What is Multinationality, Tax Haven Utilization, Uncertainty Tax

and Disclosure of Corporate Social Responsibility Affected Tax

Avoidance by Multinational Companies?

Trisni Suryarini

1

and Retnoningrum Hidayah

1

1

Faculty of Economics, Semarang State University, Semarang-Indonesia

Keywords: Tax avoidance, multinational, tax haven, tax uncertainty

Abstract: The practice of tax avoidance is carried out because debt is greater than the capital, especially that debt

obtained from the same group of companies. This study aims to obtain empirical evidence regarding the

influence of multinational, utilization of tax havens, tax uncertainty, and Corporate Social Responsibility

disclosure on tax avoidance. The population in this study are multinational companies listed on the

Indonesia Stock Exchange in 2012-2016. Technique in this study was purposive sampling and obtained a

sample of 38 companies. The analysis used Ordinal Least Square (OLS) with SPSS. The results of the study

show that multinational, utilization of tax havens, uncertainty in taxes and disclosure of CSR did not affect

tax avoidance.

1 INTRODUCTION

Tax is the heart of state income. For the 2017 State

Budget itself, tax accounts for 85% of all state

revenues (www.kemenkeu.go.id/apbn2017). Even

so, tax revenues in Indonesia since 2012 continue to

miss from what is targeted and this has continued to

occur repeatedly over the past five years. Benefit

theory of taxation shows this taxation can be done

because there is a relationship (economic

attachment) between Indonesia as a source state with

activities that provide such income.

Margaret, Lynch, & Rego (2009) state that

corporate tax aggressiveness is an act of

manipulating taxable income done by the company

through tax planning actions, both using legally

classified methods (tax avoidance) or illegal (tax

evasion). Not all actions taken in an effort to tax

aggressiveness violate regulations, but the more

loopholes used to reduce tax costs, the company is

considered more aggressive towards taxes. Actions

of tax aggressiveness tend to be carried out by

companies because there are many interests in it, and

the tax burden borne by corporate taxpayers is

greater than the individual taxpayers.

Tax avoidance cases that are part of tax

aggressiveness are rampant in Indonesia, thus

placing Indonesia ranked 11th as the country with

the highest level of tax avoidance. First place the

most tax avoidance is carried out by the United

States where the company has cost the country 188.8

billion US dollars (www.tribunnews.com).

Companies in the mining sector are not immune

from tax aggressiveness activities. The flow of

illegal money abroad has nearly doubled over the

past ten years from Rp 141.82 trillion in 2003 to Rp

227.75 trillion in 2014. Significant increase mainly

occurs in the mining sector. The run of funds abroad

is due to weak government oversight toward

financial activities and corporate tax payments.

Economic policy researchers from Publish What

You Pay (PWYP) Indonesia, says illegal money

flows in the mining sector are caused by trade

transactions with fake invoices (trade miss

invoicing). The surge in the amount of illegal money

flows in the mining sector indicates tax avoidance

and tax evasion involving Indonesian mining

companies (PWYP).

The research of Taylor & Richardson (2013)

related to the determinant of the effect of tax

avoidance practices results that multinationality, tax

haven utilization, withholding tax, and tax

uncertainty have a significant positive effect on the

practice of thin capitalization in Australian

1154

Suryarini, T. and Hidayah, R.

What is Multinationality, Tax Haven Utilization, Uncertainty Tax and Disclosure of Corporate Social Responsibility Affected Tax Avoidance by Multinational Companies?.

DOI: 10.5220/0009507311541162

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1154-1162

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

companies. Meanwhile, for research conducted in

Indonesia, it has been carried out by Nuraini &

Marsono (2014) give result that multinationality, tax

haven utilization, and withholding tax have a

significant positive effect on the practice of tax

avoidance in multinational companies in Indonesia,

but institutional ownership has no effect on the

practice of tax avoidance. The lack of influence of

institutional ownership is also supported by research

conducted by Dewi & Jati (2014). Desai, Foley, &

Hines (2006) say that it is very possible for

companies that carry out tax avoidance actions to

combine controlled entities into the Tax Haven

Country in an effort to avoid domestic taxes

significantly. This is in accordance with the research

conducted by Taylor & Richardson (2013) as well as

Nuraini & Marsono (2014) that the utilization of Tax

Haven significantly affects tax avoidance practices.

The characteristics of the company also become

one of the factors in the practice of tax avoidance

actions. These characteristics can be seen from

company size (Surbakti, 2012). The characteristics

of a company can be seen from the size of the

company and multinational company (Dewi & Jati,

2014). According to Rego (2003), the larger the size

of the company, the more transactions will be

carried out. Thus, it allows companies to take

advantage of existing gaps to carry out tax

avoidance actions from each transaction. A large

company certainly requires tighter supervision and

good corporate governance. Good corporate

governance arises because of the separation of duties

and authority and the existence of a supervisory

committee. Therefore, the audit committee in this

case as a supervisor of the company has an

important role in overseeing the practice of tax

avoidance actions.

Arthana (2011) in Maraya & Yendrawati (2016)

mentions Corporate Social Responsibility Disclosure

(CSRD) is a process of communicating the social

and environmental impacts of a company's economic

activities towards groups that have an interest in the

company as a whole. The concept of legitimacy

shows the existence of corporate responsibility

towards society. The company is aware of its

survival in relation to the company's image in the

eyes of the public. To be able to maintain its

survival, the company seeks a kind of legitimacy or

recognition from investors, creditors, consumers, the

government and the surrounding community.

The result of research conducted by Lanis &

Richardson (2013) shows a negative association

between the activity / level of Corporate Social

Responsibility disclosure and tax aggressiveness/ tax

avoidance in Australian and US public companies.

This supports the application of stakeholder theory

as an approach in the activities of the company's

Corporate Social Responsibility and implements

taxes as part of Corporate Social Responsibility.

Watson (2015) in his research shows the result that

there is a positive relationship between tax

avoidance and company's Corporate Social

Responsibility activities. This is different from

Arianto (2014) where the result of his research

shows that Corporate Social Responsibility does not

affect tax avoidance.

The phenomenon of quite a number of PMA

companies that report losses in their financial

statements and did not pay taxes consecutively for 5

years or more, among others, allegedly due to tax

avoidance practices, demanding more attention from

the government, especially the Directorate General

of Taxes. (Rahayu, 2010). In an effort to address the

problems above, this study tries to examine the

extent of the relationship of multinational companies

in Indonesia in the practice of tax avoidance,

especially tax avoidance. Research on tax avoidance

practices in Indonesia is still rarely found because of

the limitations of data and regulations on tax

avoidance in Indonesia which are still very new

because they were only active in 2016. Based on the

description above, researchers are interested in

conducting research entitled “The Effect of

Multinationality, Utilization of Tax Haven, Tax

Uncertainty, Disclosure of CRS on Tax Avoidance”.

2 THEORICAL FRAMEWORK

Stakeholder theory states that companies have social

responsibility that requires them to consider the

interests of all parties affected by their actions.

Management should not only consider shareholders

in the decision-making process, but also anyone who

is influenced by business decisions. Roberts (1992)

argues that the parties included in the stakeholder

are stockholders, creditors, employees, customers,

suppliers, public interest groups, and governmental

bodies.

The government as a regulator, is one of the

stakeholders of the company, therefore the company

must pay attention to the interests of the

government. One of them is by following all

regulations made by the government, including

compliance with paying taxes, and not doing tax

evasion (Kuriah & Asyik, 2016). Tax aggressiveness

by means of both tax avoidance and tax evasion is

an action that can harm the state. Losses experienced

by the state will have an indirect impact on the

community, because the tax received by the state is

income that will be allocated for the prosperity of

the community. If the company does tax

What is Multinationality, Tax Haven Utilization, Uncertainty Tax and Disclosure of Corporate Social Responsibility Affected Tax Avoidance

by Multinational Companies?

1155

aggressiveness, then this is not in accordance with

stakeholder theory which states that the company

always considers the interests of its stakeholders. To

prevent this from happening and supervise if the

performance of the company does not harm

stakeholders, then the stakeholders give authority to

the board of commissioners to supervise the

company (Lanis & Richardson, 2011)

According to the trade off theory stated by Myers

(2001) that the company will owe up to a certain

level of debt, where the tax savings (tax shields)

from additional debt is equal to the cost of financial

difficulties (financial distress). The costs of financial

difficulties (financial distress) are bankruptcy costs

or reorganization, and agency costs which are

increased due to a decrease in the credibility of a

company. Trade off theory in determining optimal

capital structure includes several factors among

others tax, agency cost and financial distress cost,

but still maintains the assumption of market

efficiency and symmetric information as a balance

and benefit of using debt. The optimal debt level is

achieved when tax shields reach the maximum

amount on the cost of financial distress.

Legitimacy theory states that large companies

will have greater responsibility than small

companies. This is due to large companies having

higher and more complex operational activities that

have a wider impact than small companies. In

addition, the legitimacy theory states that

organizations must constantly try to ensure that they

carry out activities in accordance with the

boundaries and norms of society (Rustiarini, 2011).

One of the efforts that can be done to get positive

legitimacy from the community is to take actions

that are ethical and socially responsible. These

actions can be implemented by the way companies

are involved in financing Corporate Social

Responsibility and adhering to tax provisions

(Mulyani & Suryarini, 2017). The Corporate Social

Responsibility activities will be disclosed by the

company through annual reports or sustainability

reports (if the company issues). The company has a

social contract with the community in its business

environment and through the disclosures, it is

expected that the company will gain legitimacy from

the community that has an impact on the company's

survival (Lindawati & Puspita, 2015)

The activity of tax aggressiveness is viewed

negatively by the community, because it is

considered to have violated social norms. A

company that carries out tax aggression can be

regarded as a company that does not care about the

social conditions around it (Meiranto Wahyu &

Nugraha, 2015).

Development of Hypotheses

The Effects of Multinationality on Tax Evasion

Multinational companies that have subsidiaries

and branches of companies spread across various

countries can be assumed that obtaining foreign

income and applying efficient tax planning among

their group entities. To examine the effect of

multinationality on tax avoidance, the hypothesis

developed is.

H1: Multinationality has a positive effect on tax

avoidance.

The Effects of Utilizing Tax Haven on Tax

Avoidance

Tax haven countries are countries that provide

facilities to other countries 'taxpayers and their

income from other countries' taxpayers can be

directed to countries that are members of tax havens

which will benefit those taxpayers because their

income will not be deducted from taxes. Large and

multinational companies use tax haven countries as a

place to avoid their income or profits from tax

burdens because tax haven countries will not cut or

only deduct a little tax on the company's income.

Desai, Foley, & Hines (2006) provide data that

American multinational companies are making large

use of the Tax Haven country, in 1999, 59% of

multinational companies in the United States that

had relations in Tax Haven.

H2: The Utilization of Tax Haven has an effect

on Tax Avoidance

The Effect of Tax Uncertainty on Tax Avoidance

Management may face significant uncertainty in

determining tax estimates based on differences in

interpretation of tax law (Desai & Dharmapala,

2006). Desai & Dharmapala, (2006) explain that tax

uncertainty can be used by corporate management as

a tool to cover tax avoidance activities. This

certainly includes the practice of thin capitalization.

In addition, when a company enters a "gray area"

where the boundary between the implementation of

tax planning and tax avoidance becomes unclear,

there is an accompanying tax uncertainty. Dyreng,

Hanlon, & Maydew (2014) explain that tax authority

can challenge corporate argument in doing this, and

can result in the company experiencing losses due to

fines imposed by the authority to the company.

H3: Tax uncertainty has a positive effect on tax

avoidance.

CSR Disclosure on Tax Avoidance

One of the efforts that can be done to get positive

legitimacy from the community is by taking actions

that are ethical and socially responsible. These

actions can be implemented by the way companies

are involved in financing Corporate Social

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1156

Responsibility and adhering to tax provisions

(Mulyani & Suryarini, 2017).

Previous research shows that CSR disclosure can

affect on tax aggressiveness. Lanis & Richardson

(2013) in their research shows the result that there is

a negative influence between CSR and tax

aggressiveness, which can be interpreted if the

higher the CSR disclosure of a company, the less

aggressive action of the company. The result of this

study is reinforced by the research of several

researchers which show the same results, namely

carried out by Laguir et al (2015) and Kuriah &

Asyik (2016). Their results show that disclosure of

CSR has a negative effect on tax aggressiveness.

Tax is one form of CSR from companies to the

government and society. This is due to taxes are

used by the government as a fund to finance people's

welfare. Therefore, companies that have high CSR

activities, the level of tax aggressiveness carried out

is low or vice versa. This is because the company

considers tax as a form of social responsibility

carried out by the company to the government and

society.

H4 : Disclosure of Corporate Social Responsibility

has a negative effect on tax avoidance.

3 RESEARCH METHOD

The population in this study were multinational

companies listed on the Indonesia Stock Exchange

for the period 2014-2016. The sampling technique in

this study was purposive sampling technique,

namely data selected based on certain criteria that

were in accordance with the research objectives.

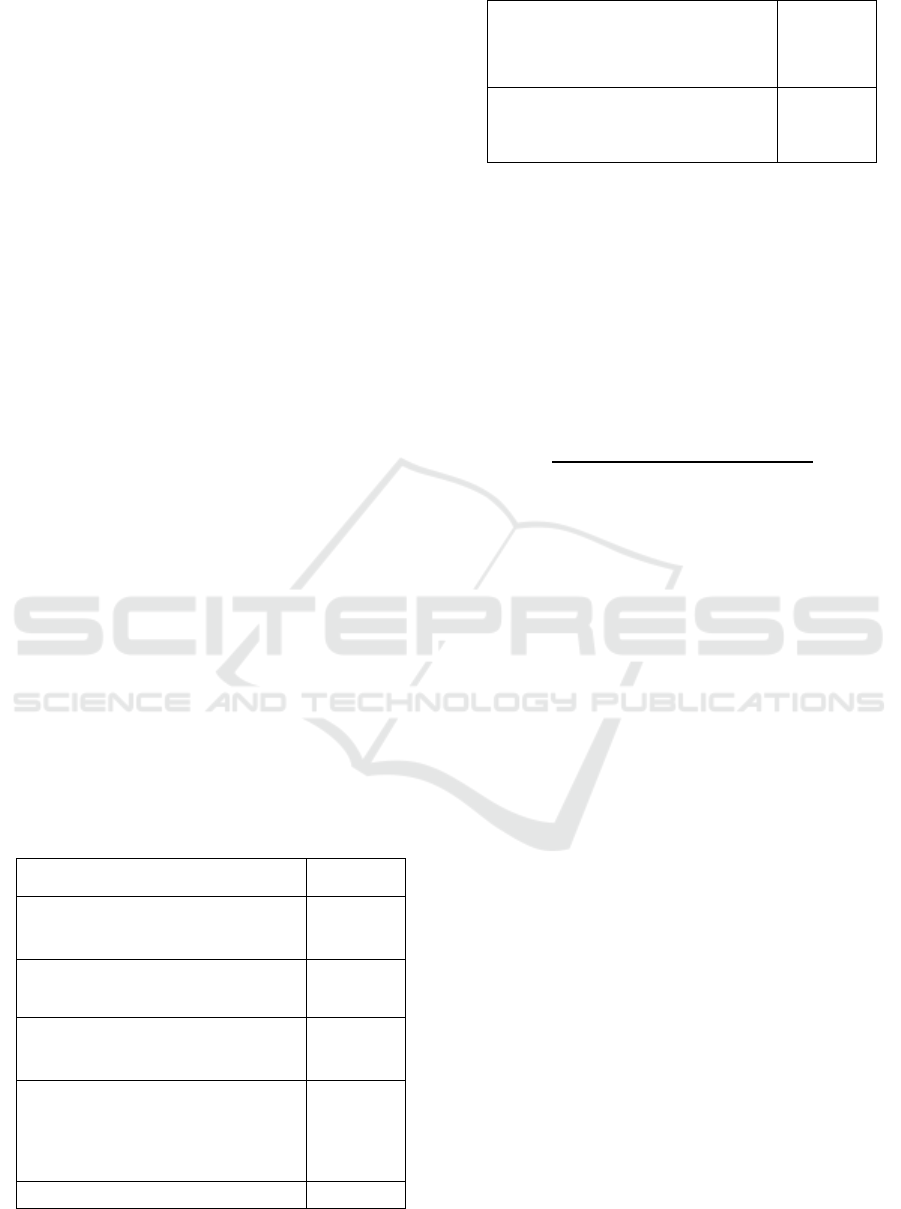

Table 1: Sampling Criteria

Sample Criteria Number

Multinational companies listed

on the BEI in a row

116

Companies that suffered losses (55)

Companies that received tax

utilization

(19)

Companies that received zero tax

loss compensation

(1)

Incomplete data (3)

Number of companies that met

the criteria as samples

38

Number of Analysis Unit

(Period 2012-2016)

190

Source: Secondary data processed, 2018

Dependent Variable

Tax aggressiveness is an act of engineering

taxable income done by company through tax

planning actions, both using methods that are

legally classified (tax avoidance) or illegal (tax

evasion). The proxy used in calculating tax

aggressiveness was effective tax rate (ETR).

PPh Expense

ETR =

Earning Before Tax

The higher the ETR, the lower the company's tax

aggressiveness. Meanwhile, if the ETR gets

smaller then the company's tax aggressiveness

will be higher (Lanis & Richardson, 2013). In

order to facilitate the presentation of result, the

ETR value in this study was multiplied by

negative one (-1).

Independent Variables

1. Multinationality

The measurement used dummy variable where "1" if

the company had at least five subsidiaries or

branches of companies incorporated outside

Indonesia, otherwise stated “0”. The measurement of

this variable was in accordance with previous

research that has been done by Nuraini & Marsono

(2014) which also measured multinationality by

seeing companies had at least five subsidiaries or

branches of companies incorporated outside

Indonesia.

2. The Utilization of Tax Haven

Tax Haven is a country with low tax jurisdiction or

no tax at all which gives investors the opportunity to

take tax avoidance actions (Desai et al., 2006). The

utilization of tax haven was measured by companies

that had at least 1 subsidiary company domiciled in

tax haven countries. The utilization of tax haven

measured as a dummy variable, "1" if the company

had at least two subsidiaries incorporated in a tax

haven recognized in the OECD, conversely stated

What is Multinationality, Tax Haven Utilization, Uncertainty Tax and Disclosure of Corporate Social Responsibility Affected Tax Avoidance

by Multinational Companies?

1157

“0”. The measurement of this variable was in

accordance with previous research conducted by

Taylor & Richardson (2013) and Nuraini & Marsono

(2014) which measured the utilization of tax haven

by looking at companies that had at least 1

subsidiary company domiciled in tax haven

countries.

3. Tax Uncertainty

Tax uncertainty is when management faces

significant uncertainty in determining tax estimates

based on differences in interpretation of tax law

(Desai & Dharmapala, 2006). Tax uncertainty was

measured by the company that issued a statement

regarding "Tax Uncertainty Exposures" in the notes

to its financial statements. The variable of tax

uncertainty was measured by variebel dummy,

namely "1" if the company included "tax uncertainty

exposure" in the notes to its financial statements,

otherwise stated “0”. The measurement of this

variable was in accordance with the previous

research conducted by Taylor & Richardson (2013)

and Christiana (2015) which measured tax

uncertainty by seeing whether the company revealed

uncertainty in measuring taxes in the notes to its

financial statements.

4. CSR Disclosure

CSR is the responsibility which adheres in every

investment company to continue to create a

relationship which is harmonious, balanced and in

accordance with the environment, values, norms and

culture of the local community. CSR disclosure is a

disclosure done by the company on CSR activities

carried out by the company. The measurement of

CSR disclosure used GRI version 4.0 issued by the

Global Reporting Initiative which consisted of 91

items of disclosure consisting of 6 indicators namely

economic indicators (9 items), environment (34

items), employment practices and work convenience

(16 items), human rights (12 items), community (11

items) and responsibility for the product (9 items).

This was in accordance with research conducted by

Krisna & Suhardianto (2016) and Fauziah (2016).

CSR disclosure was done by checking one by one

GRI version 4.0 items. If the item was disclosed, it

was given score 1, whereas if it was not disclosed,

the score was 0. The score of each item disclosure

was summed and divided by the total item disclosure

in order to obtain a disclosure score for each

company. The formula that could be used was as

follows: =∑/

Explanation:

CSRIj : Extensive index of corporate social

and environmental responsibility disclosure

Σxyi : score 1 = if item yi disclosed; 0

= if item yi not disclosed.

ni : number of items for the

company i, ni ≤ 91

Analysis of Multiple Linear Regression

Regression analysis is used by the researcher if the

researcher intends to predict the state of the

dependent variable, and if two or more independent

variables as predictors are manipulated or rise and

value in value.

In this study, the multiple regression models that

was developed were as follows:

.

,

,

,

,

,

,

4 ANALYSIS

The results of descriptive statistics in this study

describe data from the dependent variable as

follows:

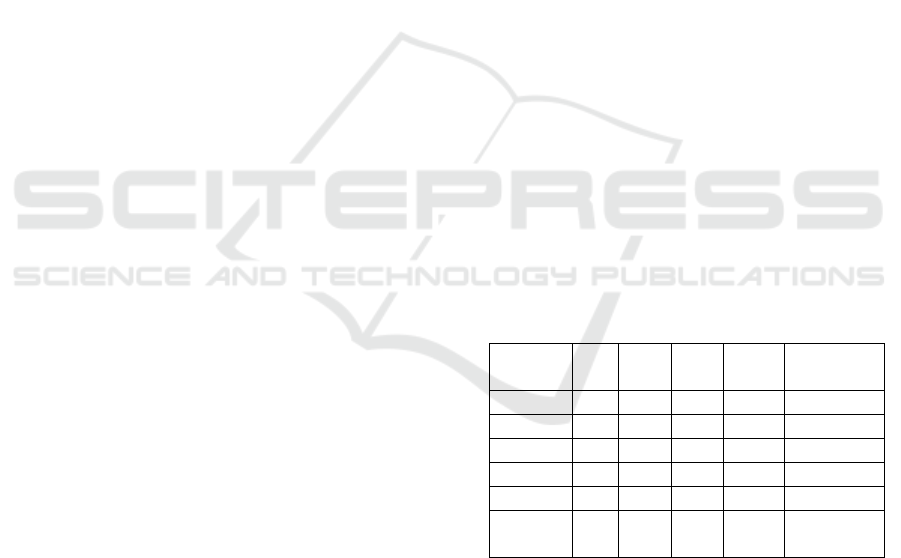

Table 2: Descriptive Statistics

N

Min Max Mean Std.

Deviation

ETR 190 .04 .80 .2704 .10577

CSR 190 .00 .89 .1824 .14911

Multi 190 .00 1.00 .2947 .45713

TH 190 .00 1.00 .5421 .49954

PP 190 .00 1.00 .2579 .43863

Valid N

(listwise)

190

Source: secondary data processed

The result of descriptive statistics in Table 2 shows

that the Tax Avoidance variable (ETR) has a value

range of 0.04 (minimum) to 0.80 (maximum). The

company that has the lowest (minimum) ETR value

is to allow the company not to do tax avoidance and

see the result showing that the average company

does not do tax avoidance, which is seen from the

mean shows the number 0.2704. The statistic

description shows that many companies do not carry

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1158

out tax avoidance. It is proven from the average

which do not do tax avoidance is 0.2579. On the

other hand, many companies use Tax Heaven. It is

proven from the average of companies which carry

out Tax Heaven is 0.5421.

Hypothesis testing

The t test is used to examine the effect of each

independent variable individually or partially on the

dependent variable. The testing is done by looking at

the variable significance value at a significance level

of 0.05 (5%). The result of partial test from multiple

linear regression equations are presented in the table

as follows

Table 3: Partial Test Results

Beta sig

ETR 0.245

CSR 0.066 0.206

Multinationalit

y

0.005 0.905

The

Utilization of Tax

Haven (TH)

0.003 0.873

Tax

Uncertainty (PP)

0.053 0.255

Source: Output SPSS 21, 2018

5 DISCUSSION

The Effect of Multinationality on Tax Avoidance

The first hypothesis in this research states that there

is an effect of multinationality on tax avoidance.

Based on the result of the study proves that there is

no effect between multinationality on tax avoidance,

the first hypothesis is rejected. This means that the

more a multinational company has subsidiary or

branches outside Indonesia, the more triggered the

company to practice tax avoidance. The result of this

study is in line with agency theory which states that

the desire of management to improve their personal

and management interests will strive to minimize the

company's tax burden in order to avoid a high tax

burden.

The practice of tax avoidance can only be done

by multinational companies because multinational

companies have large groups that are not only in

Indonesia but also outside Indonesia, therefore the

practice of tax avoidance can be done. This is also in

accordance with the trade off theory stated by Myers

(2001) where the company will owe up to a certain

level of debt, where the tax savings (tax shields)

from additional debt is equal to the cost of financial

difficulties (financial distress). According to Myers

(2001) financial distress refers to the cost of

bankruptcy or reorganization, and agency costs that

arise when the feasibility of a company's debt is in

doubt. The debt is played in a group of multinational

companies in various ways so that later the corporate

income tax becomes to a minimum.

Another reason is supported by the absence of

regulations on thin capitalization rules until 2016

through the Minister of Finance Decree Number 169

/ PMK.010 / 2015 which makes multinational

companies freely play debt among their groups. By

this, then multinational companies can optimize their

interest debt rates so that the interest expense can

befully deductible expense for Taxable Income

(PKP). Thus, the tax borne by the company will

shrink. In the end, PMK No.169 / PMK.010 / 2015

came out and finally set a limit on the ratio between

debt and capital of 4: 1. \Until 2016, the ratio

between debt and capital was released to any

number which eventually made multinational

companies practiced tax avoidance in their large

groups.

Indonesian companies that have a

multinationality character have higher debt to equity

values than companies that do not have this

character. This can happen because the character of

multinationality allows them to achieve profits that

are greater than the value of the deductible interest

expense, by utilizing different tax rates between tax

jurisdictions. Indonesian companies can make

profits when receiving loans from creditors located

in locations that charge lower corporate tax rates

from Indonesia.

The result of this study is supported by research

conducted by Taylor & Richardson (2013) which

states that multinationality has a significant positive

effect on tax avoidance practices. Research

conducted by Nuraini & Marsono (2014) also proves

the same thing with the result that multinational

companies has a significant positive effect on thin

capitalization considering that multinational

companies usually implement efficient tax planning

in all of their corporate entities, because with

subsidiaries or branches companies that obtain

foreign income will be involved in greater tax

avoidance activities. Research conducted by

Christiana (2015) also gives the same result, namely

Indonesian companies that have the characteristics

of multinationality, tax havens and tax uncertainty,

are proven to have a higher value of debt to capital

What is Multinationality, Tax Haven Utilization, Uncertainty Tax and Disclosure of Corporate Social Responsibility Affected Tax Avoidance

by Multinational Companies?

1159

ratio than companies that do not have these

characteristics.

The Effects of Utilizing Tax Haven on Tax

Avoidance

The second hypothesis in this study states that there

is an effect of the utilization of tax haven on tax

avoidance. Based on the result of the study proving

that there is an effect between the utilization of tax

haven on tax avoidance, the second hypothesis is

rejected. The direction of the relationship between

the utilization of tax haven and tax avoidance has a

positive effect. This shows that the more subsidiaries

or branches of companies placed in tax haven

countries, the higher the possibility of tax avoidance

practices.

The result of this study is in line with agency

theory which states that management has the desire

to improve their personal and management interests

will strive to minimize the company's tax burden in

order to avoid a high tax burden. Multinational

companies set up companies in gray countries or tax

haven countries in order to avoid taxes in Indonesia.

Where in the country does not follow international

tax regulations that make the country free to

determine taxes and even not charge tax. This is

used by multinational companies that have a large

group network to place one or more companies in

the country for investment purposes.

The utilization of tax haven which partially has a

significant effect on tax avoidance. This signifies

that tax haven country is a gap for multinational

companies to practice tax avoidance. Indonesian

companies that have subsidiaries in tax haven

countries have a higher average debt ratio than

companies that do not place their subsidiaries in tax

haven countries. When Indonesian companies obtain

loans from their subsidiaries in tax haven countries,

then benefits of using interest loans to minimize

group tax burden are maximized. Indonesian

companies can reduce the interest expense with a

high value, and interest income received by

subsidiaries will not be subject to high taxes in tax

haven countries.

The very low tax rate or even the absence of

taxation in tax haven country invited many

multinational companies to invest there and even

established branches or subsidiaries, including

multinational companies in Indonesia. Researchers

in processing the data of this study saw a large

number of multinational companies that establish

branches in several tax haven countries, such as the

British Virgin Islands, Netherlands, Cayman Islands,

Singapore, Panama, etc.

The result of this study is in line with the

research conducted by Taylor & Richardson (2013)

which states that companies that have at least one

subsidiary placed in tax haven countries have thin

capitalization capital structure. Nuraini & Marsono

(2014) also state things that are in line that

multinational companies can use an entity in

financing in tax haven to make safe tax deduction to

pay interest debt by subsidiaries in countries that

invest high tax rates. Even Christiana (2015) also

states that the utilization of tax havens has a

significant positive effect on tax avoidance.

The Effect of Tax Uncertainty on Tax Avoidance

The third hypothesis in this study states that there is

an effect of tax uncertainty on tax avoidance. Based

on the result of the study prove that there is an effect

between tax uncertainty on tax avoidance, the third

hypothesis is rejected. This shows that the company

that publishes uncertainty in determining its income

tax makes the company more likely to practice tax

avoidance.

The result of this study is in line with agency

theory which states that the desire of management to

improve their personal and management interests

will strive to minimize the company's tax burden in

order to avoid a high tax burden. In order to practice

tax avoidance, multinational companies cover it by

acknowledging that the company cannot definitively

determine its income tax due to the interpretation of

complex tax regulations. Even Desai & Dharmapala

(2006) state that tax uncertainty can be used by

company management as a tool to camouflage or

cover up tax avoidance practices. Including in the

practice of tax avoidance, tax uncertainty can be

used for reasons where the company has difficulty in

determining taxes due to capital structure.

Researchers in this study see the tendency of

companies that include uncertainty in determining

taxes in the notes to financial statements are

companies that have a corporate structure with

subsidiaries and branches of the company more than

five companies outside Indonesia, including placing

them in tax haven countries. This is in accordance

with the research conducted by Taylor & Richardson

(2013) that companies with multinationality

corporate structure, tax haven utilization, and tax

uncertainty have a significant positive effect on thin

capitalization. The result of this study is not in line

with the research conducted by Christiana (2015)

which states that there is a negative correlation

between the tax uncertainty variable and thin

capitalization. With the reason that when Indonesian

companies disclose uncertainty in determining tax

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1160

value due to being in a legal process with the tax

authority, it indirectly has a negative impact on their

reputation.

The Effect of (Corporate Social Responsibility)

CSR Disclosure on Tax Avoidance

The fourth hypothesis in this study is that CSR

disclosure has a negative effect on tax avoidance.

The result of research based on statistical tests in

Table 4.4 show that CSR disclosure has a positive

direction and does not affect tax aggressiveness, so

hypothesis (H4) is rejected. Responsibility

Corporate Social Responsibility is the process of

communicating the social and environmental

impacts of the organization's economic activities

towards specific groups that have an interest in and

towards society as a whole (Kuriah & Asyik, 2016).

In this study, the disclosure of CSR carried out by

companies does not affect the level of corporate tax

avoidance, which means that the corporate CSR

does not affect the company so that the company

pays tax burden according to the tax rules or does

not carry out tax aggressive actions. This shows that

the disclosure of CSR done by companies is only to

fulfil formal obligations. In which law No. 40 of

2007 concerning Limited Liability Companies and

Law No. 25 of 2007 concerning Investment requires

the Company whose field of business is in or related

to the natural resources sector to carry out social and

environmental responsibility as well as if the

company does not carry out social responsibility

obligations will be subject to sanctions in

accordance with the provisions of the legislation.

The result of this study is similar to the result of

studies conducted by Jessica & Toly (2014) and

Napitu & Kurniawan (2016), where the research

shows the results that the disclosure of CSR does not

affect on tax avoidance. Jessica & Toly (2014) argue

that based on the Indonesian conditions, the

disclosure of CSR carried out by companies is still

general and not detailed. Therefore, when compared

with the CSR disclosure of GRI version 4.0 which

has been very detailed, it will show that the level

Disclosure of CSR in Indonesia is very low.

Whereas Napitu & Kurniawan (2016) argue that

companies do not focus on CSR disclosure as one of

the efforts that can reduce the value of tax

avoidance. For companies, CSR programs are still

limited to the realization of a charity program that

has not been able to empower the community.

Unstable data is also a cause of insignificance in the

relationship between CSR disclosure and tax

avoidance.

The result of this study opposes legitimacy

theory, which in this theory explains that in order to

get positive legitimacy from society, companies

need to carry out social responsibility. One of them

is through CSR activities carried out by the

company. The disclosure of CSR is expected to

bring positive legitimacy, but in reality, mining

companies have not been able to prove that CSR

disclosure can increase the legitimacy of society and

government for companies because high or low

disclosure of CSR by companies does not guarantee

that companies have high or low tax avoidance.

6 CONCLUSIONS

Based on the results of research on multinational

companies show unsatisfactory result, it is

concluded that there is no significant effect of

multinationality on tax avoidance. There is no

significant effect on the utilization of tax haven on

tax avoidance, there is no significant effect of tax

uncertainty on tax avoidance, there is no significant

effect on CSR disclosure on tax avoidance.

REFERENCES

Boyatzis, R. E. (2008) ‘Competencies in the 21st

century’, Journal of Management

Development. Edited by R. Boyatzis.

Emerald Group Publishing Limited, 27(1),

pp. 5–12. doi: 10.1108/02621710810840730.

Christiana, D. (2015). Determinan Praktik Thin

Capitalization Listed Companies Di

Indonesia 2010-2013. Universitas Indonesia..

Desai, M. A., & Dharmapala, D. (2006). Corporate

tax avoidance and high-powered incentives.

Journal of Financial Economics, 79(1), 145–

179.

Desai, M. A., Foley, C. F., & Hines, J. R. (2004). A

Multinational Perspective on Capital

Structure Choice and Internal Capital

Markets. The Journal of Finance, 59(6),

2451–2487. https://doi.org/10.1111/j.1540-

6261.2004.00706.x

Desai, M. A., Foley, C. F., & Hines, J. R. (2006).

The demand for tax haven operations. Journal

of Public Economics, 90(3), 513–531.

Dewi, N. N. K., & Jati, I. K. (2014). Pengaruh

Karakter Eksekutif, Karakteristik Perusahaan,

Dan Dimensi Tata Kelola Perusahaan Yang

Baik Pada Tax Avoidance Di Bursa Efek

What is Multinationality, Tax Haven Utilization, Uncertainty Tax and Disclosure of Corporate Social Responsibility Affected Tax Avoidance

by Multinational Companies?

1161

Indonesia. E-Jurnal Akuntansi, 6(2), 249–

260.

Dyreng, S., Hanlon, M., & Maydew, E. L. (2014).

When Does Tax Avoidance Result in Tax

Uncertainty? Retrieved from

https://ssrn.com/abstract=237494

Myers, S. C. (2001). Reading 4 Capital

Structure.pdf. Journal of Economic

Perspectives, 15(2), 81–102.

https://doi.org/10.1257/jep.15.2.81

Nuraini, N. S., & Marsono. (2014). Analisis Faktor-

Faktor yang Mempengaruhi Thin

Capitalization pada Perusahaan Multinasional

di Indonesia. Diponegoro Journal of

Accounting, 3(3), 1–9. Retrieved from

http://ejournal-

s1.undip.ac.id/index.php/accounting

OECD. (2012). Thin Capitalisation Legislation: A

Background Paper of Country Tax

Administrations.

Rahayu, N. (2010). Evaluasi Regulasi Atas Praktik

Penghindaran Pajak Penanaman Modal

Asing. Jurnal Akuntansi Dan Keuangan

Indonesia, 7(1), 61–78.

Rego, S. O. (2003). Tax Avoidance Activities of

U.S. Multinational Corporations.

Contemporary Accounting Research, 20(4),

805–833. https://doi.org/10.2139/ssrn.320343

Surbakti, T. A. V. (2012). Pengaruh Karakteristik

Perusahaan dan Reformasi Perpajakan

Terhadap Penghindaran Pajak di Perusahaan

Industri Manufaktur yang Terdaftar di Bursa

Efek Indonesia Tahun 2008- 2010.

Universitas Indonesia.

Taylor, G., & Richardson, G. (2013). The

determinants of thinly capitalized tax

avoidance structures: Evidence from

Australian firms. Journal of International

Accounting, Auditing and Taxation, 22(1),

12–25.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1162