Analysis of Conventional and Sharia Monetary Policies through Asset

Prices on Inflation in Indonesia

Julika Rahma Siagian

1

, Dede Ruslan

2

and Arwansyah

2

1

Post Graduate School, State University of Medan, North Sumatra, 20219, Indonesia

2

Department Economics, Faculty of Economics, State University of Medan, North Sumatra, 20219, Indonesia

Keywords: Sharia Monetary, Conventional Monetary, Error Correction Model (ECM)

Abstract: This study aims to analyze the transmission mechanism of monetary policy in Indonesia in controlling

inflation, both in terms of sharia and conventional terms. The data used in this empirical study is time series

data during 2011:1-2017:4 originating from Bank Indonesia and the Central Statistics Agency (BPS). The

analysis tool used is the Error Correction Model (ECM). This study analyzes the relationship between

independent and dependent variables both in the short and long term. The results of this study indicate that

from conventional monetary variable SBI (certifikat of bank indonesia) variables that have a positive and

significant effect on inflation in the long-term. Whereas in the short term the variable money supply has a

negative effect and variable interest rates on Bank Indonesia, bonds have a positive and significant effect on

inflation. In Islamic monetary variables, SBIS have a positive and significant effect on inflation in the long-

term. Islamic bond variables (Sukuk) have a negative and significant effect on inflation in the long-term.

While in the short-term the variable money supply, Islamic interest rates, and Islamic bonds have a positive

and significant effect on inflation.

1 INTRODUCTION

Monetary policy serves as a key to achieve

macroeconomic goals within a country. The

Government through the Central Bank as a monetary

policy aksekutor keep trying to regulate the amount

of money in circulation by trying to maintain the

stability of the value of money from various internal

and external factors. Those factors are not detached

from the steps of the Government in setting and

regulating interest rates, credit, asset prices, the

company's balance sheet, the exchange rate and

inflation expectations (Daniar, 2016).

To reduce the impact of the global economy jolts

to the economy in the country, it is a policy that is

effective and efficient, good monetary policy or

fiscal policy and other economic policies. The focus

of the implementation of monetary policy in

Indonesia according law No. 23-year 1999 amended

in Act No. 3 of the year 2004 concerning the

monetary policy of central bank Indonesia said that

given the dual mandate as monetary authorities that

can run conventional monetary policy as well as the

Sharia, then monetary policy that is using a dual

monetary policy i.e. conventional and Sharia with

the ultimate goal of monetary policy in Indonesia is

to achieve and maintain the stability of the value of

the the rupiah, that is the price (inflation) and the

exchange rate of the rupiah.

Based on the PMK No. 93/PMK. 011/2014

Target of inflation in 2016, 2017, and 2018 the date

21 may 2014 target for inflation set by the

Government for the period 2016 – 2018,

respectively by 4%, 4% and 3.5% respectively with

a deviation of ± 1%. (Bank Indonesia, 2018). As

seen in the graph below:

466

Siagian, J., Ruslan, D. and Arwansyah, .

Analysis of Conventional and Sharia Monetary Policies through Asset Prices on Inflation in Indonesia.

DOI: 10.5220/0009502304660472

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 466-472

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Figure 1: The growth of Inflation and actual

inflation target

According to Mishkin (1995), the transmission

mechanism of monetary policy is a complex process

because in theory of monetary economics is often

referred to as "Black box". This is because the

transmission is much influenced by three factors,

namely, the first change in the behavior of the

central bank, banking and economic actors in a

variety of financial and economic activity.

This research uses the variable bonds and Islamic

bonds (sukuk), asset prices as an indicator of

monetary policy through the asset price is a

monetary policy which will also affect the

development of the prices of other assets, whether

such financial asset price yield bond and stock

prices, as well as the physical assets of the particular

property and stock prices of gold. The influence of

price on the consumption of the asset investment

also would affect aggregate demand and will

ultimately determine the level of real output and

inflation in the economy (warjiyo, 2004).

As the Monetary Authority, Bank Indonesia will

usually accept and regulate the money supply to

stabilize the monetary economy of the country. A

stable money supply will hit the high inflation rate.

Open market operation as an indirect monetary

instruments can affect its operational objectives,

namely the interest rate or the amount of circulating

more effectively. By using the Certificates of Bank

Indonesia (SBI) as monetary instruments accounting

and Bank Indonesia Certificates (SBIS) Sharia as

monetary instruments. With Bank Indonesia

Certificate (SBI) and Bank Indonesia Certificates

(SBIS) Shariah-compliant central bank buying and

selling activities of securities with market

participants, both at the primary or secondary

markets that serve the main indirect operational

instruments monetary control.

Figure 2: The growth of Bank Indonesia Certificates

(SBI), Bank Indonesia Certificates sharia (SBIS),

bonds and Islamic Bonds (Sukuk), Year 2011 – 2014

in (billion)

Source: Bank Indonesia and the financial services

authority (OJK)

Based on the above graph shows the trend of the

decline in the value of the SBI from year 2011 until

2014. Carried out in respect of article IBPA

(Indonesia Agency) 2015, SBI tends to decline

because the flow of funds banking on SBI receding

more in line with the direction of the monetary

policy of the central bank, where BI is deliberately

reducing the absorption of funds through the SBI in

order to the Bank is funneling more enterprising

credit so that it will have an impact on the rupiah

exchange rate remained stable. If the Fund's bank in

SBI, BI has to accumulate increasingly bear the

brunt of an increasingly large flowers.

Policies that central banks do so showing the

value of SBIS decreases and SBIS increases, keep

paying attention to the amount of money in

circulation is also increasing every year. In addition,

the development of assets such as bonds and Islamic

bonds (sukuk) continues to increase, which means it

can be said that investment with assets such as this

demand by investors.

Like the previous explanation of inflation which

remained persisted each year greatly affect the

amount of money in circulation. Where in the year

2011 the money supply amounted to 2,877,220

Billion while in the year 2014 growing money

supply followed by high inflation in that year

reached 8.36% with the amount of money floating

Analysis of Conventional and Sharia Monetary Policies through Asset Prices on Inflation in Indonesia

467

around 4,170,731 billion. This greatly influenced the

development of the price of other assets such as the

SBI in 2012 and 2014 is declining while the SBIS in

2014 rising high in the follow with the development

of conventional bonds and Islamic bonds.

2 THEORICAL FRAMEWORK

The transmission mechanism of monetary policy is a

process where a policy can affect economic growth

and inflation in a country, the transmission channels

of monetary policy is carried out through six

channels namely interest rates, credit, the company's

balance sheet, assets prices, exchange rates and

expectations.

According to Dornbusch, et al (2004), the

monetary policy affects the economy, first, by

influencing interest rates then affect aggregate

demand. The increase in the money supply lower

interest rates, increasing investment spending and

aggregate demand, and therefore increase the

equilibrium output.

Indonesia began to adopt the dual banking

system after the banking policy issued in 1998 Act

No. 10 of the double-banking, (Dahlan Slamat,

2005:407). The dual banking system is the

application and enforcement of this two banking

systems (conventional or public bank system that

operates with the flowers and the banks that operate

with the Sharia system side by side), which

generally also not limit of conventional commercial

banks in providing Islamic services through

mechanisms of islamic window by first forming the

Syariah Business Units (UUS).

Specifically, Taylor, 1995 (in Warjiyo, 2004)

stated that the mechanisms of monetary transmission

to bijakan is “the process through which monetary

policy decision are transmitted into changes in real

GDP and inflation”. This means that the

transmission Mechanism of monetary policy is the

paths traveled by the monetary policy to be able to

influence the final target of monetary policy, namely

national income and inflation.

Monetary policy through the price of the asset

can be via two channels i.e. channel wealth (the

wealth effect) and Tobin-q (Mishkin: 1955). Lines

of wealth (the wealth effect) affects the level of

consumption, and consumption affect aggregate

demand, aggregate demand and further affect the

output gap and ultimately affect the rate of inflation.

Asset prices through the channels on the Tobin-q

will affect the level of investment and the impact on

aggregate demand and ultimately influence the

inflation rate. In this context, the channel-a channel

that gives the stress on the transmission mechanism

of monetary policy is Tobin's theory and the

influence of wealth (the wealth effect) of

consumption. Through Tobin's q theory, if q is

defined as the relative market value of companies-

companies that can purchase a variety of fixtures by

simply issuing equities, and vice versa.

The role of asset price in the transmission

mechanism of monetary policy is known

theoretically, though difficult to illustrate

empirically. Monetary policy shocks results in

fluctuations in the price of assets with monetary

policy can boost stock prices in two ways namely by

making equities relatively more attractive for bond

and an improvement in the Outlook for corporate

earnings as a result of spending more households.

Thobin q theory describes the mechanism of

monetary policy in a manner affecting the economy

through its impact on equity valuations. (Asif Idres

et al, 2005)

According to Edward and Khan (1985) there are

two types of factors that determine the value of the

interest rate i.e. the internal and external factors.

Internal factors include the national income, the

amount of money in circulation, and inflation. While

the external factor is the foreign interest rate and the

rate of foreign currency exchange rate changes are

expected. (Neny Erawati,2002:99)

The mechanism works BI Rate until affect

inflation is often referred to as the transmission

mechanism of monetary policy. The mechanism

describing the actions of Bank Indonesia through the

vicissitudes of monetary instruments and operational

targets affecting various economic and financial

variables before ultimately influential to the end goal

of inflation. (Bank Indonesia, 2015).

3 RESEARCH METHOD

This study uses secondary data runtun time (time

series) in the form of a monthly period January

2011-December 2017. This research was conducted

to look at variables-variables that affect the

transmission of conventional monetary policy and

asset prices through Sharia. Variables-variables that

will be scrutinized is the SBI, SBIS, money supply,

bonds, Islamic bonds (Sukuk) in Indonesia. Data

obtained from Bank Indonesia (BI) and the financial

services authority (OJK).

The estimation model used in this study is the

analysis of dynamic model with the regression that

is by using the model of error correction (Error

Correction Model/ECM) Domowitz and granger. In

the context of Economics, dynamic model

specification is very important because it deals with

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

468

the establishment of the model of the economic

system that is associated with the change in time

both short term and long term. This study uses

statistics programs help E-views Version 9.0..

4 ANALYSIS

4.1 Stationeritas Test

The first thing to do is to examine whether the data

is stationary or not. This Stasioneritas test needs to

be done because a regression analysis should not be

did when the data used is not stationary and

normally if it still done the resulting equations then

are a spurious regression.

4.1.1 Unit Root Test

A variable is said to be stationary if the mean value,

variance, and kovariansnya always constant at any

point in time. There are some proper ways can be

done to measure the existence of stasionaritas, one

of them is by using the Dickey Fuller (DF), i.e. If

the absolute value larger than his statistics DF Mc

Kinnnon Critical Value (depending on the level of

selected beliefs 1%, 5%, or 10%), then it can be

inferred that such data stationary. In this research a

critical value used was 5% which is not too low and

not too high.

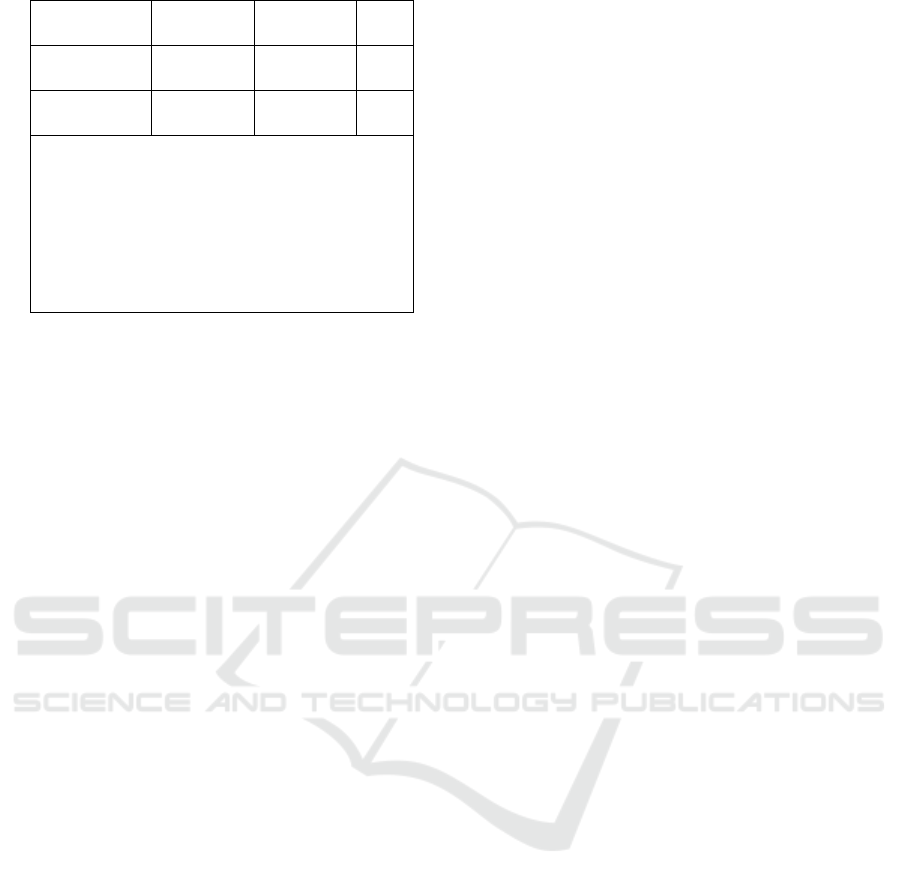

Table 2: Unit Root Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Description

INF -1.095811 -2.976263 Non

Stationary

MS -3.893595 -2.976263 Stationary

SBI -2.638140 -2.981038 Non

Stationary

BONDS -2.403553 -2.976263 Non

Stationary

SBIS -2.638140

-2.981038

Non

Statioary

ISLAMI

C

BONDS

(SUKUK)

-1.497680

-2.976263

Non

Stationary

4.1.2 Integration Test

A test of the degree of integration is a continuation

of the test unit and the roots are only required when

all the data has not been stationary at zero degrees or

1. A test of the degree of integration used to know at

how data will be stationary. When the data have not

been stationary at one, then testing must remain

continued until each variable is stationary. This test

is used to perform test Dickey Fuller (DF). Which

table II explained that a variable (MS) on the level

of the stationary level. Whereas in variable INF,

SBI, BONDS, ISLAMIC BONDS (SUKUK) on the

stage level not stationary then performed a test of the

degree of intergrasi.

Table 3: Integration Test Results

Variables

Value

ADF

Critical

Value

McKin

non (α =

5%)

Description

INF -3.797454 -2.981038 Stationary

MS -6.646262 -2.981038 Stationary

SBI -2.595987 -2.981038 Non

Stationary

OBL -2.981038 -2.082098 Non

Stationary

SBIS -1.132217 -2.981038 Non

Stationary

SUKUK -6.589875 -2.981038 Stationary

Table 4: Integration Test Results

Vari

ables

Valu

e ADF

Critic

al Value

McKi

nnon (α =

5%)

Descrip

tion

INF -

5.089589

-3.004861 Stationa

ry

MS -

9.099494

-2.986225 Stationa

ry

SBI -

4.525525

-2.986225 Stationa

ry

OBL -

3.476526

-2.986225 Stationa

ry

SBIS -

3.466009

-2.991878 Stationa

ry

SUKUK -

4.579899

-3.004861 Stationa

ry

4.1.3 Cointegration Test

In this research to test the residual method based on

Granger test. Residual-based test methods using

Analysis of Conventional and Sharia Monetary Policies through Asset Prices on Inflation in Indonesia

469

statistical tests Augmented Dickey-Fuller (ADF)

regression by observing the rest of Granger was

stationary or not. The value of this residue will be

tested using the test Augmented Dickey-Fuller

(ADF) to find out whether the value of the

remaining stationary or not. The results of this

research show that the value of the ADF tests

estimated > Critical Value α = 5% (-4.612624 >-

2.981038). So it can be concluded that the empirical

model used in this study are eligible to test Granger.

Table 5: Cointegration Test Results

Va

riables

Value

ADF

Critica

l Value

McKin

non (α =

5%)

Ket

ECT -4.612624 0.0012 Stasion

ary

4.2 Estimation Error Correction Model

(ECM)

Table 6: The Results of The Estimation of the Error

Correction Model (ECM) Short-Term

Indep

endent

Variables

Coefficient

t-

Statistic

Pro

b

D(Ln

MS)

-

5.089649

-

2.752699

0.01

56

D(LnS

BIS)

3.6585

54

4.0321

25

0.00

12

D(LnS

UKUK)

-

0.493542

-

4.528430

0.00

05

ECT

1.2872

58

6.0022

74

0.00

00

C

0.3357

69

1.1666

29

0.26

28

R-squared

Adjusted R-

squared

F-statistic

Prob(F-

statistic)

Durbin-

Watson stat

0.904034

0.869760

26.37686

0.000001

2.179223

Equation Error Correction Model (ECM) for

long-term periods are as follows:

On the table are able to be known that the

estimation of sharia monetary policies where MS,

SBIS, and short-term variable are significant

affected. Where MS is negative and significant

influence of inflations as also for SUKUK

variables. Only the SBIS is positive and significant

influence on Indonesia’s inflation.

Table 7: The Results of The Estimation of Error

Correction Model (ECM) Long-Term.

Independ

ent

Variables

Coefficient t-Statistic Prob

D(LnMS) -0.056966 -1.020440 0.3181

D(LnSBIS

)

1.108118 3.0605074 0.0055

D(LnSUK

UK)

-0.409202 -2.063630 0.0505

C 4.251129 2.601117 0.0160

R-squared

Adjusted R-

squared

F-statistic

Prob(F-

statistic)

Durbin-

Watson stat

0.433574

0.359692

5.868482

0.003958

0.685553

Table 8: The Results of The Estimation of the Error

Correction Model (ECM) Short-Term

Independen

t Variables

Coefficient t-Statistic Prob

D(LnMS) -2.642198 -3.116654 0.0071

D(LnSBI) -0.064296 -3.045324 0.0082

D(LOBLIG

ASI)

-0.439834 -1.973081 0.0672

ECT 0.938950 5.140962 0.0001

C 0.714068 3.788115 0.0018

R-squared

Adjusted R-

squared

F-statistic

Prob(F-

statistic)

Durbin-

Watson stat

0.756959

0.675946

9.343614

0.000335

1.834620

Table 9: The Results of The Estimation of Error

Correction Model (ECM) Long-Term.

Independent

Variables

Coefficien

t

t-Statistic

Pro

b

D(LnMS) -2.642198 -3.116654

0.16

17

SUKUK

SBISMSn

493542.0

658554.3089649.5575499.5INFL

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

470

D(LnSBI) -0.064296 -3.045324

0.02

81

D(LOBLIGA

SI)

-0.439834 -1.973081

0.13

75

C 0.938950 5.140962

0.02

16

R-squared

Adjusted R-

squared

F-statistic

Prob(F-

statistic)

Durbin-

Watson stat

0.367696

0.285221

4.458297

0.013102

0.602493

4.3 Test Determination (R

2

)

4.3.1 F-Test (Simultaneous Test)T

F test or simultaneous test is conducted to see the

effect of independent variables simultaneously or

together on the dependent variable. From the results

of the model estimation for inflation in the short

term, the calculated F value is 26.37686 with a

probability level of 0.000001. Then the variable is)

the money supply (MS), sbi and sbis and bonds and

sukuk in the short term which have a simultaneous

significant effect on inflation (INF) in Indonesia.

From the results of the model estimation for

inflation in the long run, the Fcount value is

7.664799 with a probability level of 0.001429. Then

the variable is the money supply (MS), sbi and sbis

and bonds and sukuk in significant simultaneous

inflation (INF) in Indonesia.

5 RESULTS

5.1 Influence of The Money Supply on

Inflation in Indonesia

According to Adiwarman (2010), the concept of

money in the economy of islam is different with the

concept of money in the economy. In economics, the

concept of money is very clear and definite that

money is money, money is not the capital. On the

contrary, the concept of money expressed in

conventional economic generalized back and forth,

namely money as money and money as capital.

Based on the estimation of the long and short

term of the dual policy, the money supply has a

significant negative effect on the short term with a

probability value of> 0.05%. Whereas in the long

run both monetary and sharia monetary policies have

no significant effect. This is in line with Keynes's

theory that increases in the money supply can

increase prices, but the increase in money supply is

not always proportional to the increase in the price

of goods.

5.2 Influence Of Sbi And SBIS On

Inflation In Indonesia

The fact is that in this variable, the SBI and SBI

influence inflation in the long and short term

estimates for both conventional and sharia monetary

policies both have a negative and significant effect.

This identifies that variable inflation is strong in

influencing sharia variables, that is, except for sharia

policy rate variables or Indonesian bank sharia

certificates (SBIS), and conventional SBI variables.

On the channel of asset prices through Tobin-q

will affect the level of investment and have an

impact on aggregate demand and ultimately affect

the inflation rate. The problem is how monetary

policy changes equity prices. If monetary policy

takes place contractively, members of the public will

get the fact that they have less money to spend.

Furthermore, an increase in interest rates causes the

cost of holding money more expensive,

consequently (cateris paribus), the acquisition of

deposits is greater than equity, consequently the

company's market value decreases. Thus the

company's ability to carry out an expansion is

experiencing congestion, investment is down, and

economic growth stops. This situation will suppress

the output gap, thereby reducing inflation.

5.3 Ifluence of Obligasi and Obligasi

Syariah (sukuk) on Inflation in

Indonesia

Through the estimation of the error correction

model, it is known that the two double monetary

variables in the SUKUK variable sharia monetary

policy have a significant negative effect on inflation

in Indonesia through the asset price path both long

term and short term with a probability value>

0.05%. Whereas in conventional monetary policy

the asset price variable asset path in the short term

has a significant negative effect, the long-term

estimation of this variable reverses the previous

estimation results because it does not affect inflation

in Indonesia.

Monetary policy influences the development of

prices of other assets, both the price of financial

assets such as bond yields and stock prices, or the

price of physical assets, especially the price of

Analysis of Conventional and Sharia Monetary Policies through Asset Prices on Inflation in Indonesia

471

property assets and gold. This transmission occurs

because the investment of funds by investors in their

investment portfolios is not only in the form of

deposits in banks and other instruments in the rupiah

and foreign exchange money markets, but also in the

form of bonds, shares, and physical assets. Thus,

changes in interest rates and exchange rates as well

as the amount of investment in the rupiah and

foreign exchange money markets will also affect the

volume and price of bonds, shares and physical

assets.

6 CONCLUSIONS

Based on the description stated, it can be concluded

that in the short term the speed of transmission of

monetary policy in conventional banks is relatively

stronger compared to monetary policy in Islamic

banking. Inflation is more influenced by variables in

conventional banking. Most of the influence of

inflation is influenced by SBI which in the long and

the short term has a negative and significant effect

while the MS variable has negative and significant

influence and the BONDS has a significant negative

effect on the short term while the long term is not

significant in the transmission of monetary policy.

For variables sharia, which has a big effect on

inflation and the effectiveness of a policyMonetary

is influenced by SBIS variables. The implications of

SBIS are increasing investment community in

banking sharia, SBIS will go up and aggregate

demand rises, then people's income will grow. Then,

monetary policy for 'inflation reduction' with a

pattern Sharia is more effective than pattern

Conventional.

REFERENCES

Arends, R. I. (2008) LEARNING TO TEACH (Belajar

Untuk Mengajar) Buku Dua. Jogyakarta: Pustaka

Pelajar. Available at: http://buku-rahma-

detail.blogspot.com/2011/11/learning-to-teach-

belajar-untuk_27.html.

Boyatzis, R. E. (2008) ‘Competencies in the 21st century’,

Journal of Management Development. Edited by R.

Boyatzis. Emerald Group Publishing Limited, 27(1),

pp. 5–12. doi: 10.1108/02621710810840730.

Center, P. P. R. (2010) ‘21 st Century Skills for Students

and Teachers’, Journal Research & Evaluation, pp.

1–25.

Dick, W., Carey, L. and Carey, J. O. (2005) The

systematic design of instruction. Pearson/Allyn and

Bacon.

Dole, S., Bloom, L. and Kowalske, K. (2015)

‘Transforming Pedagogy : Changing Perspectives

from Teacher-Centered to Learner-Centered The

Interdisciplinary Journal of Problem-based Learning

Transforming Pedagogy : Changing Perspectives

from Teacher-Centered to Learner-Centered’,

Interdisciplinary Journal of Problem-based

Learning, 10(1). Available at: at:

https://doi.org/10.7771/1541-5015.1538.

Hung, W. (2009) ‘The 9-step problem design process for

problem-based learning: Application of the 3C3R

model’, Educational Research Review, 4(2), pp.

118–141. doi: 10.1016/j.edurev.2008.12.001.

Majid, A. and Rochman, C. (2015) Pendekatan Ilmiah

Dalam Implementasi Kurikulum 2013. Bandung:

Remaja Rosdakarya.

Permendiknas (2007) ‘Permendiknas No. 16 Tahun 2007,

Tentang Standar Kualifikasi dan Kompetensi Guru’.

Rusman (2011) Model-model pembelajaran:

mengembangkan profesionalisme guru. Rajawali

Pers/PT Raja Grafindo Persada.

Sani, R. A. (2014) ‘Pembelajaran saintifik untuk

implementasi kurikulum 2013’. Bumi Aksara.

Slameto (2003) Belajar dan faktor-faktor yang

mempengaruhi. Jakarta: Rineka Cipta. doi: 2003.

Tarmizi, R. A. and Bayat, S. (2010) ‘Effects of problem-

based learning approach in learning of statistics

among university students’, Procedia - Social and

Behavioral Sciences, 8(5), pp. 384–392. doi:

10.1016/j.sbspro.2010.12.054.

Trianto (2010) Mendesain ModelMendesain Model

Pembelajaran Inovatif Progresif. Jakarta: Kencana.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

472