Determinants of Customer's Decision in Selecting Banking Services in

the Province of Jambi

Ilham Wahyudi

1

and Eka Julianti Efris Saputri

1

1

Faculty of Economics and Business, Universitas Jambi, Jambi-Indonesia

Keywords: Islamic Bank, Conventional Bank, Profit Sharing, Interest, Reputation, Information Asymmetry

Abstract: This study was intended to examine the effect of profit sharing principle and interest, bank reputation, and

information asymmetry against customer decision in choosing banking services between islamic bank and

conventional bank in Jambi Province. In this study, data was obtained from primary data using a

questionnaire. The respondent obtained from customer of islamic bank and conventional bank in Jambi

Province. The sample selection used nonprobability sampling with acidental sampling technique and

analized by using discriminant analysis. The results showed that in choosing banking services, the customer

of islamic and conventional banks in Jambi Province did not take attention about the principle of profit

sharing and interest, bank reputation and information asymmetry.

1 INTRODUCTION

In the assessment of the Global Islamic Financial

Report (GIFR) in 2016 Indonesia got ranks sixth of

the country that has the potential and is conducive in

the development of the islamic finance industry after

Malaysia, Iran, Saudi Arabia, United Arab Emirates,

and Kuwait, Indonesia is projected to rank first in

next few years. This optimism is in line with the

pace of institutional expansion and the accelerated

growth in the assets of islamic banks which are very

high, coupled with the volume of sukuk issuance

that continues to increase (IslamicFinancialPolicy,

2016).

Finance Minister Bambang Brodjonegoro in the

National Sharia Economy seminar at the Ministry of

Finance Complex, Jakarta, Tuesday, April 14, 2015,

stated that the reason Islamic banks have a stronger

endurance than conventional banks faced with the

global crisis is because islamic banks tend to play

safe which means every transaction in islamic

finance must be based on underlying asset. That is

different from conventional banks that tend to be

speculative. Many conventional banks play at the

level of high speculative. Whereas Islamic banks are

not in the area, they tend to be more conservative

and prioritize caution. However, it does not mean

riskless Islamic banking. If the management does

not go well, then there is a possibility that it can be

problematic (Anonim, 2015).

Islamic banks are banks that in their operations

do not use the interest system, but use the basic

principles in accordance with Islamic sharia. In

determining the rewards, both rewards given and

received, Islamic banks do not use interest systems

like conventional banks, but use the concept of

reward in accordance with the agreed contract which

is often called a profit sharing system (Ismail,

2014). Whereas according to (Undang-

UundangNo21, 2008), conventional banks are banks

that carry out their business activities conventionally

and based on their types consist of conventional

commercial banks and rural credit banks, while

conventional commercial banks are conventional

banks which provide services in payment traffic and

people's credit banks are conventional banks which

in their activities do not provide services in payment

traffic.

This research intended to examine the effect of

profit sharing and interest principle, bank reputation,

and information asymmetry against customer

decision in choosing banking services between

islamic bank and conventional bank in Jambi

Province.

Wahyudi, I. and Saputri, E.

Determinants of Customer’s Decision in Selecting Banking Services in the Province of Jambi.

DOI: 10.5220/0009501513491356

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1349-1356

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1349

2 THEORETICAL FRAMEWORK

According to (Maisur, et al., 2015) the principle of

profit sharing is the profit obtained by sharia-

compliant banks that are shared with customers. The

level of division must be based on the percentage

ratio and not the specified amount.

Interest is additional money deposited in

financial institutions or money lent. The amount of

interest to be paid is set in advance regardless of

whether the financial institution of the deposit

recipient or the borrower is successful in his

business or not. The amount of interest that must be

paid is listed as a percentage number or per hundred

in a year which means that if money is not paid or

deposits are not taken in a few years the debt can

occur or the savings will multiply (Muhammad,

2011)

The issue of interest responsiveness to savings

and its effect on economic growth in developing

countries (LDCs) concluded that the high interest of

the people in saving was influenced by the high and

low interest rates. The higher interest rate results in

an increase in the amount of savings. If the interest

rate is high, then the community will reduce current

consumption to increase savings (Arrieta, 1988).

Financing projects are at the core of people's

lives and development bases. Funding patterns,

instruments and frameworks facilitate financing and

lead to development. Several types of financing

instruments are common in developed countries that

lubricate the wheels of development. Islam forbids

flowers and justifies profit sharing. Both provide

benefits but have fundamental differences as a result

of investment and money saving (Maisur, et al.,

2015).

In conducting transactions in Islamic banks,

customers only consider the profit sharing factor.

When it is found that the profit sharing rate of

Islamic banks is higher than the interest rate of

conventional banks, such as when the research is

conducted, they will join Islamic banks. The rest, if

the situation is reversed, it is feared they will choose

to join a conventional bank. From here a simple

prediction can be made if the interest rate is high

while the profit sharing rate is unable to keep pace

with the rate of interest, it is not impossible if the

customer will transfer funds to a conventional bank

which offers higher economic benefits (Misanam &

Liana, 2007).

The policy carried out by the company to achieve

reputation is by holding a personal selling, because it

is considered that this program can be closer to

themselves between companies and consumers

(Azis, 2001). Several things related to this are that

personal selling must take place through face to face

with customers and must be aggressive in order to

provide communication between customers and

companies that will provide a form of service (Azis,

2001).

The company's reputation is built on a network

of stakeholder partnerships through which

companies continue to improve organizational

learning and develop new business solutions. In

particular, the activation of decision processes that

involve stakeholders, partnership building, and

supportive behavioral stimulation, allows companies

to recover from severe losses of investor confidence

(Romenti, 2010).

Even though the company's reputation is

everywhere, it is still relatively replaceable. Some,

surely because reputation is rarely noticed until they

are threatened. Economists see reputation as a

transitory signal. Game theory describes reputation

as a character that distinguishes between types of

companies and can explain their strategic behavior.

Signaling Theory calls our attention to the

information content of reputation. Both recognize

that reputation is actually the perception of the

company that is owned by external observers. For

Game Theory experts, reputation is functional: they

generate perceptions among employees, customers,

investors, competitors, and the general public about

what a company is, what it does, what it means. This

perception stabilizes the interaction between the

company and its people (Fombrun & Riel, 1997).

Past behavior, attitudes and product attributes

together have a significant effect on interest in

saving (Sagan, et al., 2012). Examined the effect of

service facilities, products and promotions on

customer decisions in saving where the factors of

service facilities, products and promotions have an

influence on customer decisions in saving (Yupitri

& Sari, 2012).

Disclosure of information to bank stakeholders,

should not be limited to financial information alone,

but also non-financial information that allows

customers to know the level of suitability of bank

operations with the principles that exist in the bank.

This is because with the existence of complete

reporting of information it will support the

relationship of corporate governance that is

beneficial for both parties (Yulianto, 2010).

The desire of customers to obtain financial

information as complete as possible is difficult to

fulfill by management because it is influenced by

several factors such as the cost of presenting

information, management's desire to avoid risks to

see its weaknesses, and time used to present

information (Yaya & Ahim Abdurahim, 2003).

Besides this according to (Yaya, et al., 2007)

management needs to consider cost and benefits in

presenting disclosure in financial reports or annual

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1350

reports. management and cost can also be used by

management in providing financial information, so

that management will be more selective in delivering

financial information.

Customers need non-financial information

regarding the application of the principles and

quality of services provided by the bank. Non-

financial information will be used to assess the

quality of the application of the principles and

quality of actual bank services because this is the

main reason customers save in the bank (Yaya, et

al., 2007).

3 RESEARCH METHOD

The population in this study were customers of

conventional banks and Islamic banks in Jambi

Province. The method of data collection in this study

is to distribute questionnaires and conduct

interviews with respondents. The selection of

samples to be tested in this study using

nonprobability sampling technique. Nonprobability

sampling techniques include, systematic sampling,

quota sampling, incidental sampling, purposive

sampling, saturated sampling, and snowball

sampling. Of the six Nonprobability Sampling

techniques, this study uses accidental sampling

techniques (Sugiyono, 2012), which is the sample in

this study are customers of islamic banks in Jambi

Province and customers of conventional banks in

Jambi Province.

Exogenous variables in this study are the

principle of profit sharing and bank interest, bank

reputation, and bank information asymmetry. The

endogenous variable in this study is the customer's

decision.

The analysis used in this study is discriminant

analysis. Before discriminant analysis, the data must

first be tested whether the data is normal and the

absence of multicollinearity between independent

variables and each independent variable follows the

normal distribution function and homogeneity of

variance between groups of data (Yamin & Heri,

2014). This research was tested in the following

discriminant model:

Z = + w

1

X

1

+ w

2

X

2

+ w

3

X

3

Where:

Z = Value of the discriminant function

= Constanta value

w1 = The coefficient of the principle of profit

sharing and interest

X

1

= The principle of profit sharing and

interest

w2 = Bank Reputation Coefficient

X

2

= Bank's reputation

w3 = Information Asymmetry Coefficient

X

3

= Information Asymmetry

So the discriminant function can be written as:

Z = w1 The Principle Of Profit Sharing And

Interest + w2 Bank’s Reputation + w3

Information Asymmetry

The steps taken in discriminant analysis are

identifying discriminant variables, discriminant

functions, and classifications.

4 ANALYSIS

Before discriminant analysis, make sure the data is

normally distributed, and the absence of

multicollinearity between independent variables and

each independent variable follows the normal

distribution function and homogeneity of the

variance between groups of data (Yamin & Heri,

2014).

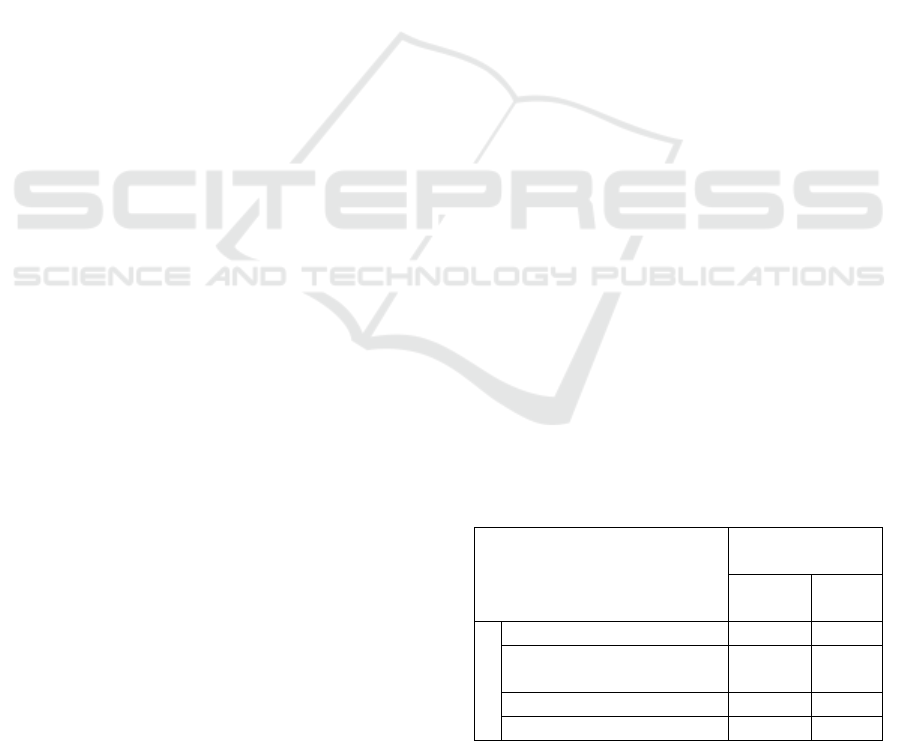

4.1 Multicollinearity Test Results

Seeing the results of the calculation of tolerance

values in table 1, there is no independent variable

that has a tolerance value of less than 0.10 which

means there is no correlation between independent

variables whose value is more than 95%. The results

of the calculation of the Variance Inflation Factor

(VIF) also show the same thing, namely there is not

one independent variable that has a VIF value of

more than 10. So it can be concluded that there is no

multicollinearity between independent variables.

Tabel 1: Multikolinierity Test Result

Model

Collinearity

Statistics

Toleranc

e VIF

(Constant)

Prinsip Bagi Hasil da

n

Bun

g

a

,301 3,324

Reputasi Ban

k

,428 2,334

Asimetri Informasi ,224 4,465

Determinants of Customer’s Decision in Selecting Banking Services in the Province of Jambi

1351

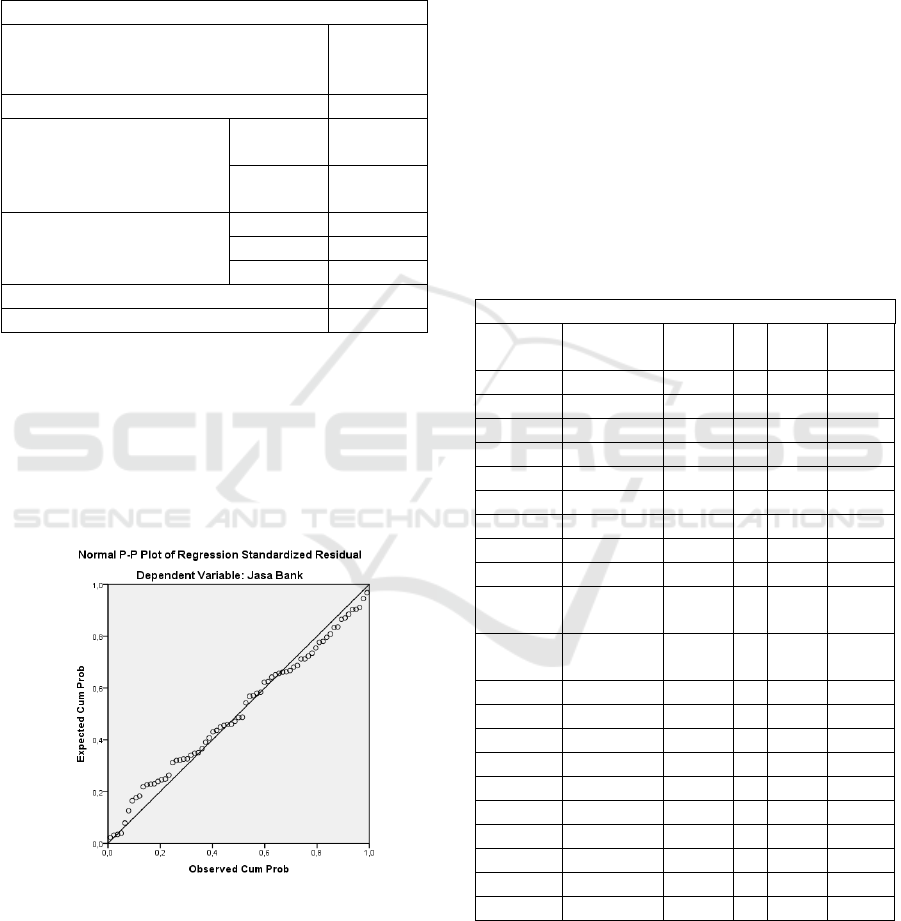

4.2 Normality Test Result

The data normality test was carried out by

Kolmogorov-Smirnov nonparametric statistical test

and normal distributed data can also be seen on

Normal P Plot Regression Standardized Residual

Graph.

Table 2 : Kolmogrov-Smirnov test Result

One-Sample Kolmogorov-Smirnov Test

Unstan

dardized

Residual

N

71

Normal Parameters

a,b

Mean ,000000

0

Std.

Deviation

,332989

86

Most Extreme Differences Absolute ,053

Positive ,039

N

e

g

ative -,053

Test Statistic ,053

As

y

mp. Si

g

. (2-tailed) ,200

c,d

From the results of the Kolmogrov-Smirnov Test

in table 2, the results of the Kolmogrov-Smirnov

value are 0.053 with Asymp. Sig. (2-tailed) 0.200.

This result shows normality data because of the

asymp value. Sig. (2-tailed)> 0.05, which means that

a disturbing or residual variable has a normal

distribution.

Figure 1: Normal P-P Plot of Regression Standardize

Residual

By looking at normal P-Plot of regression

standadized residual graphs in picture 1, the points

spread around the diagonal line, and the spread does

not move away from the diagonal line which means

the normal P-chart The standadized residual plot

shows a normally distributed model.

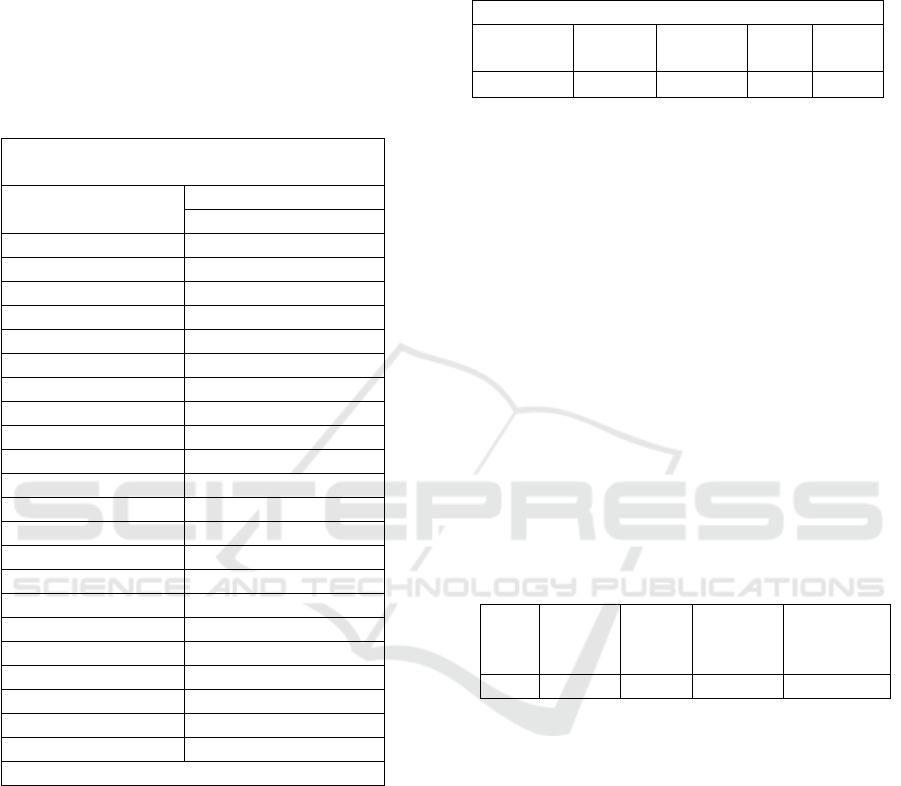

4.3 Identifying Discriminant Variables

Identifying discriminant variables can be seen F test

statistics, for F test can be used p-value in the

significant column where:

1. Sig. > 0,05, means there are no differences

between groups.

2. Sig. < 0,05, means there are differences between

groups.

From the explanation of table 3, it can be seen

that only four variables are (X2.6), (X2.7), (X2.8),

and (X2.9) which can be used to identify differences

between categories. So the variables that are feasible

and can be used for discriminant analysis are

variables (X2.6), (X2.7), (X2.8), and (X2.9).

Table 3: Discriminant Variable Identification

Results

Tests of Equality of Group Means

Wilks'

Lambda F

d

f1 df2 Sig.

X1.1 ,995 ,334 1 69 ,565

X1.2 ,993 ,513 1 69 ,476

X1.3 ,995 ,326 1 69 ,570

X1.4 ,994 ,388 1 69 ,535

X2.1 ,959 2,986 1 69 ,088

X2.2 ,984 1,092 1 69 ,300

X2.3 ,992 ,533 1 69 ,468

X2.4 ,999 ,103 1 69 ,749

X2.5 ,986 ,992 1 69 ,323

X2.6

,862

11,04

8

1 69 ,001

X2.7

,724

26,26

6

1 69 ,000

X2.8 ,943 4,174 1 69 ,045

X2.9 ,881 9,308 1 69 ,003

X3.1 ,990 ,689 1 69 ,409

X3.2 ,970 2,119 1 69 ,150

X3.3 1,000 ,000 1 69 ,989

X3.4 1,000 ,017 1 69 ,896

X3.5 ,997 ,230 1 69 ,633

X3.6 ,995 ,323 1 69 ,571

X3.7 ,986 ,972 1 69 ,328

X3.8 1,000 ,011 1 69 ,917

4.4 Discriminant Function

The discriminant function equation can be seen in

the canonical discriminant function coefficients table

in table 4. Then the discriminant function equation

in this study is:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1352

Z = 0,447 + 0,153*X1.1 + -0,467*X1.2 + -

0,048*X1.3 + 0,192*X1.4 + 0,704*X2.1 +

0,009*X2.2 + -0,032*X2.3 + -0,517*X2.4 +

-0,063*X2.5 + 0,007*X2.6 + 0,454*X2.7 + -

0,472*X2.8 + 0,776*X2.9 + -0,009*X3.1 + -

0,051*X3.2 + -0,125*X3.3 + 0,203*X3.4 + -

0,463*X3.5 + -0,069*X3.6 + 0,171*X3.7 + -

0,331*X3.8

Table 4 : Discriminant Function Result

Canonical Discriminant Function

Coefficients

Function

1

X1.1 ,153

X1.2 -,467

X1.3 -,048

X1.4 ,192

X2.1 ,704

X2.2 ,009

X2.3 -,032

X2.4 -,517

X2.5 -,063

X2.6 ,007

X2.7 ,454

X2.8 -,472

X2.9 ,776

X3.1 -,009

X3.2 -,051

X3.3 -,125

X3.4 ,203

X3.5 -,463

X3.6 -,069

X3.7 ,171

X3.8 -,331

(Constant) ,447

Unstandardized coefficients

From the equation, it can be seen that the most

dominant variable X2.9 is to predict differences in

groups of types of sharia bank customers and

conventional bank customers, because it has the

highest coefficient value of 0,776 while variable

X2.4 is a weak factor to predict customer decisions

in choosing banking services between Islamic banks

and conventional banks, this difference is seen from

the coefficient value of – 0,517.

To test the statistical significance of the

discriminant function, multivariate test of

significance is used, so to test the differences

between the two groups of banks, namely Islamic

banks and conventional banks for all variables,

multivariate tests are used together. The wilk’s

lamda test can be approximated by the chi-square

statistic (Ghazali, 2011).

Table 5 : Wilks Lamda Test Result

Wilks' Lambda

Test of

Function(s)

Wilks'

Lambda

Chi-

square df Sig.

1

,437 48,378 21 ,001

Based on table 5, the value of wilks lamda is

0.437 with a significant value of 0.001 <0.05, then

there is a significant difference between sharia bank

customer decisions and conventional bank customer

decisions which means accepting the hypothesis H0

is 48,378 compared to the value The chi-square table

that can be seen with the chi-square table (n-1 with

significance 0.05) is equal to 90.53> from the

calculated chi-square value of 48.378 with a

significant number of 0.001 so that there is a

significant (real) difference between decisions of

sharia bank customers and conventional bank

customer decisions which means accepting the

hypothesis H

0.

To test how big and meaningful the differences

between the two groups of companies can be seen

from the square canonical correlation (CR2) value

shown in table 6.

Table 6 : Eigenvalues Test Result

Eigenvalues

Func-

tion

Eigen-

value

% of

Varian-

ce

Cumula-

tive %

Canonical

Correlation

1

1,286

a

100,0 100,0 ,750

The result of table 6 shows the canonical

correlation number is 0.750 which if squared (0.750)

2 is 0.563. This means that 56.3% of the variance of

the customer's decision variables in selecting

banking services can be explained by the principle

of profit sharing and banks, bank reputation, and

bank information asymmetry.

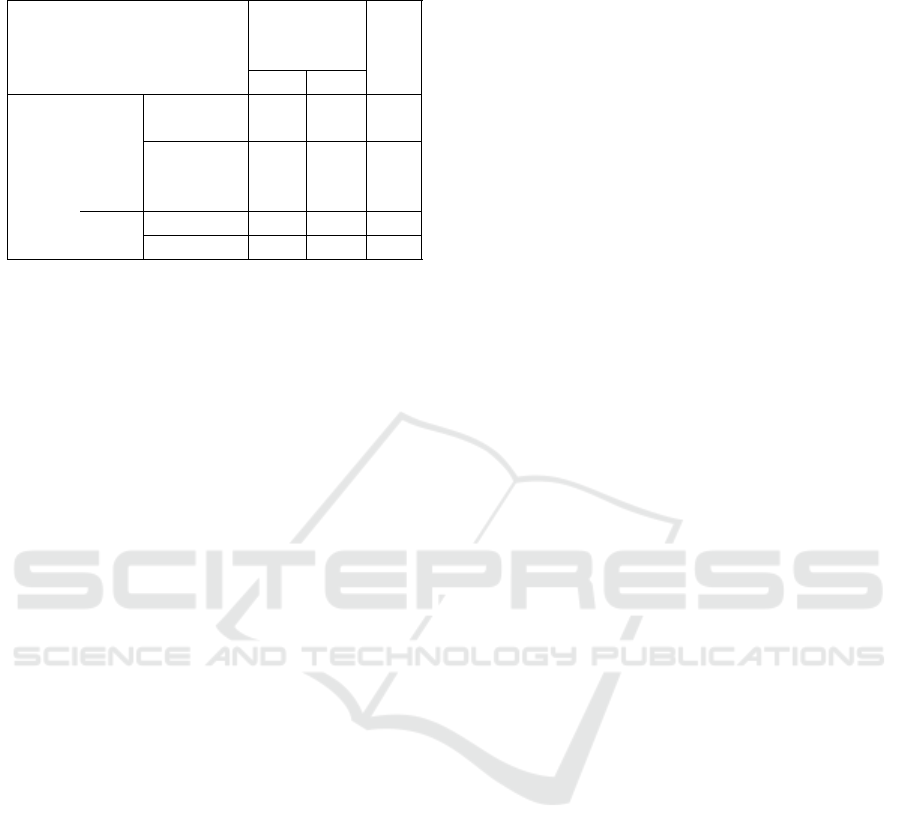

4.5 Classification

One of the discriminant functions is to classify

future observations into one of two groups of

companies. In this study the two groups of

companies in question are the decisions of customers

in choosing banking services between conventional

Islamic banks and banks which can be seen in table

7.

Determinants of Customer’s Decision in Selecting Banking Services in the Province of Jambi

1353

Table 9 : Classification Results

Classification Results

a

Jasa

Bank

Predicted

Group

Membership

To

tal

1 2

Origin

al

Count Bank

S

y

ariaah

30 5 35

Bank

Konvensio

nal

5 31 36

% 1 85,7 14,3 100,0

2 13,9 86,1 100,0

a. 85,9% of original grouped cases correctly

classified.

Table 7 shows that there were 10 respondents

who were misclassified, namely 5 respondents who

initially decided to choose the services of a

conventional bank were then predicted to choose

Islamic banking services, and 5 respondents who

actually chose Islamic banking services were

predicted to choose the services of conventional

banks. Overall, the discriminant model formed has a

fairly high validation level is 85.9%. The survey

results above show the results of the accuracy of the

discriminant model which is quite high.

5 RESULTS

5.1 Effect of Profit Sharing Principles and

Interest on Customer Decisions

The result of the study shows that the principle of

profit sharing and interest does not affect the

customer's decision in choosing banking services

between islamic banks and conventional banks. The

tendency of customers to choose banking services

viewed in terms of profit causes customers to prefer

saving to conventional banks compared to Islamic

banks because the interest gains obtained at

conventional banks are higher even though basically

the customer knows that the principle of interest is

usury for non-Muslim customers, while profits on

Islamic banks are volatile. This was made clear by

(Arrieta, 1988) who concluded that the high interest

of people in saving was influenced by the high and

low interest rates.

The tendency of customers to choose banking

services in terms of benefits supported by (Misanam

& Liana, 2007) states that in conducting transactions

in Islamic banks, customers only consider profit

sharing factors. When it is found that the shari'ah

bank profit sharing rate is higher than the

conventional bank interest rate, then they will join a

sharia bank.

The results of the study show the customer's

perceptions of the principle and profit sharing

system and interest that the customer does not

understand well the concept of profit sharing and

interest, both in the product and the operational

mechanism, especially for the principle of Islamic

banks. In this case the socialization of the

community for Islamic bank principles in particular

and conventional banks is very necessary because

there are still many people who do not yet know the

principles of interest and profit sharing so that

customers consider basically the same.

The results of interviews with one of the

customers when interviewed claimed that if making

a loan with an Islamic bank would be more

disadvantage compared to a conventional bank, this

is because the installments paid every month on

Islamic banks are larger than conventional banks.

Conversely, there are also customers who argue that

making loans to Islamic banks can actually pay

lower interest compared to conventional banks.

Differences of opinion expressed by customers can

be caused by policies in determining profit sharing

and interest in different banks and in principle the

profit sharing system in Islamic banks and interest in

conventional banks is different.

After the research was found other factors that

influence customers in making decisions to choose

banking services, namely factors that are influenced

by aqeedah and according to Islamic law, customer

thinking about usury which is forbidden in the

Qur'an and Hadith makes customers more Islamic

banks than banks conventional. In this regard also

the factor of the length of time the customer relates

to the bank contributes to the loyalty of the tendency

of customers to choose bank services that are used

today even though the customer understands that

bank interest is contrary to Islamic sharia. Like

customers in conventional banks who are reluctant

to move to Islamic banks because they have long

been customers of conventional banks, this can be

seen from the sample that the length of time being a

customer in a conventional bank is dominated by 5-

10 years and more than 20 years for 58%. the length

of being a bank customer in sharia is dominated for

0-5 years and 5-10 years by 89%.

5.2 Reputation Effect of Banks on Customer

Decisions

The result of the study shows that the bank's

reputation does not have a significant influence on

the customer's decision in choosing banking services

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1354

for both islamic banks and conventional banks.

However, four indicators of the bank's reputation

variables are (1) the availability of strategic

locations for branch offices that are easily reached,

not far from home, and have access to public

transportation facilities to the bank office, (2) easy

location for ATM availability, (3) excellence bank

products, and (4) bank achievements that have

already been achieved and perceptions of both the

people who have used products at the bank have an

influence on the customer's decisions in choosing

banking services.

The results showed that the level of employee

honesty, speed and responsiveness of employees in

dealing with complaints of problems needs to be

improved, so that customers will be more trusting

and more loyal to use banking services. In addition,

the level of comfort of the atmosphere of the room at

the bank office given to the bank at this time (such

as the waiting room, transaction space) must be

further increased so that customers feel comfortable

despite waiting with a long queue number.

Safe bank area conditions such as the location of

the bank, parking lot, CCTV monitoring, etc. need to

be considered so that customers can feel safe to

transact with the bank, no need to worry about

unwanted things. The large availability of strategic

location of branch offices and the ease of finding

locations for the availability of ATMs can attract

customers to use bank services where customers

more easily reach bank offices and find ATMs if

they want to make transactions.

After conducting a survey and conducting

interviews with several customers, one of the

reasons customers choose bank services currently

used is due to the needs and information obtained.

The customer claims to use the bank that he is

currently using because of the need factor in which

the employee's salary is now transferred and taken

through the bank in collaboration with the office

both government and private offices. Likewise,

students who will get a scholarship where the

scholarship money will be transferred through a

bank account according to the requirements when

applying for a scholarship that inevitably requires

students to open a new account according to a

predetermined bank. In addition there are banks that

offer Hajj savings and some customers use Islamic

banks for the benefit of Hajj, this is also because

generally Hajj travel services work together with

Islamic banks.

The number of easy to find branch offices also

affects customers in choosing banking services. In

the regency area, the number of sharia bank branch

offices can be calculated compared to the number of

conventional bank offices. Recognition of customers

from one of the districts that were respondents

claimed why they prefer the services of conventional

banks, because conventional bank offices have long

been established compared to Islamic banks that

have only been established for the past 3 months.

With a bank office that has only one office location

far from the customer's home, customers are also

increasingly lazy to use Islamic banking services.

Conventional bank customers also say why to

choose the services of conventional banks. This is

because they have long been customers of

conventional banks for 5-10 years or even more than

20 years, at that time not getting information for

Islamic banks. The lack of socialization of Islamic

banks compared to conventional banks that often

socialize offering products through offices in Jambi

Province and Universities in Jambi City makes

customers prefer conventional banking services.

5.3 Effect of Information Asymmetry on

Customer Decisions

The result of the study shows that information

asymmetry does not have a significant effect on the

customer's decision in choosing banking services for

both Islamic banks and conventional banks.

The results showed that there were still many

banks that did not provide complete financial

information to customers, such as information on the

calculation of the distribution of interest and interest

for the customer and the bank, and information on

how to calculate Loan to Deposits Ratio (LDR), Non

Performing Loans (NPL), and the Bank's Capital

Adequacy Ratio (CAR) to customers. Even though

the customer already knows the benefits for the

customer, the calculation of the determination of

profit sharing and interest for the bank and the

customer remains important, because the customer

needs information to know the calculation of the

profit sharing and interest system, because the

customer is the biggest uncertainty.

The survey results of one of the bank's former

employees said why the banks did not provide

information on the calculation of LDR, NPL, and

CAR. They themselves as bank employees did not

know the calculation even the value of LDR, NPL,

and CAR, with reasons that knew financial matters.

is part of their accounting and supervisor. Although

there are several bank customers both in Islamic

banks and conventional banks do not understand the

Loan to Deposits Ratio (LDR), Non Performing

Loans (NPL), and Capital Adequacy Ratio (CAR),

but this information is still important because many

Determinants of Customer’s Decision in Selecting Banking Services in the Province of Jambi

1355

customers want financial information as complete as

possible to find out how the real condition of the

bank, and should be a bank employee must also

understand this not only accounting and supervisors.

6 CONCLUSIONS

The principle of profit sharing and interest does not

have an influence on the decisions of customers in

choosing banking services, which means the

principle of interest and profit sharing does not

cause customers to choose banking services for both

conventional and Islamic banks.

Reputation has no effect on customers decisions

in choosing banking services, which means that

employee performance, facilities, environment and

products do not cause customers to choose banking

services.

Information Asymmetry has no influence on

customer decisions in choosing banking services,

which means that moral hazard and adverse

selection do not cause customers to choose banking

services.

REFERENCES

Anonim. (2015). Detik Finance. Retrieved April Tuesday,

2017, from https://finance.detik.com/moneter/

2886801/menkeu-bambang-bank-syariah-lebih-tahan-

menghadapi-krisis

Arrieta. (1988). Interest Rates, Savings, and Growth in

LDCs: An Assessment of Recent Empirical Research.

World Development, 16, 589-605.

Azis, S. (2001). Analisis Faktor-Faktor yang

Mempengaruhi Reputasi (Studi Pada Bank Mandiri

Purwokerto). Semarang: Universitas Diponegoro.

Fombrun, C., & Riel, C. V. (1997). The Reputation

Landscape. Corporate Reputation Review, 1, 5-13.

Ghazali, I. (2011). Aplikasi Analisis Multivariate dengan

Program IBM SPSS 19 (5 ed.). Semarang: BP

Universitas DIPONEGORO.

Islamic FinancialPolicy. (2016). Islamic Financial

Country Index. London: Global Islamic Financial

Repot.

Ismail. (2014). Perbankan Syariah. Jakarta: Kencana

Prenada Media Group.

Maisur, M.Arfan, & M.Shabri. (2015). Pengaruh Prinsip

Bagi Hasil, Tingkat Pendapatan, Religiusitas dan

Kualitas Pelayanan terhadap Keputusan Menabung

Nasabah Pada Bank Syariah di Banda Aceh. Jurnal

Magister Akuntansi Pascasarjana Universitas Syiah

Kuala, 4, 1-8.

Misanam, M., & Liana, L. (2007). Bunga Bank, Bagi

Hasil dan Relijiusitas: Suatu Investigasi Loyalitas

Nasabah Terhadap Perbankan Syari'ah. SINERGI, 9,

69-86.

Muhammad. (2011). Manajemen Bank Syariah.

Yogyakarta: UPP STIM YKPN.

Romenti, S. (2010). Reputation and Stakeholder

Engagement: an Italian Case Study. Emerald Insight,

14, 306-318.

Sagan, A. D., Tabrani, M., & Darsono, N. (2012). Analisis

Perilaku Nasabah PT.Bank Aceh (Survei Pada Kantor

Pusat Operasional Banda Aceh). Jurnal Ilmu

Manajemen Pascasarjana Universias Syiah Kuala, 1,

19-36.

Sugiyono. (2012). Metode Penelitian Bisnis. Bandung:

ALFABETA.

Undang-UundangNo21. (2008). Perbankan Syariah.

Jakarta: Republik Indonesia.

Yamin, & Heri. (2014). SPSS Complete: Teknik Analisis

Statistik Terlengkap dengan Sofware SPSS. Jakarta:

Salemba Infotek.

Yaya, R., Abdurahim, A., & Nugraha, D. A. (2007).

Kesenjangan Harapan Antara Nasabah dan

Manajemen terhadap Penyampaian Informasi

Keuangan dan Non Keuangan Bank Syariah. Jurnal

Akuntansi dan Investasi, 8, 1-16.

Yulianto, A. (2010). Analisis Asimetri Informasi

Keuangan dan Non Keuangan (Studi Bank Syariah di

Semarang). Jurnal Dinamika Akuntansi, 2, 110-117.

Yupitri, E., & Sari, R. L. (2012). Analisis Faktor-Faktor

yang Mempengaruhi Non Muslim Menjadi Nasabah

Bank Syariah Mandiri Medan. Jurnal Ekonomi dan

Keuangan, 1, 46-60.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1356