owned by ordinal data. However, it does not have an

absolute zero value as in the ratio data. Research,

that uses regression, path analysis, or the similar

things, requires data with the interval scale.

However, most of the data we get through

questionnaires has an ordinal scale. Therefore, to

process it, the data must be increased to the interval

scale first. One method of data conversion that is

often used by researchers to increase the level of

ordinal measurement into intervals is the Method of

Successive Interval (MSI).

2.2 Multiple Regression Analysis

Multiple Regression Testing is carried out by

applying a multiple linear regression equation test.

Multiple linear regression analysis is a linear

correlation between two or more independent

variables (X1, X2, X3, X4, ……Xn) with the

Effect of the Quality of Human Resource, Information System of Regional Financial Management, and Regional Asset Management toward

the Quality of Financial Statement of Regional Staff Organization in the Deli Serdang Regency Government

1021

dependent variable (Y). This analysis is carried out

to determine the direction of the correlation between

the independent variable and the dependent variable

whether each independent variable is positively or

negatively correlated. In addition, it functions to

predict the value of the dependent variable if the

value of the independent variable increases or

decreases. The data used usually has interval or ratio

scale. This model is used to test whether there is a

causal correlation between the two variables to

examine how much effect between the independent

variables on the dependent variable (Quality of

Financial Statement of Regional Staff Organization

(OPD)). The equation of multiple linear regression

used in this research is as follows:

Y= a + β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ e

Description:

Y = (Quality of Financial Statement of

Regional Staff Organization (OPD))

A = Constants (Y value, if X = 0)

β

1

, β

2

, β

3

= Regression Coefficient

X

1

= Quality of HR

X

2

= Information System of Financial

Management

X

3

= Asset Management

e = error term

2.3 Testing of Research Hypotheses

2.3.1 Simultaneous Hypothesis Testing (F-Test)

It is used to simultaneously determine the effect of

independent variables consisting of the Quality of

Human Resource, Information System of Financial

Management and Asset Management which

significantly affect the Quality of Financial

Statement of OPD in Deli Serdang Regency

Government with confidence level of 95% (α = 5%

or 0.05).

The hypothesis model of the F-test includes:

a. If the significance value is > 0.05, H1 is rejected

and H0 is accepted. It means that all independent

variables do not have simultaneous effect on the

dependent variable.

b. If the significance value is < 0.05, H1 is accepted

and H0 is rejected. It means that all independent

variables have simultaneous effect on the

dependent or bound variable.

2.3.2 Partial Hypothesis Testing (t-test)

It is used to partially determine the effect of

independent variables consisting of the Quality of

Human Resource, Information System of Financial

Management and Asset Management which

significantly affect the Quality of Financial

Statement of OPD in Deli Serdang Regency

Government with confidence level of 95% (α = 5%

or 0.05). Test criteria based on probability are as

follows:

a. If the probability (significance) > 0.05 (α), the

independent variables individually do not affect

the dependent variable.

b. If the probability (significance) < 0.05 (α), the

independent variables individually affect the

dependent variable.

2.3.3 Coefficient of Determination (Adjusted R

2

)

The coefficient of determination (R

2

) aims to

measure to what extent the ability of the model to

explain the variation of the dependent variable. The

value of the coefficient of determination is between

0 and 1. The value of R

2

reflects the ability of

independent variables to explain the very limited

variation of the dependent variable. The fundamental

weakness of the use of the coefficient of

determination is the bias towards the number of

independent variables in the model. Every additional

1 independent variable, the value of R

2

must

increase no matter the variable has a significant

effect on the dependent variable or not. Therefore,

many researchers recommend to use Adjusted R

2

(Ghozali, 2006).

3 FINDINGS

3.1 Multiple Linear Regression Test

Regression analysis is used to determine the effect

of the quality of human resource, information

system of regional financial management and

regional asset management towards the quality of

financial statement. In this study, n = 54 at a

significant level of 5% or α = 0.05.

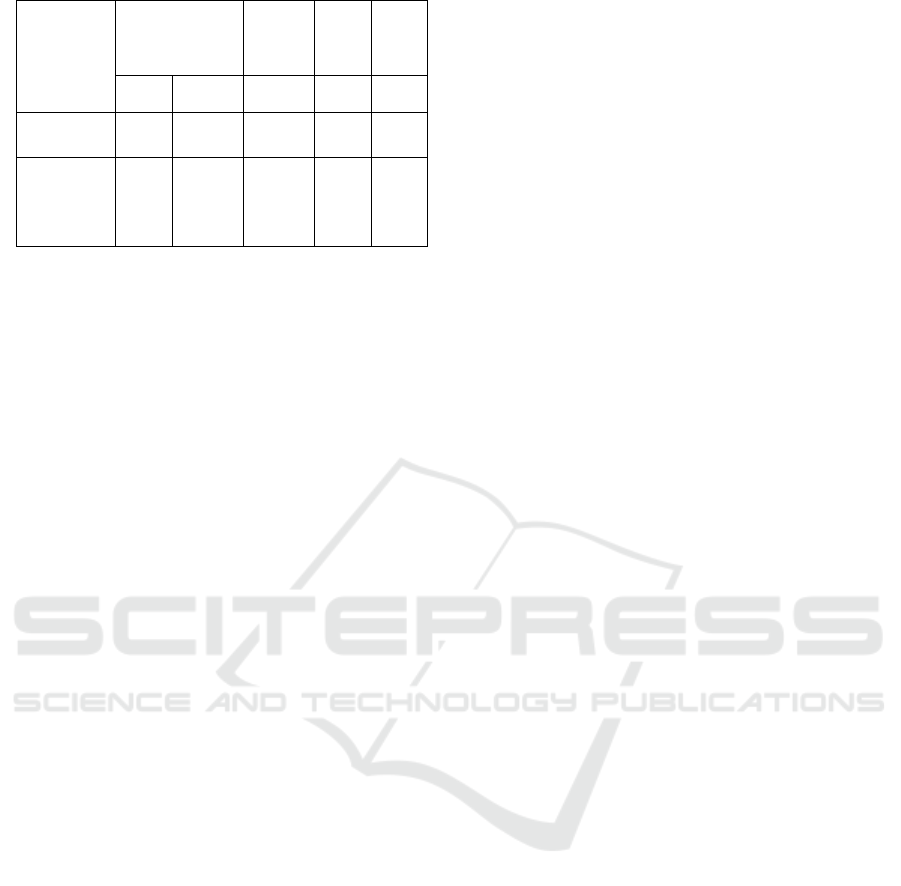

Table 1: Multiple Linear Regression Test

Model

Unstandardized

Coefficients

Standar

dized

Coeffic

ients

t Sig.

B

Std.

Error

Beta

(Constant) .293 .338 .489 .866 .390

Quality of

Human

Resource

(X

1

)

.423 .107 .251

3.94

4

.000

Information

System of

Regional

Financial

.217 .100 .131

2.17

4

.034

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1022

Model

Unstandardized

Coefficients

Standar

dized

Coeffic

ients

t Sig.

B

Std.

Error

Beta

Manageme

nt (X

2

)

Regional

Asset

Manageme

nt (X

3

)

.141 .123 .489

1.15

1

.255

Based on the above regression coefficient

table, it produces the following multiple linear

regression equation model:

Y = 0,293+ 0,423X

1

+ 0,217X

2

+ 0,141X

3

Based on the above regression coefficient table,

it produces the following multiple linear regression

equation model:

a. The constant value of 0.293 means that if the

independent variable is zero (0), the variable

value of the quality of the financial statement of

the local government will increase by 0.293.

b. The regression coefficient of the quality of

human resources (X1) is 0.423 (positive value).

If other independent variables have fixed values

and the quality of human resources has

increased by 1%, the quality of financial

statements has increased by 0.423. Positive

coefficient means a positive or unidirectional

correlation between the quality of human

resources and the quality of financial

statements. The better the quality of human

resources, the better the quality of financial

statements and vice versa if the quality of

human resources is inadequate then the quality

of the financial statements is also not good. This

is based on the idea that in order to be able to

produce quality financial statement, the quality

of the people who carry out the tasks in

preparing financial statements must be the main

concern in which the employees involved in

these activities must understand and master how

the process and implementation of accounting is

carried out based on the applicable provisions.

If employees involved in the preparation of

financial statements understand and master the

processes and elements in the financial

statements, the quality of financial statements

will be good.

c. The regression coefficient of the information

system of regional financial management (X2)

is 0.217 (positive value). It means that if the

other independent variables are fixed values and

the information system of regional financial

management has increased by 1%, the quality of

financial statements has increased by 0.217.

Coefficient is positive, meaning that there is a

positive or unidirectional correlation between

the use of information system of financial

management and the quality of financial

statements. The better the utilization

information system of financial management,

the better the quality of financial statements and

vice versa. The worse the utilization of

information system of financial management,

the worse the financial statements. This is based

on the idea that the existence of information

system of financial management specifically

designed for the process of preparing financial

statements ranging from recording journals,

ledgers to all financial reports has been

systemized using computerization will reduce

the level of errors in calculations and save time.

d. The regression coefficient of regional asset

management (X3) is 0.141 (i.e. positive). It

means if another independent variable has a

fixed value and management of regional assets

has increased by 1%, the quality of financial

statements has increased by 0.141. Coefficient

is positive, meaning that there is a positive or

direct correlation between the regional asset

management and the quality of financial

statements. The better the regional asset

management, the better the quality of financial

statements and vice versa. The worse the

regional asset management, the worse the

quality of the financial statements. It is based on

the obligation that preparing balance sheet as

part of the government’s financial statements,

the recognition and presentation and disclosure

of regional assets is the main focus. It is because

the assets have very significant and very

complex qualities. Administration and reporting

of fixed assets is very meaningful for the

fairness of financial statements so that the

management of regional assets can improve

reliability, reduce misrepresentation, reduce

objectivity of information, prevent

inconsistencies and facilitate the financial

statement audit process which will ultimately

improve the quality of financial statements.

Effect of the Quality of Human Resource, Information System of Regional Financial Management, and Regional Asset Management toward

the Quality of Financial Statement of Regional Staff Organization in the Deli Serdang Regency Government

1023

3.2 Research Hypothesis Testing

3.2.1 Statistic F-Test (Simultaneous

Significance Test)

Below is the result of a simultaneous test (F-test) on

the quality of human resource, information system

of regional financial management and regional asset

management variables.

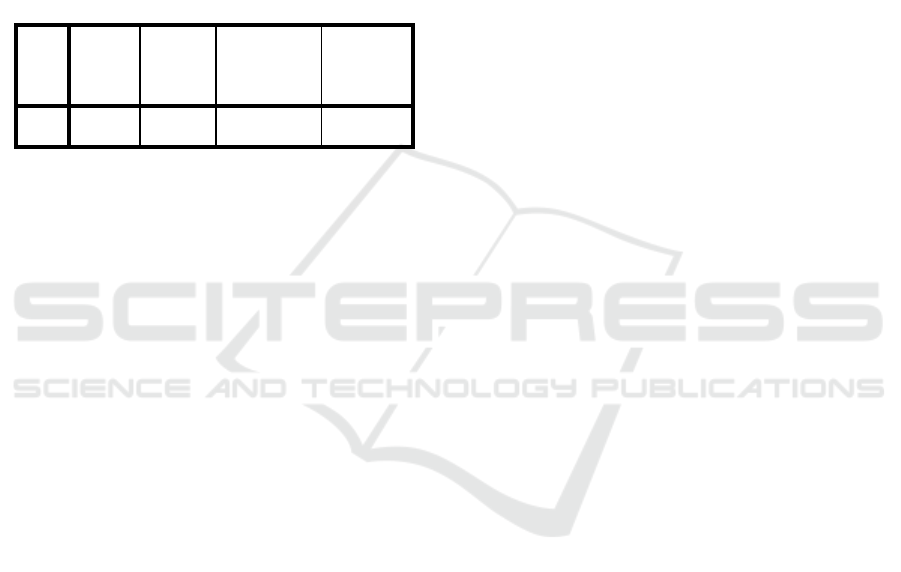

Table 2: Simultaneous Effect Test with F-Test

ANOVA

a

Model

Su

m of

Squares

Df

Mean

Square

F

S

ig.

Regression

8.4

78

3 2.826

2

0.112

.

000

b

Resid

ual

7.0

25

50 .141

Total

15.

503

53

a. Dependent Variable: quality of financial

statement

b

. Predictors: (Constant), regional asse

t

management (X3), information system o

f

regional financial

management (X2), quality of human

resource (X1)

Based on the above results of the ANOVA test or

F-test, the Fcalculate value is 20.112 at the level of α

= 0.05 with the degrees of freedom of numerator df1

(k) = 3 (number of independent variables) and

degrees of freedom denominator df2 (nk-1) = 50

then Ftable is 2.79. Based on the above results,

Fcalculate 20.112 >Ftable 2.60 and p value with

level of significant (α) 0.000 < 0.05. Therefore, it is

concluded that the independent variables, consisting

of the quality of human resource, information

system of regional financial management and

regional asset management have significant and

simultaneous effect on the quality of financial

statement.

3.2.2 t Statistic Test (Partial Significance Test)

The following presents the results of the partial test

(t-test) on the quality of human resource,

information system of regional financial

management and regional asset management

variables.

Table 3: Significance Test of Partial Effect (t-

Test)

Model

Unstan

dardized

Coefficient

s

Standar

dized

Coeffic

ients

T Sig.

B Std.

Error

Beta

Model

Unstan

dardized

Coefficient

s

Standar

dized

Coeffic

ients

T Sig.

B Std.

Error

Beta

(Constant

)

.29

3

.338 .489 .866 .390

Quality

of

Human

Resource

(X

1

)

.42

3

.107 .251 3.944 .000

Informati

on

System

of

Regional

Financial

Manage

ment (X

2

)

.21

7

.100 .131 2.174 .034

Regional

Asset

Manage

ment (X

3

)

.14

1

.123 .489 1.151 .255

Coefficients

a

a. Dependent Variable: Quality of Financial

Statement

Based on the statistical t-test, it yields the

following equation model:

Y = 0,390+ 0,000X

1

+ 0,034X

2

+ 0,255X

3.

Based on the analysis, the following conclusions

can be drawn:

a. The quality of human resource (X

1

) has

significance value of 0.000 < 0.05 which means

that X

1

has a significant positive effect on Y and

a t

calculate

of 3.944 > t

table

2.0086 which means

that X

1

has an effect on Y. Based on the value, it

is concluded that the first hypothesis accepted or

explained that the variable quality of human

resources partially affects the quality of

financial statement.

b. Information system of regional financial

management (X

2

) has a significance value of

0.034 < 0.05, which means that X

2

has a

significant positive effect on Y and t

calculate

2.174

>t

table

2.0086 which means that X

2

affects Y.

Based on the value, it is concluded that the

second hypothesis is accepted or explained that

the information system of regional financial

management variable partially affects the

quality of financial statement.

c. Regional asset management (X

3

) has a

significance value of 0.255 > 0.05, which means

that X

3

has a positive but not significant effect

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1024

on Y and a t

calculate

of 1.151 <t

table

2.0086 which

means that X

3

does not affect Y. Based on the

value, it is concluded that the third hypothesis is

rejected or explained that the regional asset

management variable partially has no significant

effect on the quality of financial statement.

3.2.3 Coefficient of Determination

(Adjusted R2)

The following are the results of the coefficient of

determination test:

Table 4: Coefficient of Determination Test

Model Summary

Model R R Square

Adjusted R

Square

Std. Error

of the

Estimate

1 .739

a

.547 .520 .3748423

a. Predictors: (Constant), regional asset

management (X

3

), information system of

regional financial management (X

2

), quality of

human resource (X

1

)

The overall regression analysis shows that Adjusted

R Square is 52%. It means that the quality of human

resource, information system of regional financial

management and regional asset management

variables can explain the variable quality of financial

statement by 52% and the remaining 48% is affected

by other variables.

4 DISCUSSION

4.1 The Effect of Quality of Human Resource

toward the Quality of Financial Statement

The quality of human resource variable shows that it

has a significant positive effect on the quality of

financial statement. It can be seen from a significant

value of 0.043 which is smaller than 0.05 and a

t

calculate

greater than ttable i.e. 2.084 > 2.019. This

result indicates that the quality of human resources

is an important factor that can improve the quality of

financial statements. In other words, the better the

quality of human resources, the better the quality of

financial statements.

If human resources understand the logic of

accounting, the level of errors in the preparation of

financial statements will be smaller. Thus, these

financial statements can fulfill the information as

expected and be able to improve the quality of

results and the availability of timely financial

reports.

This finding is in line with research conducted by

(Mahaputra, 2014) which found that the quality of

human resources has a positive and significant effect

on the quality of financial statements. However, it

contradicts the research conducted by (Husna, 2013)

on the Effect of Quality of Human Resources,

Financial Supervision, and Government Internal

Control Systems on Government Financial

Reporting Values which explain that the variable

Quality of Human Resources does not have a

significant effect on the financial reporting value.

This finding is also in line with the direction of

the Ministry of Home Affairs which stated that

reliable HR is required to realize accountable

government financial governance. In the future, it is

necessary to strengthen the quality of human

resources so that the people’s desire to have a truly

clean government can be achieved and obtain a

reasonable opinion without exception

(www.kemendagri.go.id, 2017). If HR understands

regional government accounting, they are expected

to be able to assist the financial reporting process so

that they can produce reliable and timely financial

reports.

4.2 The Effect of Information System of Regional

Financial Management toward the Quality of

Financial Statement

Information system of regional financial

management variable indicates that it has a positive

and significant effect on the quality of financial

statement. This can be seen from the significant

value of 0.043 which is smaller than 0.05 and the

t

calculate

which is greater than t

table

2.084 > 2.019. This

result indicates that information system of regional

financial management is an important factor that can

improve the quality of financial statements. In other

words, the better the information system of regional

financial management, the better the quality of

financial statements.

Information system of regional financial

management, that is specifically designed for the

process of preparing financial statements starting

from recording journals, ledgers to financial reports,

has been systemized using computerization. It can

reduce the level of errors in calculations and save

time in the process of compiling. Therefore, the

financial statements can fulfill the information as

expected and be able to improve the quality of

results and the availability of timely financial

reports.

This finding is in line with the research

conducted by (Yuliani, 2014) which found that the

Effect of the Quality of Human Resource, Information System of Regional Financial Management, and Regional Asset Management toward

the Quality of Financial Statement of Regional Staff Organization in the Deli Serdang Regency Government

1025

information system of regional financial

management has a positive and significant effect on

public accountability. However, it contradicts the

research conducted by (Diani, 2014) on the effect of

understanding accounting, utilization of information

system of regional financial accounting and the role

of internal audit on the quality of local government

financial statement who explained that the utilization

of information system of regional financial

accounting variable has no significant effect on the

quality of financial statement.

This finding is also in line with (Government

Regulation Number 56 of 2005) concerning

Regional Financial Information Systems; the

obligation of the central and regional governments to

use the information system of regional financial

management. The information system of regional

financial management is expected to be able to assist

the financial reporting process so that it can produce

reliable and timely financial reports. Local

governments are obliged to develop and utilize

information systems for regional financial

management to improve their ability in managing

regional finance and channeling regional financial

information to public services.

4.3 The Effect of Regional Asset Management

toward the Quality of Financial Statement

Regional asset management variable indicate that it

has a positive and not significant effect on the

quality of financial statement. It can be seen from

the significant value of 0.255 which is bigger than

0.05 and the t

calculate

which is smaller than t

table

1.151

< 2.0086.

Regional asset management has a positive and

insignificant effect on the quality of local

government financial reports because the Regional

Staff Organization (OPD), as a the user, has not fully

implemented regional asset management based on

(Minister of Home Affairs Regulation No. 19 of

2016) for instance, land under the road or land used

for irrigation has not been certified, the recording of

assets is not in order which still overlaps between

the OPD, asset maintenance is still minimal. As the

results, many assets are damaged and not

functioning properly. Thus, it affects the fixed asset

values recorded in the balance sheet and is not in

accordance with the actual conditions. It may lead to

the decline in the quality of the financial statement

of OPD in the regional government of Deli Serdang

Regency.

This finding is in line with the research

conducted by (Harahap, 2015) which found that the

regional asset management has a positive and

insignificant effect on the value of local government

financial reporting information. However, it

contradicts the research conducted by (Anshari,

2012) on the effect of regional goods management

on the quality of financial statement of Padang City

Government which explained that the Inventory of

Regional Property, Regional Property Assessment,

Supervision and Control variables have significant

effect on the quality of financial statements.

4.4 The Effect of Quality of Human Resource,

Information System of Regional Financial

Management, and Regional Asset

Management Simultaneously toward the

Quality of Financial Statement of OPD

The quality of human resource, information system

of regional financial management and regional asset

management simultaneously affect the quality of

financial statement of OPD in Deli Serdang Regency

Government. These research findings cannot be

compared because there is no research that has the

exact same independent and dependent variables.

5 CONCLUSIONS

Based on the research findings, after going through

the stages of data collection, data processing, data

analysis and finally the interpretation of data

regarding the effect of quality of human resource,

information system of regional financial

management and regional assets management

toward the quality of financial statement at Deli

Serdang Regency Government, by using normally

distributed data, there is no multicollinearity. Thus,

the following conclusions can be drawn:

1. Based on the results of simultaneous data

analysis, it was found that the quality of human

resource, information system of regional

financial management and regional asset

management have significant effect on the

quality of the financial statements of OPD at the

Deli Serdang Regency Government.

2. The quality of human resource and information

system of regional financial management have

significant effect on the quality of financial

statement of OPD at the Deli Serdang Regency

Government.

3. Regional asset management does not have

significant effect on the quality of financial

report of OPD at the Deli Serdang Regency

Government.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1026

REFERENCES

Anshari, E. S. (2012) ‘Pengaruh Pengelolaan Barang Milik

Daerah Terhadap Kualitas Laporan Keuangan

Pemerintah Kota Padang’, Universitas Negeri Padang,

pp. 1–18.

Bastian, I. (2005) Akuntansi Sektor Publik : Suatu

Pengantar. Jakarta: Erlangga.

Diani, D. I. (2014) ‘Pengaruh Pemahaman Akuntansi,

Pemanfaatan Sistem Informasi Akuntansi Keuangan

Daerah Dan Peran Internal Audit Terhadap Kualitas

Laporan Keuangan Pemerintah Daerah (Studi Empiris

Pada Satuan Kerja Perangkat Daerah Di Kota

Pariaman)’, Universitas Negeri Padang

Erlina (2011) Metodologi Penelitian. Medan: Penerbit

USU Press.

Ghozali, I. (2006) Aplikasi Analisis Multivariate dengan

Program SPSS. Edisi 4. Semarang: Badan Penerbit

Universitas Diponegoro.

Government Regulation Number 56 of 2005 concerning

Regional Financial Information Systems

Harahap, A. J. (2015) Analisis Faktor-Faktor Yang

Mempengaruhi Nilai Informasi Pelaporan Keuangan

Pemerintah Daerah Dengan Audit Internal Sebagai

Variabel Moderating (Studi Empiris Pada Pemerintah

Provinsi Sumatera Utara). Medan.

Husna, F. (2013) Pengaruh Kualitas Sumber Daya

Manusia, Pengawasan Keuangan, Dan Sistem

Pengendalian Imtern Pemerintah Terhadap Nilai

Pelaporan Keuangan Pemerintah (Studi Empiris

Satuan Kerja Perangkat Daerah Kota Padang Panjang),

Universitas Negeri Padang, pp. 55–60.

Law No 33 of 2004 concerning Financial Balance

between the Central Government and Regional

Government.

Law No 23 of 2014 concerning Regional Government..

Jakarta.

Mahaputra, P. I. P. U. R. (2014) ‘Analisis Faktor-Faktor

Yang Memengaruhi Kualitas Informasi Pelaporan

Keuangan Pemerintah Daerah’, E-Jurnal Akuntansi

Universitas Udayana 8.2 (2014): 230-244

Minister of Home Affairs Regulation No. 19 of 2016

concerning Guidelines for Management of Regional

Property

Sinulingga, S. (2017) Metodologi Penelitian. Medan:

USUpress.

Sugiyono (2004) Metode Penelitian Bisnis. Bandung:

Alfabeta.

Sutrisno, E. (2011) Manajemen Sumber Daya Manusia.

Jakarta: Kencana.

Kemendagri (2017) Meraih Status Wajar Tanpa

Pengecualian. Available at:

http://www.keuda.kemendagri.go.id/artikel/detail/34-

meraih-status-wtp (Accessed: 29 September 2017).

Yuliani, N. L. (2014) ‘Sistem informasi pengelolaan

keuangan daerah dan penerapan anggaran berbasis

kinerja terhadap akuntabilitas publik 1,2’, Syariah

Paper Accounting FEB UMS, (2014), pp. 301–312.

Effect of the Quality of Human Resource, Information System of Regional Financial Management, and Regional Asset Management toward

the Quality of Financial Statement of Regional Staff Organization in the Deli Serdang Regency Government

1027