The Influence of Monetary Instrument toward Money Demand M2

under Dual Banking System in Indonesia Period 2015-2018

Imam Haryadi and Vinny Kurniati

Islamic Economics Department, Faculty of Economics and Management, University of Darussalam Gontor, Indonesia

Keyword: Dual Banking System, Monetary Instruments.

Abstract: Money demand holds an important role in monetary policy’s behaviour in overall economic activities.

Moreover, Bank Indonesia use monetary instrument which transform to dual banking system. This research

has purpose to analyze the influence of monetary instruments toward money demand M2 under dual banking

system and to know the monetary instrument more stable and faster in influencing money demand M2 under

dual banking system. The data used in this research was secondary data earned from Indonesia Banking

Statistics (SPI), Sharia Banking Statistics (SPS), Indonesian Financial Statistic (SEKI) and Financial Service

Authority (OJK). using the time series data from January 2015 till December 2018. In order to achieve the

purpose, this research used Vector Autoregression/Vector Error Correction Model. The research concluded

that the influence of monetary instruments toward M2 under dual banking system are significant. Based on

VECM result, conclude that Islamic monetary instruments are more significant influenced than conventional

one toward M2. based on IRF result, conventional monetary instrument more stable and faster than Islamic

monetary instrument which FASBI and SRR more stable and faster than FASBIS and SRRISL in influencing

money demand M2. But, SBIS is more stable and faster than SBI to influence Islamic M2 and increase

economic growth.

1 INTRODUCTION

According to the law No. 10 1998 Indonesia has

operating dual banking system. It is due to the fact

that monetary policy has practiced dual system which

monetary stability be the same purpose of them and

become the most important targets. There are the

different principle of taking profit between dual

banking system, distribution of fund in conventional

bank based on interest rates. On the contrary, Islamic

bank did not based on interest rate for taking the

profit.

In addition, the inflation would give the effect in

reducing effectiveness monetary policy especially,

for influencing money demand

, money instability and

purchasing power of money. Moreover, this

decreasing, would effect to demand for holding

money or saving money. Conceptually, the inflation

volatility is the result one of the highest growth of

money supply.

Whereas, Bank Indonesia as monetary authority,

maintain the money stability by optimizing monetary

operation in money market and strengthen the

monetary policy by stabilizing monetary instrument

in financial system. Commonly, there are the

monetary instruments through conventional banking

system such as Open Market Operation (OMO),

discount rate and reserve requirement. While, Islamic

banking system, bank Indonesia used reserve

requirement (SRR), Open Market Operations and

Standing Facilities.

The different concept between Islamic bank and

conventional bank for getting the profits which

influence the money demand M2 under dual banking

system. Then, this paper will compare the monetary

instruments in every bank.

Actually, those instruments are influenced by

interest rate and interest rate negatively correlated to

the money demand and income positively correlated

against money demand. This describes that the

influence of interest rate, because the Government

conducts the monetary contraction, interest rate will

be raised which cause increasing on monetary

instruments such as SBI, FASBI and SRR. From here

the Government wants to decrease money demand

and money supply in the community. It will slow the

economic growth.

46

Haryadi, I. and Kurniati, V.

The Influence of Monetary Instrument toward Money Demand M2 under Dual Banking System in Indonesia Period 2015-2018.

DOI: 10.5220/0010114600002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 46-51

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The Islamic financial system operates PLS system

in executing monetary operation. Islamic monetary

instruments are not different as conventional

monetary instrument, but Islamic financial system use

SBIS and FASBIS which have several differences to

SBI and FASBI. Hence, the researcher specifies the

following research model:

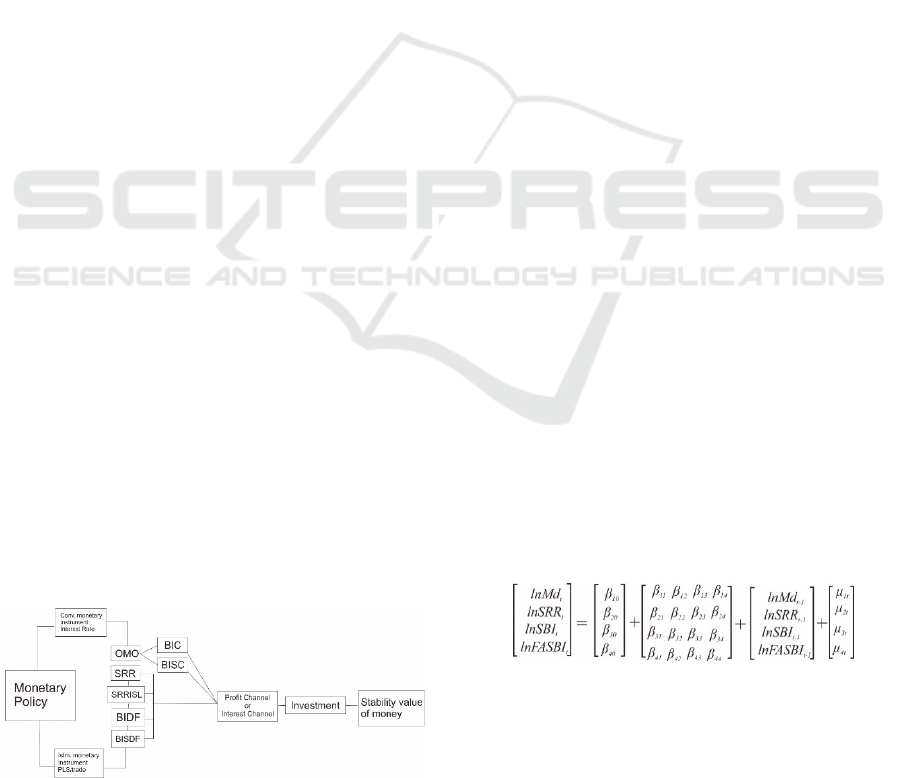

Md = f (SRR, SBI, FASBI) (1)

MdISL = f (SRR, SBIS, FASBIS) (2)

The differences between the two models is

opportunity cost variable in holding money for each

model. Opportunity cost for conventional M2 model

is the interest rate and for Islamic M2 model is the

return sharia (Figure 1).

Discount rate and moral suasion is not discussed

in this research. The researcher using instruments

OMO (Open Market Operation) SRR, FASBI and

FASBIS

2 LITERATURE REVIEW

Monetary instruments is Bank Indonesia instruments

which have influenced to the operational target in a

direct or indirect target. These instruments used by

Bank Indonesia through monetary instruments to

change profit-sharing ratio and the high currency

value through SBI and other securities transaction

(Daisy, 2010). There are other monetary instrument

such as open market operation, reserve requirement,

discount facility dan moral suasion.

From these several monetary instruments,

Ascarya (2002) differ into three types: 1) According

to operational target, divided into direct and indirect

instrument, 2) According to orientation in financial

market, divided into market oriented and non-market

oriented, 3) According to discretion. Generally, the

direct instrument is a non-market oriented and the

discretion in central bank as monetary authority.

While indirect instrument is a market oriented or a

non-market oriented and discretion in central bank.

different

from the characteristics of the system of

Figure 1: Theoretical Framework.

revenue sharing. Interest rates may be determined at

any time by the banking authorities and its nominal

movement can be seen by the public.

Meanwhile, Hasanah et.al (2008) explains that the

characteristics of the system of interest is very

Thus, its movement can lead to speculative

activities. In contrast, the nisbah is set and its value

remains valid throughout the contract. Meanwhile,

the returns will follow the actual business. In a profit-

sharing system (sharia return), profits will be shared

as well as the loss will also be shared. Therefore,

profit-sharing system will ensure the fairness and

neither party will be harmed. In Islamic banking,

profit-sharing system can be shaped as wadha

contract, musharaka, mudharaba.

Moreover, Ahmad Kaleem explains the demand

for Islamic monetary instruments in

case of dual banking system. It also demonstrates the

validity and effectiveness of these instruments for

monetary policy purposes. Apart from this Islamic

bank is also not allowed to issue securities involving

interest like long and short-term bonds, debentures

and preference shares. Currently, Islamic banks on its

liability side of their balance sheet are based on four

main sources of funds. This includes shareholder’s

funds, current, saving and investment accounts.

3 RESEARCH METHOD

This study used quantitative and comparative

research. Other side, this research used the time series

data, then it would cause the data not stationer which

show the failure in forecasting economy. This

condition called by spurious correlation which cause

to false regression. So, the problem solving is Vector

Auto Regression (VAR)/Vector Error Correction

Model (VECM).

Where in the VAR model all variables are treated

as endogenous variables. Then the VAR equation

model for conventional monetary instruments can be

written as follows:

(3)

Then, if the data are stationary at first difference

and having one co-integration, the next process is

performed using the error correction method. Then

the VECM equation model for conventional

monetary instruments can be written as follows:

The Influence of Monetary Instrument toward Money Demand M2 under Dual Banking System in Indonesia Period 2015-2018

47

(4)

While, VAR equation model for Islamic monetary

instruments can be written as follows:

(5)

Because the data is stationary at frist difference

between variables and there are co-integration among

VAR models and the test will continue to VECM

models. VECM equation model for Islamic monetary

instrument can be written as follows:

(6)

4 RESULT DISCUSSION

4.1 Unit Root Test and Co-integration

Test

This method used to perform stationary test data

using ADF test by 5% significance level. On the

contrary, when the probability t-statistic higher than

5% significance level, it would conclude non

stationary data. Roots unit test is done at the level

until the first difference level.

The all variables are

not supposed to be stationary at the level. Therefore,

unit root test needs to be continued on the first

difference level (Table 1).

Table 1: Summary of Root Test.

From information above, it can be concluded that

all variables have the same order of integration or it

is called as co-integration. Co-integration among

variables show based on trace method, see from a

trace-statistic value greater than the critical value

which indicated there are co-integration on the model.

Based on co-integration test, shows that there is at

least one co-integration on a 5% significance level.

Conventional M2 and Islamic M2 both have one co-

integration (Table 2).

Table 2: Co-integration Test.

4.2 VECM Estimation

After the co-integration test, it is known that M2

model and M2ISL model have the co-integration,

then it can be extended to the VECM phase. At this

step, the result of VECM will be used to determine

the long-term and short-term relationships between

variables of research. The variable is called

significant in influencing other variables when the

value of t-statistics higher than t-table on rank 1.96 (t

statistic > 1.96) (Table 3).

Table 3: Summary of VECM Estimation.

Based on the VECM results, in the conventional

model there is an error term amount 0.277016 and

shows that the error need to be corrected by the model

27%. The adjustment required to reach the stability

condition (1/0.277016) is 3 months. While, in Islamic

model there are an error term amount 0.075989 and

show that the error needs to correct by the model 7%.

The adjustment required to reach the stability

condition (1/0.075989) is 13 months. From this

explanation, conclude that the Islamic model need

more times than conventional.

While, money demand M2 conventional in the

long term showed the significant correlation between

variables. SBI had negatively correlated toward

conventional M2 with coefficient -0.067994, which

means increasing SBI by one per cent would trigger

the decline to M2 by -0.067994 per cent. On the

Test

ADF Prob ADF Prob

M2 -0.347276 0.9093 -7.746453

0.0000

Stationary

M2ISL -0.442398 0.892 -3.0059

0.0427

Stationary

SBI -1.59791 0.4755 -4.251412

0.0015

Stationary

SBIS -1.577392 0.4859 -5.0871

0.0001

Stationary

FASBI -2.003262 0.2844 -9.429407

0.0000

Stationary

FASBIS -2.619637 0.0962 -6.557681

0.0000

Stationary

SRR -1.32294 0.6113 -8.280907

0.0000

Stationary

SRRISL -1.13741 0.6932 -7.922341

0.0000

Stationary

Augmented Dickey-Fuller

VARIABLES

Level first difference

Note

None * 68.73692 0.0002 None * 49.28524 0.0365

At most 1 29.35191 0.0562 At most 1 9.415262 0.9876

At most 2 10.55512 0.2404 At most 2 3.507152 0.9392

At most 3 1.308699 0.2526 At most 3 0.080677 0.7764

M2IS L M2

Hypothesized No.

Of CE(s)

Trace

Stat istic

Prob.**

Hypothesized No.

Of CE(s)

Trace

Stat istic

Prob.**

Variables Coefficient T-Statistic Variables Coefficient T-Statistic

SBI -0.067994

-2.40326

SBIS 0.072545

2.77159

FASBI 1.003219

4.50062

FASBIS 0.079495

2.92258

SRR -1.442787

-2.70387

SRRISL -0.637239

-25.9177

CointEq1 -0.277016 -3.07945 CointEq1 -0.075989 -0.48727

D(M 2(-1)) -0.418997

-2.23523

D(M 2ISL(-1)) -0.399005 -1.88453

D(M 2(-2)) -0.201427 -1.14298 D(M2ISL(-2)) -0.16707 -0.91693

D(SBI(-1)) 0.001279 0.1116 D(SBIS(-1)) -0.092833 -1.43093

D(SBI(-2)) 0.012795 1.18346 D(SBIS(-2)) 0.083996 1.34172

D(FASBI(-1)) 0.019478 1.63439 D(FASBIS(-1)) -0.019796 -0.74899

D(FASBI(-2)) -0.001664 -0.17272 D(FASBIS(-2)) -0.024069 -0.96362

D(SRR(-1)) -0.042317 -0.61071 D(SRRISL(-1)) -0.156775 -1.62165

D(SRR(-2)) 0.070875 1.0195 D(SRRISL(-2)) -0.056821 -0.66523

LO NG TERM

SHORT TERM

LO NG TERM

SHORT TERM

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

48

contrary, SBIS had positive influence on Islamic M2

Islam with t coefficient of 0.072545, which means

when SBIS increased by one per cent it will trigger an

increase in Islamic M2 by 0.072545 per cent.

Moreover, FASBI had a significant impact of

conventional M2 with the coefficient 1.003219,

which means when FASBI increased by one per cent,

it would trigger the increase of conventional M2 by

1.003219 per cent. While, FASBIS had positive

correlated on Islamic M2 with coefficient of

0.079495, which means when FASBIS increased by

one per cent it will trigger increase in Islamic M2 by

0.079495 per cent.

Whereas, SRR variable in conventional banking

had negatively correlated toward conventional M2

with coefficient -1.442787 per cent, which means

when SRR increased by one per cent, it would trigger

a decline in conventional M2 by -1.442787 per cent.

Moreover, SRRISL negatively correlated to Islamic

M2 by coefficient -0.637239, which means when the

level SRRISL increases by one per cent it will trigger

a decrease on Islamic M2 of -0.637239 per cent.

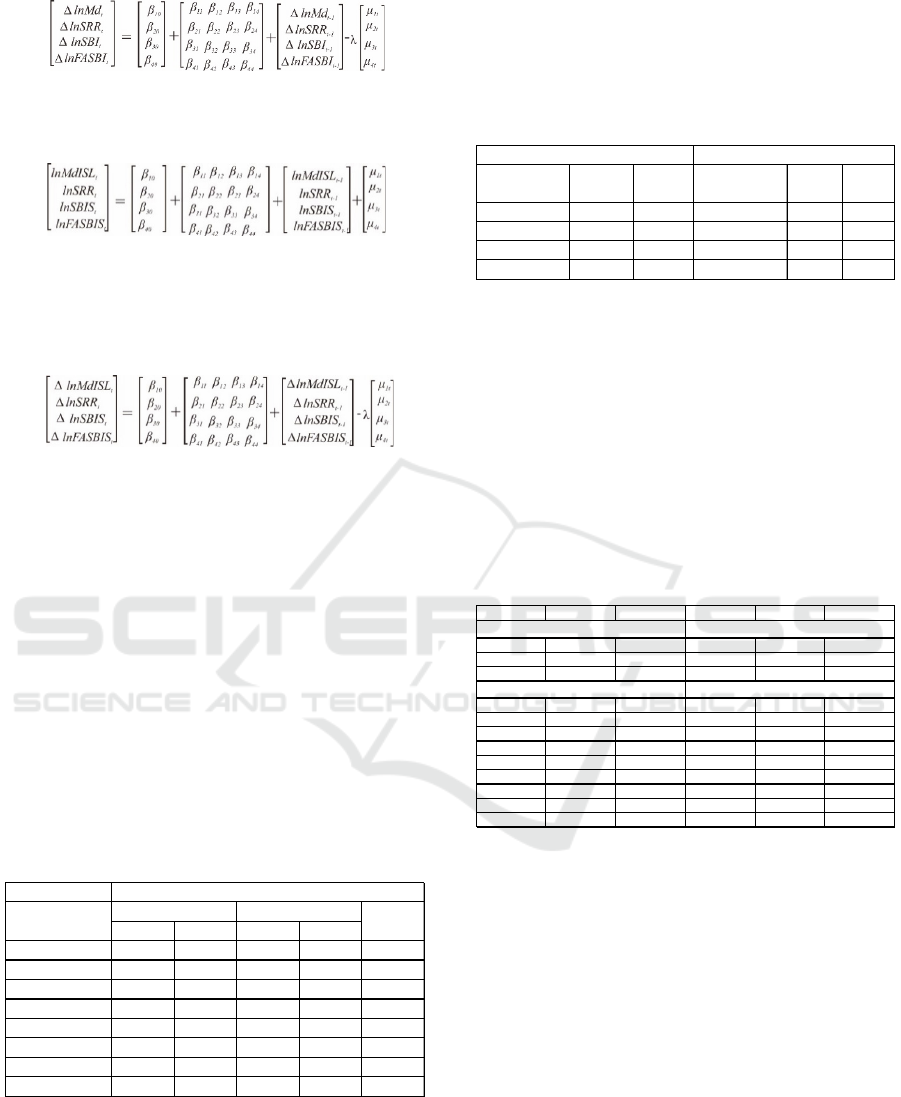

4.3 Impluse Response Function

Impluse Response Function shows the conventional

M2 responded to shocks from other variables. The

shocks of SRR variables have positively responded

by conventional M2 for overall of the forecast. In the

third period, the shocks of SRR for one standard

deviation led an increase of conventional M2 for

0.000983 standard deviations, but this is not

permanent because the decline continued during the

fourth period until the ten a period. Those responses

began to stable from the tenth period to until the end

of the forecast.

On the contrary, the shock of FASBI has

negatively responded by conventional M2 for overall

the forecast. Shocks of FASBI for one standard

deviation will trigger a decline conventional M2 by -

0.002273 standard deviations, but this is not

permanent because it has increased in the fifth period

until ninth period. The repons of conventional M2

began to stable in eleventh period which is indicated

by the coefficient of -0.00108 standard deviations.

While, the shock of SBI has positively responded

by conventional M2 for the overall forecast. On the

fourth period, the shock of SBI for one standard

deviation will trigger an increase the conventional M2

by 0.000451 standard deviation. Increasing of

conventional M2 responce has occurred from the fifth

period until the ninth period and getting stable in the

fourteenth period and indicated by 0.000847 until the

end of the forecast (Figure 2).

Figure 2: IRF of Conventional M2 Model.

Moreover, Impluse Response Function for

Islamic model is Uneven. the second period until the

end of forecast Islamic M2 has negatively responded

to a shock from SRRISL variables. The shock of

SRRISL for one standard deviation can lower Islamic

M2 by -0.0018 standard deviation, but this did not

happen continuously because Islamic M2 has

positively responded in the next period. In the sixth

period shocks of SRRISL for one standard deviation

would an increase Islamic M2 by 0.0047 and will be

stable in twentieth period.

Meanwhile, the Islamic M2 had negatively

responded to shocks of FASBIS variable for the

overall forecast. In the third period, the shock of

FASBIS for one standard deviation led to decrease

the Islamic M2 by -0.0047 standard deviation. But

this is not permanent because it would increase until

the eighth period. The response would be stable from

the fifteenth period until the end of the forecast.

Moreover, Islamic M2 variable had positively

responded to the shock of SBIS variable in the first

period until the fourth period. The shock of SBIS for

one standard deviation would trigger an increase in

Islamic M2 to 0.0013 standard deviations. But this is

not permanent because the next period Islamic M2

had negatively responded until the end of the forecast.

The shock of SBIS in the fifth period for one standard

deviation would trigger a reduce the Islamic M2 by -

0.0004 standard deviations and would be stable in

twelve period (Figure 3)

Figure 3: IRF of Islamic M2 Model.

-0,0030

-0,0020

-0,0010

0,0000

0,0010

0,0020

1

8

15

22

29

36

43

50

57

64

71

78

85

92

99

SBI SRR FASBI

-0,0100

-0,0050

0,0000

0,0050

0,0100

1

7

13

19

25

31

37

43

49

55

61

67

73

79

85

91

97

SBIS SRRISL FASBIS

The Influence of Monetary Instrument toward Money Demand M2 under Dual Banking System in Indonesia Period 2015-2018

49

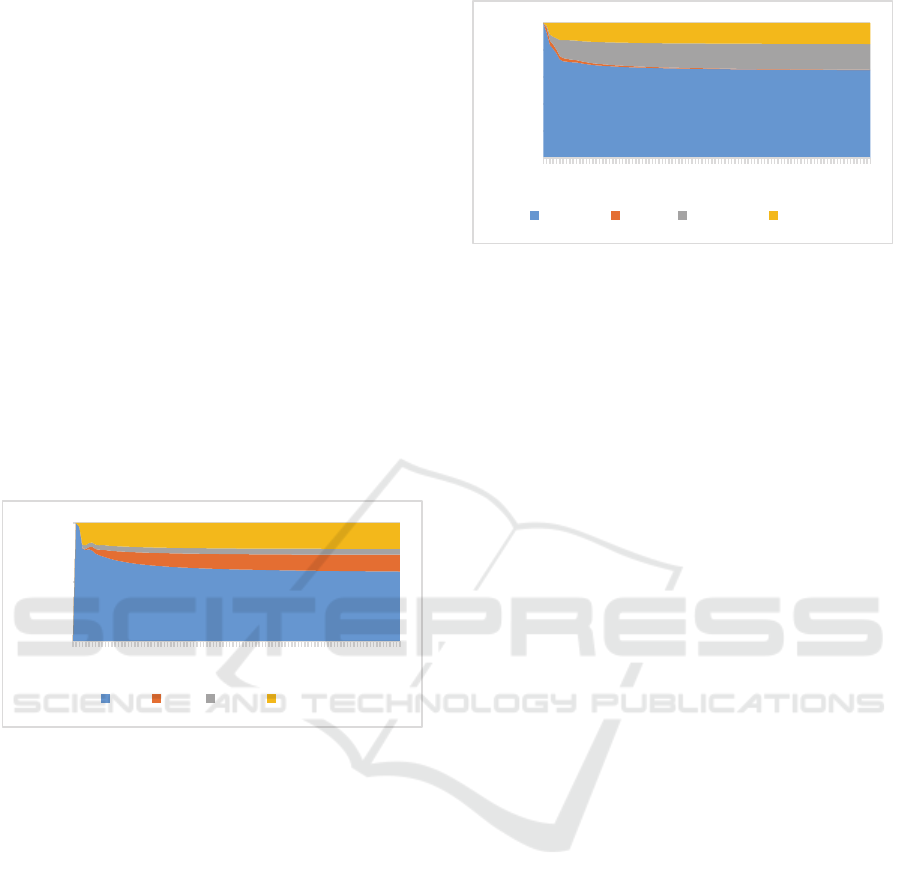

4.4 Forecasting Error Variance

Decomposition

The conventional M2 model on the first period was

influenced by conventional M2 variable itself by 100

per cent. Meanwhile, the effect of variable

conventional M2 decreased to 58.96 per cent in 100

th

period. The results of FEVD indicate the information

that conventional M2 can be explained by variables

SRR, FASBI and SBI by 0.00 per cent in the first

period.

Furthermore, conventional M2 can be explained

by the variable SRR by 4.92 per cent in 100

th

period.

This show that SRR has the smallest influence and

contribution to the conventional M2. Results of

FEVD provides information that SBI had influenced

by 14.11 per cent in the 100

th

period. While the

influence of FASBI amounted 21.99 per cent in the

100

th

period. Meanwhile, FASBI has significant

influence and contributing to the conventional M2

(Figure 4).

Figure 4: Forecasting Error Variance Decomposition of

Conventional M2 Model.

Moreover, FEVD for Islamic M2 in the first

period was affected by Islamic M2 itself by 100 per

cent. However the influence of Islamic M2 decreased

to 65.12 per cent in the 100

th

period. Furthermore,

from results FEVD it can be seen that the information

could be explained by the Islamic M2 such as

SRRISL, FASBIS and SBIS with 0.00 per cent in the

first period.

Furthermore, Islamic M2 can be explained by the

variable SBIS with 0.27 per cent in the 100

th

period.

In addition, the results of FEVD provide information

that FASBIS influenced by 15.61 per cent during the

100

th

period. while SRRISL was influenced by 18.98

per cent in the 100

th

period. This indicates that the

variable SRRISL has higher influence and

contribution to the Islamic M2 (Figure 5).

Figure 5: Forecasting Error Variance Decomposition of

Islamic M2 Model.

5 CONCLUSSION

Some the goals of this research are as follow, first, to

analyze empirically the influence of monetary

instrument toward M2 under dual banking system.

Second, to know which one monetary instrument

more stable and quicker in influencing M2 under dual

banking system

Empirically, the influence of monetary

instruments toward M2 under dual banking system

are significant. Based on VECM result, it can be

concluded that Islamic monetary instruments has

more significant influence than conventional one

toward money demand M2. This reality is the result

of the prohibition of interest rate in the Islamic

financial system. On the contrary, the conventional

financial system used interest rate channel and that

cause the negative impact and economic instability.

Based on the IRF result, the conventional

monetary instrument more stable and faster than

Islamic monetary instrument which FASBI and SRR

more stable and faster than FASBIS and SRRISL in

influencing money demand M2. But, SBIS is more

stable and faster than SBI. The shock of SBIS will be

responded negatively by Islamic M2 in 12

th

period.

While, SBI will responded positively by conventional

M2 and stable in 14

th

period. SBI will increase

inflation and shock while SBIS will decrease inflation

but increase economic growth.

REFERENCES

Ascarya, 2002. Monetary Policy Transmission Mechanism

Under Dual Financial System In Indonesia: Interest-

Profit Channel. International Journal of Economics,

Management and Accounting 22, No. 1

Daisy, Ebrinda. 2008, Analisis Pengaruh Social Values

Terhadap Permintaan Uang Islam di Indonesia, Skripsi

0%

50%

100%

1

8

15

22

29

36

43

50

57

64

71

78

85

92

99

M2 SBI SRR FASBI

0%

20%

40%

60%

80%

100%

1

8

15

22

29

36

43

50

57

64

71

78

85

92

99

M2ISL SBIS SRRISL FASBIS

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

50

Fakultas Ekonom dan Mabagement, Institut Pertanian

Bogor

Hasanah, Heni. 2008. Demand For Money And Monetary

Stability Under Dual Financial System In Indonesia.

Third Islamic Banking, Accounting and Finance

Conference. Malaysia

Kaleem, Ahmad. Modeling Monetary Stability Under Dual

Banking System: The Case of Malaysia. International

Journal of Islamic Financial Services, Vol. 2 No. 1

The Influence of Monetary Instrument toward Money Demand M2 under Dual Banking System in Indonesia Period 2015-2018

51