Sales of Life Insurance Products in Indonesia:

InsurTech and Traditional Insurance Agents

Debrina Ferezagia

1

1

Insurance and Actuary Departement, Vocational Education Program, Universitas Indonesia

Keywords: Technology, Insurance, Agent, Competencies

Abstract: This study aims to overview life insurance market development in industry 4.0. It also attempts to examine

the utilization of insurance technology and what competencies must be owned by insurance agents. The

authors collected literature on insurance technology, which is used in Indonesia. Then, the author

interviewed 15 respondents who often use the insurTech application to see what factors influence the

response of the portal. The data found is processed using descriptive statistical methods. Based on the

results, the insurance market has implemented the “4.0”. Insurance sales distribution in Indonesia with the

hybrid method is to combine the internet and face to face. Futuready has a portal with attractive, user-

friendly, complete product sales, whereas the online portal provides complete premium simulation, namely

Cekpremi. Insurance agents are still needed as an intermediary between customers and the insurance

industry. The competencies of insurance agents are knowledgeable of law/regulation, skills in implementing

codes of ethics, knowledge of life insurance, knowledge of products, skills/expertise of marketers, and

personal development. This paper contributes to marketing insurance management. The use of InsurTech in

the insurance marketing process will increase, but currently, InsurTech will not replace the role of the

insurance agent.

1 INTRODUCTION

Today, there are massive changes in the world

industry, as well as in the insurance industry sector.

The industrial revolution 4.0 has an impact on the

sustainability of the consistency of an industry. The

factors that determine changes in the insurance

market are increased risk, technological

development, information asymmetry, changes in

generation and their social norms (Millennial

generation or Y). This generation is the future client

of the insurance company and others. In addition,

technology development (eg Big Data analytics,

Internet of Things, Artificial Intelligence,

autonomously controlled technical facilities (cars,

drones), connected sensors) also became the trigger

factors for the need for life insurance market

development (KLAPKIV, Lyubov et al., 2017).

Thus, the insurance industry is required to be able to

survive the industrial revolution 4.0.

In Indonesia, the insurance industry is still not

proliferating. Other countries experience the same

thing. Moaradi (2015) has examined the factors that

have caused the development of the insurance

industry to be difficult, namely at the level of

insurance sales services. One of the factors that

caused the insurance industry to reach the right level

of insurance services became difficult was that the

sales network was inefficient, growth failure was

hampered, and the sales network was a presence in

the insurance market. (Moradi, 2015).

In addition, three main factors cause people to

invest in low self-insurance: namely, the availability

of insurance, insurance features, and behaviour

characteristics of individual agents (Mol, Botzen, &

Blasch, 2018). These factors are a significant

concern for the insurance industry in Indonesia. The

development of the insurance industry, especially in

the marketing system, is focused on two dominant

things: how to market and who the marketer is.

Further, there are technological-supported

innovations in the insurance industry that are

combined with technological finance. This insurance

technology is often referred to as “InsurTechs.” The

advantage is offering more straightforward products

and a more efficient customer experience, which

serves an increasingly evolving generation towards

Ferezagia, D.

Sales of Life Insurance Products in Indonesia: InsurTech and Traditional Insurance Agents.

DOI: 10.5220/0010029700002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 59-63

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

59

the millennium generation (Shanique, Manager, &

Ford, 2017).

However, InsurTech has not been able to

develop a stand-alone business model. It still

requires licensed support staff in marketing

insurance. Human capital (Human Capital - HC) of a

company is part of capital intellectual (intellectual

capital) owned by the company, which together with

financial capital (financial capital) can provide

market value (market value) for the company

(Wibawa, 2010). InsurTech, combined with a

marketing agency, is expected to be able to reduce

the weaknesses of insurance technology that has not

been able to stand alone in developing the model.

In Indonesia, an intermediary between insurance

companies and customers is one of them using agent

services to market insurance products. The thing that

is of concern is how to use agent service that is able

to market insurance products appropriately. In

Taiwan, to improve the ethical behaviour of

insurance agents, the Financial Supervisory

Commission (FSC) in Taiwan has issued

“Regulations Governing Insurance Lawyer

Supervision”. Insurance agents fail to comply with

regulations (Tseng, Kang, & Chung, 2010). This

condition is a concern for the insurance industry

agency department to develop human capital.

These insurance agents are workers who are

externalized (i.e., not under company ownership).

Therefore, corporate investment in the loyalty of

agents and agents in serving their companies is very

relevant (Galunic et al., 2019). Therefore, education

and training programs are needed to improve the

knowledge, expertise, and professionalism of agents

in order to have high competence and integrity in

providing the best service to their customers. It has

also been developed a premise that insurance is

“influenced by the public interest,” because it has “a

range of influences and consequences outside and

different from ordinary business in the commercial

world” (Helfand et al.,2017). Strict regulation of this

insurance agent occurs in Indonesia.

In accordance with Minister of Finance

Regulation in Indonesia, Insurance Companies that

conduct marketing through Insurance Agents must

provide continuous education and training to

Insurance Agents in order to be able to carry out

professions with high competence and integrity.

Human capital is an investment asset that varies

significantly between individuals. This investment

shows a significant advantage of insurance (Krebs,

Kuhn, & Wright, 2017). The same thing also

mentions that human resource management is

essential for effective performance and assessment

that will guarantee an increase in employee

performance and sustainability for the achievement

of organizational goals. (Chukwuka & Nwakoby,

2018).

The author further emphasizes that how to

achieve marketing success that synergies between

insurTech and competent agents, both collaborate

very well. InsureTech success depends on wise use

while the success of insurance agents focuses on

higher levels of individual competence (Amodu,

Alege, Oluwatobi, & Ekanem, 2017). So that the

goals of insurance companies to increase profits and

corporate accountability will be fulfilled. (Crick,

Jenkins, & Surminski, 2018).

2 LITERATURE REVIEWS

2.1 Insurance Technology

One of the drivers of socio-economic change, digital

technology plays a significant role. Technology

creates enormous potential for new ways to inform

people (Lee, 2008; Porter and Heppelmann, 2014;

McAfee and Brynjolfsson, 2012). At the same time,

existing IT infrastructure enables new forms of

trade, which can lead to innovation through

platform-based interaction and systemic value

creation (Lusch and Nambisan 2015). This change

provides an opportunity for insurance companies to

enter a new phase of digital insurance (Nicoletti

2016).

The potential of digital technology for innovation

in the insurance industry is quite significant (Eling

and Lehmann, 2018). This potential includes the

implementation of new forms of online marketing

and sales activities (Seitz, 2017). The implications of

digital technology for the insurance industry are

mainly related to online distribution channels

(Garven 2002; Dumm and Hoyt 2003), particularly

concerning their consequences for insurance agents

(Eastman et al. 2002), Kaiser 2002 customer

orientation) and Meyer and Krohm 1999

regulations).

In addition, older data processing systems in

companies are seen primarily as a means of

increasing efficiency, and a new generation of

digital technology is expected to improve market

dynamics and competition. Due to higher

transparency, lower transaction costs and a more

extensive range of online platforms are needed

(Schulte-Noelle 2001; Taylor 2001).

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

60

2.2 Agents Insurance

Related to the success of insurance determined by a

marketer (agent), agents are people, who are bound

by insurance companies who act to find customers,

negotiate policy provisions, and serve policyholders.

In an insurance practice, an agent may be appointed

by the insurer. The assignment can be a half-day or a

full day’s assignment. An agent has to disseminate

the correct information about insurance practices to

explain to the public how important it is to have an

insurance policy, fill out an application form for

people who are interested in buying a policy, in this

case, the agent will explain the policies and terms

and conditions before the buyer signs the application

form. Agents can also help serve payments from

policyholders and maintain good relations between

the perpetrators and policyholders, one of the factors

that influence between service companies and

consumers are the services performed by agents as

part of human resources that offer products directly

to the public or consumers. Without the role of the

agent, the prospect of having difficulty obtains

insurance services. For individual companies, if the

insurance agent does not play an optimal role, sales

productivity will be low (Juwono, 2010).

In an insurance company, a salesperson provides

direct interviews to consumers carried out by an

agent. According to M. Wahyu Prihartono (2010),

agents are the spearhead of the success of achieving

organizational goals. Nowadays, agents are very

instrumental in the current new product offering in

Islamic insurance. Moreover, they provide services

in offering protection services to the financial needs

of both individuals and groups, both health and

property needs. These services are provided to

consumers in order to be successful and satisfying.

This attitude is a commitment to work and is needed

to be always practised consistently. Therefore, the

agent must have knowledge about insurance.

In dealing with prospective policyholders, an

agent is required to be able to maintain trust. The

agent is the one who plays a role in providing

services by bringing the vision and mission in

marketing insurance to the community. This act can

be understood by comparing the problems faced by

consumers in buying insurance policies. Consumers

can receive valuable assistance from agents when

the loss occurs. An agent will help consumers by

providing data regarding losses received and will be

a defender if it turns out the company does not want

to admit the loss. Besides that, agents will be able to

help consumers make overall plans (Juwono, 2010).

3 METHODOLOGY

This research will discuss the hypothesis about the

existence of InsurTech and the competencies that

must be possessed by an insurance agent. To answer

this hypothesis, researchers are looking for

supporting data. The data used in this study comes

from secondary data primary data. Researchers are

looking for information about the existence of

InsurTech in Indonesia. Then the author interviewed

15 users of the insurance market portal to find out

about people’s preferences for the portal.

Descriptive statistics will analyze the data.

Furthermore, the method used is a literature study of

competencies that must be possessed by agents

through sharing relevant information sources and

government regulations.

4 DISCUSSIONS

4.1 InsurTechs

Indonesia, there is a real opportunity for innovative

technology to shape the future of emerging

insurance markets in the region. As markets become

globalized, individual capabilities or functions in the

value chain (i.e. the modular economy) are

becoming increasingly portable between markets.

Any InsurTech predicated upon a solution-driven

business model supported by product, geographic

and financial agnosticism is likely to be replicable in

other markets. While Emerging Asia may be in its

early stages of growth and development, the region

has effectively served as an incubator for Insurance

Technology that ultimately ends up transforming

more developed markets currently controlled by

traditional incumbents. Distribution in Indonesia

markets and relatively low demand for cover have

prevented the penetration of innovative products in

many markets. The proliferation of hand-held smart

technology and digital awareness among consumers,

coupled with increased demand, however, has begun

to change the landscape.

Online insurance product selling portal in

Indonesia, namely Cermati, Asuransi88.com,

Cekpremi, Futuready, DuitPintar.com, Pasarpolis,

Premiro, RajaPremi. Tokopedia insurance, Cekaja,

PasarPolis, RajaPremi, aturDuit. The researcher

interviewed 15 respondents to compare the four best

online stores in Indonesia, namely Asuransi88,

Tokopedia Insurance, CheckPrime, and Futuready.

Factors that influence online sales include attractive

Sales of Life Insurance Products in Indonesia: InsurTech and Traditional Insurance Agents

61

appearance, user-friendliness, the complete product

information, and explicit premium simulations.

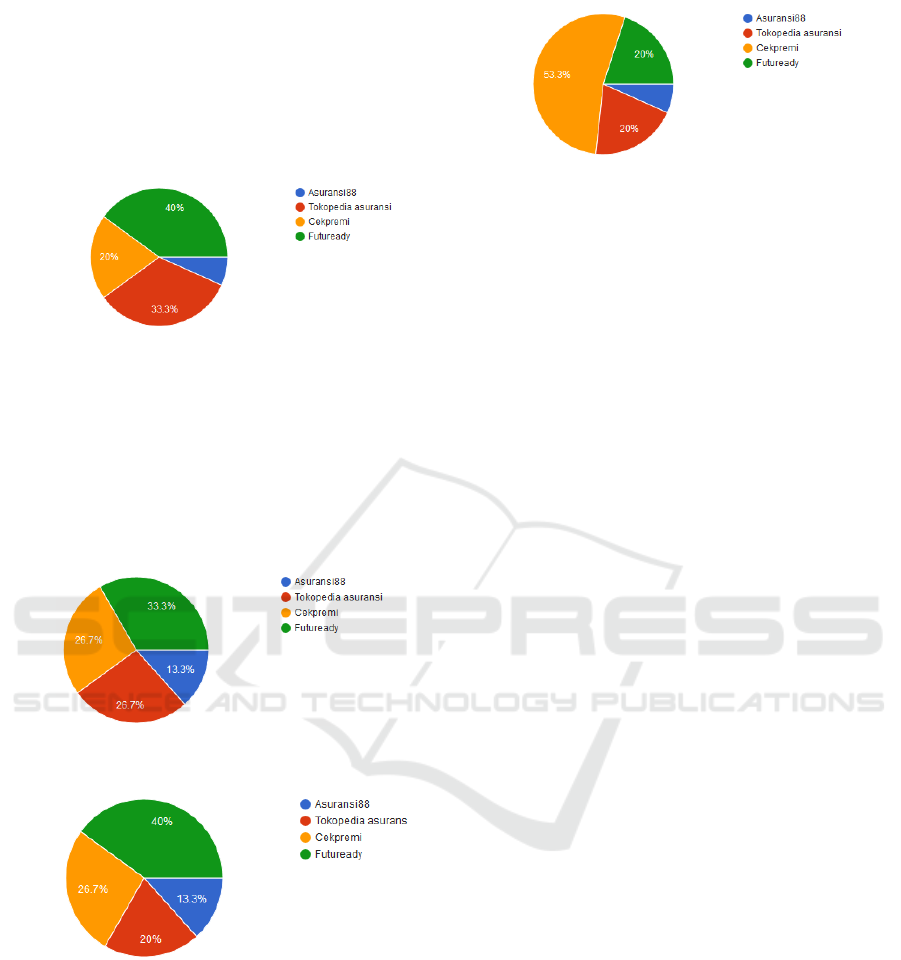

Based on interviews, 40% of respondents liked

Futuready as a provider of online insurance products

with the most attractive portal display, while the

portal that had an unattractive appearance was

Asuransi88.

Figure 1: The most interesting appearance.

Based on the results of interviews, user-friendly

information is one of the factors that affect the sale

of a product through the web. As many as 33.3% of

respondents answered Futuready as a portal with

easy use of features. Likewise, the complete product

information, available at Futuready, with the results

of interviews of 40% of respondents

Figure 2: User-Friendly.

Figure 3: The complete product information.

This result is different from the previous results

that FutureReady is very popular. This finding is

different from the results of interviews about

premium simulations. Of the four insurance portals,

Cekpremi has a premium summarization feature

from various insurance companies. Prospective

buyers of insurance products can compare premium

prices from various insurance companies, so that

prospective buyer can make their choices easily and

quickly.

Figure 4: Displaying premium simulations.

4.2 Competencies of Agents

The task of the Agency Department is essential to

maintain the quality of an insurance agent, such as

maintaining the quality of education and training. In

addition, an insurance agent is also required to be

skilled, intelligent, competitive and have high

business ethics. Moreover, do not forget to serve

with heart, understand life insurance products that

are needed most by their customers and master the

techniques / good marketing cycle. This service is

part of the attitude of professionalism to be better

prepared in facing free-market competition. For this

reason, education and training programs are needed

to increase the knowledge, expertise, and

professionalism of agents to have high competence

and integrity in providing the best service to their

customers. The attitude from insurance agents is also

a consideration of customers in purchasing a

product. Therefore, it can be concluded that the

competencies that need to be owned by an insurance

agent are knowledge, skills, and Personal

Development.

The knowledge that must be known by agents

including Product Knowledge, Customer Protection,

Know Your Customer / KYC, Laundering / AML

Anti Money, Law / Regulation on Insurance,

Knowledge of Insurance Law, Knowledge of

Investment Law, Underwriting, Claims, Investment.

Skills that an agent needs to have are Techniques for

Prospecting; identifying, selecting & approaching

the prospect, Closing Sales, Techniques for

exploring personal market strategy and selling,

Services after sales; long term relationship with

customer, Leadership, Effective communication.

Personal Development that must be owned by an

agent is the way to behave/speak/ dress, Personality,

Agency Code of Ethics.

In accordance with Minister of Finance

Regulation (PMK) No. 152 of 2012 Article 67a and

Financial Services Authority Regulation (POJK) No.

2 of 2014 Article 74 that, Insurance Companies that

conduct marketing through Insurance Agents, must

provide continuous education and training to

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

62

Insurance Agents in order to be able to carry out

professions with high competence and integrity.

SE No. 267 / AAJI / 2015 dated 17 December

2015 concerning the Implementation of the CPD

Program. The CPD program is an ongoing education

and training program. The aim is to increase the

knowledge and expertise/skills of the

agents/marketers so that they can carry out their

profession with high competence and integrity, and

can provide the best service to their customers.

The Indonesian Life Insurance Association

(AAJI) continues to strive to maintain public trust by

recruiting highly qualified and licensed marketing

personnel. Head of AAJI Communication

Department Nini Sumohandoyo said that the number

of licensed life insurance marketers in the first

quarter of 2019 increased 0.4% to 595,192 people,

compared to 592,913 people in the previous year, of

which 90.3% of the marketers came from channels

agency.

5 CONCLUSIONS

Based on the results of the study, it can be stated that

insurance marketing in Indonesia is done online and

face to face. Online insurance product selling portal

in Indonesia, namely Cermati, Asuransi88.com,

Cekpremi, Futuready, DuitPintar.com, Pasarpolis,

Premiro, RajaPremi. Tokopedia insurance, Cekaja,

PasarPolis, RajaPremi, aturDuit. Futuready has a

portal with attractive, user-friendly, complete

product sales. Whereas the online portal provides

complete premium simulation, namely Cekpremi.

Insurance sales are not only done online, but an

agent is still needed. This is because life insurance

products are personal and more complex compared

to insurance. Competencies that must be possessed

by an agent can be grouped in knowledge, skills, and

Personal Development.

ACKNOWLEDGEMENTS

The researcher thanked the Insurance laboratory,

Vocational Education Program for their support in

completing this paper.

REFERENCES

KLAPKIV, Lyubov et all. 2017. Technological

innovations in the insurance industry. Journal of

Insurance, Financial Markets & Consumer Protection

No. 26 (4/2017). rf.gov.pl/join/wp-

content/uploads/2018/01/RU26-5.pdf

Shanique, B., Manager, C., & Ford, H. (2017). By

Shanique (Nikki) Hall, CIPR Manager, (March), 22–

28.

Moradi, M. (2015). Examining of Life Insurance

Improvement and Marketing : A Case Study in Iranian

Insurance Industry, 2(9), 258–266.

Krebs, T., Kuhn, M., & Wright, M. (2017). Review of

Economic Dynamics Under-insurance in human

capital models with limited. Review of Economic

Dynamics, 25, 121–150.

https://doi.org/10.1016/j.red.2017.02.008

Chukwuka, E. J., & Nwakoby, N. P. (2018). Effect of

Human Resource Management Practices on Employee

Retention and Performance in Nigerian Insurance

Industry, (April).

Wibawa, Brata. 2010. Mengukur Kontribusi Human

capital terhadap tujuan perusahaan. Binus Business

Review.

journal.binus.ac.id/index.php/BBR/article/download/1

084/951

Helfand, B. R. D., Bagley, C., Ballen, R. G., Ballon, I. C.,

Barry, H. V, Baumgarten, J. A., Connor, M. O. (2017).

JO U R N A L O F Executive Managing Editor.

Amodu, L., Alege, P., Oluwatobi, S., & Ekanem, T.

(2017). The Effect of Human Capital Development on

Employees ’ Attitude to Work in Insurance Industry in

Nigeria, 2017. https://doi.org/10.5171/2017

Tseng, L., Kang, Y., & Chung, C. (2010). The insurance

agents ’ intention to make inappropriate product

recommendations Some observations from Taiwan

life. https://doi.org/10.1108/JFRC-03-2015-0014

Crick, F., Jenkins, K., & Surminski, S. (2018). Science of

the Total Environment Strengthening insurance

partnerships in the face of climate change – Insights

from an agent-based model of flood insurance in the

UK. Science of the Total Environment, 636, 192–204.

https://doi.org/10.1016/j.scitotenv.2018.04.239

Mol, J. M., Botzen, W. J. W., & Blasch, J. E. (2018).

Behavioral motivations for self-insurance under

different disaster risk insurance schemes. Journal of

Economic Behavior and Organization.

https://doi.org/10.1016/j.jebo.2018.12.007

Galunic, D. C., Anderson, E., Science, S. O., Feb, N. J.,

Galunic, D. C., & Anderson, E. (2019). From Security

to Mobility : Generalized Investments in Human

Capital and Agent Commitment From Security to

Mobility : Generalized Investments in Human Capital

and Agent Commitment, 11(1), 1–20.

Juwono, Stephen B. 2010. Agen Asuransi Wajib Ikut

Lisensi Lanjutan.

https://keuangan.kontan.co.id/news/agen-asuransi-

wajib-ikut-lisensi-lanjutan. Diakses 12 November

2018.

Sales of Life Insurance Products in Indonesia: InsurTech and Traditional Insurance Agents

63