Analysis of Implementation of Sistem Akuntansi Instansi Berbasis

Akrual (SAIBA): A Case Study on the Central Jakarta Work Unit of

the Ministry of Religious Affairs

Humairoh Hanif

1

and Dodik Siswantoro

1

1

Faculty of Economics and Business, Universitas Indonesia, Jakarta - Indonesia

Keywords: SAIBA, Central Jakarta Working Unit of Ministry of Religious Affairs, System, procedures

Abstract: This study aims to analyze the problems that occur in the application of SAIBA in the Central Jakarta Work

Unit of the Ministry of Religious Affairs (Kemenag Satker Jakarta Pusat). This study employed the

qualitative methods with a case study approach to analyze the problem and solution in the application of

SAIBA at the Central Jakarta Work Unit in 2016. Based on the results of interviews, it can be concluded

that there are problems of procedure. The problems of procedure are in the forms of non-real-time SPM and

SP2D data input, data input error of SPM, delayed collection of LPJ, and employees’ competence not

supporting financial reporting process. The problem solving include verifying the SP2D data input process,

developing the SPM application, conducting training on technical guidance which contains materials about

compilation process of financial and technical report of application of SAIBA.

1 INTRODUCTION

The Central Jakarta Work Unit of the Ministry of

Religious Affairs (Kemenag Satker Jakarta Pusat) is

one of the works units obliged to implement SAIBA

in efforts to arrange the financial reports in

compliance with the prevailing Government’s

Accounting Standards (SAP). Upon the auditing of

the financial report of the Ministry of Religious

Affairs, the Financial Audit Board (BPK) gave the

qualified opinion (WDP), the opinion of which

improved in 2016 to become WTP. This is the key

for the success of financial reporting in the Ministry

of Religious Affairs in earning the unqualified

opinion (WTP).

SAIBA is a form of the initiatives of the Ministry

of Finance expected improves the accounting report

at the state institutions or ministries. SAIBA is

expected to improve the implementation and some

adaptation and collaboration with other parties are

required. Meanwhile, although the BPK audit to the

financial report of the Ministry of Religious Affairs

shows an improved opinion in 2016, the Kemenag

Satker Jakarta Pusat as a work unit of the Ministry

of Religious Affairs constantly have the problems of

SAIBA implementation. Therefore, the researchers

would like to have an in-depth analysis of the

procedural problems in the application of SAIBA at

the Kemenag Satker Jakarta Pusat and identify the

possible solution. Considering that it earned an

improved opinion in 2016, the Kemenag Satker

Jakarta Pusat is included in the study because the

Kemenag Satker Jakarta Pusat has arranged the

financial report compliant with the SOP. However,

they have not realized the SOP stipulated in the

PMK 225 of 2016 on the Application of

Government’s Accrual-Based Accounting Standard

at the Central Government and the Kemenag Satker

Jakarta Pusat being at the lowest level of the

hierarchy of the Ministry of Religious Affairs. It is

expected that proses of the development of the

financial report at the work unit level can improve

the capacity in the proses the development of the

financial report.

Based on the aforementioned description, the

following problems can be formulated: (a) what are

the procedural problems in the application of SAIBA

at the Kemenag Satker Jakarta Pusat? (b) What are

the solutions for the procedural problem in the

application of SAIBA at the Kemenag Satker Jakarta

Pusat? The researchers limit the scope of the

research in the application of SAIBA at the

Hanif, H. and Siswantoro, D.

Analysis of Implementation of Sistem Akuntansi Instansi Berbasis Akrual (SAIBA): A Case Study on the Central Jakarta Work Unit of the Ministry of Religious Affairs.

DOI: 10.5220/0009509711971201

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1197-1201

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1197

Kemenag Satker Jakarta Pusat in 2016. This

research will focus on the analysis of the procedural

problem in the application of SAIBA at the

Kemenag Satker Jakarta Pusat in 2016.

2 THEORICAL FRAMEWORK

Romney and Steinbart (2012) suggests that system is

a set of two or more interrelated and interacted

components to reach a particular objective. Most of

systems consist of smaller subsystems that support

the larger system. Each subsystem is designed to

reach one or more organizational purposes.

Subsystem cannot be changed without careful

consideration to the effect on other subsystems and

the system as a whole. Conflicting goals will result

when the objectives of the goals of one subsystem is

not compliant with other subsystems or with the

whole system. Compliance of objective will result

when a subsystem successfully reach its objective

while contributing to the achievement of the

organizational goals. The larger the organization and

the more complicated the system, the more difficult

to reach the expected objectives.

Warren et al. (2005) define accounting as a

method or procedure to collect, clarify, summarize,

and report the firm’s operation and finance. Mulyadi

(2001) defines the accounting system as the

organization’s forms, notes, and reports coordinated

in such a way to provide financial information to

facilitate the management in managing the firm.

Romney and Steinbart (2012) defines that

Accounting Information System combines, records,

stores, and process the data to result in the

information required by the decision makers.

Information is needed by persons, procedure,

instruction, data, software, information technology

infrastructure, internal control, and securitization.

Mulyadi (2008) reveals that accounting information

system is a form of information systems intended to

provide information for business managements,

improve the information provided by the existing

system, and improve the accounting control and

internal audit.

The existence of information system in the form

of an application will facilitate the work and

minimize the error level in the development of the

financial report. Such risk of mistyping,

miscounting, and account misclassification can be

minimized with the application. Later, the provided

information will be more accurate and valid. Valid

information will facilitate the unbiased decision

making (Ribeiro and Prataviera, 2014). The use of

information technology will minimize mistakes or

errors resulting from one’s carelessness and inability

in the development of the financial report (Zahroh,

2012).

According to the Finance Minister’s Regulation

No. 215 of 2016 on Accounting System and Central

Government’s Financial Reporting, SAIBA is

defined as a set of manual or computerized

procedure ranging from data collection, recording,

summarizing, and reporting of the financial position

and operation. SAIBA is an accounting procedure

applied in the state ministries / institutions. The

application of SAIBA includes the processing of

transaction of finance, goods, and other kinds to

result in a beneficial and useful financial report.

The application of SAIBA in the government’s

financial reporting changed from cash basis to

accrual basis in 2015. SAIBA consists of Financial

Accounting System (SAK) and Management

Information System (SIMI and State-Owned Goods

Accounting (BMN). SAK is designed to result in the

financial report of the Work Unit. The report

includes Budget Absorption Report (LRA), Balance

Sheet, Operational Report (LO), Equity Change

Report (LPE) and Remark on Financial Report

(CALK). BMN is a system that reports the

information on fixed asset, supplies, and other assets

for the development of the balance sheet, state-

owned goods report, and other managerial reports.

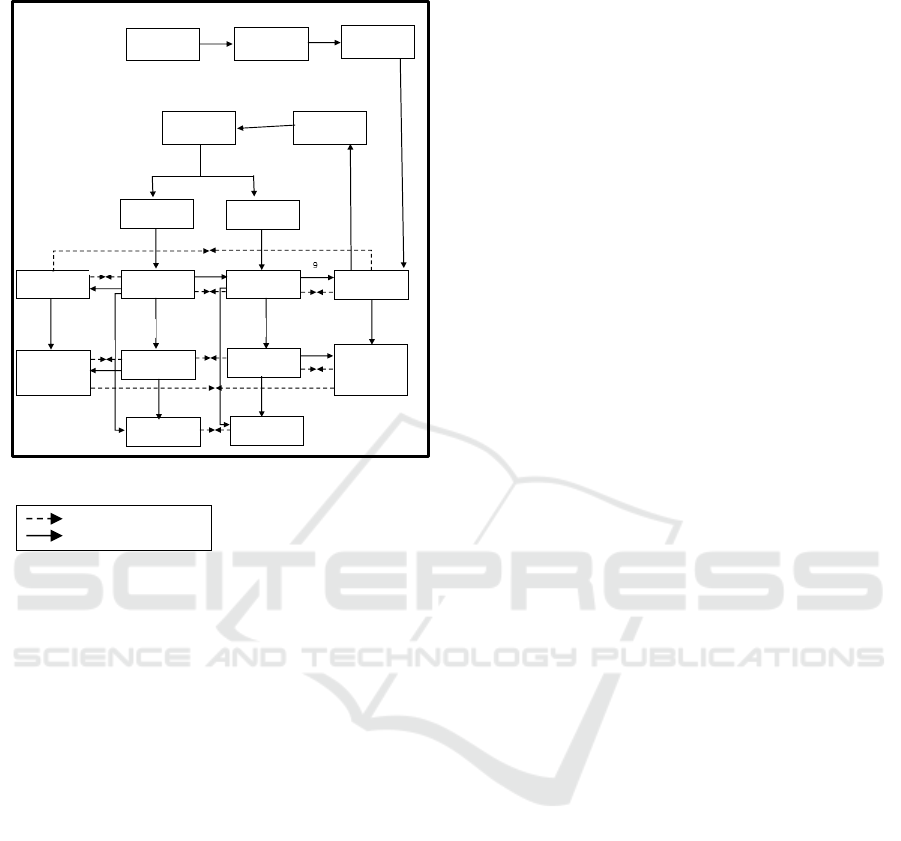

The hierarchical establishment of the Accounting

and Reporting Unit ranging from UAKPA, UAPPA-

W, UAPPA-El, to UAPA, as well as the Reporting

Accounting Unit of BMN has not been absolutely

implemented in all state ministries / institutions. The

establishment of the Accounting and Reporting Unit

has to adjust to such unique characteristics of the

respective ministries / institutions as the

organizational structure of the ministries /

institutions. The following figure illustrates the

mechanism of the development of the financial

report at the level of UAKPA.

Figure 1 shows that the financial reporting

mechanism at the work unit of UAKPA starts from

the state budget spent by the divisions in charge of

carrying out public service programs. The state

budget spent on the service programs is reported in

the Accountability Report (LPJ) that will be

submitted to the Treasurer. The LPJ has to include

the valid documents such as invoice, receipt, tax bill,

etc. Upon the receipt of the LPJ and the enclosed

documents, the Payment Request (SPP) is issued and

submitted to the department of SPM. The

department of SPM will issue a Payment Instruction

(SPM) to KPPN for approval. Based on the SPM,

the KPPN will issue a Fund Clearance Instruction

(SP2D) for the Work Unit.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1198

19

18

23

17

KPKNL

UAKPA

KP PN

UAKPB

KANWIL

DJKN

UAKPPB-W

UAPPA-W

KANWIL

Ditjen PBN

UAPPA-E1

UAPPB-E1

8

11

10

14

16

13

11

12

15

24

22

21

BMN

SAIBA

Dokumen

Sumber

L PJ beserta

bukti

SPP

SPM

SP2D

1

2

3

4

5

6

7

Figure 1: Mechanism of Financial Reporting in

Work Unit

Source: Data of PMK 215 in 2016

Reconciliation

Reporting

Based on the SPM and SP2D, the work unit will

input the data to SAIBA and BMN. The transaction

recorded to the SAIBA includes the financial

transactions resulting in LO, LPE, LRA, Balance

Sheet, and CALK. Meanwhile, BMN recorded and

accounted all transactions of fixed assets, supplies,

and other assets. The reports in BMN and SAIBA

undergo internal reconciliation for the transactions

of fixed assets, supplies, and other assets. BMN

report is incorporated in the balance sheet prepared

by SAIBA. After the two reports are consolidated,

the reports are submitted to the KPPN to undergo

external reconciliation. Reports are reconciled by

matching the SAIBA reports with the database of the

KPPN. The Database of the KPPN derives from the

SPM and SP2D already developed in the fund

invoicing and clearance phase. Reconciliation with

KPPN is made every month.

Every semester the UAKPA reports to the

regional office of UAPPA-W. The report includes

LO, LPE, LRA, balance sheet, and CALK. Every

month the BMN performs external reconciliation

with the State-Property Service and Auction Office

(KPKNL) concerning the reports of fixed assets,

supplies, and other assets. Every semester BMN

reports fixed assets, supplies and other assets to the

Regional Auxiliary Unit of Property Users (UAPPB-

W). The UAPPB-W will report it to the echelon 1

and in turn, the echelon 1 will report it to the

ministry / institution.

Afifah (2013) conducted a case study on the

accounting analysis for the application of accounting

system in the ministry of public housing. Results of

the research show that the accrual basis applied by

the Ministry of Public Houses is compliant with the

prevailing regulations and it has earned the BPK’s

unqualified opinion although it still has some

technical mistakes. Kusuma (2013) conducted a

research on the analysis of government preparedness

in applying the government’s accrual-based

accounting standard in Kabupaten Jember. The

research indicates that viewed from the integrity

parameter, the local government of Kabupaten

Jember has been prepared. They also have relatively

well-prepared human resource, information system,

and facilities and infrastructures although there

develop the LKPD manually (with excel) due to the

lack of a special software, limited quantity human

resource to execute the program, lack of technical

guidance or trainings, lack of socialization, and

inadequate facilities and infrastructures.

Zawitri and Kurniasih (2015) conducted a

research of SAIBA mandated by the government

regulation of PP No. 71 / 2010 in the Pontianak State

Polytechnic. They concluded that the Pontianak

State Polytechnic nearly meets the six conditions

required to anticipate the change of accounting

system from CTA to the accrual-based accounting

mandated by the government regulation of PP 71 /

2010. They record the transaction/account in the

current period indicating the transformation to the

accrual-based accounting system by collecting and

recording the salary back pay in the form of deferred

salary payment.

Permana (2016) conducted a research on the

application of application SAIBA in the

development of the financial report. They concluded

in their research that the application is relatively new

and is under the continuous development. Therefore,

it inherently has some weaknesses although the

application is superior to the existing systems. The

weakness of this application is associated with the

stability (settlement) of application. A new

application will need some improvement in order to

be relevant with the organizational development.

However, in spite of the weaknesses, the application

is beneficial in the development of the financial

report in the Pratama Office of Tax Service (Kantor

Pelayanan Pajak) Pratama.

Herwiyanti et al. (2017) conducted a research

and analyzed the implementation of the accrual-

based accounting system in the Inspectorate General

of the Ministry of Finance. They concluded in their

research that in general, the Inspectorate General of

the Ministry of Finance have been prepared to apply

Analysis of Implementation of Sistem Akuntansi Instansi Berbasis Akrual (SAIBA): A Case Study on the Central Jakarta Work Unit of the

Ministry of Religious Affairs

1199

the accrual-based accounting system including such

aspects as communication, resources, organizational

commitment, and bureaucracy structure. The,

research also found that the accrual-based

accounting system in the Inspectorate General of the

Ministry of Finance has been applied satisfactorily,

as indicated by the high score of 93.40%.

3 RESEARCH METHOD

This research employs a qualitative method with a

case-study approach in the Central Jakarta Work

Unit of the Ministry of Religious Affairs. The

researchers had in-depth interviews with the

operator of SAIBA, treasurer, and coordinator of

team of financial report development team of the

Central Jakarta Work Unit. In addition to interviews,

the researchers also observed and collected

documents of regulations, acts, government’s

official websites, and sample of Payment Request

form (SPP), Payment Instruction (SPM), and Fund

Clearance Instruction (SP2D) of the Central Jakarta

Work Unit of the Ministry of Religious Affairs.

4 RESULT AND DISCUSSION

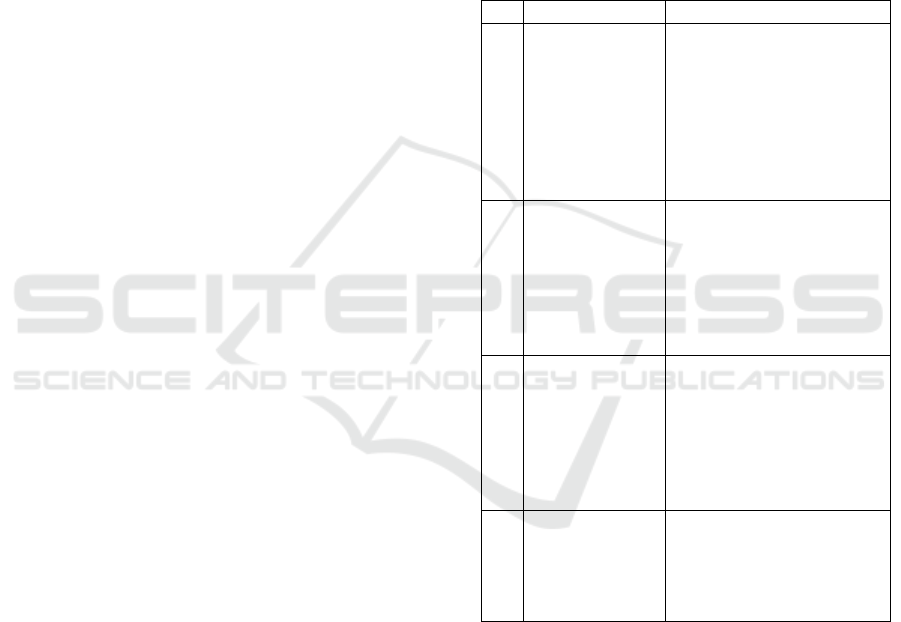

Based on Table 1 the procedure problem in the

application of SAIBA at the Central Jakarta Work

Unit of the Ministry of Religious Affairs can be

solved in the following ways:

1. Non real-time input of SPM and SP2D data

The KPPN and the Central Jakarta Work Unit of the

Ministry of Religious Affairs had different numbers.

The difference has resulted from the monthly input

of data instead of the real-time input of SP2D data.

Consequently, some SPM and SP2D data are not

input. The missing input of SP2D data has resulted

in the different data between the Kemenag Satker

Jakarta Pusat and the KPPN. The problem will be

solved when the financial executive coordinator

(Korpel) performs supervision in the inputting of

SP2D data. When the field coordinator improves the

supervision error or mistake of input can be

minimized. In case an error of input occurs, the

executive coordinator will soon inform it to the

Operator SAIBA in order that corrections can be

made to ensure the development of better financial

reports. Accordingly, the operator of SAIBA is

supposed to input the SP2D data when the SP2D is

issued to avoid missing data in the process of data

input.

2. Error in input of SPM data

The Kemenag Satker Jakarta Pusat collected the

SPM and SP2D data for one month before it input

the data into the application of SAIBA. This practice

has caused the missing data in the process of SPM

and SP2D data input. The operator of SAIBA has to

perform real-time input of SPM data to avoid the

errors of data input. The operator SAIBA has

practiced this effectively.

Table 1: The procedure problem in the application of

SAIBA

No

Problems

Recommended Actions

1

Non real-time

input of SPM and

SP2D data has

resulted in the

inappropriate

transaction value

due to the missing

data input.

The executive coordinator will

have to verify the proses of

input of SP2D data to ensure

the quality of supervision.

2

Error in inputting

the SPM data

The operator of SAIBA has to

input the SPM data at the real

time of transaction to avoid

error and mistake in the input

of the SPM data. The operator

of the SAIBA has ever done it

effectively.

3

Delayed

submission of

LPJ.

The executive operator has to

have a clearly and strictly

specified regulations and

require inform all divisions

using the budget about the

timeliness of the submission of

LPJ to the Treasurer.

4

Employees’ lack

of competence for

the process of the

financial report

development.

Provide trainings on technical

guidance on how to develop

the financial report and

technically apply the SAIBA.

Source: Results of observation and interview with

the operator of SAIBA

3. Delayed Submission of LPJ

Delayed submission of LPJ by the budget executives

has frequently occurred. This problem can be solved

by developing a timeline of the LPJ submission. The

field coordinator of finance has to take a strict action

and develop a strict deadline for the budget users in

order that they can work in time. When the budget

users submit the report later than the required time,

the financial executive coordinator (Korpel) will

have to strictly give warning or penalty to minimize

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1200

the problems in the future. The Kemenag Satker

Jakarta Pusat has currently taken this relatively

effective action.

4. Employees’ lack of competence in the process

of report development.

Lack of knowledge on the application of SAIBA at

the Ministry of Religious Affairs is a crucial

problem since it can delay the development of the

financial reporting. The increasing complexities of

the accrual-based accounting will surely complicate

the use of the accrual-based accounting system

application in the government offices requiring the

accounting system and IT based system

(Simanjuntak, 2010; Bastian, 2006). Therefore,

competent employees with relevant technical

experience background and trainings are needed.

The technical trainings will improve the competence

of the employees. The materials of the trainings will

include the process of the development of the

financial report, technical application of SAIBA,

effective teamwork, communication technique, and

still many others.

6 CONCLUSION

Based on the results of the research it can be

concluded that there are problems of system or

procedure in the application of SAIBA at the

Kemenag Satker Jakarta Pusat. The conclusions are

summarized as follows:

1. The problem of procedure in the application of

SAIBA at the Kemenag Satker Jakarta Pusat does

not have a real-time input SPM and SP2D data. This

inefficient practice has resulted in the missing of

SPM and SP2D, errors in the input of SPM data,

delayed submission of LPJ, employees’ lack of

competence of the financial report development, and

ignorance of the existing documented SOP.

2. The executive coordinator can solve the

procedural problem can be by verifying the input of

SP2D data and intensify the supervision. The

operator of SAIBA have to engage in real-time input

of the SPM data in order that the mistaken input of

SPM data can be avoided. The executive coordinator

and the chief of administrative units have to enforce

the strict and clear rules informed it to all budget

users about the submission of LPJ. In addition, the

executive coordinator can also provide technical

guidance and trainings containing such materials as

the development of the financial report and the

technical application of SAIBA.

REFERENCES

Afifah, Y. (2013). Analisis Pelaksanaan Sistem Akuntansi

Instansi (SAIBA) Pada Kementerian Perumahan

Rakyat. Skripsi Fakultas Ekonomi Program Studi

Akuntansi Universitas Indonesia

Permana, A. D. (2016). Penerapan Aplikasi SAIBA untuk

Penyusunan Laporan Keuangan. Magister

Akuntansi Universitas Sebelas Maret Surakarta.

Bastian, Indra. (2006). Akuntansi Sektor Publik: Suatu

Pengantar. Erlangga: Jakarta.

Herwiyanti, E., Sukirman S., and Aziz, F. S. (2017).

Analisis Implementasi Akuntansi Berbasis Akrual

pada Inspektorat Jenderal Kementerian Keuangan.

The institute of research & Community Outreach-

Petra Christian University.

Mulyadi (2001). Sistem Akuntansi. Edisi Ketiga. Jakarta:

Salemba Empat.

Mulyadi (2008). Sistem Akuntansi, Jakarta. Salemba

Empat.

Ribeiro. E. M. S. and Prataviera. G. A. (2014).

Information Theoretic Approach for Accounting

Classification. International Journal of Accounting

Information Systems 416, pp. 651–660.

Romney, M. B. and Steinbart, P. J. (2012) Accounting

Information System (12th Edition). London:

Prentice Hall.

Simanjuntak, Binsar. (2010). Penerapan Akuntansi

Berbasis Akrual di Sektor Pemerintahan di

Indonesia. Makalah ini Disampaiakan Dalam

Kongres IAI ke XI. Jakarta 9 Desember.

Kusuma, R. S. (2013). Analisis Kesiapan Pemerintah

dalam Menerapkan Standar Akuntansi Pemerintah

Berbasis Akrual studi kasus Pada Pemerintah

Kabupaten Jember. Skripsi Fakultas Ekonomi

Universitas Jember.

Zawitri, S. and Kurniasih, N. (2015). Penerapan Sistem

Akuntansi Instansi Berbasis Akrual Sebagai

Implementasi PP No. 71 Tahun 2010 pada

Politeknik Negri Pontianak. Jurnal Ekonomi

Bisnis dan Kewirausahaan.

Warren, C. S., Reeve, P. E. and Fess. (2005). Pengantar

Akuntansi. Edisi 21. Edisi Bahasa Indonesia.

Terjemahan Aria Farahmita, Amanugrahani dan

Taufik Hendrawan. Jakarta: Salemba Empat.

Zahroh N. (2012). Bias in Accounting and The Value

Relevance of Accounting Information. Procedia

Economics and Finance 2, pp. 145 – 156.

Analysis of Implementation of Sistem Akuntansi Instansi Berbasis Akrual (SAIBA): A Case Study on the Central Jakarta Work Unit of the

Ministry of Religious Affairs

1201